Bruce looks at the Berkshire Hathaway 2022 shareholder letter, which Buffett published over the weekend. Stocks covered AVAP, SLP and GBG.

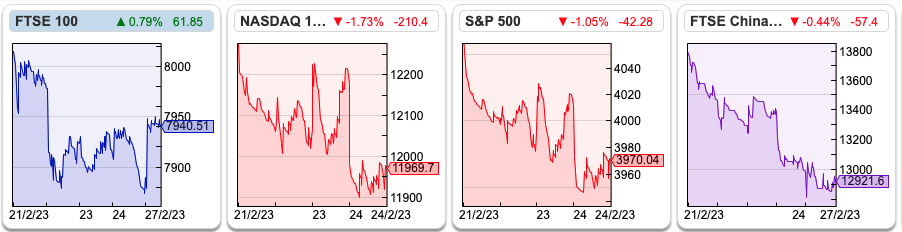

The FTSE 100 remained just below 8,000, and was down less than -1%, recovering from a sell-off early last week. The Nasdaq100 and S&P500 sold off more heavily, down -3.9% and -3.0% respectively. The US 10Y bond yield rose to 3.95%, and the UK 10Y rose to 3.8%. That’s the same yield as early November last year. Brent crude was down -4% to $82 per barrel.

Mr Buffett published his annual shareholders’ letter over the weekend. The whole thing is just 10 and a half pages, so it doesn’t take much time to peruse yourself. The BRK share price was up +4% in 2022, versus the S&P500 down -18%. The BRK share price CAGR now stands at +19.8%, versus the S&P +9.9% since 1965. Buffett says most of his investment decisions have been “so-so”, but a dozen truly good (spectacularly good, if you ask me) decisions over the almost 60 years have generated the bulk of the outperformance. I didn’t find much new thinking in this year’s missive, but you can’t argue with the Sage’s track record.

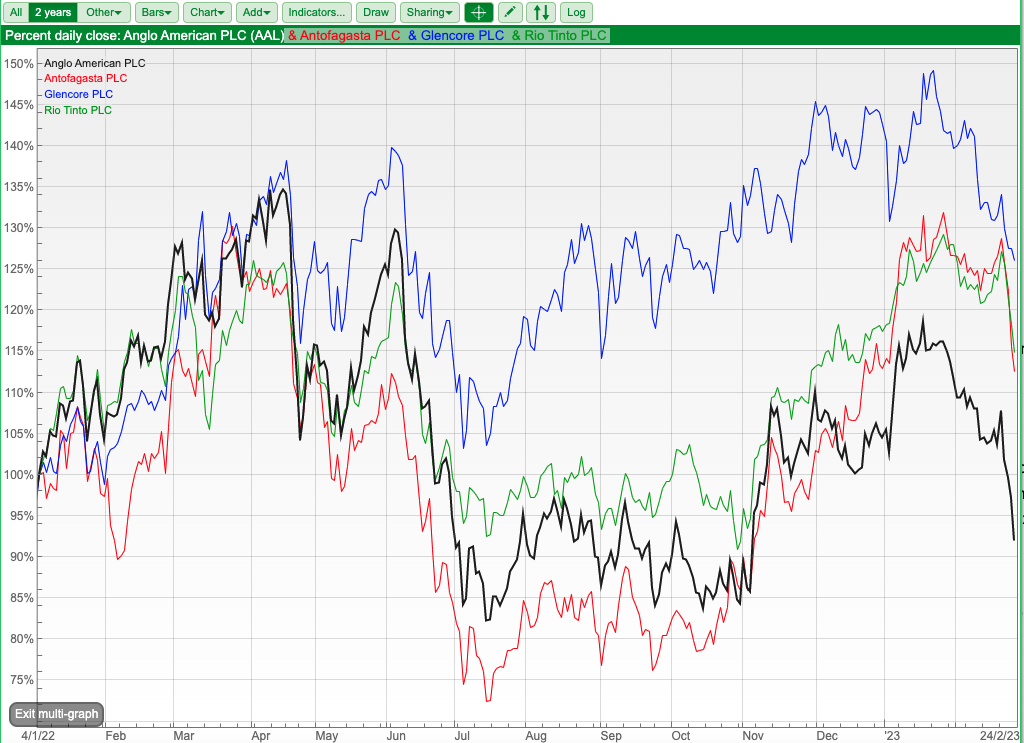

Last week we saw some dividend cuts from large-cap stocks. In the US, Intel Corp the chip company cut its dividend by two-thirds (or $4bn in absolute terms). In the UK, Rio Tinto, the iron ore, copper and aluminium miner, halved its dividend from $8bn paid out in 2021. It’s interesting to note that the four FTSE 100 miners (Anglo American, Antofagasta, Glencore and Rio Tinto) haven’t done particularly well over the last two years, despite the idea that they might benefit from higher commodity prices. As the chart below shows, Glencore has been the best performer. The main reason was half of GLEN’s FY Dec 2022 profits came from coal.

