Diageo has many attractive characteristics as a business but its shares have delivered steady rather than exceptional returns to investors. Phil has a look at the company to see if it might reward investors better in the future than it has in the past.

For many long-term investors, Diageo is a company that ticks a lot of boxes. It is a world-leading consumer goods company with an enviable portfolio of popular spirits brands. In addition, it is very profitable and has been very dependable at growing steadily over time.

It is seen as an investment that people can tuck away in their portfolios and leave it to grow in value. For many who follow a quality investing approach, Diageo is often a core holding for them.

The problem that investors face with businesses such as Diageo is that the good things about it are very well-known and understood by the stock market. As a result, its shares – and others like it – tend to have full valuations attached to them.

You are very unlikely to have an information edge with a business as big as this. Unless there is a period of general stock market pessimism, you are also unlikely to buy the shares cheaply and gain from an increase in its valuation.

This doesn’t mean that you can’t make money from owning the shares. It is a type of company that should reward patient and long-term investors if profits keep growing.

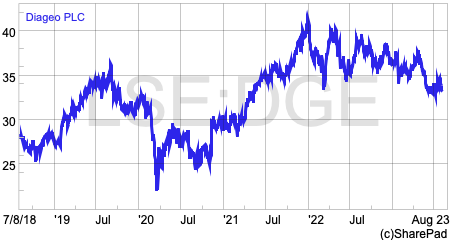

That said, looking back over the last decade, you could make a strong case for arguing that Diageo shares have been somewhat disappointing.

Source: SharePad

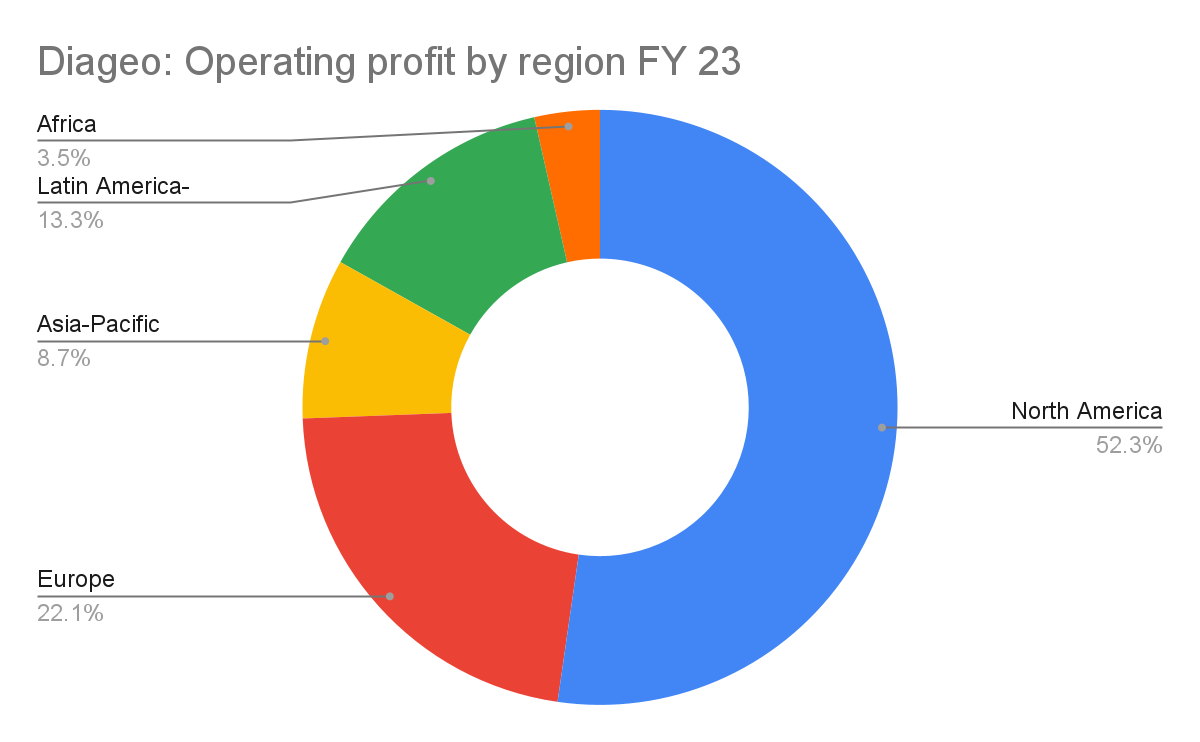

During that time, the shares have generated total investment returns of 88 per cent compared to the FTSE All Share index which has returned 67 per cent. That’s alright but investors would have been much better off investing in the shares of its global competitors.

Diageo has underperformed the UK market over the last year as rising costs have put pressure on its profit margins and higher interest rates have reduced the high valuation that was attached to the shares.

So where does that leave Diageo shares as a potential investment now?

Business Model

Diageo is home to some of the world’s favourite spirits brands such as Johnnie Walker whisky, Smirnoff vodka, Baileys liqueur, Captain Morgan rum, Tanqueray gin and Guinness beer.

