Not so long ago, Domino’s Pizza was seen as an attractive growth stock with a lot going for it.

Investors viewed the company as a classic retail “roll out” situation where strong growth from existing stores could be turbocharged by opening lots of new ones. This was then rounded off with an asset-light business model backed by highly predictable and very profitable franchise royalty cash flows.

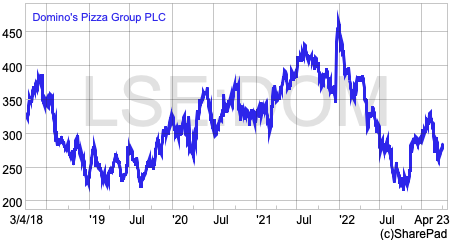

Sadly, the last few years have not been happy ones for long-term holders of the shares. Total returns are down by 22 per cent over the last year whilst shareholders have made nothing from the shares over the last five years.

The main reason for this has been down to the way the business has been run.

Franchise businesses can make great long-term investments providing that the relationship between the franchisor and the franchisee is seen as being fair.

Long-term growth can only be achieved if franchisees are incentivised to open new stores by making reasonable profits from doing so.

In the last few years, it has been clear that Domino’s UK franchisees felt that they have not been getting a good deal.

Domino’s management pursued a strategy which arguably led to its profit goals to come at the expense of its franchisees.

In response, franchisees cut back on opening new stores, and as a result, the profitability of Domino’s UK business has stagnated.

Domino’s has tried to mend this relationship but whether shareholders will be happy is by no means certain. The company’s recent share price performance suggests that investors have doubts that the tweaks to the business model can make them better off.

Still a very profitable business

Domino’s still retains the hallmarks of a very good business.

