Bruce suggests that the nature of cross border capital flows might present an opportunity in front of our eyes, in FTSE and AIM stocks. Companies covered LGEN, JUST and TRMR.

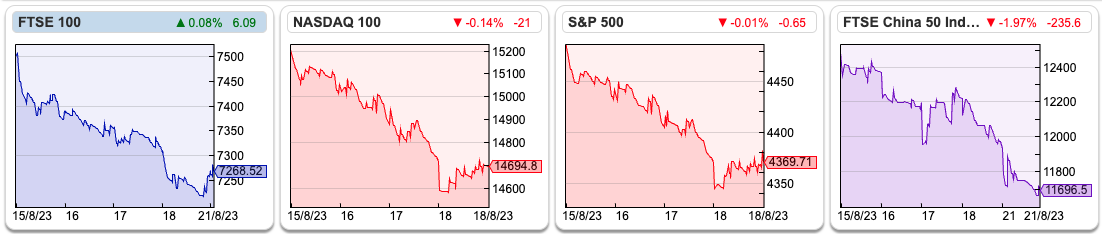

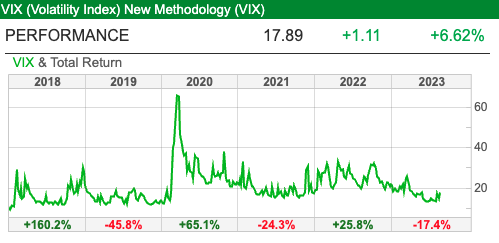

Last week I suggested that with the VIX below 16, some complacency might be creeping back into markets. Right on cue, the FTSE 100 fell -3.2% to 7,288, while the Nasdaq100 was down -2.2% and the S&P500 fell -2.1%. The VIX, measuring volatility rose +13% to 18. Last week I also suggested that cross border flows of capital from countries with a trade surplus played a role in the 2007-9 financial crisis. Once again it looks like liquidity is draining away, one difference though is that the nature of the cross-border assets has changed.

In the previous crisis it was AAA rated debt securities, but the most obvious of the new cross border flows are now in equity. An obvious example is the trophy assets like football teams (Newcastle Town FC, Paris St Germain, Manchester City and perhaps Manchester United if the Glazers ever decide to sell). Qatar’s $450bn Sovereign Wealth Fund the QIA owns Harrods, the Shard, the stockbroker Panmure Gordon and a large stake in Canary Wharf. None of these investments are accessible to private investors, but in any case, they do not look particularly shrewd at the moment.

For contrast Saudia Arabia’s SWF, often in partnership with the $100bn Soft Bank Vision Fund, owns equity in companies like Uber. I came across this blog post from former equity research technology analyst Jonathan Crosier on his Crow Knows blog. He says that in the last five years Uber has made operating losses of $22.2 billion on revenues of $85.9 billion. The Saudis, via the Vision Fund, also backed New York listed, loss making food delivery company DoorDash and rented office start-up WeWork. This FT Alphaville article suggests that most venture capital investments lose money. Lex Greensill also seems to have courted the Saudi’s money.

So, if pre-2008 cross border debt resulted in cheaper mortgages for households in trade deficit nations, post-2008 financial crisis the benefit of cross border flows seems to have gone to anyone with a half-baked start-up idea and ultimately to consumers who use riding hailing, co-working spaces and food delivery apps. Many of these businesses are loss making, with unit economics that imply they will continue to be so. That’s bad news for the Gulf states funding “moonshots”, but perhaps good for the rest of us who enjoy watching more entertaining football.

For contrasts there are 150 companies in the FTSE 350 trading on less than 12x forecast PER, and 105 companies in the same index on a dividend yield of 5% or higher. Private investors don’t need access to the smartest VC deals, or worry about the lack of listed football clubs on the UK stockmarket. Instead, the low PER and high dividend yields on AIM and FTSE, suggests to me that market weakness could present us will an opportunity in plain sight. It still feels to me early, but I am certainly on the lookout for bargains.

