While the dividend yield on the FTSE and AIM indices is not high relative to history, it does seem remarkable that >8% yields are available on companies in so many different sectors. Stocks covered KOO, SUP and SMV.

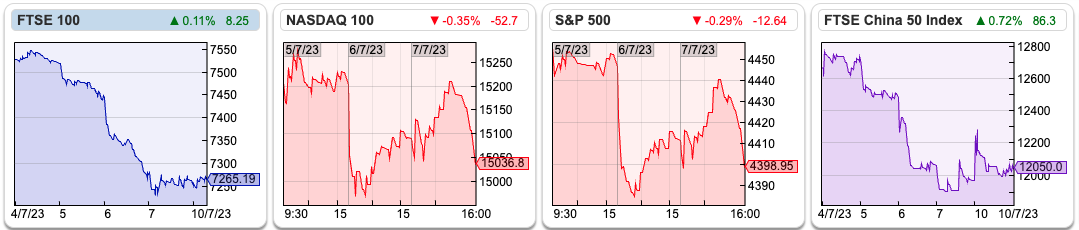

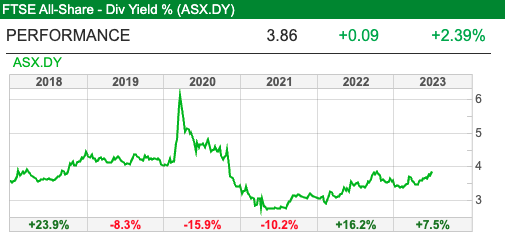

The FTSE 100 fell -3.5% in the last 5 days, with the Nasdaq 100 up +0.7% and S&P500 flat. The UK 10Y govt bond yield (UKTSY10) is up +25% YTD, currently 4.7%. That gilt yield compares to a dividend yield on the FTSE All Share (ASZ.DY) of 3.9%, which doesn’t look particularly attractive relative to pre-pandemic levels.

Last week we had a London IPO: CAB Payments, which raised over £300m, at 335p per share valuing the company at £851m. The company does international payments and forex, so a competitor to WISE. The main selling shareholder was Helios, an Africa-focused Private Equity firm. I tend to avoid new IPO’s but will likely look at the investment case depending on how the shares do in H2. It’s a remarkable achievement to raise money from investors in this difficult market, but the UK press gave it the thumbs down.

I have suggested before that banks not passing on the benefits of interest rate rises to savers could be a theme when they report H1 results later in July. The Bank of England reported that in May households withdrew £4.6bn from banks and building societies. That monthly figure is the highest level on record (the time series began in October 1997). Withdrawals from instant access savings accounts more than doubled from £5.4bn in April to £11.4bn in May. There were £3.3bn of withdrawals from current accounts in May, the 7th consecutive month of outflows. Some of that was offset by flows into accounts offering fixed rate deals (£4.9bn), as banks have been promoting 2-year savings bonds to fund their mortgage books.

I talk about the BoE’s latest mortgage approvals data below in the section on Smoove (previously ULS Technology).

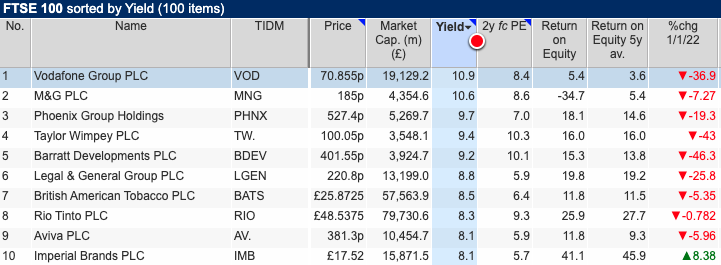

With the FTSE All share down -3% YTD and AIM down -11%, the deposit outflows that the BoE is reporting haven’t gone into the UK stock market. Although the dividend yield of the market doesn’t look particularly attractive relative to history (ASX.DY) there are some large-cap, “blue chip” names currently trading on remarkable dividend yields.

Savings in a bank account are guaranteed by the UK government, whereas it’s possible to lose money investing in a high-yielding company that turns out to be a “value trap” (ahem Vodafone). What seems noteworthy is that the high yields are spread across so many different sectors (telcos, insurance, house building, tobacco, mining).