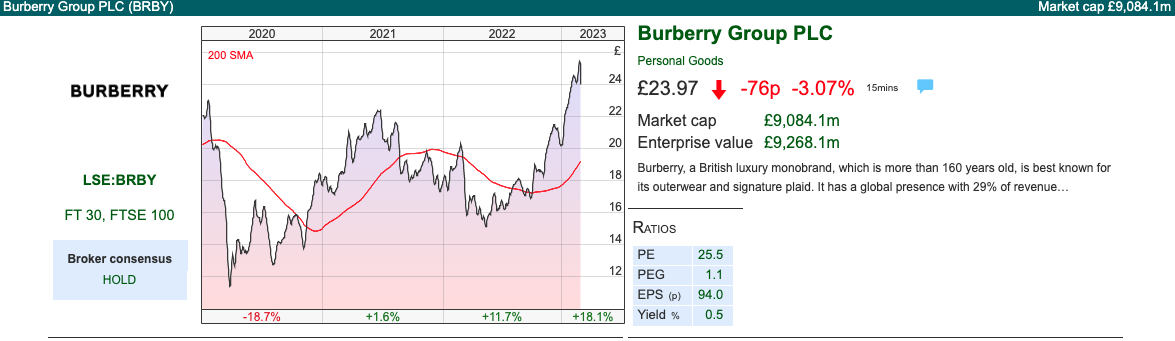

The FTSE 100 miners have also had a difficult start to 2023, despite China re-opening from Covid Zero policies. Arguably a better way to play the themes of higher inflation and China re-opening is luxury goods brands like Burberry and LVMH.

This week I look at Avation (AVAP), the aircraft leasing business, Sylvania (SLP) the Platinum Group Metals company and GB Group’s (GBG) minor profit warning. Last week I also did my first podcast, discussing my top 5 positions and the advantages that amateur investors enjoy against professional fund managers.

Avation Profit Upgrade FY June

This aircraft leasing business had a tough pandemic but is now raising guidance on the back of lower costs (both aircraft transition, but also admin and legal expenses) and a gain on an investment in a listed airline. Last Friday AVAP management said that they expect to be ‘significantly’ ahead of market expectations for FY to 30th June. They will report H1 results to Dec on Friday 3rd March.

They owned 37 aircraft at the end of Dec 2022, with a weighted average age of 6.1 years and 5.4 years average remaining lease terms. They have 16 airline customers across the world, this graphic from their FY results presentation is slightly out of date, but shows the diversification in their business:

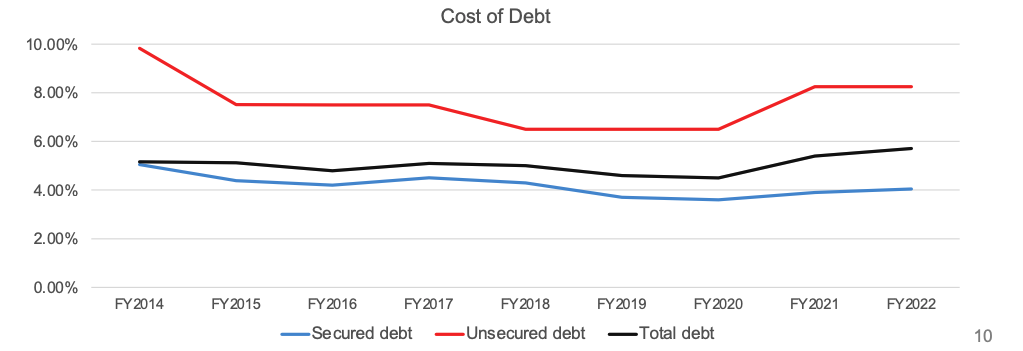

Marc Rubinstein has written up some great background on the economics of aircraft leasing, looking at Tony Ryan’s first aircraft business Guinness Peat Aviation (GPA), before he went on to found Ryanair. The economics are straightforward: a leasing company rents out planes at a rate of around 11-13% a year and finances itself at between 4-7% a year depending on Central Bank interest rates. AVAPS weighted average cost of debt was 5.7% FY June 2022. As the chart from the same presentation shows, that’s up from a couple of years ago but looks manageable versus the historic cost of debt.

Receiving double-digit income while being financed at around half that rate sounds like a good business. However, between that spread, the lessor suffers the cost of a depreciating fleet of aircraft. 25 years of equipment life and a 15% residual value at the end of that are common assumptions. Return on Assets is around 7% for the industry, according to Marc. Sharepad shows a 1.8% RoA for AVAP FY 2022, and the business was loss-making before that. However, some of that is due to the difficult conditions created by the pandemic.

There are a couple of risks. One is that the airline industry is essentially transferring fixed costs to the lessor’s balance sheet – that allows companies like RyanAir and EasyJet to respond quickly to the ups and downs in demand, consequently AVAP might end up with too many planes not being leased out to anyone. AVAP currently have four unutilised aircraft, which they are looking to sell. A second risk is that the lessor is borrowing short-term to fund long-term assets with uncertain residual value. 87% of AVAP’s $1.2bn debt outstanding at June 2022 falls due within 5 years or less. Looking at a detailed breakdown of the maturity structure, there is a large $348m unsecured loan coming due in FY 2027.

