Bruce discusses how long term compounders capitalise on trust. When applied shrewdly, this can be very rewarding. Companies covered HAT, TCAP and OCN

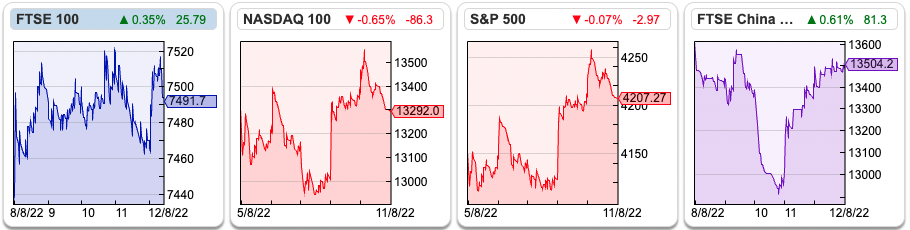

The FTSE 100 was up less than 1% last week to 7,492. The Nasdaq 100 was up +0.7%, while the S&P500 was stronger up +1.5%. The US 10Y government bond yield continued to rise, to 2.88% though still well below its mid-June peak of 3.45%. Brent crude was $97 per barrel, up +2.6% last week.

Here’s a link to an interview from Patrick O’Shaugnessey’s ‘Invest Like the Best’ podcast with Will Thorndike, author of The Outsiders. The book is a decades long study of eight successful companies, whose returns outperformed the S&P 500 by a factor of twenty— that is, an investment of $10,000 with each of these CEOs, on average, would have been worth over $1.5 million twenty-five years later. The author digs into the financials, but also tells a story about the contrarian characters who built these businesses (my favourite chapter is Henry Singleton at Teledyne, who invited unicycling mathematician Claude Shannon to help assess acquisitions). Buffett recommended the book in 2012 and has also spoken admiringly of Teledyne in his 1981 shareholder letter.

Aside from Buffett, it’s unusual to find anyone in finance talking about long holding periods as a source of competitive advantage, because so many vested interests profit from activity and trading. As I’ve watched my portfolio over the years, I’ve noticed that my most expensive mistakes have often been selling too early. I mentioned Keywords Studios last week as an example.

The podcast updates Thorndike’s research, about companies that compound at high rates for abnormally long periods of time. For instance, he believes that revenue quality (defined as contractually recurring revenue) is more valuable than organic revenue growth. He makes a couple of other counter intuitive observations about long term compounders: i) their Chief Execs spend as little time as possible on Investor Relations ii) they operate highly decentralised businesses, with very low overheads at head office and give divisional heads responsibility. The natural tendency is for Chief Execs to consolidate decision making and centralise power, but great CEOs resist this. They prefer to work with good people who they trust, and allow those business unit managers to make decisions.

As an investor, if you choose to hold a company for decades, you’re making a similar choice trusting management. The philosopher Baroness O’Neill pointed out in the that trust requires judgement, seems risky and is differentiated. Simply being more trusting is not an intelligent aim, instead seeking to place more trust in the competent, reliable and honest, will likely be rewarded (and avoid those who will abuse our trust).

I’ve always thought this is what went wrong at banks, who took control away from branch managers with local knowledge (probably based on gossip at the golf club). My experience of working at international banks in London was that they paid staff very well and didn’t trust anyone to do their jobs. SocGen was probably the worst, there was a French lady in Paris who corrected my research notes and went through my valuation models with a fine toothcomb, meaning that it took weeks to publish anything, with lots of stressful back and forth. Eventually I went on holiday, and came back to find that the Head of Research had hired a rival UK banks’ analyst to replace me. They didn’t fire me, instead they suggested I should start writing about Icelandic and Hungarian banks (this was in 2007).