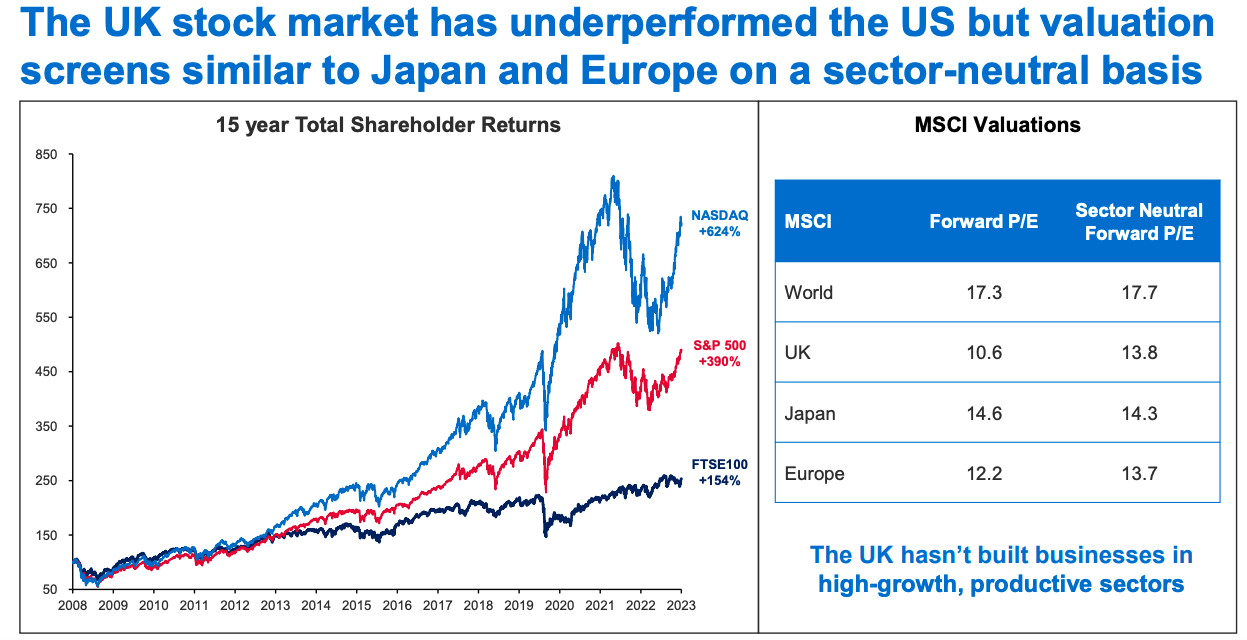

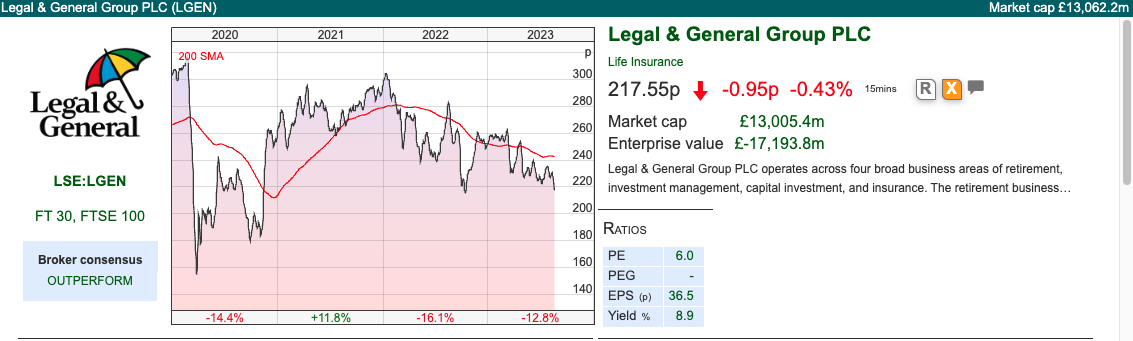

An example is LGEN’s results, which I look at below. One slide from the LGEN presentation pack jumped out at me, showing the performance of UK markets versus the USA. Some of this is due to the FTSE 100 unfashionable constituents like banks, oil companies, tobacco and ‘last century’ TMT stocks like Vodafone and Pearson. However, LGEN’s slide shows that even adjusting for a sector neutral stance, there was still 22% discount (17.7x PER v 13.8x PER) versus the MSCI World Index. Those numbers suggest that we don’t need to hunt very far to find attractive value, in my opinion it’s under our noses on the FTSE and AIM.

Aside from LGEN, other stocks covered below are mortgage equity withdrawal company JUST and AdTech company TRMR.

LGEN H1 Jun 2023

Legal & General reported Operating PBT down -2% to £941m for H1 to Jun. However, taking account a fair value decline in their investments, profit attributable to shareholders and EPS fell -45% to £316m and -46% to 5.2p respectively. The group reported RoE of 13% including that FV decline, but without the unrealised mark to market loss, RoE would have been an eye catching 37% in H1.

The basic rule of thumb when thinking about banks and insurance companies is that there is an asymmetry of uncertainty on the balance sheet. Banks have long term assets (mortgages, corporate loans) of uncertain value, they fund these with customer deposits and interbank funding, and these shor-term liabilities are easy to calculate. On the other hand, insurers have uncertain long-term liabilities (annuities, policy holder payouts) which they meet with investments on the asset side of the balance sheet, which are reasonably easy to calculate on a fair value basis.

Hence, when prices fall, insurers record a negative investment variance through their p&l. In normal times, investors tend to look through this, as the expected return ought to be positive through the cycle. We don’t always have normal times in financial markets though (for instance TMT markets crash 2000-3, GFC 2007-9). At the point of stress, the investment variance becomes so large that investors fear insurers may need to raise capital at the worst point in the cycle. In 2009, when LGEN’s share price fell below 30p there was a specific fear about exposure to troubled banks subordinated debt. As it turned out, those fears were not realised and the falling long bond yield was very helpful for LGEN’s dividend.

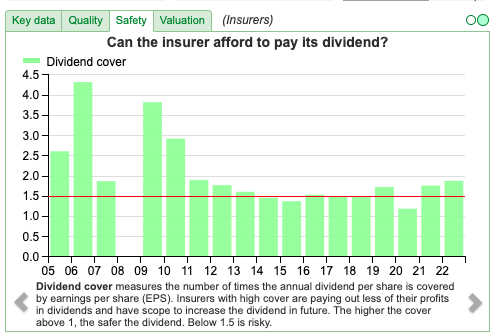

There are a few slides at the back of the most recent analyst presentation suggesting that LGEN owns mostly investment grade (IG) bonds, which rarely default, even in a recession. This is deliberately misleading, when corporates struggle in a recession then rating agencies respond by belatedly downgrading their IG bonds to “junk”, which then has a higher risk of default. History suggests if we were to enter a severe recession, banks and insurers would lose money on their IG bond portfolios and corporate loans. That concern is also reflected in LGEN and AV. c. 9% dividend yields, which suggest that investors are concerned about headwinds for the insurance sector.

