A look at a possible reason for the outperformance of large-cap US technology stocks, and what might reverse the trend in favour of smaller companies. Stocks covered: ZOO, KETL, TMG.

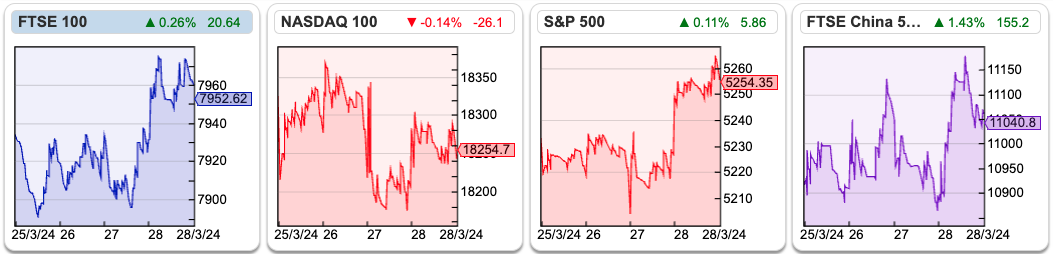

The FTSE 100 was up +0.9% last week to 7,952. Nasdaq100 was down -0.3% while the S&P500 was up by a similar amount. China resumed its downward path with both the Hang Seng -1.9% and FTSE China 50 down -1.2%. Both Brent Crude and gold rose +2.3%, the former to $87 per barrel while gold continued to hit a new high of $2,193 per ounce.

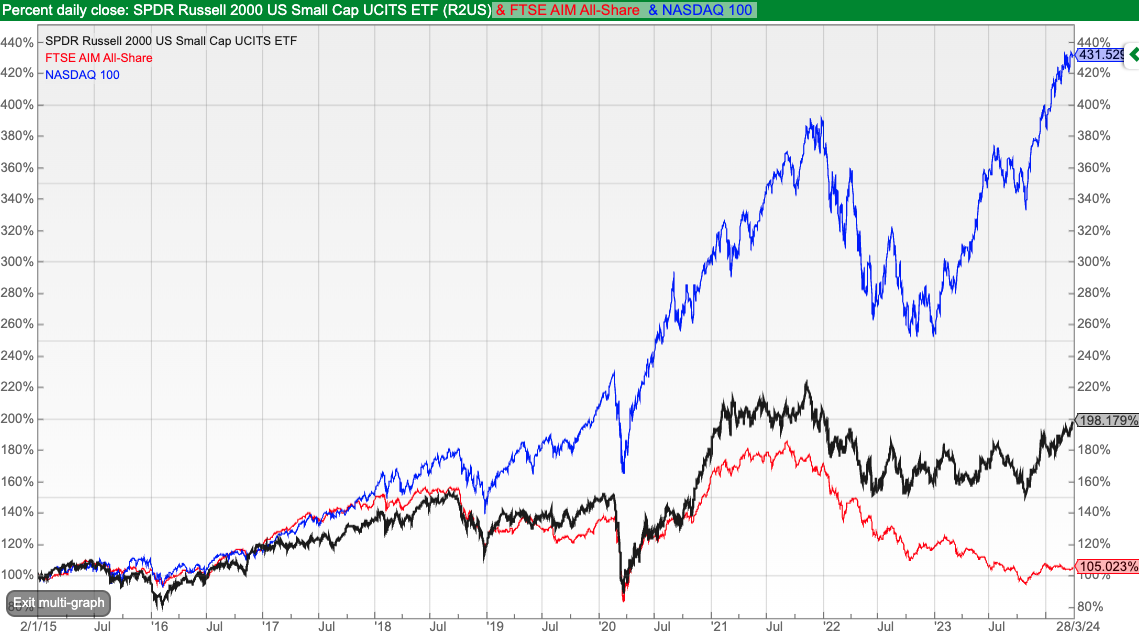

Russell Clark, a former long-short hedge fund manager has an interesting theory about why large-cap US stocks are outperforming their smaller peers. Sharepad’s multigraph feature shows that the Nasdaq100 (blue) has more than quadrupled, versus the Russell 2000 (black) of smaller companies which has not quite doubled over the last decade. US large-cap stocks have done even better compared to AIM (red).

