Bruce uses Sharepad to graph UK house prices and mortgage approvals data back to the 1980s. Companies covered BLV, SHOE and OTB.

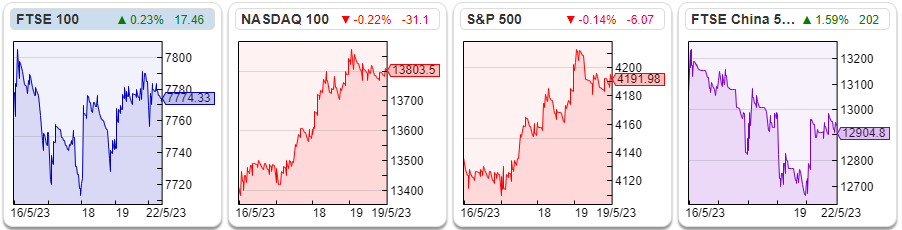

The FTSE 100 was flat in the last 5 days, at 7,774. The Nasdaq100 was up strongly +3.4%, as was the KBW US regional banks index (KRE) up +7.7% while the S&P500 was up +1.6%. Brent Crude was up less than 1% over the same time period and is down -12% YTD. Russia’s invasion of Ukraine doesn’t seem to be causing the oil price shock that many had anticipated. Interestingly the China CSI 300 Index (Shanghai) and the FTSE China 50 Index, are the worst-performing indices over the last 20 days (down -5%) while Japan’s Nikkei was the best-performing (up +8%). I suggested in July two years ago that Chinese Central Bank activity and the Chinese stock market is worth keeping an eye on, as a leading indicator of US and UK markets.

