Bruce reminisces about the demise of Pali, a firm he worked at in 2008 and looks at a couple of computer games companies (DEVO and FDEV) plus BOTB that reported last week.

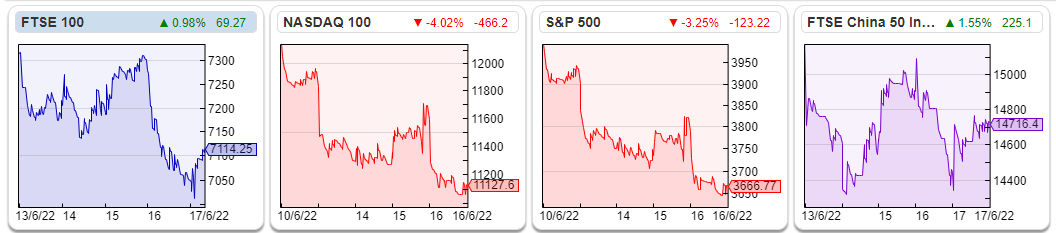

Markets had a difficult week with the FTSE 100 was down -3% to 7,114. The S&P500 and Nasdaq100 both fell -9% as the Federal Reserve raised rates by 75bp and the US 10-year-long bond yield peaked at 3.45%, before dropping back later in the week to around 3.20%.

In the UK the Bank of England raised interest rates by 25bp to 1.25%. That’s despite the BoE expecting inflation to be over 9% in the current months, rising to 11% in October this year, which is an increase on the BoE’s previous forecasts. To understand what’s going on there’s an interesting MoneyWeek podcast interview with James Ferguson. I used to work with James at Pali Securities, and he was very good at helping me understand the banking crisis because he’d spent time in Japan in the 1990s. That experience gives him a broader perspective than many market commentators, as he can parse what Central Banks are saying into actionable trading ideas (mainly “sell” ideas at the moment.)

In case you were wondering why the name Pali Securities sounds unfamiliar – the broker itself didn’t survive the financial crisis. It was owned by a couple of US billionaires, called Bert and Brad, who used to fly around on private jets. I have no idea why they named a brokerage firm after an ancient Indo-Aryan liturgical language. Many things about Pali didn’t quite make sense, there was a $25m loan from a bank in Panama. Brad was an early promoter of SPACs, the blank cheque companies that enjoyed a revival in the frothy market conditions last year. Bert and Brad then fell out and sued each other.

I was lucky enough to be made redundant from Pali in 2008 before the firm failed, so received 3 months’ salary in lieu of notice. The receptionist, who was kept on until the final day, didn’t receive her last month’s pay. There’s a fun Reuters piece, titled ‘Lawsuits, poker and the death of a boutique bank’ about Pali. Management spent $20m on legal expenses suing each other in 2008-9 when that money might have been more useful to support the business. Later, one of the billionaires, Brad was arrested at the start of 2020, on suspicion for defrauding an insurance company of $34m and allegedly trying to destroy evidence and giving the auditors fake documents.

Aside from the management, Pali was a great place to work, with some real City characters. James Ferguson is a great antidote to the bullishness that pervades financial services. He is not a “stopped clock”, repeating the same narrative and only telling the right time twice a day. In 2008, based on his experiences in Japan, he was convinced the banks were concealing their losses and we were at risk of a huge deflationary shock. Now he thinks we are facing sustained inflation – James was right last time and I think he’s right this time, so do listen to the podcast for some top-down macro analysis.

This week I look at two computer game companies: Devolver which has warned on profits, and Frontier Developments which has been more upbeat, following a disappointing 12 months. I also look at the Best of the Best FY April results and their 600p tender offer.