Below, I look at Kooth’s (mental health app) contract win and capital raise, Supreme (vaping) announced distribution agreement, and FY March results. Plus mortgage conveyancer Smoove, with some comments on how mortgage approvals, which tend to be a lead indicator for the housing market, are performing.

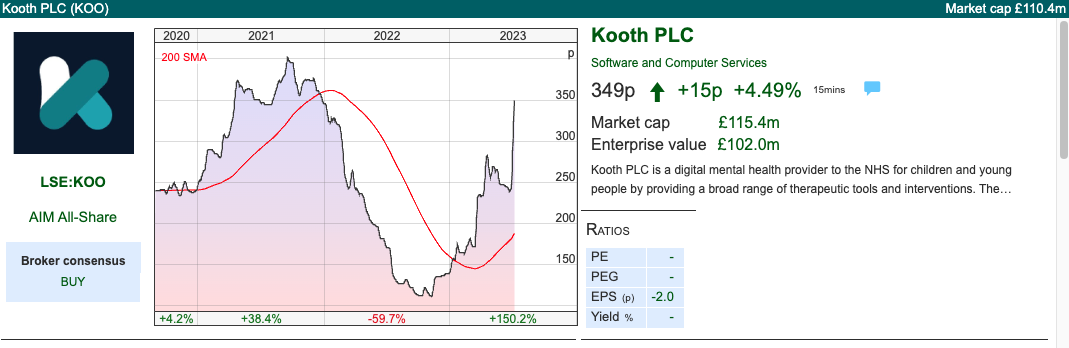

Kooth large contract win and capital raise

This mental health app aimed at 13 to 25-year-olds announced a $188m contract win in California (and a large increase in 2023F guidance) plus a £10m placing at 300p per share. Half of the money raised will go towards accelerating their platform development and the other half in US growth. As a result of the contract win, they now expect Dec 2023F revenue of “not less than £34m” (previous Sharepad forecast £24m). The shares responded by rising +30% on the morning of last week’s RNS, and YTD are up +151% making it the best performer on AIM (assuming £100m market cap minimum) since the start of this year.

History: The business has a surprisingly long history, founded in 2001 by Elaine Blousfield, who at the time was a counsellor working with adolescents and young adults. She wanted to expand access to mental health services to groups that might not typically seek help. The idea was to eliminate obstacles such as waiting lists, referrals and general bureaucracy that were preventing people from seeking help. The technology offers anonymous professional counselling (at a minimum counsellors are BACP registered, with 450 hours post-qualification experience) peer-to-peer support and self-help tools. No personal information is required to use the service, which helps to support anonymity.

The business came to market in Sept 2020, raising £26m, of which £16m went to the company and just under £10m went to the selling shareholder (Root Capital, a London-based Private Equity company that had bought Kooth in 2015). The placing price was 200p, which valued the business at £66m. At the time of the IPO, they had £13m of Annual Recurring Revenue (ARR), so the business has continued to grow the top line impressively at +25% CAGR since then, but remains loss-making.

In March this year, the company announced that they had been selected by California’s Department of Health Care Services (DHCS) to deliver part of the Master Plan for Kids’ Mental Health. The US state has 6 million 13 to 25-year-olds and the details of the contract would be agreed later this year. Then last week, they announced the contract with the DHSC had a minimum value of $188m, through to June 2027. KOO will incur significant upfront costs to deliver this, so it sounds like they will remain loss-making this year. By Dec 2025F they expect a mid-teens EBITDA margin for the remaining life of the Contract “with the potential to improve after the initial investment phase”.

Competition: The main innovation here seems to be persuading government health departments to pay for subscriptions, rather than individuals. A neurologist friend who works for a VC/health department joint venture that funds healthcare start-ups is reluctant to invest in any mental health app because there’s significant competition. Apps like ‘Calm’, ‘Headspace’ are examples, as well as many start-ups trying similar ideas, some linked to wearable tech (Oura Ring). With her own money, she’s invested in Compass Pathways, the UK-headquartered but Nasdaq-listed company hoping to use psychedelics for Treatment-Resistant Depression (TRD).