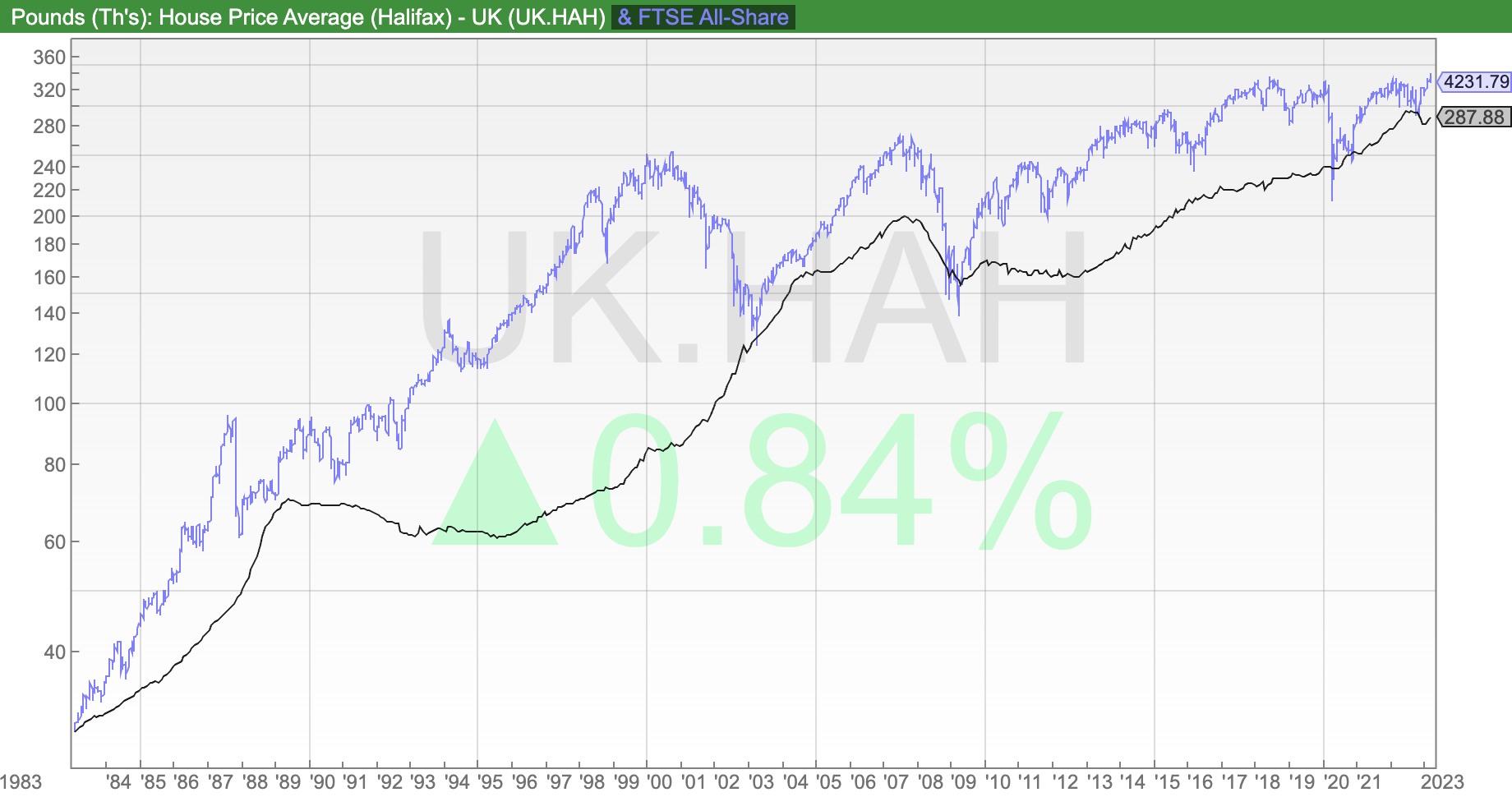

I am also keeping half an eye on UK house prices as interest rate rises feed through to the rest of the economy. The Halifax House Price Index showed annual growth slowing to just +0.1% in April, from +1.6% in March. A typical property now costs £286,896, which is around £7,000 below last summer’s peak; though that’s still £28,000 more than two years ago. Sharepad has this index going back to the mid-1980’s (UK.HAH) and I have plotted it against the FTSE All Share (ASX, in blue).

Remarkably the FTSE All Share halved in value between 2000-2003, but UK house prices doubled over roughly the same time period as the BoE cut interest rates and Northern Rock and HBOS grew their mortgage books aggressively. Currently, UK house prices are overvalued on any conventional measure, but it’s widely agreed that the UK stock market is cheap – see these 6 charts from Schroders – I wonder if at some point we might see the opposite of 2000-2003: the stockmarket doing well, but house prices going backwards?

Remarkably the FTSE All Share halved in value between 2000-2003, but UK house prices doubled over roughly the same time period as the BoE cut interest rates and Northern Rock and HBOS grew their mortgage books aggressively. Currently, UK house prices are overvalued on any conventional measure, but it’s widely agreed that the UK stock market is cheap – see these 6 charts from Schroders – I wonder if at some point we might see the opposite of 2000-2003: the stockmarket doing well, but house prices going backwards?

There’s a fascinating Policy Outlook from the Resolution Foundation, pointing out that because 2-5 year fixed rate mortgages have become much more popular since the financial crisis, there’s still a significant amount of pain to come for borrowers. Annual mortgage bills are likely to hit disposable income, the average rise is expected to be £2,300 for the 1.6 million households with expiring fixed-rate deals in the coming year, according to the Resolution Foundation. I think Central Banks need to keep interest rates at their current level or perhaps even higher, to regain their lost inflation-fighting credibility. 5% interest rates ought to be manageable for most companies, I’m less convinced that some overly indebted households can cope though.

Below I look at Belvoir, the letting agent, plus Shoe Zone and On The Beach. The latter two companies ought to be enjoying favourable conditions now that the pandemic is well and truly over, yet neither could really be said to be firing on all cylinders, perhaps because some consumers are becoming more cautious on their spending.

This week is Mello, which I’m looking forward to attending in Chiswick and meeting company management, as well as readers. Please come and say hello. David looks to have put together a diverse collection of companies, so there should be something for everyone.

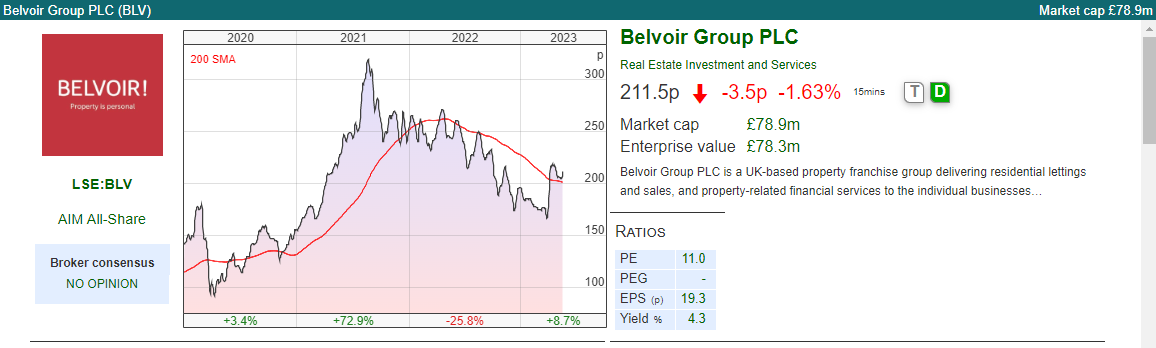

Belvoir AGM trading statement

This letting agent with a December year-end put out an “in line” AGM trading update for FY Dec 2023F. That resilient performance is encouraging given rising interest rates and they say that a degree of stability has returned to the UK mortgage market. They point out in last week’s RNS that mortgage approvals rose in February and March, by which they mean were above the levels seen in January and Q4 last year.

