Phil asks whether AG Barr’s recent acquisitions can turn it into a growing business again.

Soft drinks companies are a long-term favourite with investors. Their products are affordable, small and regular consumer purchases which can produce a nice blend of steady growth and resilience which can make them all-weather investments.

The giants of the industry such as Coca-Cola (NYSE:KO) and Pepsico (NYSE:PEP) have steadily compounded in value over the decades whilst paying a growing dividend.

Five years ago it would not have been seen as ridiculous to say that AG Barr had similar characteristics. It was seen as a well-managed company that had done well for its investors, underpinned by the strength of its iconic IRN BRU brand.

Sadly, the intervening period has not been a good one. A big profit warning in 2019, the hit of Covid-19 and a lack of exposure to the growing segments of the soft drinks market have seen the company and its investors go through tough times.

Its share price has halved since its 2019 peak and has significantly underperformed the FTSE-All Share index. Total returns over the last five years have been negative to the tune of 22.4 per cent whilst the FTSE-All share has returned 19.1 per cent.

With the exception of Britvic, Barr’s sector peers have also disappointed.

Barr used to command a high and premium valuation to most of its sector peers. This has now disappeared. Just before its 2019 profit warning, AG Barr shares traded on a forecast PE ratio of over 26 times. At the time of writing, they can be picked up for just over 15 times at a share price of 488p.

UK Soft Drinks Companies: Investment Performance

Source: SharePad

What has gone wrong?