Valuation: Sharepad is showing revenues trebling from £20m FY Dec 2022 to £67m FY Dec 2024F, but then flattening out, presumably as the impact from the DHSC contract is realised. That puts the shares on 1.7x Dec 2024F revenue, and a PER of 44x the same year.

To justify the valuation there are some numbers quoted in the IPO prospectus which give some idea of the scale of the problem/addressable market. In the UK 1 in 4 adults and 1 in 5 children experience a diagnosable mental health problem every year. The NHS has budgeted £13bn in the year before the pandemic, but despite that spend, the supply of mental health support hasn’t kept pace with demand.

Opinion: I would really like this to be successful, but despite the contract wins, I think it could disappoint at some stage. No one has a 100% rigorous explanation of why mental health problems have avalanched in the most recent decades. Some well-researched suggestions are i) technology (particularly smartphones and social media) fragmenting attention and amplifying unfavourable social comparisons; ii) processed food and unhealthy lifestyles causing autoimmune inflammation iii) loss of status and prosperity iv) loss of community in the real world. It would be great if we could solve mental health with a simple app-based solution, but I am sceptical that the root cause of the mental health epidemic can be so easily (and profitably) resolved. One risk factor mentioned in the prospectus is that KOO may fail to demonstrate positive outcomes.

That said, with over-stretched healthcare budgets, this does seem like a solution that will appeal to Govt healthcare departments, and they (not individual users) are the ones signing the cheques.

Supreme FY March 2023 results and vaping distribution deal

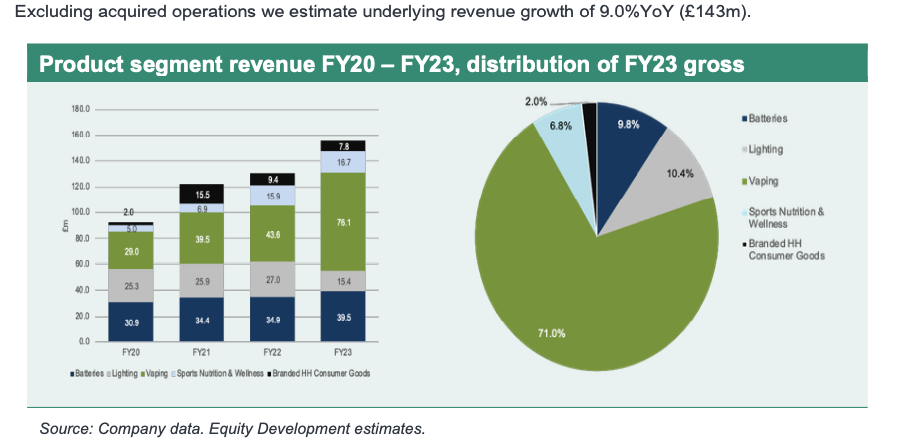

This manufacturer and distributor of vaping products, release a FY March RNS, but also announced a significant distribution agreement last week. They have four other product categories: batteries, lights, sports nutrition and wellness, but most of the excitement seems to be around their 88Vape brand. The Vaping division reported +75% revenue growth, to £76m (half of group revenues), however, they made a couple of acquisitions: Liberty Flights, Cuts Ice and Superdragon. These all sound like indie bands from the 1990’s to me.

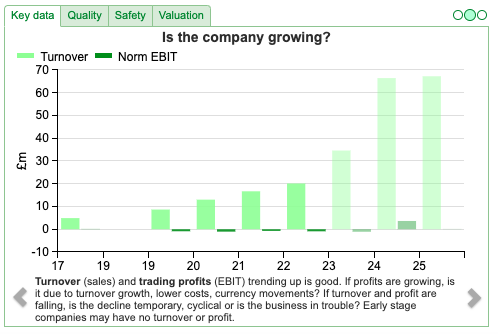

Group FY Mar revenue was up +19% to £156m. They say that half of the revenue growth was acquisitions and half was organic. Equity Development have published a 20-page note, and I have taken the charts below which show the progress since FY Mar 2020 (left bar chart) and that Vaping now makes up 71% of gross profit (right pie chart).

Despite the top-line growth statutory PBT fell -11% to £14.4m. The fall in PBT was driven by the Lighting division, where revenue fell -43% to £15m, as customers had overstocked. Net cash adjusted for IFRS lease obligations was £3.2m at the end of March. Including lease liabilities net debt was £4m.