Source: SharePad

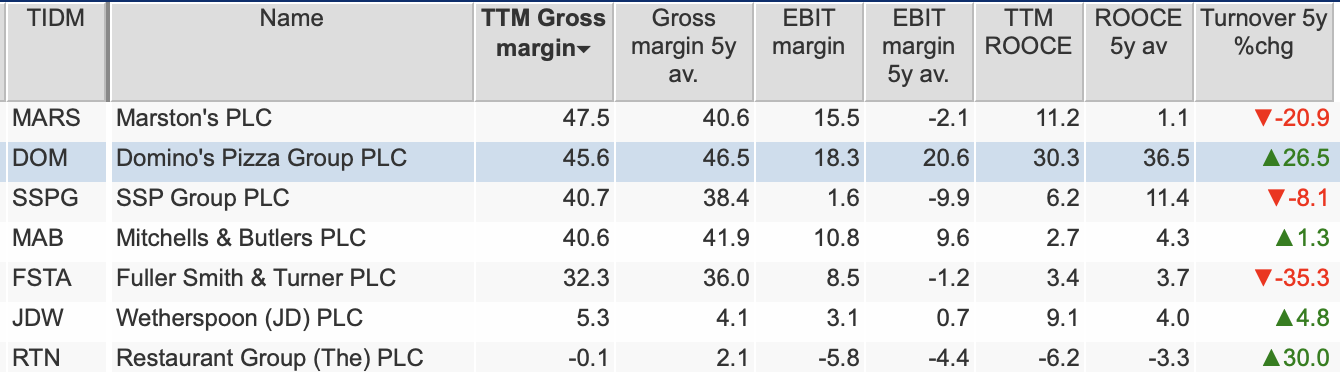

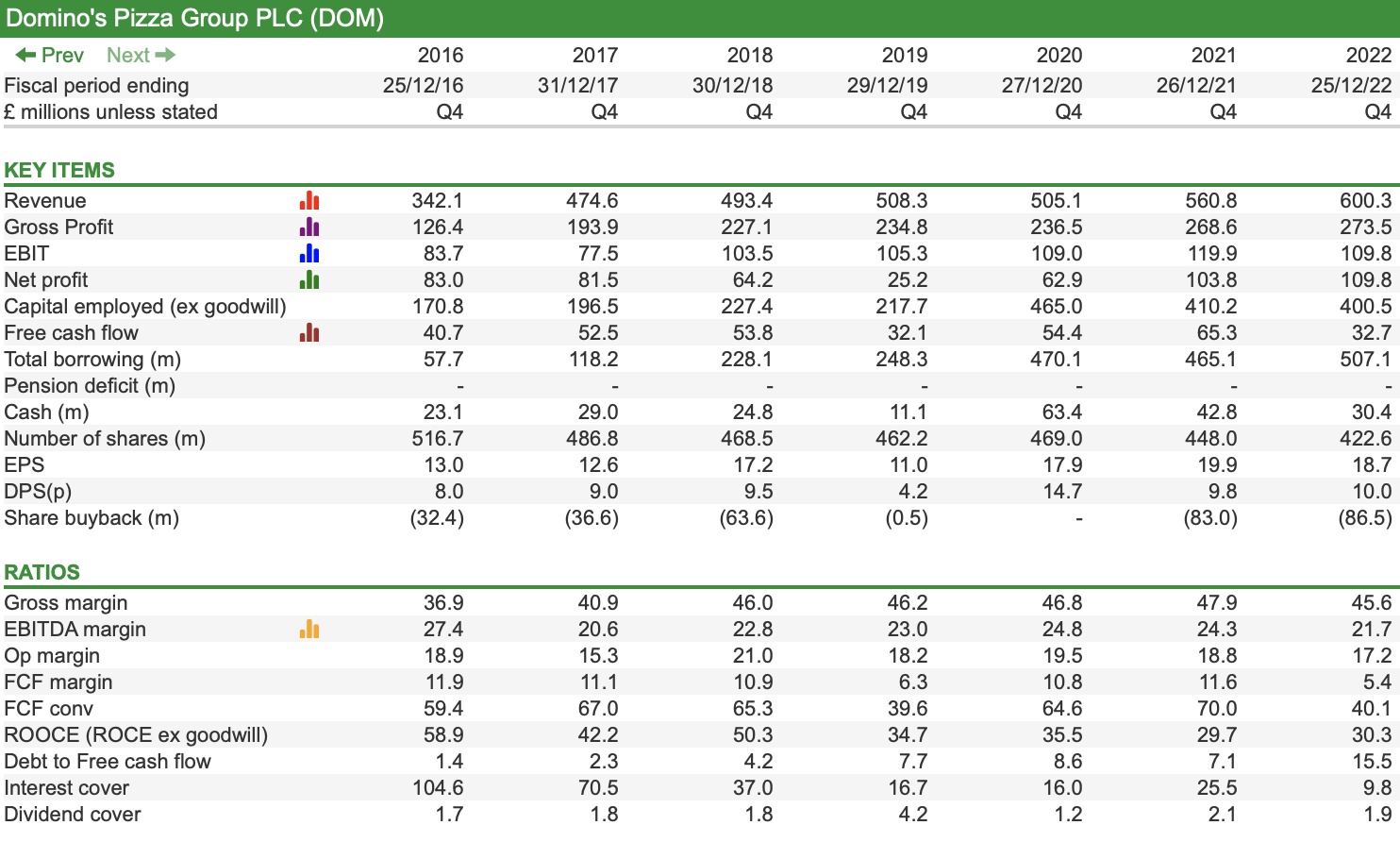

Gross profit margins have remained at good levels as well as being relatively stable. Operating profit margins are still attractive but have been on a downwards trend over the last few years.

Source: SharePad

Return on operating capital employed (ROOCE) remains a very decent 30 per cent which makes Domino’s a standout performer compared with its sector peers.

Since 2018, the company has spent £233m repurchasing nearly 71m shares and has increased its borrowings to do so. Share buybacks are often misunderstood by investors and do not always make shareholders better off.

Buybacks may increase earnings per share (EPS) but that’s not been too difficult a task when interest rates have been near zero up until about a year ago.

A more simplistic way of looking at Domino’s buybacks is that it has paid an average price of 329p per share compared with a share price at the time of writing of 285p.