At the same time, the French bank put far more trust in head office based rogue trader Jerome Kerviel, who was making unauthorised trades of up to €50bn exposure. He actually made €1.4bn of ‘rogue’ profits in 2007, before Soc Gen admitted to €4.9bn in losses January 2008. The shares have halved in value since 2011 and SocGen now trades on a distressed valuation of 4.3x PER and 0.3x book; I’m glad that I sold my shares when I left.

This week I look at 125 year old pawnbroker, H&T and TP ICAP, the Interdealer Broker currently benefiting from volatility in markets. Last week both of these released positive results with the shares up +8% and +9% respectively. I also look at Ocean Wilsons, the Brazilian ports business with a portfolio of hedge funds, which was less positive.

H&T Group

This pawnbroker released positive H1 results last week. I’m wary of speciality lenders ahead of the coming recession, however it’s worth noting that HAT shares outperformed the UK banks in the 2007-9 crisis falling ‘only’ 40% peak to trough, before then going on to almost treble from their Nov 2008 low in the following two years. Door step lender, Provident Financial also did well through the financial crisis, although later went on to mess things up from 2017 onwards.

Very often in finance perceived risk and actual risk are very different. Problems occur when perceived risk has been low and too much leveraged is applied (Abbey’s ‘investment grade’ debt exposure in 2002, Northern Rock’s funding model and now German property sector companies like Adler, Grand City and Vonovia).

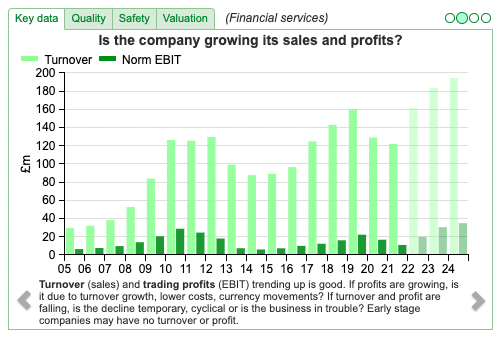

H&T’s group revenue increased +50% to £77.7m and gross profit was up +35% to £47.6m. Within that figure Net Revenue from Pawnbroking (ie lending secured on pledged items) was up +24% to £22.9m, which was net of the impairment charge trebling to £7m. H&T is also a retailer of second hand jewellery, and retail sales increased +68% to £21m. Most of this goes through their shops, online was 14% of total sales. There’s also a miscellaneous businesses like Gold Purchasing, Pawnbroking Scrap, FX, Money Transfer and Cheque Cashing which together generated £8.2m of revenue (ie 11% of the total) but is growing at +75%.

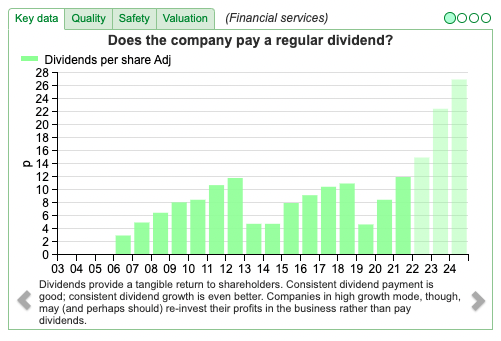

PBT was £6.7m +43% y-o-y. The balance sheet looks conservative with net assets of £139m, versus £21m of total borrowing. Net debt was just £8.6m. The dividend history shows that they cut the dividend a decade ago, and also at the beginning of the pandemic, but the dividend per share is now forecast to grow at above +20% to 27p in FY Dec 2024F.

Outlook: Growth has been strong as customers need to borrow small sums of short-term credit with several competitors retreating from the unsecured lending market. Lending volumes in the pawnbroking business are now more than 40% in excess of pre-pandemic levels. They see the near term environment as positive for them, across the product range. In early July they announced the acquisition of a watch repair / servicing business, Swiss Time Services for £4.3m. The rationale for the deal was that watches are an increasingly important part of H&T’s business, and they’ve had a trading relationship with the firm for many years because many second hand watches sold by H&T need first to be repaired or serviced.