History: The business was founded in 1975 by GS Chadha, the father of the current Chief Exec. They’ve been distributing Duracell and other battery brands since the mid-1990s. They took some Private Equity money in 2003, but sales declined over the next couple of years and Sandy Chadha, the current Chief Exec bought the assets from the administrators in 2007. They’ve been in the vaping market for a decade, first with the KiK brand, then a year later with 88Vape. They do their own manufacturing at a factory in Trafford Park and from 2017 expanded into contract manufacturing of e-liquids (ie that go into the vapes) for third parties. They’ve expanded the capacity to over 290m bottles of e-liquid per annum. Looking at their website each bottle currently sells for £1.

In January 2021 the business listed on AIM at 134p, with £6m going to the company and £58m going to the Chief Exec, Sandy Chadha. He still owns 57% of the shares, with a further 24% owned by Supreme 8, a company that he controls. In August last year, they announced the acquisition of Cuts Ice Ltd, another independent vaping company which had European distribution and Flavour Core Ltd, a Swindon-based manufacturer of e-liquids.

Outlook statement: Aside from the FY Mar results, they also announced a distribution agreement which they expect to generate a further £25-30m of revenue and c £2m incremental adj EBITDA to distribute Elfbar and Lost Mary. These are popular brands in the USA and UK, and owned by a Chinese company. As a result, management guide FY Mar 2024F will be “significantly ahead of current consensus”, given in a footnote as £159m revenue, £23m adj EBITDA.

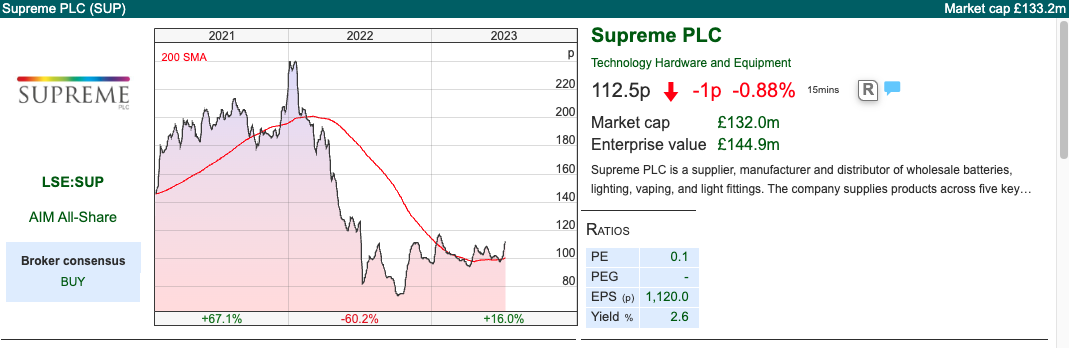

Valuation: Taking Equity Development’s forecast put the shares on a PER 9x Mar 2024F and 8x Mar 2025F. That equates to 0.7x revenue, and a dividend yield of just below 4%.

Opinion: I had been wondering if standalone vaping brands are the bear case on large-cap tobacco stocks like BATS and IMP, which are trading on mid-single-digit PER multiples. Vaping is relatively new, but SUP management have built up their expertise in manufacturing and distribution over decades. The shares are still below their Jan 2021 IPO price of 134p but are now up +50% from their October 2022 low. This is the first time I’ve looked at the company, so not a high-conviction idea, but the investment case looks attractive at first glance.