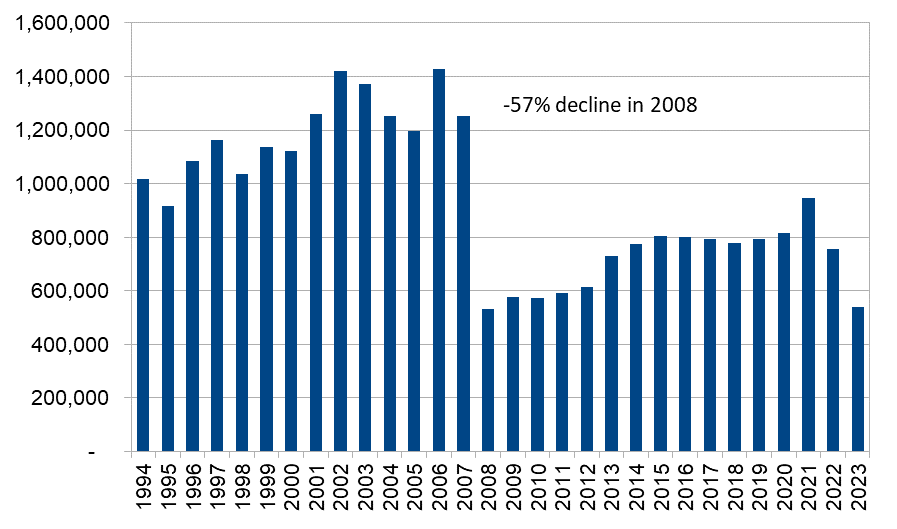

It is true that mortgage approvals did rise to 52K in March, versus 44K in February, according to the Bank of England data, but I would focus on the year-on-year comparisons. On that basis, approvals for house purchases are down by a quarter versus March 2022. On a Q1 2023 v Q1 last year, mortgage approvals are down -36%. Aside from house price data, Sharepad also has BoE mortgage approvals data going back to the early 1990’s (UK.HMA), so I have produced the chart below, with 2023 annualised from the first 3 months of the year. The chart shows that mortgage approvals for house purchases have never recovered from the 1.25m-1.45m levels before the financial crisis, despite very low-interest rates up until last year. Annualising Q1 2023 figures gives 540K, which is around the same level as 2008 and down -42% from 2021.

Belvoir has two divisions: i) estate agents franchises like Belvoir, Lovelle, Newton Fallowell, Nicholas Humphreys, Northwood and Mr and Mrs Clarke, which were 46% of revenue, plus ii) a financial services division of mortgage advisers around 54% of revenue. The franchises often provide a lead to customers looking for mortgage broking and other financial services.

For FY Dec 2022 property revenue was up + 3%, supported by lettings +5%, whereas property sales commissions were down -15% on a like-for-like basis. Traditionally Belvoir has been stronger in lettings than sales, which seems to suit the current environment. For the first four months of this year rents on new tenancies are up +10%. I’m not sure that BTL landlords are going to find it easy to push through lettings above inflation increases, the Renters Reform Bill and Department for Levelling Up, Housing and Communities show the political direction we are travelling in. We could see the shrewder Buy To Let investors recognise that the easy gains were made in the 1990s and 2000s and begin selling off houses in their BTL portfolios.

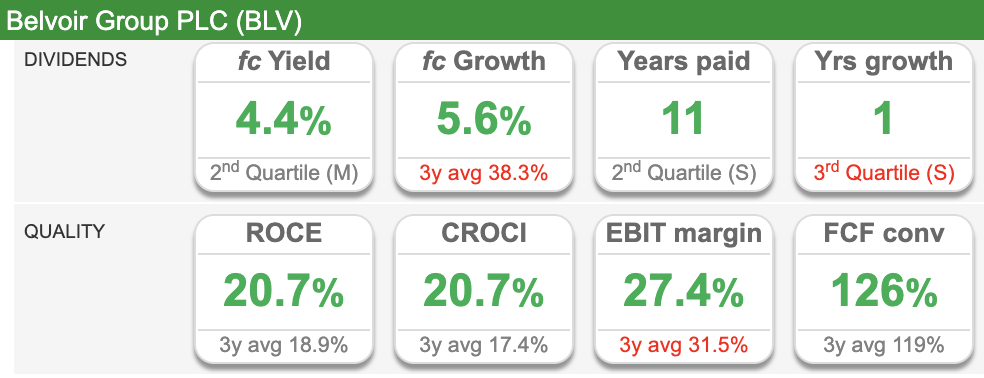

Valuation: The shares are trading on 11x Dec 2024F PER, which seems low given the track record of RoCE, almost 30% EBIT margin and income growth.

Opinion: It could be worth keeping an eye on both estate agents and housebuilders as interest rates rise. Currently, valuations in both of these sectors seem good value, but they are highly cyclical so they could be value traps / cheap for a reason. BLV management believe that visibility is good enough in the housing market to confirm FY Dec guidance, but perhaps they are being over-optimistic as the effects of interest rate rises have yet to be fully felt?

I would wait until Q3 this year and then re-examine the investment case.

