While active fund managers are seeing redemptions, platforms like AJB and IHP have been reporting healthy quarterly inflows. Other stocks covered DPP, NXQ, CRPR.

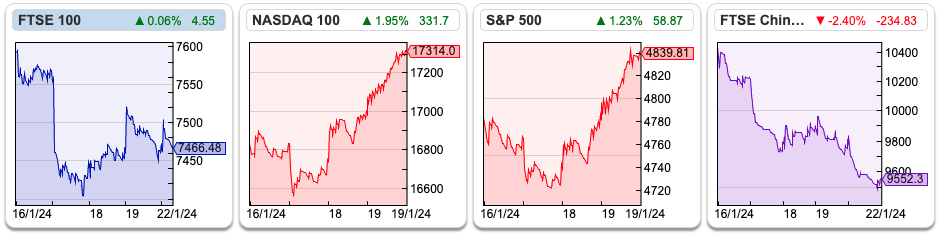

The FTSE 100 fell -1.7% last week to 7,466. The Nasdaq100 and S&P500 rose +2.9% and 1.25% respectively. US markets are enjoying a reasonably strong start to the year, and are the second best performing major indices behind Japan’s Nikkei 225 up a remarkable +7.5%. Contrast that with the FTSE China 50 Index which was down -8.7% in the last 5 days, and is down -13% since the start of the year.

I wrote about red flags in the Chinese property sector in mid 2021, and that proved prescient. I have a theory that Financial Times is too US centric, and that what’s happening in China gets relatively little attention compared to the impact on markets.

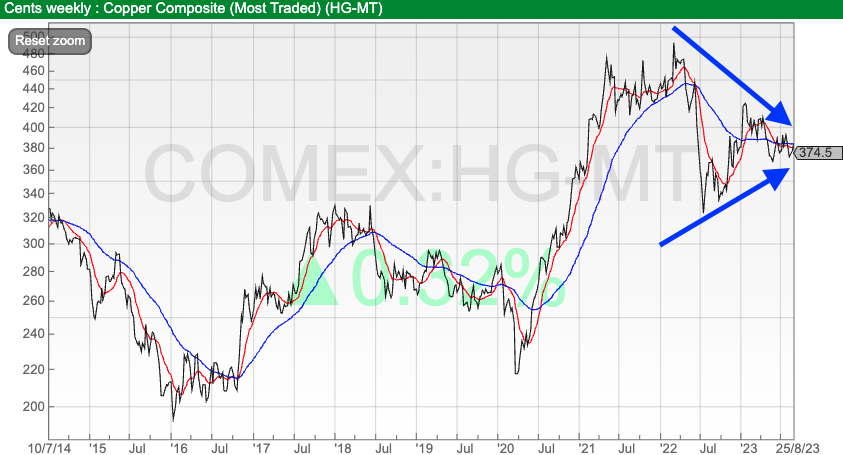

As the inverted yield curve in the US is no longer a reliable predictor of recessions, I’m keeping an eye on the copper chart (HG-MT below). This can be a good proxy for the strength / weakness of the global economy particularly China. Copper at the moment is forming a “wedge”, making lower highs, and higher lows – I’m not sure in which direction it eventually breaks out into – but I think well worth following over the coming weeks.

January is a busy month for RNS’s. I’m trying to strike the right balance between recovery stocks that are bouncing (TMG, FDEV), ahead of expectations (Nexteq, IQG, CWK, GMS, CNC), contract wins (CWR, CODE), quality long term outperformers (JDG), profit warnings (WOSG, BGO, CRPR, MUL, TRI), and stocks that look undervalued and are reporting solid in line results (too many to list).

I’ve started with Domino’s Pizza Poland, because it now looks to be a viable business that should – finally – breakeven in FY Dec 2024F, but I find the voluntary disclosure around “cash at bank” a red flag. I’ve also written up Nexteq, which used to be called Quixant, and is reporting “comfortably ahead” PBT, despite revenue falling -4% y-o-y. James Cropper has been around since 1845, so I don’t think there’s much chance that it will fail but I would wait 3-6 months following their profit warning before re-evaluating the investment case.

