The best performing FTSE 100 stock last week was Rolls Royce, up 19%. The worst was Unilever down 6.5%, which suggests expectations of a vaccine are inoculating investors against risk. On Nasdaq, the vaccine stock Moderna, was the best performing up 44% in the last 5 days, while Zoom was the second worst performing down 7% while the appropriately named Splunk fell 20%.

The huge rally in markets since April means that 2020 hasn’t been a good year for short sellers. But their time will come again. Last week I listened in to an FT event “How to Spot an Accounting Fraud” with Carson Block of Muddy Waters.

On the call, Block made the distinction between Sino Forrest, the Chinese timber company listed in Canada, which was an outright fraud where the assets didn’t exist and Enron. Though Enron management were found guilty of fraud and sent to prison, it was a real company, their combination of aggressive mark-to-market “fair value” accounting profits plus a debt funded balance sheet is not illegal in itself. He said many companies still operate like Enron, but who are staying just on the right side of the law.

On NMC Health, the collapsed Dubai hospitals business, he said a major red flag was an acquisition they made from Tenet, a US healthcare business which disclosed lease liabilities on its balance sheet. When NMC bought the business, the lease liabilities disappeared from the disclosure. Block said that he had no idea that NMC Health had over $4bn of hidden debt off balance sheet, but he did know that their audited disclosure could not be relied upon. Block was keen to emphasize that auditors often gave investors a false sense of security. Audits are not designed to catch senior management defrauding investors, they are designed to make sure the correct accounting standards are followed, which is subtly different.

Even if you have no interest in shorting stocks, short sellers’ methods can help investors avoid frauds and “police” the market. Short sellers can’t afford to make false claims, unlike management of some companies who often over-claim in the management commentary with no repercussions. In August 2019 Muddy Waters published a short report on Burford, which at the time had been a ten bagger for me. MW made good points about the company’s disclosure, although I think that they should have also emphasized the business was not an outright fraud like their other targets (eg Sino Forrest and NMC Health).

Tremor International, the adtech platform and Boku, the mobile phone payments and identity verification business, both reported positive trading updates. I also look at SDI Group who bought a business and ULS Technology the online conveyancing service sold one for cash.

Tremor International Trading Update

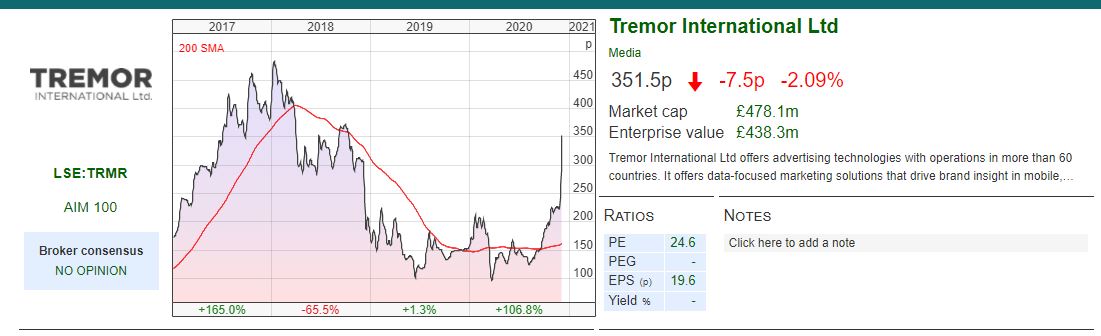

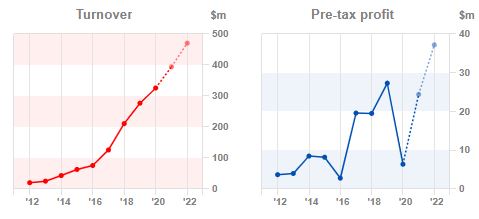

Tremor put out a trading update for FY 31 December 2020. The company anticipates that they will achieve 37-43% revenue growth in H2 2020, compared to H2 2019. FinnCap their broker is now forecasting net revenue (revenue less media cost) of $394m FY 2020 and 19% growth next year to $470m FY 2021. This gives adjusted EPS of 21c$, putting the company on a 2021F PER of 22x the broker’s numbers. FinnCap point out that this is the third upgrade since Covid-19 impacted the advertising market.