Shoe Zone H1 1st April Results

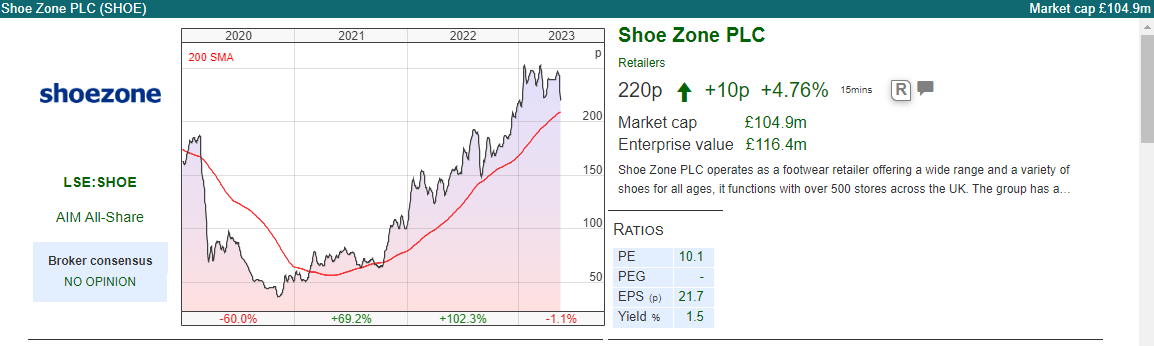

So many fashion retailers have struggled over the last 18 months (SDRY, ASOS, BOO) but this shoe retailer, with 336 stores and an online shoezone.com store was, until last week, going against the trend. Their average selling price for a pair of shoes is £12, which they achieve through buying directly from factories in China. There’s a longer explanation of how they do this on their website. They also say that part of the success is down to their efficient returns process, where customers can order shoes online but return shoes that they don’t want to the physical stores. Currently, the return rate is 11%, which I think is lower than most retailers.

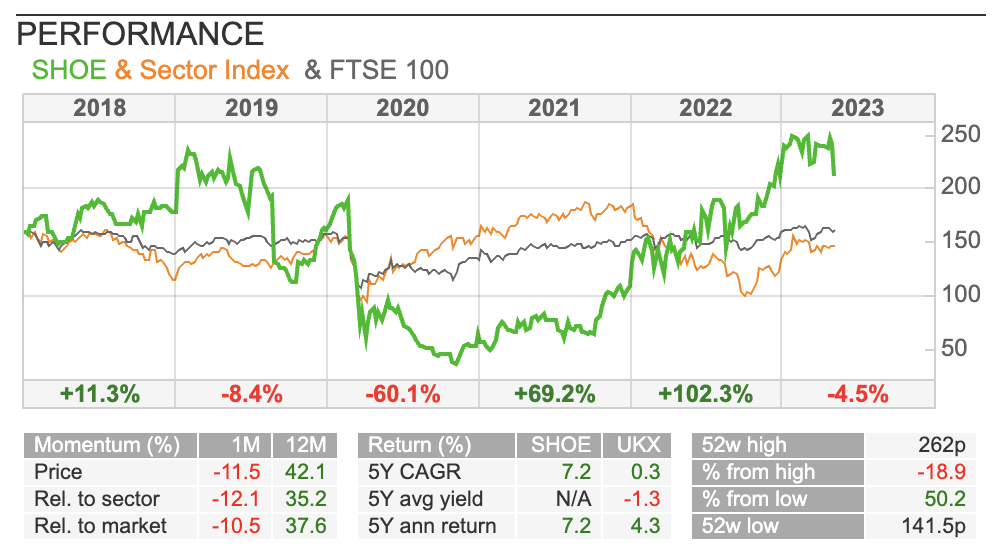

The previous 18 months has been very strong, both in absolute terms (green) and against the rest of the retail sector (orange).

The company has an odd habit of having their period ends on the first day of the month, rather than the final day. Effectively having a 1 Oct year-end, is the equivalent of Sept year-end for other companies.

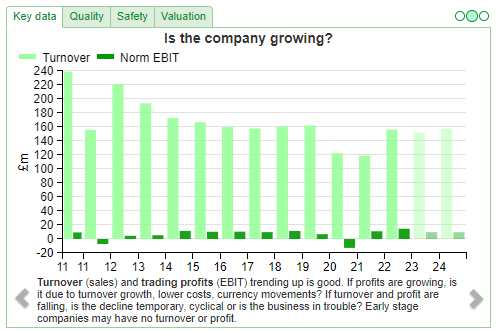

H1 results to 1st April showed revenues +8% to £75m, that is an impressive performance given that the company has been closing and/or re-fitting stores, so they traded out of 52 less stores versus 12 months ago. It’s worth noting that even before the pandemic the company has been struggling to growth the top line, as the chart below shows.

Adj PBT was down -19% to £2.5m for the half. The company had £28m of stock at the period end, down £3m on the same point last year. The net cash balance fell £1m to £12.9m, partly due to capital expenditure fitting out stores, but also a buyback of £3m and £8m of dividends paid.

History: The company was founded in 1980 by two brothers Michael and Christopher Smith, and management then passed on to son and nephews Anthony and Charles Smith, who are the current CEO and Chairman, owning 31% and 25% of the company respectively. That means there’s a risk that the de-list the company at a low price (like IBPO and KAPE). Management’s track record of behaviour suggests that they will treat minority shareholders fairly, but I’m flagging the possibility as something to be aware of.

In the 1980s they grew organically and by acquisition and changed their name from Bensonshoe to Shoe Zone in 1996. They launched the Shoezone.com website in 2010. In May 2014 Shoe Zone listed at 160p, raising £35m for selling shareholders and valuing the market cap of the company at £80m. Just before the pandemic, the shares were trading above £2 but then crashed to below 40p as most of their sales were through high street stores. However, they managed to survive the pandemic without issuing any equity, the number of shares outstanding is 49m, following last year’s buyback is currently below the 50m at the IPO.

