Bruce uses Sharepad to look at H1 mortgage approvals data going back to the mid-1990s, and house prices back to the 1950s. Companies covered: GRG, TW. and DEVO.

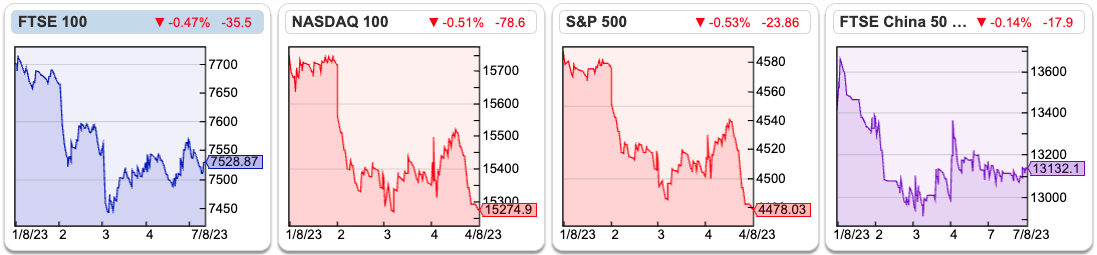

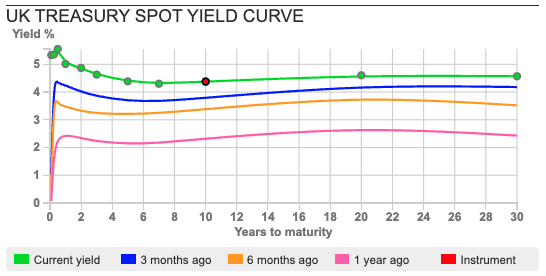

All three of the FTSE 100, S&P500 and FTSE China50 were down -2.2% in the last 5 days. The Nasdaq100 was even worse down -3%. The US 10-year Govt bond yield rose to 4.12% (v 3.45% 3 months ago) and the UK 10-year Govt bond yield was 4.47% (v 3.73% 3 months ago). Investors tend to assume when the yield curve is inverted (long bond yields lower than 2-year bond yields) this will correct when a recession arrives and Central Banks cut interest rates in response. Instead, what is happening is that the long bond yield in the US and UK has risen in parallel with shorter-dated Govt bonds.

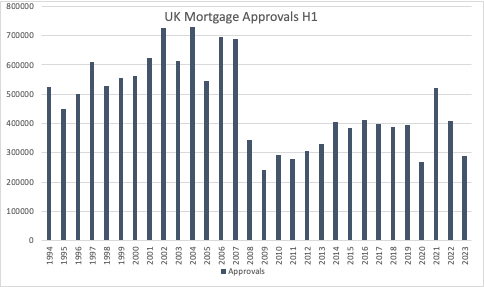

The Bank of England released mortgage approvals data for June a couple of weeks ago, which shows a rise +7% from 51,100 in May to 54,700 in June. However, that rise in sequential data looks less impressive when we compare the H1 2023 with previous years’ H1s. I’ve downloaded Sharepad’s UK.HMA data series into Excel then summed the first six months of each year going back to 1994.

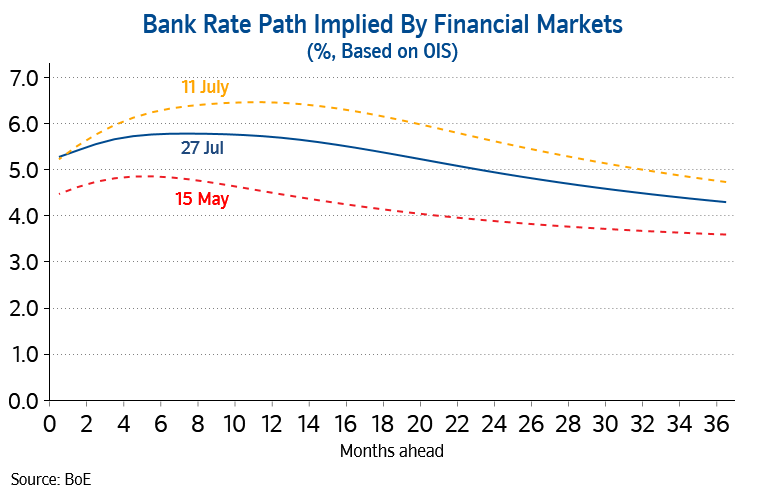

The graph shows that H1 2023 was 290K, -29% below 407K in H1 2022 and -44% below 520K in H1 2022. It’s fair to point out that the first half of 2020 was equally weak as H1 2023, however following stamp duty cuts and Central Bank support measures H2 2020 we saw a huge boost to the mortgage market 3 years ago. If anything, I think we can expect H2 this year to be even more difficult given the movement in the 2-year government bond yield. Interest rate expectations have fallen in the last couple of weeks, following the inflation data, but remain well above where we were in mid-May as this BoE chart (on the Nationwide website) shows.