In addition to these global brands, it has many local brands such as Crown whiskey in Canada and what it calls Reserve brands such as Bulleit bourbon, Talisker single malt whisky and Don Julio tequila.

Nearly 70 per cent of group revenues come from its global and reserve brands.

| Segment | Brands | % net sales |

| Global | Johnnie Walker, Smirnoff, Baileys, Captain Morgan, Tanqueray, Guinness | 39 |

| Reserve | Bulleit, Don Julio, Casamigos, Scotch Malts, Ketel One, Ciroc | 29 |

| Local | J&B, Yen Raki, Crown Royal, Buchanan’s, Old Parr, Shui Jing Fang | 18 |

Source: Diageo

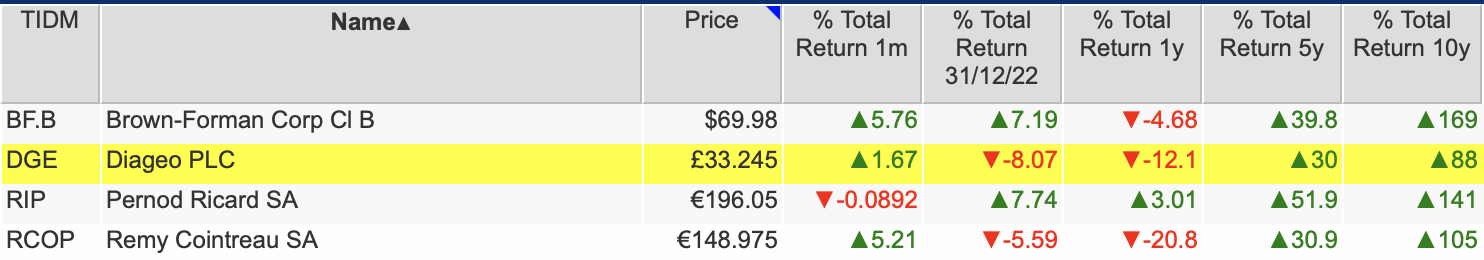

Looking at its revenues in more detail, over half of them come from scotch whisky, beer and tequila.

Source: Diageo

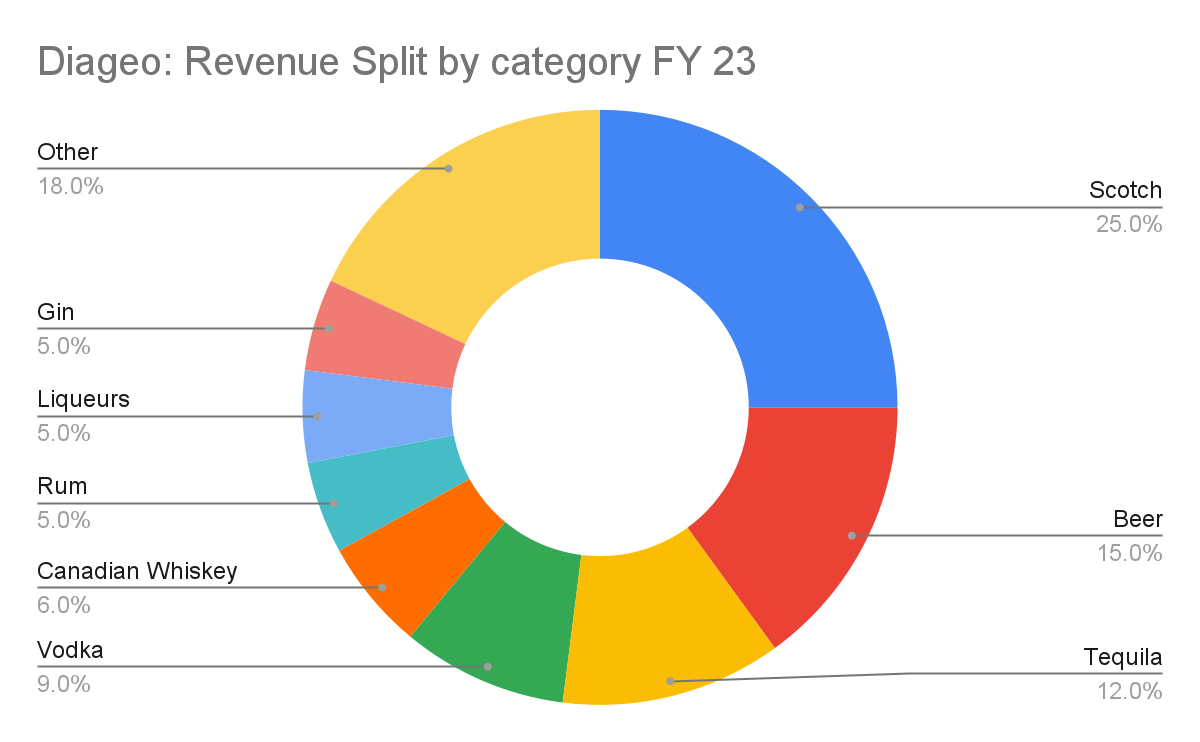

When it comes to profits, the US market – the world’s biggest spirits market – remains all-important. Over half of Diageo’s operating profits came from North America last year.

