Platforms have made it easier for retail shareholders to vote at company AGMs, remuneration committees should take note. Plus a look at the computer games sector: TM17, TBLD, KWS and a couple of financials AQX and BUR.

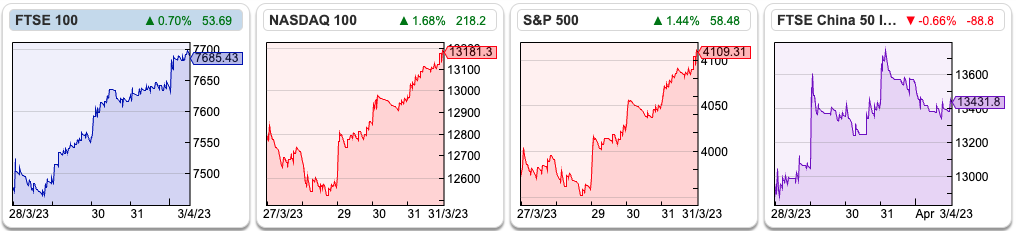

The FTSE 100 rose to 7,685 last week, an increase of +2.9%. The Nasdaq100 and the S&P500 were up +3.3% and +3.5% respectively. Brent Crude was up +8% to $82 a barrel in the last 5 days, as Opec+ nations said that they would cut production by 1m barrels. Both the US and UK 10y government bonds have converged to yielding 3.5%.

There’s an interesting article in MoneyWeek about how platforms such as Hargreaves Lansdown, AJ Bell and Interactive Investor are making it easier for investors to vote at AGMs. That seems to me a positive trend, though might be viewed with mixed feelings by any remuneration committee. In the past, there’s been a feeling that professional fund managers find it hard to police the pay awards of corporate management, not least as fund managers can sometimes be richly rewarded for poor performance too! Amateur investors, who earn closer to the average salary, are more likely to vote against rewards for failure.

So, it’s interesting to see a list of shares which received the most retail AGM votes and compare it to their share price performance over the last 5 years: Lloyds (-26%), BP (+6%), GSK (0%), Aviva (-17%), Vodafone (-54%). I don’t think the Chief Execs should be paid many millions for delivering that kind of lacklustre performance. Merryn Somerset Webb (who used to be editor of MoneyWeek) has published a book, Share Power, suggesting that ordinary people can change the way capitalism works, while at the same time making money.

This week I look at computer game companies, recently listed tinyBuild plus Team17 and Keywords Studios. I start with Burford’s case against Argentina for expropriating an oil company and finish with Aquis Exchange.

Burford Summary Court Judgement

The Southern District Court of New York has released a judgement, saying that Burford does have a liability against the Argentinian government, but not against YPF itself, the oil company that is the centre of the dispute. This is a claim by two shareholders in YPF (Petersen and Eton Park) that Burford is funding saying that Argentina breached their obligations under YPF’s by-laws to buy out all other shareholders when the oil company was nationalised.

Argentina has already settled with Repsol, the Spanish oil company, which was a 51% majority owner of YPF. Originally Repsol management were looking for over $10bn, but settled for $5bn from Argentina rather than face a long, drawn-out court battle.

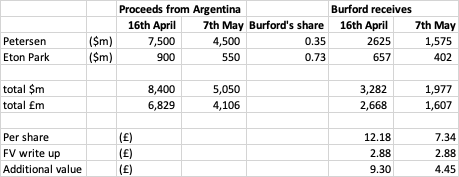

Petersen, who Burford are representing, owned 25% of YPF. Later, Burford sold down their interest but bought Eton Park’s (the third largest shareholder in YPF) stake, making an advance of $21m in return for 73% of the proceeds if the case wins, net of expenses. The damages will be paid in US dollars, not Argentinian pesos – which was one suggestion that the Financial Times had lent weight to. The case needs to go to court to determine the correct level of interest rates to apply, and when Argentina expropriated YPF from shareholders: either 16th April 2012, when the Presidential decree was implemented or 7th May, when there was legislature follow-up action.

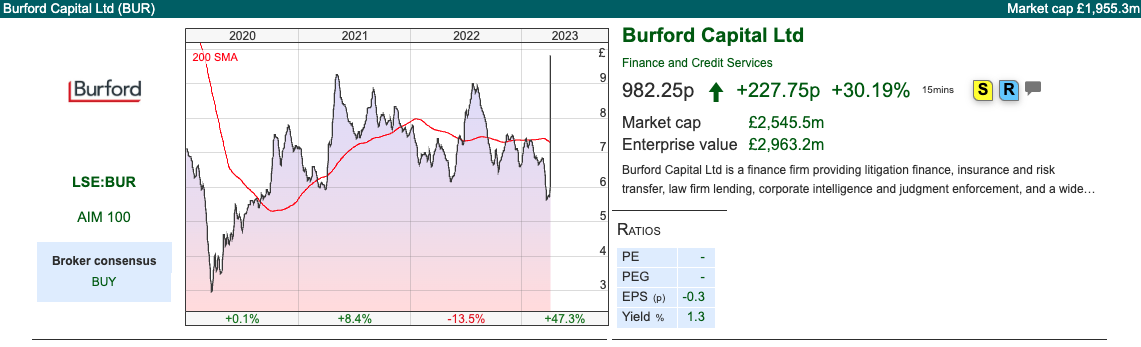

Currently, the YPF asset is valued at $777m (or 288p per share) of which $50m was cost and $727m was an unrealised fair value gain. I have made a table showing the different outcomes, though it should be noted that this is before interest.

So, the court case needs to be heard and then Argentina will almost certainly appeal the decision. Burford also cautions that disputes often resolve for considerably less than the amount of the judgement rendered by the courts.