History Founded in Israel in 2007, Tremor is incorporated under Israeli law and listed on AIM in 2014. The company listed as Marimedia, then in 2015 changed its name to Taptica and then in June 2019 Tremor. They bought RhythmOne in April 2019 for $176m issuing share 49.9% of their shares at 170p. RhythmOne used to be Blinkx and had a chequered history, with the shares falling 50% in one day when they were accused of fraud by a Harvard Business School academic.* Blinkx was also Carson Block’s first publicly disclosed short position in London.

Adtech platforms In a “network effects” business like a stock exchange, buyers and sellers benefit from coming together on the same platform and the platform then enjoys growing revenues on a fixed cost base. However, the ad-tech industry structure is more complicated with both “demand side” and “supply side” platforms. Demand Side Platforms (DSPs) provide tools so that advertisers can specify the audiences that they would like to target. Supply Side Platforms (SSPs) are the mirror image of this, but for publishers (eg an online newspaper.) Publishers use SSPs to auction off an “inventory” of their readers’ eyeballs and control which advertisers are allowed to show ads to their readers. The rationale for the combination of Tremor with RhythmOne/Blinkx was to combine Tremor’s demand-side platform (“DSP”) with RhythmOne’s supply-side platform (“SSP”).

Then in January this year Tremor bought another SSP (Unruly Holdings) from News Corp and announced a partnership with the newspaper publisher. Unruly has more than 2,000 publishers on its platform, and claims a 1.2bn audience, including privileged access to News Corp’s readership. Tremor issued 8m shares (just under 7% of share capital) to News Corp when the shares were 175p, and announced a partnership. FinnCap suggests more acquisitions of this type are likely in the future.

Tremor expensed all of its R&D spending through the p&l ($33m in 2019 v $20m in 2018) and I can’t see any red flags in the cashlow statement. On the balance sheet there are around $230m of intangible assets, including goodwill or 77% of shareholders’ equity of $300m. Sharepad shows both historic PBT and RoCE has been very volatile: RoCe 22% in 2018, but falling to -6% Trailing 12 Months (TTM) to June 2020 then forecast to recover this year and next.

Institutions Tosca owns 23%, Schroders 15%, Mithaq 14%, News Corp 6%. This should give investors some reassurance, though I think it is no substitute for doing your own research. This Wednesday at 3p.m. the company will hold an investor day, to demonstrate the capabilities of its cloud-based platform on a finnCap Tech VirtualDemo. Interested readers can contact IR@finncap.com to join.

Is adtech a bubble? Google and Facebook are competitors in ad-tech and the landscape can change very quickly (for instance wide adoption of “adblockers”, automated “bots” that view a page impression, aside from fraud and money laundering concerns.) There’s a new book by a former Google employee, Tim Hwang** arguing that online advertising data is unreliable, automated advertising bidding should be regulated and most online ad money is wasted. I do wonder if targeted advertising is a product that is designed to give a false sense of control to those with marketing budgets to spend, rather than because it actually works. I receive many Plus500 and eToro adverts, presumably because cookies identify me as someone who is interested in finance. Yet I have zero interest in using CFD brokers. I’m sure they are bidding high for my eyeballs and attention, however their marketing has the opposite effect: I’m irritated and doubt their business models. It’s not just me: Wey Education, the online school, said on their most recent investor call that online marketing became poor value for them as soon as Covid-19 hit. Searches for “online learning” were bid up, whereas Wey’s advertising on radio stations like LBC and Heart FM became both better value and more effective, in their view.

Rory Sutherland, the marketing chap***, points out that brands work because “buyers usually care less about seeking perfection and more about avoiding catastrophe”. On that basis I think I would avoid investing in the whole adtech industry.

