Bruce looks at the divergent performance of the Nasdaq100 +22% since its October lows, versus AIM which is flat over the same time period. Companies covered OMG, GHH, OCN and ADB.

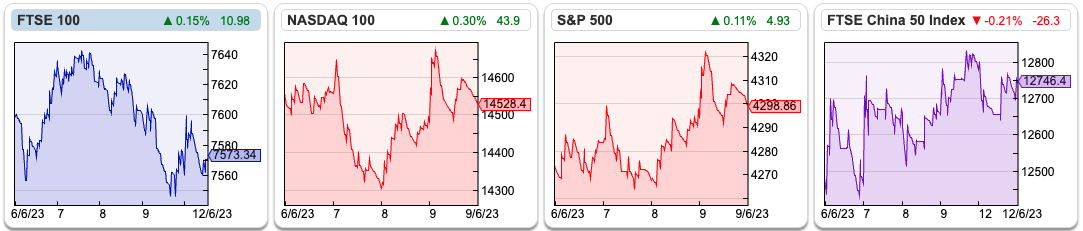

The FTSE 100 fell -0.3% to 7,573 last week. The Nasdaq100 and S&P500 were both flat over the last 5 trading days. A week ago market commentators declared the Nasdaq100 in a bull market, as the US tech index has now rallied over +20% from its lows. For AIM investors this is still very much a bear market, with the index down -40% from its Sept 2021 peak. Both indices rallied sharply together from the March 2020 lows, then rolled over as the vaccine rally ran out of steam in the face of higher inflation. Yet performance has bifurcated in 2023, as the graph below shows.

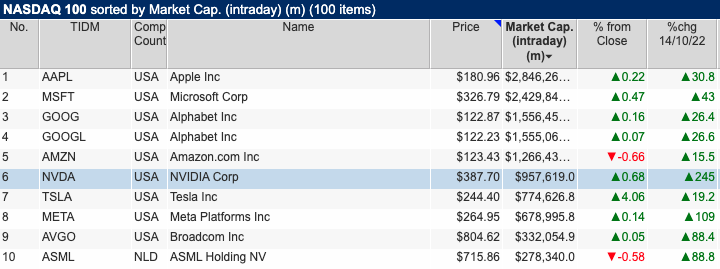

Nasdaq has benefited from excitement about Artificial Intelligence, with Nvidia the best-performing stock up +245% since mid-October last year. The GPU chip maker is the 6th largest stock on Nasdaq, and the other > $500bn stocks are all up strongly. Meta has doubled, while the two weakest performers were Tesla and Amazon, which were still up +19% and +16% respectively.

The two largest constituents on AIM Jet2 (market cap £2.8bn) and Burford (market cap £2.3bn) have done well, up +80% and +60%, but the broader index has failed to keep up. Four of the top-performing AIM stocks are mining companies: Kodal Minerals, Hummingbird Resources, and Zanaga Iron Core. These shares are up by between +140% to +313%, which is impressive even in the context of Nasdaq100’s top performers. However, these mining companies have market caps of around £50m- £150m, so have failed to make much contribution to the overall AIM index performance, which is flat versus mid-October last year. Lord Lee spoke at Mello last month, beginning with the observation: “You make your money in bear markets, you just don’t know it until a couple of years later.”

This week I look at Oxford Metrics, where Progressive have raised forecasts for this year, but not for next year. Plus Gooch & Housego, where the new Chief Exec seems to be executing a turnaround to plan, Ocean Wilsons which is conducting a strategic review and Suffolk brewery Adnams FY Dec results.