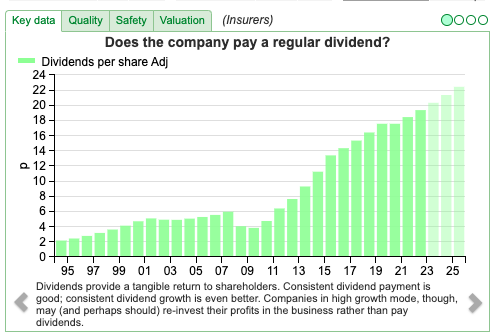

Outlook: Aside from growing the dividend +5% between H1 June 2021 to FY Dec 2024F, Legal & General set out five-year ambitions in a November 2020 Capital Markets Day. They are aiming for capital generation of £8-9bn, well above cumulative dividends of £5.6-5.9bn. Hence EPS should grow faster than dividends. So far they have achieved that aspiration.

Valuation: Insurers used to be valued on a multiple of embedded value (1.7x in a bull market, 0.5x in a bear market). Insurers don’t seem to disclose that EV figure any more, but the shares are on 1.1x NAV (ie the middle of their historic trading range) and a forecast PER of 9x.

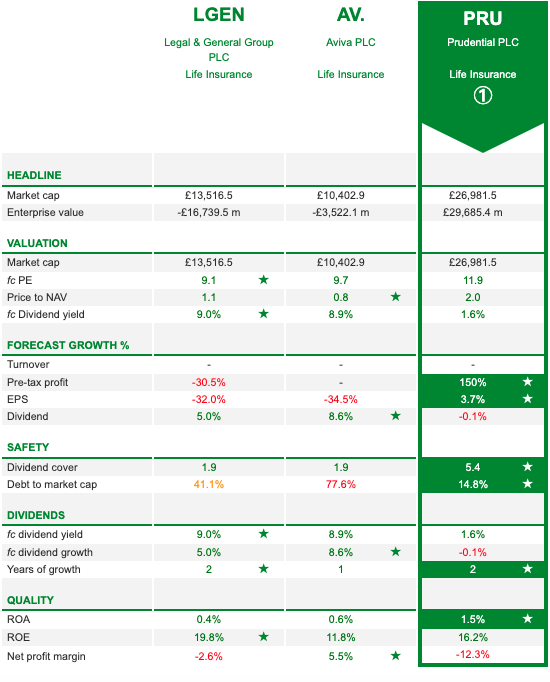

Opinion: I understand why many investors put this sector in the “too hard” pile. I feel the insurance companies themselves don’t communicate their investment case well to generalists. Equity research insurance analysts tend to muddy the water further. In the past I have made good money buying LGEN at the tail end of the GFC in February/March 2009, and I would suggest a similar market timing strategy might work in future. Despite the high dividend yields, it doesn’t feel to me like the right time to be opening a new position. I’ve used SharePad’s “compare tab” to analyse the strengths of the 3 large insurers, and that ranking algorithm suggests PRU, with a dividend yield below 2% is more attractive than the c. 9% yielding LGEN and AV.

JUST H1 Jun 2023

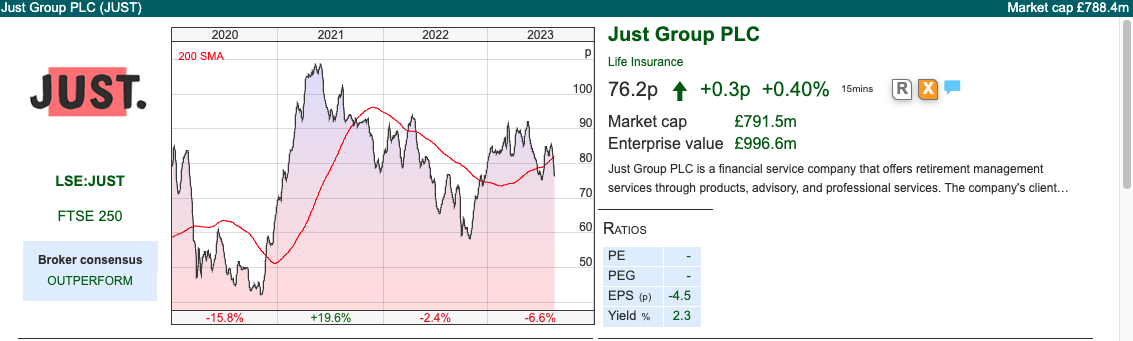

This mortgage equity release company that used to be called Just Retirement, and now is just called Just Group, released H1 results. The results look impressive, with the first 2 bullet points saying underlying operating profit is up +154% to £173m and Retirement Income sales more than doubled to £1.9bn. Those figures were in a trading statement which they put out on 18th July, hence the share price didn’t react last week. However, SharePad shows the company is trading on a PER of 2.6x FY Dec 2024F, so presumably investors have identified a risk that means we can’t take the headlines at face value.

I think that the concern is about the group’s exposure to falling house prices and No-Negative-Equity Guarantees (NNEG). Guy Thomas, who wrote the book Free Capital, posted about this in 2018 and then later in 2020. This discussion has the potential to make readers eyes glaze over, however given that JUST is currently trading on such a low valuation, while beating expectations, understanding the issue might prove profitable.

I’m a long way from being an insurance sector expert, but many banks like Lloyds, HBOS and Abbey used to own life assurance subsidiaries (Scottish Widows, Clerical Medical and Abbey Life) so banks’ analyst did have to try to understand embedded value accounting for closed life books. I should also say that my friend, insurance analyst Marcus Barnard, used to cover JUST as their house broker.