Verdict The 40% revenue growth expected this year, looks exciting. But this wouldn’t be a high conviction idea for me because I think the premise of the whole sector is flawed. I’d certainly ignore the investment case based on peer group comparison, because The Trade Desk is changing hands at 183x forecast earnings, 60x historic revenue and 70x book value, which looks overvalued on any sensible valuation metric. That high valuation could be reflecting the “winner takes all” nature of the business. But if so, is buying Tremor International then the equivalent of backing the second horse in a 2 horse race? The third horse in the race is Fyber, a Berlin based adtech business backed by Lars Windhorst, and seems already on its way to the knacker’s yard.

BOKU Trading Update

Boku put out a brief trading update saying that Group EBITDA for the year ending 31 December 2020 should be at least $13.5 million, ($1 million higher than consensus). The company’s technology enables mobile phone users to pay for items by charging their phone bill or pre-paid balance. This is known as Direct Carrier Billing (DCB).

History – The company was founded in 2009, and listed on AIM in 2017 at 59p raising £13m in a placing that valued the company at £126m. At the start of 2019 they bought Danal, a US business specialising in digital identity for $25m (by issuing 26.7m shares). The idea was to expand the US company’s technology to become global. Instead of using an SMS text message for 2 Factor authentication (that is sending a six digit one time PIN code to a user’s mobile phone) Boku’s connectivity to a mobile operators’ network means that they can verify a user’s identity seamlessly. In June this year Boku acquired an Estonia based DCM competitor called Fortumo for $45m (financed by placing 24m shares at 85p). The price was 6.25x FY19 revenues.

Management –Aside from technology, what sets Boku apart is the quality of the management, in my view. Mark Britto, the non Exec Chairman is Chief Revenue Officer at PayPal. Jon Prideaux the Chief Executive Officer is ex Visa Europe, but also has experience growing sales, and profits, at smaller companies (SecureTrading, Shopcreator). The Chief Executive earned £301K total compensation in 2019, though this doesn’t include the LTIP where he currently has over 4m options. Encouragingly these are not nil cost options, but have a strike price between 37$c and 28$c. He has also been awarded 650,000 Restricted Stock Units (RSUs). The LTIP rewards to the Chief Executive and other senior management explain the $6.8m share based compensation expense in the p&l.

Institutions: Danske Capital Management 6.6%, BlackRock 4.3%, Swedbank 3.9%, Schroders 3.49%

Growth and returns – Last year Boku flagged a one off $3.2m revenue benefit in H2 19, from the release of a customer provision. Edison, the paid for research house, forecast $55m of revenue FY20G, growing by 20% in FY 21F, with a forecast gross profit margin of 90%. The company has been loss making in the past, but is forecast to grow profits strongly in 2021F and 2022F.

Verdict This company looks to have an interesting story, with the network effects beginning to show through revenue, profits and return measures like RoCE and CRoCI all look to be heading in the right direction. That said, the shares are trading on 7x 2021F revenues, so the market appears to be already pricing in the opportunity. My mother owns some, because it fits her process of ignoring valuation and backing good management and exciting growth potential, but the price is too rich for my taste.

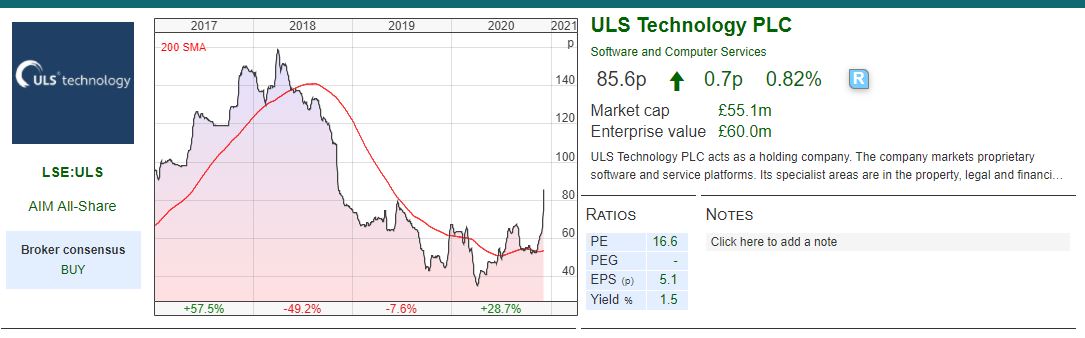

ULS Technology – disposal

ULS technology, the online conveyancing platform, announced that it has sold a subsidiary Conveyancing Alliance for £27.3m of cash (versus a market cap of below £40m when the deal was announced). The buyer was the curiously named Project Ophelia Bidco Limited, who control O’Neill Patient Solicitors LLP, the largest conveyancer on the CAL panel. CAL provides a conveyancing comparison tool, perhaps similar to GoCompare, whereas ULS’s eConveyancer and DigitalMove software provide consumers with a more integrated service, with secure messaging, property searches, utility bill changes etc.