If you think Domino’s shares are worth a lot more than 329p each then this fact will not trouble you. If you don’t, then you will probably take a less favourable view.

Is Domino’s supply chain margin still too high?

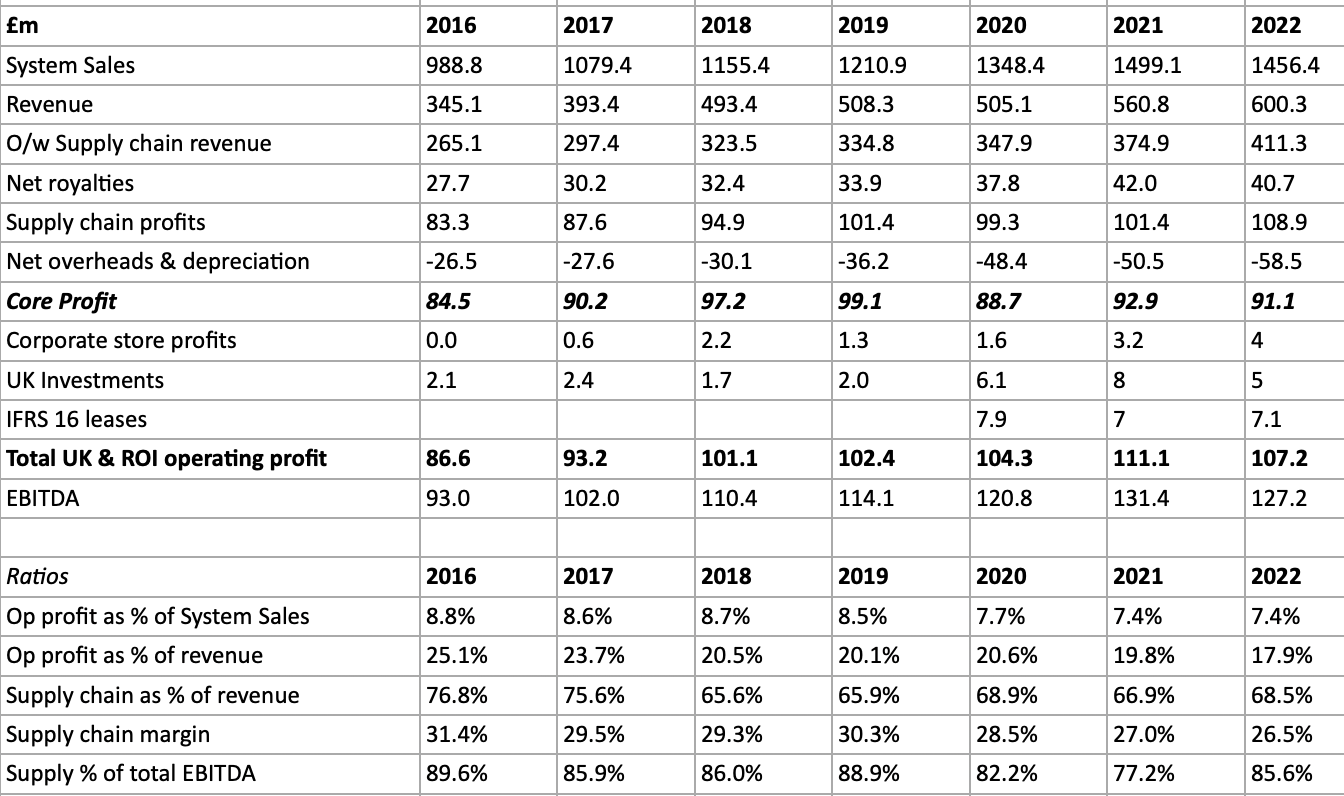

The key to understanding Domino’s current predicament is by examining how it makes its profits. Nearly 70 per cent of its revenue comes from selling pizza ingredients and equipment to its franchisees. Over 85 per cent of its EBITDA comes from this source.