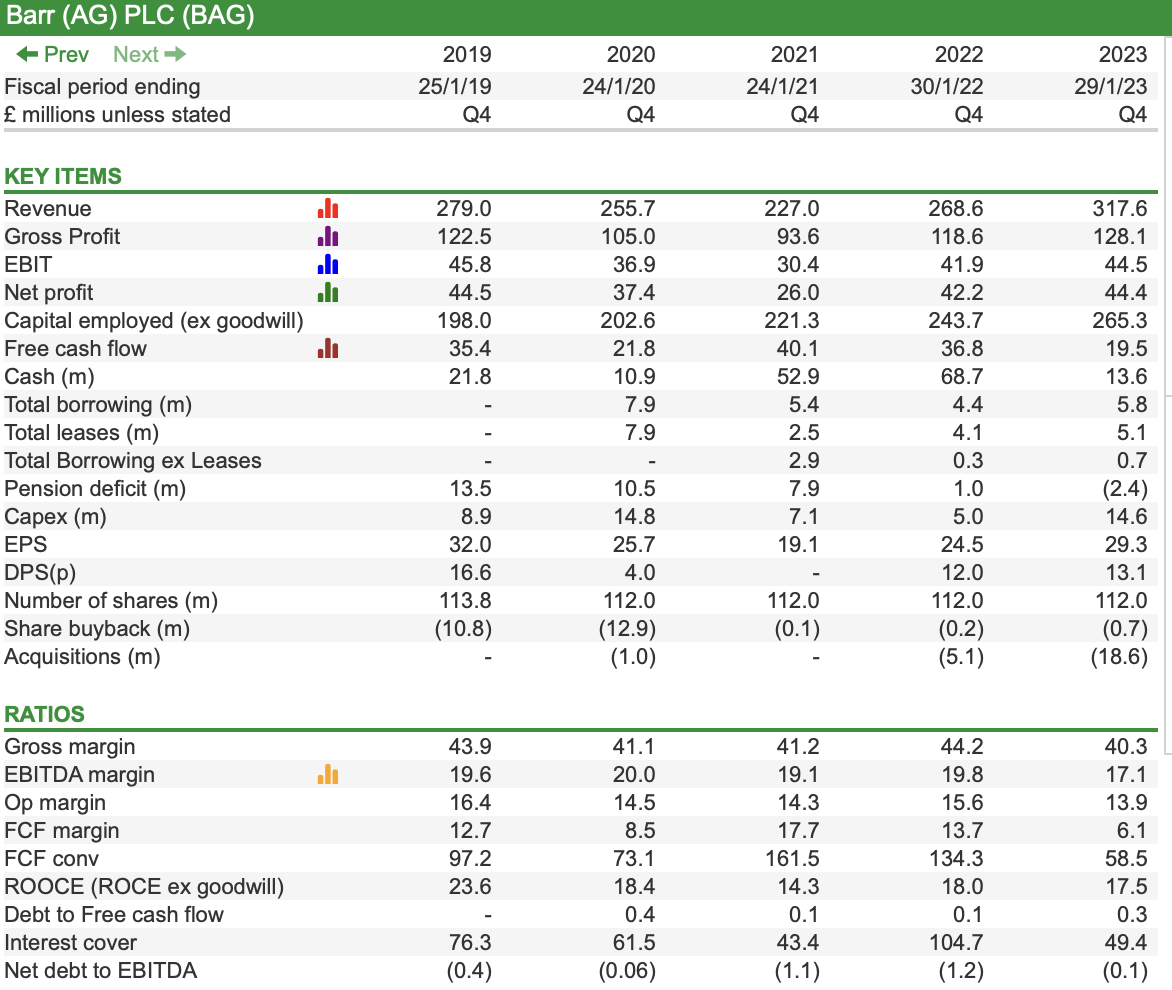

If you open up SharePad and look for shares with the financial hallmarks of quality – such as decent profit margins, good returns on operating capital employed (ROOCE), low debt and strong free cash flow generation – then AG Barr still ticks a lot of boxes.

However, one vital ingredient has been missing in recent years – profit growth.

Several hallmarks of quality with one missing ingredient – growth

Source: SharePad

A snapshot of a company’s financial performance and its key ratios is a great way to begin looking at a business and SharePad does this brilliantly.

However, you can get an even better insight into understanding a company and how it is performed by looking at changes over a period of time.

This is quite simple to do.

By exporting some key numbers from SharePad into a spreadsheet (using the sharing option) you can look at how a company has performed by looking at the changes and the incremental profitability and returns it has generated.

The incremental performance ratios you are calculating and how to calculate them are as follows:

- Gross margin = change in gross margin/change in turnover.

- EBIT margin = change in EBIT/change in turnover.

- Capital turnover = change in turnover/change in capital employed.

- ROCE = change in EBIT/change in capital employed.

- Free cash flow margin = change in free cash flow/change in turnover

- Free cash conversion = change in free cash flow/change in post-tax or net profit.

If you want to calculate the five-year incremental performance of a company, you simply take away the performance from five years ago from the current performance to see the change in actual numbers. You then use those changes to calculate the financial ratios.

When you do this for AG Barr it tells you a lot as to why the shares have performed so badly.

AG Barr: Incremental Financial Analysis

|

Cumulative analysis: |

5Y |

10Y |

|

Revenue |

53.5 |

80.0 |

|

Gross Profit |

11 |

20.1 |

|

EBIT |

0 |

9.6 |

|

Net profit |

-0.5 |

12.8 |

|

Operating Capital Employed |

74.4 |

116.0 |

|

Free Cash Flow |

-11.7 |

19.0 |

|

Ratios: |

||

|

Gross margin |

20.6% |

25.1% |

|

EBIT margin |

0.0% |

12.0% |

|

Capital Turnover(x) |

0.72 |

0.69 |

|

ROCE |

0.0% |

8.3% |

|

Free cash flow margin |

-21.9% |

23.7% |

|

Free cash flow conversion |

N/A |

148.2% |

Source: SharePad/My calculations

Over the last five years, the company has added £53.5m in additional revenues with no increases in profit and a reduction in its free cash flow. Essentially, It has increased its operating capital employed by over ££74m over this time and added nothing.

Over ten years, the performance looks a little better, especially from a free cash flow perspective, but the incremental return on £116m of extra investment has been just 8.3 per cent.

As a result, ROOCE has declined from over 23 per cent in 2012 to just over 17 per cent for the year to January 2023.

In isolation, a 17 per cent ROOCE doesn’t look too bad but the incremental analysis exposes a worrying trend.