Presumably a limited partnership would not be able to finance this purchase with cash, unless there was some private equity backing. It also perhaps explains the departure of the previous Chief Executive in September, if there has been a disagreement over strategy.

The shares were up 20% on the day the news was announced. ULS are now unlikely to need any capital from investors, and there may be a capital return in future. The company reports H1 results to 30 September 2020 on Tuesday 08 December. I’m planning to listen in to the analyst call that day and will report back in detail next week.

SDI acquisition

SDI, the acquisitive digital imaging group,that Richard Beddard likens to Judges Scientific announced another buy: Monmouth Scientific, a UK manufacturer of biological safety cabinets, fume cupboards, laminar flow cabinets and cleanrooms. Total consideration, including earnout, is expected to be approximately £5.8 million.

Monmouth Scientific achieved revenues of £6.2 million, and EBIT of £0.4 million (unaudited) for FY to March 2020. The company has seen increased demand for its instruments due to Covid-19, so revenues to H1 September were £3.7m. The acquisition is mainly in cash, with just 231K shares issued at 87 pence per share. The price looks reasonable, around 1x historic revenues, for a company that in the last 6 months has seen a surge in demand from the virus, which is expected to continue into next year. Total consideration is capped at £6.9m, and would require Monmouth to earn more than PBT £1.9m (ie the price SDI has paid would be capped at 5x post tax earnings). FinnCap, SDI’s broker is now forecasting the company’s net debt to be £4.3m which is negligible compared to a market cap of £84m.

Following the acquisition, the broker is now forecasting EPS of 4.5p in April 2021F, putting the company on 21x PER. The market cap is still less than £100m, versus £360m for Judges, so still plenty of room to grow. I’ve owned the shares since 2016, and like the strategy and the management.

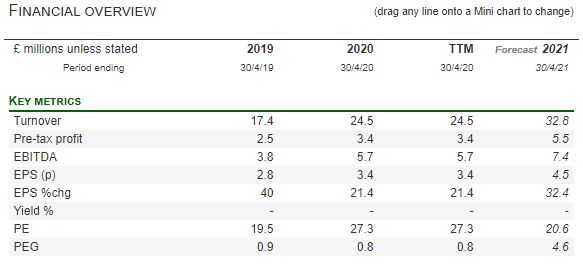

Oxford Metrics FY end Sept

I covered this company’s trading statement in detail in early November and they’ve now reported FY results to end of September. The numbers are inline with their previous trading statement, revenue down 14% to £30.3m and Adjusted PBT down 55% to £2.6m. They maintained their final dividend of 1.8p, the same amount as last year. The company had £14.9m of cash at the end of September and is now looking to make acquisitions to strengthen both of its divisions.

Outlook The outlook statement suggests Vicon (motion measurement 80% of revenues) pipeline is comparable to this time last year (ie pre Covid-19 levels) although the USA remains subdued. They expect Yotta (cloud based infrastructure management for local authorities 20% of revenues) to be profitable for FY20/21. Yotta has been loss making for several years, as the business switches to a SaaS model charging customers an annual recurring fee. Pleasingly Yotta did turn a profit in H2 and the commentary says that the business has a 12% market share, suggesting plenty of room for growth.

That said, I couldn’t help thinking to myself that describing their Yotta business which has been losing money for several years as “market leading” is odd. There are two interpretations. I) They have a market leading business in a sector where all the players fail to make a return for their investors II) They don’t have a market leading business.