Outlook: The shares were off -15% on the day of the results, despite the £2.5m adj PBT being “slightly above management expectations”. I haven’t seen the broker note from Zeus, so I wonder if the broker has cut next year’s forecasts. In last week’s RNS, management warn about higher staff costs from the National Living Wage increases.

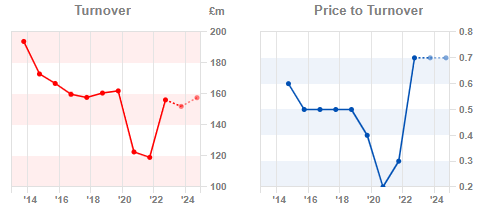

Valuation: The shares are trading on 16x Sept 2023F rising to 17x Sept 2024F. Before the pandemic 3-year average RoCE was 24% versus 19% currently. The profitability is impressive, but critics could also point out that peak revenue was £166m in 2015, versus £ 156m for 2023F so there hasn’t been any revenue growth, just a recovery from the pandemic.

Opinion: I like the differentiated business model and family ownership. This shows that there’s lots of upside in retailers if you can pick the ones with a good strategy and sustainable finances. The current valuation looks about right given the lack of top-line growth. I think if you had read the RNS in isolation, particularly the adj PBT “slightly above management expectations”, then there would have been little reason to anticipate last week’s -14% share price fall. In my view, investing ought to be a level playing field, with any bad news spelt out in the RNS, rather than having to read between the lines of management commentary or published separately in broker notes.

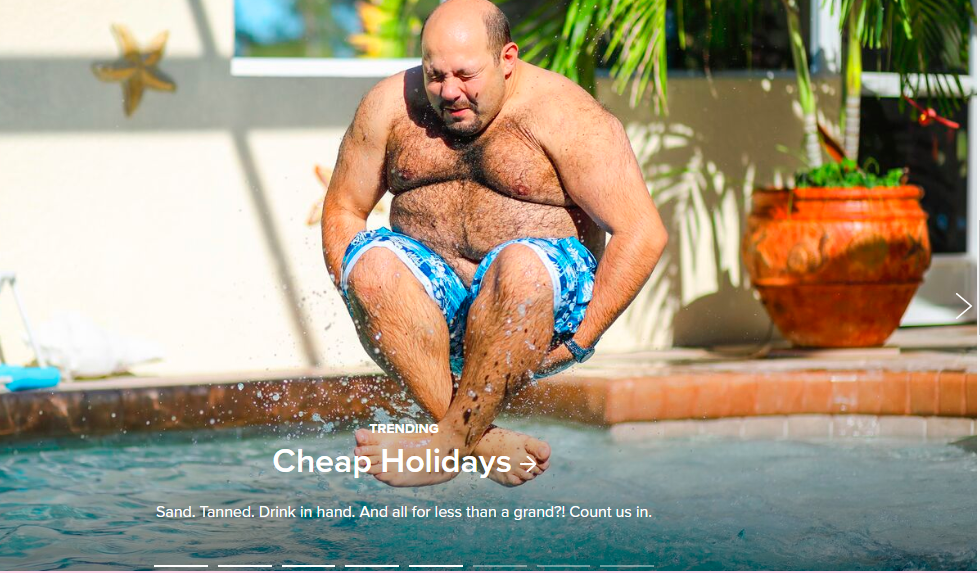

On The Beach H1 to March Results

This online retailer of holidays that is attempting to disrupt tour operators and travel agents announced, H1 to March results with group revenue recovering to +38%, but a loss before tax of £6m (down from £7m loss the previous year). Net debt was £20m at the end of March, versus £1m end of March last year. The company has £60m of credit facilities with Lloyds and NatWest, of which half has been drawn down.

The “disruptive” part of the business model is to let customers put together the components of their holiday (including flights, hotels and transfers) to build custom-made holidays from millions of flight and hotel combinations, as opposed to using a traditional tour operator which offers pre-packaged holidays.

History: The company started life offering skiing holidays as On The Piste Travel in 1996, but then changed its name to On The Beach a couple of years later. They originally advertised holidays through Teletext, with bookings taken by a call centre, before moving on to the web in 2004. At first, this was just a static website, showing hotels to prospective customers, but they then moved to a dynamic website in 2005, which allowed customisation of packages. The Private Equity firm Livingbridge invested in 2007, which in turn was bought by another PE firm: Inflexion.

The company listed on the LSE (not AIM) in September 2015, at 184p per share, raising just £6m of new money with selling shareholders (Inflexion) receiving £84m for 36% of the company. That valued the company at £240m market cap on admission.

Before the pandemic hit, the business model appeared to be working well, with revenue in FY Sept 2019 of £140m, and PBT of £20m. That fell to £21m of revenue and a £37m pre-tax loss two years later. Current forecasts assume that the pre-pandemic trend should re-assert itself.