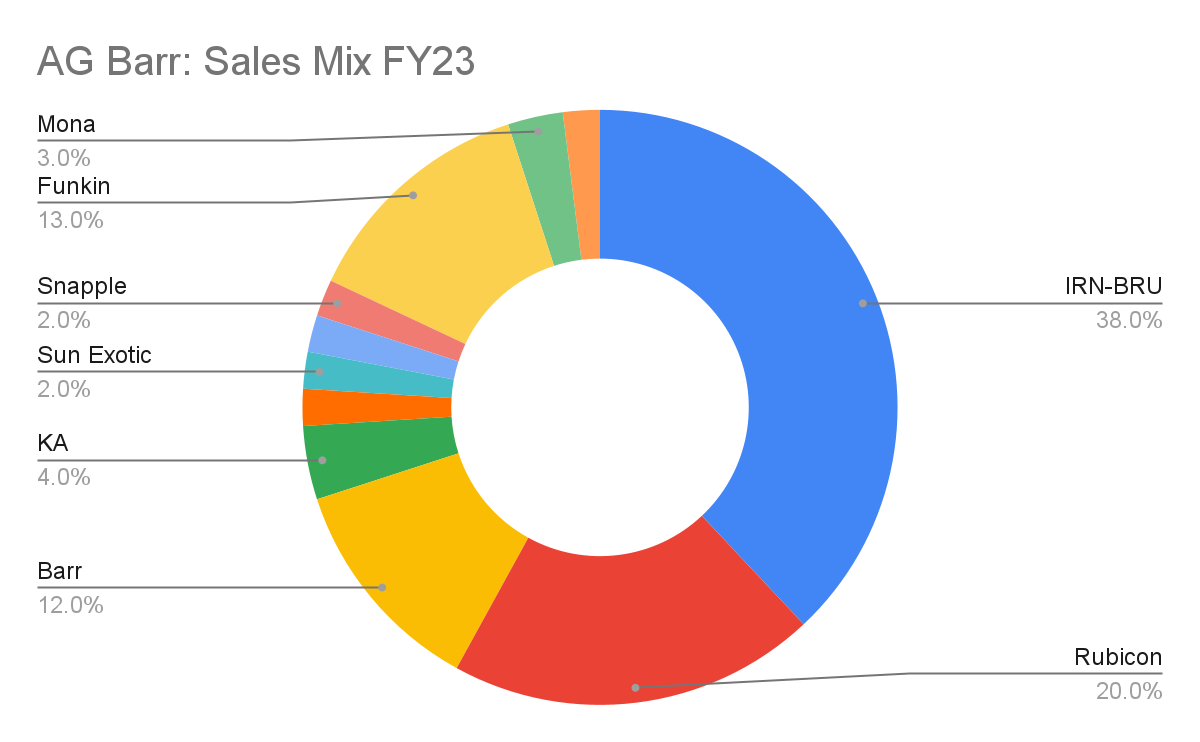

Too reliant on IRN-BRU?

Source: AG Barr

AG Barr’s business is underpinned by a very strong iconic brand in IRN-BRU and backed up by a strong stable of Barr-branded fizzy drinks which sell very well in their home Scottish market.

Whilst these products have proven to be very dependable, they are perhaps a bit too local in nature whilst their revenues have matured to a steady rather than strong rate of growth.

Barr has added to this bedrock by making a number of acquisitions over the years to expand the range of its drinks offer.

AG Barr: Major Acquisitions

| Acquisition | Products | Year |

| Strathmore | Water | 2006 |

| Rubicon | Fruit Drinks | 2008 |

| Funkin | Ready-made cocktails | 2015 |

| Moma | Porridge products and Oat drinks | 2021/2022 |

| Boost | Energy and Sports drinks | 2022 |

Source: AG Barr

Rubicon and Funkin have been decent acquisitions and are delivering meaningful sales.

However, in recent years Barr has suffered from a lack of exposure to areas of the UK soft drinks market that have seen the strongest growth in value such as cola, dairy and energy drinks.