Domino’s Pizza UK: Financial Performance

Source: Domino’s Pizza/My calculations

Source: Domino’s Pizza/My calculations

What this shows is that Domino’s business model hugely incentivises it to grow its supply of ingredients to its franchisees by growing the size of the store network. This brings in a lot more profit than the net royalty fees. (UK franchisees pay 5.5 per cent of system sales to Domino’s Pizza UK who pay 2.7 per cent back to Domino’s Pizza Inc giving a net royalty of 2.8 per cent).

Domino’s supply chain EBITDA margins are very high at 26.5 per cent and have been over 30 per cent as recently as 2019.

The question is: Are these margins excessive with the potential to fall a long way?

Possibly, in my view.

If you look at the latest accounts of the global master franchisor, Domino’s Pizza Inc (NYSE: DPZ), you can see its supply chain margins are much smaller at just under 9 per cent.

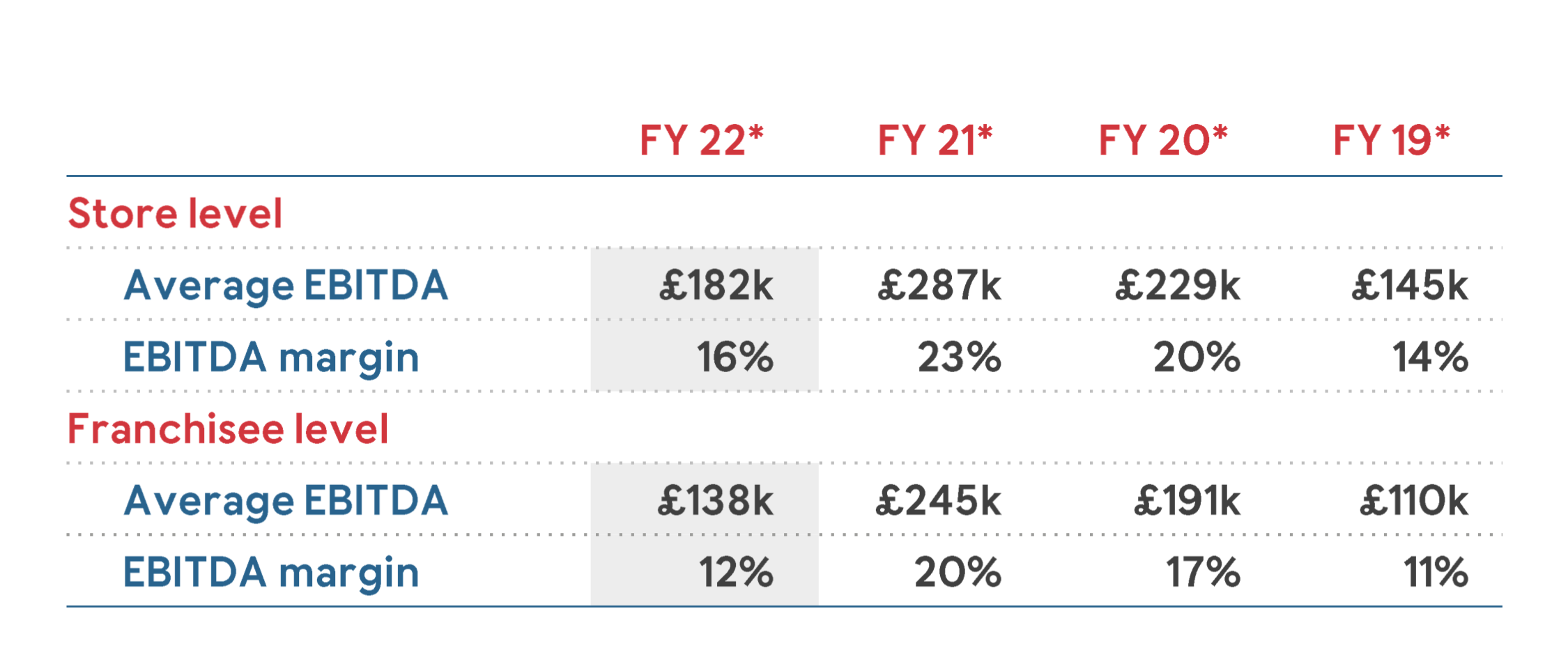

Last year, the average Domino’s Pizza UK store had EBITDA margins of 16 per cent. At the franchisee level – which includes all central costs – the margin was just 12 per cent.