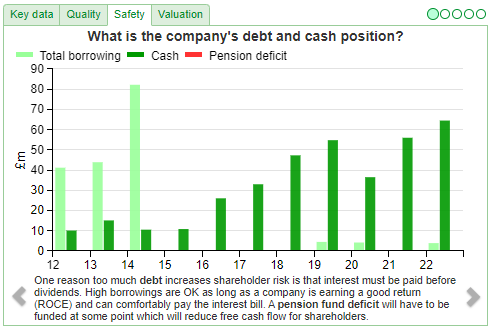

This industry is by its nature seasonal, currently, the balance sheet looks OK, with no long-term debt, but £312m of payables – most of which is presumably commitments as customers pay in advance, but OTB pays for hotels later. That means the business is a positive working capital business, however, in my experience that doesn’t mean that high profitability necessarily follows, just because a business receives its cash upfront. On the asset side, I’m slightly surprised that cash in the bank has fallen -43 to just below £10m, versus H1 last year. I would have expected the H1 cash position to be improving, but perhaps that is just a timing difference. Year-end cash (green bar in the chart below) was £64.5m at the end of September 2022.

Outlook: They say that momentum has continued into April and point out that Summer 2022 saw widespread airline and airport disruption, which ought to flatter this year in comparison to last year’s summer. The Founder, Simon Cooper, is stepping down from the Chief Exec role and is being replaced by the current Finance Director, Shaun Morton. The founder will remain on the board as a Non-Exec as he still owns 5.8% of the shares.

Valuation: The shares are trading on 7x Sept 2024F PER, which implies the EBIT margin recovering to 16% versus 2.9% reported last year. In 2017 and 2018 RoCE peaked in the mid 20’s, which surprised me given that people buying holidays can be quite price sensitive, shopping around for the best deals. That suggests to me that customers do value what OTB offers.

Opinion: Traditionally foreign holidays are one of the first items to be cut when households finances are under pressure – so I would be cautious. I’m also a little wary of businesses when the founder chooses to step down. I can understand that having founded OTB more than 25 years ago and seeing it through both the IPO and then the pandemic, perhaps the founder needs a well-earned holiday. Again this is a company I would look at again in 6 months’ time, as I think there could be a good story here when the economy is more helpful.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 23/05/23 | BLV, SHOE, OTB | Does the house always win?

Bruce uses Sharepad to graph UK house prices and mortgage approvals data back to the 1980s. Companies covered BLV, SHOE and OTB.

The FTSE 100 was flat in the last 5 days, at 7,774. The Nasdaq100 was up strongly +3.4%, as was the KBW US regional banks index (KRE) up +7.7% while the S&P500 was up +1.6%. Brent Crude was up less than 1% over the same time period and is down -12% YTD. Russia’s invasion of Ukraine doesn’t seem to be causing the oil price shock that many had anticipated. Interestingly the China CSI 300 Index (Shanghai) and the FTSE China 50 Index, are the worst-performing indices over the last 20 days (down -5%) while Japan’s Nikkei was the best-performing (up +8%). I suggested in July two years ago that Chinese Central Bank activity and the Chinese stock market is worth keeping an eye on, as a leading indicator of US and UK markets.

I am also keeping half an eye on UK house prices as interest rate rises feed through to the rest of the economy. The Halifax House Price Index showed annual growth slowing to just +0.1% in April, from +1.6% in March. A typical property now costs £286,896, which is around £7,000 below last summer’s peak; though that’s still £28,000 more than two years ago. Sharepad has this index going back to the mid-1980’s (UK.HAH) and I have plotted it against the FTSE All Share (ASX, in blue).

There’s a fascinating Policy Outlook from the Resolution Foundation, pointing out that because 2-5 year fixed rate mortgages have become much more popular since the financial crisis, there’s still a significant amount of pain to come for borrowers. Annual mortgage bills are likely to hit disposable income, the average rise is expected to be £2,300 for the 1.6 million households with expiring fixed-rate deals in the coming year, according to the Resolution Foundation. I think Central Banks need to keep interest rates at their current level or perhaps even higher, to regain their lost inflation-fighting credibility. 5% interest rates ought to be manageable for most companies, I’m less convinced that some overly indebted households can cope though.

Below I look at Belvoir, the letting agent, plus Shoe Zone and On The Beach. The latter two companies ought to be enjoying favourable conditions now that the pandemic is well and truly over, yet neither could really be said to be firing on all cylinders, perhaps because some consumers are becoming more cautious on their spending.

This week is Mello, which I’m looking forward to attending in Chiswick and meeting company management, as well as readers. Please come and say hello. David looks to have put together a diverse collection of companies, so there should be something for everyone.

Belvoir AGM trading statement

This letting agent with a December year-end put out an “in line” AGM trading update for FY Dec 2023F. That resilient performance is encouraging given rising interest rates and they say that a degree of stability has returned to the UK mortgage market. They point out in last week’s RNS that mortgage approvals rose in February and March, by which they mean were above the levels seen in January and Q4 last year.

It is true that mortgage approvals did rise to 52K in March, versus 44K in February, according to the Bank of England data, but I would focus on the year-on-year comparisons. On that basis, approvals for house purchases are down by a quarter versus March 2022. On a Q1 2023 v Q1 last year, mortgage approvals are down -36%. Aside from house price data, Sharepad also has BoE mortgage approvals data going back to the early 1990’s (UK.HMA), so I have produced the chart below, with 2023 annualised from the first 3 months of the year. The chart shows that mortgage approvals for house purchases have never recovered from the 1.25m-1.45m levels before the financial crisis, despite very low-interest rates up until last year. Annualising Q1 2023 figures gives 540K, which is around the same level as 2008 and down -42% from 2021.