Devolver Digital profit warning

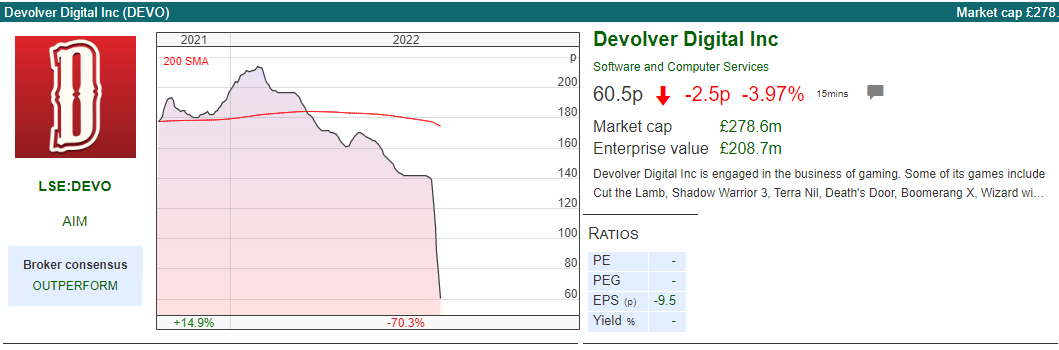

This company IPO’ed at 157p in November last year. In April I wrote about DEVO, saying that although the business model made sense, it looked like they had “timed their IPO to take advantage of an exceptionally good 2020, not because they needed the money.” Unfortunately, it looks like trading conditions are much less favourable now.

Last Monday they put out a statement saying that sales from new games so far this year (FY Dec 2022) have been slower than expected. They blame the disappointment on a competitive release window and specific factors for each title which are being actively addressed for future titles. Frontier Developments also warned on sales at the end of last year – but put out a more positive RNS last week (see next section below).

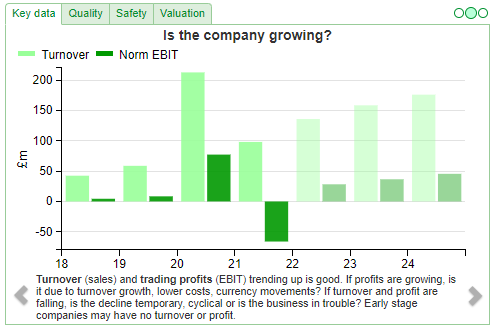

The large drop in Normalised EBIT in 2021 is due to Sharepad adjusting out a $115m positive exceptional item, which was a gain on sale of publishing rights and IP. The gain arose because DEVO had a successful hit called ‘Fall Guys’ which was released in August 2020. They then sold the rights to ‘Fall Guys’ in April 2021 to Epic Games, creating an exceptional gain on sale. Sharepad rightly excludes this gain from ‘normalised’ earnings. So statutory PBT was $52m FY 2021, but without the exceptional gain, drops to a loss of -$63m, driven in part by $55m of stock-based compensation and $8m IPO costs.

The directors, who own 57% of the company, have 12-month lock-ins at the time of the IPO in November last year. NetEase and FortuneEase, other shareholders who own 10% have lock-ins that have expired. NetEase is a US-listed games platform, with a market cap of $71bn, who Devolver distributes through (similar to Tencent, Apple and Sony).

Valuation: Guidance is now for between $130m and $140m revenues, implying +30% y-o-y growth. Adjusted EBITDA is for between $27m and $32m FY 2022F. They also talk about higher amortisation costs, so PBT will be hit even harder. Their broker, Zeus Capital, lowered their 2022F revenue by 6% and their Adjusted EBITDA forecast by 34%.

Following the de-rating Sharepad shows the PER is 12x Dec 2023F, dropping to below 10x the following year. That’s not expensive, particularly as the business had $86m of net cash at the December year-end, which is 25% of the market cap.

Opinion: The shares have fallen -70% YTD, so this is yet another example of an IPO which would have best been avoided. I can’t believe professional fund managers keep buying these companies that are being listed at the wrong price and the wrong time (for buyers). That said, I don’t think that the business is in trouble longer term though. Similar to MRK last week, I would wait for the lock-ins to expire and look at this early next year.

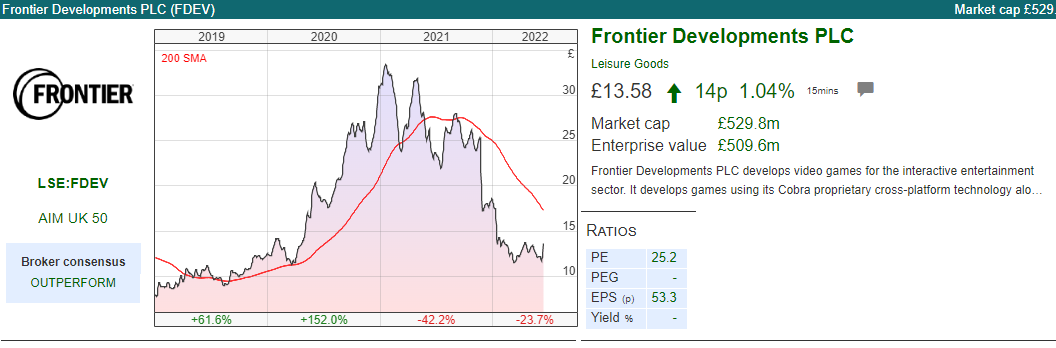

Frontier Developments Trading Update FY May 2022

Frontier Developments, David Braben’s computer games company founded in 1994 put out a Trading Update for FY May 2022. They develop games such as Elite, Planet Zoo and Planet Coaster internally. Frontier also publishes games developed by other partner studios (that is, a similar strategy to Devolver above) under its Frontier Foundry games label. Their latest games are tie-ups with Jurassic World, timed to coincide with the film release and Warhammer 40,000: Chaos Gate where they use Games Workshop’s IP to create a computer game.