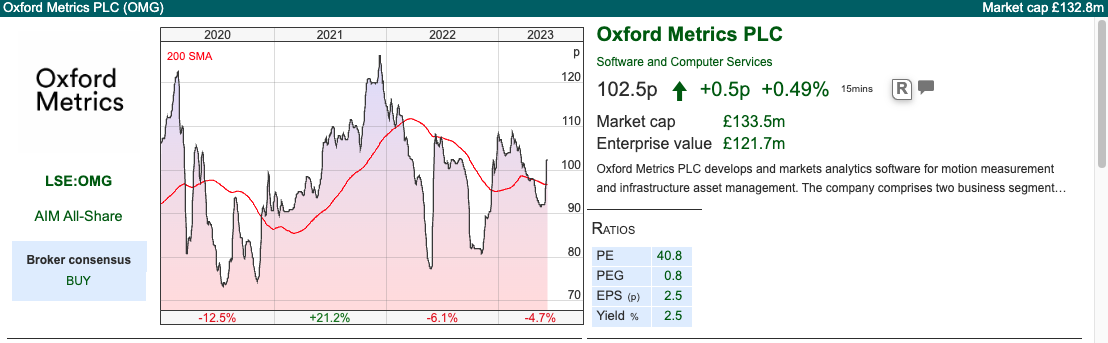

Oxford Metrics H1 to March

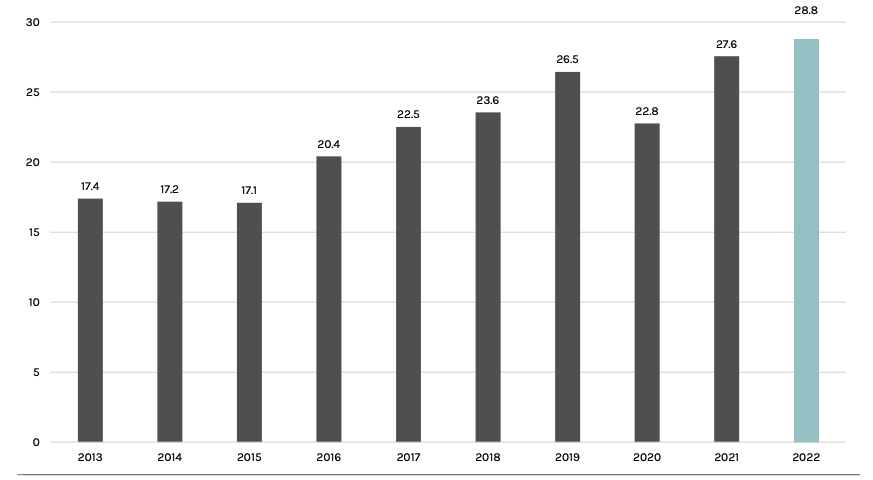

OMG sold its loss-making Yotta division for £54m in cash last year (23% of revenue, £400K loss FY Mar 2022). Following the disposal, they are left with Vicon, which does motion measurement analysis for health (eg Guy’s Hospital) entertainment (film companies like Disney but also computer game companies like Electronic Arts and Activision) engineering (MIT, NASA). Sharepad shows the track record including the business that they sold, instead below is the 10-year track record of revenues of just the Vicon business, taken from management’s FY Sept 2022 slide deck.

As a former management consultant and connoisseur of voluntary disclosure, I award full marks to whoever did the graph above. Positioning the £28.8m above the horizontal £30m line means the trend looks much more positive than the previous year’s £27.6m, rather than the rather lacklustre +4% growth reported last year. If the company achieves Progressive’s £39m forecast for FY Sept 2023 implies +39% y-o-y growth then that is genuinely to be applauded.

All four divisions have been performing well, but demand looks particularly strong in Entertainment (film, TV and computer games) with revenue rising 2.75x to £11m. Group adj PBT was up 13x to £4.1m – the adjustments include £0.5m of prior year central overheads that have been allocated to the division that they have retained, but even on a statutory basis PBT was up 6x to £3.9m. At the end of March, they had £64m of net cash, which is just under half of the market cap.

Outlook statement: Management reiterate their 5-year plan (announced Oct 2021) which aims to increase revenues 2.5x (ie to £72m) and deliver 15% adjusted profits (ie above £10m). The commentary also says: “Considering the current order book, the expected rise in the cost base and with supply chain challenges diminished, the Board believes that Oxford Metrics is well placed to deliver full-year results ahead of current market expectations.”

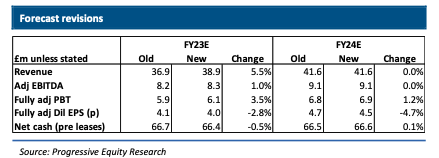

Forecasts: Progressive have raised revenue for FY Sept 2023F by +5% to £39m. However, their research note also points to higher headcount-related costs and to me it looks like Progressive’s FY Sept 2023F PBT would have been unchanged if the p&l hadn’t been helped by increased income in the rising interest rate environment on their £64m of cash. Progressive haven’t raised FY Sept 2024F forecasts (revenue and EBITDA are flat and fully diluted EPS is actually cut by -4.7%) which seems odd given the management commentary. One possible interpretation is that management have specifically asked Progressive not to raise next year’s forecast, which results in upwards pressure on numbers and perhaps another “ahead” RNS in 6-12 months from now.

Valuation: The shares are trading on a PER of 23x FY Sept 2024F or 3x revenue the same year. However, if we deduct the £64m of net cash from the market cap, next year’s PER drops to around 11x, which seems very reasonable.

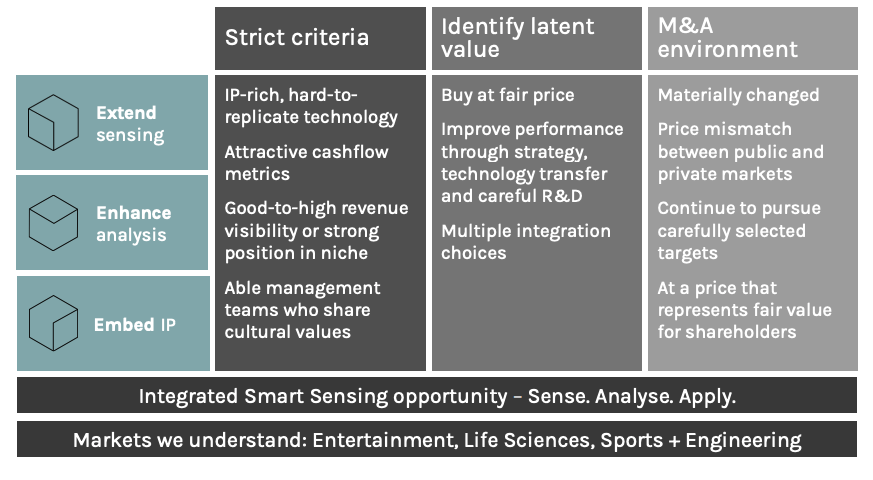

Management are actively looking to do deals (see their slide below outlining their thoughts on M&A). They point out that private market valuations are now becoming more attractive for buyers. Progressive comment that they would be surprised not to see one deal, possibly more, before the company reports again in December.

Opinion: I own this and am happy to continue letting the position run. The cash on the balance sheet ought to mean that the shares hold up well into any H2 market weakness. Rather than the cash, the investment case really depends on continued operational execution, and not overpaying for any duff acquisitions. Having sold Yotta last year for what looks like a good price, I will give management the benefit of the doubt.