Belvoir has two divisions: i) estate agents franchises like Belvoir, Lovelle, Newton Fallowell, Nicholas Humphreys, Northwood and Mr and Mrs Clarke, which were 46% of revenue, plus ii) a financial services division of mortgage advisers around 54% of revenue. The franchises often provide a lead to customers looking for mortgage broking and other financial services.

For FY Dec 2022 property revenue was up + 3%, supported by lettings +5%, whereas property sales commissions were down -15% on a like-for-like basis. Traditionally Belvoir has been stronger in lettings than sales, which seems to suit the current environment. For the first four months of this year rents on new tenancies are up +10%. I’m not sure that BTL landlords are going to find it easy to push through lettings above inflation increases, the Renters Reform Bill and Department for Levelling Up, Housing and Communities show the political direction we are travelling in. We could see the shrewder Buy To Let investors recognise that the easy gains were made in the 1990s and 2000s and begin selling off houses in their BTL portfolios.

Valuation: The shares are trading on 11x Dec 2024F PER, which seems low given the track record of RoCE, almost 30% EBIT margin and income growth.

Opinion: It could be worth keeping an eye on both estate agents and housebuilders as interest rates rise. Currently, valuations in both of these sectors seem good value, but they are highly cyclical so they could be value traps / cheap for a reason. BLV management believe that visibility is good enough in the housing market to confirm FY Dec guidance, but perhaps they are being over-optimistic as the effects of interest rate rises have yet to be fully felt?

I would wait until Q3 this year and then re-examine the investment case.

Shoe Zone H1 1st April Results

So many fashion retailers have struggled over the last 18 months (SDRY, ASOS, BOO) but this shoe retailer, with 336 stores and an online shoezone.com store was, until last week, going against the trend. Their average selling price for a pair of shoes is £12, which they achieve through buying directly from factories in China. There’s a longer explanation of how they do this on their website. They also say that part of the success is down to their efficient returns process, where customers can order shoes online but return shoes that they don’t want to the physical stores. Currently, the return rate is 11%, which I think is lower than most retailers.

The previous 18 months has been very strong, both in absolute terms (green) and against the rest of the retail sector (orange).

The company has an odd habit of having their period ends on the first day of the month, rather than the final day. Effectively having a 1 Oct year-end, is the equivalent of Sept year-end for other companies.

H1 results to 1st April showed revenues +8% to £75m, that is an impressive performance given that the company has been closing and/or re-fitting stores, so they traded out of 52 less stores versus 12 months ago. It’s worth noting that even before the pandemic the company has been struggling to growth the top line, as the chart below shows.

Adj PBT was down -19% to £2.5m for the half. The company had £28m of stock at the period end, down £3m on the same point last year. The net cash balance fell £1m to £12.9m, partly due to capital expenditure fitting out stores, but also a buyback of £3m and £8m of dividends paid.

History: The company was founded in 1980 by two brothers Michael and Christopher Smith, and management then passed on to son and nephews Anthony and Charles Smith, who are the current CEO and Chairman, owning 31% and 25% of the company respectively. That means there’s a risk that the de-list the company at a low price (like IBPO and KAPE). Management’s track record of behaviour suggests that they will treat minority shareholders fairly, but I’m flagging the possibility as something to be aware of.

In the 1980s they grew organically and by acquisition and changed their name from Bensonshoe to Shoe Zone in 1996. They launched the Shoezone.com website in 2010. In May 2014 Shoe Zone listed at 160p, raising £35m for selling shareholders and valuing the market cap of the company at £80m. Just before the pandemic, the shares were trading above £2 but then crashed to below 40p as most of their sales were through high street stores. However, they managed to survive the pandemic without issuing any equity, the number of shares outstanding is 49m, following last year’s buyback is currently below the 50m at the IPO.

Outlook: The shares were off -15% on the day of the results, despite the £2.5m adj PBT being “slightly above management expectations”. I haven’t seen the broker note from Zeus, so I wonder if the broker has cut next year’s forecasts. In last week’s RNS, management warn about higher staff costs from the National Living Wage increases.

Valuation: The shares are trading on 16x Sept 2023F rising to 17x Sept 2024F. Before the pandemic 3-year average RoCE was 24% versus 19% currently. The profitability is impressive, but critics could also point out that peak revenue was £166m in 2015, versus £ 156m for 2023F so there hasn’t been any revenue growth, just a recovery from the pandemic.

Opinion: I like the differentiated business model and family ownership. This shows that there’s lots of upside in retailers if you can pick the ones with a good strategy and sustainable finances. The current valuation looks about right given the lack of top-line growth. I think if you had read the RNS in isolation, particularly the adj PBT “slightly above management expectations”, then there would have been little reason to anticipate last week’s -14% share price fall. In my view, investing ought to be a level playing field, with any bad news spelt out in the RNS, rather than having to read between the lines of management commentary or published separately in broker notes.

