Bruce looks at the performance of the UK economy muddling through WWI and the Spanish flu pandemic, an era when global trade flows and productivity also went into retreat. Stocks cover SFOR, IPX and OMG.

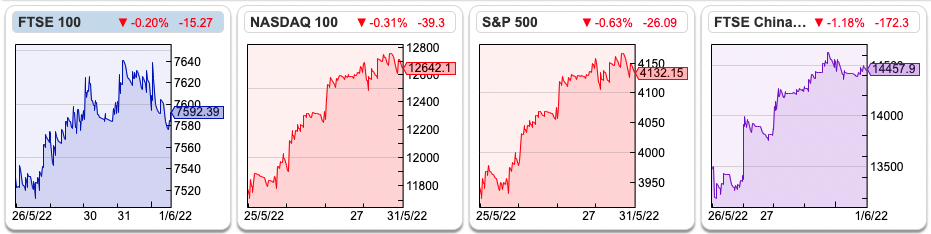

The FTSE 100 rose +1.3% to 7592, in a short week due to the Platinum Jubilee. The price of oil rose to $123 per barrel. One thing to note is that there’s a shortage of refining capacity, so the price drivers pay at the pump is now much higher than it was last time the oil price spiked to this level. The UK and Europe have agreed on an insurance ban on ships carrying Russian oil. China is also easing lockdown restrictions and has restricted fuel exports.

I came across a fun little book about the last 200 years of the British economy, called Two Hundred Years of Muddling Through: The surprising story of Britain’s economy from boom to bust and back again – it was 99p on the Kindle when I bought it, but the price has jumped to £8.99 less than 2 days later. That’s Amazon’s manipulative pricing algo rather than runaway inflation.

The most interesting section is on pre-WWI globalisation and how it came to an end when Archduke Franz Ferdinand was shot dead in June 1914 in Sarajevo. Initially, the London stock market didn’t react, but four weeks later Austria issued an ultimatum to Serbia and the Vienna stock exchange closed, which caused an international scramble for liquid assets. London was the pre-eminent financial centre, with many banks such as Barings, Kleinwort’s and Grenfell lending money overseas, including loans to German entities. Meanwhile, European banks called in their loans to UK entities. Share prices fell sharply and market makers refused to deal. Discount houses that bought and sold international bills of exchange to fund trade were also exposed. There was a rush to convert these assets into cash, and cash into gold.

There wasn’t a VIX index back then, but if there had been I’m sure measures of volatility would have shot up. The Bank of England hiked rates from 3% to 10% in a matter of days – a reminder that in the past Central Banks used to raise rates in the face of panics. A two day bank holiday was announced in August 1914 and the stock market was closed while the government pledged to buy pre-war bills and put in place a moratorium on commercial contracts to prevent mass insolvencies. The stock exchange re-opened January 1915.

As the war progressed the government then began nationalising strategic industries (railways, shipbuilding and coal mines) for the war effort, which shrank the number of listed companies. For instance, railway branch lines were requisitioned, dismantled and the steel sent to the battlefields of Flanders and France. The trade deficit ballooned but Britain’s “invisible exports”, for example, insurance via Lloyds of London, continued to do well.

As the war evolved, the stock market shifted its focus from financing companies and international trade to government debt, with War Loans sold to investors. The Chancellor Andrew Bonar Law urged the public to borrow from their banks to buy the 1917 5% War Loan, and given that there was a general shortage of goods to buy, this was popular. I doubt the FCA would be pleased if Rishi Sunak encouraged people to borrow from high street banks to buy government debt today. Instead, we have regulations encouraging pension funds to match their long term liabilities by buying government bonds and Quantitative Easing. Government debt/GDP rose from 25% in 1913 to 135% in 1919 compared to c. 90% today (though household indebtedness is much higher, as there were no credit cards and few people had a mortgage back then).

As my favourite Sharepad chart (showing UK inflation back to 1914) reveals that there then followed a deflationary bust, caused in part by the Spanish flu which killed around 200,000 in Britain but also higher taxes to pay for the war and other policy errors which shrank demand. Protracted wars are expensive and WWI was funded with 10-year government debt that needed to be refinanced, the cost of this jumped in the 1920s.

In conclusion, we can see that while the “panic” stage of a crisis can be over quickly (the London Stock Exchange was closed for less than 6 months) the long term effects of borrowing to fund wars can take decades to work their way through. We hear a lot about the “roaring 20s” but this was only true of the USA. Germany saw hyperinflation – which the UK avoided but instead, our GDP per capita fell from 1913 and did not recover to the same level until 1927.

