With inflation peaking in the UK (at least for now), Bruce looks at some larger cap stocks that have broken through their 200-day moving averages on the upside. Companies covered: ONT, DARK, HL., AJB

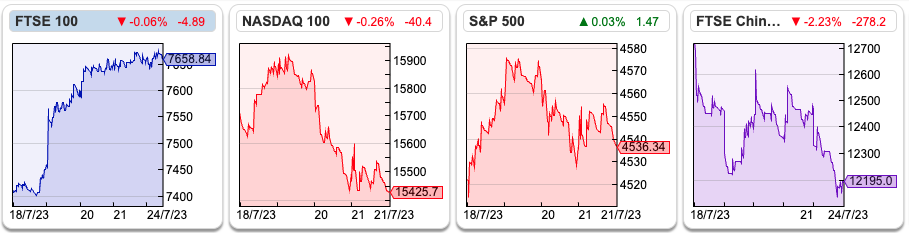

The FTSE 100 enjoyed a strong week up 3.4% to 7,658 as last week the UK’s inflation data was better than expected: falling to +7.9% in June, and importantly core inflation (ex-energy and food prices) fell to +6.9% versus +7.1% in the previous month (a 31-year high). Analysts had expected it to be unchanged, so this may mark an inflexion point. Persimmon and Barratt Developments both rose +13% while Taylor Wimpey was up +12% respectively last week. The UK 2-year government bond yield (UKTSY02) has come down 43bp from its 5.33% peak at the beginning of the month to 4.92%.

In the USA the Nasdaq 100 was down -0.9% and the S&P500 was up +0.7%. The FTSE China 50 index sold off heavily -4.5%, so perhaps in H2 we might see some outperformance from the UK markets versus the rest of the world.

Apologies if the subject of inflation is beginning to bore readers, I do think it is the single most important trend to understand in order to form an outlook on markets. The worst-case scenario is a secondary wage-price spiral in the UK, and the BoE having to raise interest rates to very uncomfortable levels, which would be negative for UK equity markets, and even more negative for the UK housing market.

The more benign scenario is energy prices come down as the price of natural gas in wholesale markets falls. The Natural Gas contract is down -39% YTD, and down -73% from its August 2022 peak, so we should see energy price inflation go negative in the UK, due to base effects (distortions in the time series data when energy prices spiked upwards for a few months in the middle of last year).

Simon French, Panmure’s Chief Economist and former UK cabinet office tweeted this last week:

His point is that UK inflation has been higher than Eurozone and the USA not because we are less productive, but because of the difference in the way governments have tried to protect households from rising energy costs. The UK figure has been more volatile and now should enjoy the deflationary benefit of that. At the beginning of this year James Ferguson was saying something similar about a rapid decline in inflation in the middle of this year, he even suggested we would see this in the June data because of base effects.

For my part, I have been buying MP Evans (6% dividend yield), the Malaysian palm oil company and British American Tobacco (9.4% dividend yield). John Rosier flagged the stock in April 2022 as attractive, but since then the share price has fallen another -25%. These are not recommendations, but I am sharing how I am positioning myself.

I know the BATS product kills the customers, but I believe people should be allowed to buy tobacco and smoke if they want to. I’m more upset about the ethics of food companies and supermarkets who are adding sugar and other unhealthy ingredients to food without people realising and likely causing an epidemic of type II diabetes and food allergies.