History: This business was founded 125 years ago by Walter Harvey and Charles James Thompson (hence H&T) at a small store in Vauxhall, London. The shares have been listed on AIM since 2006, coming to market at 172p valuing the company at £58m market cap. Revenue tends to grow in sporadic fashion, quadrupling to £126m between 2006 and 2010, then falling back to £96m in 2016. FY 2020 revenue was £122m and PBT £7.9m, well below 2019 figures of £160m and £20m respectively. The share price is up +49% this year, so it does look like momentum is back with the business after a difficult pandemic.

Shareholders: Fidelity owns 15.7%, private client stockbroker Close Brothers holds 10.4%, Artemis 8.0% and Octopus 6.5%.

Valuation: The shares are trading on a PER of 8x FY Dec 2023F, dropping to below 7x the following year. That’s an attractive valuation, despite the shares doubling from the ‘vaccine rally’ in November 2020 onwards. The dividend yield is 2.7% historic, but as the dividend is forecast to grow strongly the yield rises to over 6% in FY Dec 2024F.

Opinion: This looks more defensive than the likes of DUKE and Funding Circle, and if the price of gold ever begins to rise then that could also be a positive. My concern would be the low through-the-cycle RoCE, which has averaged 8.6% since 2013. RoCE peaked at 13.6% in 2019, so the business has not been particularly profitable even in helpful years. Competition may have driven down returns, but perhaps also fear of regulatory intervention if H&T are seen to be making high profits at the expense of vulnerable customers?

TP ICAP H1 results to June

This interdealer broker reported H1 results with revenue ex Liquidnet, a business they bought in October 2020, up +7%. On a reported basis revenue was up +15% to £1.08bn. July saw revenue +1% versus the same month in 2020 on a constant currency basis.

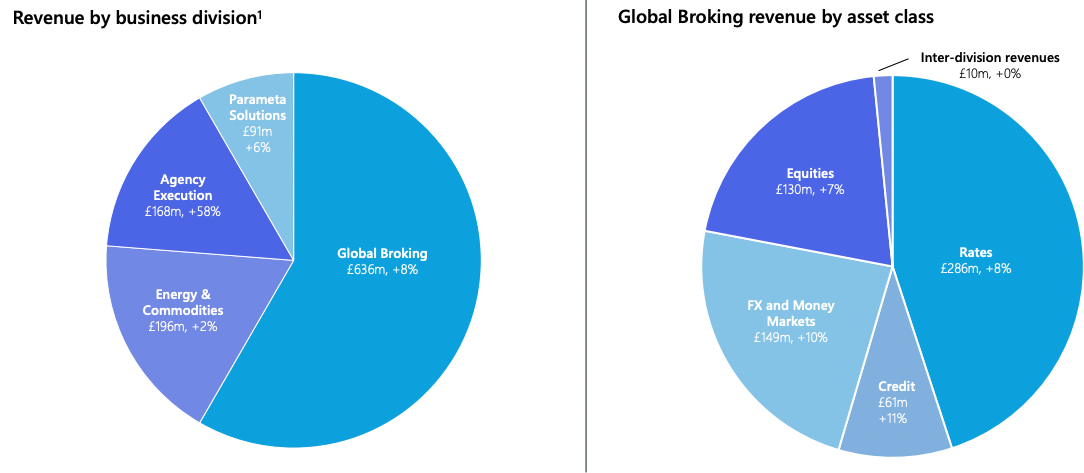

They provide a revenue split by business, with Global Broking making up c. 60%, Parameta Solutions is a higher margin data analytics and post trade solutions provider. Agency Execution includes Liquidnet which they bought for $700m total consideration, including up to $125m of earn-out in October 2020. Liquinet does low touch cash equity execution, and is primarily focused on the buyside (ie fund managers) rather than investment banks, who do the OTC trading.

The chart on the right further breaks down Global Broking revenue further by asset class.

