A look at how commodity prices have performed since Putin’s invasion of Ukraine. Companies covered: BKS, FCH and NEXN.

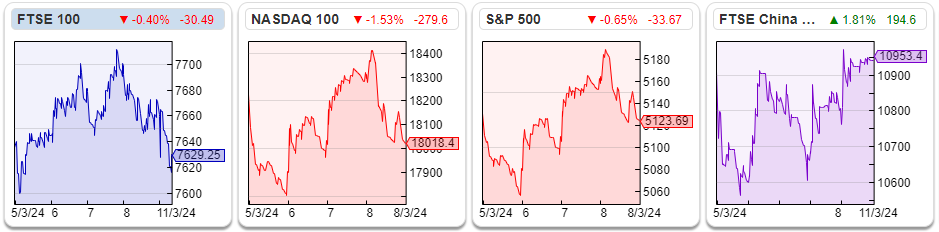

The FTSE 100 was flat last week at 7,629, as were the S&P500 and the FTSE China 50. The Nasdaq100 was down -1.5%. Bitcoin rose +9% to within touching distance of $70K and gold was up +5% to $2150. The US 10Y government bond yield was 4.08%, within a couple of basis points of where it was trading during the first week of January.

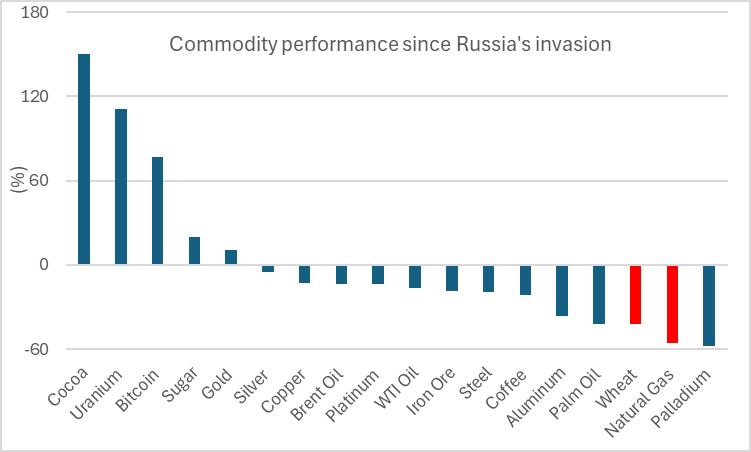

The war in Ukraine appears to be going badly. However, the effect of the war on commodity prices has been far smaller than many initially assumed. I have used Sharepad’s commodity button to sort through the performance of commodities since Putin’s invasion. The highest price spike has been cocoa, up +150%. Fortunately, the world doesn’t run on chocolate or Bitcoin either, which is up +77% since 24th Feb 2022.

Commodities like natural gas (NG-MT) -55% and wheat (MKC-FM) -42% in red are down steeply since before the invasion. Brent crude and WTI oil are down -14% and -17% respectively, that’s in the middle of the range of constituents.

Ironically the best performing stock in the FTSE All Share since the invasion has not been a defence stock but Bank of Georgia, up 4.5x as the country’s banking system has benefited from an influx of Russians who don’t want to fight.

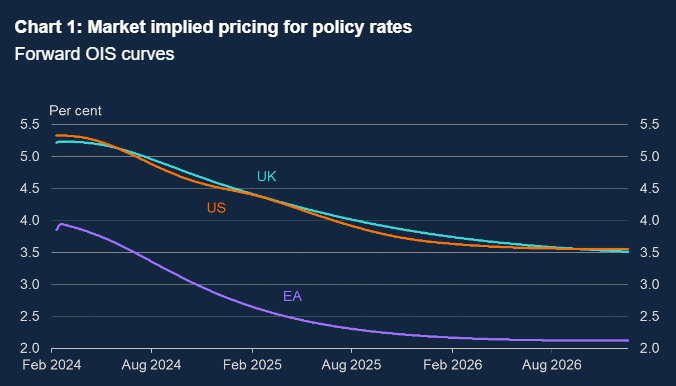

We are now most of the way through the winter, so it’s hard to see energy costs spiking in the next 6 months even if the situation in the Middle East or Ukraine deteriorates further. That suggests that we have avoided the dreaded inflationary spiral, as the chart below from the Bank of England shows, Central Banks should have room to cut interest rates at some point this year.