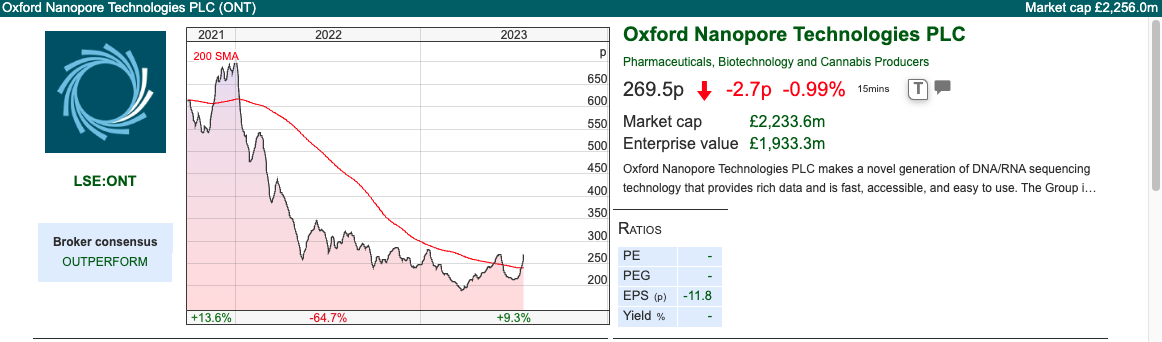

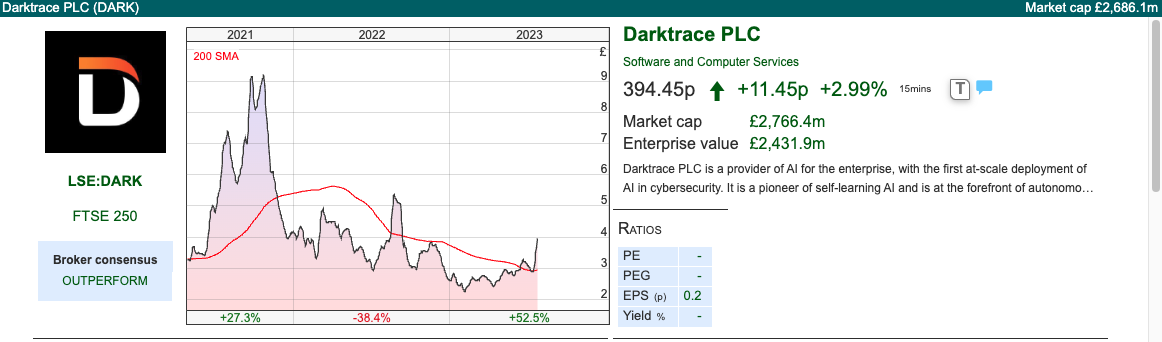

This week I look at four trading updates from larger companies Oxford Nanopore, Darktrace, Hargreaves Lansdown and AJ Bell. The first three have broken through their 200-day simple moving averages, so could be an interesting way to play the market turn on technicals rather than fundamental valuation. Of the three I prefer HL. which I bought earlier this year.

Oxford Nanopore H1 June Trading Update

This molecular biotech company whose sensors were used to detect Covid variants issued an “inline” trading update. The shares responded by rising +14% on the day of the announcement. That caught my interest as often an “inline” update accompanied by a >10% share price rise can be a positive momentum indicator. In the same way, an “ahead” update accompanied by a >10% share price fall is often a sign that expectations are too high, even if published broker EPS forecasts are rising.

ONT is yet another 2021 vintage IPO that has disappointed. The shares came to market at 425p and then rose +43% to over 600p, only to disappoint in the following months. It was also backed by IP Group, which I covered here, which I am keeping an eye on as a way to play the re-opening of the IPO market in London.

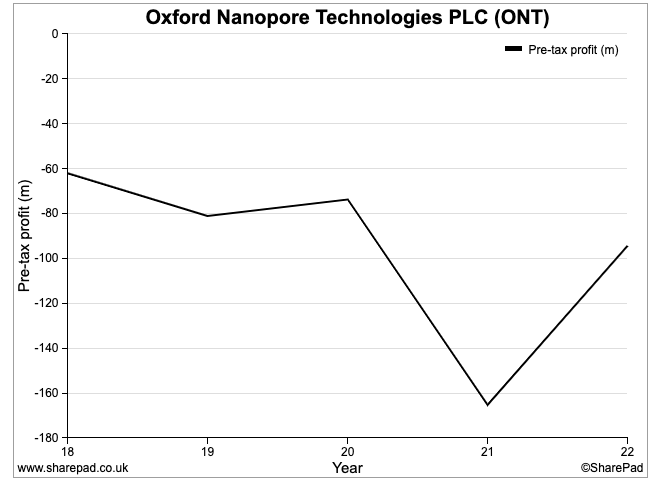

History: Oxford Nanopore was founded in 2005 and has incurred net losses with negative cashflow in every financial year since then. Between 2018 and 2022 the group has reported cumulative losses of £400m, with Sharepad showing forecast losses of over £100m in FY Dec 2023F and FY Dec 2024F. The company’s RNS last week doesn’t mention the cash position, but at Dec 2022 it was £558m, down from £618m the previous year.

ONT was a standard listing, rather than a premium listing on the LSE, which means that many index trackers will not buy the shares. On page 49 of the IPO prospectus they set down the various chapter headings of the listing rules which they weren’t able to comply with; I think it would be much more useful if management were required to explicitly explain why they don’t qualify for a premium listing rather than simply name the chapter headings. I can remember asking HeiQ this question on a conference call and receiving an unsatisfactory response about why they didn’t qualify for a premium listing. HeiQ shares are still suspended as they have failed to publish an audited Annual Report within 6 months of their year-end.

At ONT’s IPO in October 2021, they raised £330m for the company and £166m for selling shareholders (IP Group, Acacia Research, Lansdowne Partners among others). The 425p listing price valued the company’s market cap at £3.4bn.

Technology: ONT’s products provide DNA/RNA analysis and are used in cancer research and plant, animal, pathogen and environmental analyses. The word “platform” appears 128 times in the company’s IPO prospectus. I’ve noted in the past that life sciences companies like Gingko Bioworks (ticker: DNA) are appropriating the language of software companies to try to convince investors that they have attractive economics of fixed costs and growing revenues. So far though both ONT and DNA are just burning cash, with little evidence of Microsoft/Google/Facebook-like returns. My thesis is that software has attractive economic characteristics, that don’t easily translate into more capitally intense technology sectors like hydrogen fuel cells or life sciences.