Gooch & Housego H1 to March

This international photonics business delivered encouraging results, following the replacement of their CEO last year. Revenue was up +32% to £71m and statutory PBT rose 2.75x to £3.3m. Net debt has more than doubled to £12.9m v £5.9m end of March last year, the majority of the increase seems to be driven by a £5m rise in inventories (ie to protect them from any further supply chain disruption). Including IFRS leases the net debt figure rises to £19m, which looks easily manageable in the context of £151m market cap.

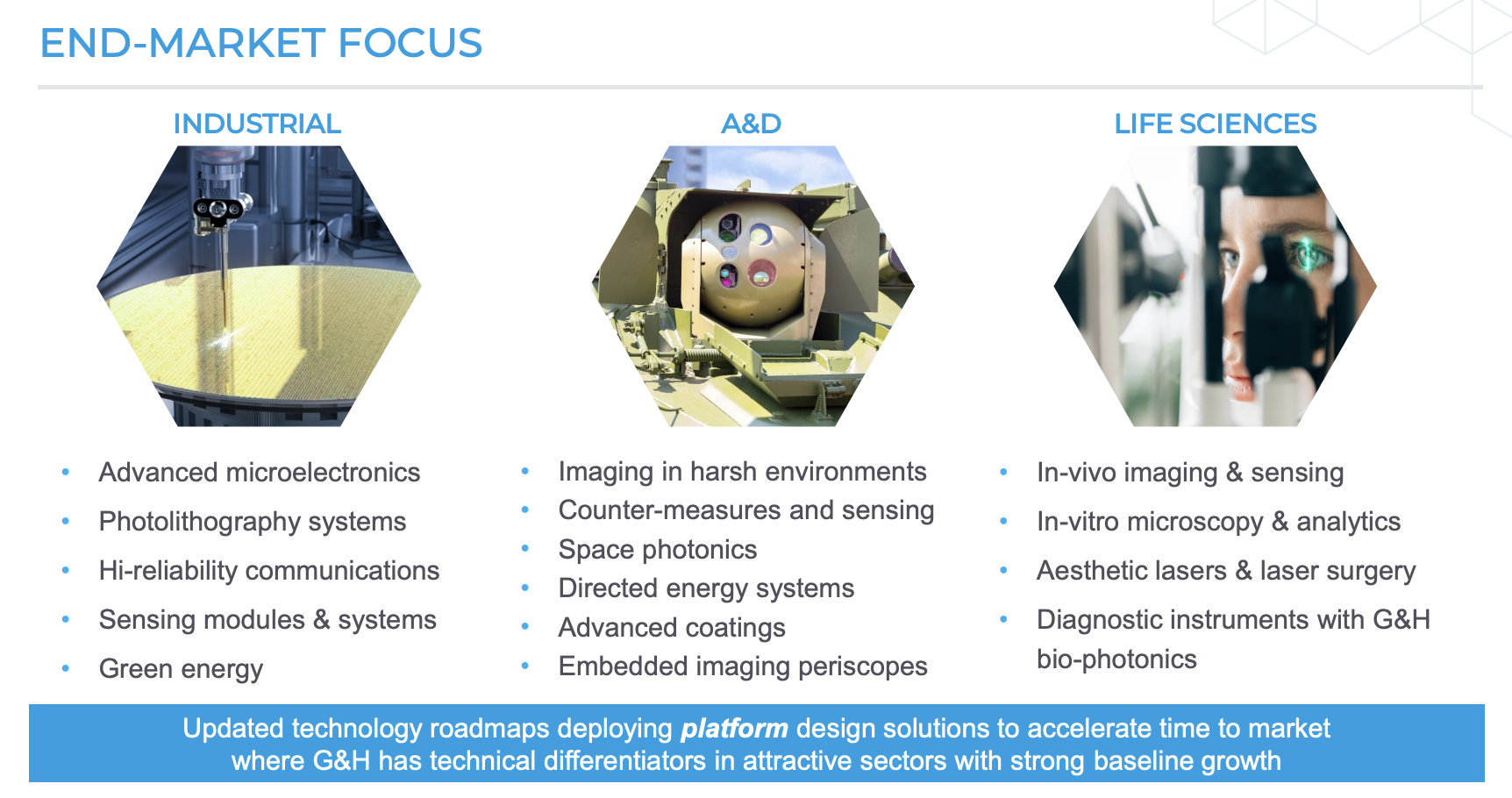

They mention customers in Aerospace and Defence (25% of revenue), Industrial (53% of revenue), Life Sciences (22% of revenue) and even nuclear fusion research.