From its 2024 financial year onwards, Diageo will change its reporting currency from pounds to US dollars. It has no plans to move its main stock market listing from London.

Europe remains an important source of profits, whilst the company is aiming to grow its profits in many of the emerging markets found in Asia and Latin America.

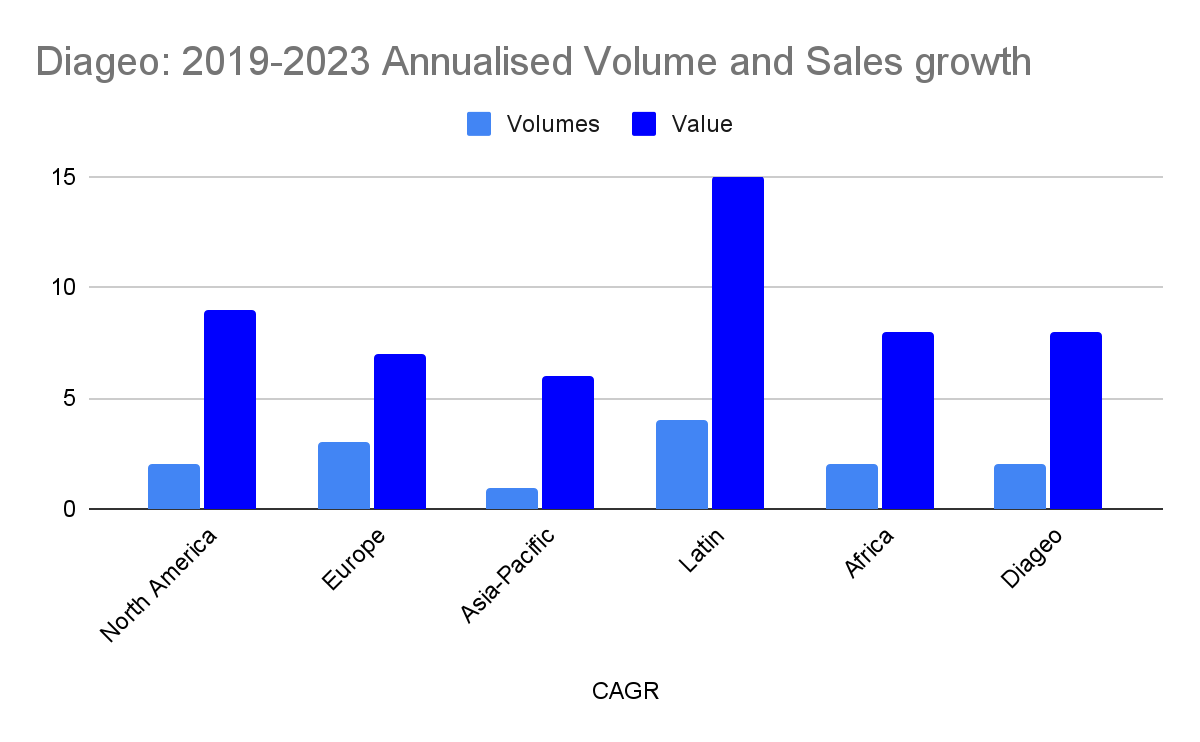

Over the last few years, Diageo has been successful at growing its businesses across the world.

What is encouraging is that volumes have grown which shows that the company is selling more of its products and not just relying on price increases. This is not always the case with consumer goods companies where in some cases they have little or declining volume growth.

That said, the value of its sales have increased at a much faster rate than its volumes. There are a couple of reasons for this. Firstly, Diageo has been following a strategy of premiumisation – selling customers better and more expensive versions of its brands – which has increased its average selling prices.

Prices have also increased in response to cost inflation and reflect that Diageo is a business with a reasonable amount of pricing power due to the strength of its brands.