In UK equity markets we saw a bid for Spirent, which does automated testing for telco networks. The offer was 175p per share in cash, a 62% premium to the previous closing price. This values the firm at a PER 16x Dec 2024F and 13x Dec 2025F. Spirent had sold off heavily last year, as the company warned of a difficult operating environment and the outlook statement sounded similarly downbeat, so we are seeing bids for companies reporting near-term headwinds. We also saw a bid for Virgin Money from Nationwide, at 220p (or £2.9bn) a 38% premium to the closing price. Virgin Money is the old Northern Rock, which they bought from the UK government for £747m in 2011, a couple of years after the financial crisis.

We also saw a bid for Mattioli Woods, the Wealth Manager with £15bn of client assets, at 804p (£432m or 2.9% of AuM), which is a 32% premium to the closing price. The bidder is Pollen Street Capital, a Private Equity fund. The Wealth Management sector is consolidating at the moment, Permira the PE fund merged Smith & Williamson into Tierney to create a WM with £56bn of AuM a couple of years ago. The Canadian bank RBC bought Brewin Dolphin and Rathbones has acquired Investec’s WM division in an all-share deal worth £840m. I wouldn’t be surprised if Mattioli Woods trades through the terms of the offer, as investors anticipate another buyer stepping in. On the other hand, Elliott announced that they would not be making an offer for Currys. LoopUp, the conference call software group announced it would de-list, having fallen -99% in the last five years.

This week I look at a couple of idiosyncratic financial companies: Beeks Cloud Financial and Funding Circle. Both have a track record of growing the top line, but burning cash and accumulating losses – both now seem to have found a path to profitable growth. I also look at an Israeli Adtech firm formerly known as Tremor International, but now Nexxen. All three companies refer to themselves as platforms.

Beeks Cloud Financial H1 Dec Results

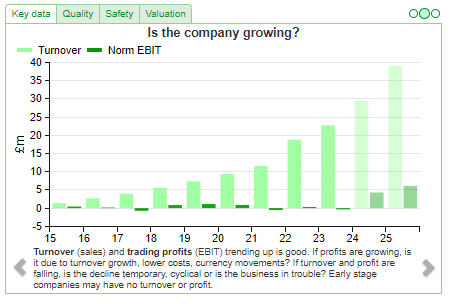

This Glasgow headquartered connectivity and cloud infrastructure provider for exchanges announced H1 Dec 2023 revenues +25% to £13m. The company has a history of delivering 20-30% revenue growth but struggled to generate meaningful profits. H1 statutory PBT was £160K, which is an improvement on a £650K loss in H1 last year. The company had net cash of £5.4m December last year, up from £3.3m December 2022.

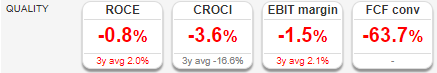

In H1 management capitalised £1.4m of development costs onto the balance sheet. There’s £9m of intangible assets (around 2/3 of which was development costs) accumulated on the balance sheet versus £17m of Property Plant and Equipment. That suggests historic losses would have been even higher if management expensed development costs through the P&L. Worth noting too that the company received a £1.25m R&D tax credit FY Jun 2023, without which historic losses would also have been higher. The gross margin is 39% and the EBIT margin is 2%, so the bull case is that as the company scales margins improve. The bear case is that the growth requires too much capital to and hasn’t generated returns for shareholders. The number of shares outstanding has increased by +43% since the time of the IPO to 70.5m to fund the growth.

History: The company was founded in 2010 by CEO Gordon McArthur (currently 37% shareholder). Its first site was in a New Jersey data centre providing low latency services to automated retail trading, quickly followed by London where it served FX markets. In 2015 they expanded into German and Japanese exchanges and futures markets. They listed on AIM at 50p per share, with £4.5m gross received by the company and around half that amount going to selling shareholders. This valued the market cap of the company at £35m on admission in November 2017.