This week I look at the Q1 update from S4 Capital, Oxford Metrics’ disposal of their loss-making Yotta business for 6.5x revenue and Impax AM.

S4 Capital Q1 update

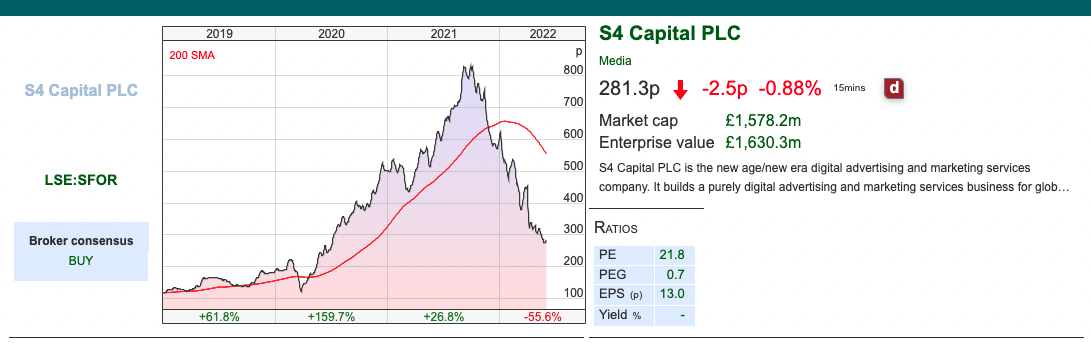

Sir Martin Sorrell’s ad tech venture released a Q1 update, saying net revenue was up +65% to £171m or +35% on a like-for-like basis. As a reminder, net revenue is the figure to focus on for advertising companies, because they re-bill a proportion of their gross revenues to their clients which distorts the reported figures. Management expects net revenue to increase +25% this year, in line with previous guidance.

Despite the slowdown in the advertising market, they still expect 10-15%, growth in its share of US advertising spend from 61% currently to 68% in 2025. Net debt was £48m at the end of March but see below my comment on deferred acquisition costs, contingent payments and further share issuance.

They’ve bought 30 companies in the last four years which has created some integration risk, as PwC refused to sign off on the accounts until mid-May. That hasn’t stopped Sir Martin from pressing ahead, most recently buying TheoremOne last month, which generated FY Dec 2021 revenues of $58m and grew last year by almost +40%. They haven’t disclosed the price they paid, but the deal was 50:50 cash and equity but with SFOR equity issued at 425p, as opposed to the current share price of 281p. Future deals will not issue equity at lower than 425p, which was the average price SFOR traded at before the accounting delays were announced.

Outlook: performance continues in line with the Group’s 3-year plan to double organically. They said that there will be an H2 weighting. Given the group has grown by acquisitions, it’s hard to know the H1 v H2 split. WPP has a split of 48% in H1 v 52% in H2 over the last 3 years. The RNS tries to sound upbeat, saying that the experience of 2020 demonstrates that even in a recession digital marketing expenditure remains robust. I think that’s rather misleading, in 2020 there was a recession in bars, restaurants, and airlines but the unusual nature of the lockdown meant there was significant sums of money spent promoting pelotons, food delivery, online fashion, computer games, investing and other similar lockdown activities.

Work From Home: An interesting observation from Sir Martin Sorrell is that they have normalised to a 60% office working rhythm, with Monday and Friday being the most frequent WFH days. There’s a large variation though, with the Americas at 34% office utilisation, EMEA close to 100% and APAC at 75%. It strikes me that if most employees are going to work from the office Tuesday, Wednesday and Thursday, then this doesn’t mean that companies can save costs by reducing their office leases. Instead, we’re more likely to have a situation where offices aren’t used much at the start or end of the week, but 100% occupancy in the middle – if you’re going to make the effort to travel in, presumably you want to be at the office when co-workers are also there? He suggests that SFOR has reduced office space to 60% of pre-pandemic (on a proforma basis) levels, but that’s hard to square with what he says of the hybrid working patterns adopted.

Delayed Annual Report: I also looked at the delayed Annual Report, which was finally published in mid-May, after having been scheduled for the end of March. They will strengthen financial controls, treasury and legal, risk and governance functions. Rupert Faure Walker is being replaced as Chair of the Audit and Risk Committee but will remain on the committee. They will also hire a new Group Financial Controller, a new CFO for the Content practice, a new Global Finance Transformation head, a new Group Treasurer and a new Global Compliance head. The Key Audit Matter section in the Annual Report says:

“Modified opinions were received from PwC component teams relating to revenue and cost of sales on open contracts, representing approximately 5% of recognised Group revenue across four Content components as a consequence of identifying significant control deficiencies. These significant control deficiencies also impacted two other Content components in respect of the accuracy of the percentage of completion of open contracts. In addition, we identified a risk of error in relation to the misapplication of IFRS 15 Revenue from Contracts with Customers (‘IFRS 15’) given the varying levels of understanding of this standard by management within these six components. These issues reinforced our initial risk assessment and resulted in extended testing by the Group audit team.”