Source: Diageo

A quick look at the key numbers

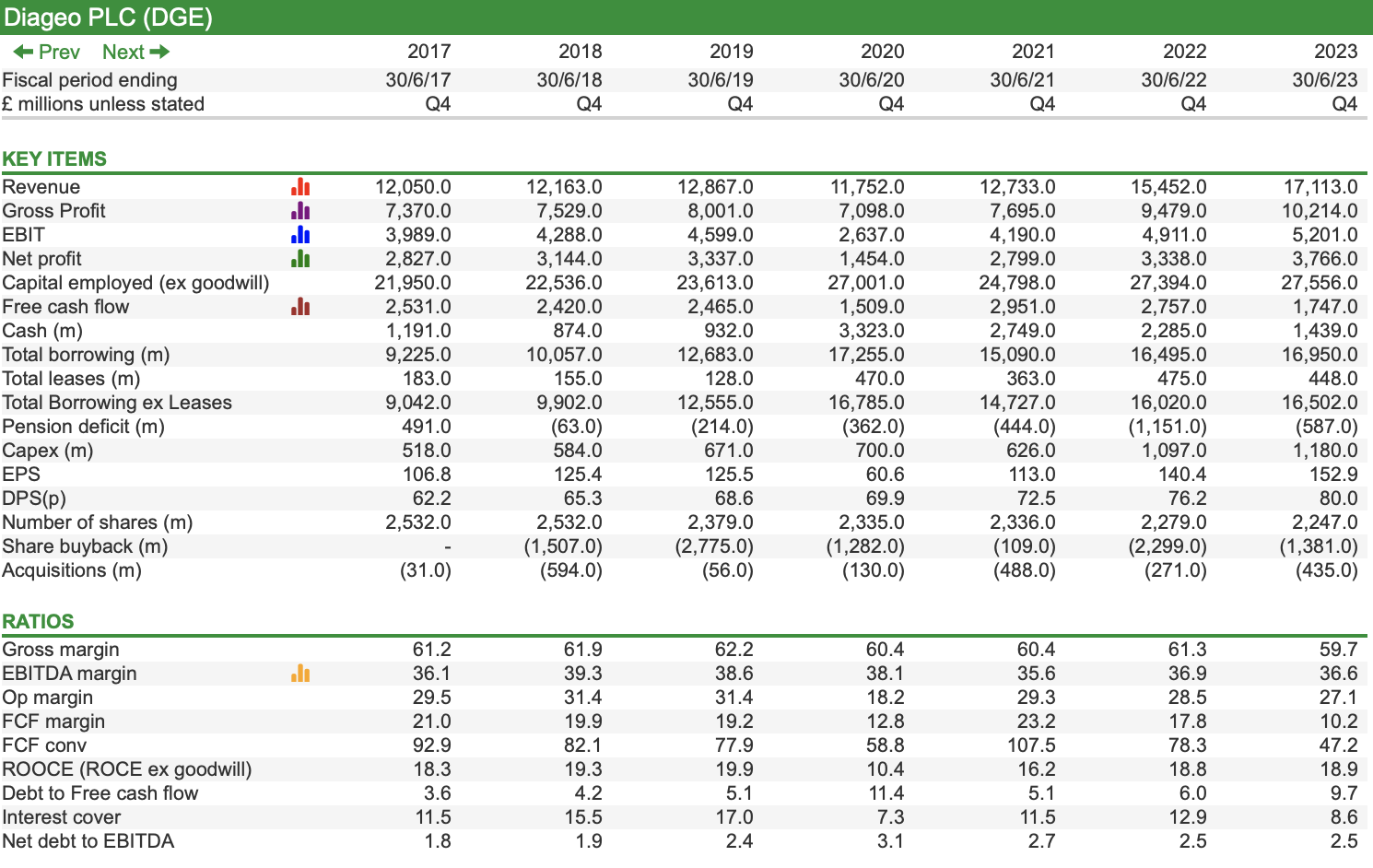

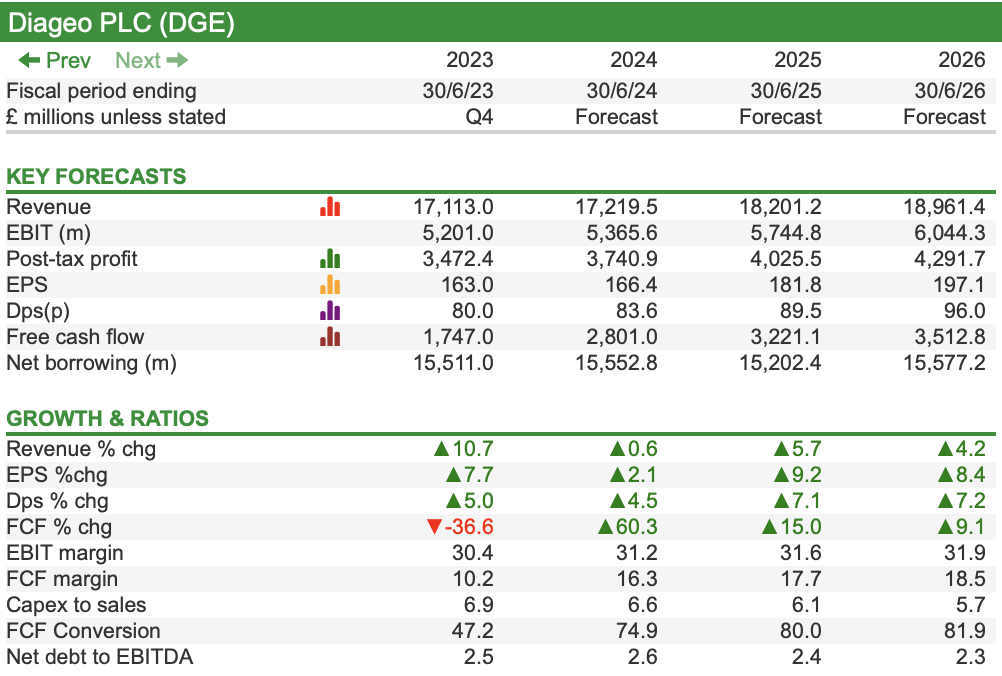

On opening up SharePad to look at Diageo’s recent numbers there’s a lot to like. There has been reasonable growth in revenues, profits and dividends.

Its financial ratios also highlight that Diageo is a very profitable and high-quality business.