Unlike houses or land, equipment tends to fall in value with use and depreciation; there’s no law of nature that states after 25 years the aircraft is worth anything. For instance, the fuel efficiency or engine noise regulations could become stricter, meaning that old aircraft have little residual value. A leasing company can theoretically boost profits by choosing a less conservative depreciation policy and shareholders would likely only know years, if not decades, into the future. This is true for all lessors, whatever the equipment they are leasing out. A couple of decades ago, I can remember the old Bank of Scotland lost significant sums of money with optimistic assumptions about the residual value of second-hand cars. Abbey owned a train leasing business (Porterbrook) which became a headache at one point. Despite owning shares in airline companies (US Air in the 1980s, more recently Delta, American Airlines, South West and United Airlines) and looking at getting into aircraft leasing a few times, Buffett has avoided the sector, calling it ‘a scary business’ in his 2016 shareholders’ letter.

Unlike a loan, leasing a piece of equipment means it ought to be legally straightforward to recover any asset that has defaulted. If an aircraft has been leased, there is no dispute with other creditors of a bankrupt company about who owns a re-possessed aircraft. Often the maintenance records are as important as the physical aircraft, which are required for the plane to get off the ground into international airspace.

Forecasts: WH Ireland publishes paid for research on Avation, and said that before last Friday’s announcement, they had been looking for an adjusted pre-tax loss of -$3.4m FY Jun 2023F. They didn’t publish any new numbers following the company RNS, but instead said they would wait a week until the H1 results are published. Their current (stale) estimates are:

FY Jun 2023F EPS -4.8c, Net Debt $772.5m recovering to FY 2024E EPS 2.5c, Net Debt $742.2m. Notice that Net Debt figure is almost 10x the market cap, approaching the level of balance sheet gearing we normally see in banking. It’s also notable that WH Ireland revised down guidance in a note published as recently as 3rd Feb.

Valuation: The shares are trading on a PER 60x Jun 2024F, according to those WH Ireland estimates. On the other hand, profits are still suppressed at this point in the cycle. The reported NAV as at 30 June 2022 stood at $227.1m, equivalent to $3.27/268p per share, which includes some purchase rights valued at $65.3m, according to WH Ireland. With the share price at 125p, that’s a 53% discount to historic NAV.

Background reading: This strikes me as an industry where deep background knowledge is an asset. I’ve just bought a book by one of the GPA executives (an airline lawyer) who published an inside account of the failure of the company, called Crash Landing. I tend to learn more by reading about failures, and hopefully, I can absorb some lessons vicariously. This is an industry that attracts its fair share of ‘plane spotter’ anoraks, and Carcosa on Twitter has pointed me to this discussion board on AVAP. His latest post suggests that raising FY Jun 2023F guidance due to lower costs may not be a positive if the lower cost mean that AVAP have also failed to divest or recover aircraft that they had previously planned to.

Opinion: AVAP shares have doubled from their mid-2022 low, so this could be a good way to play the recovery in air travel. However, for me it can’t be a high-conviction idea, there are so many moving parts to the investment case (leverage, interest rates, attractiveness of different aircraft models: widebody, narrowbody, turboprop, air travel demand, residual life assumptions etc), there are wheels within wheels within wheels. That said, I think AVAP could make sense as part of a well-diversified portfolio, particularly if you have confidence that you will cut your losses quickly if it looks like the investment case is going wrong. This strikes me as an investment where you might want a stop loss.

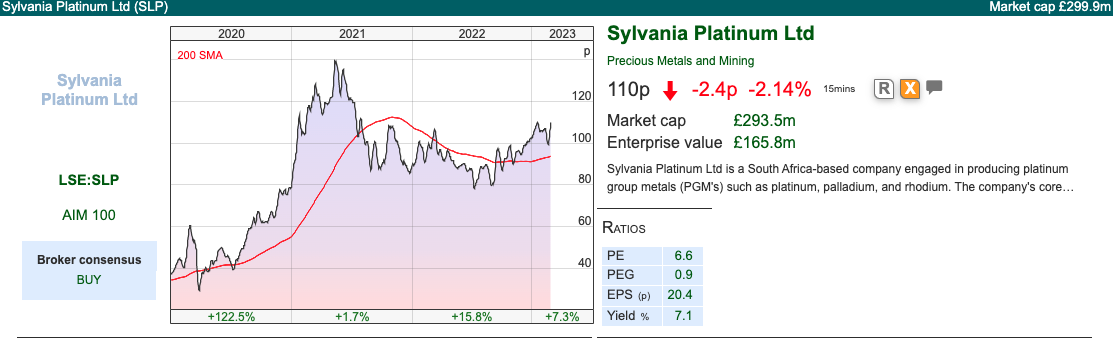

Sylvania Platinum H1 Dec

This South African-based Platinum Group Metals (PGM) chrome tailings business announced H1 results. They’d already reported Q2 results at the end of January, so investors knew that H1 revenue was up +16% to $80m and EBITDA was +26% to $45.6m. Cash balance was $124m at the end of December (35% of the current market cap of £294m), again not a new figure. I didn’t cover those numbers at the time, so I will write up a brief comment below.