He suggests that the American political system regulates competition tightly in consumer-facing businesses, keeping costs down for voters. However, the rules are different for corporates, who the government doesn’t protect against cartel-like pricing. He gives healthcare as an example, which in the US is typically paid for by a corporate employer, and so a system developed where list prices are extraordinarily high. Americans are spending roughly double GDP per capita on healthcare than other developed countries, yet receive worse health outcomes (for instance life expectancy in the US is just below that of Albania).

He points out that: “the leading companies in the US combine a free or low-cost consumer-facing business, with a heavily consolidated and powerful business facing business. Meta, Google, Apple, Visa, Mastercard, and Walmart all have these two-sided businesses.”

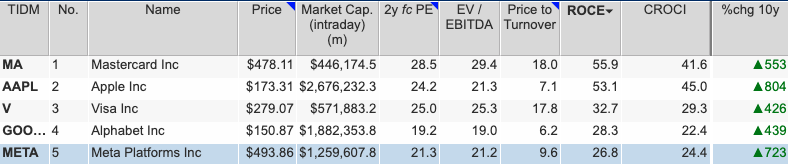

So while we might think of Apple as a consumer brand, the App Store makes a high margin from other businesses, as do Google and Meta through advertising. Visa and Mastercard also operate a similar model, where the consumer doesn’t pay the price, the corporation does. Over the last 10 years, these 5 ‘Goliath’ stocks are up on average over 580%. The average RoCE is 39%, and they trade on well over 20x 2-year forecast PER and EV/EBITDA, as the table I created from Sharepad shows.

Thinking in terms of a “cartel boom” rather than a “tech and innovation boom” helps explain the recent poor performance of ARK’s innovation ETF, which hasn’t kept pace with these corporate Goliaths. ARKK (red in the chart below) is not invested in these established cartels.

The exploitative nature of large corporates explains why small business optimism surveys in the US have been collapsing, he says. This trend can’t continue forever in a functional democracy, as concentrated corporate power is unpopular with the majority of voters. Hence one trade would be to go along with smaller companies, which historically have outperformed until the most recent decade. Russell Clark’s analysis is focused on US corporate power, but I think the idea that we are approaching a turning point for small v large cap performance could also apply globally. I noted last week that the Vanguard Global Small Cap Index (VIGSCA) was up +20% since October, and looked to be forming a positive trend.

This week I look at ZOO Digital’s positive trading update, Strix and The Mission Group’s FY results. First though, 5 brief comments about companies that I’ve mentioned recently that also made announcements last week:

- CML announced a profit warning last week, with Progressive cutting PBT by -24% FY Mar 2024F and not publishing any FY Mar 2025F forecast. I own this and I am disappointed, but net cash is currently 38% of the market cap, so the profit warning is unlikely to be a disaster. I wrote about CML here.

- RBGP has sold Convex Capital back to management for £2.6m, the litigation finance company bought the corporate finance advisor in September 2019, for £22m total consideration. Corporate financiers tend to be very good at timing when to sell their own business to “dumb money”. I wrote about RBGP here.

- DPP raised yet more capital, this time the Polish pizza company raised £20m at 9.92p, a 20% discount to the previous day’s close. That said, DPP now looks like a viable business so there could be upside if management can demonstrate profitable growth. I wrote about DPP here.

- Julian Dunkerton announced he does not intend to make an offer for Superdry. Instead, he is looking at a deeply discounted equity raise, conditional on him delisting the company. I got this one wrong, but cut my losses when the PUSU was extended. I wrote about SDRY here.

- Adnams, the Suffolk brewery, announced the appointment of my friend Jenny Hanlon as Chief Exec. The RNS lists Jenny’s previous employers as Ernst & Young, Barclays and Greene King, among others, but she left off her experience working in equity research at Credit Suisse from her corporate biography. Readers will know I enjoy flagging ‘voluntary disclosure’ and what information management choose to leave out from RNS’s. I wrote about Adnams here.