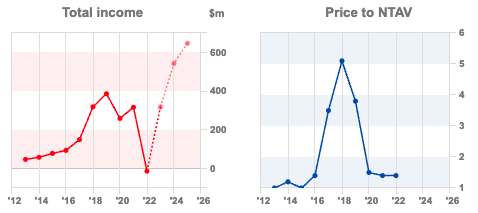

Opinion: This is obviously good news, with the shares responding +30% on Friday before being suspended then a further +30% on Monday to above £10. I own it. As well as the circa £5-10 value per share of value BUR could receive, I think that this validates the litigation finance business model and (to a lesser extent) management’s decision to write up the fair value of the asset. BUR is a business that the market really struggles to value, but assuming that the news continues to be positive, this ought to be a source of returns uncorrelated with whatever the rest of the stockmarket is doing.

I also wonder if this case has implications for the $16bn of Credit Suisse Additional Tier 1 owners, who saw their holdings written down by the Federal Council of Switzerland last month.

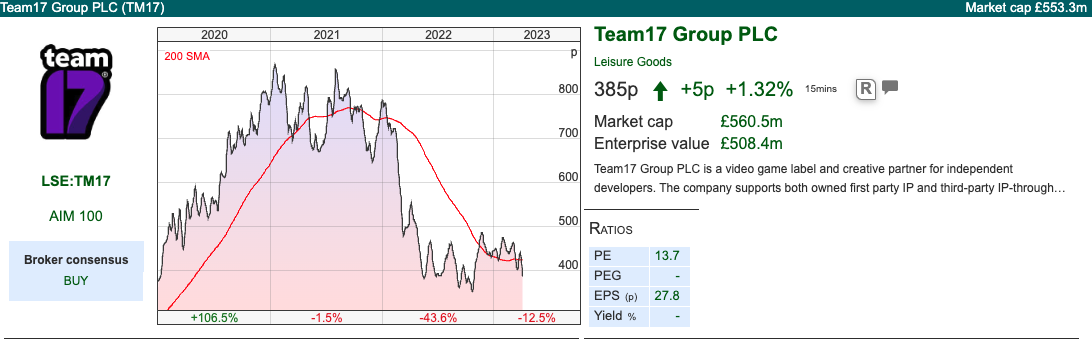

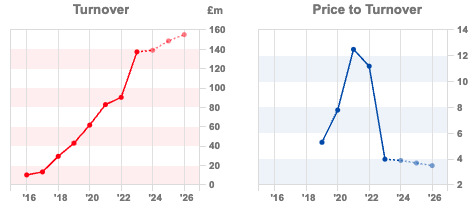

Team17 FY Dec Results

This computer games company put out FY results and announced that Chief Exec Debbie Bestwick would step down. A successor has not been announced, and she will continue to run the business in the meantime. She will then become a Non-Exec, so it sounds like she will keep her 21% shareholding, rather than being a large seller in the market.

The results themselves looked impressive at first glance, with revenue growth +52%, a gross profit margin of 51% and cash of £51m. However, that was helped by three acquisitions in January last year (Hell Let Loose, Astragon, and The Label). Organic like-for-like revenues grew just +3%, I think this could be why the shares reacted down -9% on the morning of the RNS.

Outlook statement: Management sounds a little cautious, citing global macroeconomic pressures. They do still expect to deliver their growth plans, without giving any detail. In September they talked about an H2 weighting for results (which tends to make investors nervous) but then delivered a “significantly ahead of market expectations” of adjusted EBITDA in a trading update in mid-January.

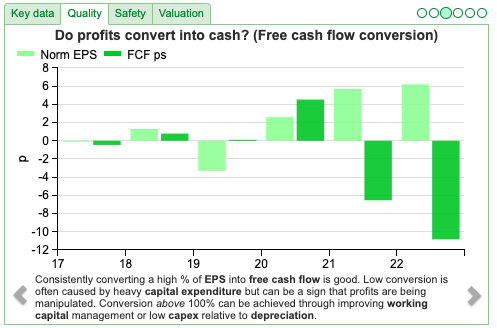

However, there is a significant difference between adjusted EBITDA of £48.8m (up +36%) and reported PBT £28.7m (down -2%). There were £9.2m of acquisition-related costs, which is fair enough to exclude. There were also £26m of capitalised development costs (almost treble the figure last year) which didn’t go through the p&l. That is the correct accounting treatment (computer games are software developed for external users) but is nonetheless a real cash cost. The company says a high proportion will be written off in the 12 months after the games that have been developed are released.

Also worth noting that both Frontier Developments (-53% YTD) and tinyBuild (-58% YTD) have disappointed this year, so, understandably, investors are cautious.

Share count: The year-end number of shares increased by +11%. 2m shares were issued as part of the initial consideration to Hell Let Loose management and 11m shares were placed at 714p to raise £78.6m to support the acquisition of Astragon. Debbie Bestwick exercised just under 1m new shares, following options that she received as part of the IPO. Before last year the number of shares had stayed constant from the IPO in May 2018, so historically the company hasn’t relied on issuing paper to grow revenue and profits.

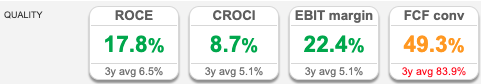

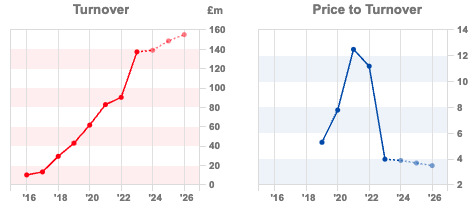

Valuation: The shares are trading on a PER of between 13 to 14x FY Dec 2024F and FY Dec 2025F. The company’s RoCE of 16% and EBIT margin of 24% are below the 3-year average, suggesting that now is the correct time in the cycle to be looking at investing, rather than when the company is reporting strong growth and peak margins.