I’m not sure which interpretation is true. But I thought it was worth flagging. If I went to watch Southend United (currently at the bottom of League Two) and they claimed to be leading the Premiership, I would treat managements claim with some scepticism. The tone of the announcement sounds optimistic and upbeat, but we now need to see management deliver profitable growth, not just talk a good game.

Bruce Packard

Notes

The author owns shares in ULS Technology, SDI Group and Oxford Metrics

Author’s mother owns Boku

* https://www.independent.co.uk/news/business/news/blinkx-shares-take-tumble-after-harvard-blog-accusations-9097690.html

** https://www.amazon.co.uk/Subprime-Attention-Crisis-Advertising-Originals-ebook/dp/B084M1R3JW/

***I’m sure Rory would hate to be called a “marketing guru”. I laughed out loud when I read his piece on targeted ads in Campaign magazine:

https://www.campaignlive.co.uk/article/targeted-messaging-one-piece-advertising-puzzle/1488565

By deluding everyone that the whole of advertising is reducible to “the efficient and inexpensive delivery of targeted messages” through the extensive use of data and algorithms, two companies have gained a multi-billion-dollar rent-seeking monopoly over the majority of advertising activity.

The simple fact is that Facebook and Google cannot realistically claim to have a monopoly on creative ideas. So they grotesquely overstate the relative importance of those parts of the business where they do enjoy a natural monopoly. Clients, keen to demonstrate quantifiable incremental improvements, willingly go along with this fiction. Media agencies, understandably eager to raise the status and complexity of what they do, connive in the deception…

Weekly Commentary: 07/12/20 – Vaccine inoculating risk tolerance

The best performing FTSE 100 stock last week was Rolls Royce, up 19%. The worst was Unilever down 6.5%, which suggests expectations of a vaccine are inoculating investors against risk. On Nasdaq, the vaccine stock Moderna, was the best performing up 44% in the last 5 days, while Zoom was the second worst performing down 7% while the appropriately named Splunk fell 20%.

The huge rally in markets since April means that 2020 hasn’t been a good year for short sellers. But their time will come again. Last week I listened in to an FT event “How to Spot an Accounting Fraud” with Carson Block of Muddy Waters.

On the call, Block made the distinction between Sino Forrest, the Chinese timber company listed in Canada, which was an outright fraud where the assets didn’t exist and Enron. Though Enron management were found guilty of fraud and sent to prison, it was a real company, their combination of aggressive mark-to-market “fair value” accounting profits plus a debt funded balance sheet is not illegal in itself. He said many companies still operate like Enron, but who are staying just on the right side of the law.

On NMC Health, the collapsed Dubai hospitals business, he said a major red flag was an acquisition they made from Tenet, a US healthcare business which disclosed lease liabilities on its balance sheet. When NMC bought the business, the lease liabilities disappeared from the disclosure. Block said that he had no idea that NMC Health had over $4bn of hidden debt off balance sheet, but he did know that their audited disclosure could not be relied upon. Block was keen to emphasize that auditors often gave investors a false sense of security. Audits are not designed to catch senior management defrauding investors, they are designed to make sure the correct accounting standards are followed, which is subtly different.

Even if you have no interest in shorting stocks, short sellers’ methods can help investors avoid frauds and “police” the market. Short sellers can’t afford to make false claims, unlike management of some companies who often over-claim in the management commentary with no repercussions. In August 2019 Muddy Waters published a short report on Burford, which at the time had been a ten bagger for me. MW made good points about the company’s disclosure, although I think that they should have also emphasized the business was not an outright fraud like their other targets (eg Sino Forrest and NMC Health).

Tremor International, the adtech platform and Boku, the mobile phone payments and identity verification business, both reported positive trading updates. I also look at SDI Group who bought a business and ULS Technology the online conveyancing service sold one for cash.

Tremor International Trading Update

Tremor put out a trading update for FY 31 December 2020. The company anticipates that they will achieve 37-43% revenue growth in H2 2020, compared to H2 2019. FinnCap their broker is now forecasting net revenue (revenue less media cost) of $394m FY 2020 and 19% growth next year to $470m FY 2021. This gives adjusted EPS of 21c$, putting the company on a 2021F PER of 22x the broker’s numbers. FinnCap point out that this is the third upgrade since Covid-19 impacted the advertising market.