It’s entirely possible that the 12-month figure for 2023 mortgage approvals falls below the 533K level we saw for 2008, in my view. Although mortgage approvals are a lead indicator, we won’t see problems emerge until we get September’s data, which will be published by the BoE at the end of October.

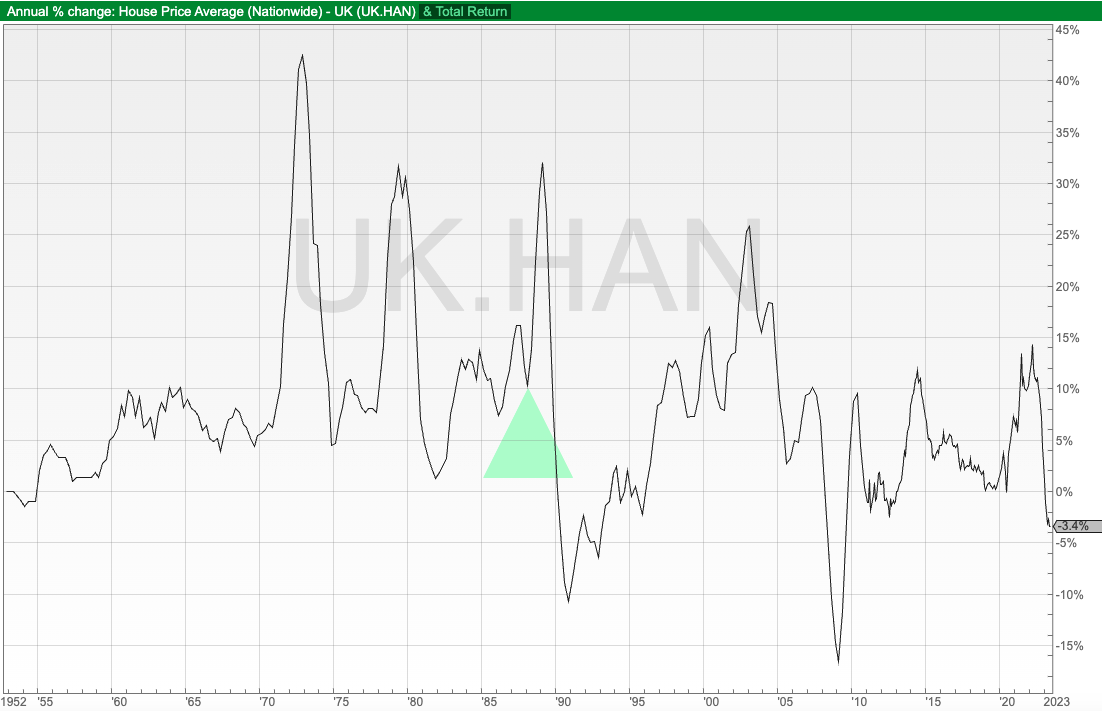

Meanwhile Nationwide revealed their latest House Price Index data, showing a y-o-y fall in the average house price of -3.8% to £261K. That is the weakest since July 2009, and house prices are now -4.5% below their peak in August 2022. Nationwide says that “a prospective buyer, earning the average wage and looking to buy the typical first-time buyer property with a 20% deposit, would see monthly mortgage payments account for 43% of their take-home pay (assuming a 6% mortgage rate).” This is anecdotal but a friend with several Buy-to-Let properties in London says that he has had tenants move out from two properties, and re-rented one for +25% more and the second for +46% more, but given interest rate rises the rental increases only just covers the interest costs on each mortgage. That suggests to me that there are second-round effects to inflation, implying higher interest rates even if energy and food costs fall.

Sharepad has Nationwide’s UK HPI going back to 1952 when the average house cost around £2K versus £261K in July. The ticker is UK.HAN, and I show the y-o-y house price growth, though the chart hasn’t been updated for the most recent month of July data yet.

My feeling is that UK equity markets look for good value, but there could be bad news to come from UK property-related stocks. I cover housebuilder Taylor Wimpey’s results below which appeared reassuring. Last week Belvoir also announced a trading update that was said the estate agent is “trading comfortably in line with management’s expectations for the year ending December 2023.” I think there’s still scope for disappointment in H2, based on my top-down analysis of approvals data though.

Other stocks covered below are Greggs, the baker and Devolver Digital’s (video games) profit warning.