Domino’s Pizza UK: Store and Franchisee EBITDA and margins

Source: Domino’s Pizza

Domino’s franchisees had benefited from a temporary cut to VAT during the Covid-19 pandemic which boosted their margins. Now that has gone, you can understand why Domino’s supply chain margins might be a bone of contention and that franchisees might want some of it for themselves.

The significance of supply chain profits arguably led to some bad strategic decisions by the company which have soured relations with its franchisees.

A good example of this was the decision to open another store in the same area as an existing store – known as splitting territories. This usually increased Domino’s share of the market in an area and gave more business to Domino’s supply chain. However, at the same time the new store took revenues and reduced the profits of the existing store, annoying franchisees in the process.

Some franchisees have also complained that Domino’s has previously profited from falling raw ingredients prices – particularly cheese – by being slow to pass them on. Other complaints have been that franchisees have not seen better buying terms as the size of their business has got bigger.

There is also a concern that the four per cent of sales that franchisees pay into a national advertising fund (NAF) – a significant £72m in total last year – has not been spent effectively. Also, Domino’s might not have done enough to help franchisees cope with labour shortages and rising costs.

Will the franchise agreement boost growth without hitting margins?

At the end of 2021, Domino’s came to an agreement with its franchisees to incentivise them to open more stores in the UK.

Getting franchisees on side is key to sustainable growth but the concern is that lower margins for Domino’s might be the cost of doing so.

By getting franchisees to open around 45 stores per year between 2022 and 2025, the hope is that system sales will grow to the upper end of the £1.6bn-£1.9bn target range with both parties benefiting from higher profits.

The main features of the franchise agreement are:

- Investment in e-commerce with a particular focus on growing sales through the mobile app. Customers using the app tend to have bigger orders and order more frequently.

- Big incentives for opening new stores to improve franchisee payback rates on their investment. These will be paid in three equal instalments and total £100,000 for a store in a new area and £150,000 for a store in a split territory.

- More targeted marketing campaigns and promotions. There will be a bigger focus on collection orders which have a lower cost to serve than deliveries and are therefore more profitable for the franchisee. The introduction of a delivery charge will also help franchisees recover higher delivery costs.

- Bigger food rebates for franchisees opening more stores and achieving order count targets.

Should this be successful then there are grounds for thinking that profits could be materially higher in a few years’ time.

However, the strategy is not without risks.

A key concern is what happens after the three-year agreement ends. Franchisees have clearly won some valuable concessions from Domino’s and they may ask for more when the agreement ends.

Another is that the opening of 45 stores per year is going to lead to a lot more splitting of territories. This will need to be carefully managed in order to prevent significant damage to the profits of existing stores.

For the strategy to really bear fruit for Domino’s order volumes are going to have to increase significantly. This might not be easy to achieve for a business which already has a 47 per cent market share, selling to a financially stretched UK consumer.

Takeaway pizza is not a cheap option for families. This begs the question as to whether recent price cuts and promotions – such as the £8,£10, and £12 price points for small, medium and large pizzas – will have to be permanent.

Domino’s believes that its competitive edge is not just down to price and highlights its excellent delivery performance versus its competitors. Whether consumers take the same view is another matter.

Supply chain margins have already come down as Domino’s has delayed passing on cost increases to franchisees. It is possible to improve supply margins with higher volumes that lower the fixed cost of production but whether margins have bottomed is hard to work out.

Whilst collections have higher margins for franchisees, the overall level of profits is lower because the order size tends to be smaller. Franchisees are going to have to increase the order size to make the collections generate higher overall profits.