That’s not particularly clear what has happened, except that PwC thought the accounting standards were being incorrectly applied. For context 5% of group revenue, FY Dec 2021 equates to £34m. When a charismatic leader sets demanding targets, there’s obviously pressure for middle management to hit the numbers, and a temptation to push the boundaries.

Ownership: Sir Martin Sorrell holds one B share, which allows him to appoint or replace one Director, plus he has a veto on other appointments and removals from the Board. No shareholder resolutions can be proposed without his consent and he also has a veto on acquisitions. He will lose that B share if he sells any ordinary shares that he holds unless it is for tax liabilities. He is also the largest ordinary shareholder with 9.75% of the shares. Other institutions are Rathbones IM 4.9%, Canaccord WM 4.8% and Jupiter 4.8%.

Contingent consideration: As the company has used its own shares as acquisition currency, the number of shares has grown from 365m at the end of 2019 to 556m end of 2021. There’s going to be a further c.33m of share issuance, plus 51m of contingent consideration (assuming the current share price) and a further £125m of cash consideration including TheoremOne.

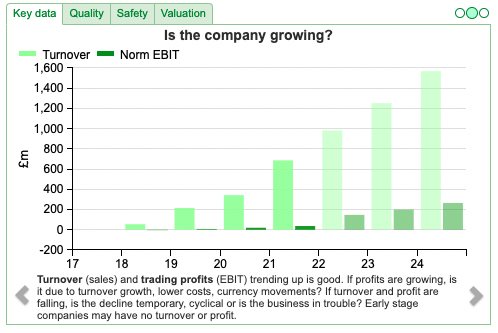

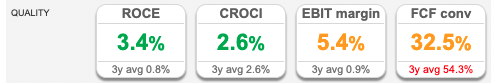

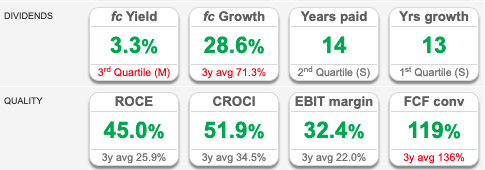

Valuation: The shares are trading on 17x 2022F PER dropping to 13x 2023F – although don’t forget that 15% dilution coming. That could be good value if these shares can weather the downturn, however, there is some risk that they have grown too fast and failed to integrate properly. Growth has been very strong, but quality measures like RoCE, CashRoCI, EBIT margin and FCF conversion suggest that high growth needs to convert into profitability at some point in the future.

Opinion: My view is that the outlook statement is too bullish, in a “proper” recession (ie not like the pandemic lockdowns) marketing budgets are cut. Sir Martin has come through plenty of downturns at his previous company WPP and knows this. I think this could be interesting at some point in H2 or maybe next year but feels like the risk is on the downside, particularly with the H2 weighting.