Smoove FY March results and takeover update

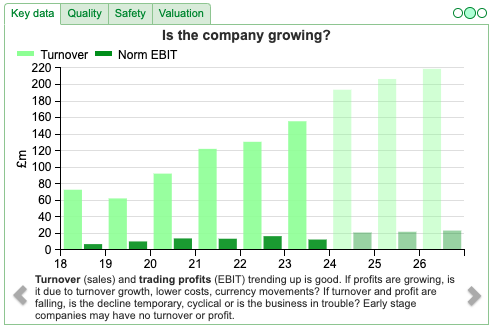

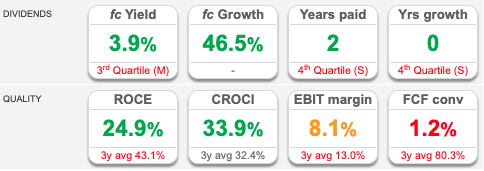

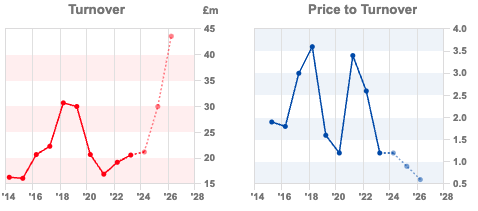

This technology company, with a DigitalMove website, that hopes to disrupt the mortgage conveyancing market announced FY revenues +7% to £21m. They are heavily loss-making: net cash has fallen from £20m in March last year to £10m in March this year, which consists of £6m statutory losses and £4m returned to shareholders via a Tender Offer. They are forecasted to be loss-making this year too, but much closer to breakeven.

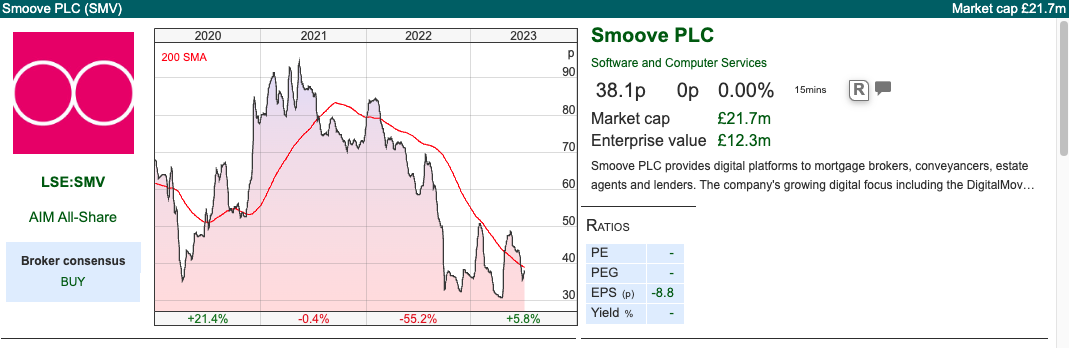

They received a takeover approach at the end of April from PEXA, an Australian conveyancing company that also has operations in the UK. The Takeover Panel’s Put Up or Shut Up (PUSU) has been extended to 5pm 14th July. The deadline can be extended further, with permission from the Panel.

Industry data: The latest mortgage approvals data was released by the Bank of England at the end of June, with 50K of approvals for house purchases in May.

That’s a -23% decrease on the same month last year. For 6 months to March v the same period last year (ie SMV’s reporting period) mortgage approvals for house purchases were down by a third. SMV reported conveyancing instructions for house moves down -25%, so it looks like they are growing market share in a shrinking market. They have also increased their re-mortgaging instructions by +41% to 43K, however, they have warned in the past that this is lower margin business.

Strategic Partnership with MAB: At the beginning of June they also announced a strategic partnership with Mortgage Advice Bureau (MAB). SMV will provide conveyancing comparison and other related services to MAB’s 2,000+ of mortgage advisers.

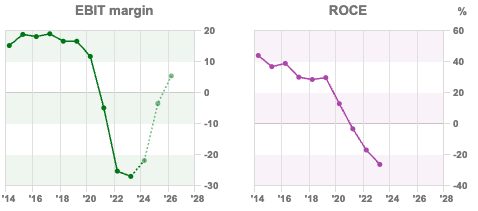

Valuation: The business is loss-making but trades on 1.2x Mar 2024F revenue, dropping to 0.6x two years later as revenues are forecast to double. According to my notes, the previous Chief Exec had previously guided to £8m of PBT this year, so there has been a history of disappointment, which the charts below also show.

Opinion: I bought this a while ago, and averaged down earlier this year. I pointed out in May, that SMV’s share price peaked at over 160p in 2018 and they’ve never explained why DigitalMove has not gained market share as planned. I think interest from an overseas competitor vindicates that there is a viable opportunity to disrupt the conveyancing market if management can execute. Presumably, major shareholders (Kestrel own 28%, Harwood Capital 13%, Schroders 9%) would prefer to see a successful turnaround rather than a bid at a low point in the cycle, unless it comes in at a substantial premium.