Outlook: Back in January, management raised their FY Jun 2023 production guidance to 70K to 72K 4E PGM ounces, previously 68K -70K. However, a couple of weeks ago in mid-February Edison (who SLP pay to publish research) lowered their price forecast for the PGM basket (higher platinum prices, but weaker rhodium and palladium prices). Edison also reduced their SLP FY Jun 2023F and FY Jun 2024F EPS estimates by -10% and -17% to 22c and 21c respectively. Management were asked on the presentation last week if FY consensus expectations were still too high. They responded that they were using current spot prices (both for forex and PGM prices) so these sensitivities can move around. Thus results may disappoint if spot prices deteriorate.

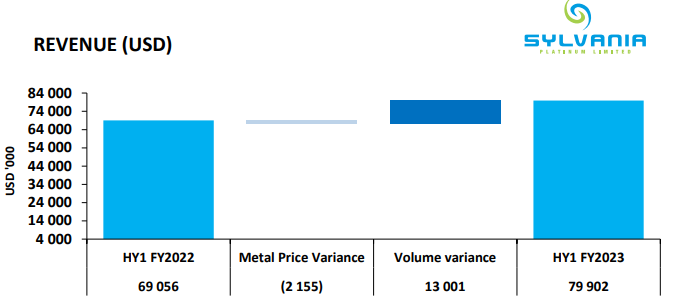

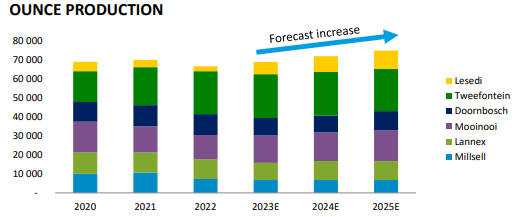

This time last year, H1 PGM production volumes fell -11% to 32K ounces, due to lower feed grades. However, revenue was supported by higher PGM prices. This year we have the opposite effect, increasing production volumes but lower PGM prices, as the chart below shows.

SLP have signed long-term agreements with Samancor (the host mine which supplies them with chrome tailings), however, in the past, they have faced problems because of lower Run of Mine materials and feed grade quality coming from Samancor. South African infrastructure problems (such as power supply from the grid, and water shortages) have also affected production volumes in the past. I listened into the management presentation on InvestorMeetCompany, and they mentioned a backup power supply project for their Lesedi operations, which is particularly exposed to this issue because it’s at a chrome smelter, rather than a mine.

That said they put up the chart below in their presentation showing that they expect PGM production to increase from this year’s level over the next couple of years. Worth noting that this graphic with an upward-sloping arrow in the company’s presentation is caveated with a footnote, and I can’t find any text in their H1 results explicitly giving 2024F or 2025F forecast increases.

Management say that they remain in the lowest quartile of platinum industry cost curve, 4E “All in cost” was $1,017 $/oz at H1, down -16% v H1. 4E PGM direct cash cost is c. $742 $/oz, down -16% in US dollar terms, but -3% in rand terms.

Mine E&P: SLP also owns rights to Volspruit and Northern Limb exploration projects, which Sylvania continues to investigate. At the H1 results, they said that an updated Scoping Study is underway at Volspruit which will now include value from the South Body area and for the element rhodium. They initially excluded these two aspects from the Scoping Study for simplicity and presumably cost.

They have also commissioned a study to improve the resources estimate for their Aurora project and a further study aiming to estimate mineral resources at their Hacra project. This seems to be different from the original investment case, which was about Sylvania Dump Operations (SDO) having a low cost process to separate out chrome mining waste to produce PGMs. For FY 2023F they are guiding to $5m of spend on exploration. I suspect that the mine exploration does have potential, but also comes with higher risk of failure.

Valuation: On Edison’s numbers the company is trading on a PER of 6x Jun 2024F and 2025F. That seems remarkably cheap, especially given the £100m of cash they are holding. Note my comments on the uncertainties about the long-term prospects of their operations though.

There’s a new dividend policy of 40% of adjusted free cash flow (operating cashflow less capex commitments.) They will pay a 3p Interim Dividend in April 2023, and the new policy suggests that the declared interim dividend will be a third of the total dividend, with 2/3 being paid in December (the Final Divided). That implies a 9p dividend this year, or an 8% yield.

The Company will continue to evaluate further share buy backs as the opportunity arises; they bought back 6.6m shares or 2.1% of shares FY last year – total buybacks have been 56m shares in total (v 266m shares currently outstanding).

Opinion: Platinum usage in diesel catalytic converters is likely to decline, though both SLP and the industry organisation WPIC where I used to work have suggested that demand will come from the hydrogen economy. I think that this is worth bearing in mind, though both organisations have a vested interest in the platinum price. I continue to hold.