Valuation: ONT shares are trading on 11.7x Dec 2023F revenue, dropping to 7.2x Dec 2025F revenue. The gross margin is 62%, so I would imagine the bull case is that when the company achieves scale, the economics are attractive. For contrast, DNA on Nasdaq trades on 12.5x Dec 2023F revenues, dropping to 6.6x Dec 2025F revenues.

Opinion: This doesn’t strike me as a “buy and hold” type stock, and is well outside my circle of competence. If you’re comfortable trading the momentum, then I can see it might be possible to make money if you catch the wave of the next bull market. More broadly it’s interesting that a company that’s lost money since 2005 was still able to list in London and enjoys a similarly high valuation as its Nasdaq peer (DNA). I think ONT’s IPO also raises a question mark about the quality of the rest of IP Group’s portfolio, if this was the most “IPO ready” company that IP Group could float into buoyant markets in 2021.

Darktrace audit review and Trading Update FY June 2023

At the beginning of the year, this cyber-security firm was the victim of a short-selling attack, which suggested DARK had simulated sales to phantom end users. Quintessential Capital Management, a New York-based hedge fund, used phrases like “channel stuffing”, “round tripping” as well as “money laundering” and “fraud”. Channel stuffing is when a company sells too much product in one year, which flatters the revenue but leaves an overhang the following year as buyers need to work through the excess sitting on shelves. In the past, I’ve tended to associate it with product companies, rather than an IT services company like DARK. Round tripping is similarly a way of boosting sales, with helpful partners, that doesn’t boost cashflow. A year earlier, Shadowfall, a London-based short seller, had also targeted Darktrace. Then later in 2022 Thoma Bravo, the technology-focused Private Equity firm that owns several other cyber security businesses made an approach to DARK then pulled out in September last year, which sent the shares down -30% on the day.

In response to the allegations, Darktrace announced they would hire Ernst & Young to review their accounting policies (Grant Thornton is the group’s existing auditor). That review has now concluded, apparently giving DARK a clean bill of health, and the shares responded by rising +19%. I say apparently because the report has been made available to the Financial Conduct Authority (FCA) and Financial Reporting Council (FRC) but not shareholders.

Trading update: Last week DARK also released a trading update, showing +31% revenue growth FY Jun 2023 to $544m and an adj EBITDA margin of at least 22% (previous guidance 19%). They quote an even higher figure for Annualised Recurring Revenue (ARR) $626m.

FY Jun 2024F: Management begin the trading statement with a couple of paragraphs of caveats before saying the FY Jun 2024F is likely to be stable in H1, and re-accelerate in H2. They expect a 45/55% split in ARR between H1 and H2 and +21% to +23% for the FY as a whole. They expect y-o-y revenue growth of +22% to +23.5%, with EBITDA margins “at or around” 22%.

Autonomy: The group has many overlaps with Autonomy and Mike Lynch, including most recently him using his DARK shares to obtain bail in the USA. Lynch faces 17 separate charges in the USA over Hewlett Packard’s $11bn takeover of Autonomy. The former CFO of Autonomy has already served 5 years in prison over the deal. A number of DARK’s management, including the Chief Exec Poppy Gustafsson had positions at Autonomy, which they have removed from their bios on the Darktrace website.

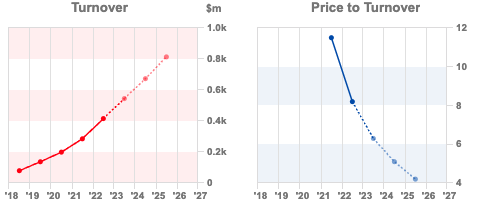

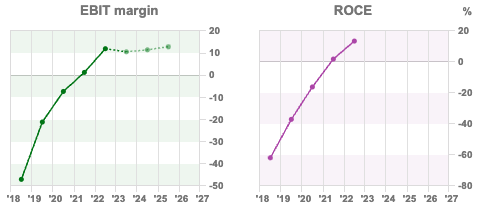

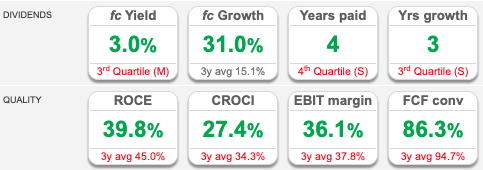

Valuation: Sharepad shows a PER ratio of 44x Jun 2024F and a price to that year’s forecast revenue of 5x. Oddly the valuation has de-rated from above 11x revenue, despite DARK accelerating top-line growth (see charts above). I’m not convinced that companies in this sector deserve a high PER or price/sales multiple because they don’t seem to have attractive EBIT margins or high RoCE (see charts below).