Notes

Bruce owns shares in SMV.

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Weekly Market Commentary | 11/07/23 | KOO, SUP, SMV | Bank deposits and dividend yields

While the dividend yield on the FTSE and AIM indices is not high relative to history, it does seem remarkable that >8% yields are available on companies in so many different sectors. Stocks covered KOO, SUP and SMV.

The FTSE 100 fell -3.5% in the last 5 days, with the Nasdaq 100 up +0.7% and S&P500 flat. The UK 10Y govt bond yield (UKTSY10) is up +25% YTD, currently 4.7%. That gilt yield compares to a dividend yield on the FTSE All Share (ASZ.DY) of 3.9%, which doesn’t look particularly attractive relative to pre-pandemic levels.

Last week we had a London IPO: CAB Payments, which raised over £300m, at 335p per share valuing the company at £851m. The company does international payments and forex, so a competitor to WISE. The main selling shareholder was Helios, an Africa-focused Private Equity firm. I tend to avoid new IPO’s but will likely look at the investment case depending on how the shares do in H2. It’s a remarkable achievement to raise money from investors in this difficult market, but the UK press gave it the thumbs down.

I have suggested before that banks not passing on the benefits of interest rate rises to savers could be a theme when they report H1 results later in July. The Bank of England reported that in May households withdrew £4.6bn from banks and building societies. That monthly figure is the highest level on record (the time series began in October 1997). Withdrawals from instant access savings accounts more than doubled from £5.4bn in April to £11.4bn in May. There were £3.3bn of withdrawals from current accounts in May, the 7th consecutive month of outflows. Some of that was offset by flows into accounts offering fixed rate deals (£4.9bn), as banks have been promoting 2-year savings bonds to fund their mortgage books.

I talk about the BoE’s latest mortgage approvals data below in the section on Smoove (previously ULS Technology).

With the FTSE All share down -3% YTD and AIM down -11%, the deposit outflows that the BoE is reporting haven’t gone into the UK stock market. Although the dividend yield of the market doesn’t look particularly attractive relative to history (ASX.DY) there are some large-cap, “blue chip” names currently trading on remarkable dividend yields.

Savings in a bank account are guaranteed by the UK government, whereas it’s possible to lose money investing in a high-yielding company that turns out to be a “value trap” (ahem Vodafone). What seems noteworthy is that the high yields are spread across so many different sectors (telcos, insurance, house building, tobacco, mining).

Below, I look at Kooth’s (mental health app) contract win and capital raise, Supreme (vaping) announced distribution agreement, and FY March results. Plus mortgage conveyancer Smoove, with some comments on how mortgage approvals, which tend to be a lead indicator for the housing market, are performing.

Kooth large contract win and capital raise

This mental health app aimed at 13 to 25-year-olds announced a $188m contract win in California (and a large increase in 2023F guidance) plus a £10m placing at 300p per share. Half of the money raised will go towards accelerating their platform development and the other half in US growth. As a result of the contract win, they now expect Dec 2023F revenue of “not less than £34m” (previous Sharepad forecast £24m). The shares responded by rising +30% on the morning of last week’s RNS, and YTD are up +151% making it the best performer on AIM (assuming £100m market cap minimum) since the start of this year.

History: The business has a surprisingly long history, founded in 2001 by Elaine Blousfield, who at the time was a counsellor working with adolescents and young adults. She wanted to expand access to mental health services to groups that might not typically seek help. The idea was to eliminate obstacles such as waiting lists, referrals and general bureaucracy that were preventing people from seeking help. The technology offers anonymous professional counselling (at a minimum counsellors are BACP registered, with 450 hours post-qualification experience) peer-to-peer support and self-help tools. No personal information is required to use the service, which helps to support anonymity.

The business came to market in Sept 2020, raising £26m, of which £16m went to the company and just under £10m went to the selling shareholder (Root Capital, a London-based Private Equity company that had bought Kooth in 2015). The placing price was 200p, which valued the business at £66m. At the time of the IPO, they had £13m of Annual Recurring Revenue (ARR), so the business has continued to grow the top line impressively at +25% CAGR since then, but remains loss-making.