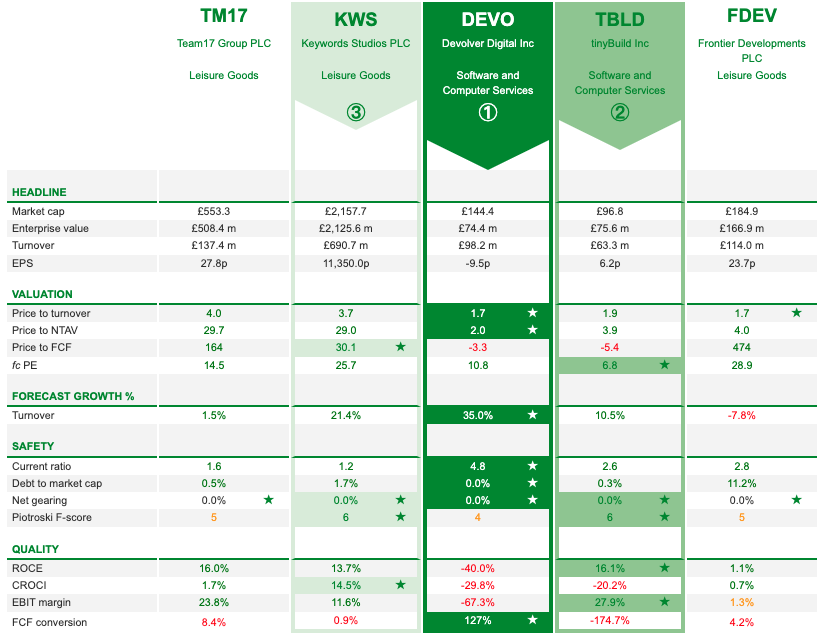

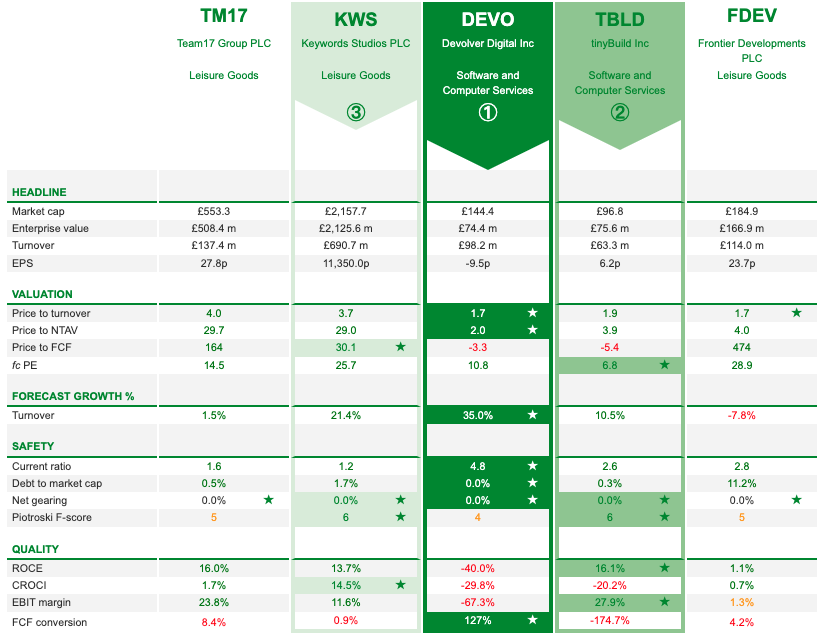

Opinion: I last wrote about the company here. The whole sector has been sold off very sharply from the pandemic highs. TM17 looks to be a quality company, however, it’s trading on 4x revenues, versus the likes of DEVO, TBLD and FDEV that are all trading on below 2x the same multiple. I look at the TBLD results below.

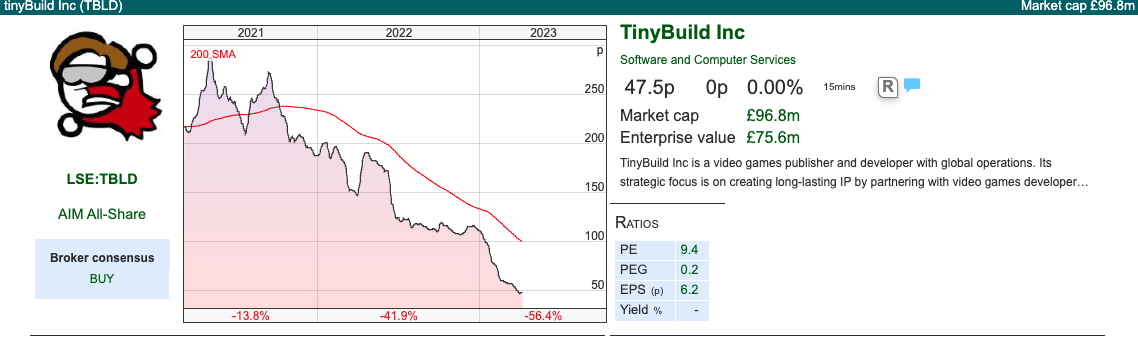

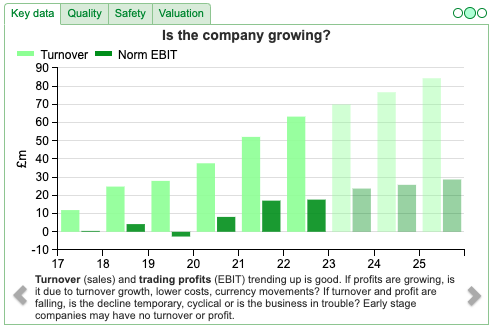

tinybuild FY Dec Results

This US headquartered computer games publisher founded in 2013 also published FY results. They listed on AIM in March 2021; given that timing and that the USA has well-functioning capital markets with investors that understand computer games companies, I’m immediately sceptical of why they have come to list in the UK. The share price is down c. -75% from 169p IPO price, meaning that TBLD is one of those pandemic IPOs with disappointing performance from my filter last month.