The bear case concerned the UK Prudential Regulation Authority’s (PRA) demand in a Consultation Paper CP13/18 which required more capital to fund Lifetime Mortgages (LTMs these used to be called equity release mortgages). These LTMs allow older homeowners – normally over 60 years old – to borrow around 30% of the value of their property and then pay back the loan when they die. For example, a 60 year old with a house worth £500K might borrow £150K, with a fixed rate charged to the owner/borrower, but not actually paid. The most popular age range for the product is older than that 70-74 year olds, and it tends to appeal to people who have not accumulated enough retirement savings outside of residential property. The LTM customer receive the money from the loan which is then paid back plus the accumulated interest from the proceeds of the house sale, for example 20-30 years later, either when the home owner dies, or moves into a care home. In March 2019 JUST cut its dividend and raised £400m of capital, including £75m of equity at a placing price of 80p per share. £300m of debt carried an interest rate of 9.375%, when the BoE rate was 75bp.

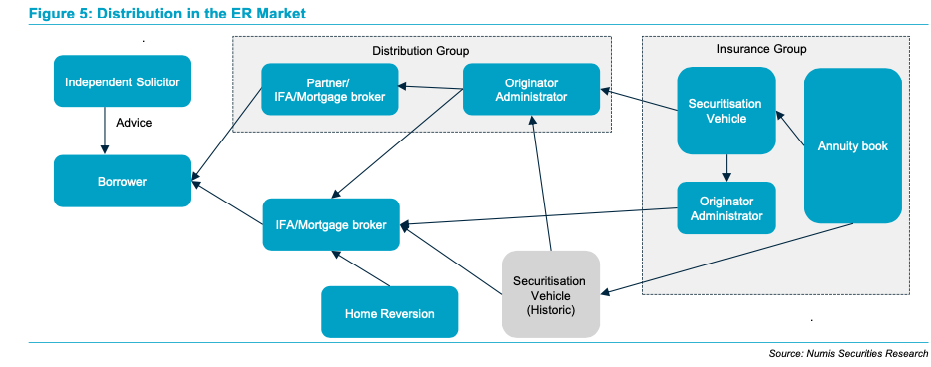

I’ve included a diagram from my friend Marcus’ 2017 Numis equity research broker note below. I would imagine if we see a steep house price fall, investors might worry about the impact on JUST’s capital ratios.

Guy Thomas is a private investor and trained actuary, he has published a couple of books and written academic papers with no particular axe to grind, that I can see. He believed the PRA’s use of Black Scholes option pricing to demand higher capital requirements for JUST was flawed. Even if this interpretation was correct, the JUST share price fell almost -80% from the beginning of 2018 to below 40p in mid 2019. The pandemic sell-off in March 2020 didn’t repeat that low.