ZOO Digital Trading Update FY March 2024

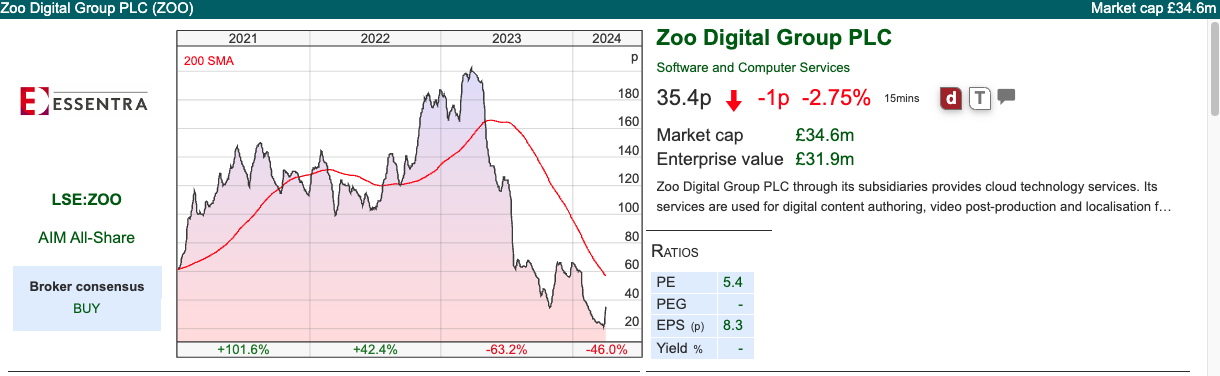

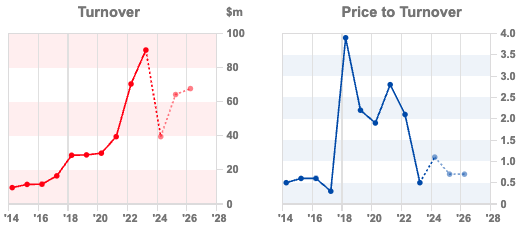

This translation services group, that provides foreign language subtitles and dubbing, for the film and TV industry, has suffered from the recent Hollywood Screenplay Writers’ Guild strike and a general reduction in spend by streaming companies following the pandemic. Management have revised guidance upwards for FY Mar 2024F, with revenues of at least $40m (previous consensus revenue forecasts of $38m, and EBITDA loss of $14m) and say that their EBITDA loss should be smaller than expected. They also expect net cash to be $3m, versus $1.6m previous consensus forecast. The shares responded by bouncing +50% on the day of the RNS.

Outlook for FY March 2025F: Management say that the order book for Q1 (ie Apr, May and Jun) is up +30%, versus Q4 of the previous financial year (ie Jan, Feb, Mar). That means they are expecting a strong recovery in the coming H1, plus the benefit of reducing direct staff costs by 30%. They also said they had been appointed by a major film and TV distributor as a primary vendor, with firm orders expected to be received in the coming weeks.

Forecast changes: Progressive published a research note on the morning of the RNS, revising up FY Mar 2024F numbers to reflect guidance, but leaving FY Mar 2025F largely unchanged. In the past, I have flagged when companies like SDI, ETP, SCE and Eleco have made upbeat statements in their RNSs, but asked their brokers to cut numbers. ZOO looks to be a similar example, though they are quietly asking analysts to keep forecasts unchanged rather than reduce next year’s EPS, presumably so that in 6 months’ time management can announce another “ahead of expectations” RNS.

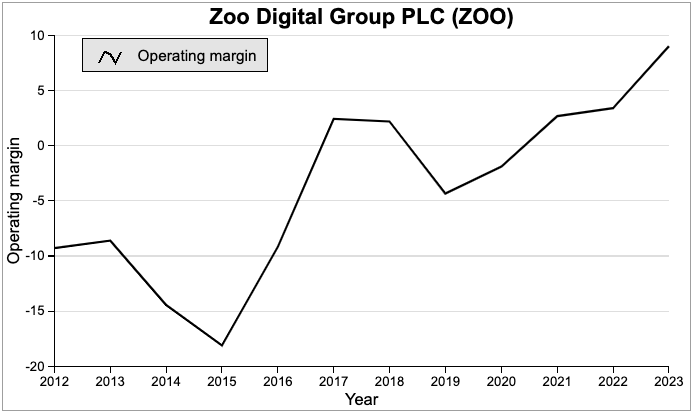

Opinion: I’m not convinced that localisation services for TV are as value added (that is high margin) as in computer games localisation, which is Keywords Studios’ niche. ZOO’s operating margin has averaged minus 3.4% over the last decade, albeit with steady progress in the last few years. For comparison, the same ratio for KWS has averaged 13% over the last decade. That said, similar to Facilities by ADF, which I looked at in March, the disruption from the strike seems to be temporary, and the shares are off -85% since their peak in March last year. So this could be an interesting recovery play, if you feel confident that now revenue is forecast to recover to $66m in FY Mar 2025F, the margin will approach double digits as it did in FY Mar 2023.