In last week’s RNS management said that they intend to be more ‘platform-based with their technology investment’ and they also plan to increase their investment in artificial intelligence. The Admission Document says they provide hardware, storage, data centre space, network and connectivity options – collectively known as ‘Infrastructure as a Service’ (IaaS) – as opposed to (SaaS). Given there is a significant hardware component, which inevitably depreciates, the economics are unlikely to be similar to the SaaS business model. Instead, they seem more comparable with equipment rental businesses like CAPD or ASY, but rather than renting out gold mining equipment or air conditioning, they provide computer servers.

The Annual Report outlines their business in cartoon style, which I think is rather fun and probably something more companies should do to make their Annual Reports enjoyable to read: “Behold Beeks, Guardian of the Capital Markets, rises to the occasion.”

Outlook: The company reiterates its 6th February RNS that they expect FY Jun 2025 trading to be ‘significantly ahead’. However, the shares had already reacted to that +74% from the start of the year. Progressive leaves their FY Jun 2024F and 2025F estimates unchanged, though they raise revenue and EPS forecasts at the beginning of February by +14% and +10% respectively. Progressive are forecasting an EBIT margin of 15% (revenues of £38m and EBIT of £5.9m).

Valuation: The shares are on a PER of 23x Jun 2025F, according to Progressive’s forecasts. That valuation implies that the historic revenue growth will become self-funded in future years and continue beyond the forecast period. Cash represents 5% of the current market cap,

Opinion: So far the top-line growth has failed to generate returns on capital for shareholders, but if the forecasts are achieved then this could be about to change. Management say that a large amount of their revenue is recurring, they also ought to have good visibility on costs so I think they are justified in sounding confident that the business has reached an inflection point.

This looks like the mirror image of Arcontech, which I looked at a couple of weeks ago, BKS is high growth, low RoCE. Hopefully, both companies can address their historic weaknesses. BKS gets the thumbs up from me, though I must admit I would like to understand the size of the potential revenue pool and also the competition in the sector better.

Funding Circle FY Dec Results

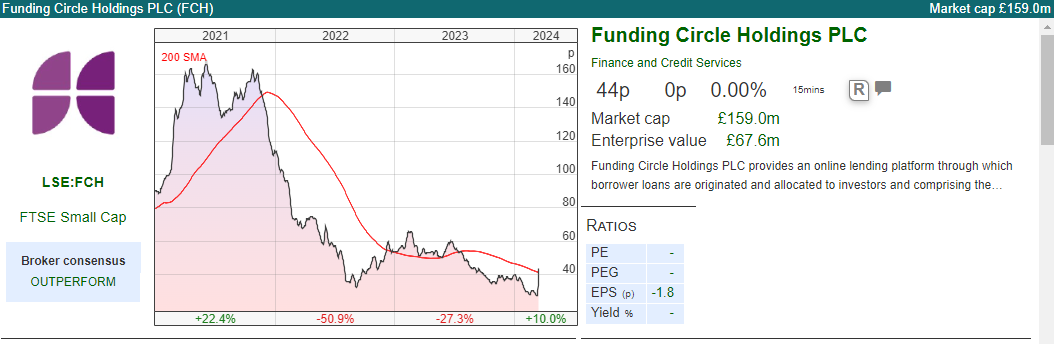

This lending platform has been on my watch list for a while, and I’ve watched as the share price sank like a lead balloon. The shares had fallen below 30p, halving in value from six months ago, but then, last week rebounded +60% on FY results, disposal and buyback announcement.

FY Dec results themselves were in line with expectations: total income +7% to £162m and a loss before tax of £33m. They announced that they will focus on their UK business and will put the US business which lost £23m last year up for sale. They have already received indications of interest. They also announced a £25m buyback because management believes the shares are materially undervalued.

The core UK loans business is profitable, generating £6.5m of PBT on £121m of revenue. I like the transparency on their website, offering loans at 6.9%. Most banks tend to create complexity and make direct comparisons difficult.

FCH have recently launched a UK SME credit card business: FlexiPay, which reported £16m of losses on revenues of £8m. They say that the advantage of FlexiPay is that it is more flexible than a loan and more transparent than an overdraft. SME customers are charged a simple flat fee per transaction. Management seems to believe this could be a much larger business and are trying to take advantage of the opportunity. FlexiPay transactions quadrupled last year, and FCH issued 6,600 cards so far. They say that FlexiPay unit economics are attractive, but the business is only loss-making due to upfront marketing costs.