In March this year, the company announced that they had been selected by California’s Department of Health Care Services (DHCS) to deliver part of the Master Plan for Kids’ Mental Health. The US state has 6 million 13 to 25-year-olds and the details of the contract would be agreed later this year. Then last week, they announced the contract with the DHSC had a minimum value of $188m, through to June 2027. KOO will incur significant upfront costs to deliver this, so it sounds like they will remain loss-making this year. By Dec 2025F they expect a mid-teens EBITDA margin for the remaining life of the Contract “with the potential to improve after the initial investment phase”.

Competition: The main innovation here seems to be persuading government health departments to pay for subscriptions, rather than individuals. A neurologist friend who works for a VC/health department joint venture that funds healthcare start-ups is reluctant to invest in any mental health app because there’s significant competition. Apps like ‘Calm’, ‘Headspace’ are examples, as well as many start-ups trying similar ideas, some linked to wearable tech (Oura Ring). With her own money, she’s invested in Compass Pathways, the UK-headquartered but Nasdaq-listed company hoping to use psychedelics for Treatment-Resistant Depression (TRD).

Valuation: Sharepad is showing revenues trebling from £20m FY Dec 2022 to £67m FY Dec 2024F, but then flattening out, presumably as the impact from the DHSC contract is realised. That puts the shares on 1.7x Dec 2024F revenue, and a PER of 44x the same year.

To justify the valuation there are some numbers quoted in the IPO prospectus which give some idea of the scale of the problem/addressable market. In the UK 1 in 4 adults and 1 in 5 children experience a diagnosable mental health problem every year. The NHS has budgeted £13bn in the year before the pandemic, but despite that spend, the supply of mental health support hasn’t kept pace with demand.

Opinion: I would really like this to be successful, but despite the contract wins, I think it could disappoint at some stage. No one has a 100% rigorous explanation of why mental health problems have avalanched in the most recent decades. Some well-researched suggestions are i) technology (particularly smartphones and social media) fragmenting attention and amplifying unfavourable social comparisons; ii) processed food and unhealthy lifestyles causing autoimmune inflammation iii) loss of status and prosperity iv) loss of community in the real world. It would be great if we could solve mental health with a simple app-based solution, but I am sceptical that the root cause of the mental health epidemic can be so easily (and profitably) resolved. One risk factor mentioned in the prospectus is that KOO may fail to demonstrate positive outcomes.

That said, with over-stretched healthcare budgets, this does seem like a solution that will appeal to Govt healthcare departments, and they (not individual users) are the ones signing the cheques.

Supreme FY March 2023 results and vaping distribution deal

This manufacturer and distributor of vaping products, release a FY March RNS, but also announced a significant distribution agreement last week. They have four other product categories: batteries, lights, sports nutrition and wellness, but most of the excitement seems to be around their 88Vape brand. The Vaping division reported +75% revenue growth, to £76m (half of group revenues), however, they made a couple of acquisitions: Liberty Flights, Cuts Ice and Superdragon. These all sound like indie bands from the 1990’s to me.

Group FY Mar revenue was up +19% to £156m. They say that half of the revenue growth was acquisitions and half was organic. Equity Development have published a 20-page note, and I have taken the charts below which show the progress since FY Mar 2020 (left bar chart) and that Vaping now makes up 71% of gross profit (right pie chart).

Despite the top-line growth statutory PBT fell -11% to £14.4m. The fall in PBT was driven by the Lighting division, where revenue fell -43% to £15m, as customers had overstocked. Net cash adjusted for IFRS lease obligations was £3.2m at the end of March. Including lease liabilities net debt was £4m.

History: The business was founded in 1975 by GS Chadha, the father of the current Chief Exec. They’ve been distributing Duracell and other battery brands since the mid-1990s. They took some Private Equity money in 2003, but sales declined over the next couple of years and Sandy Chadha, the current Chief Exec bought the assets from the administrators in 2007. They’ve been in the vaping market for a decade, first with the KiK brand, then a year later with 88Vape. They do their own manufacturing at a factory in Trafford Park and from 2017 expanded into contract manufacturing of e-liquids (ie that go into the vapes) for third parties. They’ve expanded the capacity to over 290m bottles of e-liquid per annum. Looking at their website each bottle currently sells for £1.