Statutory PBT was up 2.5x to £72m, or +32% on the company’s adjusted basis. They have taken a £32m p&l charge for Russian sanctions, which is also their maximum exposure.

They have redomiciled to the Channel Islands, and have identified £100m of capital that can be released to pay down debt. They expect to do this by the end of 2023. Net debt including lease liabilities was £311m, or £9m without. £9m of net debt might sound small in the context of a market cap of £1.2bn, but it’s the balancing item between £807m of financial assets and £816m of borrowing. They need to operate with sizable cash balances in order to post collateral for back-to-back trades, so that cash figure is real but it isn’t available to be distributed to shareholders without curtailing the business model of being an intermediary.

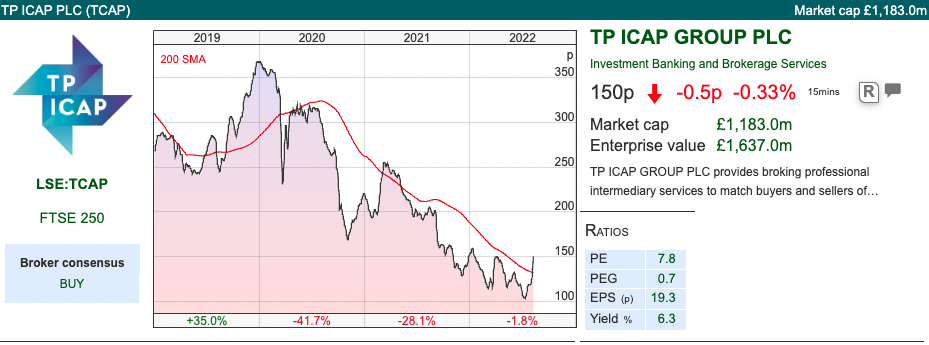

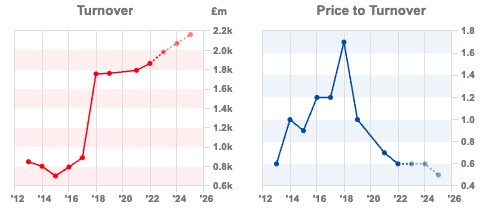

Valuation: The shares are trading on a PER of 6x FY Dec 2023F, dropping to 5x the following year. The historic dividend yield is 6.3%, forecast to rise to 9.5% yield 2024F. That valuation suggests considerable scepticism about the sustainability of results – the chart above also shows how the business has de-rated on a price to turnover basis. Like HAT, the business struggles to achieve double digit RoCE.

Opinion: I bought a starter position in this a couple of months ago. Then got nervous (didn’t sell, but didn’t buy anymore) after I spoke to a friend who used to trade FX options at UBS, and dealt with IDB’s all the time. He has retired to Cornwall with a surfboard so his information might be out of date. He thought the core business (ie facilitating Over The Counter trades between investment banks, hedge funds etc) was still in decline.

TP ICAP also relies on people, who tend to capture the gains, and the shareholders can be left with the residual risk (Credit Suisse and many other examples). There are exceptions to this (Morgan Stanley and Goldman Sachs) but I think it’s uncontroversial to say that an exchange like the LSE (up 9x in the last decade) is an easier business to manage than an investment bank or IDB. I’m still pondering TP ICAP, if any readers have insights please do post in the chat.