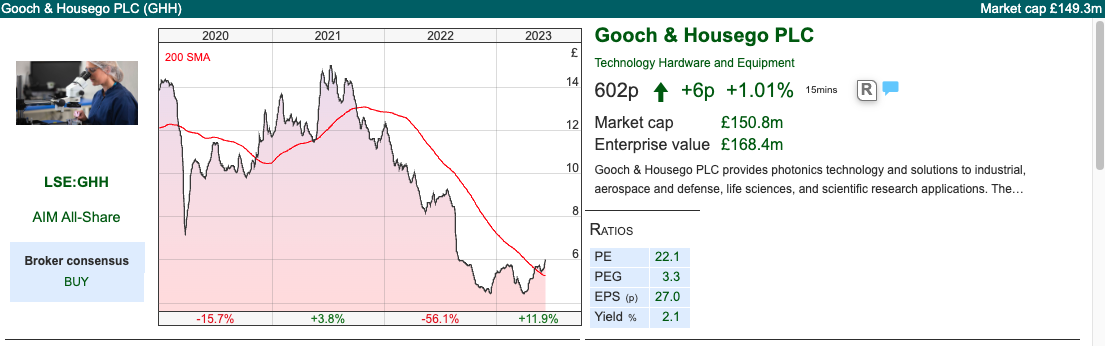

Although GHH are headquartered in Ilminster, Somerset, just 17% of revenue comes from the UK. North and South America is 37%, Europe 24% and Asia Pacific 22%. I last wrote about them when they had a profit warning in August last year. The shares peaked at almost £19 in 2018, when PBT was £10m, but performance has struggled since then and they reported a £2.3m loss FY Sept 2022. Hopefully, the new Chief Exec, Charlie Peppiat can turn things around.

Although GHH are headquartered in Ilminster, Somerset, just 17% of revenue comes from the UK. North and South America is 37%, Europe 24% and Asia Pacific 22%. I last wrote about them when they had a profit warning in August last year. The shares peaked at almost £19 in 2018, when PBT was £10m, but performance has struggled since then and they reported a £2.3m loss FY Sept 2022. Hopefully, the new Chief Exec, Charlie Peppiat can turn things around.

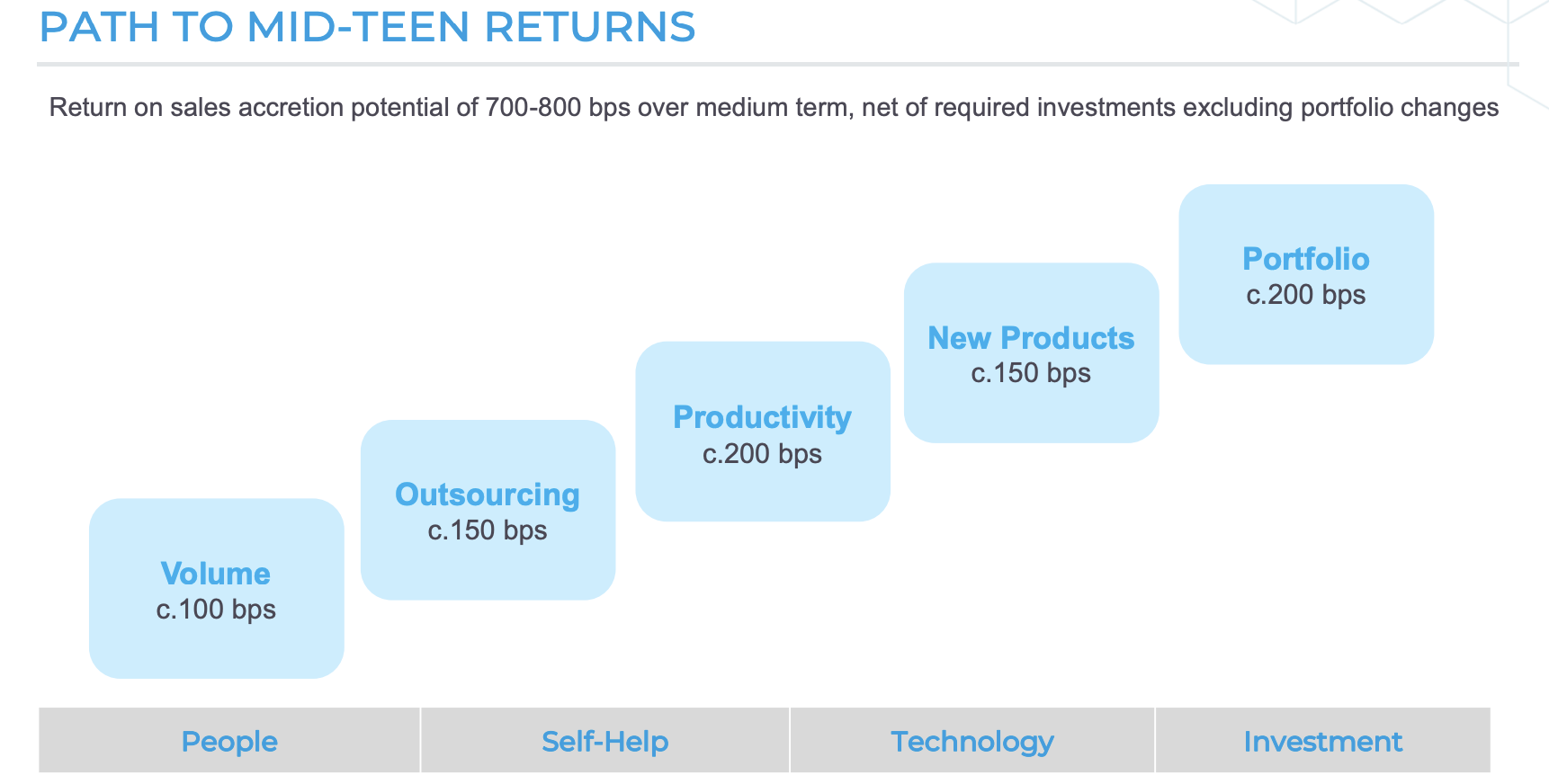

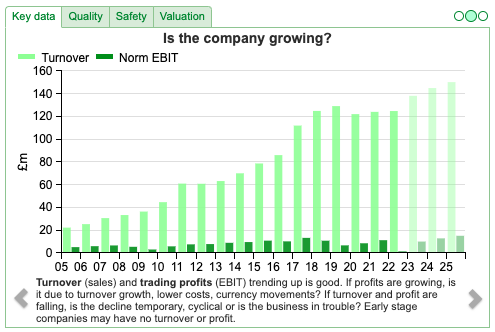

Outlook: He’s completed a strategy review and believes there’s a clear route to mid-teens returns in the medium term. I had assumed that he meant RoCE (3-year historic average is 5.8%), but looking at the presentation I think he means margins (3-year average EBIT margin 7.1%). Using Sharepad to go back further EBIT margin peaked above 14% in Sept 2013, when FY revenues were £63m.