On The Beach H1 to March Results

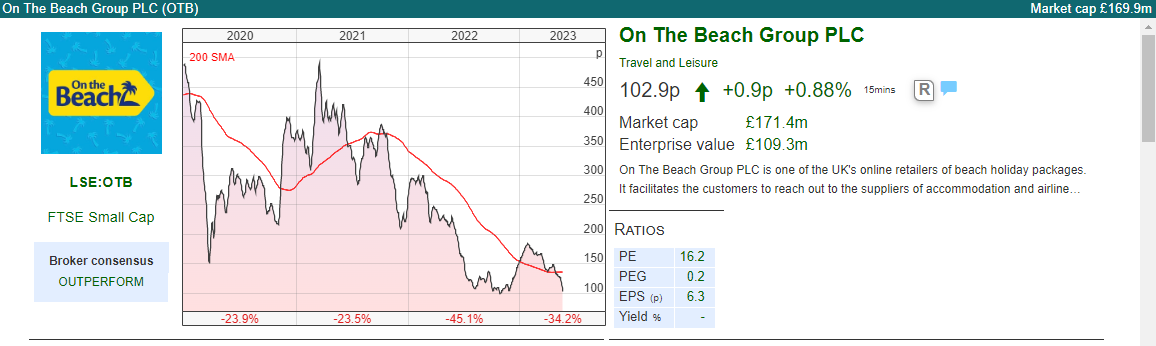

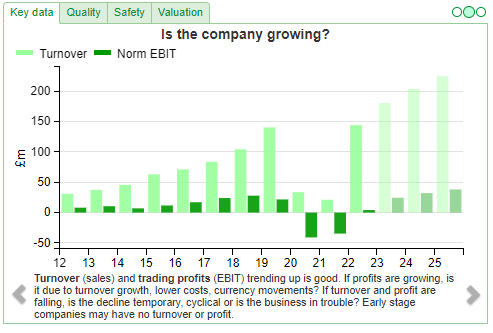

This online retailer of holidays that is attempting to disrupt tour operators and travel agents announced, H1 to March results with group revenue recovering to +38%, but a loss before tax of £6m (down from £7m loss the previous year). Net debt was £20m at the end of March, versus £1m end of March last year. The company has £60m of credit facilities with Lloyds and NatWest, of which half has been drawn down.

The “disruptive” part of the business model is to let customers put together the components of their holiday (including flights, hotels and transfers) to build custom-made holidays from millions of flight and hotel combinations, as opposed to using a traditional tour operator which offers pre-packaged holidays.

History: The company started life offering skiing holidays as On The Piste Travel in 1996, but then changed its name to On The Beach a couple of years later. They originally advertised holidays through Teletext, with bookings taken by a call centre, before moving on to the web in 2004. At first, this was just a static website, showing hotels to prospective customers, but they then moved to a dynamic website in 2005, which allowed customisation of packages. The Private Equity firm Livingbridge invested in 2007, which in turn was bought by another PE firm: Inflexion.

The company listed on the LSE (not AIM) in September 2015, at 184p per share, raising just £6m of new money with selling shareholders (Inflexion) receiving £84m for 36% of the company. That valued the company at £240m market cap on admission.

Before the pandemic hit, the business model appeared to be working well, with revenue in FY Sept 2019 of £140m, and PBT of £20m. That fell to £21m of revenue and a £37m pre-tax loss two years later. Current forecasts assume that the pre-pandemic trend should re-assert itself.

This industry is by its nature seasonal, currently, the balance sheet looks OK, with no long-term debt, but £312m of payables – most of which is presumably commitments as customers pay in advance, but OTB pays for hotels later. That means the business is a positive working capital business, however, in my experience that doesn’t mean that high profitability necessarily follows, just because a business receives its cash upfront. On the asset side, I’m slightly surprised that cash in the bank has fallen -43 to just below £10m, versus H1 last year. I would have expected the H1 cash position to be improving, but perhaps that is just a timing difference. Year-end cash (green bar in the chart below) was £64.5m at the end of September 2022.

Outlook: They say that momentum has continued into April and point out that Summer 2022 saw widespread airline and airport disruption, which ought to flatter this year in comparison to last year’s summer. The Founder, Simon Cooper, is stepping down from the Chief Exec role and is being replaced by the current Finance Director, Shaun Morton. The founder will remain on the board as a Non-Exec as he still owns 5.8% of the shares.

Valuation: The shares are trading on 7x Sept 2024F PER, which implies the EBIT margin recovering to 16% versus 2.9% reported last year. In 2017 and 2018 RoCE peaked in the mid 20’s, which surprised me given that people buying holidays can be quite price sensitive, shopping around for the best deals. That suggests to me that customers do value what OTB offers.

Opinion: Traditionally foreign holidays are one of the first items to be cut when households finances are under pressure – so I would be cautious. I’m also a little wary of businesses when the founder chooses to step down. I can understand that having founded OTB more than 25 years ago and seeing it through both the IPO and then the pandemic, perhaps the founder needs a well-earned holiday. Again this is a company I would look at again in 6 months’ time, as I think there could be a good story here when the economy is more helpful.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.