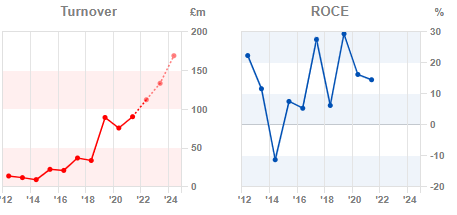

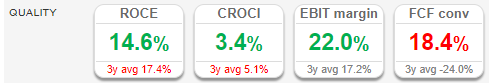

Last week they released a trading update, saying that revenue should be up +26% to £114m. Sales of Jurassic World Evolution 2 have been encouraging, with 1.3m games sold. Plus they have been selling additional ‘Paid Downloadable Content’ (PDLC) to keep players engaged and boost revenue. This means that they expect FY May 2023 to be off to a strong start. That’s very encouraging because Elite Odyssey FY revenue was below expectations. Then they warned in November that the latest Jurassic World game sales were lower than expected on the PC platform. Management put the Jurassic World disappointment down to a short-term effect from a more crowded release window than expected, that is, competing against other games that had launched in the same pre-Christmas window. It’s good to see management vindicated, and the reason for the early disappointment was indeed a temporary factor. FDEV shares responded +19% on the day of last week’s RNS.

Outlook: Warhammer 40,000: Chaos Gate – Daemonhunters, which is a Frontier Foundry title was launched on 5 May 2022. After one month of sales, it has already become their most successful Frontier Foundry title to date, with performance above expectations. There’s a medium-term aspiration to grow revenue at +20% per annum. Despite the strong start to FY May 2023 they are not raising guidance (+19% forecast FY May 2023F), which is understandable – given the uncertain nature of new releases. They expect to provide trading updates, alongside FY May 2022 audited results in mid-September, following the release of F1 Manager 2022, which is their major title for FY May 2023, scheduled for release end of August.

RoCE has been falling in recent years, from a high of 30% a couple of years ago and FCF could be improved. The company has £39m cash, down -7% from the previous year, which reflects increased investments in games and buying back £5m of shares for the EBT. That is, buying back shares to prevent share awards to employees increasing the share count. Cash is 7% of the market cap.

Hopefully, if the new releases go well, that should be positive for revenue, cash flow and profitability.

Valuation: The shares are trading on 29x PER FY May 2023F and 21x PER FY May 2024F. That seems expensive for this market, though I do think David Braben, who still owns 33% of the shares, is a quality Chief Exec.

Opinion: Good to see the shares responding well and the company putting a couple of disappointing updates behind it. Despite the bounce last week, the shares are still -60% off their peak at the start of 2021. I’m tempted to buy some, although it’s psychologically hard for me because I first looked at the shares in 2016 when they traded around the £2 level.

Best of the Best FY April 2022

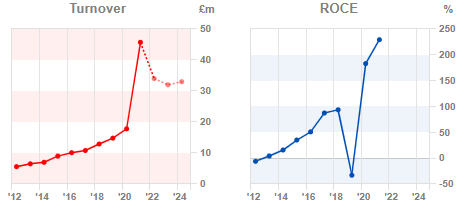

This operationally geared online ‘Dream Car’ competition company released FY to April results. Revenues were £35m, down -24% from the previous year, which was a pandemic bonanza. Management points out in the commentary that this year’s revenue is still almost double the FY Apr 2020. PBT has more than halved to £5m v £11.5m last year. They still have a marketing database of 1.8m contactable individuals, and they are looking at possible partnership deals (maybe advertisers, maybe white label deals with football clubs).

Despite the fall in profitability, they are still cash generative, with cash increasing by £8m to stand at £11m at the end of April. Hence they are raising the final dividend by +20% to 6p. There was no interim dividend at the half-year stage, but the previous year they had a special interim dividend of 50p.