Valuation: GHH is trading on a PER 16x Sept 2024F and 14x Sept 2025F. That isn’t resoundingly cheap for a company that has had a difficult few years, but in the context of the long-term track record looks about fair value.

Opinion: I commented last August that it was too early in the turnaround for me to take a position. The shares subsequently fell to 400p a couple of months ago. They’ve bounced +37% and are now above their 200 SMA, following a trading update at the start of April. I think we’re past the worst, though I don’t have a strong conviction the share price will return to its previous £19 peak.

Ocean Wilsons Strategic Review

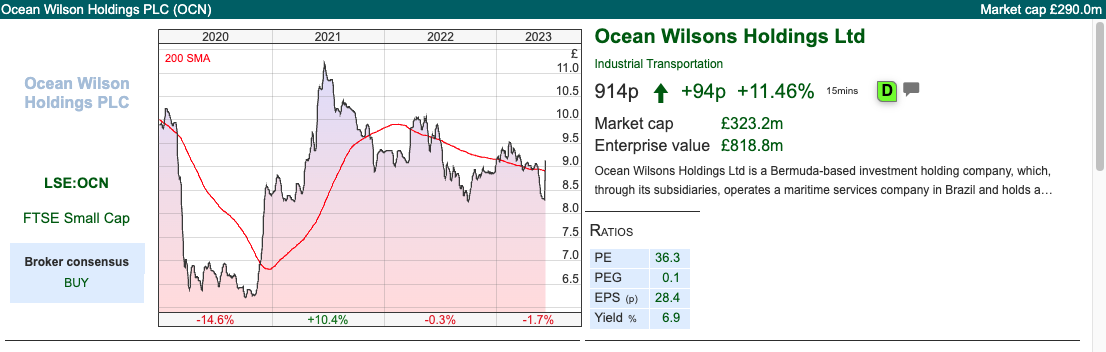

A terse announcement from this Brazilian ports business (Wilson Sons’) and hedge fund portfolio (OWIL), noting speculation in the Brazilian press that they are undertaking a strategic review. Monday’s RNS says that the discussion is at an early stage, and there can be no certainty as to its outcome. The shares were up +11.5% on the morning of the announcement.

Valuation: The company’s most recent Q1 update, released in early May, said that the implied NAV for the company was £17.81, so the shares trade at a 50% discount. The portfolio of hedge funds has increased in value just 20% over the last 10 years, versus the S&P500 which has trebled over the same time period. The hedge funds have also underperformed versus inflation and represent 683p of the holding company’s NAV, versus 1724p if management had bought the S&P index tracker.

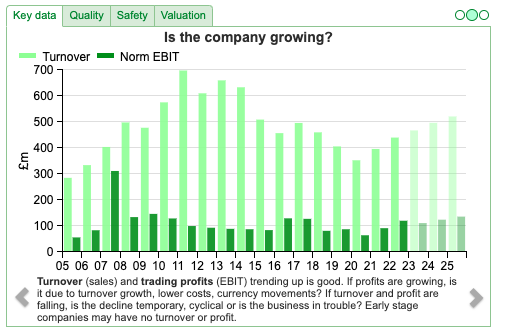

The 57% share in Wilson Sons’ (the Brazilian ports business) was worth 1079p NAV. Sharepad’s chart below shows Wilson Sons’ revenue and EBIT (in US dollars, not pounds) progress over the last couple of decades.

Opinion: Management ought to do something to close the discount to NAV, as I noted last August. Directors William Salmon and Christopher Townsend own 24%, while Hansa Investment and Victualia Ltd Partnership (controlled by the same Directors) take their stake well above 50%.

The reason that the holding company shares (OCN) trades at a discount is that management have a poor track record of allocating capital, in my view. If management had sold their hedge funds and bought an S&P500 index tracker ten years ago they would have received a double benefit from i) the OCN NAV would have been just over £28 ii) the share price discount to NAV would be much smaller.

Adnams FY to Dec

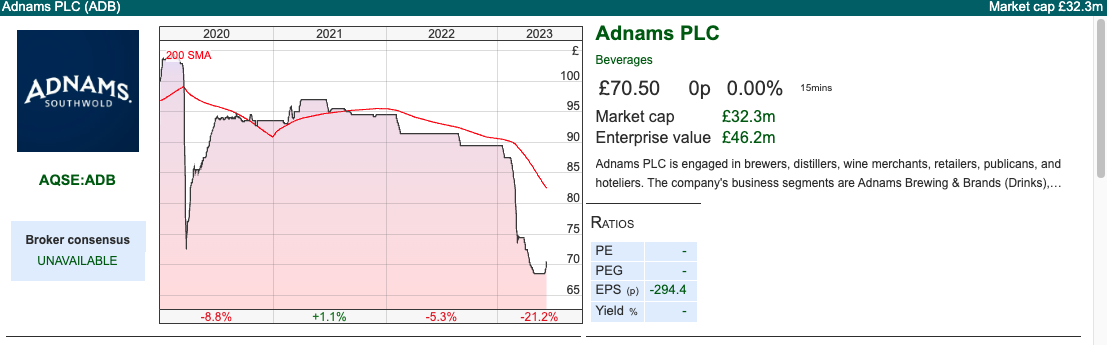

A brief mention of this 150-year-old, family-owned Southwold brewery, as it draws out themes I’ve written about previously: dual share class structure and voluntary disclosure. When I say that the brewery is 150 years old, that refers to the company. There’s been a brewery selling beer in Southwold since 1345, before the Black Death. The shares are listed on Aquis Exchange, so this is not a stock for day traders.