Diageo: Key financials and ratios

Source: SharePad

The company generates high gross and operating margins which show the strength of its products. Its return on operating capital employed (ROOCE) has been very healthy and stable which is reassuring.

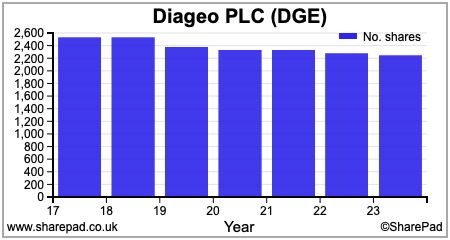

Free cash flow has declined as the company has invested more money in its business as shown by its rising capital expenditure(capex). You can also see that in addition to paying a growing dividend per share, Diageo has spent a lot of money buying back its own shares and reducing the number of shares in issue.

It has also been regularly buying companies (acquisitions) and when combined with the money spent on buybacks, debt levels have increased. Net debt to EBITDA – a common measure of company debt relative to its profits – has increased from 1.8 times in 2017 to 2.5 times in the year to June 2023.

Given the company’s high levels of profitability and the relative stability of its revenues, this is not something that investors should worry about. Last year, Diageo’s operating profits covered its annual interest bill on its borrowings by more than eight times which is evidence of a strong financial position.

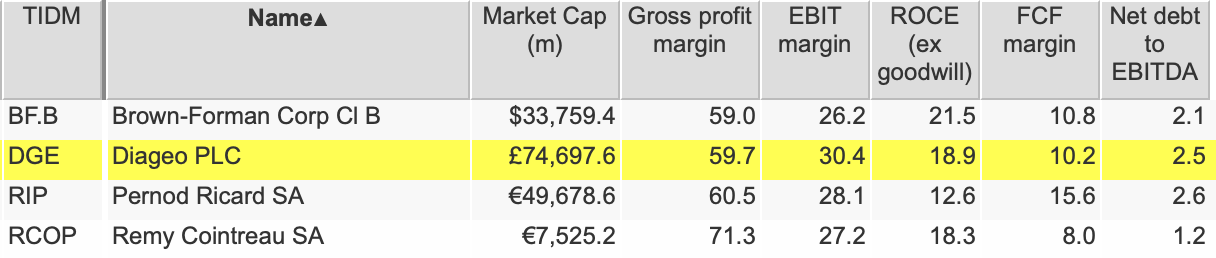

Diageo vs its peers

Source: SharePad

Comparing Diageo with its global peers also makes for reassuring viewing. Its profit margins compare favourably, whilst ROOCE is similar to Remy Cointreau and slightly less than Brown-Forman.

What is also encouraging is that Diageo continues to generate good rates of incremental returns on its investments in its business. Over the last five years, it has increased its operating capital employed by £5bn and added an extra £913m of trading profit (EBIT) – and incremental ROOCE of 18.2 per cent.

Diageo: Five-year cumulative ratio analysis

| Cumulative analysis: | 5Y |

| Revenue | 4950 |

| Gross Profit | 2685 |

| EBIT | 913 |

| Net profit | 622 |

| Operating Capital Employed | 5020 |

| Free Cash Flow | -673 |

| Ratios: | |

| Gross margin | 54.2% |

| EBIT margin | 18.4% |

| Capital Turnover(x) | 0.99 |

| ROCE | 18.2% |

| Free cash flow margin | -13.6% |

| Free cash flow conversion | N/A |

Source: SharePad/My calculations

Analysis Points – Stocks and Marketing

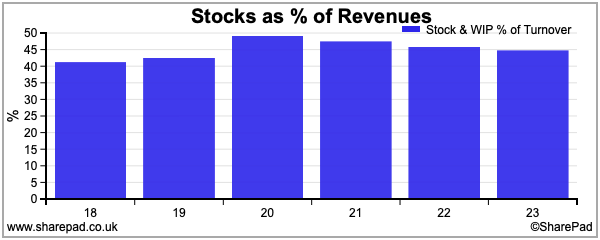

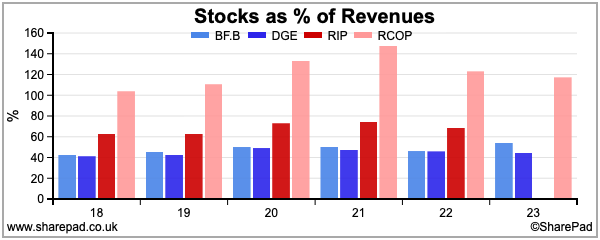

Spirits companies have very high levels of stocks/inventories relative to their revenues/turnover. This is because many of the drinks spend years maturing in barrels before they are bottled and sold to customers.

Stocks make up a considerable portion of a company’s capital employed and the financing of them is a significant barrier to competition.

Diageo has a very high stock-to-revenue ratio of around 45 per cent. It has increased slightly in recent years but has not deviated much from its long-term trend to cause concern.

Comparing Diageo with its peers shows that its levels are not out of step. In fact, they are much better than those of Pernod and Remy Cointreau.

Remy, in particular, has a very high ratio. This can perhaps be explained by the costly characteristics of some of its products and how long they are left to age. Its Louis XIII cognac sells at £3200 per 700ml bottle (only its cost of ingredients will be reflected in its stock value) but can be left to mature for between 40 and 100 years.