Energy drinks has been a missed opportunity and not helped by the loss of the Rockstar UK production licence to rival Britvic back in 2020.

The company has tried to build its own energy drink products from scratch using its IRN BRU and Rubicon brands but so far without success.

Will Moma and Boost transform the fortunes of AG Barr?

In order to try and put the company on a growth footing, AG Barr has been buying companies in different parts of the soft drinks market. It bought oat drinks and products business Moma for a total of £9.6m in two separate transactions in 2021 and 2022.

Last December, it bought UK energy drinks maker Boost for a cost of up to £32m depending on its profits over the next two years.

Organic growth is always seen as preferable and more valuable than buying growth which can sometimes become an act of desperation that does not pay off. However, Barr’s two recent buys look as if they are pretty wise purchases as they give it meaningful exposure to growth markets.

Moma sells food and drink made from wholegrain British oats. These include porridge, muesli, granola and oat drinks. Oat drinks account for nearly 70 per cent of Moma’s turnover.

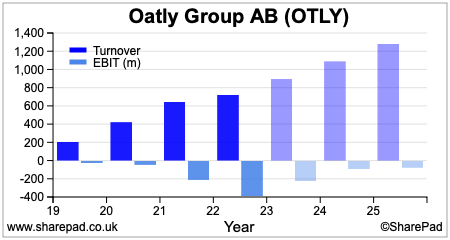

According to AG Barr, the UK oat milk market is expected to be worth £242m by 2025 compared to £161m in 2022. That’s decent growth but whether it will produce decent profits is open to debate.

There are growing concerns that the market for plant-based products is now saturated with many companies withdrawing products or going out of business.

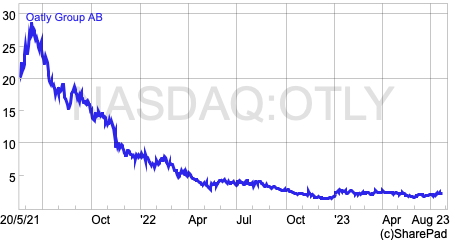

Swedish oat drinks company Oatly is showing strong revenue growth but is still expected to be making losses for the foreseeable future.

The stock market’s enthusiasm for its shares has collapsed. This is arguably not a good sign for Barr’s acquisition of Moma.

Thankfully, AG Barr has not spent a huge amount of money on Moma which will limit the damage if things do not turn out well. Given the small size of this business in terms of Barr’s overall revenue mix, it is unlikely that Moma is going to be a game changer for the company’s shareholders.

When it comes to the acquisition of Boost, there are much stronger grounds for optimism.