Ocean Wilsons H1 results to June

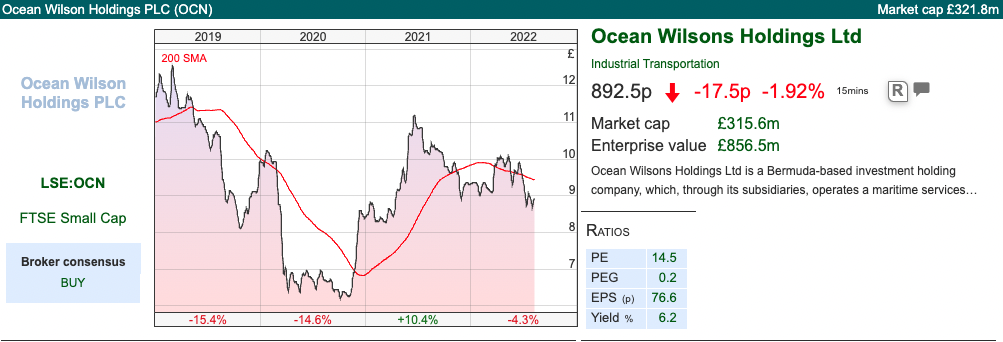

This holding company reported H1 result to June. The group consists of two subsidiaries i) Wilson Sons, a Brazilian ports business, which it owns a majority 57% stake – the remaining 43% non-controlling interest is listed on the Brazilian stock exchange and ii) OWIL, a 100% owned portfolio of hedge funds worth $297m.

Wilson Sons, the ports business, saw Q2 revenues up +12% v Q2 last year. 48% of that was towage, +10% to $102m. The container terminals division saw operating volumes -15%, affected by lack of shipping containers, bottlenecks and port closures in China, which they think will improve in H2. Logistics revenue was very strong +51% to $24m. Operating profit for Wilson Sons was flat at $55m, as revenue growth was offset by higher fuel costs and wage bills.

The investment portfolio, OWIL was down $49m or -14.5% YTD. 5 year return is +4.3% CAGR, versus US inflation benchmark of +6.9% CAGR. So they’ve underperformed their benchmark over 5 years, but still say they are pleased with performance. It could be a good time to pitch them my Slough based hedge fund – although I think the largest shareholder Hansa and William Salomon will prefer to stick with Findlay Park Fund -24% YTD, which has offices in the same street as The Golden Lion pub in St James’s that I mentioned last week.

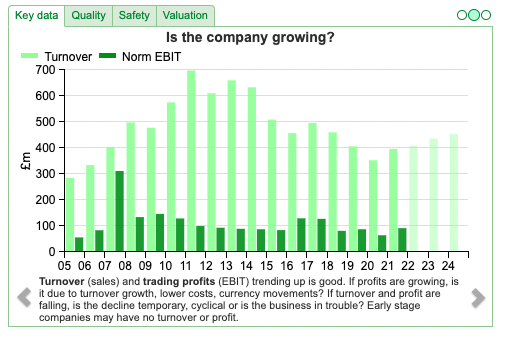

Valuation: Wilson Sons trades on a PER ratio of 12x and a dividend yield of 5.2% on the Brazilian stock exchange. The market price of the 57% stake that OCN owns is worth $420m, add to that the portfolio of hedge funds $297m gives a NAV of $717m or £587m at today’s USD/GBP exchange rate. That represents NAV of 1660p per share, versus the actual share price which is 892p – so a 46% discount to NAV. The chart below shows that revenue has been declining over the last decade, but is now forecast to recover.

Opinion: I’ve owned the shares for a couple of years. I haven’t lost money but I am disappointed how long it is taking for management to realise what the rest of us already know: a portfolio of hedge funds with offices in expensive locations is almost certain to underperform a low-cost index tracker over the long term. In theory, management and institutional investors can be trusted to act in their own best interests, but OCN is evidence that that doesn’t always happen.

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Notes

The author owns shares in TP ICAP and Ocean Wilsons.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 15/08/22 | HAT, TCAP, OCM | Trust in long time horizons

Bruce discusses how long term compounders capitalise on trust. When applied shrewdly, this can be very rewarding. Companies covered HAT, TCAP and OCN

The FTSE 100 was up less than 1% last week to 7,492. The Nasdaq 100 was up +0.7%, while the S&P500 was stronger up +1.5%. The US 10Y government bond yield continued to rise, to 2.88% though still well below its mid-June peak of 3.45%. Brent crude was $97 per barrel, up +2.6% last week.