Strix FY Dec 2023 Results

This kettle safety controls business reported FY Dec revenue +35% to £144m, and statutory PBT +10% to £18m. Management’s adjusted PBT figure, which is £4m higher at £21m, was down -1%. There are twelve adjusting items over the last two years, which seems bizarre for a business this size. The three largest were i) acquisition-related costs: £2.1m (£4m previous year) ii) goodwill amortisation £1.3m (zero the previous year) and iii) restructuring and reorganisation costs of £400K. Strix has incurred “exceptional” reorganisation costs every year since at least 2014.

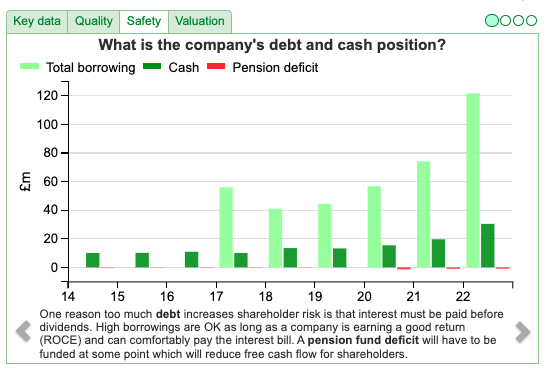

Net debt ex-lease liabilities was £84m, which is slowly coming down but still looks high in the context of the group. Management say that they are focused on cash generation to support debt reduction which means no dividends in FY Dec 2024F, but with a planned return to a sustainable dividend pay-out ratio of 30% of adjusted PAT in FY Dec 2025F. The business is operating just within its banking covenants: net debt leverage 2.19x (max limit 2.25x), debt service ratio 1.18x (min limit 1.1x). A new facility was agreed on 22 March, with a maximum net debt leverage of 2.75x, but management expects the ratio to be less than 2.0x by the end of FY Dec 2024.

Background: Strix is the world’s leading supplier of kettle controls, they make a bi-metal blade that ‘clicks’ when water reaches boiling point and automatically turns off the kettle. The business has been going since the 1960s, but when the founder John Taylor retired, he sold it to Private Equity in 2005. Predictably PE loaded it up with debt and listed it on AIM at 100p in 2017. Some of the proceeds went to paying down debt £145m of shareholder loans, which appeared within other liabilities, so are not included in Sharepad’s chart above. Net debt was £46m FY Dec 2017, the first full set of results after listing. The share price peaked at just under 400p during the vaccine rally, however there then followed a series of profit warnings, which Maynard wrote up here.

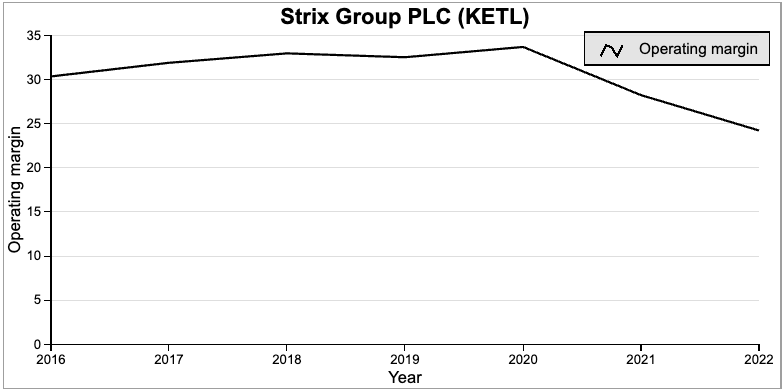

The group claims a 56% global market share by value. The company’s share within regions that enforce higher kettle safety standards — such as the UK, the EU and the USA — is even higher at 75%. Such a dominant market share means that the company can make a decent margin, although this has been trending down from 34% FY Dec 2020 to 22% just reported (not yet updated on Sharepad’s charts).