The other thing to be aware of with stocks is the level of stocks held by distributors. One of the ways a spirits company can flatter its revenues in a particular year is to ship a lot of stock to distributors – a practice known as channel stuffing. What tends to happen the year after is that distributors have too much stock and don’t need to buy as much. As a result, the sales of the company can fall.

Diageo had a problem with stocks with its US distributors last year. They had too much and consequently sales volumes in the US did not grow. The company has reassured investors that distributor stock levels were in line with historic averages at the end of the 2023 financial year in June. Hopefully, this should help volumes to start growing again.

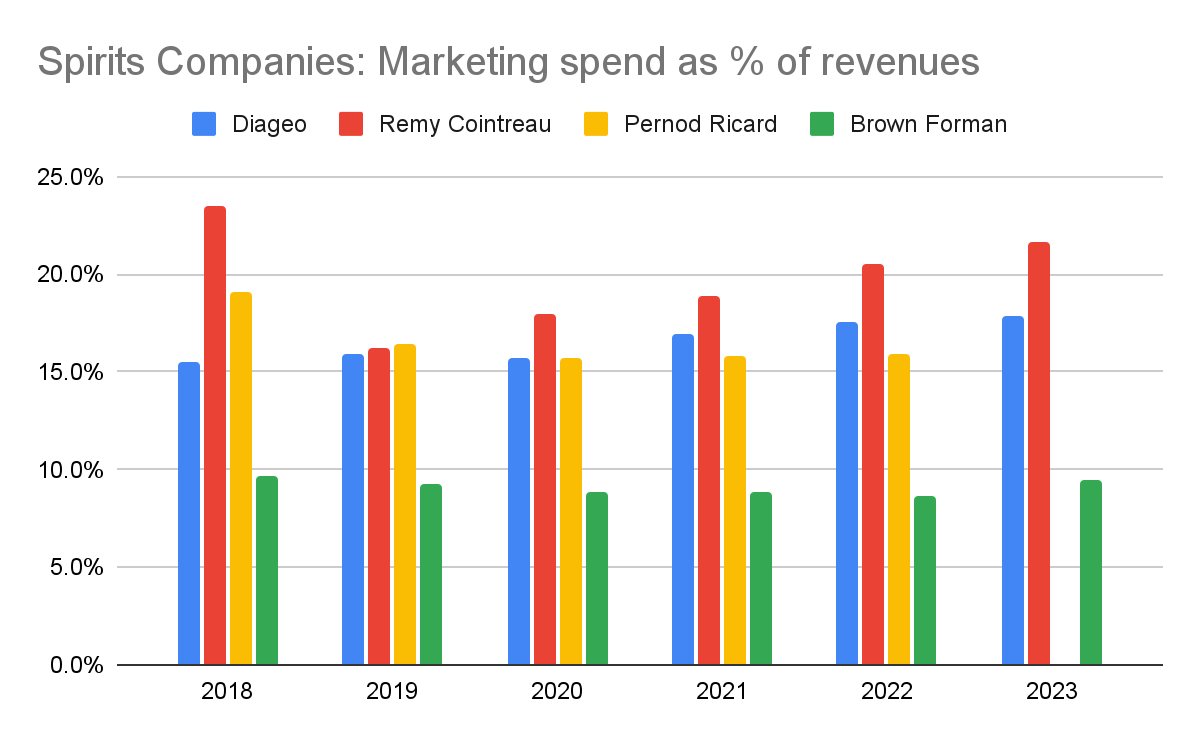

Another number to keep an eye on when it comes to consumer goods companies is how much they spend on advertising/marketing as a percentage of their revenues.

Brands need investment to keep sales growing and stay ahead of the competition. Diageo has upped its marketing spend in recent years but still lags behind Remy Cointreau and Pernod.

Source: Annual Reports/my calculations

Brown Forman’s marketing spend has been consistently lower than its peers. Perhaps this is a testament to the strength of its Jack Daniel’s brand which doesn’t need as much help to sell and is a go-to Bourbon for many consumers.

Where is Diageo’s growth going to come from?

Diageo’s historic financial performance makes for comforting reading. However, it is the future which matters. Investors are only likely to benefit from owning its shares if revenues and profits show meaningful growth.

The company’s ambition is to achieve organic net sales growth of 5-7 per cent per year with organic operating profit growth of 6-9 per cent between 2023 and 2025.