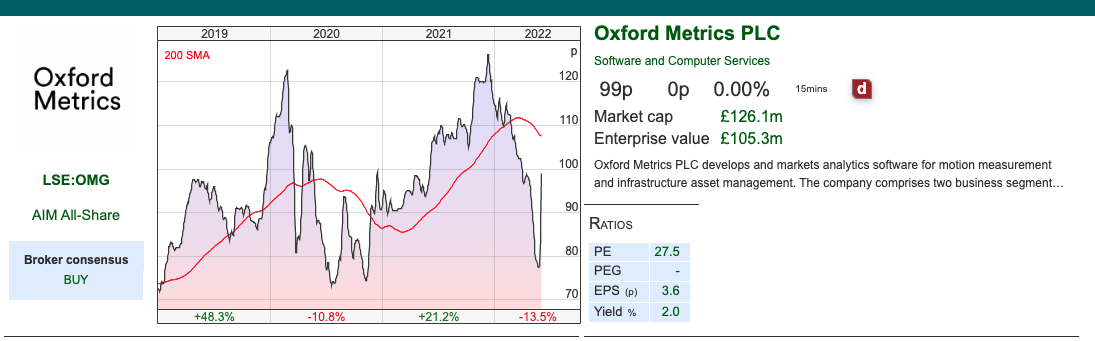

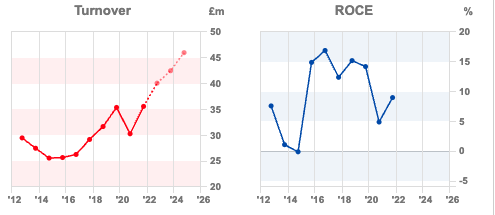

Oxford Metrics disposal

This motion sensor company which consists of loss-making Yotta (23% of revenue, £400K loss last year) and Vicon (77% of revenue, £3.5m of PBT last year) announced the disposal of Yotta. The profitable Vicon does motion measurement analysis for health (eg Guy’s Hospital) entertainment (film companies such as Industrial Light & Magic founded by George Lucas and Disney but also computer game companies like Electronic Arts and Activision) engineering (MIT, NASA). This seems quite niche but has a gross margin of 73% and a good track record of profitability.

The smaller business, Yotta, that is being sold is “cloud-based infrastructure asset management software” is used by local government agencies and other infrastructure owners to manage their assets. Clients include VicRoads in Australia, Auckland Motorway System in New Zealand, and, in the UK, National Highways and over 160 local authorities. There’s a long track record of losses.

Last week, OMG announced that it was selling Yotta for cash consideration of £52m – equating to 6.4x historic revenue. That looks like a very attractive multiple in these markets. This isn’t a distressed sale, Oxford Metrics had £23m of net cash at the September year-end and generated £14.5m cash from operations FY Sept 2021.

That said, the group had a five-year plan “amplify the core” announced in December 2016, which aimed to double PBT from £5.4m FY Sept 2016 and aspired to “significant revenue growth” from Yotta’s £9.1m FY Sept 2016. They don’t refer to these goals in more recent commentary – and for good reason. Statutory PBT fell -41% over the last five years to £3.2m FY Sept 2021 and Yotta’s revenue fell -11% to £8.1m. I’m all for companies having ambitious targets, and undoubtedly the pandemic made things more challenging – but we can say the company has unambiguously failed to deliver its 2016 Five Year Plan. Hence a re-think and disposal make sense to me. The shares were up +27% on the morning of the RNS, so other market participants clearly approve too.

Management have decided that a new Five Year Plan is in order. This new plan aims for revenue growth by 2.5x and an adjusted PBT margin of 15% from the group. Let’s hope they do better than the USSR, which tended to announce a succession of Five Year Plans without much improvement in productivity.

Incentives: Nick Bolton, the Chief Exec was paid a salary of £260K and a bonus of £261m last year. He’s also been awarded 1.2m of nil cost options (worth £1.2m) at today’s share price. The vesting of his options is not subject to any performance criteria, other than remaining in employment. To be fair the OMG share price has doubled from below 50p in December 2016. Aside from the share price performance though, I think we should question whether the remuneration committee has done a good job at aligning incentives with delivering on the PBT and revenue growth targets.

Ownership: This seems to be a favourite of private client stockbrokers with Charles Stanley 11.7%, Canaccord Genuity WM 8.8% and Investec Wealth 5.2%. Other institutions include Aviva 7.9%, Tellworth Investments (Paul Marriage ex HBOS / Insight IM) 7.7%, Herald IM 6.4%, BlackRock and Liontrust AM both own 3%. I hope those institutions register their dissatisfaction with the remuneration committee, not because the plan failed, but because incentives seem out of kilter with what was actually delivered.

Valuation: Cash now represents 60% of the market cap. If we adjust for that, gives a market cap of £51m around double Vicon’s FY Sept 2021 revenue of £27m and 10.8x last year’s adj post-tax profits. We don’t know what the company intends to do with the cash – hopefully, it’s not a duff acquisition. Progressive Research’s most recent research note on the company was in early April, so without detailed forecasts, I think that’s the best we can do.

Opinion: This is a company I’ve held for a while, thinking that eventually, Yotta ought to be a valuable business. I liked the public targets, but I also think that when companies fail to deliver they should communicate honestly with their shareholders about what hasn’t worked and why. As a shareholder, I dislike bonuses and nil cost option awards for failure.

The investment case reminds me of ULS Technology (now renamed Smoove) as the business is struggling to grow revenue, but following a disposal has a significant “war chest” of cash. In these markets, well-capitalised companies are likely to outperform, and I would hope that as a shareholder in both OMG and SMV they can either re-invest the cash wisely or return it to shareholders via a buyback or special dividend.