History Founded in Israel in 2007, Tremor is incorporated under Israeli law and listed on AIM in 2014. The company listed as Marimedia, then in 2015 changed its name to Taptica and then in June 2019 Tremor. They bought RhythmOne in April 2019 for $176m issuing share 49.9% of their shares at 170p. RhythmOne used to be Blinkx and had a chequered history, with the shares falling 50% in one day when they were accused of fraud by a Harvard Business School academic.* Blinkx was also Carson Block’s first publicly disclosed short position in London.

Adtech platforms In a “network effects” business like a stock exchange, buyers and sellers benefit from coming together on the same platform and the platform then enjoys growing revenues on a fixed cost base. However, the ad-tech industry structure is more complicated with both “demand side” and “supply side” platforms. Demand Side Platforms (DSPs) provide tools so that advertisers can specify the audiences that they would like to target. Supply Side Platforms (SSPs) are the mirror image of this, but for publishers (eg an online newspaper.) Publishers use SSPs to auction off an “inventory” of their readers’ eyeballs and control which advertisers are allowed to show ads to their readers. The rationale for the combination of Tremor with RhythmOne/Blinkx was to combine Tremor’s demand-side platform (“DSP”) with RhythmOne’s supply-side platform (“SSP”).

Then in January this year Tremor bought another SSP (Unruly Holdings) from News Corp and announced a partnership with the newspaper publisher. Unruly has more than 2,000 publishers on its platform, and claims a 1.2bn audience, including privileged access to News Corp’s readership. Tremor issued 8m shares (just under 7% of share capital) to News Corp when the shares were 175p, and announced a partnership. FinnCap suggests more acquisitions of this type are likely in the future.

Tremor expensed all of its R&D spending through the p&l ($33m in 2019 v $20m in 2018) and I can’t see any red flags in the cashlow statement. On the balance sheet there are around $230m of intangible assets, including goodwill or 77% of shareholders’ equity of $300m. Sharepad shows both historic PBT and RoCE has been very volatile: RoCe 22% in 2018, but falling to -6% Trailing 12 Months (TTM) to June 2020 then forecast to recover this year and next.

Institutions Tosca owns 23%, Schroders 15%, Mithaq 14%, News Corp 6%. This should give investors some reassurance, though I think it is no substitute for doing your own research. This Wednesday at 3p.m. the company will hold an investor day, to demonstrate the capabilities of its cloud-based platform on a finnCap Tech VirtualDemo. Interested readers can contact IR@finncap.com to join.

Is adtech a bubble? Google and Facebook are competitors in ad-tech and the landscape can change very quickly (for instance wide adoption of “adblockers”, automated “bots” that view a page impression, aside from fraud and money laundering concerns.) There’s a new book by a former Google employee, Tim Hwang** arguing that online advertising data is unreliable, automated advertising bidding should be regulated and most online ad money is wasted. I do wonder if targeted advertising is a product that is designed to give a false sense of control to those with marketing budgets to spend, rather than because it actually works. I receive many Plus500 and eToro adverts, presumably because cookies identify me as someone who is interested in finance. Yet I have zero interest in using CFD brokers. I’m sure they are bidding high for my eyeballs and attention, however their marketing has the opposite effect: I’m irritated and doubt their business models. It’s not just me: Wey Education, the online school, said on their most recent investor call that online marketing became poor value for them as soon as Covid-19 hit. Searches for “online learning” were bid up, whereas Wey’s advertising on radio stations like LBC and Heart FM became both better value and more effective, in their view.

Rory Sutherland, the marketing chap***, points out that brands work because “buyers usually care less about seeking perfection and more about avoiding catastrophe”. On that basis I think I would avoid investing in the whole adtech industry.