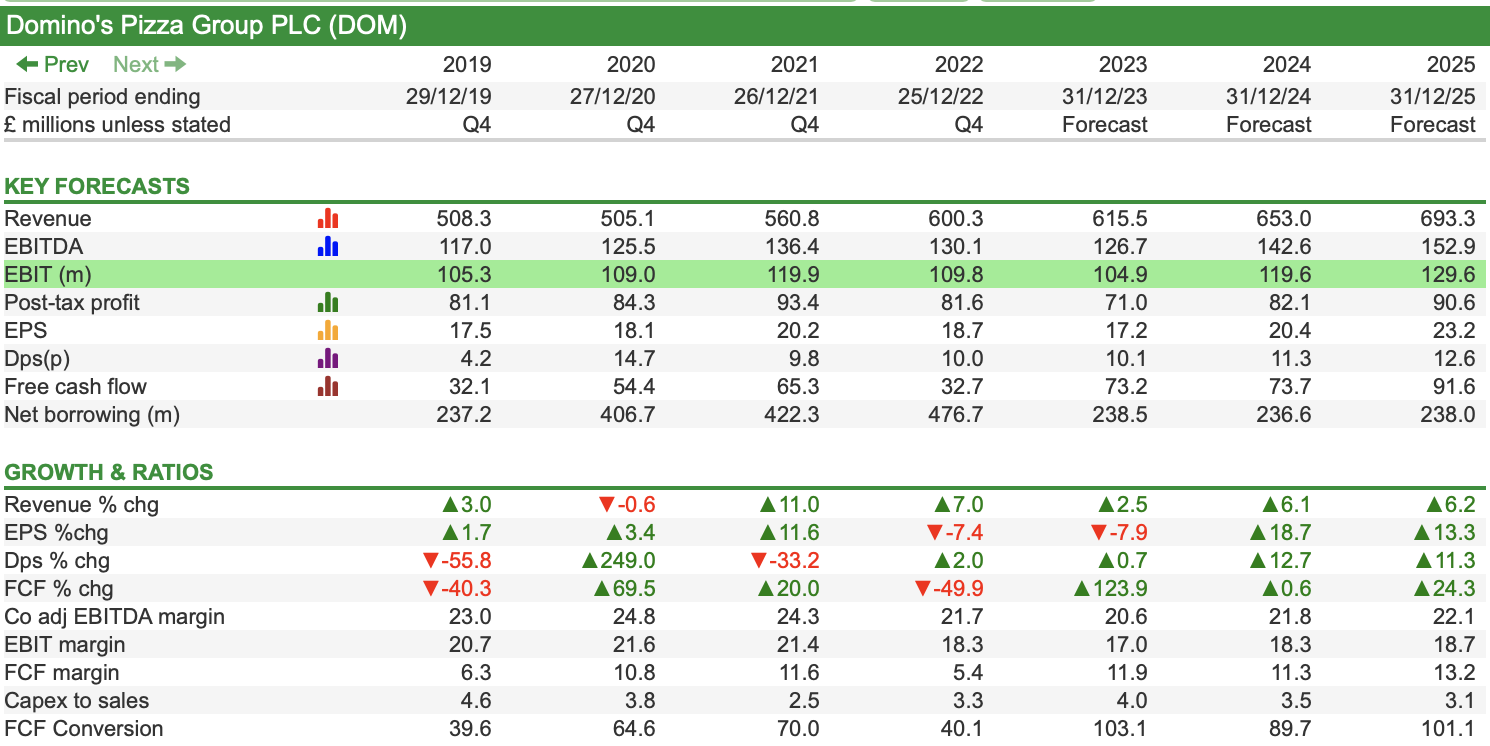

Do current forecasts look reasonable?

City analysts’ are currently forecasting earnings before interest and tax (EBIT) of £104.9m for the year to December 2023. This broadly reflects the guidance given at the time of the company’s annual results last month.

Yet, it is difficult to ignore that the momentum in forecasts for the company has been sharply downward over the last year. At the beginning of 2022, nearly £130m of EBIT was being forecast for 2023.

Domino’s Pizza UK: Trend in 2023 EBIT Forecast

Source: SharePad

The good news is that the business has continued to see order volume growth in the first two months of 2023 and this has seen it take further market share. Domino’s has also yet to benefit from a full year of being on Just Eat’s platform which is bringing new customers to the business.