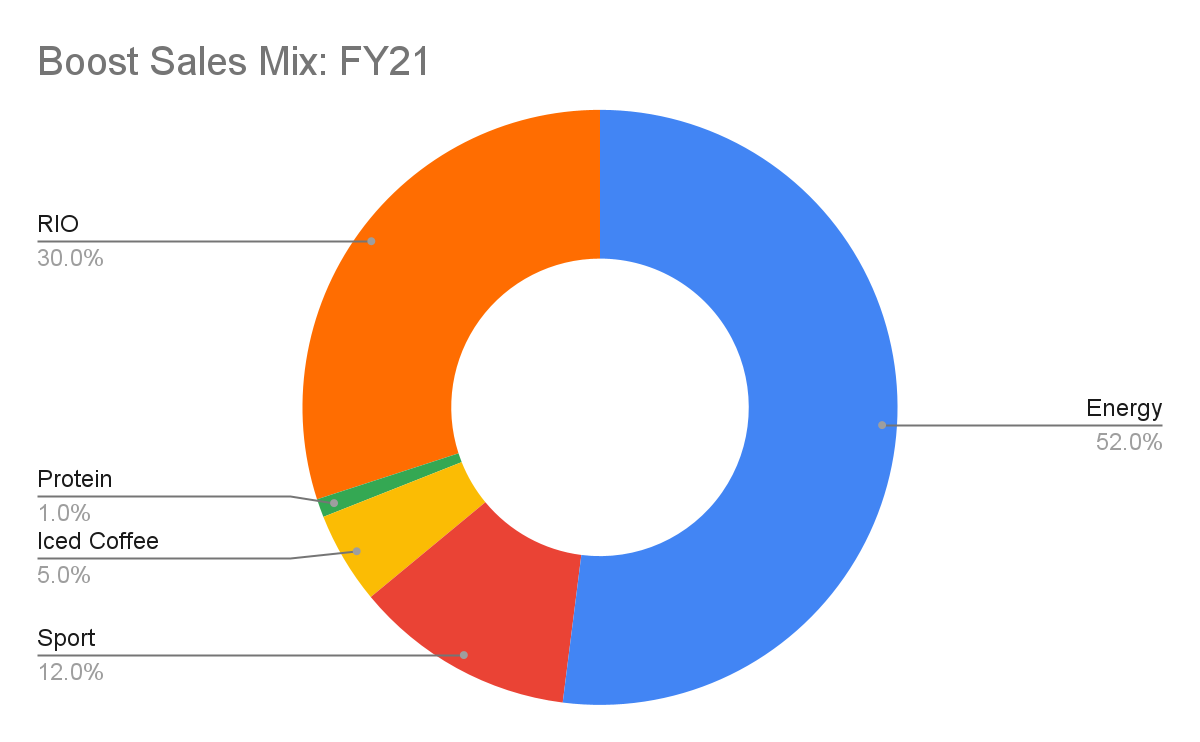

Source: AG Barr

Boost has been in business since 2001 and derives most of its sales from energy and sports drinks where sales have been growing rapidly in recent years.

Three-quarters of its sales come from England with a strong presence also in Ireland. It brings a meaningful sales base to Barr and will account for roughly 14 per cent of the company’s revenues in 2023/24.

The business has a strong sales presence with UK independent retailers and operates an asset-light business model – similar to Fevertree and Nichols – with production, warehousing and logistics outsourced to third parties. It has an exclusive sales and distribution with the fruit drinks brand, RIO.

Boost’s management team are staying with the business and it will remain as a standalone company for now.

Boost gives Barr a meaningful presence in the fast-growing energy and sports drink market. Boost sales were £42m in 2021 and are expected to be £65m this year.

Unfortunately for Barr’s shareholders, the profit contribution is not likely to be much in the short term – about £1m this year – due to earn-out costs.

Looking further out, there seems to be good prospects for growth and synergies with Barr’s existing businesses.

Opportunities for Barr include:

- Improved distribution and marketing with more routes to market such as supermarkets.

- Bringing Boost production in-house with its Milton Keynes slim can facility. This will allow Barr to benefit from the leveraging of Boost’s revenues over its fixed overheads to generate higher profits

Boost is going to reduce Barr’s profit margins in the short term. Its gross margins are currently very thin at around 12 per cent whilst short-term profit growth is going to benefit Boost’s previous owners for the next couple of years.

That said, Boost made £2.5m in pre-tax profit in 2020 and should be capable of making much more in the future given the potential revenue growth of its products, new routes to market and cost improvements. It looks as if Barr stands a good chance of making the acquisition work well for its investors.

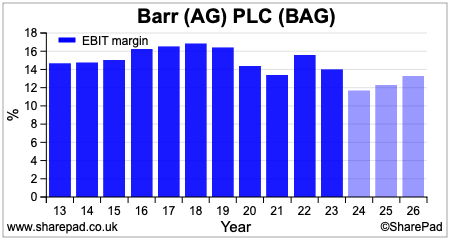

From 2025 onwards, Barr is confident that it can improve its own profit margins back to the 14-15 per cent range. With a growing revenue stream from energy drinks, this suggests that Barr has a good chance of delivering much higher profits than it is currently.