FCH have £221m of cash, of which £170m was unrestricted (ie available for general use, not payable to third parties) so they don’t need to make a profit on disposal of their US business to fund the buyback. They are also not in financial distress and forced to sell at an unattractive price.

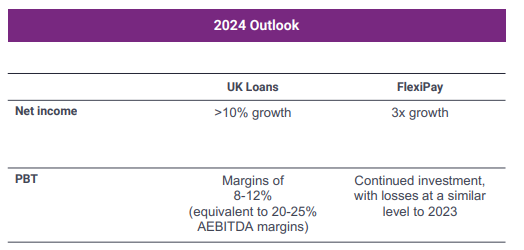

Outlook: Management have set out very clear guidance.

Medium-term guidance is for topline growth of ~15-20%; PBT margins increasing to >15%. They also announced that Eric Daniels, the former Lloyds Chief Exec who took the bank to court over not being paid a bonus for the disastrous HBOS deal, won’t be standing for re-election as a Non-Exec Director. His departure is a positive, in my view.

Valuation: Assuming the UK loans business grows to £133m and generates £16m of PBT. There’s £85m of accumulated losses recorded on the balance sheet, so we could just put that £16m of PBT on a multiple of 10x to reach a valuation of £160m. I’m not sure how to value either FlexiPay or the US business, but I would imagine they could each be worth 1/3 of the core UK loans business. That would get us to a target market cap of £260m or 70p per share. Net assets are £247m or 68p per share.

However, that analysis leaves out the £170m of unrestricted cash which represents more than the current market cap, even after last week’s +60% bounce. Previously I had worried that management would continue burning cash to grow the top line, so shareholders faced an uncertain and distant future pay-off. It now looks like management have given up their international ambitions and are focused on profitable growth in the UK, returning excess cash to shareholders, which I think is the correct decision.

Opinion: I last wrote about the shares 2 years ago, when the price was above 70p, concluding “could be interesting at the right point in the cycle and an attractive valuation.” I think we could have reached that point, so when I read the RNS last week I bought a starter position. TrustPilot reviews and Net Promoter Score are much higher for Funding Circle than for traditional UK banks, so I believe this has the chance to be a much larger business in 5 years’ time.

Nexxen FY Dec 2023 Results

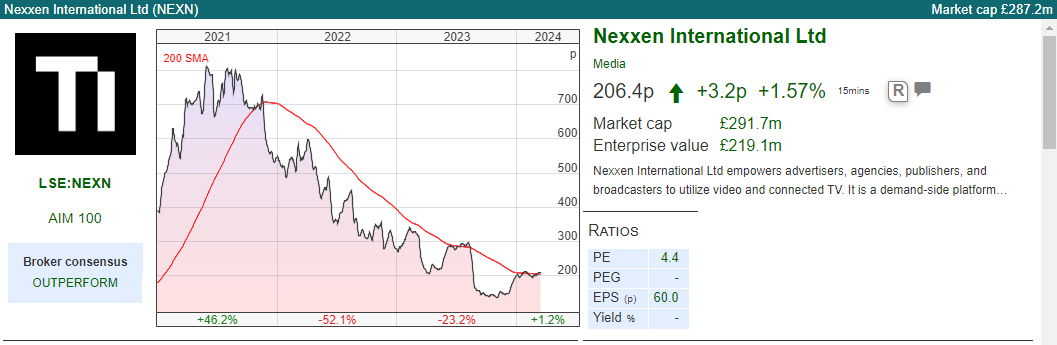

This Israeli adtech firm that used to be Taptica then changed its name to Tremor International, and renamed itself yet again in January this year. The shares are dual listed on AIM and Nasdaq, but headquartered in Tel Aviv. I’m sceptical of ad-tech, but now the company is down -75% from its September 2021 peak, the investment case may be worth a second look.

Nexxen’s strengths are in video and Connected TV (which I think means streaming). The business comprises of a demand-side platform (DSP), supply-side platform (SSP), ad server and data management platform (DMP). That seems to me rather a lot of platforms in one company.