Some of the sell-off is not their fault; they bought development studios in Ukraine (Hologryph LLC, October 2020) and in Russia (Moom Moose, Nov 2020 and Hungry Couch, Feb 2021). They have successfully relocated over a hundred people from those countries and set up a new studio in Belgrade in response to the war. That’s one-fifth of the entire company. Putting the past overvaluation aside, and starting from where we are now, I think this could now be worth looking at as the track record of revenue and profits looks impressive.

Revenue was +21% to $63m FY Dec 2022. They have grown by acquisitions, and don’t split out how much of that revenue growth is organic, however, they do say that 80% of revenue comes from the back catalogue, rather than games released in 2022. PBT was +27% to $15.9m. Despite the profits, net cash fell -46% to $26m reflecting development costs (up 2.4x to $36m) which weren’t expensed through the p&l and a $4m payment for an acquisition. Just to emphasize, the accounting treatment is correct, but investors need to be aware that reported profits or adj EBITDA (+10%) in this sector often don’t accurately reflect the reality of cash.

History: The company was founded in the Netherlands, before moving its headquarters to the USA. TBLD started out as an independent game developer, before quickly moving into publishing other people’s games in their first year. They were early to see the opportunity of influencer-based marketing of games before this became mainstream. The strength seems to be in Eastern Europe and South America, where developers are cheaper and the coverage by publishers is lower. They IPO’ed at 169p, with selling shareholders receiving £118m and the company receiving £29m of new money. On admission, the market cap was £340m.

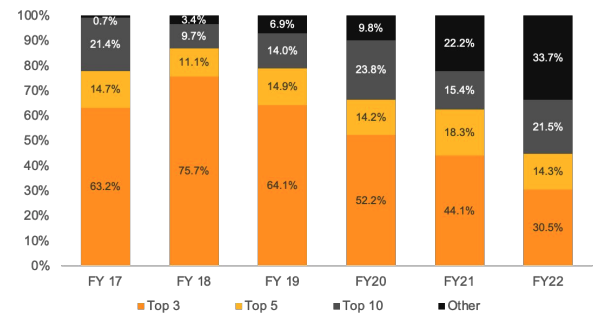

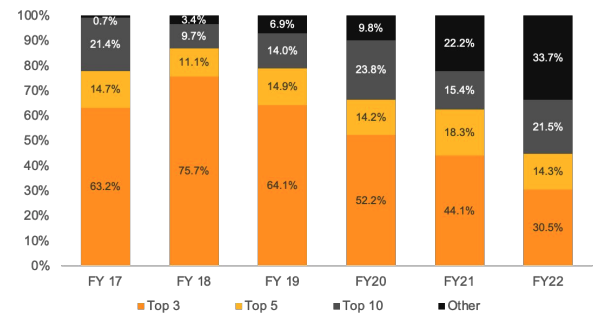

They currently have over 80 games, with the top 3 representing just under a third of FY revenue (down from almost 2/3 in 2017).

Founder: The founder, Alex Ņičiporčiks, became a professional gamer when 13 years old. He then worked as a games’ journalist, then producer, and then in marketing. tinyBuild bought a 49% stake in a games conference organiser (DevGAMM) in 2017, while his wife, Lerika Mallayeva, still owns 51%. At the IPO he sold 33m shares, worth £56m, but still owns 76m or 37.8% of the shares.

He started the company in his early 20’s and is still only in his early 30’s. Like Morgan Tillbrook at Alpha Group, he communicates in an idiosyncratic style in the management commentary and I would say that he sounds like an interesting character:

Balance sheet: As you would expect for people business growing by acquisitions, the balance sheet is top heavy with intangible assets: $80m versus shareholders’ equity of $111m. The intangible assets would have been higher, but they wrote down $11m relating to two previous acquisitions (Versus Evil and Red Cerberus) with a corresponding decrease in contingent consideration (to zero), which is helpfully split out separately on the face of the balance sheet. One other thing to note is that they have a US auditor, Clark Nuber, who I haven’t heard of before.

Shareholders: Aside from the founder Alex Ņičiporčiks with his 37.8% stake, Swedbank Robur, who also owns KWS and FDEV) own 8%. Luke Burtis, the COO who has just announced he is stepping down, owns 7% which may create an overhang. However, he did sell £23m worth of shares at the IPO, so I imagine that he probably doesn’t need the money unless the ‘cost of living’ crisis has got really bad. NetEase, the Hong Kong based computer game company, owned 14% pre-IPO and 6% today. Premier Miton bought 4.7% at the IPO but appears to have cut their losses.

Outlook: Management expects net cash to decline in H1 this year, as they continue to invest in new games but to rise above the Dec 2022 $26.5m (unless they buy more studios). They released 9 titles last year, and talk about a strong pipeline for this year.

Valuation: The shares are trading on 6x Dec 2024F and 2025F. On a price-to-revenue multiple, they’re on 1.6x 2024F. Looking at Sharepad’s forecasts suggests $11m of free cashflow in 2024F, but then dropping to below $5m in 2025F.

Opinion: Looks interesting. I think I would need to do more work to understand the business, but in general, I feel like IPO’s that have fallen in value 80% in the last two years are not a bad place to look when fishing for bargains.