GB Group Profit Warning

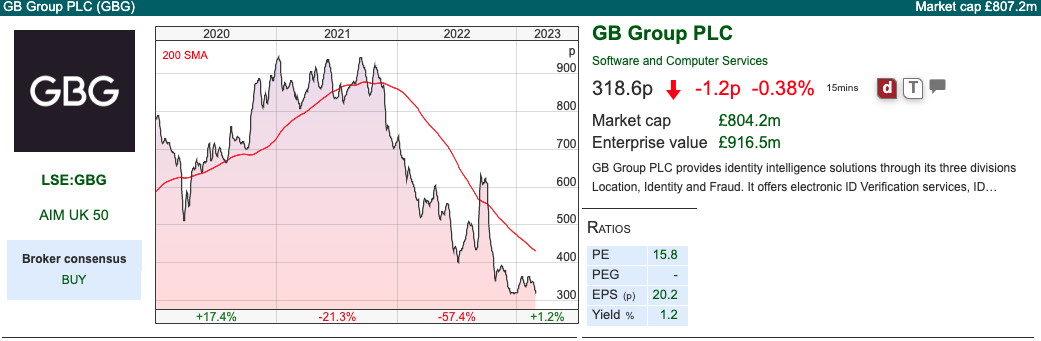

This fraud prevention, geo-location and identity confirmation company that has had a weak share price over the last couple of years announced a profit warning last week. I thought it was worth looking at, as despite the warning the shares sold off less than -5%. Maybe that means expectations have now bottomed? That new revenue guidance is a slight nudge down from ‘mid-single digits’ mentioned in the H1 to c. +4%, FY end March.

The group is split into 3 divisions, and the trends and break down comes from H1 results which were published in late November:

Identity (61% of revenue) includes recent acquisitions of Acuant and Cloudcheck. They saw a decline due to cryptocurrency and internet-economy customers experiencing a more difficult environment. These challenging conditions have continued into the second half of the year. By geography, most of these customers are in North America.

Location (26% of revenues) saw topline growth of +10%, helped by FinTech firms like Klarna and Wise, but also traditional companies like Pepsi and Sonos, who use the service to support direct-to-consumer sales.

Fraud Prevention (13% of revenues) saw decent revenue growth +14%, where they mention a couple of Asian banks plus the UK’s Department for Work & Pensions.

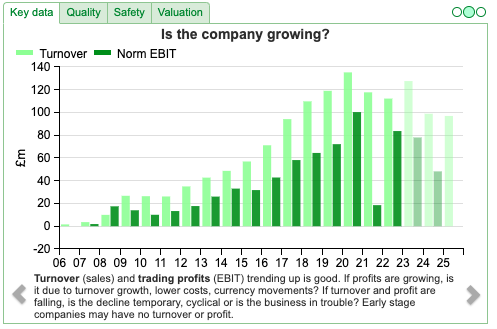

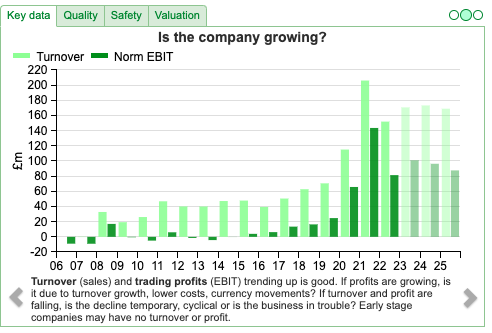

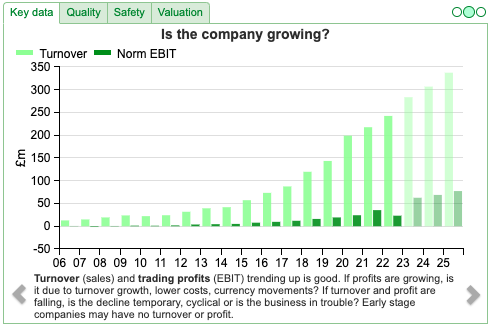

Recent history: The long-term track record is very impressive as the chart above show, but more recently the wheels have come off. Management bought Acuant, a US identity and fraud prevention company, in November 2021 for £555m. They paid for this by raising £305m in a placing at 725p, £163m from their own cash and new debt, and issuing £87m worth of shares to the selling shareholders. Then in September 2022 there was an approach from a US private equity bidder GTCR, which meant the share price rose to almost 650p. However, GTCR failed to make a formal offer by the 4th October Takeover Panel rules deadline, so the deal fell through, resulting in the share price halving. At the end of October there was a nasty profit warning, as management warned they were being hit by a reduction in activity from cryptocurrency and ‘gig-economy’ fintech customers in the Americas and net debt at £133m was higher than anticipated (partly due to GBP weakness).

Outlook: Last week’s RNS also talks about expectations for FY Mar 2024F, with organic constant currency revenue growth likely to improve gradually from +4% currently towards high single-digits in the latter part of the year. They guide that cost control for FY 2024F should mean adjusted operating profit margins at around current levels (£60m FY 2023F or 21.5%). They held a Capital Markets Day in mid-January when they put up a slide suggesting 2026F revenues of c. £400m and Adj profit of c. £100m.

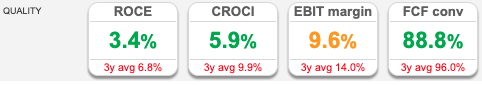

Valuation: The shares peaked at c. 950p in September 2021, but have since fallen by two thirds. They are now trading on a PER of 17x Mar 2024F falling to 15x May 2025F. This is a technology company with a gross margin above 70%, yet that has not translated into high EBIT margins or Returns on Capital Employed, as Sharepad’s quality metrics below reveal.