FY Dec 2023 revenues were down -1% to $332m and gross profits were down -12% to $219m. The company made an after tax loss of $22m, though $43m of that was amortisation of intangibles. Net cash generated from operating activities was $60m FY Dec 2023, down by -65% versus two years previously. Adj EBITDA of $83m is down -43%, but above the midpoint of previous guidance. Management say that the decline is due to the integration of Amobee, which they bought for a total consideration of $239m in July 2022, as the acquired business is lower profitability than Nexxen’s pre-acquisition standalone business. Adj EBITDA also declined because of reduced spending from some of the Company’s largest customers throughout 2023 compared to 2022.

Guidance: FY 2024F guidance is for $340-345m of net revenue and c $100m of adj EBITDA, implying +10% revenue growth and +20% adj EBITDA growth. Cavendish, their broker, are forecasting +10% net revenue growth the following year and +13% adj EBITDA. The broker has $20m of share buybacks resulting in $174m of net cash.

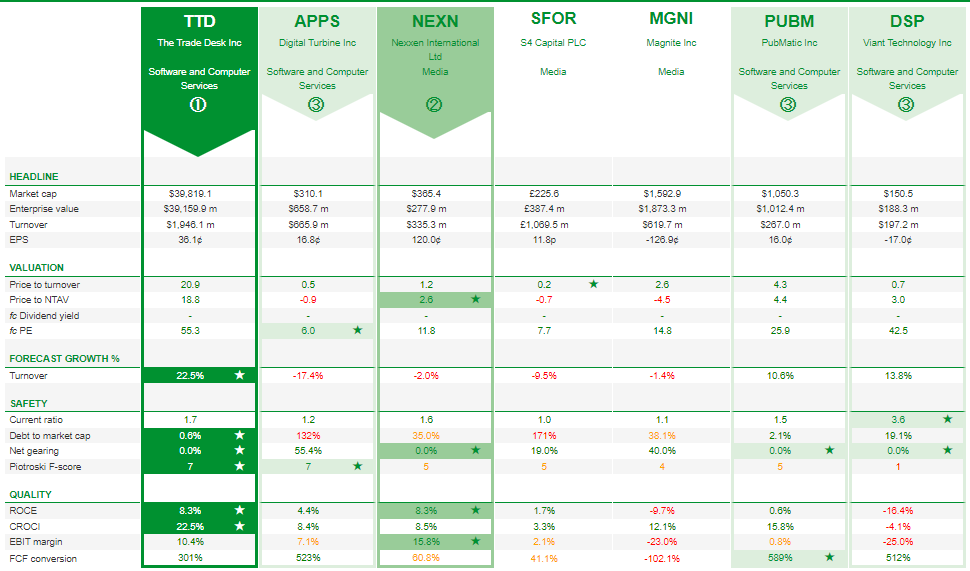

Valuation: The shares are trading on a PER of 7x Cavendish’s Dec 2025F forecasts. Sharepad shows the price/revenue multiple has also de-rated significantly over the last 2 years.

NEXN and other competitors are dwarfed by The Trade Desk, which still trades on above 20x revenues and is the market leader. For comparison, the next highest rated is PUBM on 4x revenues and APPS trades on 0.5x revenues.

Opinion: I last wrote about Tremor here. I think some investors could make sizeable gains timing the recovery in advertising and marketing spend, but this is a sector where things can change very fast (for instance removal of cookies, Apple asking users to ‘opt-in’ to be tracked). I don’t think any companies in the sector (ex Alphabet perhaps?) qualify as a long term “buy and hold” investment. If I was going to buy into NEXN, I would follow closely results at other Nasdaq-listed competitors in the sector like Magnite, PubMatic, Viant and Digital Turbine to really try to get my timing right.

Notes

Bruce owns shares in Funding Circle, Bank of Georgia and Arcontech

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 12/03/2024 | BKS, FCH, NEXN | A good thing that the world doesn’t run on chocolate

A look at how commodity prices have performed since Putin’s invasion of Ukraine. Companies covered: BKS, FCH and NEXN.