Most people already own a kettle though, so revenue progress has been unimpressive until the last couple of years, helped by the acquisition of LAICA in 2021, which cost £24m and added sales of £22m and Billi at the end of 2022, which cost £38m and added £41m of revenues. LAICA is an Italian design and manufacturer of sophisticated kettles and Billi is an Australian brand of boiling, chilled and sparkling water systems, by which I think they mean that they make those taps that pour boiling, filtered or fizzy water. I’ve seen this in someone’s house in London and didn’t realise how expensive they were, according to this website.

Without those two acquisitions, revenues would be around £60m lower, so the core business has shown lacklustre growth since the 2017 IPO.

Valuation: On Equity Development’s forecasts the shares are trading on a PER of 7x FY Mar 2024F and 2025F. On an EV/EBITDA basis, the shares are on 5x. That looks cheap, but maybe “cheap for a reason”.

Opinion: I think the investment case rests on your view of the recent acquisitions. The core business is low growth, decent margin and relatively easy to value. If you think consumers will increasingly spend their money on fancy LAICA kettles, which cost £70 on Amazon, and Billi taps which can cost in the thousands then this could be very good. Very few of my friends are in this category though, so I will avoid for now, but keep an open mind if we start seeing organic growth and debt reduction faster than planned.

The Mission Group FY Dec 2023 Results

This marketing group released their FY results on Thursday afternoon after the market close, at 17:30. I can’t think of a good reason why management would release their results at this time, but I can imagine a few bad reasons. TMG had already put out a profit warning, saying that net debt had ballooned to £25.5m, and they would breach banking covenants.

Revenue on continuing operations was up +9%, (or +2% on a like-for-like basis) and they reported a £11m loss before tax. Net bank debt was £15m at December, but has grown to £20m as of 29th February. They are in breach of covenants but have received a waiver for this March. Readers should know that when management quote “net bank debt” it is always worth searching through the RNS to see what other liabilities are. At the end of 2023, the group had £5.5m of acquisition obligations (ie paying staff from companies that they had acquired in previous years) payable in a mixture of cash and shares. £1.75m of this is due in March and April of this year. There is also £1.8m of HMRC tax liabilities.

Balance sheet: They wrote down the value of a couple of prior year acquisitions (Story, Krow) by £10m, but there remains £91m of intangible assets on the balance sheet, versus net assets of £76m, so tangible book value is negative.

In the “going concern” statement, management say that because of actions taken in Q4 last year, they are well placed to recover previous levels of profitability and cash generation. They have refinanced their debt facility with NatWest. So the Board believe it is appropriate to adopt the going concern basis for their financial statements. They have already made one disposal, Pathfindr (£0.3m profit on disposal), but say if the downturn was more sustained, they would look to make more disposals. In note 20 of the accounts they talk about a “de-leveraging event”, which they say is an equity raise of £4m or more, no later than 30th June 2024.

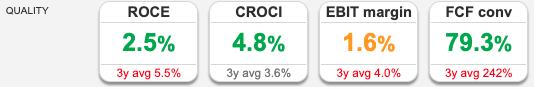

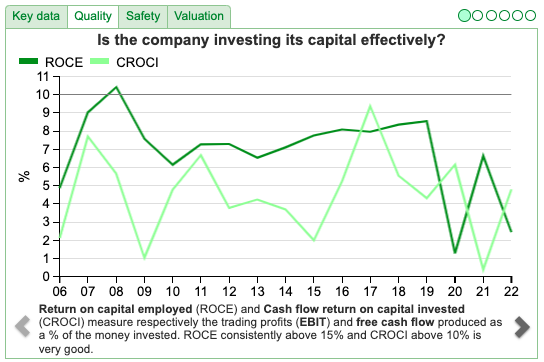

Growth Share Scheme: Management have enjoyed a “Growth Share Scheme” which awarded shares for hitting a share price target of 75p, which resulted in 7% dilution to shareholders in 2020. They followed up with a further scheme, but this time with a price target of 150p and 4% dilution, which didn’t convert last year. They say that these “Growth Share Schemes” are necessary to retain talented employees, but looking at the company’s track record of RoCE would imply that the “talent” has consistently failed to generate returns above the CoE. Perhaps they should let these people leave? This talent of earning high rewards while failing to deliver returns to shareholders suggests that TMG’s employees could be offered senior management positions running UK banks.