In January 2021 the business listed on AIM at 134p, with £6m going to the company and £58m going to the Chief Exec, Sandy Chadha. He still owns 57% of the shares, with a further 24% owned by Supreme 8, a company that he controls. In August last year, they announced the acquisition of Cuts Ice Ltd, another independent vaping company which had European distribution and Flavour Core Ltd, a Swindon-based manufacturer of e-liquids.

Outlook statement: Aside from the FY Mar results, they also announced a distribution agreement which they expect to generate a further £25-30m of revenue and c £2m incremental adj EBITDA to distribute Elfbar and Lost Mary. These are popular brands in the USA and UK, and owned by a Chinese company. As a result, management guide FY Mar 2024F will be “significantly ahead of current consensus”, given in a footnote as £159m revenue, £23m adj EBITDA.

Valuation: Taking Equity Development’s forecast put the shares on a PER 9x Mar 2024F and 8x Mar 2025F. That equates to 0.7x revenue, and a dividend yield of just below 4%.

Opinion: I had been wondering if standalone vaping brands are the bear case on large-cap tobacco stocks like BATS and IMP, which are trading on mid-single-digit PER multiples. Vaping is relatively new, but SUP management have built up their expertise in manufacturing and distribution over decades. The shares are still below their Jan 2021 IPO price of 134p but are now up +50% from their October 2022 low. This is the first time I’ve looked at the company, so not a high-conviction idea, but the investment case looks attractive at first glance.

Smoove FY March results and takeover update

This technology company, with a DigitalMove website, that hopes to disrupt the mortgage conveyancing market announced FY revenues +7% to £21m. They are heavily loss-making: net cash has fallen from £20m in March last year to £10m in March this year, which consists of £6m statutory losses and £4m returned to shareholders via a Tender Offer. They are forecasted to be loss-making this year too, but much closer to breakeven.

They received a takeover approach at the end of April from PEXA, an Australian conveyancing company that also has operations in the UK. The Takeover Panel’s Put Up or Shut Up (PUSU) has been extended to 5pm 14th July. The deadline can be extended further, with permission from the Panel.

Industry data: The latest mortgage approvals data was released by the Bank of England at the end of June, with 50K of approvals for house purchases in May.

That’s a -23% decrease on the same month last year. For 6 months to March v the same period last year (ie SMV’s reporting period) mortgage approvals for house purchases were down by a third. SMV reported conveyancing instructions for house moves down -25%, so it looks like they are growing market share in a shrinking market. They have also increased their re-mortgaging instructions by +41% to 43K, however, they have warned in the past that this is lower margin business.

Strategic Partnership with MAB: At the beginning of June they also announced a strategic partnership with Mortgage Advice Bureau (MAB). SMV will provide conveyancing comparison and other related services to MAB’s 2,000+ of mortgage advisers.

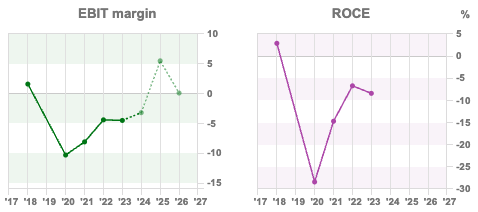

Valuation: The business is loss-making but trades on 1.2x Mar 2024F revenue, dropping to 0.6x two years later as revenues are forecast to double. According to my notes, the previous Chief Exec had previously guided to £8m of PBT this year, so there has been a history of disappointment, which the charts below also show.

Opinion: I bought this a while ago, and averaged down earlier this year. I pointed out in May, that SMV’s share price peaked at over 160p in 2018 and they’ve never explained why DigitalMove has not gained market share as planned. I think interest from an overseas competitor vindicates that there is a viable opportunity to disrupt the conveyancing market if management can execute. Presumably, major shareholders (Kestrel own 28%, Harwood Capital 13%, Schroders 9%) would prefer to see a successful turnaround rather than a bid at a low point in the cycle, unless it comes in at a substantial premium.

Notes

Bruce owns shares in SMV.

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.