The FTSE 100 was flat last week at 7,629, as were the S&P500 and the FTSE China 50. The Nasdaq100 was down -1.5%. Bitcoin rose +9% to within touching distance of $70K and gold was up +5% to $2150. The US 10Y government bond yield was 4.08%, within a couple of basis points of where it was trading during the first week of January.

The war in Ukraine appears to be going badly. However, the effect of the war on commodity prices has been far smaller than many initially assumed. I have used Sharepad’s commodity button to sort through the performance of commodities since Putin’s invasion. The highest price spike has been cocoa, up +150%. Fortunately, the world doesn’t run on chocolate or Bitcoin either, which is up +77% since 24th Feb 2022.

Commodities like natural gas (NG-MT) -55% and wheat (MKC-FM) -42% in red are down steeply since before the invasion. Brent crude and WTI oil are down -14% and -17% respectively, that’s in the middle of the range of constituents.

Ironically the best performing stock in the FTSE All Share since the invasion has not been a defence stock but Bank of Georgia, up 4.5x as the country’s banking system has benefited from an influx of Russians who don’t want to fight.

We are now most of the way through the winter, so it’s hard to see energy costs spiking in the next 6 months even if the situation in the Middle East or Ukraine deteriorates further. That suggests that we have avoided the dreaded inflationary spiral, as the chart below from the Bank of England shows, Central Banks should have room to cut interest rates at some point this year.

In UK equity markets we saw a bid for Spirent, which does automated testing for telco networks. The offer was 175p per share in cash, a 62% premium to the previous closing price. This values the firm at a PER 16x Dec 2024F and 13x Dec 2025F. Spirent had sold off heavily last year, as the company warned of a difficult operating environment and the outlook statement sounded similarly downbeat, so we are seeing bids for companies reporting near-term headwinds. We also saw a bid for Virgin Money from Nationwide, at 220p (or £2.9bn) a 38% premium to the closing price. Virgin Money is the old Northern Rock, which they bought from the UK government for £747m in 2011, a couple of years after the financial crisis.

We also saw a bid for Mattioli Woods, the Wealth Manager with £15bn of client assets, at 804p (£432m or 2.9% of AuM), which is a 32% premium to the closing price. The bidder is Pollen Street Capital, a Private Equity fund. The Wealth Management sector is consolidating at the moment, Permira the PE fund merged Smith & Williamson into Tierney to create a WM with £56bn of AuM a couple of years ago. The Canadian bank RBC bought Brewin Dolphin and Rathbones has acquired Investec’s WM division in an all-share deal worth £840m. I wouldn’t be surprised if Mattioli Woods trades through the terms of the offer, as investors anticipate another buyer stepping in. On the other hand, Elliott announced that they would not be making an offer for Currys. LoopUp, the conference call software group announced it would de-list, having fallen -99% in the last five years.

This week I look at a couple of idiosyncratic financial companies: Beeks Cloud Financial and Funding Circle. Both have a track record of growing the top line, but burning cash and accumulating losses – both now seem to have found a path to profitable growth. I also look at an Israeli Adtech firm formerly known as Tremor International, but now Nexxen. All three companies refer to themselves as platforms.

Beeks Cloud Financial H1 Dec Results

This Glasgow headquartered connectivity and cloud infrastructure provider for exchanges announced H1 Dec 2023 revenues +25% to £13m. The company has a history of delivering 20-30% revenue growth but struggled to generate meaningful profits. H1 statutory PBT was £160K, which is an improvement on a £650K loss in H1 last year. The company had net cash of £5.4m December last year, up from £3.3m December 2022.

In H1 management capitalised £1.4m of development costs onto the balance sheet. There’s £9m of intangible assets (around 2/3 of which was development costs) accumulated on the balance sheet versus £17m of Property Plant and Equipment. That suggests historic losses would have been even higher if management expensed development costs through the P&L. Worth noting too that the company received a £1.25m R&D tax credit FY Jun 2023, without which historic losses would also have been higher. The gross margin is 39% and the EBIT margin is 2%, so the bull case is that as the company scales margins improve. The bear case is that the growth requires too much capital to and hasn’t generated returns for shareholders. The number of shares outstanding has increased by +43% since the time of the IPO to 70.5m to fund the growth.