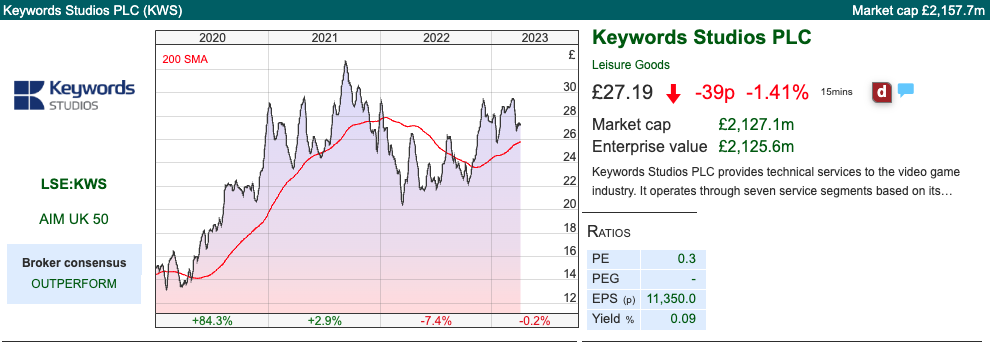

Keywords Studios Acquisition

Last week this computer games translation and technical support services company announced a $100m acquisition ($68m initial consideration, of which $57m cash, $11m shares; then deferred consideration of $32m in a mix of cash and shares). That equates to 3x historic revenues. They are funding this by drawing down their €150m revolving credit facility and issuing new shares. The company they are buying is called DMM, a Los Angeles headquartered social media marketing agency, founded in 2010. A couple of weeks ago, KWS released FY results. I didn’t cover them at the time, so I will give a quick update below.

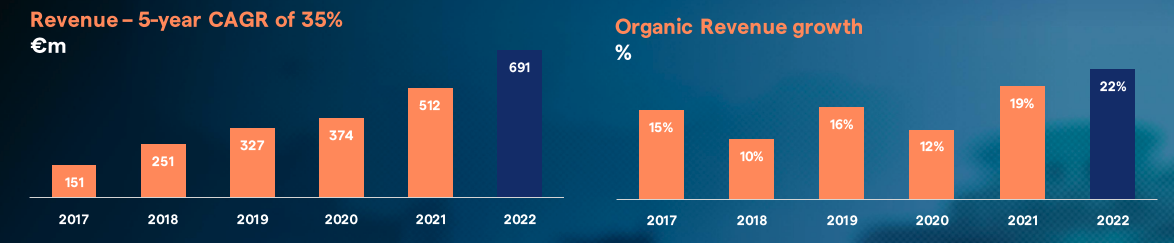

Keywords Studios reported revenues +35% to €691m and adj PBT +30%. The company made five acquisitions last year costing €140m, but on an organic basis revenue growth was still impressive +22%. They had €82m net cash as of Dec 2022, although given last week’s acquisition that will have reduced now.

Outlook: They expect organic growth to moderate from the +22% just reported, but remain above medium-term guidance of +10%. Adj PBT margin to be 15% (down from 16% just reported) in FY 2023F, excluding higher interest costs from any debt used to fund acquisitions.

Valuation: Given we don’t know how many shares they are issuing, it’s hard to know what the EPS is likely to be. Sharepad has a PER of 23x Dec 2024F and 21x Dec 2025F, which will include brokers’ estimates from the results, but not last week’s acquisition. They are on 2.7x 2024F revenues. Note the comparably low 3-year average RoCE and EBIT margin (both below 10%) which suggests investors are paying a premium price compared to the other games companies.

Opinion: A remarkable performance for a company that reported just €16m of revenue when they IPO’ed a decade ago. They have expanded both geographically and into adjacent services from localisation: artwork, games marketing, functional testing, audio, player support and development. Perhaps the rating is justifiable because the organic revenue has equated to +15% CAGR since the IPO? However, having sold too early, it’s psychologically hard for me to buy back in at a much higher price. Below I show a comparison table of the sector.

Aquis Exchange FY results

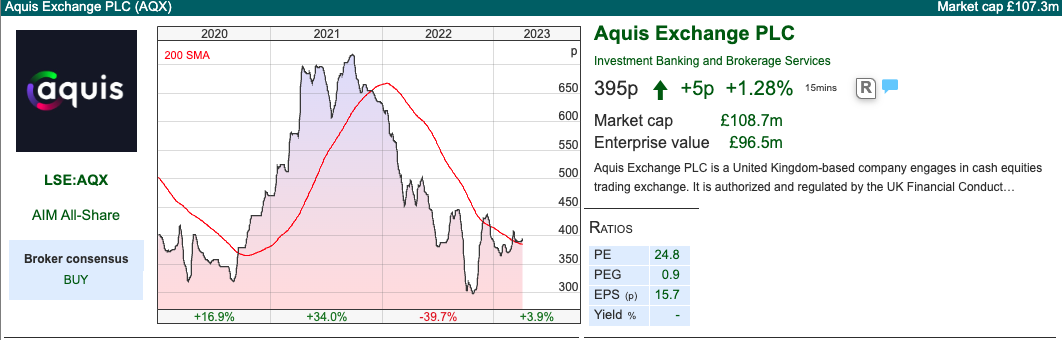

A brief mention of this exchange, because despite revenue doubling in the last two years, the share price is the same level as when I last wrote about AQX in October 2020. A reminder that valuation matters!

Last week the company reported revenue +24% to £20m, PBT +24% to £4.5m. Profit hasn’t converted into a respective increase in cash as there was £1.5m cash used in investing activities (split 50/50 between intangible assets and PPE) and a £2m loan to the Employee Benefit Trust. They had £14m of net cash on their balance sheet at the end of last year. Despite difficult market conditions, that have hurt brokers like finnCap, Cenkos, Peel Hunt and Numis, AQX saw 22 new IPOs in 2022. That compares to 15 IPOs on AIM in 2022. Aquis has even managed to do three IPOs this year, and management claim to have a ‘pipeline’ of 50 companies.