For comparison, Nasdaq-listed Crowdstrike (ticker CRWD) which is ten times the market cap of DARK trades on even higher valuation multiples, but has worse EBIT margins and RoCE.

Opinion: DARK shares have now bounced about their 200-day moving average, so perhaps the controversy has cleared? For my part, I think there are easier businesses to understand and profit from. WISE trades on 6.5x Mar 2024F revenue and a PER of 36x the same year, which seems a more straightforward investment case.

Hargreaves Lansdown Q4 June trading update

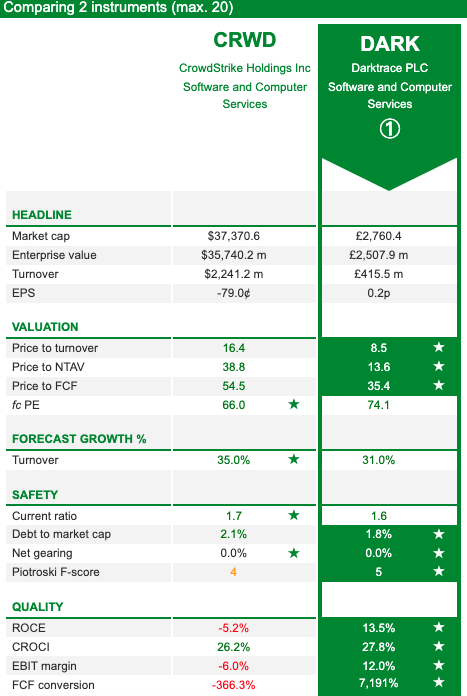

A curious trading update from this investment platform with a June year-end, as they don’t mention revenue or PBT. They must know this figure, so it’s an odd “voluntary disclosure” decision to not share this with investors, particularly as they normally do give revenue in their RNS updates. Study silence to learn the music.

As a reminder, in May management said the 9M YTD revenue was up +23% to £538m (9M FY22: £438m). Share dealing volumes were down -20% on the previous year, but this was more than offset by HL. earning more interest on client balances. I question how sustainable this is, as customers are likely to either invest money into equity markets like I am doing now, or buy money market funds which pay close to banks’ funding costs in wholesale markets, as I was doing earlier in the year.

Last week’s RNS shows share dealing volumes are still suppressed, down -12% in the quarter from the previous year, but at least the rate of decline is slowing. HL. is currently investing £175m of strategic investment spend, to offer “augmented advice” – which Hargreaves Lansdown defines as “hyper-personalised guidance at moments that matter to you”. This has met with a sceptical reaction from Peter Hargreaves, the company’s co-founder and largest shareholder.

Sharepad shows the FY Jun 2024F and FY Jun 2025F revenue forecast implies +3% then +4% growth respectively. I’m a little nervous that those revenue forecasts are too optimistic, and that there may yet be a profit warning from the recently appointed Chief Exec, Dan Olley, who will join on Monday 7th August and might take the opportunity to manage down expectations for 2024F and 2025F. The company will report FY Jun 2023 results on 19th September (last year FY June results were published in early August). The share price reaction to the RNS +6% on the morning of last week’s RNS suggests that this is a risk investors might be overlooking.

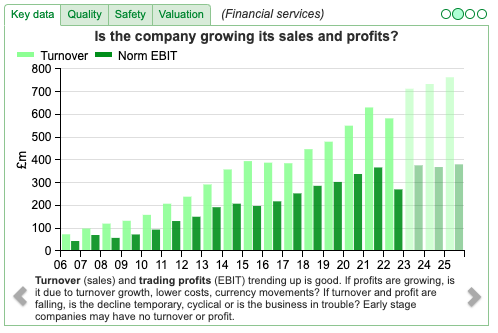

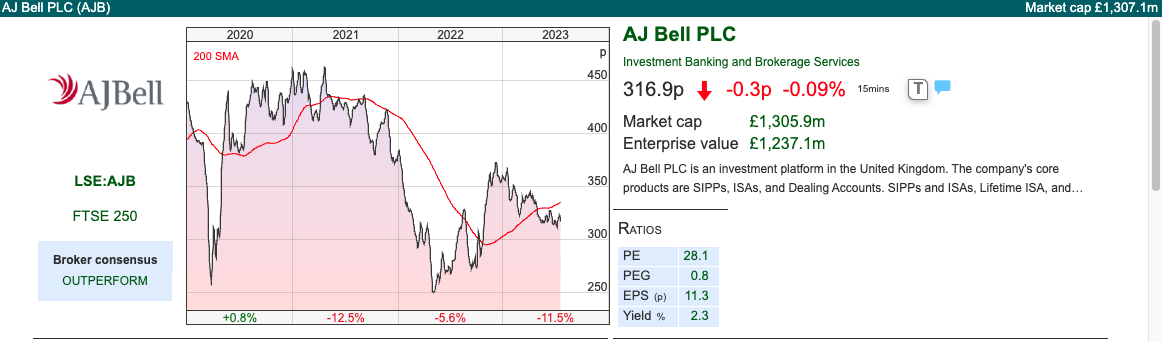

Valuation: The shares are on 15x Jun 2024F PER and 6x that year’s sales. The RoCE and EBIT margins have declined in the last couple of years from above 60% to mid-40s, but are still very impressive both versus traditional Wealth Managers and financial services companies generally. I think that Hargreaves Lansdown can justifiably use the word “platform” as it does seem to share some of the characteristics of a successful software business, but also offers an attractive 4.5% dividend yield.