History: The company was founded in 2010 by CEO Gordon McArthur (currently 37% shareholder). Its first site was in a New Jersey data centre providing low latency services to automated retail trading, quickly followed by London where it served FX markets. In 2015 they expanded into German and Japanese exchanges and futures markets. They listed on AIM at 50p per share, with £4.5m gross received by the company and around half that amount going to selling shareholders. This valued the market cap of the company at £35m on admission in November 2017.

In last week’s RNS management said that they intend to be more ‘platform-based with their technology investment’ and they also plan to increase their investment in artificial intelligence. The Admission Document says they provide hardware, storage, data centre space, network and connectivity options – collectively known as ‘Infrastructure as a Service’ (IaaS) – as opposed to (SaaS). Given there is a significant hardware component, which inevitably depreciates, the economics are unlikely to be similar to the SaaS business model. Instead, they seem more comparable with equipment rental businesses like CAPD or ASY, but rather than renting out gold mining equipment or air conditioning, they provide computer servers.

The Annual Report outlines their business in cartoon style, which I think is rather fun and probably something more companies should do to make their Annual Reports enjoyable to read: “Behold Beeks, Guardian of the Capital Markets, rises to the occasion.”

Outlook: The company reiterates its 6th February RNS that they expect FY Jun 2025 trading to be ‘significantly ahead’. However, the shares had already reacted to that +74% from the start of the year. Progressive leaves their FY Jun 2024F and 2025F estimates unchanged, though they raise revenue and EPS forecasts at the beginning of February by +14% and +10% respectively. Progressive are forecasting an EBIT margin of 15% (revenues of £38m and EBIT of £5.9m).

Valuation: The shares are on a PER of 23x Jun 2025F, according to Progressive’s forecasts. That valuation implies that the historic revenue growth will become self-funded in future years and continue beyond the forecast period. Cash represents 5% of the current market cap,

Opinion: So far the top-line growth has failed to generate returns on capital for shareholders, but if the forecasts are achieved then this could be about to change. Management say that a large amount of their revenue is recurring, they also ought to have good visibility on costs so I think they are justified in sounding confident that the business has reached an inflection point.

This looks like the mirror image of Arcontech, which I looked at a couple of weeks ago, BKS is high growth, low RoCE. Hopefully, both companies can address their historic weaknesses. BKS gets the thumbs up from me, though I must admit I would like to understand the size of the potential revenue pool and also the competition in the sector better.

Funding Circle FY Dec Results

This lending platform has been on my watch list for a while, and I’ve watched as the share price sank like a lead balloon. The shares had fallen below 30p, halving in value from six months ago, but then, last week rebounded +60% on FY results, disposal and buyback announcement.

FY Dec results themselves were in line with expectations: total income +7% to £162m and a loss before tax of £33m. They announced that they will focus on their UK business and will put the US business which lost £23m last year up for sale. They have already received indications of interest. They also announced a £25m buyback because management believes the shares are materially undervalued.

The core UK loans business is profitable, generating £6.5m of PBT on £121m of revenue. I like the transparency on their website, offering loans at 6.9%. Most banks tend to create complexity and make direct comparisons difficult.

FCH have recently launched a UK SME credit card business: FlexiPay, which reported £16m of losses on revenues of £8m. They say that the advantage of FlexiPay is that it is more flexible than a loan and more transparent than an overdraft. SME customers are charged a simple flat fee per transaction. Management seems to believe this could be a much larger business and are trying to take advantage of the opportunity. FlexiPay transactions quadrupled last year, and FCH issued 6,600 cards so far. They say that FlexiPay unit economics are attractive, but the business is only loss-making due to upfront marketing costs.

FCH have £221m of cash, of which £170m was unrestricted (ie available for general use, not payable to third parties) so they don’t need to make a profit on disposal of their US business to fund the buyback. They are also not in financial distress and forced to sell at an unattractive price.

Outlook: Management have set out very clear guidance.

Medium-term guidance is for topline growth of ~15-20%; PBT margins increasing to >15%. They also announced that Eric Daniels, the former Lloyds Chief Exec who took the bank to court over not being paid a bonus for the disastrous HBOS deal, won’t be standing for re-election as a Non-Exec Director. His departure is a positive, in my view.