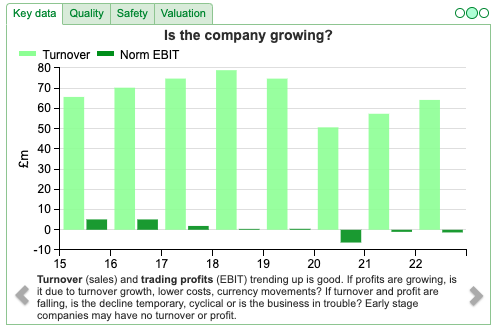

Revenue grew +12% to £64m, while they reported a loss of £2.3m, struggling to emerge from the aftermath of the pandemic. The five-year track record shows that country pubs were having a difficult time even before Covid-19.

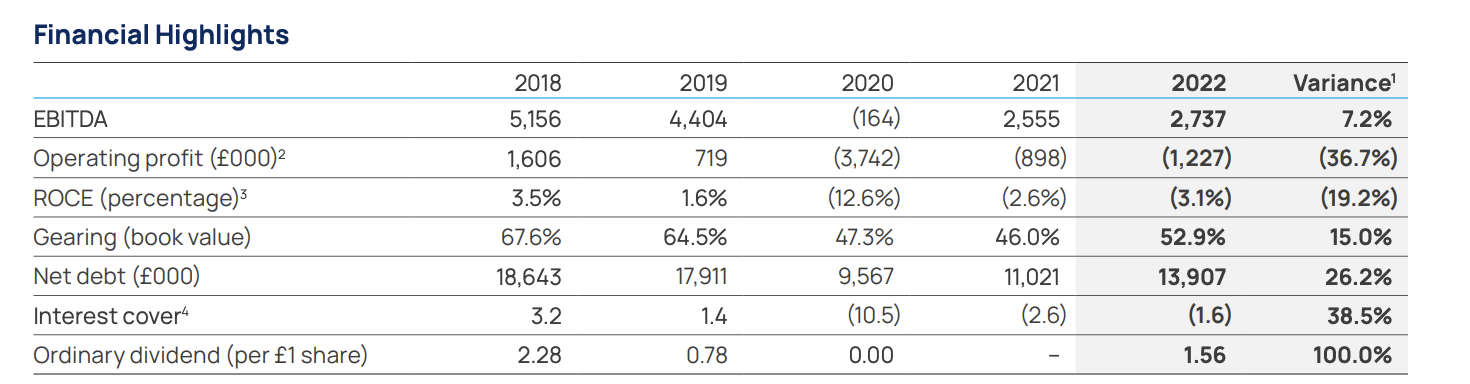

I’ve always been impressed with the company’s voluntary disclosure. Adnams is one of the few companies that consistently reports RoCE in their Annual Report (see above), even though returns have fallen from double digits pre-financial crisis to negative in recent years.

Before the 07-08 financial crisis Sir Ron Brierly’s Guinness Peat Group (GPG) bought a stake and encouraged management to gear up their balance sheet (for instance sale and leasebacks of their freehold property) in the way other pub companies had done. However, the dual-class shareholder structure* meant that the family could resist this – which turned out to be the correct decision given the carnage the financial crisis caused for financially engineered companies like MAB, Punch Taverns and Enterprise Inns. GPG then faced its own activist campaign because the fund was trading at a large discount to NAV. Sir Ron Brierly stepped down from GPG in 2011 and wound down its investments, selling the Adnams stake.

Since then Adnams shares have had a difficult decade, in part because of competition from supermarkets and customers drinking alone at home. The anthropologist Robin Dunbar says there are very real health benefits to drinking alcohol together with friends. Human beings need a location to meet others regularly, according to Dunbar. If I was Primeminister I would look again at the tax system and find a way of supporting village pubs and local brewers.

Valuation: There are no Adnams forecasts in the market, and the dual share class structure also complicates valuation. Assuming no control premium for the A shares* implies a market cap of £42m, versus last year’s sales of £64m.

Opinion: I first bought the shares in the 1990s recession and they were a ten-bagger for me. They taught me that you don’t need to invest in speculative technology story stocks to achieve high returns. Later I sold my Adnams shares before the financial crisis (a lucky decision which was precipitated because of changes in CGT rules) but then bought back a small position a while ago, for sentimental reasons rather than expectations of further large gains.

Notes

The author owns shares in OMG, OCN and Adnams.