Here’s a link to an interview from Patrick O’Shaugnessey’s ‘Invest Like the Best’ podcast with Will Thorndike, author of The Outsiders. The book is a decades long study of eight successful companies, whose returns outperformed the S&P 500 by a factor of twenty— that is, an investment of $10,000 with each of these CEOs, on average, would have been worth over $1.5 million twenty-five years later. The author digs into the financials, but also tells a story about the contrarian characters who built these businesses (my favourite chapter is Henry Singleton at Teledyne, who invited unicycling mathematician Claude Shannon to help assess acquisitions). Buffett recommended the book in 2012 and has also spoken admiringly of Teledyne in his 1981 shareholder letter.

Aside from Buffett, it’s unusual to find anyone in finance talking about long holding periods as a source of competitive advantage, because so many vested interests profit from activity and trading. As I’ve watched my portfolio over the years, I’ve noticed that my most expensive mistakes have often been selling too early. I mentioned Keywords Studios last week as an example.

The podcast updates Thorndike’s research, about companies that compound at high rates for abnormally long periods of time. For instance, he believes that revenue quality (defined as contractually recurring revenue) is more valuable than organic revenue growth. He makes a couple of other counter intuitive observations about long term compounders: i) their Chief Execs spend as little time as possible on Investor Relations ii) they operate highly decentralised businesses, with very low overheads at head office and give divisional heads responsibility. The natural tendency is for Chief Execs to consolidate decision making and centralise power, but great CEOs resist this. They prefer to work with good people who they trust, and allow those business unit managers to make decisions.

As an investor, if you choose to hold a company for decades, you’re making a similar choice trusting management. The philosopher Baroness O’Neill pointed out in the that trust requires judgement, seems risky and is differentiated. Simply being more trusting is not an intelligent aim, instead seeking to place more trust in the competent, reliable and honest, will likely be rewarded (and avoid those who will abuse our trust).

I’ve always thought this is what went wrong at banks, who took control away from branch managers with local knowledge (probably based on gossip at the golf club). My experience of working at international banks in London was that they paid staff very well and didn’t trust anyone to do their jobs. SocGen was probably the worst, there was a French lady in Paris who corrected my research notes and went through my valuation models with a fine toothcomb, meaning that it took weeks to publish anything, with lots of stressful back and forth. Eventually I went on holiday, and came back to find that the Head of Research had hired a rival UK banks’ analyst to replace me. They didn’t fire me, instead they suggested I should start writing about Icelandic and Hungarian banks (this was in 2007).

At the same time, the French bank put far more trust in head office based rogue trader Jerome Kerviel, who was making unauthorised trades of up to €50bn exposure. He actually made €1.4bn of ‘rogue’ profits in 2007, before Soc Gen admitted to €4.9bn in losses January 2008. The shares have halved in value since 2011 and SocGen now trades on a distressed valuation of 4.3x PER and 0.3x book; I’m glad that I sold my shares when I left.

This week I look at 125 year old pawnbroker, H&T and TP ICAP, the Interdealer Broker currently benefiting from volatility in markets. Last week both of these released positive results with the shares up +8% and +9% respectively. I also look at Ocean Wilsons, the Brazilian ports business with a portfolio of hedge funds, which was less positive.

H&T Group

This pawnbroker released positive H1 results last week. I’m wary of speciality lenders ahead of the coming recession, however it’s worth noting that HAT shares outperformed the UK banks in the 2007-9 crisis falling ‘only’ 40% peak to trough, before then going on to almost treble from their Nov 2008 low in the following two years. Door step lender, Provident Financial also did well through the financial crisis, although later went on to mess things up from 2017 onwards.

Very often in finance perceived risk and actual risk are very different. Problems occur when perceived risk has been low and too much leveraged is applied (Abbey’s ‘investment grade’ debt exposure in 2002, Northern Rock’s funding model and now German property sector companies like Adler, Grand City and Vonovia).