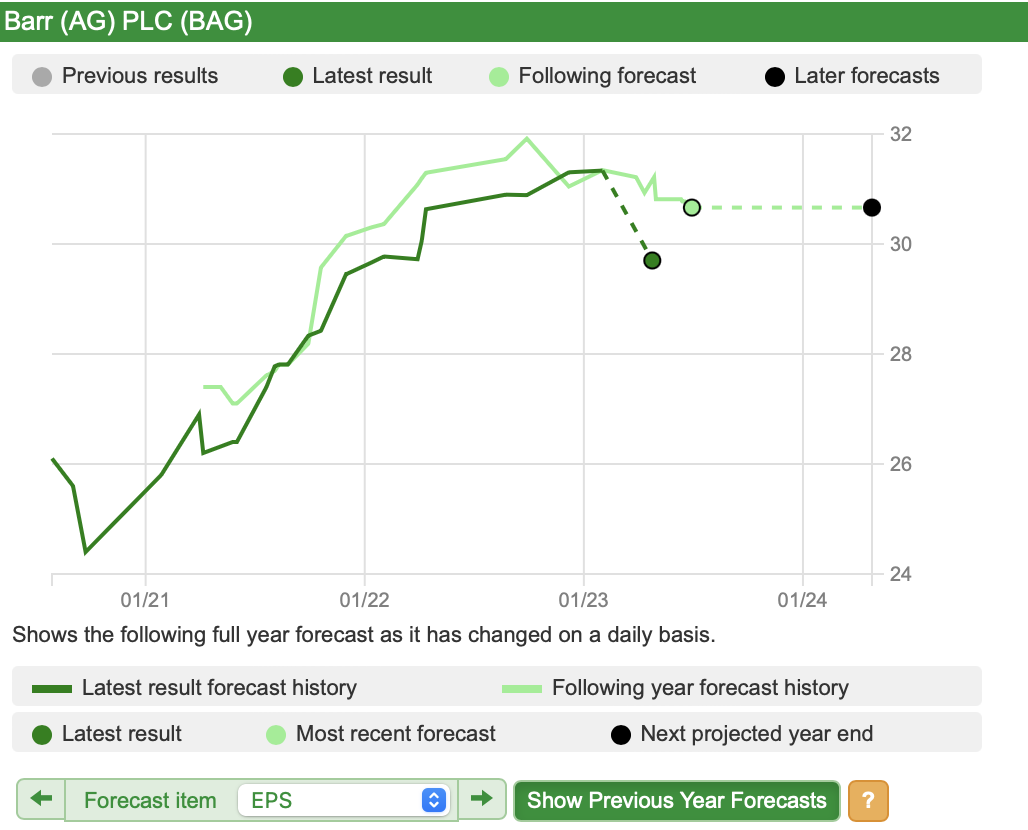

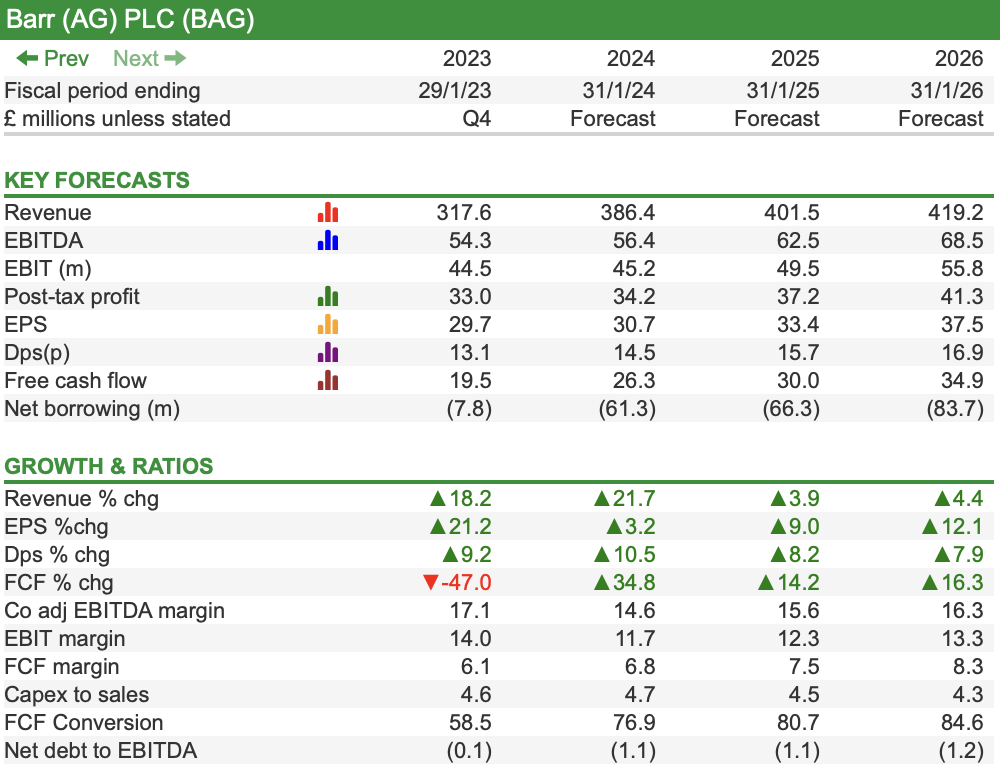

Resilient profit forecasts

Source: SharePad

Barr’s current guidance for its current financial year is for its underlying revenues to increase by 7-8 per cent excluding the acquisition of Boost. Given the current rate of UK inflation, most of this growth is likely to come from price increases rather than selling more drinks.

The company has coped with cost inflation well by raising prices and selling more profitable products. Unilever’s recent results suggest that strong brands do have pricing power whilst the decent summer weather should have helped sales.

Barr has hedged its exposure to key commodities such as aluminium, energy and ingredients and will not benefit from falling prices yet.

That said, profits are expected to make modest progress according to City analysts’ forecasts with a big jump expected when the Boost earn-out ends and margins rebuild from 2025.