Outlook: Management say FY Dec 2024F has started in line with expectations, and point to European football and the Olympics as likely to drive a pick-up in marketing spend this year. Historically, TMG has been H2 weighted, as that is when marketing budgets tend to be spent.

Valuation: The outlook statement doesn’t suggest significant downgrades, so the shares look very cheap on a PER of 3x FY Dec 2024F and 2025F, though there could be some dilution for shareholders who don’t participate in the suggested “de-leveraging event”.

Opinion: I bought into this at 20p per share a decade and a half ago, and held on as it rose by 5x to above 100p just before the pandemic. I’ve now watched it retreat all the way back down again. The shares tend to trade on a mid-single-digit PER ratio, partly because the track record of RoCE is poor (peak RoCE over the last decade was just 8.4% in 2018), so growth isn’t creating any value for shareholders. Recent events also demonstrate that investor scepticism has been justified. I’m not planning to sell now but I am very disappointed that management have made the same mistake as 2008-2009 when they over-stretched the balance sheet at exactly the wrong point in the cycle.

Notes

Bruce owns shares in TMG, CML and Adnams

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 02/04/2024 | ZOO, KETL, TMG | Challenging Goliath

The FTSE 100 was up +0.9% last week to 7,952. Nasdaq100 was down -0.3% while the S&P500 was up by a similar amount. China resumed its downward path with both the Hang Seng -1.9% and FTSE China 50 down -1.2%. Both Brent Crude and gold rose +2.3%, the former to $87 per barrel while gold continued to hit a new high of $2,193 per ounce.

Russell Clark, a former long-short hedge fund manager has an interesting theory about why large-cap US stocks are outperforming their smaller peers. Sharepad’s multigraph feature shows that the Nasdaq100 (blue) has more than quadrupled, versus the Russell 2000 (black) of smaller companies which has not quite doubled over the last decade. US large-cap stocks have done even better compared to AIM (red).

He suggests that the American political system regulates competition tightly in consumer-facing businesses, keeping costs down for voters. However, the rules are different for corporates, who the government doesn’t protect against cartel-like pricing. He gives healthcare as an example, which in the US is typically paid for by a corporate employer, and so a system developed where list prices are extraordinarily high. Americans are spending roughly double GDP per capita on healthcare than other developed countries, yet receive worse health outcomes (for instance life expectancy in the US is just below that of Albania).

He points out that: “the leading companies in the US combine a free or low-cost consumer-facing business, with a heavily consolidated and powerful business facing business. Meta, Google, Apple, Visa, Mastercard, and Walmart all have these two-sided businesses.”

So while we might think of Apple as a consumer brand, the App Store makes a high margin from other businesses, as do Google and Meta through advertising. Visa and Mastercard also operate a similar model, where the consumer doesn’t pay the price, the corporation does. Over the last 10 years, these 5 ‘Goliath’ stocks are up on average over 580%. The average RoCE is 39%, and they trade on well over 20x 2-year forecast PER and EV/EBITDA, as the table I created from Sharepad shows.

Thinking in terms of a “cartel boom” rather than a “tech and innovation boom” helps explain the recent poor performance of ARK’s innovation ETF, which hasn’t kept pace with these corporate Goliaths. ARKK (red in the chart below) is not invested in these established cartels.

The exploitative nature of large corporates explains why small business optimism surveys in the US have been collapsing, he says. This trend can’t continue forever in a functional democracy, as concentrated corporate power is unpopular with the majority of voters. Hence one trade would be to go along with smaller companies, which historically have outperformed until the most recent decade. Russell Clark’s analysis is focused on US corporate power, but I think the idea that we are approaching a turning point for small v large cap performance could also apply globally. I noted last week that the Vanguard Global Small Cap Index (VIGSCA) was up +20% since October, and looked to be forming a positive trend.

This week I look at ZOO Digital’s positive trading update, Strix and The Mission Group’s FY results. First though, 5 brief comments about companies that I’ve mentioned recently that also made announcements last week:

ZOO Digital Trading Update FY March 2024

This translation services group, that provides foreign language subtitles and dubbing, for the film and TV industry, has suffered from the recent Hollywood Screenplay Writers’ Guild strike and a general reduction in spend by streaming companies following the pandemic. Management have revised guidance upwards for FY Mar 2024F, with revenues of at least $40m (previous consensus revenue forecasts of $38m, and EBITDA loss of $14m) and say that their EBITDA loss should be smaller than expected. They also expect net cash to be $3m, versus $1.6m previous consensus forecast. The shares responded by bouncing +50% on the day of the RNS.