Verdict The 40% revenue growth expected this year, looks exciting. But this wouldn’t be a high conviction idea for me because I think the premise of the whole sector is flawed. I’d certainly ignore the investment case based on peer group comparison, because The Trade Desk is changing hands at 183x forecast earnings, 60x historic revenue and 70x book value, which looks overvalued on any sensible valuation metric. That high valuation could be reflecting the “winner takes all” nature of the business. But if so, is buying Tremor International then the equivalent of backing the second horse in a 2 horse race? The third horse in the race is Fyber, a Berlin based adtech business backed by Lars Windhorst, and seems already on its way to the knacker’s yard.

BOKU Trading Update

Boku put out a brief trading update saying that Group EBITDA for the year ending 31 December 2020 should be at least $13.5 million, ($1 million higher than consensus). The company’s technology enables mobile phone users to pay for items by charging their phone bill or pre-paid balance. This is known as Direct Carrier Billing (DCB).

History – The company was founded in 2009, and listed on AIM in 2017 at 59p raising £13m in a placing that valued the company at £126m. At the start of 2019 they bought Danal, a US business specialising in digital identity for $25m (by issuing 26.7m shares). The idea was to expand the US company’s technology to become global. Instead of using an SMS text message for 2 Factor authentication (that is sending a six digit one time PIN code to a user’s mobile phone) Boku’s connectivity to a mobile operators’ network means that they can verify a user’s identity seamlessly. In June this year Boku acquired an Estonia based DCM competitor called Fortumo for $45m (financed by placing 24m shares at 85p). The price was 6.25x FY19 revenues.

Management –Aside from technology, what sets Boku apart is the quality of the management, in my view. Mark Britto, the non Exec Chairman is Chief Revenue Officer at PayPal. Jon Prideaux the Chief Executive Officer is ex Visa Europe, but also has experience growing sales, and profits, at smaller companies (SecureTrading, Shopcreator). The Chief Executive earned £301K total compensation in 2019, though this doesn’t include the LTIP where he currently has over 4m options. Encouragingly these are not nil cost options, but have a strike price between 37$c and 28$c. He has also been awarded 650,000 Restricted Stock Units (RSUs). The LTIP rewards to the Chief Executive and other senior management explain the $6.8m share based compensation expense in the p&l.

Institutions: Danske Capital Management 6.6%, BlackRock 4.3%, Swedbank 3.9%, Schroders 3.49%

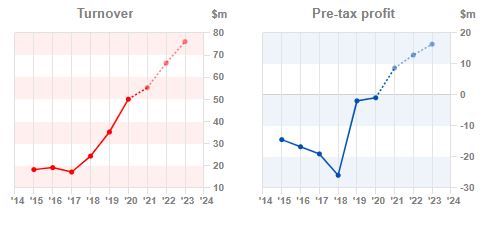

Growth and returns – Last year Boku flagged a one off $3.2m revenue benefit in H2 19, from the release of a customer provision. Edison, the paid for research house, forecast $55m of revenue FY20G, growing by 20% in FY 21F, with a forecast gross profit margin of 90%. The company has been loss making in the past, but is forecast to grow profits strongly in 2021F and 2022F.

Verdict This company looks to have an interesting story, with the network effects beginning to show through revenue, profits and return measures like RoCE and CRoCI all look to be heading in the right direction. That said, the shares are trading on 7x 2021F revenues, so the market appears to be already pricing in the opportunity. My mother owns some, because it fits her process of ignoring valuation and backing good management and exciting growth potential, but the price is too rich for my taste.

ULS Technology – disposal

ULS technology, the online conveyancing platform, announced that it has sold a subsidiary Conveyancing Alliance for £27.3m of cash (versus a market cap of below £40m when the deal was announced). The buyer was the curiously named Project Ophelia Bidco Limited, who control O’Neill Patient Solicitors LLP, the largest conveyancer on the CAL panel. CAL provides a conveyancing comparison tool, perhaps similar to GoCompare, whereas ULS’s eConveyancer and DigitalMove software provide consumers with a more integrated service, with secure messaging, property searches, utility bill changes etc.

Presumably a limited partnership would not be able to finance this purchase with cash, unless there was some private equity backing. It also perhaps explains the departure of the previous Chief Executive in September, if there has been a disagreement over strategy.

The shares were up 20% on the day the news was announced. ULS are now unlikely to need any capital from investors, and there may be a capital return in future. The company reports H1 results to 30 September 2020 on Tuesday 08 December. I’m planning to listen in to the analyst call that day and will report back in detail next week.