*There are 744K of 25p A shares and 286K £1 B shares. Both the A and B shares carry a single vote, but the A shares are unlisted and tightly held by management and family, whereas the B shares are traded on Aquis Exchange. The B shares receive 4x the dividend of the A shares. That’s different to the dual-class voting structures than WISE, SFOR, MANU, META that I have written about in the past, where management’s shares carry 10x voting rights, but are eligible for the same dividends.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Weekly Market Commentary | 13/06/23 | OMG, GHH, OCN, ADB | A bifurcating bull market

Bruce looks at the divergent performance of the Nasdaq100 +22% since its October lows, versus AIM which is flat over the same time period. Companies covered OMG, GHH, OCN and ADB.

The FTSE 100 fell -0.3% to 7,573 last week. The Nasdaq100 and S&P500 were both flat over the last 5 trading days. A week ago market commentators declared the Nasdaq100 in a bull market, as the US tech index has now rallied over +20% from its lows. For AIM investors this is still very much a bear market, with the index down -40% from its Sept 2021 peak. Both indices rallied sharply together from the March 2020 lows, then rolled over as the vaccine rally ran out of steam in the face of higher inflation. Yet performance has bifurcated in 2023, as the graph below shows.

Nasdaq has benefited from excitement about Artificial Intelligence, with Nvidia the best-performing stock up +245% since mid-October last year. The GPU chip maker is the 6th largest stock on Nasdaq, and the other > $500bn stocks are all up strongly. Meta has doubled, while the two weakest performers were Tesla and Amazon, which were still up +19% and +16% respectively.

The two largest constituents on AIM Jet2 (market cap £2.8bn) and Burford (market cap £2.3bn) have done well, up +80% and +60%, but the broader index has failed to keep up. Four of the top-performing AIM stocks are mining companies: Kodal Minerals, Hummingbird Resources, and Zanaga Iron Core. These shares are up by between +140% to +313%, which is impressive even in the context of Nasdaq100’s top performers. However, these mining companies have market caps of around £50m- £150m, so have failed to make much contribution to the overall AIM index performance, which is flat versus mid-October last year. Lord Lee spoke at Mello last month, beginning with the observation: “You make your money in bear markets, you just don’t know it until a couple of years later.”

This week I look at Oxford Metrics, where Progressive have raised forecasts for this year, but not for next year. Plus Gooch & Housego, where the new Chief Exec seems to be executing a turnaround to plan, Ocean Wilsons which is conducting a strategic review and Suffolk brewery Adnams FY Dec results.

Oxford Metrics H1 to March

OMG sold its loss-making Yotta division for £54m in cash last year (23% of revenue, £400K loss FY Mar 2022). Following the disposal, they are left with Vicon, which does motion measurement analysis for health (eg Guy’s Hospital) entertainment (film companies like Disney but also computer game companies like Electronic Arts and Activision) engineering (MIT, NASA). Sharepad shows the track record including the business that they sold, instead below is the 10-year track record of revenues of just the Vicon business, taken from management’s FY Sept 2022 slide deck.

As a former management consultant and connoisseur of voluntary disclosure, I award full marks to whoever did the graph above. Positioning the £28.8m above the horizontal £30m line means the trend looks much more positive than the previous year’s £27.6m, rather than the rather lacklustre +4% growth reported last year. If the company achieves Progressive’s £39m forecast for FY Sept 2023 implies +39% y-o-y growth then that is genuinely to be applauded.

All four divisions have been performing well, but demand looks particularly strong in Entertainment (film, TV and computer games) with revenue rising 2.75x to £11m. Group adj PBT was up 13x to £4.1m – the adjustments include £0.5m of prior year central overheads that have been allocated to the division that they have retained, but even on a statutory basis PBT was up 6x to £3.9m. At the end of March, they had £64m of net cash, which is just under half of the market cap.

Outlook statement: Management reiterate their 5-year plan (announced Oct 2021) which aims to increase revenues 2.5x (ie to £72m) and deliver 15% adjusted profits (ie above £10m). The commentary also says: “Considering the current order book, the expected rise in the cost base and with supply chain challenges diminished, the Board believes that Oxford Metrics is well placed to deliver full-year results ahead of current market expectations.”

Forecasts: Progressive have raised revenue for FY Sept 2023F by +5% to £39m. However, their research note also points to higher headcount-related costs and to me it looks like Progressive’s FY Sept 2023F PBT would have been unchanged if the p&l hadn’t been helped by increased income in the rising interest rate environment on their £64m of cash. Progressive haven’t raised FY Sept 2024F forecasts (revenue and EBITDA are flat and fully diluted EPS is actually cut by -4.7%) which seems odd given the management commentary. One possible interpretation is that management have specifically asked Progressive not to raise next year’s forecast, which results in upwards pressure on numbers and perhaps another “ahead” RNS in 6-12 months from now.

Valuation: The shares are trading on a PER of 23x FY Sept 2024F or 3x revenue the same year. However, if we deduct the £64m of net cash from the market cap, next year’s PER drops to around 11x, which seems very reasonable.

Management are actively looking to do deals (see their slide below outlining their thoughts on M&A). They point out that private market valuations are now becoming more attractive for buyers. Progressive comment that they would be surprised not to see one deal, possibly more, before the company reports again in December.

Opinion: I own this and am happy to continue letting the position run. The cash on the balance sheet ought to mean that the shares hold up well into any H2 market weakness. Rather than the cash, the investment case really depends on continued operational execution, and not overpaying for any duff acquisitions. Having sold Yotta last year for what looks like a good price, I will give management the benefit of the doubt.