Greggs H1 to 1 July

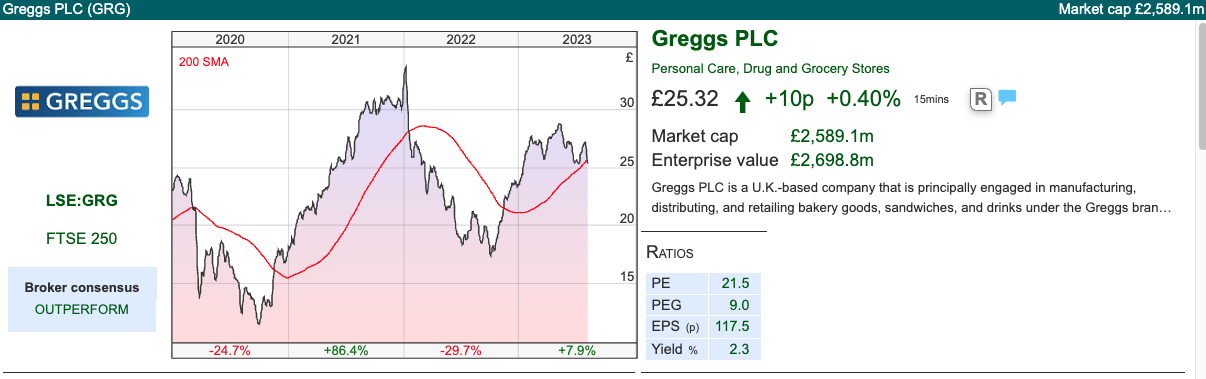

This baked goods and food-on-the-go specialist reported H1 results to 1 July, with total sales up +22% to £844m and company-managed Like-For-Like sales +16%. Reported PBT includes £16m of covid insurance claims, so underlying PBT of £64m, +14% is a more representative figure. They have £136m of cash, down -5% from June the previous year. That’s because they are self-funding a multi-year investment programme, with full-year guidance of £200m capex.

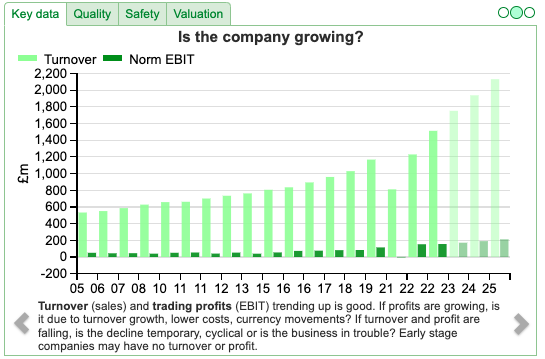

The Sharepad graph below shows the long-term track record of +11% CAGR of both revenue and profits over the last decade, interrupted briefly during the pandemic.

Outlook: Cost inflation has started to ease and they reiterate full year expectations (Sharepad shows total sales growing +15% to £1.7bn and PBT up +10% to £163m). The shares reacted by falling -7.5% on the morning of the RNS. A share price falling by that much following an “in line” RNS, perhaps suggests some investors were expecting a stronger H2 and raised expectations. They suggest that supply chain capacity utilisation is currently at a historically high level and this will fall in future, modestly reducing ROCE in the short term. I suspect that section of the outlook statement may have caused the negative share price reaction.

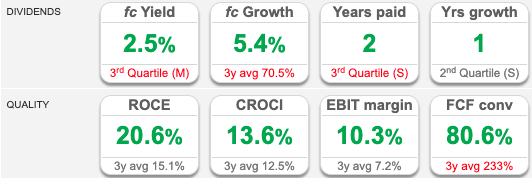

Valuation: The shares are trading on a PER of 19x and 17x FY Dec 2024F and 2025F respectively. RoCE is now above 20% and EBIT margin is 10%. The dividend yield is only 2.5%, however, excluding the pandemic, they do have a strong track record of growing the dividend over time.

Opinion: This has been a quality long-term performer, with the share price up 6.5x in the last decade. Hopefully, management are investing wisely, I do wonder if at some point this might go “ex growth”. For instance, the trend of office workers WFH on Mondays and Fridays has been unhelpful and means that they have had to focus more on car-accessible locations and a food delivery partnership with Just Eat. I have to admit that I have never tried the product, so I’m not quite sure what the secret of their success is.