H&T’s group revenue increased +50% to £77.7m and gross profit was up +35% to £47.6m. Within that figure Net Revenue from Pawnbroking (ie lending secured on pledged items) was up +24% to £22.9m, which was net of the impairment charge trebling to £7m. H&T is also a retailer of second hand jewellery, and retail sales increased +68% to £21m. Most of this goes through their shops, online was 14% of total sales. There’s also a miscellaneous businesses like Gold Purchasing, Pawnbroking Scrap, FX, Money Transfer and Cheque Cashing which together generated £8.2m of revenue (ie 11% of the total) but is growing at +75%.

PBT was £6.7m +43% y-o-y. The balance sheet looks conservative with net assets of £139m, versus £21m of total borrowing. Net debt was just £8.6m. The dividend history shows that they cut the dividend a decade ago, and also at the beginning of the pandemic, but the dividend per share is now forecast to grow at above +20% to 27p in FY Dec 2024F.

Outlook: Growth has been strong as customers need to borrow small sums of short-term credit with several competitors retreating from the unsecured lending market. Lending volumes in the pawnbroking business are now more than 40% in excess of pre-pandemic levels. They see the near term environment as positive for them, across the product range. In early July they announced the acquisition of a watch repair / servicing business, Swiss Time Services for £4.3m. The rationale for the deal was that watches are an increasingly important part of H&T’s business, and they’ve had a trading relationship with the firm for many years because many second hand watches sold by H&T need first to be repaired or serviced.

History: This business was founded 125 years ago by Walter Harvey and Charles James Thompson (hence H&T) at a small store in Vauxhall, London. The shares have been listed on AIM since 2006, coming to market at 172p valuing the company at £58m market cap. Revenue tends to grow in sporadic fashion, quadrupling to £126m between 2006 and 2010, then falling back to £96m in 2016. FY 2020 revenue was £122m and PBT £7.9m, well below 2019 figures of £160m and £20m respectively. The share price is up +49% this year, so it does look like momentum is back with the business after a difficult pandemic.

Shareholders: Fidelity owns 15.7%, private client stockbroker Close Brothers holds 10.4%, Artemis 8.0% and Octopus 6.5%.

Valuation: The shares are trading on a PER of 8x FY Dec 2023F, dropping to below 7x the following year. That’s an attractive valuation, despite the shares doubling from the ‘vaccine rally’ in November 2020 onwards. The dividend yield is 2.7% historic, but as the dividend is forecast to grow strongly the yield rises to over 6% in FY Dec 2024F.

Opinion: This looks more defensive than the likes of DUKE and Funding Circle, and if the price of gold ever begins to rise then that could also be a positive. My concern would be the low through-the-cycle RoCE, which has averaged 8.6% since 2013. RoCE peaked at 13.6% in 2019, so the business has not been particularly profitable even in helpful years. Competition may have driven down returns, but perhaps also fear of regulatory intervention if H&T are seen to be making high profits at the expense of vulnerable customers?

TP ICAP H1 results to June

This interdealer broker reported H1 results with revenue ex Liquidnet, a business they bought in October 2020, up +7%. On a reported basis revenue was up +15% to £1.08bn. July saw revenue +1% versus the same month in 2020 on a constant currency basis.

They provide a revenue split by business, with Global Broking making up c. 60%, Parameta Solutions is a higher margin data analytics and post trade solutions provider. Agency Execution includes Liquidnet which they bought for $700m total consideration, including up to $125m of earn-out in October 2020. Liquinet does low touch cash equity execution, and is primarily focused on the buyside (ie fund managers) rather than investment banks, who do the OTC trading.

The chart on the right further breaks down Global Broking revenue further by asset class.

Statutory PBT was up 2.5x to £72m, or +32% on the company’s adjusted basis. They have taken a £32m p&l charge for Russian sanctions, which is also their maximum exposure.