Outlook for FY March 2025F: Management say that the order book for Q1 (ie Apr, May and Jun) is up +30%, versus Q4 of the previous financial year (ie Jan, Feb, Mar). That means they are expecting a strong recovery in the coming H1, plus the benefit of reducing direct staff costs by 30%. They also said they had been appointed by a major film and TV distributor as a primary vendor, with firm orders expected to be received in the coming weeks.

Forecast changes: Progressive published a research note on the morning of the RNS, revising up FY Mar 2024F numbers to reflect guidance, but leaving FY Mar 2025F largely unchanged. In the past, I have flagged when companies like SDI, ETP, SCE and Eleco have made upbeat statements in their RNSs, but asked their brokers to cut numbers. ZOO looks to be a similar example, though they are quietly asking analysts to keep forecasts unchanged rather than reduce next year’s EPS, presumably so that in 6 months’ time management can announce another “ahead of expectations” RNS.

Opinion: I’m not convinced that localisation services for TV are as value added (that is high margin) as in computer games localisation, which is Keywords Studios’ niche. ZOO’s operating margin has averaged minus 3.4% over the last decade, albeit with steady progress in the last few years. For comparison, the same ratio for KWS has averaged 13% over the last decade. That said, similar to Facilities by ADF, which I looked at in March, the disruption from the strike seems to be temporary, and the shares are off -85% since their peak in March last year. So this could be an interesting recovery play, if you feel confident that now revenue is forecast to recover to $66m in FY Mar 2025F, the margin will approach double digits as it did in FY Mar 2023.

Strix FY Dec 2023 Results

This kettle safety controls business reported FY Dec revenue +35% to £144m, and statutory PBT +10% to £18m. Management’s adjusted PBT figure, which is £4m higher at £21m, was down -1%. There are twelve adjusting items over the last two years, which seems bizarre for a business this size. The three largest were i) acquisition-related costs: £2.1m (£4m previous year) ii) goodwill amortisation £1.3m (zero the previous year) and iii) restructuring and reorganisation costs of £400K. Strix has incurred “exceptional” reorganisation costs every year since at least 2014.

Net debt ex-lease liabilities was £84m, which is slowly coming down but still looks high in the context of the group. Management say that they are focused on cash generation to support debt reduction which means no dividends in FY Dec 2024F, but with a planned return to a sustainable dividend pay-out ratio of 30% of adjusted PAT in FY Dec 2025F. The business is operating just within its banking covenants: net debt leverage 2.19x (max limit 2.25x), debt service ratio 1.18x (min limit 1.1x). A new facility was agreed on 22 March, with a maximum net debt leverage of 2.75x, but management expects the ratio to be less than 2.0x by the end of FY Dec 2024.

Background: Strix is the world’s leading supplier of kettle controls, they make a bi-metal blade that ‘clicks’ when water reaches boiling point and automatically turns off the kettle. The business has been going since the 1960s, but when the founder John Taylor retired, he sold it to Private Equity in 2005. Predictably PE loaded it up with debt and listed it on AIM at 100p in 2017. Some of the proceeds went to paying down debt £145m of shareholder loans, which appeared within other liabilities, so are not included in Sharepad’s chart above. Net debt was £46m FY Dec 2017, the first full set of results after listing. The share price peaked at just under 400p during the vaccine rally, however there then followed a series of profit warnings, which Maynard wrote up here.

The group claims a 56% global market share by value. The company’s share within regions that enforce higher kettle safety standards — such as the UK, the EU and the USA — is even higher at 75%. Such a dominant market share means that the company can make a decent margin, although this has been trending down from 34% FY Dec 2020 to 22% just reported (not yet updated on Sharepad’s charts).

Most people already own a kettle though, so revenue progress has been unimpressive until the last couple of years, helped by the acquisition of LAICA in 2021, which cost £24m and added sales of £22m and Billi at the end of 2022, which cost £38m and added £41m of revenues. LAICA is an Italian design and manufacturer of sophisticated kettles and Billi is an Australian brand of boiling, chilled and sparkling water systems, by which I think they mean that they make those taps that pour boiling, filtered or fizzy water. I’ve seen this in someone’s house in London and didn’t realise how expensive they were, according to this website.