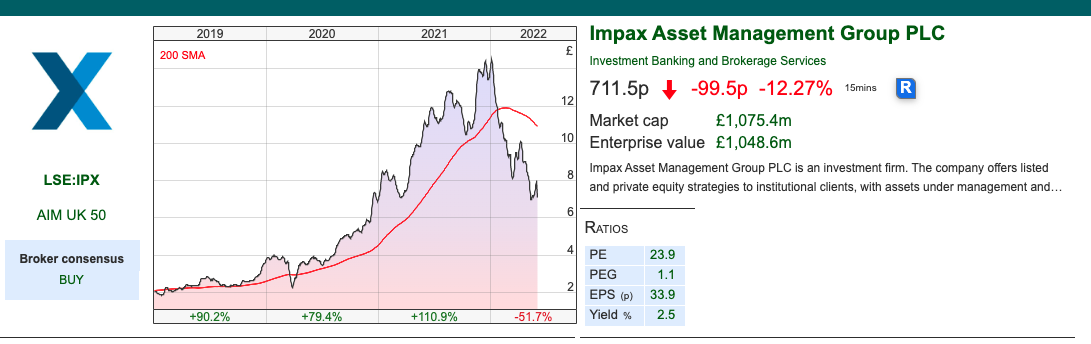

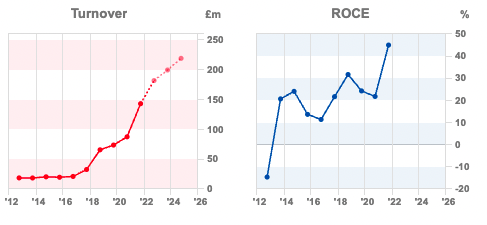

Impax Asset Management H1 March

Impax AM, the sustainable fund management company announced H1 results in March. Assets Under Management (AUM) stood at £38bn in March 2022 up +27% from the previous year. Most of that AuM growth came in their financial H2 last year though, in H1 (ie Sept 21-March 22) they saw inflows of £2.5bn in the half, offset by a decline of £1.7m. Revenues were £89m +46% and PBT more than doubled to £33m, demonstrating operational gearing working in the right direction.

Outlook: Management point to the recent focus on energy security being positive for the markets which Impax invests in: renewable power generation, zero-emissions transportation, climate resilience, resource efficiency and ecosystem protection. They also think mandatory “sustainable finance” disclosure requirements will mean that Impax continues to be well-positioned.

Valuation: The shares fell -12% on the morning of the results. Similar to KNOS last week, attractive high growth stocks with excellent profit margins have been de-rated, without those companies doing anything wrong. Impax is trading on 19x Sept 2023F PER, and the market cap is 2.8% of AUM. That’s well below the historic percentage of AUM, which has been over 4% for the last few years. The dividend, profitability and FCF conversion are really impressive.

Opinion: Historically Impax has done well with a rising oil price, as it means that the sustainable forms of energy that it finances become more viable. However, there seems to be a backlash going on against ESG investing, with many companies being accused of “greenwashing”. Deutsche Bank was the latest financial institution to be suspected of this, as German police raided their office last week.

This has been a long term holding for me, buying at below 50p a few years ago. I consider it one of my worst investments because although I bought at below 50p and then sold some last year at 1299p an almost 30x return, my position sizing was too small. A reminder that rather than focusing too much on entry and exit price, position size generates the bulk of returns.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Notes

The author owns shares in OMG and IMPAX AM

Weekly Market Commentary 06/06/22|SFOR, IPX, OMG|The Price of War

Bruce looks at the performance of the UK economy muddling through WWI and the Spanish flu pandemic, an era when global trade flows and productivity also went into retreat. Stocks cover SFOR, IPX and OMG.

The FTSE 100 rose +1.3% to 7592, in a short week due to the Platinum Jubilee. The price of oil rose to $123 per barrel. One thing to note is that there’s a shortage of refining capacity, so the price drivers pay at the pump is now much higher than it was last time the oil price spiked to this level. The UK and Europe have agreed on an insurance ban on ships carrying Russian oil. China is also easing lockdown restrictions and has restricted fuel exports.

I came across a fun little book about the last 200 years of the British economy, called Two Hundred Years of Muddling Through: The surprising story of Britain’s economy from boom to bust and back again – it was 99p on the Kindle when I bought it, but the price has jumped to £8.99 less than 2 days later. That’s Amazon’s manipulative pricing algo rather than runaway inflation.

The most interesting section is on pre-WWI globalisation and how it came to an end when Archduke Franz Ferdinand was shot dead in June 1914 in Sarajevo. Initially, the London stock market didn’t react, but four weeks later Austria issued an ultimatum to Serbia and the Vienna stock exchange closed, which caused an international scramble for liquid assets. London was the pre-eminent financial centre, with many banks such as Barings, Kleinwort’s and Grenfell lending money overseas, including loans to German entities. Meanwhile, European banks called in their loans to UK entities. Share prices fell sharply and market makers refused to deal. Discount houses that bought and sold international bills of exchange to fund trade were also exposed. There was a rush to convert these assets into cash, and cash into gold.