Gooch & Housego H1 to March

This international photonics business delivered encouraging results, following the replacement of their CEO last year. Revenue was up +32% to £71m and statutory PBT rose 2.75x to £3.3m. Net debt has more than doubled to £12.9m v £5.9m end of March last year, the majority of the increase seems to be driven by a £5m rise in inventories (ie to protect them from any further supply chain disruption). Including IFRS leases the net debt figure rises to £19m, which looks easily manageable in the context of £151m market cap.

They mention customers in Aerospace and Defence (25% of revenue), Industrial (53% of revenue), Life Sciences (22% of revenue) and even nuclear fusion research.

Outlook: He’s completed a strategy review and believes there’s a clear route to mid-teens returns in the medium term. I had assumed that he meant RoCE (3-year historic average is 5.8%), but looking at the presentation I think he means margins (3-year average EBIT margin 7.1%). Using Sharepad to go back further EBIT margin peaked above 14% in Sept 2013, when FY revenues were £63m.

Valuation: GHH is trading on a PER 16x Sept 2024F and 14x Sept 2025F. That isn’t resoundingly cheap for a company that has had a difficult few years, but in the context of the long-term track record looks about fair value.

Opinion: I commented last August that it was too early in the turnaround for me to take a position. The shares subsequently fell to 400p a couple of months ago. They’ve bounced +37% and are now above their 200 SMA, following a trading update at the start of April. I think we’re past the worst, though I don’t have a strong conviction the share price will return to its previous £19 peak.

Ocean Wilsons Strategic Review

A terse announcement from this Brazilian ports business (Wilson Sons’) and hedge fund portfolio (OWIL), noting speculation in the Brazilian press that they are undertaking a strategic review. Monday’s RNS says that the discussion is at an early stage, and there can be no certainty as to its outcome. The shares were up +11.5% on the morning of the announcement.

Valuation: The company’s most recent Q1 update, released in early May, said that the implied NAV for the company was £17.81, so the shares trade at a 50% discount. The portfolio of hedge funds has increased in value just 20% over the last 10 years, versus the S&P500 which has trebled over the same time period. The hedge funds have also underperformed versus inflation and represent 683p of the holding company’s NAV, versus 1724p if management had bought the S&P index tracker.

The 57% share in Wilson Sons’ (the Brazilian ports business) was worth 1079p NAV. Sharepad’s chart below shows Wilson Sons’ revenue and EBIT (in US dollars, not pounds) progress over the last couple of decades.

Opinion: Management ought to do something to close the discount to NAV, as I noted last August. Directors William Salmon and Christopher Townsend own 24%, while Hansa Investment and Victualia Ltd Partnership (controlled by the same Directors) take their stake well above 50%.

The reason that the holding company shares (OCN) trades at a discount is that management have a poor track record of allocating capital, in my view. If management had sold their hedge funds and bought an S&P500 index tracker ten years ago they would have received a double benefit from i) the OCN NAV would have been just over £28 ii) the share price discount to NAV would be much smaller.

Adnams FY to Dec

A brief mention of this 150-year-old, family-owned Southwold brewery, as it draws out themes I’ve written about previously: dual share class structure and voluntary disclosure. When I say that the brewery is 150 years old, that refers to the company. There’s been a brewery selling beer in Southwold since 1345, before the Black Death. The shares are listed on Aquis Exchange, so this is not a stock for day traders.

Revenue grew +12% to £64m, while they reported a loss of £2.3m, struggling to emerge from the aftermath of the pandemic. The five-year track record shows that country pubs were having a difficult time even before Covid-19.

I’ve always been impressed with the company’s voluntary disclosure. Adnams is one of the few companies that consistently reports RoCE in their Annual Report (see above), even though returns have fallen from double digits pre-financial crisis to negative in recent years.

Before the 07-08 financial crisis Sir Ron Brierly’s Guinness Peat Group (GPG) bought a stake and encouraged management to gear up their balance sheet (for instance sale and leasebacks of their freehold property) in the way other pub companies had done. However, the dual-class shareholder structure* meant that the family could resist this – which turned out to be the correct decision given the carnage the financial crisis caused for financially engineered companies like MAB, Punch Taverns and Enterprise Inns. GPG then faced its own activist campaign because the fund was trading at a large discount to NAV. Sir Ron Brierly stepped down from GPG in 2011 and wound down its investments, selling the Adnams stake.

Since then Adnams shares have had a difficult decade, in part because of competition from supermarkets and customers drinking alone at home. The anthropologist Robin Dunbar says there are very real health benefits to drinking alcohol together with friends. Human beings need a location to meet others regularly, according to Dunbar. If I was Primeminister I would look again at the tax system and find a way of supporting village pubs and local brewers.

Valuation: There are no Adnams forecasts in the market, and the dual share class structure also complicates valuation. Assuming no control premium for the A shares* implies a market cap of £42m, versus last year’s sales of £64m.

Opinion: I first bought the shares in the 1990s recession and they were a ten-bagger for me. They taught me that you don’t need to invest in speculative technology story stocks to achieve high returns. Later I sold my Adnams shares before the financial crisis (a lucky decision which was precipitated because of changes in CGT rules) but then bought back a small position a while ago, for sentimental reasons rather than expectations of further large gains.

Notes

The author owns shares in OMG, OCN and Adnams.

*There are 744K of 25p A shares and 286K £1 B shares. Both the A and B shares carry a single vote, but the A shares are unlisted and tightly held by management and family, whereas the B shares are traded on Aquis Exchange. The B shares receive 4x the dividend of the A shares. That’s different to the dual-class voting structures than WISE, SFOR, MANU, META that I have written about in the past, where management’s shares carry 10x voting rights, but are eligible for the same dividends.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.