Opinion: I wrote up some of the themes in investment platforms like HL., AJB and Interactive Investors (now owned by ABDN) versus traditional wealth managers for MoneyWeek here. Although traditional wealth managers like Brewin Dolphin and Rathbones charge their clients more, their “cost to serve” is greater. So low-cost self-directed platforms like HL. and AJB are better businesses from an investors’ perspective (EBIT margins of between 35-60%) and high RoCE. I bought into HL. earlier this year, but I am not going to increase my position size until the new Chief Exec has presented his first set of results, where I think the outlook statement will be key.

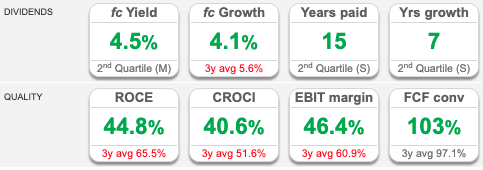

AJ Bell Q3 June trading update

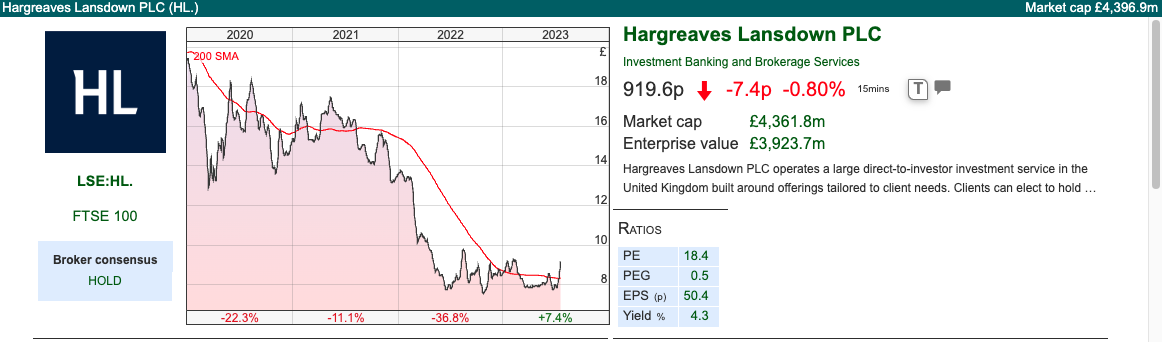

AJ Bell also produced a June trading update (they have a September year-end) with no revenue or profit figure. I have tried to compare the two companies, though this is not straightforward as AJB is a combination of i) Self-directed investors (28% of Assets under Administration) ii) Advised clients, where IFAs use the platform for their clients (64% of AuA) and iii) Non-platform, presumably traditional Wealth Management clients (8% of AuA). The self-directed investors’ (what AJB calls D2C) divisions, which competes directly with Hargreaves Lansdown is thus roughly 6x smaller than HL. by both customer numbers and AuA and has a market share of 6%.

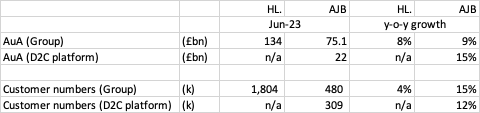

Below is a table comparing the two group’s AuA, D2C and customer numbers. At a group level the growth rate in AuA is similar (8% versus 9%), helped by favourable market movements as the stock market has bounced from June levels last year. AJB does seem to be making some progress in the D2C / self-directed platform space, with AuA rising by +15% to £22bn and customer numbers up +12%, versus just +4% growth for HL. group.

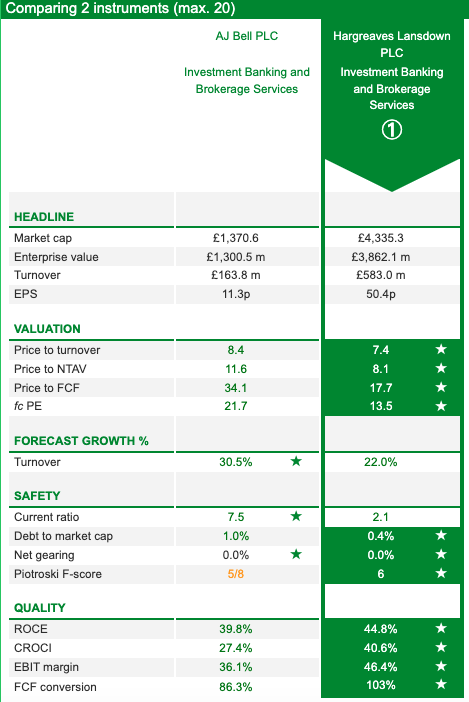

I’ve also used Sharepad’s “compare” feature to look at the financials and valuation of the two companies. The June versus September year-end means direct comparisons are impossible but the table below gives a good feel for the key numbers.