2023 was mixed in terms of meeting this target – especially in the core US market. However, the company remains confident that it can deliver against its objectives,

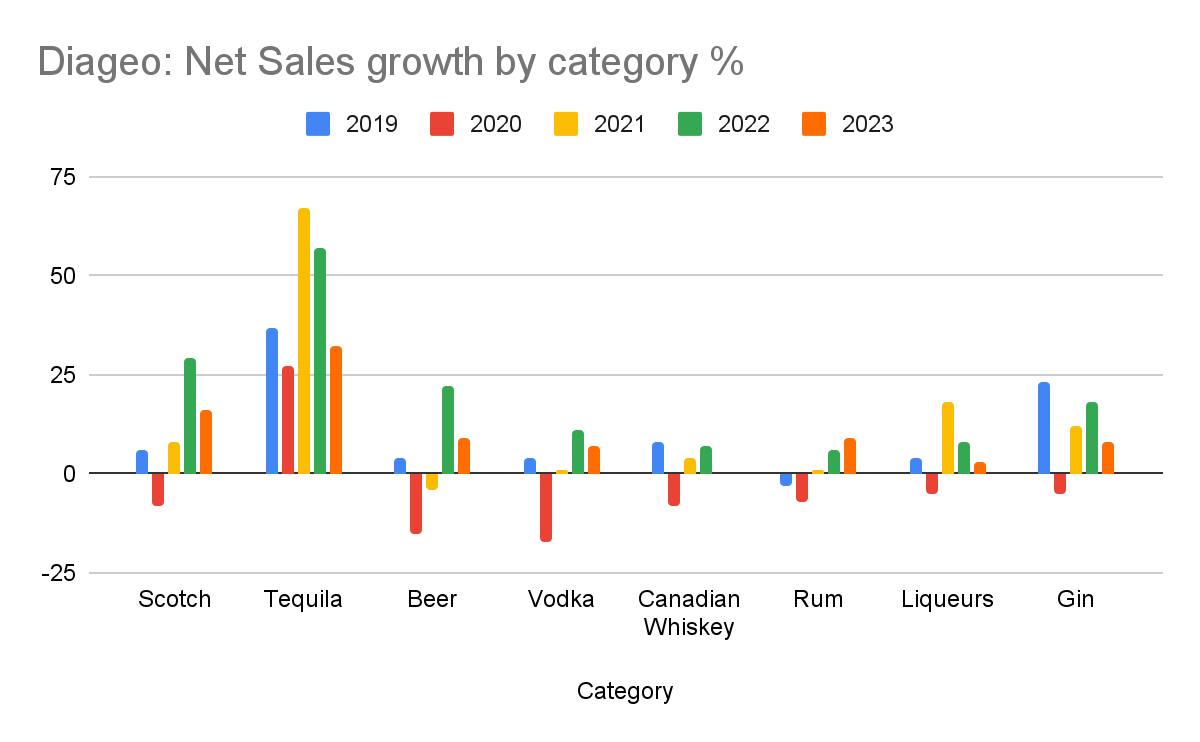

If it is to succeed, then the growth is likely to come from its three biggest revenue generators – whisky, beer and tequila.

Diageo should continue to benefit from the trend of premiumisation of spirits and the growth of the middle classes in emerging markets. Higher-quality drinks command higher selling prices and higher gross margins. Spirits are also continuing to take market share from wine and beer in the US market.

Diageo’s brand portfolio should benefit from the growth coming from the super-premium price points in the market. It does not have a huge exposure at the lower end of the market where there is evidence of customers trading down in response to the cost of living crisis.

Tequila has been a phenomenal success for Diageo with huge growth coming from its Don Julio and Casamigos brands. Five years’ ago tequila accounted for less than five per cent of Diageo’s sales. Last year it was 12 per cent.

Source: Diageo

This growth has been achieved despite tequila having a significant presence in just two markets – US and Mexico. Diageo wants to make tequila a growth product across the world and has seen good growth coming from southern European markets such as Italy, Greece and Spain.

Johnnie Walker whisky remains a very dependable grower for Diageo and is benefitting from the premiumisation trend – especially in places such as India where it is a very aspirational brand.

Premium scotch sales are also being helped by the return of tourism in many areas and the sales in the travel retail market. Diageo has been gaining market share in scotch in Europe. It has also been doing so in the US which has also seen strong sales of its Bulleit bourbon brand.

Guinness is an iconic beer brand which has seen good growth globally for Diageo in the last couple of years. It is not just popular in bars but is performing very well in the drink-at-home market.

As well as having favourable trends behind its power brands, Diageo can achieve growth by addressing areas where it is underperforming.

One of its key areas of underperformance has been in the US ready-to-drink (RTD) market which has been the fastest segment of growth in alcoholic beverages in recent years. The company is raising its game with new products but also wants to use pre-prepared cocktails as a source of growth for its core spirits brands.

Crown whiskey has been disappointing in Canada. A recovery here would provide a useful boost and Diageo knows its needs to be more innovative with this brand.

Diageo is also taking costs out of business and becoming more efficient. This should be supportive to profit growth in the coming years.

Forecasts – subdued growth expected in 2024

Source: SharePad

Diageo’s current growth forecast for 2024 is nothing to write home about. The company expects organic sales growth to accelerate in the second half of 2024 and into 2024 but analysts’ are not predicting much revenue growth for the current year.

It is worth noting that the company is facing another exchange rate headwind this year. Last year, the pound averaged $1.20 and is currently trading at $1.27. If it stays around this level it will reduce growth when revenues and profits are translated from US dollars back into pounds.

On a constant currency basis, Diageo would be much closer to its organic growth target. If analysts are right, then profit margins are expected to improve and earnings and dividend growth should be satisfactory, but not exceptional over the next few years.