They also announced a tender offer to buy back £6.3m of shares at £6 per share, which is a +52% premium to the closing price of 394p before the RNS. The tender offer is for 1 of every 9 shares held, but I also imagine that many investors might not tender their shares if they have anchored themselves on the £35 price level that the share price peaked at in the middle of last year. The offer sends a very strong signal by management about what they believe are the future prospects for the business.

Outlook: Management talk about preparing the business for a higher level of growth than pre-pandemic. From 2015 to 2020 they doubled revenue to £18m (a CAGR of +14.8%). Trading in H2 (Oct-April) was slightly ahead of (previously downgraded) expectations. The current financial year has started in line with expectations.

Valuation: FinnCap’s new forecasts, which assume an 11% reduction in the number of shares, are for 60p of EPS in FY Apr 2024F and 65p in FY Apr 2025F implying a PER of 8x Apr 2024F and 7x the year after. Despite management’s commentary, which implies revenue growth of greater than +14% per annum, their broker is forecasting flat revenue out to 2025F. That implies to me that the risk is on the upside.

Opinion: The commentary specifically mentions Apple’s iOS 14 update affecting audience targeting and Meta increasing cost per 1000 impression (CPM) pricing. Knowing Rupert Garton from his university days, I would say that BOTB does seem to me to have a good management team who can adapt though. For instance, they lost their British Airport Authority contract in 2011. Not being able to physically put their sports cars in BAA airport locations seemed like a big blow and meant BOTB was loss-making the year after they lost the contract.

They were able to adapt and recover and no longer rely on airport locations. Back then they also launched a tender offer, offering to buy 1 of every 6 shares (ie 16.67%) If you had taken up the tender offer at 63p per share in 2011, you would have regretted it, even after the difficult year BOTB has had, the new tender offer is 9.5x higher than the level a decade ago.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 20/06/22|DEVO, FDEV, BOTB| Remembering the days of Pali

Bruce reminisces about the demise of Pali, a firm he worked at in 2008 and looks at a couple of computer games companies (DEVO and FDEV) plus BOTB that reported last week.

Markets had a difficult week with the FTSE 100 was down -3% to 7,114. The S&P500 and Nasdaq100 both fell -9% as the Federal Reserve raised rates by 75bp and the US 10-year-long bond yield peaked at 3.45%, before dropping back later in the week to around 3.20%.

In the UK the Bank of England raised interest rates by 25bp to 1.25%. That’s despite the BoE expecting inflation to be over 9% in the current months, rising to 11% in October this year, which is an increase on the BoE’s previous forecasts. To understand what’s going on there’s an interesting MoneyWeek podcast interview with James Ferguson. I used to work with James at Pali Securities, and he was very good at helping me understand the banking crisis because he’d spent time in Japan in the 1990s. That experience gives him a broader perspective than many market commentators, as he can parse what Central Banks are saying into actionable trading ideas (mainly “sell” ideas at the moment.)

In case you were wondering why the name Pali Securities sounds unfamiliar – the broker itself didn’t survive the financial crisis. It was owned by a couple of US billionaires, called Bert and Brad, who used to fly around on private jets. I have no idea why they named a brokerage firm after an ancient Indo-Aryan liturgical language. Many things about Pali didn’t quite make sense, there was a $25m loan from a bank in Panama. Brad was an early promoter of SPACs, the blank cheque companies that enjoyed a revival in the frothy market conditions last year. Bert and Brad then fell out and sued each other.

I was lucky enough to be made redundant from Pali in 2008 before the firm failed, so received 3 months’ salary in lieu of notice. The receptionist, who was kept on until the final day, didn’t receive her last month’s pay. There’s a fun Reuters piece, titled ‘Lawsuits, poker and the death of a boutique bank’ about Pali. Management spent $20m on legal expenses suing each other in 2008-9 when that money might have been more useful to support the business. Later, one of the billionaires, Brad was arrested at the start of 2020, on suspicion for defrauding an insurance company of $34m and allegedly trying to destroy evidence and giving the auditors fake documents.

Aside from the management, Pali was a great place to work, with some real City characters. James Ferguson is a great antidote to the bullishness that pervades financial services. He is not a “stopped clock”, repeating the same narrative and only telling the right time twice a day. In 2008, based on his experiences in Japan, he was convinced the banks were concealing their losses and we were at risk of a huge deflationary shock. Now he thinks we are facing sustained inflation – James was right last time and I think he’s right this time, so do listen to the podcast for some top-down macro analysis.

This week I look at two computer game companies: Devolver which has warned on profits, and Frontier Developments which has been more upbeat, following a disappointing 12 months. I also look at the Best of the Best FY April results and their 600p tender offer.