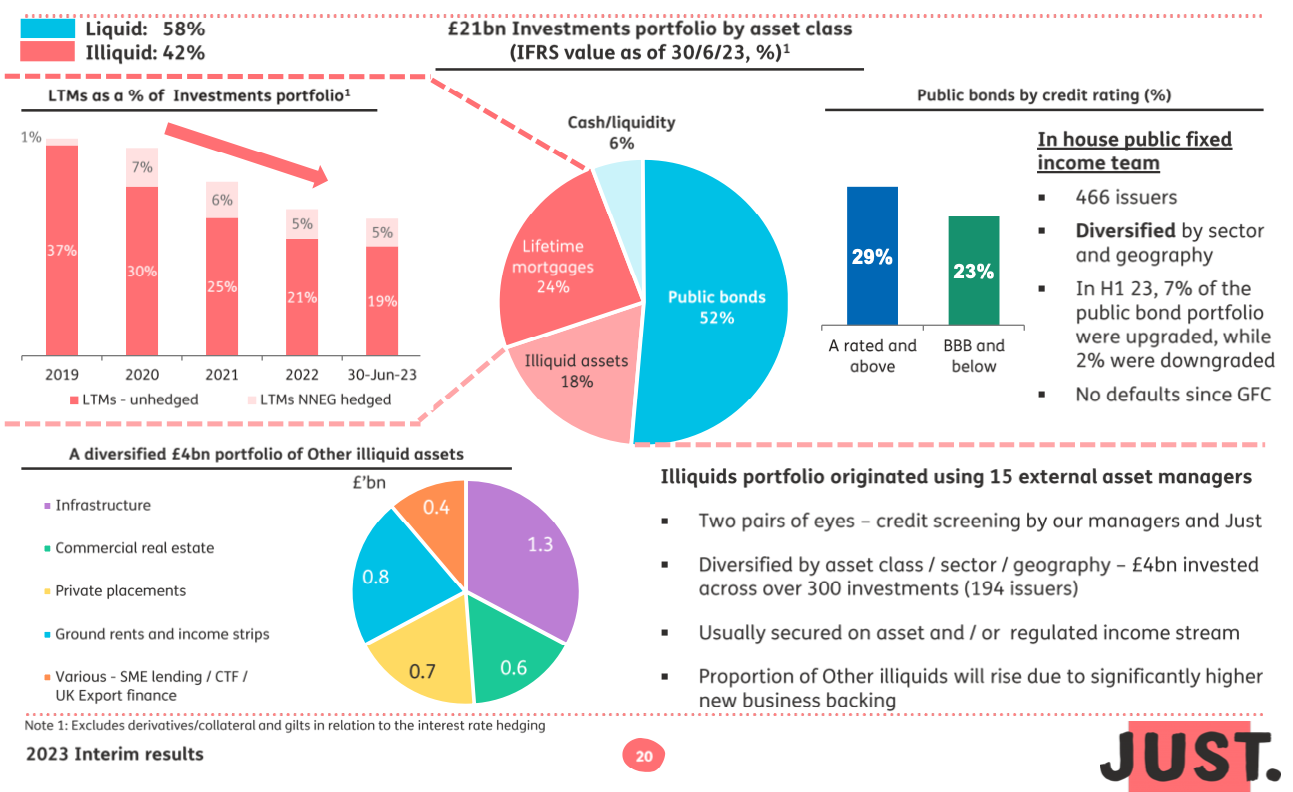

More recently JUST has diversified the asset side of their balance sheet, and LTMs have shrunk from 37% of the investment portfolio to around 20%, as the slide below shows.

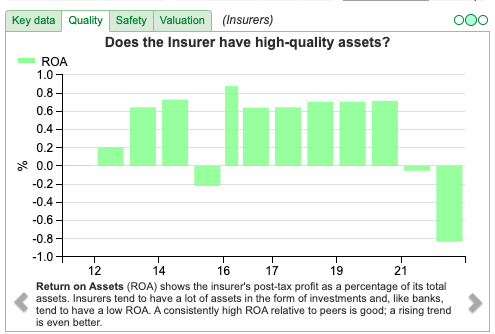

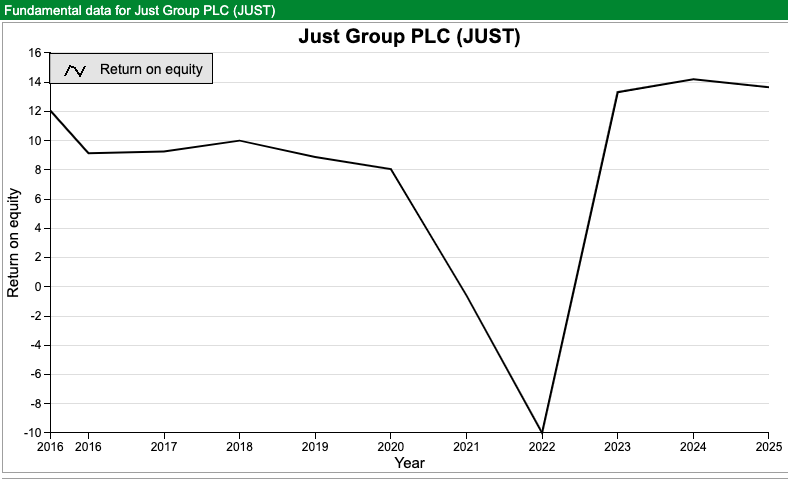

Insurance accounting makes litigation finance fair value accounting look easy to understand in my experience. Insurance analysts I have known often struggle to answer a simple question like “what will happen to life insurance sector share prices when the long bond yield rises?” Invariably the answer begins “It’s complicated, so…” and ends 15 minutes later with me experiencing a dull throbbing pain behind my eyes and wishing that I hadn’t asked the question. With that caveat in mind, I think it makes sense to use SharePad to look at JUST’s Return on Equity history.

Outlook: JUST said last week that given the very strong profit growth in H1 Jun 2023, they are highly confident of comfortably exceeding +15% growth in underlying operating profits for the full year. The positive outlook further supports their confidence in Just’s ability to deliver +15% growth in underlying operating profit per annum, on average over the medium term.

Valuation: JUST shares are trading on an 0.4x discount to NAV, which given the 3 year historic RoE of 5.4% may be justified. However if JUST can achieve mid teens RoE and operating profit growth (as the chart above suggests), then it seems likely we could see a re-rating at some point.

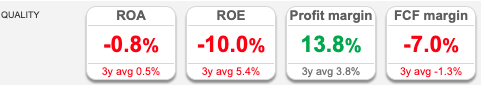

The UK Life Insurance sector (red) has been a much better performer in the low interest rate environment since the 2007-9 GFC than the UK Banking sector (black), but most of that outperformance happened early on in the time period when Govt long bond yields were falling.

Opinion: This whole insurance sector looks interesting at the moment, as much to understand the risk scenarios that the market is currently pricing in. If readers want to add further comments or links to blog posts, do let me know in the “chat” function on SharePad. My feeling is JUST and LGEN are worthy of further study, and it might be possible to gain an analytical edge as many investors put the sector (understandably) in the “too hard” pile.