Hargreaves Lansdown appears more attractive on both the valuation measures (Price/FCF 17.7x, fc Price/Earnings 13.5x) and quality measures (RoCE 44.8%, and EBIT margin 46.4%). I would imagine this implies that investors are worried about the sustainability of the historic numbers at HL., whereas AJ Bell represents a challenger brand making inroads to HL.’s larger market share.

Notes

The author owns shares in Hargreaves Lansdown.

Bruce Packard

brucepackard.com

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 25/07/23 | ONT, DARK, HL., AJB | Base effects

With inflation peaking in the UK (at least for now), Bruce looks at some larger cap stocks that have broken through their 200-day moving averages on the upside. Companies covered: ONT, DARK, HL., AJB

The FTSE 100 enjoyed a strong week up 3.4% to 7,658 as last week the UK’s inflation data was better than expected: falling to +7.9% in June, and importantly core inflation (ex-energy and food prices) fell to +6.9% versus +7.1% in the previous month (a 31-year high). Analysts had expected it to be unchanged, so this may mark an inflexion point. Persimmon and Barratt Developments both rose +13% while Taylor Wimpey was up +12% respectively last week. The UK 2-year government bond yield (UKTSY02) has come down 43bp from its 5.33% peak at the beginning of the month to 4.92%.

In the USA the Nasdaq 100 was down -0.9% and the S&P500 was up +0.7%. The FTSE China 50 index sold off heavily -4.5%, so perhaps in H2 we might see some outperformance from the UK markets versus the rest of the world.

Apologies if the subject of inflation is beginning to bore readers, I do think it is the single most important trend to understand in order to form an outlook on markets. The worst-case scenario is a secondary wage-price spiral in the UK, and the BoE having to raise interest rates to very uncomfortable levels, which would be negative for UK equity markets, and even more negative for the UK housing market.

The more benign scenario is energy prices come down as the price of natural gas in wholesale markets falls. The Natural Gas contract is down -39% YTD, and down -73% from its August 2022 peak, so we should see energy price inflation go negative in the UK, due to base effects (distortions in the time series data when energy prices spiked upwards for a few months in the middle of last year).

Simon French, Panmure’s Chief Economist and former UK cabinet office tweeted this last week:

His point is that UK inflation has been higher than Eurozone and the USA not because we are less productive, but because of the difference in the way governments have tried to protect households from rising energy costs. The UK figure has been more volatile and now should enjoy the deflationary benefit of that. At the beginning of this year James Ferguson was saying something similar about a rapid decline in inflation in the middle of this year, he even suggested we would see this in the June data because of base effects.

For my part, I have been buying MP Evans (6% dividend yield), the Malaysian palm oil company and British American Tobacco (9.4% dividend yield). John Rosier flagged the stock in April 2022 as attractive, but since then the share price has fallen another -25%. These are not recommendations, but I am sharing how I am positioning myself.

I know the BATS product kills the customers, but I believe people should be allowed to buy tobacco and smoke if they want to. I’m more upset about the ethics of food companies and supermarkets who are adding sugar and other unhealthy ingredients to food without people realising and likely causing an epidemic of type II diabetes and food allergies.

This week I look at four trading updates from larger companies Oxford Nanopore, Darktrace, Hargreaves Lansdown and AJ Bell. The first three have broken through their 200-day simple moving averages, so could be an interesting way to play the market turn on technicals rather than fundamental valuation. Of the three I prefer HL. which I bought earlier this year.

Oxford Nanopore H1 June Trading Update

This molecular biotech company whose sensors were used to detect Covid variants issued an “inline” trading update. The shares responded by rising +14% on the day of the announcement. That caught my interest as often an “inline” update accompanied by a >10% share price rise can be a positive momentum indicator. In the same way, an “ahead” update accompanied by a >10% share price fall is often a sign that expectations are too high, even if published broker EPS forecasts are rising.

ONT is yet another 2021 vintage IPO that has disappointed. The shares came to market at 425p and then rose +43% to over 600p, only to disappoint in the following months. It was also backed by IP Group, which I covered here, which I am keeping an eye on as a way to play the re-opening of the IPO market in London.

History: Oxford Nanopore was founded in 2005 and has incurred net losses with negative cashflow in every financial year since then. Between 2018 and 2022 the group has reported cumulative losses of £400m, with Sharepad showing forecast losses of over £100m in FY Dec 2023F and FY Dec 2024F. The company’s RNS last week doesn’t mention the cash position, but at Dec 2022 it was £558m, down from £618m the previous year.