There wasn’t a VIX index back then, but if there had been I’m sure measures of volatility would have shot up. The Bank of England hiked rates from 3% to 10% in a matter of days – a reminder that in the past Central Banks used to raise rates in the face of panics. A two day bank holiday was announced in August 1914 and the stock market was closed while the government pledged to buy pre-war bills and put in place a moratorium on commercial contracts to prevent mass insolvencies. The stock exchange re-opened January 1915.

As the war progressed the government then began nationalising strategic industries (railways, shipbuilding and coal mines) for the war effort, which shrank the number of listed companies. For instance, railway branch lines were requisitioned, dismantled and the steel sent to the battlefields of Flanders and France. The trade deficit ballooned but Britain’s “invisible exports”, for example, insurance via Lloyds of London, continued to do well.

As the war evolved, the stock market shifted its focus from financing companies and international trade to government debt, with War Loans sold to investors. The Chancellor Andrew Bonar Law urged the public to borrow from their banks to buy the 1917 5% War Loan, and given that there was a general shortage of goods to buy, this was popular. I doubt the FCA would be pleased if Rishi Sunak encouraged people to borrow from high street banks to buy government debt today. Instead, we have regulations encouraging pension funds to match their long term liabilities by buying government bonds and Quantitative Easing. Government debt/GDP rose from 25% in 1913 to 135% in 1919 compared to c. 90% today (though household indebtedness is much higher, as there were no credit cards and few people had a mortgage back then).

As my favourite Sharepad chart (showing UK inflation back to 1914) reveals that there then followed a deflationary bust, caused in part by the Spanish flu which killed around 200,000 in Britain but also higher taxes to pay for the war and other policy errors which shrank demand. Protracted wars are expensive and WWI was funded with 10-year government debt that needed to be refinanced, the cost of this jumped in the 1920s.

In conclusion, we can see that while the “panic” stage of a crisis can be over quickly (the London Stock Exchange was closed for less than 6 months) the long term effects of borrowing to fund wars can take decades to work their way through. We hear a lot about the “roaring 20s” but this was only true of the USA. Germany saw hyperinflation – which the UK avoided but instead, our GDP per capita fell from 1913 and did not recover to the same level until 1927.

This week I look at the Q1 update from S4 Capital, Oxford Metrics’ disposal of their loss-making Yotta business for 6.5x revenue and Impax AM.

S4 Capital Q1 update

Sir Martin Sorrell’s ad tech venture released a Q1 update, saying net revenue was up +65% to £171m or +35% on a like-for-like basis. As a reminder, net revenue is the figure to focus on for advertising companies, because they re-bill a proportion of their gross revenues to their clients which distorts the reported figures. Management expects net revenue to increase +25% this year, in line with previous guidance.

Despite the slowdown in the advertising market, they still expect 10-15%, growth in its share of US advertising spend from 61% currently to 68% in 2025. Net debt was £48m at the end of March but see below my comment on deferred acquisition costs, contingent payments and further share issuance.

They’ve bought 30 companies in the last four years which has created some integration risk, as PwC refused to sign off on the accounts until mid-May. That hasn’t stopped Sir Martin from pressing ahead, most recently buying TheoremOne last month, which generated FY Dec 2021 revenues of $58m and grew last year by almost +40%. They haven’t disclosed the price they paid, but the deal was 50:50 cash and equity but with SFOR equity issued at 425p, as opposed to the current share price of 281p. Future deals will not issue equity at lower than 425p, which was the average price SFOR traded at before the accounting delays were announced.

Outlook: performance continues in line with the Group’s 3-year plan to double organically. They said that there will be an H2 weighting. Given the group has grown by acquisitions, it’s hard to know the H1 v H2 split. WPP has a split of 48% in H1 v 52% in H2 over the last 3 years. The RNS tries to sound upbeat, saying that the experience of 2020 demonstrates that even in a recession digital marketing expenditure remains robust. I think that’s rather misleading, in 2020 there was a recession in bars, restaurants, and airlines but the unusual nature of the lockdown meant there was significant sums of money spent promoting pelotons, food delivery, online fashion, computer games, investing and other similar lockdown activities.