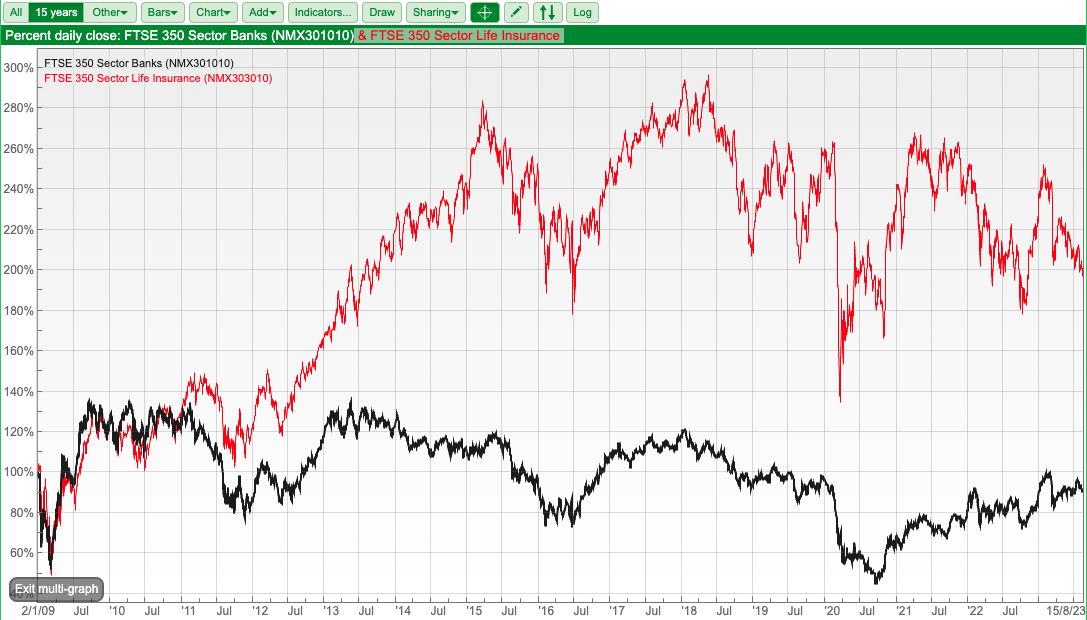

Tremor H1 Jun 2023

I covered this stock a couple of times in 2020 and then in 2021, but lost interest because the valuation seemed bonkers to me. I think that it’s worth revisiting, as a lesson in how to avoid losing money.

My conclusion in May 2021 was that:

AdTech seems to me a business where things can change very quickly, and I’m skeptical of the idea that the stock should trade on a similar valuation to The Trade Desk 150x 2020A EV/EBITDA and 34x revenue.

My thinking was that TTD high valuation was reflecting the “winner takes all” nature of AdTech platforms. There’s in 2020, about the mathematics of compound decline. If you have one company growing revenue exponentially in a market, that implies unless the market itself is growing rapidly, then competitors will struggle. Early on the decline will be mostly too small to take seriously. But the rate of decline will accelerate alarmingly, in the way that compounding growth also accelerates. Being an actuary, he’s stated a formal mathematical proof, but the author Ernest Hemmingway had the same insight, when he answered the question: “How did you go bankrupt?”

“Two ways. Gradually, then suddenly.”

The Trade Desk shares are actually up +24% since I last wrote about the AdTech sector in May 2021. TTD company has grown into its valuation and now trades on a PER of 48x Dec 2024F and 15x Price/Sales Dec 2024F. For comparison TRMR is down -80% over the same time period, and now trades on 5x Dec 2024F and 0.8x Price/Sales the same year, according to FinnCap’s forecasts. I intend to re-visit the investment case in 3-6 months.

Digital Turbine (ticker APPS) has done even worse, over the same time period, down almost -90%. As a reminder, APPS and various other speculative stocks were being heavily promoted a couple of years ago by the anonymous (sunglasses and funky wig) YouTuber and Twitter personality @FunkyFinance. I noticed that he was gradually posting less as his “hot tips” fell, then all of a sudden Mr Funky disappeared. He deleted his Twitter account and removed all his videos from YouTube.

Caveat Emptor.

Bruce Packard

Conclusion

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: https://privateinvestors.supercast.com/

Weekly Market Commentary | 22/08/23 | LGEN, JUST, TRMR | An opportunity in plain sight?

Bruce suggests that the nature of cross border capital flows might present an opportunity in front of our eyes, in FTSE and AIM stocks. Companies covered LGEN, JUST and TRMR.

Last week I suggested that with the VIX below 16, some complacency might be creeping back into markets. Right on cue, the FTSE 100 fell -3.2% to 7,288, while the Nasdaq100 was down -2.2% and the S&P500 fell -2.1%. The VIX, measuring volatility rose +13% to 18. Last week I also suggested that cross border flows of capital from countries with a trade surplus played a role in the 2007-9 financial crisis. Once again it looks like liquidity is draining away, one difference though is that the nature of the cross-border assets has changed.

In the previous crisis it was AAA rated debt securities, but the most obvious of the new cross border flows are now in equity. An obvious example is the trophy assets like football teams (Newcastle Town FC, Paris St Germain, Manchester City and perhaps Manchester United if the Glazers ever decide to sell). Qatar’s $450bn Sovereign Wealth Fund the QIA owns Harrods, the Shard, the stockbroker Panmure Gordon and a large stake in Canary Wharf. None of these investments are accessible to private investors, but in any case, they do not look particularly shrewd at the moment.

For contrast Saudia Arabia’s SWF, often in partnership with the $100bn Soft Bank Vision Fund, owns equity in companies like Uber. I came across this blog post from former equity research technology analyst Jonathan Crosier on his Crow Knows blog. He says that in the last five years Uber has made operating losses of $22.2 billion on revenues of $85.9 billion. The Saudis, via the Vision Fund, also backed New York listed, loss making food delivery company DoorDash and rented office start-up WeWork. This FT Alphaville article suggests that most venture capital investments lose money. Lex Greensill also seems to have courted the Saudi’s money.

So, if pre-2008 cross border debt resulted in cheaper mortgages for households in trade deficit nations, post-2008 financial crisis the benefit of cross border flows seems to have gone to anyone with a half-baked start-up idea and ultimately to consumers who use riding hailing, co-working spaces and food delivery apps. Many of these businesses are loss making, with unit economics that imply they will continue to be so. That’s bad news for the Gulf states funding “moonshots”, but perhaps good for the rest of us who enjoy watching more entertaining football.