Fund flows

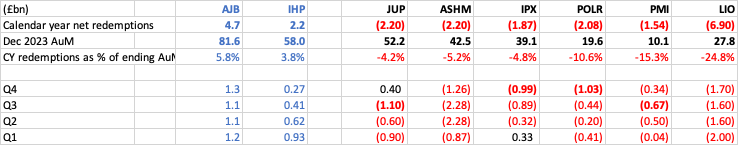

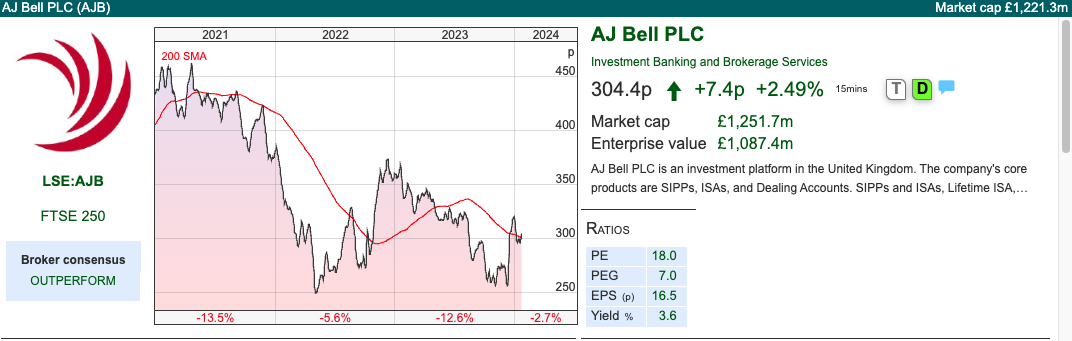

I talked about active fund manager redemptions last week. It’s worth noting though that platforms like AJ Bell and IntegraFin have both been reporting inflows through-out 2023. I’ve updated my table showing quarterly fund flows, to show that AJB and IHP (in blue) have seen in flows each quarter last year. NB their Funds under Direction/Assets under Administration are not quite the same thing as Assets under Management, as active fund managers tend to charge 50-100bp of AuM for managing your money, whereas AJB and IHP charges in the region of 20bp and 26bp for custody (ie providing the platform).

So, it looks to me as if investors are asking for their money back from active fund managers. Perhaps some of this is going to pay higher mortgage costs, but a significant amount of investors are using platforms to put their money into i) cash funds that are now earning around 5% ii) into low cost passive index trackers and probably iii) self directed share dealing. That’s what I have been doing anyway, and it looks like I am not alone. AJB £4.7bn of inflows in 2023 is a remarkable contrast to the active fund managers who are a sea of red.

I wrote up the investment platforms (HL., AJB, ABDN, PBEE) in December, also SharePad user Paul Bryant has started a substack looking at both the fund managers and platforms, so I recommend subscribing to that if you want to follow these sectors in more depth.