ONT was a standard listing, rather than a premium listing on the LSE, which means that many index trackers will not buy the shares. On page 49 of the IPO prospectus they set down the various chapter headings of the listing rules which they weren’t able to comply with; I think it would be much more useful if management were required to explicitly explain why they don’t qualify for a premium listing rather than simply name the chapter headings. I can remember asking HeiQ this question on a conference call and receiving an unsatisfactory response about why they didn’t qualify for a premium listing. HeiQ shares are still suspended as they have failed to publish an audited Annual Report within 6 months of their year-end.

At ONT’s IPO in October 2021, they raised £330m for the company and £166m for selling shareholders (IP Group, Acacia Research, Lansdowne Partners among others). The 425p listing price valued the company’s market cap at £3.4bn.

Technology: ONT’s products provide DNA/RNA analysis and are used in cancer research and plant, animal, pathogen and environmental analyses. The word “platform” appears 128 times in the company’s IPO prospectus. I’ve noted in the past that life sciences companies like Gingko Bioworks (ticker: DNA) are appropriating the language of software companies to try to convince investors that they have attractive economics of fixed costs and growing revenues. So far though both ONT and DNA are just burning cash, with little evidence of Microsoft/Google/Facebook-like returns. My thesis is that software has attractive economic characteristics, that don’t easily translate into more capitally intense technology sectors like hydrogen fuel cells or life sciences.

Valuation: ONT shares are trading on 11.7x Dec 2023F revenue, dropping to 7.2x Dec 2025F revenue. The gross margin is 62%, so I would imagine the bull case is that when the company achieves scale, the economics are attractive. For contrast, DNA on Nasdaq trades on 12.5x Dec 2023F revenues, dropping to 6.6x Dec 2025F revenues.

Opinion: This doesn’t strike me as a “buy and hold” type stock, and is well outside my circle of competence. If you’re comfortable trading the momentum, then I can see it might be possible to make money if you catch the wave of the next bull market. More broadly it’s interesting that a company that’s lost money since 2005 was still able to list in London and enjoys a similarly high valuation as its Nasdaq peer (DNA). I think ONT’s IPO also raises a question mark about the quality of the rest of IP Group’s portfolio, if this was the most “IPO ready” company that IP Group could float into buoyant markets in 2021.

Darktrace audit review and Trading Update FY June 2023

At the beginning of the year, this cyber-security firm was the victim of a short-selling attack, which suggested DARK had simulated sales to phantom end users. Quintessential Capital Management, a New York-based hedge fund, used phrases like “channel stuffing”, “round tripping” as well as “money laundering” and “fraud”. Channel stuffing is when a company sells too much product in one year, which flatters the revenue but leaves an overhang the following year as buyers need to work through the excess sitting on shelves. In the past, I’ve tended to associate it with product companies, rather than an IT services company like DARK. Round tripping is similarly a way of boosting sales, with helpful partners, that doesn’t boost cashflow. A year earlier, Shadowfall, a London-based short seller, had also targeted Darktrace. Then later in 2022 Thoma Bravo, the technology-focused Private Equity firm that owns several other cyber security businesses made an approach to DARK then pulled out in September last year, which sent the shares down -30% on the day.

In response to the allegations, Darktrace announced they would hire Ernst & Young to review their accounting policies (Grant Thornton is the group’s existing auditor). That review has now concluded, apparently giving DARK a clean bill of health, and the shares responded by rising +19%. I say apparently because the report has been made available to the Financial Conduct Authority (FCA) and Financial Reporting Council (FRC) but not shareholders.

Trading update: Last week DARK also released a trading update, showing +31% revenue growth FY Jun 2023 to $544m and an adj EBITDA margin of at least 22% (previous guidance 19%). They quote an even higher figure for Annualised Recurring Revenue (ARR) $626m.

FY Jun 2024F: Management begin the trading statement with a couple of paragraphs of caveats before saying the FY Jun 2024F is likely to be stable in H1, and re-accelerate in H2. They expect a 45/55% split in ARR between H1 and H2 and +21% to +23% for the FY as a whole. They expect y-o-y revenue growth of +22% to +23.5%, with EBITDA margins “at or around” 22%.

Autonomy: The group has many overlaps with Autonomy and Mike Lynch, including most recently him using his DARK shares to obtain bail in the USA. Lynch faces 17 separate charges in the USA over Hewlett Packard’s $11bn takeover of Autonomy. The former CFO of Autonomy has already served 5 years in prison over the deal. A number of DARK’s management, including the Chief Exec Poppy Gustafsson had positions at Autonomy, which they have removed from their bios on the Darktrace website.