Opinion: I was initially excited given the sell-off seems to be decelerating and thought it might be possible to pick up a bargain. But I would like to dig deeper to understand why RoCE and EBIT margin are low. I’m also not convinced that the situation has stabilised, so I will avoid for now and revisit later in the year. That’s partly a reflection on the fact I’ve already bought exposure to turn around situations this year at SDRY and FDEV, so don’t want to be too concentrated in that particular investment style at the moment.

Notes

The author owns shares in SLP

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 28/02/23 | AVAP, SLP, GBG| Letter from Berkshire

Bruce looks at the Berkshire Hathaway 2022 shareholder letter, which Buffett published over the weekend. Stocks covered AVAP, SLP and GBG.

The FTSE 100 remained just below 8,000, and was down less than -1%, recovering from a sell-off early last week. The Nasdaq100 and S&P500 sold off more heavily, down -3.9% and -3.0% respectively. The US 10Y bond yield rose to 3.95%, and the UK 10Y rose to 3.8%. That’s the same yield as early November last year. Brent crude was down -4% to $82 per barrel.

Mr Buffett published his annual shareholders’ letter over the weekend. The whole thing is just 10 and a half pages, so it doesn’t take much time to peruse yourself. The BRK share price was up +4% in 2022, versus the S&P500 down -18%. The BRK share price CAGR now stands at +19.8%, versus the S&P +9.9% since 1965. Buffett says most of his investment decisions have been “so-so”, but a dozen truly good (spectacularly good, if you ask me) decisions over the almost 60 years have generated the bulk of the outperformance. I didn’t find much new thinking in this year’s missive, but you can’t argue with the Sage’s track record.

Last week we saw some dividend cuts from large-cap stocks. In the US, Intel Corp the chip company cut its dividend by two-thirds (or $4bn in absolute terms). In the UK, Rio Tinto, the iron ore, copper and aluminium miner, halved its dividend from $8bn paid out in 2021. It’s interesting to note that the four FTSE 100 miners (Anglo American, Antofagasta, Glencore and Rio Tinto) haven’t done particularly well over the last two years, despite the idea that they might benefit from higher commodity prices. As the chart below shows, Glencore has been the best performer. The main reason was half of GLEN’s FY Dec 2022 profits came from coal.

The FTSE 100 miners have also had a difficult start to 2023, despite China re-opening from Covid Zero policies. Arguably a better way to play the themes of higher inflation and China re-opening is luxury goods brands like Burberry and LVMH.

This week I look at Avation (AVAP), the aircraft leasing business, Sylvania (SLP) the Platinum Group Metals company and GB Group’s (GBG) minor profit warning. Last week I also did my first podcast, discussing my top 5 positions and the advantages that amateur investors enjoy against professional fund managers.

Avation Profit Upgrade FY June

This aircraft leasing business had a tough pandemic but is now raising guidance on the back of lower costs (both aircraft transition, but also admin and legal expenses) and a gain on an investment in a listed airline. Last Friday AVAP management said that they expect to be ‘significantly’ ahead of market expectations for FY to 30th June. They will report H1 results to Dec on Friday 3rd March.

They owned 37 aircraft at the end of Dec 2022, with a weighted average age of 6.1 years and 5.4 years average remaining lease terms. They have 16 airline customers across the world, this graphic from their FY results presentation is slightly out of date, but shows the diversification in their business:

Marc Rubinstein has written up some great background on the economics of aircraft leasing, looking at Tony Ryan’s first aircraft business Guinness Peat Aviation (GPA), before he went on to found Ryanair. The economics are straightforward: a leasing company rents out planes at a rate of around 11-13% a year and finances itself at between 4-7% a year depending on Central Bank interest rates. AVAPS weighted average cost of debt was 5.7% FY June 2022. As the chart from the same presentation shows, that’s up from a couple of years ago but looks manageable versus the historic cost of debt.

Receiving double-digit income while being financed at around half that rate sounds like a good business. However, between that spread, the lessor suffers the cost of a depreciating fleet of aircraft. 25 years of equipment life and a 15% residual value at the end of that are common assumptions. Return on Assets is around 7% for the industry, according to Marc. Sharepad shows a 1.8% RoA for AVAP FY 2022, and the business was loss-making before that. However, some of that is due to the difficult conditions created by the pandemic.

There are a couple of risks. One is that the airline industry is essentially transferring fixed costs to the lessor’s balance sheet – that allows companies like RyanAir and EasyJet to respond quickly to the ups and downs in demand, consequently AVAP might end up with too many planes not being leased out to anyone. AVAP currently have four unutilised aircraft, which they are looking to sell. A second risk is that the lessor is borrowing short-term to fund long-term assets with uncertain residual value. 87% of AVAP’s $1.2bn debt outstanding at June 2022 falls due within 5 years or less. Looking at a detailed breakdown of the maturity structure, there is a large $348m unsecured loan coming due in FY 2027.