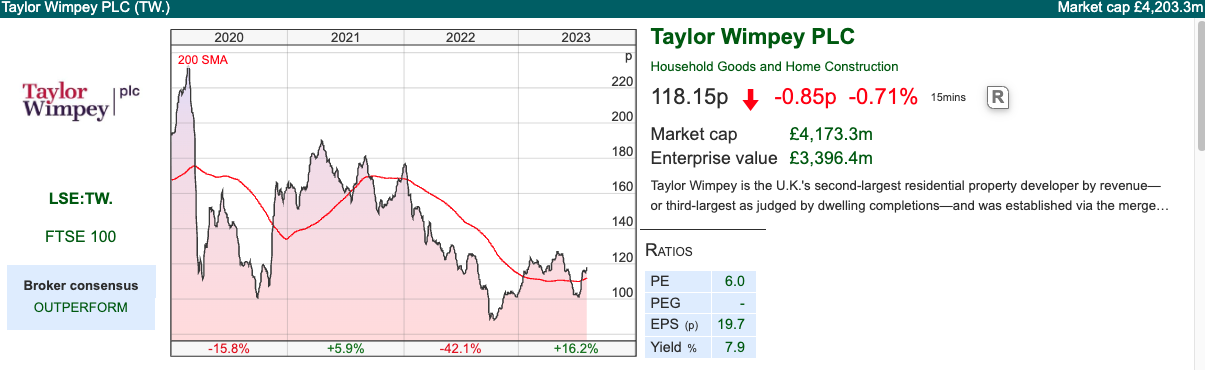

Taylor Wimpey H1 2 July 2023

Given my analysis of the mortgage approvals data in the introduction, I thought that it might be worth looking at a housebuilder to see what they are saying about the housing market at the moment. During the financial crisis, Taylor Wimpey shares fell -98% from above 500p to 8p, so the +16% performance YTD suggests that we are a long way from the credit crisis. That’s also reflected in TW.’s statutory PBT of £238m for H1 2 July, versus £2.7bn of cumulative losses between 2007-9.

The company did report a -21% fall in H1 revenue to £1.64bn, while H1 PBT before exceptional items fell -43% to £237m. There were no exceptional items this year, but there was a £80m of exceptional cost for cladding fire safety work last year. The H1 this year -21% revenue fall compares to a -57% revenue decline between FY Dec 2007 and FY Dec 2010.

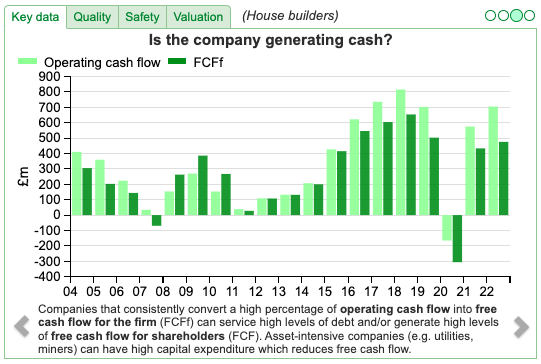

The reason the share price has been so resilient this year is that despite that fall in profits, net cash actually rose +2% to £654m. The cashflow statement shows that cash from operations fell -92% to £16m (before tax) and was minus £50m post-tax, but cash conversion improved to 70% of operating profit for the 12 months ending 2 July 2023 (12 months to 3 July 2022: 45.2%). Aside from the cash they also have £550m of undrawn borrowing facilities.

Outlook: Increased mortgage costs (Moneysavingexpert best buy table shows 2 year fixes are currently 6%) are impacting affordability for Taylor Wimpey’s house buyers. Reservations are below the levels TW. has experienced in recent years. They say that pricing is resilient, and the level of down valuations continues to be low.

That makes sense as during the financial crisis housebuilders tended not to drop prices, but instead transaction volumes collapsed. Back then, they were helped by the BoE slashing rates from 5.5% end of 2007 to 0.5bp March 2009 and later George Osborne’s Help to Buy scheme. We’re now in a high inflation, rising interest rate environment, so I’m not sure how that housebuilders can rely on Govt support measures in the future.

Valuation: The shares are trading on a PER of 12.5x and 10.5x Dec 2024F and 2025F respectively. The dividend, at 9.4p per share, is forecast to be flat for the next couple of years, but that still gives a yield of 7.9%.

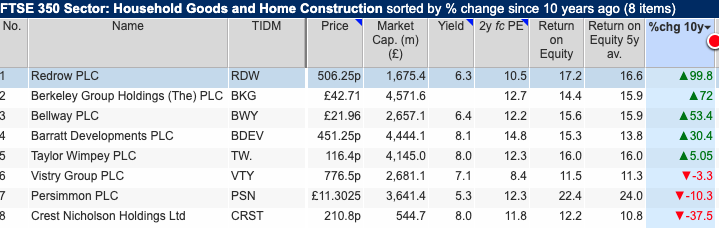

Opinion: For decades people have believed that it is impossible to lose money buying UK property. Similar to the UK banks, owning shares in the housebuilders hasn’t been especially profitable despite the booming housing market. Instead housebuilders could be “value traps” on seemingly attractive multiples, net cash and high single digit dividend yields, but deteriorating fundamentals. I would not be in a hurry to buy these shares, but when revenues begin to grow again, might think about getting involved in the sector.

Devolver Digital FY Dec 2023

Problems in the computer game sector continue with Devolver Digital warning last week. They are suffering from similar problems as tinyBuild, which I covered here. Platforms, such as Steam, Roblox and NetEase (7.9% shareholder of DEVO) which distribute games have been driving a hard bargain with publishers over their subscription deals, and DEVO has turned down some deals with platforms as they felt that they undervalued their games’ revenue opportunity. This has been a theme for this year, but they expect it to continue into FY Dec 2024.