For contrasts there are 150 companies in the FTSE 350 trading on less than 12x forecast PER, and 105 companies in the same index on a dividend yield of 5% or higher. Private investors don’t need access to the smartest VC deals, or worry about the lack of listed football clubs on the UK stockmarket. Instead, the low PER and high dividend yields on AIM and FTSE, suggests to me that market weakness could present us will an opportunity in plain sight. It still feels to me early, but I am certainly on the lookout for bargains.

An example is LGEN’s results, which I look at below. One slide from the LGEN presentation pack jumped out at me, showing the performance of UK markets versus the USA. Some of this is due to the FTSE 100 unfashionable constituents like banks, oil companies, tobacco and ‘last century’ TMT stocks like Vodafone and Pearson. However, LGEN’s slide shows that even adjusting for a sector neutral stance, there was still 22% discount (17.7x PER v 13.8x PER) versus the MSCI World Index. Those numbers suggest that we don’t need to hunt very far to find attractive value, in my opinion it’s under our noses on the FTSE and AIM.

Aside from LGEN, other stocks covered below are mortgage equity withdrawal company JUST and AdTech company TRMR.

LGEN H1 Jun 2023

Legal & General reported Operating PBT down -2% to £941m for H1 to Jun. However, taking account a fair value decline in their investments, profit attributable to shareholders and EPS fell -45% to £316m and -46% to 5.2p respectively. The group reported RoE of 13% including that FV decline, but without the unrealised mark to market loss, RoE would have been an eye catching 37% in H1.

The basic rule of thumb when thinking about banks and insurance companies is that there is an asymmetry of uncertainty on the balance sheet. Banks have long term assets (mortgages, corporate loans) of uncertain value, they fund these with customer deposits and interbank funding, and these shor-term liabilities are easy to calculate. On the other hand, insurers have uncertain long-term liabilities (annuities, policy holder payouts) which they meet with investments on the asset side of the balance sheet, which are reasonably easy to calculate on a fair value basis.

Hence, when prices fall, insurers record a negative investment variance through their p&l. In normal times, investors tend to look through this, as the expected return ought to be positive through the cycle. We don’t always have normal times in financial markets though (for instance TMT markets crash 2000-3, GFC 2007-9). At the point of stress, the investment variance becomes so large that investors fear insurers may need to raise capital at the worst point in the cycle. In 2009, when LGEN’s share price fell below 30p there was a specific fear about exposure to troubled banks subordinated debt. As it turned out, those fears were not realised and the falling long bond yield was very helpful for LGEN’s dividend.

There are a few slides at the back of the most recent analyst presentation suggesting that LGEN owns mostly investment grade (IG) bonds, which rarely default, even in a recession. This is deliberately misleading, when corporates struggle in a recession then rating agencies respond by belatedly downgrading their IG bonds to “junk”, which then has a higher risk of default. History suggests if we were to enter a severe recession, banks and insurers would lose money on their IG bond portfolios and corporate loans. That concern is also reflected in LGEN and AV. c. 9% dividend yields, which suggest that investors are concerned about headwinds for the insurance sector.

Outlook: Aside from growing the dividend +5% between H1 June 2021 to FY Dec 2024F, Legal & General set out five-year ambitions in a November 2020 Capital Markets Day. They are aiming for capital generation of £8-9bn, well above cumulative dividends of £5.6-5.9bn. Hence EPS should grow faster than dividends. So far they have achieved that aspiration.

Valuation: Insurers used to be valued on a multiple of embedded value (1.7x in a bull market, 0.5x in a bear market). Insurers don’t seem to disclose that EV figure any more, but the shares are on 1.1x NAV (ie the middle of their historic trading range) and a forecast PER of 9x.

Opinion: I understand why many investors put this sector in the “too hard” pile. I feel the insurance companies themselves don’t communicate their investment case well to generalists. Equity research insurance analysts tend to muddy the water further. In the past I have made good money buying LGEN at the tail end of the GFC in February/March 2009, and I would suggest a similar market timing strategy might work in future. Despite the high dividend yields, it doesn’t feel to me like the right time to be opening a new position. I’ve used SharePad’s “compare tab” to analyse the strengths of the 3 large insurers, and that ranking algorithm suggests PRU, with a dividend yield below 2% is more attractive than the c. 9% yielding LGEN and AV.

JUST H1 Jun 2023

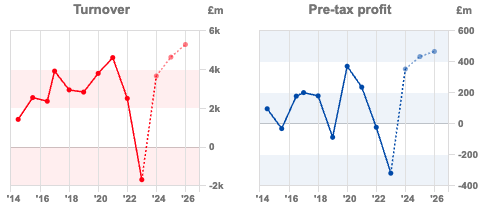

This mortgage equity release company that used to be called Just Retirement, and now is just called Just Group, released H1 results. The results look impressive, with the first 2 bullet points saying underlying operating profit is up +154% to £173m and Retirement Income sales more than doubled to £1.9bn. Those figures were in a trading statement which they put out on 18th July, hence the share price didn’t react last week. However, SharePad shows the company is trading on a PER of 2.6x FY Dec 2024F, so presumably investors have identified a risk that means we can’t take the headlines at face value.

I think that the concern is about the group’s exposure to falling house prices and No-Negative-Equity Guarantees (NNEG). Guy Thomas, who wrote the book Free Capital, posted about this in 2018 and then later in 2020. This discussion has the potential to make readers eyes glaze over, however given that JUST is currently trading on such a low valuation, while beating expectations, understanding the issue might prove profitable.