SDI acquisition

SDI, the acquisitive digital imaging group,that Richard Beddard likens to Judges Scientific announced another buy: Monmouth Scientific, a UK manufacturer of biological safety cabinets, fume cupboards, laminar flow cabinets and cleanrooms. Total consideration, including earnout, is expected to be approximately £5.8 million.

Monmouth Scientific achieved revenues of £6.2 million, and EBIT of £0.4 million (unaudited) for FY to March 2020. The company has seen increased demand for its instruments due to Covid-19, so revenues to H1 September were £3.7m. The acquisition is mainly in cash, with just 231K shares issued at 87 pence per share. The price looks reasonable, around 1x historic revenues, for a company that in the last 6 months has seen a surge in demand from the virus, which is expected to continue into next year. Total consideration is capped at £6.9m, and would require Monmouth to earn more than PBT £1.9m (ie the price SDI has paid would be capped at 5x post tax earnings). FinnCap, SDI’s broker is now forecasting the company’s net debt to be £4.3m which is negligible compared to a market cap of £84m.

Following the acquisition, the broker is now forecasting EPS of 4.5p in April 2021F, putting the company on 21x PER. The market cap is still less than £100m, versus £360m for Judges, so still plenty of room to grow. I’ve owned the shares since 2016, and like the strategy and the management.

Oxford Metrics FY end Sept

I covered this company’s trading statement in detail in early November and they’ve now reported FY results to end of September. The numbers are inline with their previous trading statement, revenue down 14% to £30.3m and Adjusted PBT down 55% to £2.6m. They maintained their final dividend of 1.8p, the same amount as last year. The company had £14.9m of cash at the end of September and is now looking to make acquisitions to strengthen both of its divisions.

Outlook The outlook statement suggests Vicon (motion measurement 80% of revenues) pipeline is comparable to this time last year (ie pre Covid-19 levels) although the USA remains subdued. They expect Yotta (cloud based infrastructure management for local authorities 20% of revenues) to be profitable for FY20/21. Yotta has been loss making for several years, as the business switches to a SaaS model charging customers an annual recurring fee. Pleasingly Yotta did turn a profit in H2 and the commentary says that the business has a 12% market share, suggesting plenty of room for growth.

That said, I couldn’t help thinking to myself that describing their Yotta business which has been losing money for several years as “market leading” is odd. There are two interpretations. I) They have a market leading business in a sector where all the players fail to make a return for their investors II) They don’t have a market leading business.

I’m not sure which interpretation is true. But I thought it was worth flagging. If I went to watch Southend United (currently at the bottom of League Two) and they claimed to be leading the Premiership, I would treat managements claim with some scepticism. The tone of the announcement sounds optimistic and upbeat, but we now need to see management deliver profitable growth, not just talk a good game.

Bruce Packard

Notes

The author owns shares in ULS Technology, SDI Group and Oxford Metrics

Author’s mother owns Boku

* https://www.independent.co.uk/news/business/news/blinkx-shares-take-tumble-after-harvard-blog-accusations-9097690.html

** https://www.amazon.co.uk/Subprime-Attention-Crisis-Advertising-Originals-ebook/dp/B084M1R3JW/

***I’m sure Rory would hate to be called a “marketing guru”. I laughed out loud when I read his piece on targeted ads in Campaign magazine:

https://www.campaignlive.co.uk/article/targeted-messaging-one-piece-advertising-puzzle/1488565

By deluding everyone that the whole of advertising is reducible to “the efficient and inexpensive delivery of targeted messages” through the extensive use of data and algorithms, two companies have gained a multi-billion-dollar rent-seeking monopoly over the majority of advertising activity.

The simple fact is that Facebook and Google cannot realistically claim to have a monopoly on creative ideas. So they grotesquely overstate the relative importance of those parts of the business where they do enjoy a natural monopoly. Clients, keen to demonstrate quantifiable incremental improvements, willingly go along with this fiction. Media agencies, understandably eager to raise the status and complexity of what they do, connive in the deception…