Valuation: Assuming the UK loans business grows to £133m and generates £16m of PBT. There’s £85m of accumulated losses recorded on the balance sheet, so we could just put that £16m of PBT on a multiple of 10x to reach a valuation of £160m. I’m not sure how to value either FlexiPay or the US business, but I would imagine they could each be worth 1/3 of the core UK loans business. That would get us to a target market cap of £260m or 70p per share. Net assets are £247m or 68p per share.

However, that analysis leaves out the £170m of unrestricted cash which represents more than the current market cap, even after last week’s +60% bounce. Previously I had worried that management would continue burning cash to grow the top line, so shareholders faced an uncertain and distant future pay-off. It now looks like management have given up their international ambitions and are focused on profitable growth in the UK, returning excess cash to shareholders, which I think is the correct decision.

Opinion: I last wrote about the shares 2 years ago, when the price was above 70p, concluding “could be interesting at the right point in the cycle and an attractive valuation.” I think we could have reached that point, so when I read the RNS last week I bought a starter position. TrustPilot reviews and Net Promoter Score are much higher for Funding Circle than for traditional UK banks, so I believe this has the chance to be a much larger business in 5 years’ time.

Nexxen FY Dec 2023 Results

This Israeli adtech firm that used to be Taptica then changed its name to Tremor International, and renamed itself yet again in January this year. The shares are dual listed on AIM and Nasdaq, but headquartered in Tel Aviv. I’m sceptical of ad-tech, but now the company is down -75% from its September 2021 peak, the investment case may be worth a second look.

Nexxen’s strengths are in video and Connected TV (which I think means streaming). The business comprises of a demand-side platform (DSP), supply-side platform (SSP), ad server and data management platform (DMP). That seems to me rather a lot of platforms in one company.

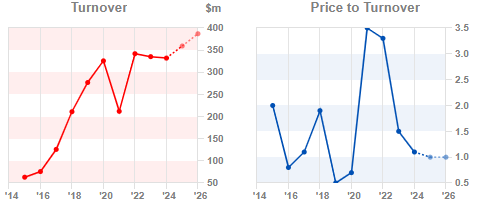

FY Dec 2023 revenues were down -1% to $332m and gross profits were down -12% to $219m. The company made an after tax loss of $22m, though $43m of that was amortisation of intangibles. Net cash generated from operating activities was $60m FY Dec 2023, down by -65% versus two years previously. Adj EBITDA of $83m is down -43%, but above the midpoint of previous guidance. Management say that the decline is due to the integration of Amobee, which they bought for a total consideration of $239m in July 2022, as the acquired business is lower profitability than Nexxen’s pre-acquisition standalone business. Adj EBITDA also declined because of reduced spending from some of the Company’s largest customers throughout 2023 compared to 2022.

Guidance: FY 2024F guidance is for $340-345m of net revenue and c $100m of adj EBITDA, implying +10% revenue growth and +20% adj EBITDA growth. Cavendish, their broker, are forecasting +10% net revenue growth the following year and +13% adj EBITDA. The broker has $20m of share buybacks resulting in $174m of net cash.

Valuation: The shares are trading on a PER of 7x Cavendish’s Dec 2025F forecasts. Sharepad shows the price/revenue multiple has also de-rated significantly over the last 2 years.

NEXN and other competitors are dwarfed by The Trade Desk, which still trades on above 20x revenues and is the market leader. For comparison, the next highest rated is PUBM on 4x revenues and APPS trades on 0.5x revenues.

Opinion: I last wrote about Tremor here. I think some investors could make sizeable gains timing the recovery in advertising and marketing spend, but this is a sector where things can change very fast (for instance removal of cookies, Apple asking users to ‘opt-in’ to be tracked). I don’t think any companies in the sector (ex Alphabet perhaps?) qualify as a long term “buy and hold” investment. If I was going to buy into NEXN, I would follow closely results at other Nasdaq-listed competitors in the sector like Magnite, PubMatic, Viant and Digital Turbine to really try to get my timing right.

Notes

Bruce owns shares in Funding Circle, Bank of Georgia and Arcontech

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.