Unlike houses or land, equipment tends to fall in value with use and depreciation; there’s no law of nature that states after 25 years the aircraft is worth anything. For instance, the fuel efficiency or engine noise regulations could become stricter, meaning that old aircraft have little residual value. A leasing company can theoretically boost profits by choosing a less conservative depreciation policy and shareholders would likely only know years, if not decades, into the future. This is true for all lessors, whatever the equipment they are leasing out. A couple of decades ago, I can remember the old Bank of Scotland lost significant sums of money with optimistic assumptions about the residual value of second-hand cars. Abbey owned a train leasing business (Porterbrook) which became a headache at one point. Despite owning shares in airline companies (US Air in the 1980s, more recently Delta, American Airlines, South West and United Airlines) and looking at getting into aircraft leasing a few times, Buffett has avoided the sector, calling it ‘a scary business’ in his 2016 shareholders’ letter.

Unlike a loan, leasing a piece of equipment means it ought to be legally straightforward to recover any asset that has defaulted. If an aircraft has been leased, there is no dispute with other creditors of a bankrupt company about who owns a re-possessed aircraft. Often the maintenance records are as important as the physical aircraft, which are required for the plane to get off the ground into international airspace.

Forecasts: WH Ireland publishes paid for research on Avation, and said that before last Friday’s announcement, they had been looking for an adjusted pre-tax loss of -$3.4m FY Jun 2023F. They didn’t publish any new numbers following the company RNS, but instead said they would wait a week until the H1 results are published. Their current (stale) estimates are:

FY Jun 2023F EPS -4.8c, Net Debt $772.5m recovering to FY 2024E EPS 2.5c, Net Debt $742.2m. Notice that Net Debt figure is almost 10x the market cap, approaching the level of balance sheet gearing we normally see in banking. It’s also notable that WH Ireland revised down guidance in a note published as recently as 3rd Feb.

Valuation: The shares are trading on a PER 60x Jun 2024F, according to those WH Ireland estimates. On the other hand, profits are still suppressed at this point in the cycle. The reported NAV as at 30 June 2022 stood at $227.1m, equivalent to $3.27/268p per share, which includes some purchase rights valued at $65.3m, according to WH Ireland. With the share price at 125p, that’s a 53% discount to historic NAV.

Background reading: This strikes me as an industry where deep background knowledge is an asset. I’ve just bought a book by one of the GPA executives (an airline lawyer) who published an inside account of the failure of the company, called Crash Landing. I tend to learn more by reading about failures, and hopefully, I can absorb some lessons vicariously. This is an industry that attracts its fair share of ‘plane spotter’ anoraks, and Carcosa on Twitter has pointed me to this discussion board on AVAP. His latest post suggests that raising FY Jun 2023F guidance due to lower costs may not be a positive if the lower cost mean that AVAP have also failed to divest or recover aircraft that they had previously planned to.

Opinion: AVAP shares have doubled from their mid-2022 low, so this could be a good way to play the recovery in air travel. However, for me it can’t be a high-conviction idea, there are so many moving parts to the investment case (leverage, interest rates, attractiveness of different aircraft models: widebody, narrowbody, turboprop, air travel demand, residual life assumptions etc), there are wheels within wheels within wheels. That said, I think AVAP could make sense as part of a well-diversified portfolio, particularly if you have confidence that you will cut your losses quickly if it looks like the investment case is going wrong. This strikes me as an investment where you might want a stop loss.

Sylvania Platinum H1 Dec

This South African-based Platinum Group Metals (PGM) chrome tailings business announced H1 results. They’d already reported Q2 results at the end of January, so investors knew that H1 revenue was up +16% to $80m and EBITDA was +26% to $45.6m. Cash balance was $124m at the end of December (35% of the current market cap of £294m), again not a new figure. I didn’t cover those numbers at the time, so I will write up a brief comment below.

Outlook: Back in January, management raised their FY Jun 2023 production guidance to 70K to 72K 4E PGM ounces, previously 68K -70K. However, a couple of weeks ago in mid-February Edison (who SLP pay to publish research) lowered their price forecast for the PGM basket (higher platinum prices, but weaker rhodium and palladium prices). Edison also reduced their SLP FY Jun 2023F and FY Jun 2024F EPS estimates by -10% and -17% to 22c and 21c respectively. Management were asked on the presentation last week if FY consensus expectations were still too high. They responded that they were using current spot prices (both for forex and PGM prices) so these sensitivities can move around. Thus results may disappoint if spot prices deteriorate.

This time last year, H1 PGM production volumes fell -11% to 32K ounces, due to lower feed grades. However, revenue was supported by higher PGM prices. This year we have the opposite effect, increasing production volumes but lower PGM prices, as the chart below shows.

SLP have signed long-term agreements with Samancor (the host mine which supplies them with chrome tailings), however, in the past, they have faced problems because of lower Run of Mine materials and feed grade quality coming from Samancor. South African infrastructure problems (such as power supply from the grid, and water shortages) have also affected production volumes in the past. I listened into the management presentation on InvestorMeetCompany, and they mentioned a backup power supply project for their Lesedi operations, which is particularly exposed to this issue because it’s at a chrome smelter, rather than a mine.

That said they put up the chart below in their presentation showing that they expect PGM production to increase from this year’s level over the next couple of years. Worth noting that this graphic with an upward-sloping arrow in the company’s presentation is caveated with a footnote, and I can’t find any text in their H1 results explicitly giving 2024F or 2025F forecast increases.