Work From Home: An interesting observation from Sir Martin Sorrell is that they have normalised to a 60% office working rhythm, with Monday and Friday being the most frequent WFH days. There’s a large variation though, with the Americas at 34% office utilisation, EMEA close to 100% and APAC at 75%. It strikes me that if most employees are going to work from the office Tuesday, Wednesday and Thursday, then this doesn’t mean that companies can save costs by reducing their office leases. Instead, we’re more likely to have a situation where offices aren’t used much at the start or end of the week, but 100% occupancy in the middle – if you’re going to make the effort to travel in, presumably you want to be at the office when co-workers are also there? He suggests that SFOR has reduced office space to 60% of pre-pandemic (on a proforma basis) levels, but that’s hard to square with what he says of the hybrid working patterns adopted.

Delayed Annual Report: I also looked at the delayed Annual Report, which was finally published in mid-May, after having been scheduled for the end of March. They will strengthen financial controls, treasury and legal, risk and governance functions. Rupert Faure Walker is being replaced as Chair of the Audit and Risk Committee but will remain on the committee. They will also hire a new Group Financial Controller, a new CFO for the Content practice, a new Global Finance Transformation head, a new Group Treasurer and a new Global Compliance head. The Key Audit Matter section in the Annual Report says:

“Modified opinions were received from PwC component teams relating to revenue and cost of sales on open contracts, representing approximately 5% of recognised Group revenue across four Content components as a consequence of identifying significant control deficiencies. These significant control deficiencies also impacted two other Content components in respect of the accuracy of the percentage of completion of open contracts. In addition, we identified a risk of error in relation to the misapplication of IFRS 15 Revenue from Contracts with Customers (‘IFRS 15’) given the varying levels of understanding of this standard by management within these six components. These issues reinforced our initial risk assessment and resulted in extended testing by the Group audit team.”

That’s not particularly clear what has happened, except that PwC thought the accounting standards were being incorrectly applied. For context 5% of group revenue, FY Dec 2021 equates to £34m. When a charismatic leader sets demanding targets, there’s obviously pressure for middle management to hit the numbers, and a temptation to push the boundaries.

Ownership: Sir Martin Sorrell holds one B share, which allows him to appoint or replace one Director, plus he has a veto on other appointments and removals from the Board. No shareholder resolutions can be proposed without his consent and he also has a veto on acquisitions. He will lose that B share if he sells any ordinary shares that he holds unless it is for tax liabilities. He is also the largest ordinary shareholder with 9.75% of the shares. Other institutions are Rathbones IM 4.9%, Canaccord WM 4.8% and Jupiter 4.8%.

Contingent consideration: As the company has used its own shares as acquisition currency, the number of shares has grown from 365m at the end of 2019 to 556m end of 2021. There’s going to be a further c.33m of share issuance, plus 51m of contingent consideration (assuming the current share price) and a further £125m of cash consideration including TheoremOne.

Valuation: The shares are trading on 17x 2022F PER dropping to 13x 2023F – although don’t forget that 15% dilution coming. That could be good value if these shares can weather the downturn, however, there is some risk that they have grown too fast and failed to integrate properly. Growth has been very strong, but quality measures like RoCE, CashRoCI, EBIT margin and FCF conversion suggest that high growth needs to convert into profitability at some point in the future.

Opinion: My view is that the outlook statement is too bullish, in a “proper” recession (ie not like the pandemic lockdowns) marketing budgets are cut. Sir Martin has come through plenty of downturns at his previous company WPP and knows this. I think this could be interesting at some point in H2 or maybe next year but feels like the risk is on the downside, particularly with the H2 weighting.

Oxford Metrics disposal

This motion sensor company which consists of loss-making Yotta (23% of revenue, £400K loss last year) and Vicon (77% of revenue, £3.5m of PBT last year) announced the disposal of Yotta. The profitable Vicon does motion measurement analysis for health (eg Guy’s Hospital) entertainment (film companies such as Industrial Light & Magic founded by George Lucas and Disney but also computer game companies like Electronic Arts and Activision) engineering (MIT, NASA). This seems quite niche but has a gross margin of 73% and a good track record of profitability.

The smaller business, Yotta, that is being sold is “cloud-based infrastructure asset management software” is used by local government agencies and other infrastructure owners to manage their assets. Clients include VicRoads in Australia, Auckland Motorway System in New Zealand, and, in the UK, National Highways and over 160 local authorities. There’s a long track record of losses.

Last week, OMG announced that it was selling Yotta for cash consideration of £52m – equating to 6.4x historic revenue. That looks like a very attractive multiple in these markets. This isn’t a distressed sale, Oxford Metrics had £23m of net cash at the September year-end and generated £14.5m cash from operations FY Sept 2021.