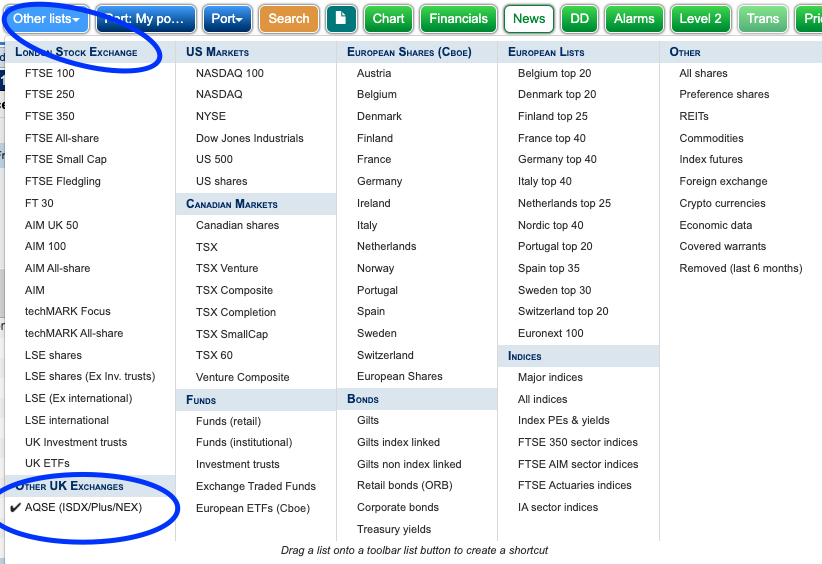

Sharepad has data on the companies listed on their exchange, which used to be called Plus Markets, if you click on the drop-down “other lists” and then at the bottom left “Other UK Exchanges”. Their exchange does contain many speculative growth companies, but also some well-established family-owned businesses like Adnams Brewery, which was my first “ten bagger”. There’s been a brewery in Southwold since before the Black Death, so I’m fairly sure Adnams will be around for a few more years.

Ownership: Stock Exchanges are natural monopolies with network effects. One way to prevent price gouging is for them to be owned by their users (similar to the foundations of Rightmove and Visa, which were both originally owned by estate agents and banks respectively). Interestingly the algorithmic trading firm XTX owns 9.5% of AQX, Rich Ricci (ex Barclays Capital) 7.8%, Canaccord own 5.4%, Schroders 4.6%, Rathbones 4.3%.

Valuation: AQS shares are now trading on a PER of 16x Dec 2024F and 15x Dec 2025. That’s still not a value stock, but it does suggest to me that it could be classified Growth at a Reasonable Price (GARP).

Opinion: Aquis has an unusual business model, Aquis charging for message traffic rather than taking a cut of each trade on the exchange. I haven’t quite worked out the strengths and weaknesses of that, but flag this as now have a more reasonable valuation.

Notes

The author owns shares in Adnams, Burford and Frontier Developments

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 04/04/23 | TM17, TBLD, KWS, AQX, BUR | Platforms for shareholder democracy

Platforms have made it easier for retail shareholders to vote at company AGMs, remuneration committees should take note. Plus a look at the computer games sector: TM17, TBLD, KWS and a couple of financials AQX and BUR.

The FTSE 100 rose to 7,685 last week, an increase of +2.9%. The Nasdaq100 and the S&P500 were up +3.3% and +3.5% respectively. Brent Crude was up +8% to $82 a barrel in the last 5 days, as Opec+ nations said that they would cut production by 1m barrels. Both the US and UK 10y government bonds have converged to yielding 3.5%.

There’s an interesting article in MoneyWeek about how platforms such as Hargreaves Lansdown, AJ Bell and Interactive Investor are making it easier for investors to vote at AGMs. That seems to me a positive trend, though might be viewed with mixed feelings by any remuneration committee. In the past, there’s been a feeling that professional fund managers find it hard to police the pay awards of corporate management, not least as fund managers can sometimes be richly rewarded for poor performance too! Amateur investors, who earn closer to the average salary, are more likely to vote against rewards for failure.

So, it’s interesting to see a list of shares which received the most retail AGM votes and compare it to their share price performance over the last 5 years: Lloyds (-26%), BP (+6%), GSK (0%), Aviva (-17%), Vodafone (-54%). I don’t think the Chief Execs should be paid many millions for delivering that kind of lacklustre performance. Merryn Somerset Webb (who used to be editor of MoneyWeek) has published a book, Share Power, suggesting that ordinary people can change the way capitalism works, while at the same time making money.

This week I look at computer game companies, recently listed tinyBuild plus Team17 and Keywords Studios. I start with Burford’s case against Argentina for expropriating an oil company and finish with Aquis Exchange.

Burford Summary Court Judgement

The Southern District Court of New York has released a judgement, saying that Burford does have a liability against the Argentinian government, but not against YPF itself, the oil company that is the centre of the dispute. This is a claim by two shareholders in YPF (Petersen and Eton Park) that Burford is funding saying that Argentina breached their obligations under YPF’s by-laws to buy out all other shareholders when the oil company was nationalised.

Argentina has already settled with Repsol, the Spanish oil company, which was a 51% majority owner of YPF. Originally Repsol management were looking for over $10bn, but settled for $5bn from Argentina rather than face a long, drawn-out court battle.

Petersen, who Burford are representing, owned 25% of YPF. Later, Burford sold down their interest but bought Eton Park’s (the third largest shareholder in YPF) stake, making an advance of $21m in return for 73% of the proceeds if the case wins, net of expenses. The damages will be paid in US dollars, not Argentinian pesos – which was one suggestion that the Financial Times had lent weight to. The case needs to go to court to determine the correct level of interest rates to apply, and when Argentina expropriated YPF from shareholders: either 16th April 2012, when the Presidential decree was implemented or 7th May, when there was legislature follow-up action.

Currently, the YPF asset is valued at $777m (or 288p per share) of which $50m was cost and $727m was an unrealised fair value gain. I have made a table showing the different outcomes, though it should be noted that this is before interest.