Industry background: Progressive have published a 36-page initiation note on DEVO’s competitor TBLD, which contains plenty of useful video game industry background. Alex Nichoporchik, the Founder/CEO of TBLD believes that the traditional publishing model, where publishers fund game developers’, help with production and marketing games, is now obsolete. That view is supported by FDEV’s decision a couple of months ago to close down their Third Party publishing label, called Foundry. Most platforms are open, so the games publishers like DEVO, which used to act as gatekeepers are being disintermediated. Nichoporchik believes there are too many publishers chasing too few quality games, hence he is focusing more on developing quality games internally (similar to FDEV and TM17 strategy). That’s an interesting insight, as in their IPO prospectus DEVO draw a parallel with the Venture Capital industry saying:

“Devolver effectively operates a venture capital model, receiving and vetting over 2,000 unsolicited title pitches per year at varying stages of progress, from initial concept to fully-formed games. Devolver does not require developers to hand over the IP or sequel rights to their games, which the Directors believe is attractive to creators.”

I wonder if what’s happened in video games has a wider lesson, and that there are currently too many VC’s chasing too few quality start-up ideas. Certainly the well-publicised problems at Tiger and Softbank suggest that might be the case.

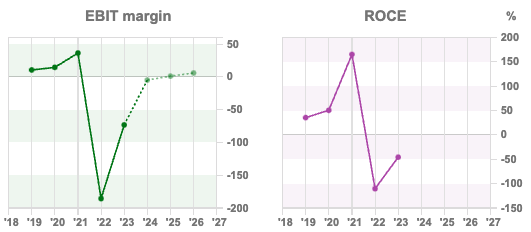

Aside from those industry headwinds in video game publishing, there were also a couple of company-specific problems mentioned by DEVO: delays to new title releases, and a lower contribution from their back catalogue. That’s having an effect on both DEVO’s deteriorating EBIT margin and RoCE.

Their latest guidance is for FY 31 Dec 2023F, Group Normalised Adjusted EBITDA to be at least break-even. The Board expects Normalised Adjusted EBITDA to return to growth in 2024 and accelerate in 2025. Previously Sharepad had £18m EBITDA (now <$1m) for FY Dec 2023F and £20m (now $11m) FY Dec 2024F. There shares responded by falling -33% last week.

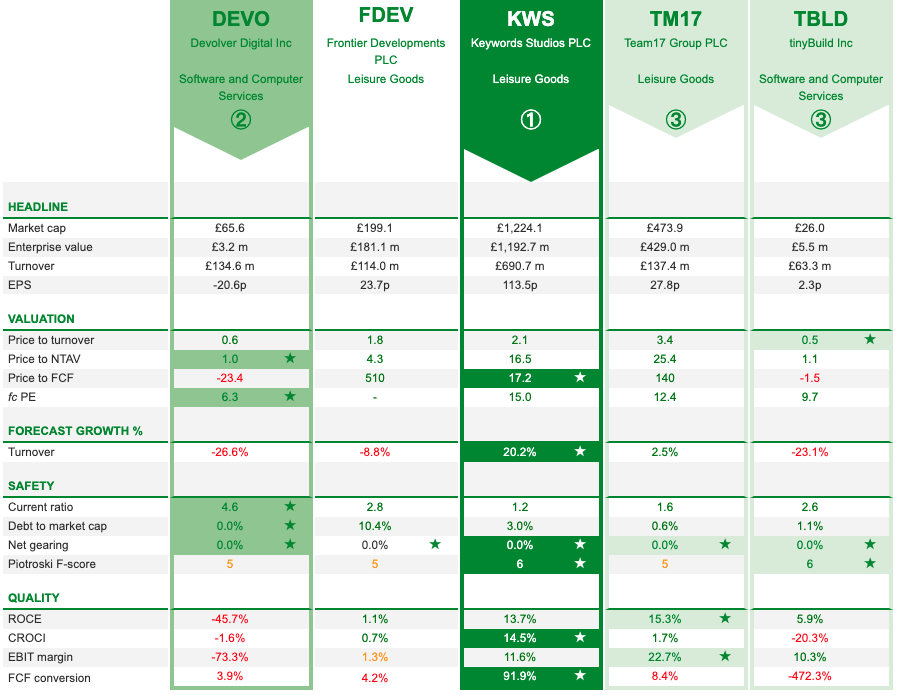

Balance Sheet: They don’t feel the need to mention a “strong balance sheet”, perhaps because they had $64m (£50m) of net cash end of June, which is 76% of the market cap. Shareholders’ equity was $172m at Dec 2020, even if we deduct $85m of intangible assets (of which $19m is goodwill from acquisitions, $66m capitalised game development costs) that still gives tangible book of $87m (£68m). In other words, the shares are trading on 1x tangible book value, which is more similar to a UK bank with a balance sheet 20x leveraged, rather than a software company with significant cash balances and operational gearing. For contrast KWS trades on 16.5x tangible book and TM17 25x tangible book.