Free cash generation is expected to be good, leading to a significant improvement in the company’s net cash position. This should support decent dividend growth and possibly the opportunity to buy back shares whilst the shares are depressed.

Source: SharePad

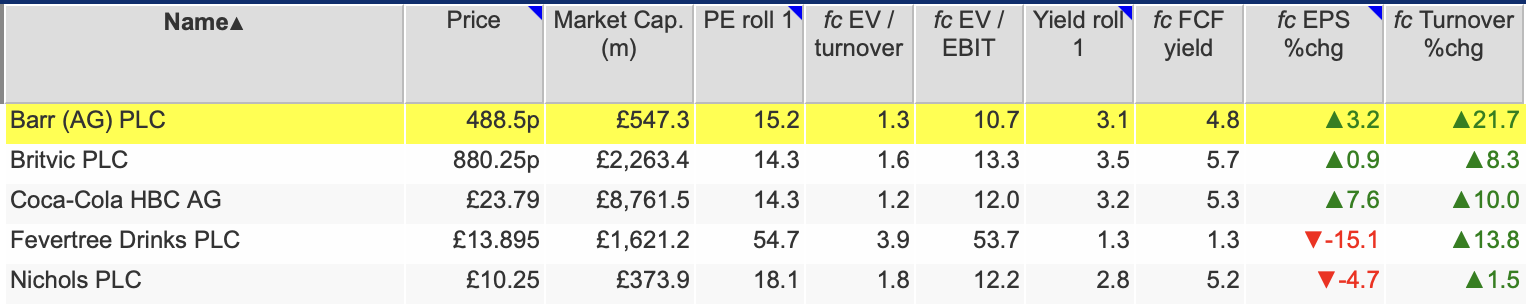

Looking at measures such as enterprise value to EBIT (EV/EBIT) – which strips out differences in tax rates and company financing which PE ratios do not – AG Barr is now the cheapest share in the UK soft drinks sector.

UK Soft Drinks Valuations

Source: SharePad

Investors are going to have to be patient, but the company looks to have a much better future with the acquisition of Boost. The shares are unlikely to make a lot of progress in the short term but buying them when sentiment is poor, as it is now, could pay off for those that are prepared to wait.

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.