Recent consumer data is not helpful though.

The latest Office for National Statistics (ONS) retail sales report points to anecdotal evidence of households spending less on takeaways due to cost of living pressures.

This is also supported by Domino’s Pizza Inc in the US and Domino’s Pizza Enterprises – the owner of the master franchises in Australia, New Zealand, France, Belgium and The Netherlands – cutting their profit forecast guidance in recent weeks.

A walk around your local supermarket will show that there are some very good quality pizzas on sale these days. It would not be any surprise if many households take this route rather than ordering a takeaway over the coming months.

The bull case for the shares is being ignored right now.

If Domino’s was to be successful in achieving £1.9bn of system sales by the end of 2025 and maintain its current profit margin on them then it would get to a £140m annual run rate of EBIT by that date.

Current forecasts are for around £130m. Given the pressure on UK consumers and the risks that the strategy may not be as successful as hoped, then it is probably too early to think that this number is currently too low and therefore not likely to be upgraded any time soon.

Source: SharePad

What is more likely is that forecasts get downgraded and this fear is clearly holding the shares back right now.

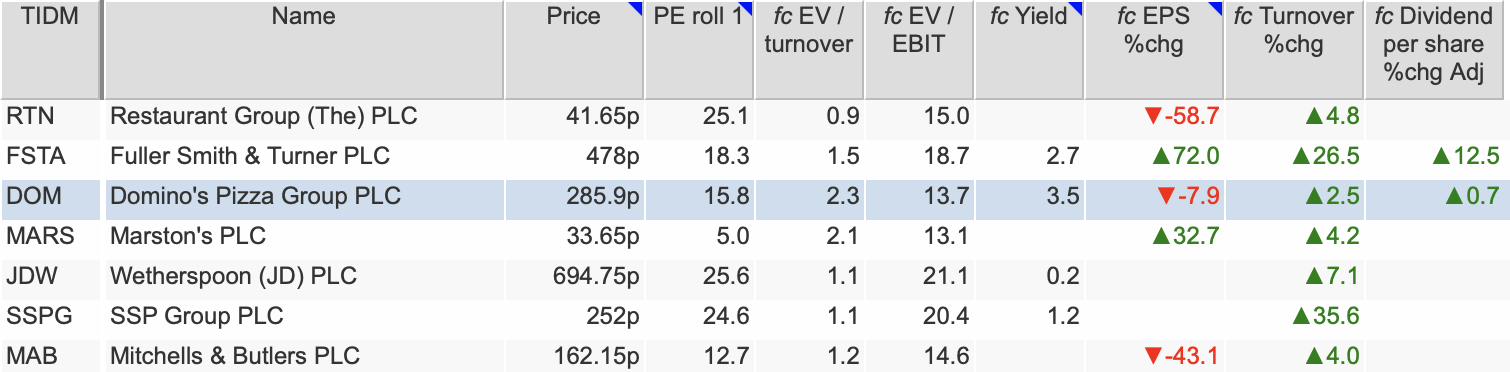

Valuation

Domino’s remains a very solid business, albeit one that perhaps doesn’t look as attractive as it did five or so years ago.

Given the challenges and uncertainties it faces in the near term, the current valuation of 15.8 times one year forecast rolling EPS looks fair enough. It’s difficult to see the shares commanding a higher valuation any time soon.

Source: SharePad

The 3.5 per cent forecast dividend yield may interest income-seeking investors. That said, dividend growth was a mere 2 per cent last year and isn’t forecast to be much better this year.

Anyone casting an eye over the group balance sheet will note that Domino’s has negative shareholders’ equity due to accumulated losses over its life. This might question its ability to keep on paying a dividend out of its distributable reserves.

There is no need to worry here. The standalone balance sheet of Domino’s Pizza UK plc – the company balance sheet – is what matters when it comes to dividend payments. This shows just under £1bn of retained profit and Domino’s ability to keep on paying dividends for many years to come.

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.