Valuation: The shares are trading on a PER of 5.7x Dec 2024F dropping to below 5x the following year. Worth noting too that the shares are now down -78% YTD to below 15p. They IPO’ed at 157p in November 2021, when they raised £30m of new money, but the bulk of the money raised (£154m) went to the selling shareholders. The shares are on 0.6x revenue, which is a sharp de-rating from the >10x revenue multiple which they IPO’ed on.

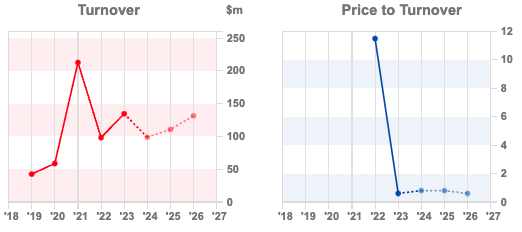

Below is the Sharepad “compare” tab showing that revenue is forecast to fall -27%, versus -23% for TBLD, but +2.5% for TM17 and +20% for KWS.

Opinion: When the tide turns for this sector, there could be considerable upside but I’ve no idea what the catalyst might be. As I already own FDEV and don’t want to increase my exposure. Contrarian investors who are coming at this with an open mind though might see opportunities here. Certainly, the net cash that both TBLD -88% YTD and DEVO -77% YTD have on their balance sheet means their risk/reward ought to be superior to (say) RBGP -65% YTD which I covered last week.

Conclusion

Bruce Packard

brucepackard.com

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 08/08/23 | GRG, TW., DEVO| The Outlook for Approvals

Bruce uses Sharepad to look at H1 mortgage approvals data going back to the mid-1990s, and house prices back to the 1950s. Companies covered: GRG, TW. and DEVO.

All three of the FTSE 100, S&P500 and FTSE China50 were down -2.2% in the last 5 days. The Nasdaq100 was even worse down -3%. The US 10-year Govt bond yield rose to 4.12% (v 3.45% 3 months ago) and the UK 10-year Govt bond yield was 4.47% (v 3.73% 3 months ago). Investors tend to assume when the yield curve is inverted (long bond yields lower than 2-year bond yields) this will correct when a recession arrives and Central Banks cut interest rates in response. Instead, what is happening is that the long bond yield in the US and UK has risen in parallel with shorter-dated Govt bonds.

The Bank of England released mortgage approvals data for June a couple of weeks ago, which shows a rise +7% from 51,100 in May to 54,700 in June. However, that rise in sequential data looks less impressive when we compare the H1 2023 with previous years’ H1s. I’ve downloaded Sharepad’s UK.HMA data series into Excel then summed the first six months of each year going back to 1994.

The graph shows that H1 2023 was 290K, -29% below 407K in H1 2022 and -44% below 520K in H1 2022. It’s fair to point out that the first half of 2020 was equally weak as H1 2023, however following stamp duty cuts and Central Bank support measures H2 2020 we saw a huge boost to the mortgage market 3 years ago. If anything, I think we can expect H2 this year to be even more difficult given the movement in the 2-year government bond yield. Interest rate expectations have fallen in the last couple of weeks, following the inflation data, but remain well above where we were in mid-May as this BoE chart (on the Nationwide website) shows.

It’s entirely possible that the 12-month figure for 2023 mortgage approvals falls below the 533K level we saw for 2008, in my view. Although mortgage approvals are a lead indicator, we won’t see problems emerge until we get September’s data, which will be published by the BoE at the end of October.

Meanwhile Nationwide revealed their latest House Price Index data, showing a y-o-y fall in the average house price of -3.8% to £261K. That is the weakest since July 2009, and house prices are now -4.5% below their peak in August 2022. Nationwide says that “a prospective buyer, earning the average wage and looking to buy the typical first-time buyer property with a 20% deposit, would see monthly mortgage payments account for 43% of their take-home pay (assuming a 6% mortgage rate).” This is anecdotal but a friend with several Buy-to-Let properties in London says that he has had tenants move out from two properties, and re-rented one for +25% more and the second for +46% more, but given interest rate rises the rental increases only just covers the interest costs on each mortgage. That suggests to me that there are second-round effects to inflation, implying higher interest rates even if energy and food costs fall.

Sharepad has Nationwide’s UK HPI going back to 1952 when the average house cost around £2K versus £261K in July. The ticker is UK.HAN, and I show the y-o-y house price growth, though the chart hasn’t been updated for the most recent month of July data yet.

My feeling is that UK equity markets look for good value, but there could be bad news to come from UK property-related stocks. I cover housebuilder Taylor Wimpey’s results below which appeared reassuring. Last week Belvoir also announced a trading update that was said the estate agent is “trading comfortably in line with management’s expectations for the year ending December 2023.” I think there’s still scope for disappointment in H2, based on my top-down analysis of approvals data though.