Valuation: Sharepad shows a PER ratio of 44x Jun 2024F and a price to that year’s forecast revenue of 5x. Oddly the valuation has de-rated from above 11x revenue, despite DARK accelerating top-line growth (see charts above). I’m not convinced that companies in this sector deserve a high PER or price/sales multiple because they don’t seem to have attractive EBIT margins or high RoCE (see charts below).

For comparison, Nasdaq-listed Crowdstrike (ticker CRWD) which is ten times the market cap of DARK trades on even higher valuation multiples, but has worse EBIT margins and RoCE.

Opinion: DARK shares have now bounced about their 200-day moving average, so perhaps the controversy has cleared? For my part, I think there are easier businesses to understand and profit from. WISE trades on 6.5x Mar 2024F revenue and a PER of 36x the same year, which seems a more straightforward investment case.

Hargreaves Lansdown Q4 June trading update

A curious trading update from this investment platform with a June year-end, as they don’t mention revenue or PBT. They must know this figure, so it’s an odd “voluntary disclosure” decision to not share this with investors, particularly as they normally do give revenue in their RNS updates. Study silence to learn the music.

As a reminder, in May management said the 9M YTD revenue was up +23% to £538m (9M FY22: £438m). Share dealing volumes were down -20% on the previous year, but this was more than offset by HL. earning more interest on client balances. I question how sustainable this is, as customers are likely to either invest money into equity markets like I am doing now, or buy money market funds which pay close to banks’ funding costs in wholesale markets, as I was doing earlier in the year.

Last week’s RNS shows share dealing volumes are still suppressed, down -12% in the quarter from the previous year, but at least the rate of decline is slowing. HL. is currently investing £175m of strategic investment spend, to offer “augmented advice” – which Hargreaves Lansdown defines as “hyper-personalised guidance at moments that matter to you”. This has met with a sceptical reaction from Peter Hargreaves, the company’s co-founder and largest shareholder.

Sharepad shows the FY Jun 2024F and FY Jun 2025F revenue forecast implies +3% then +4% growth respectively. I’m a little nervous that those revenue forecasts are too optimistic, and that there may yet be a profit warning from the recently appointed Chief Exec, Dan Olley, who will join on Monday 7th August and might take the opportunity to manage down expectations for 2024F and 2025F. The company will report FY Jun 2023 results on 19th September (last year FY June results were published in early August). The share price reaction to the RNS +6% on the morning of last week’s RNS suggests that this is a risk investors might be overlooking.

Valuation: The shares are on 15x Jun 2024F PER and 6x that year’s sales. The RoCE and EBIT margins have declined in the last couple of years from above 60% to mid-40s, but are still very impressive both versus traditional Wealth Managers and financial services companies generally. I think that Hargreaves Lansdown can justifiably use the word “platform” as it does seem to share some of the characteristics of a successful software business, but also offers an attractive 4.5% dividend yield.

Opinion: I wrote up some of the themes in investment platforms like HL., AJB and Interactive Investors (now owned by ABDN) versus traditional wealth managers for MoneyWeek here. Although traditional wealth managers like Brewin Dolphin and Rathbones charge their clients more, their “cost to serve” is greater. So low-cost self-directed platforms like HL. and AJB are better businesses from an investors’ perspective (EBIT margins of between 35-60%) and high RoCE. I bought into HL. earlier this year, but I am not going to increase my position size until the new Chief Exec has presented his first set of results, where I think the outlook statement will be key.

AJ Bell Q3 June trading update

AJ Bell also produced a June trading update (they have a September year-end) with no revenue or profit figure. I have tried to compare the two companies, though this is not straightforward as AJB is a combination of i) Self-directed investors (28% of Assets under Administration) ii) Advised clients, where IFAs use the platform for their clients (64% of AuA) and iii) Non-platform, presumably traditional Wealth Management clients (8% of AuA). The self-directed investors’ (what AJB calls D2C) divisions, which competes directly with Hargreaves Lansdown is thus roughly 6x smaller than HL. by both customer numbers and AuA and has a market share of 6%.

Below is a table comparing the two group’s AuA, D2C and customer numbers. At a group level the growth rate in AuA is similar (8% versus 9%), helped by favourable market movements as the stock market has bounced from June levels last year. AJB does seem to be making some progress in the D2C / self-directed platform space, with AuA rising by +15% to £22bn and customer numbers up +12%, versus just +4% growth for HL. group.

I’ve also used Sharepad’s “compare” feature to look at the financials and valuation of the two companies. The June versus September year-end means direct comparisons are impossible but the table below gives a good feel for the key numbers.

Hargreaves Lansdown appears more attractive on both the valuation measures (Price/FCF 17.7x, fc Price/Earnings 13.5x) and quality measures (RoCE 44.8%, and EBIT margin 46.4%). I would imagine this implies that investors are worried about the sustainability of the historic numbers at HL., whereas AJ Bell represents a challenger brand making inroads to HL.’s larger market share.

Notes

The author owns shares in Hargreaves Lansdown.

Bruce Packard

brucepackard.com

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.