Without those two acquisitions, revenues would be around £60m lower, so the core business has shown lacklustre growth since the 2017 IPO.

Valuation: On Equity Development’s forecasts the shares are trading on a PER of 7x FY Mar 2024F and 2025F. On an EV/EBITDA basis, the shares are on 5x. That looks cheap, but maybe “cheap for a reason”.

Opinion: I think the investment case rests on your view of the recent acquisitions. The core business is low growth, decent margin and relatively easy to value. If you think consumers will increasingly spend their money on fancy LAICA kettles, which cost £70 on Amazon, and Billi taps which can cost in the thousands then this could be very good. Very few of my friends are in this category though, so I will avoid for now, but keep an open mind if we start seeing organic growth and debt reduction faster than planned.

The Mission Group FY Dec 2023 Results

This marketing group released their FY results on Thursday afternoon after the market close, at 17:30. I can’t think of a good reason why management would release their results at this time, but I can imagine a few bad reasons. TMG had already put out a profit warning, saying that net debt had ballooned to £25.5m, and they would breach banking covenants.

Revenue on continuing operations was up +9%, (or +2% on a like-for-like basis) and they reported a £11m loss before tax. Net bank debt was £15m at December, but has grown to £20m as of 29th February. They are in breach of covenants but have received a waiver for this March. Readers should know that when management quote “net bank debt” it is always worth searching through the RNS to see what other liabilities are. At the end of 2023, the group had £5.5m of acquisition obligations (ie paying staff from companies that they had acquired in previous years) payable in a mixture of cash and shares. £1.75m of this is due in March and April of this year. There is also £1.8m of HMRC tax liabilities.

Balance sheet: They wrote down the value of a couple of prior year acquisitions (Story, Krow) by £10m, but there remains £91m of intangible assets on the balance sheet, versus net assets of £76m, so tangible book value is negative.

In the “going concern” statement, management say that because of actions taken in Q4 last year, they are well placed to recover previous levels of profitability and cash generation. They have refinanced their debt facility with NatWest. So the Board believe it is appropriate to adopt the going concern basis for their financial statements. They have already made one disposal, Pathfindr (£0.3m profit on disposal), but say if the downturn was more sustained, they would look to make more disposals. In note 20 of the accounts they talk about a “de-leveraging event”, which they say is an equity raise of £4m or more, no later than 30th June 2024.

Growth Share Scheme: Management have enjoyed a “Growth Share Scheme” which awarded shares for hitting a share price target of 75p, which resulted in 7% dilution to shareholders in 2020. They followed up with a further scheme, but this time with a price target of 150p and 4% dilution, which didn’t convert last year. They say that these “Growth Share Schemes” are necessary to retain talented employees, but looking at the company’s track record of RoCE would imply that the “talent” has consistently failed to generate returns above the CoE. Perhaps they should let these people leave? This talent of earning high rewards while failing to deliver returns to shareholders suggests that TMG’s employees could be offered senior management positions running UK banks.

Outlook: Management say FY Dec 2024F has started in line with expectations, and point to European football and the Olympics as likely to drive a pick-up in marketing spend this year. Historically, TMG has been H2 weighted, as that is when marketing budgets tend to be spent.

Valuation: The outlook statement doesn’t suggest significant downgrades, so the shares look very cheap on a PER of 3x FY Dec 2024F and 2025F, though there could be some dilution for shareholders who don’t participate in the suggested “de-leveraging event”.

Opinion: I bought into this at 20p per share a decade and a half ago, and held on as it rose by 5x to above 100p just before the pandemic. I’ve now watched it retreat all the way back down again. The shares tend to trade on a mid-single-digit PER ratio, partly because the track record of RoCE is poor (peak RoCE over the last decade was just 8.4% in 2018), so growth isn’t creating any value for shareholders. Recent events also demonstrate that investor scepticism has been justified. I’m not planning to sell now but I am very disappointed that management have made the same mistake as 2008-2009 when they over-stretched the balance sheet at exactly the wrong point in the cycle.

Notes

Bruce owns shares in TMG, CML and Adnams

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.