Other stocks covered below are Greggs, the baker and Devolver Digital’s (video games) profit warning.

Greggs H1 to 1 July

This baked goods and food-on-the-go specialist reported H1 results to 1 July, with total sales up +22% to £844m and company-managed Like-For-Like sales +16%. Reported PBT includes £16m of covid insurance claims, so underlying PBT of £64m, +14% is a more representative figure. They have £136m of cash, down -5% from June the previous year. That’s because they are self-funding a multi-year investment programme, with full-year guidance of £200m capex.

The Sharepad graph below shows the long-term track record of +11% CAGR of both revenue and profits over the last decade, interrupted briefly during the pandemic.

Outlook: Cost inflation has started to ease and they reiterate full year expectations (Sharepad shows total sales growing +15% to £1.7bn and PBT up +10% to £163m). The shares reacted by falling -7.5% on the morning of the RNS. A share price falling by that much following an “in line” RNS, perhaps suggests some investors were expecting a stronger H2 and raised expectations. They suggest that supply chain capacity utilisation is currently at a historically high level and this will fall in future, modestly reducing ROCE in the short term. I suspect that section of the outlook statement may have caused the negative share price reaction.

Valuation: The shares are trading on a PER of 19x and 17x FY Dec 2024F and 2025F respectively. RoCE is now above 20% and EBIT margin is 10%. The dividend yield is only 2.5%, however, excluding the pandemic, they do have a strong track record of growing the dividend over time.

Opinion: This has been a quality long-term performer, with the share price up 6.5x in the last decade. Hopefully, management are investing wisely, I do wonder if at some point this might go “ex growth”. For instance, the trend of office workers WFH on Mondays and Fridays has been unhelpful and means that they have had to focus more on car-accessible locations and a food delivery partnership with Just Eat. I have to admit that I have never tried the product, so I’m not quite sure what the secret of their success is.

Taylor Wimpey H1 2 July 2023

Given my analysis of the mortgage approvals data in the introduction, I thought that it might be worth looking at a housebuilder to see what they are saying about the housing market at the moment. During the financial crisis, Taylor Wimpey shares fell -98% from above 500p to 8p, so the +16% performance YTD suggests that we are a long way from the credit crisis. That’s also reflected in TW.’s statutory PBT of £238m for H1 2 July, versus £2.7bn of cumulative losses between 2007-9.

The company did report a -21% fall in H1 revenue to £1.64bn, while H1 PBT before exceptional items fell -43% to £237m. There were no exceptional items this year, but there was a £80m of exceptional cost for cladding fire safety work last year. The H1 this year -21% revenue fall compares to a -57% revenue decline between FY Dec 2007 and FY Dec 2010.

The reason the share price has been so resilient this year is that despite that fall in profits, net cash actually rose +2% to £654m. The cashflow statement shows that cash from operations fell -92% to £16m (before tax) and was minus £50m post-tax, but cash conversion improved to 70% of operating profit for the 12 months ending 2 July 2023 (12 months to 3 July 2022: 45.2%). Aside from the cash they also have £550m of undrawn borrowing facilities.

Outlook: Increased mortgage costs (Moneysavingexpert best buy table shows 2 year fixes are currently 6%) are impacting affordability for Taylor Wimpey’s house buyers. Reservations are below the levels TW. has experienced in recent years. They say that pricing is resilient, and the level of down valuations continues to be low.

That makes sense as during the financial crisis housebuilders tended not to drop prices, but instead transaction volumes collapsed. Back then, they were helped by the BoE slashing rates from 5.5% end of 2007 to 0.5bp March 2009 and later George Osborne’s Help to Buy scheme. We’re now in a high inflation, rising interest rate environment, so I’m not sure how that housebuilders can rely on Govt support measures in the future.

Valuation: The shares are trading on a PER of 12.5x and 10.5x Dec 2024F and 2025F respectively. The dividend, at 9.4p per share, is forecast to be flat for the next couple of years, but that still gives a yield of 7.9%.

Opinion: For decades people have believed that it is impossible to lose money buying UK property. Similar to the UK banks, owning shares in the housebuilders hasn’t been especially profitable despite the booming housing market. Instead housebuilders could be “value traps” on seemingly attractive multiples, net cash and high single digit dividend yields, but deteriorating fundamentals. I would not be in a hurry to buy these shares, but when revenues begin to grow again, might think about getting involved in the sector.