Devolver Digital profit warning

This company IPO’ed at 157p in November last year. In April I wrote about DEVO, saying that although the business model made sense, it looked like they had “timed their IPO to take advantage of an exceptionally good 2020, not because they needed the money.” Unfortunately, it looks like trading conditions are much less favourable now.

Last Monday they put out a statement saying that sales from new games so far this year (FY Dec 2022) have been slower than expected. They blame the disappointment on a competitive release window and specific factors for each title which are being actively addressed for future titles. Frontier Developments also warned on sales at the end of last year – but put out a more positive RNS last week (see next section below).

The large drop in Normalised EBIT in 2021 is due to Sharepad adjusting out a $115m positive exceptional item, which was a gain on sale of publishing rights and IP. The gain arose because DEVO had a successful hit called ‘Fall Guys’ which was released in August 2020. They then sold the rights to ‘Fall Guys’ in April 2021 to Epic Games, creating an exceptional gain on sale. Sharepad rightly excludes this gain from ‘normalised’ earnings. So statutory PBT was $52m FY 2021, but without the exceptional gain, drops to a loss of -$63m, driven in part by $55m of stock-based compensation and $8m IPO costs.

The directors, who own 57% of the company, have 12-month lock-ins at the time of the IPO in November last year. NetEase and FortuneEase, other shareholders who own 10% have lock-ins that have expired. NetEase is a US-listed games platform, with a market cap of $71bn, who Devolver distributes through (similar to Tencent, Apple and Sony).

Valuation: Guidance is now for between $130m and $140m revenues, implying +30% y-o-y growth. Adjusted EBITDA is for between $27m and $32m FY 2022F. They also talk about higher amortisation costs, so PBT will be hit even harder. Their broker, Zeus Capital, lowered their 2022F revenue by 6% and their Adjusted EBITDA forecast by 34%.

Following the de-rating Sharepad shows the PER is 12x Dec 2023F, dropping to below 10x the following year. That’s not expensive, particularly as the business had $86m of net cash at the December year-end, which is 25% of the market cap.

Opinion: The shares have fallen -70% YTD, so this is yet another example of an IPO which would have best been avoided. I can’t believe professional fund managers keep buying these companies that are being listed at the wrong price and the wrong time (for buyers). That said, I don’t think that the business is in trouble longer term though. Similar to MRK last week, I would wait for the lock-ins to expire and look at this early next year.

Frontier Developments Trading Update FY May 2022

Frontier Developments, David Braben’s computer games company founded in 1994 put out a Trading Update for FY May 2022. They develop games such as Elite, Planet Zoo and Planet Coaster internally. Frontier also publishes games developed by other partner studios (that is, a similar strategy to Devolver above) under its Frontier Foundry games label. Their latest games are tie-ups with Jurassic World, timed to coincide with the film release and Warhammer 40,000: Chaos Gate where they use Games Workshop’s IP to create a computer game.

Last week they released a trading update, saying that revenue should be up +26% to £114m. Sales of Jurassic World Evolution 2 have been encouraging, with 1.3m games sold. Plus they have been selling additional ‘Paid Downloadable Content’ (PDLC) to keep players engaged and boost revenue. This means that they expect FY May 2023 to be off to a strong start. That’s very encouraging because Elite Odyssey FY revenue was below expectations. Then they warned in November that the latest Jurassic World game sales were lower than expected on the PC platform. Management put the Jurassic World disappointment down to a short-term effect from a more crowded release window than expected, that is, competing against other games that had launched in the same pre-Christmas window. It’s good to see management vindicated, and the reason for the early disappointment was indeed a temporary factor. FDEV shares responded +19% on the day of last week’s RNS.

Outlook: Warhammer 40,000: Chaos Gate – Daemonhunters, which is a Frontier Foundry title was launched on 5 May 2022. After one month of sales, it has already become their most successful Frontier Foundry title to date, with performance above expectations. There’s a medium-term aspiration to grow revenue at +20% per annum. Despite the strong start to FY May 2023 they are not raising guidance (+19% forecast FY May 2023F), which is understandable – given the uncertain nature of new releases. They expect to provide trading updates, alongside FY May 2022 audited results in mid-September, following the release of F1 Manager 2022, which is their major title for FY May 2023, scheduled for release end of August.

RoCE has been falling in recent years, from a high of 30% a couple of years ago and FCF could be improved. The company has £39m cash, down -7% from the previous year, which reflects increased investments in games and buying back £5m of shares for the EBT. That is, buying back shares to prevent share awards to employees increasing the share count. Cash is 7% of the market cap.