So, the court case needs to be heard and then Argentina will almost certainly appeal the decision. Burford also cautions that disputes often resolve for considerably less than the amount of the judgement rendered by the courts.

Opinion: This is obviously good news, with the shares responding +30% on Friday before being suspended then a further +30% on Monday to above £10. I own it. As well as the circa £5-10 value per share of value BUR could receive, I think that this validates the litigation finance business model and (to a lesser extent) management’s decision to write up the fair value of the asset. BUR is a business that the market really struggles to value, but assuming that the news continues to be positive, this ought to be a source of returns uncorrelated with whatever the rest of the stockmarket is doing.

I also wonder if this case has implications for the $16bn of Credit Suisse Additional Tier 1 owners, who saw their holdings written down by the Federal Council of Switzerland last month.

Team17 FY Dec Results

This computer games company put out FY results and announced that Chief Exec Debbie Bestwick would step down. A successor has not been announced, and she will continue to run the business in the meantime. She will then become a Non-Exec, so it sounds like she will keep her 21% shareholding, rather than being a large seller in the market.

The results themselves looked impressive at first glance, with revenue growth +52%, a gross profit margin of 51% and cash of £51m. However, that was helped by three acquisitions in January last year (Hell Let Loose, Astragon, and The Label). Organic like-for-like revenues grew just +3%, I think this could be why the shares reacted down -9% on the morning of the RNS.

Outlook statement: Management sounds a little cautious, citing global macroeconomic pressures. They do still expect to deliver their growth plans, without giving any detail. In September they talked about an H2 weighting for results (which tends to make investors nervous) but then delivered a “significantly ahead of market expectations” of adjusted EBITDA in a trading update in mid-January.

However, there is a significant difference between adjusted EBITDA of £48.8m (up +36%) and reported PBT £28.7m (down -2%). There were £9.2m of acquisition-related costs, which is fair enough to exclude. There were also £26m of capitalised development costs (almost treble the figure last year) which didn’t go through the p&l. That is the correct accounting treatment (computer games are software developed for external users) but is nonetheless a real cash cost. The company says a high proportion will be written off in the 12 months after the games that have been developed are released.

Also worth noting that both Frontier Developments (-53% YTD) and tinyBuild (-58% YTD) have disappointed this year, so, understandably, investors are cautious.

Share count: The year-end number of shares increased by +11%. 2m shares were issued as part of the initial consideration to Hell Let Loose management and 11m shares were placed at 714p to raise £78.6m to support the acquisition of Astragon. Debbie Bestwick exercised just under 1m new shares, following options that she received as part of the IPO. Before last year the number of shares had stayed constant from the IPO in May 2018, so historically the company hasn’t relied on issuing paper to grow revenue and profits.

Valuation: The shares are trading on a PER of between 13 to 14x FY Dec 2024F and FY Dec 2025F. The company’s RoCE of 16% and EBIT margin of 24% are below the 3-year average, suggesting that now is the correct time in the cycle to be looking at investing, rather than when the company is reporting strong growth and peak margins.

Opinion: I last wrote about the company here. The whole sector has been sold off very sharply from the pandemic highs. TM17 looks to be a quality company, however, it’s trading on 4x revenues, versus the likes of DEVO, TBLD and FDEV that are all trading on below 2x the same multiple. I look at the TBLD results below.

tinybuild FY Dec Results

This US headquartered computer games publisher founded in 2013 also published FY results. They listed on AIM in March 2021; given that timing and that the USA has well-functioning capital markets with investors that understand computer games companies, I’m immediately sceptical of why they have come to list in the UK. The share price is down c. -75% from 169p IPO price, meaning that TBLD is one of those pandemic IPOs with disappointing performance from my filter last month.

Some of the sell-off is not their fault; they bought development studios in Ukraine (Hologryph LLC, October 2020) and in Russia (Moom Moose, Nov 2020 and Hungry Couch, Feb 2021). They have successfully relocated over a hundred people from those countries and set up a new studio in Belgrade in response to the war. That’s one-fifth of the entire company. Putting the past overvaluation aside, and starting from where we are now, I think this could now be worth looking at as the track record of revenue and profits looks impressive.

Revenue was +21% to $63m FY Dec 2022. They have grown by acquisitions, and don’t split out how much of that revenue growth is organic, however, they do say that 80% of revenue comes from the back catalogue, rather than games released in 2022. PBT was +27% to $15.9m. Despite the profits, net cash fell -46% to $26m reflecting development costs (up 2.4x to $36m) which weren’t expensed through the p&l and a $4m payment for an acquisition. Just to emphasize, the accounting treatment is correct, but investors need to be aware that reported profits or adj EBITDA (+10%) in this sector often don’t accurately reflect the reality of cash.

History: The company was founded in the Netherlands, before moving its headquarters to the USA. TBLD started out as an independent game developer, before quickly moving into publishing other people’s games in their first year. They were early to see the opportunity of influencer-based marketing of games before this became mainstream. The strength seems to be in Eastern Europe and South America, where developers are cheaper and the coverage by publishers is lower. They IPO’ed at 169p, with selling shareholders receiving £118m and the company receiving £29m of new money. On admission, the market cap was £340m.

They currently have over 80 games, with the top 3 representing just under a third of FY revenue (down from almost 2/3 in 2017).

Founder: The founder, Alex Ņičiporčiks, became a professional gamer when 13 years old. He then worked as a games’ journalist, then producer, and then in marketing. tinyBuild bought a 49% stake in a games conference organiser (DevGAMM) in 2017, while his wife, Lerika Mallayeva, still owns 51%. At the IPO he sold 33m shares, worth £56m, but still owns 76m or 37.8% of the shares.