I’m a long way from being an insurance sector expert, but many banks like Lloyds, HBOS and Abbey used to own life assurance subsidiaries (Scottish Widows, Clerical Medical and Abbey Life) so banks’ analyst did have to try to understand embedded value accounting for closed life books. I should also say that my friend, insurance analyst Marcus Barnard, used to cover JUST as their house broker.

The bear case concerned the UK Prudential Regulation Authority’s (PRA) demand in a Consultation Paper CP13/18 which required more capital to fund Lifetime Mortgages (LTMs these used to be called equity release mortgages). These LTMs allow older homeowners – normally over 60 years old – to borrow around 30% of the value of their property and then pay back the loan when they die. For example, a 60 year old with a house worth £500K might borrow £150K, with a fixed rate charged to the owner/borrower, but not actually paid. The most popular age range for the product is older than that 70-74 year olds, and it tends to appeal to people who have not accumulated enough retirement savings outside of residential property. The LTM customer receive the money from the loan which is then paid back plus the accumulated interest from the proceeds of the house sale, for example 20-30 years later, either when the home owner dies, or moves into a care home. In March 2019 JUST cut its dividend and raised £400m of capital, including £75m of equity at a placing price of 80p per share. £300m of debt carried an interest rate of 9.375%, when the BoE rate was 75bp.

I’ve included a diagram from my friend Marcus’ 2017 Numis equity research broker note below. I would imagine if we see a steep house price fall, investors might worry about the impact on JUST’s capital ratios.

Guy Thomas is a private investor and trained actuary, he has published a couple of books and written academic papers with no particular axe to grind, that I can see. He believed the PRA’s use of Black Scholes option pricing to demand higher capital requirements for JUST was flawed. Even if this interpretation was correct, the JUST share price fell almost -80% from the beginning of 2018 to below 40p in mid 2019. The pandemic sell-off in March 2020 didn’t repeat that low.

More recently JUST has diversified the asset side of their balance sheet, and LTMs have shrunk from 37% of the investment portfolio to around 20%, as the slide below shows.

Insurance accounting makes litigation finance fair value accounting look easy to understand in my experience. Insurance analysts I have known often struggle to answer a simple question like “what will happen to life insurance sector share prices when the long bond yield rises?” Invariably the answer begins “It’s complicated, so…” and ends 15 minutes later with me experiencing a dull throbbing pain behind my eyes and wishing that I hadn’t asked the question. With that caveat in mind, I think it makes sense to use SharePad to look at JUST’s Return on Equity history.

Outlook: JUST said last week that given the very strong profit growth in H1 Jun 2023, they are highly confident of comfortably exceeding +15% growth in underlying operating profits for the full year. The positive outlook further supports their confidence in Just’s ability to deliver +15% growth in underlying operating profit per annum, on average over the medium term.

Valuation: JUST shares are trading on an 0.4x discount to NAV, which given the 3 year historic RoE of 5.4% may be justified. However if JUST can achieve mid teens RoE and operating profit growth (as the chart above suggests), then it seems likely we could see a re-rating at some point.

The UK Life Insurance sector (red) has been a much better performer in the low interest rate environment since the 2007-9 GFC than the UK Banking sector (black), but most of that outperformance happened early on in the time period when Govt long bond yields were falling.

Opinion: This whole insurance sector looks interesting at the moment, as much to understand the risk scenarios that the market is currently pricing in. If readers want to add further comments or links to blog posts, do let me know in the “chat” function on SharePad. My feeling is JUST and LGEN are worthy of further study, and it might be possible to gain an analytical edge as many investors put the sector (understandably) in the “too hard” pile.

Tremor H1 Jun 2023

I covered this stock a couple of times in 2020 and then in 2021, but lost interest because the valuation seemed bonkers to me. I think that it’s worth revisiting, as a lesson in how to avoid losing money.

My conclusion in May 2021 was that:

AdTech seems to me a business where things can change very quickly, and I’m skeptical of the idea that the stock should trade on a similar valuation to The Trade Desk 150x 2020A EV/EBITDA and 34x revenue.

My thinking was that TTD high valuation was reflecting the “winner takes all” nature of AdTech platforms. There’s in 2020, about the mathematics of compound decline. If you have one company growing revenue exponentially in a market, that implies unless the market itself is growing rapidly, then competitors will struggle. Early on the decline will be mostly too small to take seriously. But the rate of decline will accelerate alarmingly, in the way that compounding growth also accelerates. Being an actuary, he’s stated a formal mathematical proof, but the author Ernest Hemmingway had the same insight, when he answered the question: “How did you go bankrupt?”

“Two ways. Gradually, then suddenly.”

The Trade Desk shares are actually up +24% since I last wrote about the AdTech sector in May 2021. TTD company has grown into its valuation and now trades on a PER of 48x Dec 2024F and 15x Price/Sales Dec 2024F. For comparison TRMR is down -80% over the same time period, and now trades on 5x Dec 2024F and 0.8x Price/Sales the same year, according to FinnCap’s forecasts. I intend to re-visit the investment case in 3-6 months.

Digital Turbine (ticker APPS) has done even worse, over the same time period, down almost -90%. As a reminder, APPS and various other speculative stocks were being heavily promoted a couple of years ago by the anonymous (sunglasses and funky wig) YouTuber and Twitter personality @FunkyFinance. I noticed that he was gradually posting less as his “hot tips” fell, then all of a sudden Mr Funky disappeared. He deleted his Twitter account and removed all his videos from YouTube.

Caveat Emptor.

Bruce Packard

Conclusion

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: https://privateinvestors.supercast.com/