Management say that they remain in the lowest quartile of platinum industry cost curve, 4E “All in cost” was $1,017 $/oz at H1, down -16% v H1. 4E PGM direct cash cost is c. $742 $/oz, down -16% in US dollar terms, but -3% in rand terms.

Mine E&P: SLP also owns rights to Volspruit and Northern Limb exploration projects, which Sylvania continues to investigate. At the H1 results, they said that an updated Scoping Study is underway at Volspruit which will now include value from the South Body area and for the element rhodium. They initially excluded these two aspects from the Scoping Study for simplicity and presumably cost.

They have also commissioned a study to improve the resources estimate for their Aurora project and a further study aiming to estimate mineral resources at their Hacra project. This seems to be different from the original investment case, which was about Sylvania Dump Operations (SDO) having a low cost process to separate out chrome mining waste to produce PGMs. For FY 2023F they are guiding to $5m of spend on exploration. I suspect that the mine exploration does have potential, but also comes with higher risk of failure.

Valuation: On Edison’s numbers the company is trading on a PER of 6x Jun 2024F and 2025F. That seems remarkably cheap, especially given the £100m of cash they are holding. Note my comments on the uncertainties about the long-term prospects of their operations though.

There’s a new dividend policy of 40% of adjusted free cash flow (operating cashflow less capex commitments.) They will pay a 3p Interim Dividend in April 2023, and the new policy suggests that the declared interim dividend will be a third of the total dividend, with 2/3 being paid in December (the Final Divided). That implies a 9p dividend this year, or an 8% yield.

The Company will continue to evaluate further share buy backs as the opportunity arises; they bought back 6.6m shares or 2.1% of shares FY last year – total buybacks have been 56m shares in total (v 266m shares currently outstanding).

Opinion: Platinum usage in diesel catalytic converters is likely to decline, though both SLP and the industry organisation WPIC where I used to work have suggested that demand will come from the hydrogen economy. I think that this is worth bearing in mind, though both organisations have a vested interest in the platinum price. I continue to hold.

GB Group Profit Warning

This fraud prevention, geo-location and identity confirmation company that has had a weak share price over the last couple of years announced a profit warning last week. I thought it was worth looking at, as despite the warning the shares sold off less than -5%. Maybe that means expectations have now bottomed? That new revenue guidance is a slight nudge down from ‘mid-single digits’ mentioned in the H1 to c. +4%, FY end March.

The group is split into 3 divisions, and the trends and break down comes from H1 results which were published in late November:

Identity (61% of revenue) includes recent acquisitions of Acuant and Cloudcheck. They saw a decline due to cryptocurrency and internet-economy customers experiencing a more difficult environment. These challenging conditions have continued into the second half of the year. By geography, most of these customers are in North America.

Location (26% of revenues) saw topline growth of +10%, helped by FinTech firms like Klarna and Wise, but also traditional companies like Pepsi and Sonos, who use the service to support direct-to-consumer sales.

Fraud Prevention (13% of revenues) saw decent revenue growth +14%, where they mention a couple of Asian banks plus the UK’s Department for Work & Pensions.

Recent history: The long-term track record is very impressive as the chart above show, but more recently the wheels have come off. Management bought Acuant, a US identity and fraud prevention company, in November 2021 for £555m. They paid for this by raising £305m in a placing at 725p, £163m from their own cash and new debt, and issuing £87m worth of shares to the selling shareholders. Then in September 2022 there was an approach from a US private equity bidder GTCR, which meant the share price rose to almost 650p. However, GTCR failed to make a formal offer by the 4th October Takeover Panel rules deadline, so the deal fell through, resulting in the share price halving. At the end of October there was a nasty profit warning, as management warned they were being hit by a reduction in activity from cryptocurrency and ‘gig-economy’ fintech customers in the Americas and net debt at £133m was higher than anticipated (partly due to GBP weakness).

Outlook: Last week’s RNS also talks about expectations for FY Mar 2024F, with organic constant currency revenue growth likely to improve gradually from +4% currently towards high single-digits in the latter part of the year. They guide that cost control for FY 2024F should mean adjusted operating profit margins at around current levels (£60m FY 2023F or 21.5%). They held a Capital Markets Day in mid-January when they put up a slide suggesting 2026F revenues of c. £400m and Adj profit of c. £100m.

Valuation: The shares peaked at c. 950p in September 2021, but have since fallen by two thirds. They are now trading on a PER of 17x Mar 2024F falling to 15x May 2025F. This is a technology company with a gross margin above 70%, yet that has not translated into high EBIT margins or Returns on Capital Employed, as Sharepad’s quality metrics below reveal.

Opinion: I was initially excited given the sell-off seems to be decelerating and thought it might be possible to pick up a bargain. But I would like to dig deeper to understand why RoCE and EBIT margin are low. I’m also not convinced that the situation has stabilised, so I will avoid for now and revisit later in the year. That’s partly a reflection on the fact I’ve already bought exposure to turn around situations this year at SDRY and FDEV, so don’t want to be too concentrated in that particular investment style at the moment.

Notes

The author owns shares in SLP

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.