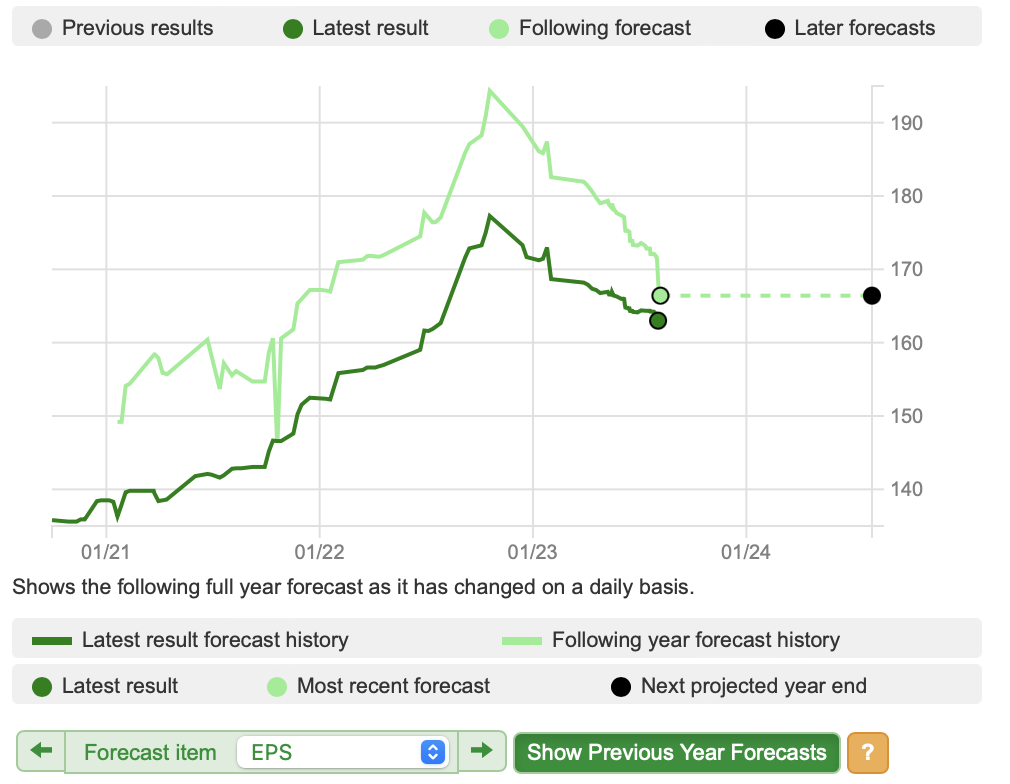

That said, the trend in 2024 EPS forecasts has not been good and are now meaningfully lower than they were at the back end of last year.

Diageo: 2024 EPS Forecast History

Source: SharePad

Are Diageo shares attractively valued at the moment?

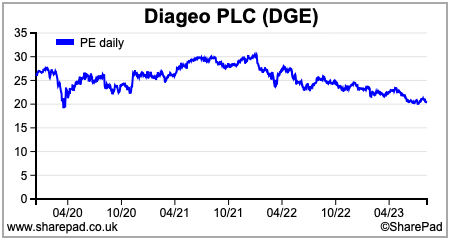

The shares have been significantly derated on a PE basis over the last year or so. At the end of 2021, they were changing hands for over 30 times trailing EPS. Today, the valuation is down to around 20 times.

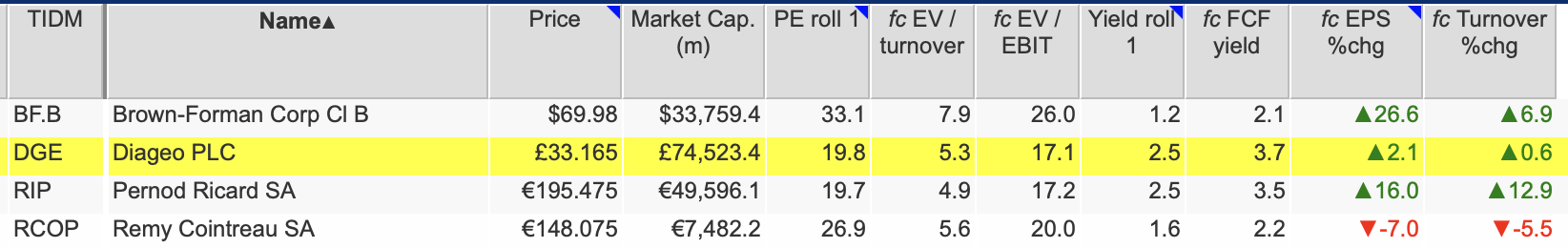

On a relative basis, the shares trade at a significant discount to Brown-Forman and Remy Cointreau when looking at the share price compared with the next twelve months’ expected EPS.

Diageo valuation vs peers

Source: SharePad

That doesn’t mean that Diageo shares are cheap in absolute terms but they are cheaper than they have been for some time.

The lacklustre short-term growth outlook may mean this is justified, but if the company can accelerate its growth rate, then it could still offer patient investors steady and dependable returns going forward.

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.