Hopefully, if the new releases go well, that should be positive for revenue, cash flow and profitability.

Valuation: The shares are trading on 29x PER FY May 2023F and 21x PER FY May 2024F. That seems expensive for this market, though I do think David Braben, who still owns 33% of the shares, is a quality Chief Exec.

Opinion: Good to see the shares responding well and the company putting a couple of disappointing updates behind it. Despite the bounce last week, the shares are still -60% off their peak at the start of 2021. I’m tempted to buy some, although it’s psychologically hard for me because I first looked at the shares in 2016 when they traded around the £2 level.

Best of the Best FY April 2022

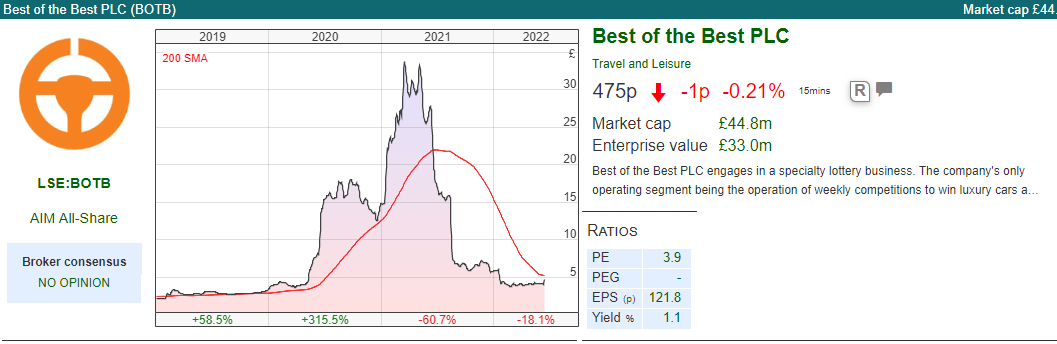

This operationally geared online ‘Dream Car’ competition company released FY to April results. Revenues were £35m, down -24% from the previous year, which was a pandemic bonanza. Management points out in the commentary that this year’s revenue is still almost double the FY Apr 2020. PBT has more than halved to £5m v £11.5m last year. They still have a marketing database of 1.8m contactable individuals, and they are looking at possible partnership deals (maybe advertisers, maybe white label deals with football clubs).

Despite the fall in profitability, they are still cash generative, with cash increasing by £8m to stand at £11m at the end of April. Hence they are raising the final dividend by +20% to 6p. There was no interim dividend at the half-year stage, but the previous year they had a special interim dividend of 50p.

They also announced a tender offer to buy back £6.3m of shares at £6 per share, which is a +52% premium to the closing price of 394p before the RNS. The tender offer is for 1 of every 9 shares held, but I also imagine that many investors might not tender their shares if they have anchored themselves on the £35 price level that the share price peaked at in the middle of last year. The offer sends a very strong signal by management about what they believe are the future prospects for the business.

Outlook: Management talk about preparing the business for a higher level of growth than pre-pandemic. From 2015 to 2020 they doubled revenue to £18m (a CAGR of +14.8%). Trading in H2 (Oct-April) was slightly ahead of (previously downgraded) expectations. The current financial year has started in line with expectations.

Valuation: FinnCap’s new forecasts, which assume an 11% reduction in the number of shares, are for 60p of EPS in FY Apr 2024F and 65p in FY Apr 2025F implying a PER of 8x Apr 2024F and 7x the year after. Despite management’s commentary, which implies revenue growth of greater than +14% per annum, their broker is forecasting flat revenue out to 2025F. That implies to me that the risk is on the upside.

Opinion: The commentary specifically mentions Apple’s iOS 14 update affecting audience targeting and Meta increasing cost per 1000 impression (CPM) pricing. Knowing Rupert Garton from his university days, I would say that BOTB does seem to me to have a good management team who can adapt though. For instance, they lost their British Airport Authority contract in 2011. Not being able to physically put their sports cars in BAA airport locations seemed like a big blow and meant BOTB was loss-making the year after they lost the contract.

They were able to adapt and recover and no longer rely on airport locations. Back then they also launched a tender offer, offering to buy 1 of every 6 shares (ie 16.67%) If you had taken up the tender offer at 63p per share in 2011, you would have regretted it, even after the difficult year BOTB has had, the new tender offer is 9.5x higher than the level a decade ago.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.