They have redomiciled to the Channel Islands, and have identified £100m of capital that can be released to pay down debt. They expect to do this by the end of 2023. Net debt including lease liabilities was £311m, or £9m without. £9m of net debt might sound small in the context of a market cap of £1.2bn, but it’s the balancing item between £807m of financial assets and £816m of borrowing. They need to operate with sizable cash balances in order to post collateral for back-to-back trades, so that cash figure is real but it isn’t available to be distributed to shareholders without curtailing the business model of being an intermediary.

Valuation: The shares are trading on a PER of 6x FY Dec 2023F, dropping to 5x the following year. The historic dividend yield is 6.3%, forecast to rise to 9.5% yield 2024F. That valuation suggests considerable scepticism about the sustainability of results – the chart above also shows how the business has de-rated on a price to turnover basis. Like HAT, the business struggles to achieve double digit RoCE.

Opinion: I bought a starter position in this a couple of months ago. Then got nervous (didn’t sell, but didn’t buy anymore) after I spoke to a friend who used to trade FX options at UBS, and dealt with IDB’s all the time. He has retired to Cornwall with a surfboard so his information might be out of date. He thought the core business (ie facilitating Over The Counter trades between investment banks, hedge funds etc) was still in decline.

TP ICAP also relies on people, who tend to capture the gains, and the shareholders can be left with the residual risk (Credit Suisse and many other examples). There are exceptions to this (Morgan Stanley and Goldman Sachs) but I think it’s uncontroversial to say that an exchange like the LSE (up 9x in the last decade) is an easier business to manage than an investment bank or IDB. I’m still pondering TP ICAP, if any readers have insights please do post in the chat.

Ocean Wilsons H1 results to June

This holding company reported H1 result to June. The group consists of two subsidiaries i) Wilson Sons, a Brazilian ports business, which it owns a majority 57% stake – the remaining 43% non-controlling interest is listed on the Brazilian stock exchange and ii) OWIL, a 100% owned portfolio of hedge funds worth $297m.

Wilson Sons, the ports business, saw Q2 revenues up +12% v Q2 last year. 48% of that was towage, +10% to $102m. The container terminals division saw operating volumes -15%, affected by lack of shipping containers, bottlenecks and port closures in China, which they think will improve in H2. Logistics revenue was very strong +51% to $24m. Operating profit for Wilson Sons was flat at $55m, as revenue growth was offset by higher fuel costs and wage bills.

The investment portfolio, OWIL was down $49m or -14.5% YTD. 5 year return is +4.3% CAGR, versus US inflation benchmark of +6.9% CAGR. So they’ve underperformed their benchmark over 5 years, but still say they are pleased with performance. It could be a good time to pitch them my Slough based hedge fund – although I think the largest shareholder Hansa and William Salomon will prefer to stick with Findlay Park Fund -24% YTD, which has offices in the same street as The Golden Lion pub in St James’s that I mentioned last week.

Valuation: Wilson Sons trades on a PER ratio of 12x and a dividend yield of 5.2% on the Brazilian stock exchange. The market price of the 57% stake that OCN owns is worth $420m, add to that the portfolio of hedge funds $297m gives a NAV of $717m or £587m at today’s USD/GBP exchange rate. That represents NAV of 1660p per share, versus the actual share price which is 892p – so a 46% discount to NAV. The chart below shows that revenue has been declining over the last decade, but is now forecast to recover.

Opinion: I’ve owned the shares for a couple of years. I haven’t lost money but I am disappointed how long it is taking for management to realise what the rest of us already know: a portfolio of hedge funds with offices in expensive locations is almost certain to underperform a low-cost index tracker over the long term. In theory, management and institutional investors can be trusted to act in their own best interests, but OCN is evidence that that doesn’t always happen.

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Notes

The author owns shares in TP ICAP and Ocean Wilsons.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.