That said, the group had a five-year plan “amplify the core” announced in December 2016, which aimed to double PBT from £5.4m FY Sept 2016 and aspired to “significant revenue growth” from Yotta’s £9.1m FY Sept 2016. They don’t refer to these goals in more recent commentary – and for good reason. Statutory PBT fell -41% over the last five years to £3.2m FY Sept 2021 and Yotta’s revenue fell -11% to £8.1m. I’m all for companies having ambitious targets, and undoubtedly the pandemic made things more challenging – but we can say the company has unambiguously failed to deliver its 2016 Five Year Plan. Hence a re-think and disposal make sense to me. The shares were up +27% on the morning of the RNS, so other market participants clearly approve too.

Management have decided that a new Five Year Plan is in order. This new plan aims for revenue growth by 2.5x and an adjusted PBT margin of 15% from the group. Let’s hope they do better than the USSR, which tended to announce a succession of Five Year Plans without much improvement in productivity.

Incentives: Nick Bolton, the Chief Exec was paid a salary of £260K and a bonus of £261m last year. He’s also been awarded 1.2m of nil cost options (worth £1.2m) at today’s share price. The vesting of his options is not subject to any performance criteria, other than remaining in employment. To be fair the OMG share price has doubled from below 50p in December 2016. Aside from the share price performance though, I think we should question whether the remuneration committee has done a good job at aligning incentives with delivering on the PBT and revenue growth targets.

Ownership: This seems to be a favourite of private client stockbrokers with Charles Stanley 11.7%, Canaccord Genuity WM 8.8% and Investec Wealth 5.2%. Other institutions include Aviva 7.9%, Tellworth Investments (Paul Marriage ex HBOS / Insight IM) 7.7%, Herald IM 6.4%, BlackRock and Liontrust AM both own 3%. I hope those institutions register their dissatisfaction with the remuneration committee, not because the plan failed, but because incentives seem out of kilter with what was actually delivered.

Valuation: Cash now represents 60% of the market cap. If we adjust for that, gives a market cap of £51m around double Vicon’s FY Sept 2021 revenue of £27m and 10.8x last year’s adj post-tax profits. We don’t know what the company intends to do with the cash – hopefully, it’s not a duff acquisition. Progressive Research’s most recent research note on the company was in early April, so without detailed forecasts, I think that’s the best we can do.

Opinion: This is a company I’ve held for a while, thinking that eventually, Yotta ought to be a valuable business. I liked the public targets, but I also think that when companies fail to deliver they should communicate honestly with their shareholders about what hasn’t worked and why. As a shareholder, I dislike bonuses and nil cost option awards for failure.

The investment case reminds me of ULS Technology (now renamed Smoove) as the business is struggling to grow revenue, but following a disposal has a significant “war chest” of cash. In these markets, well-capitalised companies are likely to outperform, and I would hope that as a shareholder in both OMG and SMV they can either re-invest the cash wisely or return it to shareholders via a buyback or special dividend.

Impax Asset Management H1 March

Impax AM, the sustainable fund management company announced H1 results in March. Assets Under Management (AUM) stood at £38bn in March 2022 up +27% from the previous year. Most of that AuM growth came in their financial H2 last year though, in H1 (ie Sept 21-March 22) they saw inflows of £2.5bn in the half, offset by a decline of £1.7m. Revenues were £89m +46% and PBT more than doubled to £33m, demonstrating operational gearing working in the right direction.

Outlook: Management point to the recent focus on energy security being positive for the markets which Impax invests in: renewable power generation, zero-emissions transportation, climate resilience, resource efficiency and ecosystem protection. They also think mandatory “sustainable finance” disclosure requirements will mean that Impax continues to be well-positioned.

Valuation: The shares fell -12% on the morning of the results. Similar to KNOS last week, attractive high growth stocks with excellent profit margins have been de-rated, without those companies doing anything wrong. Impax is trading on 19x Sept 2023F PER, and the market cap is 2.8% of AUM. That’s well below the historic percentage of AUM, which has been over 4% for the last few years. The dividend, profitability and FCF conversion are really impressive.

Opinion: Historically Impax has done well with a rising oil price, as it means that the sustainable forms of energy that it finances become more viable. However, there seems to be a backlash going on against ESG investing, with many companies being accused of “greenwashing”. Deutsche Bank was the latest financial institution to be suspected of this, as German police raided their office last week.

This has been a long term holding for me, buying at below 50p a few years ago. I consider it one of my worst investments because although I bought at below 50p and then sold some last year at 1299p an almost 30x return, my position sizing was too small. A reminder that rather than focusing too much on entry and exit price, position size generates the bulk of returns.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Notes

The author owns shares in OMG and IMPAX AM