He started the company in his early 20’s and is still only in his early 30’s. Like Morgan Tillbrook at Alpha Group, he communicates in an idiosyncratic style in the management commentary and I would say that he sounds like an interesting character:

Balance sheet: As you would expect for people business growing by acquisitions, the balance sheet is top heavy with intangible assets: $80m versus shareholders’ equity of $111m. The intangible assets would have been higher, but they wrote down $11m relating to two previous acquisitions (Versus Evil and Red Cerberus) with a corresponding decrease in contingent consideration (to zero), which is helpfully split out separately on the face of the balance sheet. One other thing to note is that they have a US auditor, Clark Nuber, who I haven’t heard of before.

Shareholders: Aside from the founder Alex Ņičiporčiks with his 37.8% stake, Swedbank Robur, who also owns KWS and FDEV) own 8%. Luke Burtis, the COO who has just announced he is stepping down, owns 7% which may create an overhang. However, he did sell £23m worth of shares at the IPO, so I imagine that he probably doesn’t need the money unless the ‘cost of living’ crisis has got really bad. NetEase, the Hong Kong based computer game company, owned 14% pre-IPO and 6% today. Premier Miton bought 4.7% at the IPO but appears to have cut their losses.

Outlook: Management expects net cash to decline in H1 this year, as they continue to invest in new games but to rise above the Dec 2022 $26.5m (unless they buy more studios). They released 9 titles last year, and talk about a strong pipeline for this year.

Valuation: The shares are trading on 6x Dec 2024F and 2025F. On a price-to-revenue multiple, they’re on 1.6x 2024F. Looking at Sharepad’s forecasts suggests $11m of free cashflow in 2024F, but then dropping to below $5m in 2025F.

Opinion: Looks interesting. I think I would need to do more work to understand the business, but in general, I feel like IPO’s that have fallen in value 80% in the last two years are not a bad place to look when fishing for bargains.

Keywords Studios Acquisition

Last week this computer games translation and technical support services company announced a $100m acquisition ($68m initial consideration, of which $57m cash, $11m shares; then deferred consideration of $32m in a mix of cash and shares). That equates to 3x historic revenues. They are funding this by drawing down their €150m revolving credit facility and issuing new shares. The company they are buying is called DMM, a Los Angeles headquartered social media marketing agency, founded in 2010. A couple of weeks ago, KWS released FY results. I didn’t cover them at the time, so I will give a quick update below.

Keywords Studios reported revenues +35% to €691m and adj PBT +30%. The company made five acquisitions last year costing €140m, but on an organic basis revenue growth was still impressive +22%. They had €82m net cash as of Dec 2022, although given last week’s acquisition that will have reduced now.

Outlook: They expect organic growth to moderate from the +22% just reported, but remain above medium-term guidance of +10%. Adj PBT margin to be 15% (down from 16% just reported) in FY 2023F, excluding higher interest costs from any debt used to fund acquisitions.

Valuation: Given we don’t know how many shares they are issuing, it’s hard to know what the EPS is likely to be. Sharepad has a PER of 23x Dec 2024F and 21x Dec 2025F, which will include brokers’ estimates from the results, but not last week’s acquisition. They are on 2.7x 2024F revenues. Note the comparably low 3-year average RoCE and EBIT margin (both below 10%) which suggests investors are paying a premium price compared to the other games companies.

Opinion: A remarkable performance for a company that reported just €16m of revenue when they IPO’ed a decade ago. They have expanded both geographically and into adjacent services from localisation: artwork, games marketing, functional testing, audio, player support and development. Perhaps the rating is justifiable because the organic revenue has equated to +15% CAGR since the IPO? However, having sold too early, it’s psychologically hard for me to buy back in at a much higher price. Below I show a comparison table of the sector.

Aquis Exchange FY results

A brief mention of this exchange, because despite revenue doubling in the last two years, the share price is the same level as when I last wrote about AQX in October 2020. A reminder that valuation matters!

Last week the company reported revenue +24% to £20m, PBT +24% to £4.5m. Profit hasn’t converted into a respective increase in cash as there was £1.5m cash used in investing activities (split 50/50 between intangible assets and PPE) and a £2m loan to the Employee Benefit Trust. They had £14m of net cash on their balance sheet at the end of last year. Despite difficult market conditions, that have hurt brokers like finnCap, Cenkos, Peel Hunt and Numis, AQX saw 22 new IPOs in 2022. That compares to 15 IPOs on AIM in 2022. Aquis has even managed to do three IPOs this year, and management claim to have a ‘pipeline’ of 50 companies.

Sharepad has data on the companies listed on their exchange, which used to be called Plus Markets, if you click on the drop-down “other lists” and then at the bottom left “Other UK Exchanges”. Their exchange does contain many speculative growth companies, but also some well-established family-owned businesses like Adnams Brewery, which was my first “ten bagger”. There’s been a brewery in Southwold since before the Black Death, so I’m fairly sure Adnams will be around for a few more years.

Ownership: Stock Exchanges are natural monopolies with network effects. One way to prevent price gouging is for them to be owned by their users (similar to the foundations of Rightmove and Visa, which were both originally owned by estate agents and banks respectively). Interestingly the algorithmic trading firm XTX owns 9.5% of AQX, Rich Ricci (ex Barclays Capital) 7.8%, Canaccord own 5.4%, Schroders 4.6%, Rathbones 4.3%.

Valuation: AQS shares are now trading on a PER of 16x Dec 2024F and 15x Dec 2025. That’s still not a value stock, but it does suggest to me that it could be classified Growth at a Reasonable Price (GARP).

Opinion: Aquis has an unusual business model, Aquis charging for message traffic rather than taking a cut of each trade on the exchange. I haven’t quite worked out the strengths and weaknesses of that, but flag this as now have a more reasonable valuation.

Notes

The author owns shares in Adnams, Burford and Frontier Developments

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.