Richard looks at the good and the ugly in Hollywood Bowl’s alternative performance measures and concludes that the company has put a positive gloss on adjusted profit.

In Getting to grips with Alternative Performance Measures (APMs), I explained that exceptional items are costs or gains that obscure the underlying performance of a business.

This does not mean the costs or gains are fictitious. It means they are unusual and may lead us to get the wrong impression of how the business is performing.

For example, Treatt, the flavouring company, has relocated its headquarters and UK distillery to a brand new purpose-built facility. It was a huge operation requiring it to run both sites simultaneously, which increased costs.

It seems unlikely the company will move into another new facility for decades, but the costs ate into profit. It is reasonable to deduct these costs from adjusted profit, as long as we trust that the company has calculated them fairly, to give a better impression of how the business traded in 2022, compared to 2021.

The costs were real, the company was less efficient in 2022 due to the relocation, but in a normal year it would have done better and that is all the adjustment is telling us.

While adjustments like this can sharpen our understanding of the figures, they can also mislead us, which is why we should not take APMs for granted.

One of the empowering things we can do as investors is roll our own APMs. I do this for every company I consider for investment.

Rolling our own Hollywood Bowl APM

Hollywood Bowl’s treatment of exceptional items includes good decisions, but also a questionable one.

The company is the UK’s biggest tenpin bowling centre operator. It is rolling out a new indoor mini-golf chain, and it recently acquired a small Canadian tenpin bowling operator, which it has already expanded.

I own some of the shares, but I am reconsidering my holding, in part due to the way that the company calculated its version of post-tax profit.

If you were to roll your own APM just once, you would probably copy the figures from the annual report, but since I do this for every share, I export a custom table of data from SharePad that contains all the reported (unadjusted) figures I need, and paste it into a spreadsheet before making the adjustments.

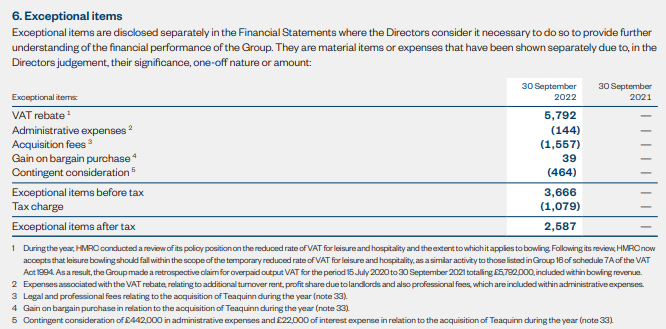

For the purpose of adjusting profit, I start with reported EBIT, earnings before interest and tax.

![]()

Source: SharePad

Then we can add costs that we deem exceptional back to EBIT (as though the company had not incurred them) and deduct gains that we deem exceptional (as though the company had not received them).

Finally, we can deduct tax at the standard UK rate of corporation tax. Although corporation tax has been 19% for some years, it is going up to 25% at the beginning of April.

I use the standard rate of corporation tax because it is easier and, as a long-term investor, I am using profitability ratios derived from my APM to compare companies using metrics like return on capital, profit margin, and cash conversion. By stripping out the impact of interest and tax, we can judge the quality of the businesses we are weighing up irrespective of the particular tax regime or debt levels they may currently be operating under.

This measure of profitability has a name, it is NOPAT or Net Operating Profit after Tax.

Back to Hollywood Bowl. Here is a screenshot of the note in the annual report on exceptional items.

Source: Hollywood Bowl Annual Report 2022

Share based payments

First the good: Share based payments, which Hollywood Bowl does not treat as an exceptional item (so it is not in the table). Many companies add this cost back to profit in their APMs, but I have never heard a justification for this that makes sense and consequently do not follow this practice when rolling my own APMs.

Now, working up from the bottom of the table, we do not have to concern ourselves with the last section relating to tax because we are going to apply the standard rate.