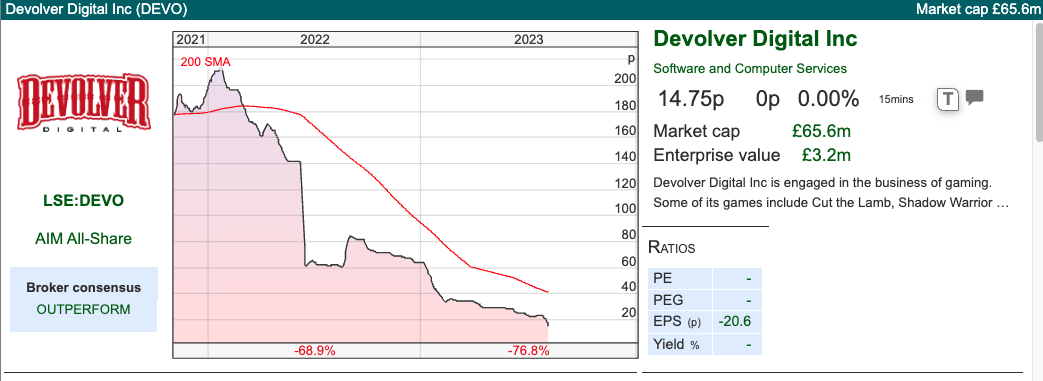

Devolver Digital FY Dec 2023

Problems in the computer game sector continue with Devolver Digital warning last week. They are suffering from similar problems as tinyBuild, which I covered here. Platforms, such as Steam, Roblox and NetEase (7.9% shareholder of DEVO) which distribute games have been driving a hard bargain with publishers over their subscription deals, and DEVO has turned down some deals with platforms as they felt that they undervalued their games’ revenue opportunity. This has been a theme for this year, but they expect it to continue into FY Dec 2024.

Industry background: Progressive have published a 36-page initiation note on DEVO’s competitor TBLD, which contains plenty of useful video game industry background. Alex Nichoporchik, the Founder/CEO of TBLD believes that the traditional publishing model, where publishers fund game developers’, help with production and marketing games, is now obsolete. That view is supported by FDEV’s decision a couple of months ago to close down their Third Party publishing label, called Foundry. Most platforms are open, so the games publishers like DEVO, which used to act as gatekeepers are being disintermediated. Nichoporchik believes there are too many publishers chasing too few quality games, hence he is focusing more on developing quality games internally (similar to FDEV and TM17 strategy). That’s an interesting insight, as in their IPO prospectus DEVO draw a parallel with the Venture Capital industry saying:

“Devolver effectively operates a venture capital model, receiving and vetting over 2,000 unsolicited title pitches per year at varying stages of progress, from initial concept to fully-formed games. Devolver does not require developers to hand over the IP or sequel rights to their games, which the Directors believe is attractive to creators.”

I wonder if what’s happened in video games has a wider lesson, and that there are currently too many VC’s chasing too few quality start-up ideas. Certainly the well-publicised problems at Tiger and Softbank suggest that might be the case.

Aside from those industry headwinds in video game publishing, there were also a couple of company-specific problems mentioned by DEVO: delays to new title releases, and a lower contribution from their back catalogue. That’s having an effect on both DEVO’s deteriorating EBIT margin and RoCE.

Their latest guidance is for FY 31 Dec 2023F, Group Normalised Adjusted EBITDA to be at least break-even. The Board expects Normalised Adjusted EBITDA to return to growth in 2024 and accelerate in 2025. Previously Sharepad had £18m EBITDA (now <$1m) for FY Dec 2023F and £20m (now $11m) FY Dec 2024F. There shares responded by falling -33% last week.

Balance Sheet: They don’t feel the need to mention a “strong balance sheet”, perhaps because they had $64m (£50m) of net cash end of June, which is 76% of the market cap. Shareholders’ equity was $172m at Dec 2020, even if we deduct $85m of intangible assets (of which $19m is goodwill from acquisitions, $66m capitalised game development costs) that still gives tangible book of $87m (£68m). In other words, the shares are trading on 1x tangible book value, which is more similar to a UK bank with a balance sheet 20x leveraged, rather than a software company with significant cash balances and operational gearing. For contrast KWS trades on 16.5x tangible book and TM17 25x tangible book.

Valuation: The shares are trading on a PER of 5.7x Dec 2024F dropping to below 5x the following year. Worth noting too that the shares are now down -78% YTD to below 15p. They IPO’ed at 157p in November 2021, when they raised £30m of new money, but the bulk of the money raised (£154m) went to the selling shareholders. The shares are on 0.6x revenue, which is a sharp de-rating from the >10x revenue multiple which they IPO’ed on.

Below is the Sharepad “compare” tab showing that revenue is forecast to fall -27%, versus -23% for TBLD, but +2.5% for TM17 and +20% for KWS.

Opinion: When the tide turns for this sector, there could be considerable upside but I’ve no idea what the catalyst might be. As I already own FDEV and don’t want to increase my exposure. Contrarian investors who are coming at this with an open mind though might see opportunities here. Certainly, the net cash that both TBLD -88% YTD and DEVO -77% YTD have on their balance sheet means their risk/reward ought to be superior to (say) RBGP -65% YTD which I covered last week.

Conclusion

Bruce Packard

brucepackard.com

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.