Acquisitions

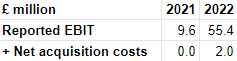

The next three items (acquisition fees, gain on bargain purchase, and contingent consideration) concern the acquisition of a chain of bowling centres and a company that equips bowling centres in Canada.

There is a tiny gain, outweighed by payments to legal and professional advisers and payments to the company’s former owner based on the acquisition’s performance as part of Hollywood Bowl.

These are real costs that net out at nearly £2 million, but the fees are one-off in nature so in judging the company’s ongoing profitability it is reasonable to add them back to profit. The payments, contingent on the performance of the acquisition, will continue until 2026, though.

These are our first adjustments. I have aggregated them in “net acquisition costs” for simplicity:

Source: Hollywood Bowl, annual report 2022

VAT windfall

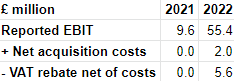

The next two items concern a large gain due to a VAT rebate and a small cost relating to securing the rebate and expenses that were incurred during the period relating to it. The net gain was just over £5.6 million.

Source: Hollywood Bowl, annual report 2022

This is a one-off gain. It relates to the reduced rate of VAT levied to support restaurants, hotels and other hospitality businesses through the pandemic. Initially, bowling alleys were not defined as hospitality businesses, but the government changed its mind and so Hollywood Bowl received a rebate.

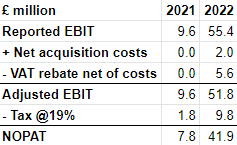

Add back the net acquisition costs and deduct the VAT rebate net of costs and we get adjusted EBIT. Deduct corporation tax from that at the standard rate, and we have rolled our own APM, a NOPAT of £41.9 million:

Source: Hollywood Bowl, annual report 2022

Putting a gloss on profit

Hollywood Bowl has made reasonable adjustments, and they are all incorporated in my after-tax profit measure, so you might ask, what’s the point?

There are three. The obvious one is that the company might have dropped in exceptional items that we do not agree with (like share based payments).

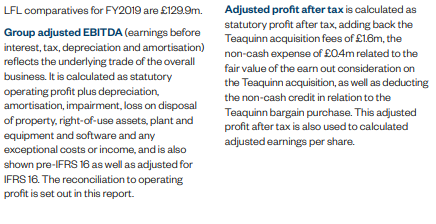

The second is that Hollywood Bowl does not provide an APM for EBIT or NOPAT, which are the measures I prefer. It provides adjusted EBITDA and adjusted post-tax profit.

The third is that sometimes by going through the numbers, you can spot something anomalous. In Hollywood Bowl’s case, I very nearly missed it because, having rolled my own APM’s I do not pay much attention to the companies’ APM calculations.

In 2022, Hollywood Bowl did something odd.

It correctly defined the VAT gain as exceptional but chose not to deduct it from adjusted profit after tax. However, it still added back the exceptional acquisition costs. So it boosted after-tax profit two ways, by ignoring one category of exceptional items and including the other.

If I had calculated NOPAT the way Hollywood Bowl calculated adjusted profit after tax, it would have boosted profit by 11%.

Disconcertingly, the definition of adjusted profit after tax given by the company does not explicitly mention this inconsistent treatment of exceptional items, nor does it explain why the company’s other adjusted profit measure, adjusted EBITDA, includes both exceptional costs and income:

Source: Hollywood Bowl, annual report 2022

Neither does Hollywood Bowl provide a reconciliation showing the calculation of profit after tax, like it does for EBITDA.

Profit after tax is the ultimate measure of profit for many investors. It is the profit component of the earnings per share calculation.

To my mind, this inconsistency defies the exhortation from the Financial Reporting Council, the accounting regulator, that companies should put equal emphasis on exceptional gains and losses in calculating APMs.

A recent review by the FRC found that, at 19 out of the 20 companies it investigated, adjustments boosted profit or reduced losses compared to the reported results.

It seems unlikely that windfalls and whatever the opposite of a windfall is, should naturally skew so heavily towards the positive, which is why we should pay attention to the adjustments.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.