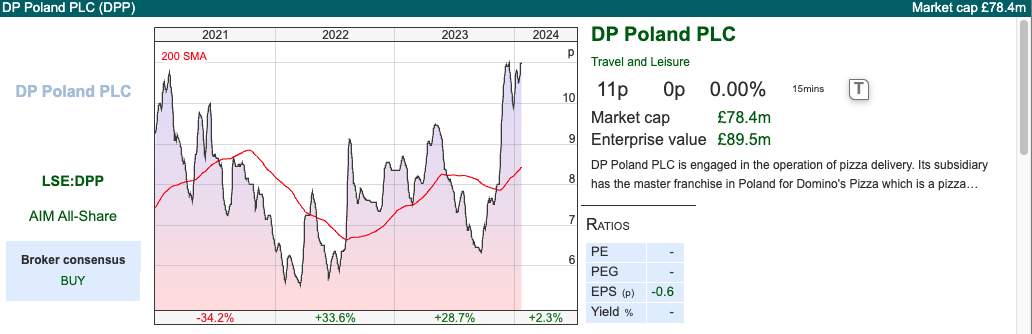

DPP FY Dec Trading Update

This Domino’s franchise that operates 116 stores in Poland and Croatia announced it was profitable on a pre-IFRS 16 (ie before the costs of leasehold property) EBITDA level. So not actually profitable, but performance is improving with Like-for-Like System Sales in Poland +20% on a FY Dec 2023 v FY Dec 2022 basis. Pleasingly the same measure improved on a Q4 v Q4 basis to +28%. I focus on the Like-for-Like numbers because during the year, they opened three stores, refurbished five stores and closed two stores in Poland. NB the company reports Polish sales in Polish Zloty, and Poland has seen 17 months of double digit inflation.

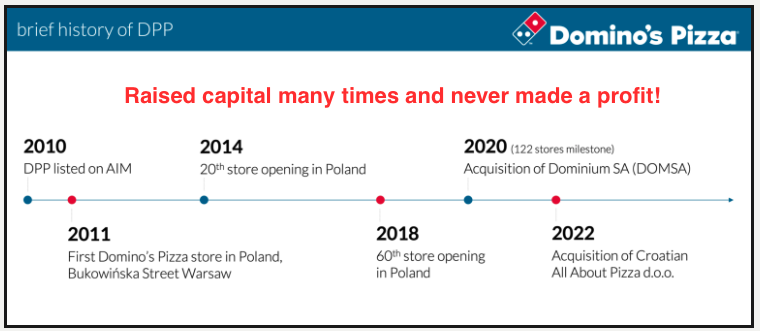

Below is a brief history of DPP which I have taken from the website, but I’ve added a comment in red, because management seem to have forgotten to mention lack of profits.

In Croatia they are growing L-f-L at +3%, and have opened 2 stores last year to bring the total for the country to 5. In other words, they are still subscale, but looking to expand quickly. The Croatian stores report in Euros. Group system sales reported in last week’s RNS were £46m. Checking back to their FY 2022 results, implies that is +25% growth – historically system sales and revenue have tracked each other closely.

The group had £2.2m of “cash at bank”. Alarm bells should be ringing whenever readers come across this phrase, it doesn’t mean the same as “net cash”. Again, we need to check back to their FY 2022 results released in June last year, when the shares came close to being suspended for failing to publish an Annual Report within 6 months of the year end. That RNS shows that tucked away in note 27 on page 64, there is Eu7.5m of loan note outstanding to Malaccan Holdings. Malaccan is a 39% shareholder of DPP and was the previous owner of Dominium, who operated 57 pizza restaurants across Poland and reversed into DPP in early 2021. The loan to Malaccan is repayable by 31 Dec 2024 – ie they have less than 12 months to pay this outstanding liability.

So £2.2m of cash at bank in December effectively translates to £4.3m of net debt, repayable in the coming months. Despite the “EBITDA level profitability” in H2, cash has fallen by £0.5m in the last 6 months. There’s no mention of the Malaccan debt in last week’s RNS, but I think that it is a significant omission. It is quite likely that we could see further dilution or risk the shareholder loan disadvantaging other minority shareholders.

Valuation: The shares are forecast to just break even FY Dec 2024F, and are trading on 1.5x sales that year. That compares to DOM, the UK business, which is trading on 2x sales and has a couple of decades of profitable growth behind it.

Opinion: The bull case is that now the business has scale, DPP can compound returns over many years as the UK and US franchises have done. Dominos Pizza UK has increased in value from less than 3.5p per share in December 2000 to 355p. A hundred bagger! The bear case is that Seymour Pierce IPO’ed DPP in July 2010 at 50p per share and the group has never made a profit.

My view is investors have to be careful not to be too early, but once it is clear that the business can self fund growth, it could work out well. I’m trying to keep an open mind, but highlight the “voluntary disclosure” – what management choose to disclose, rather than the mandatory disclosure they are required to share with investors – could be improved.

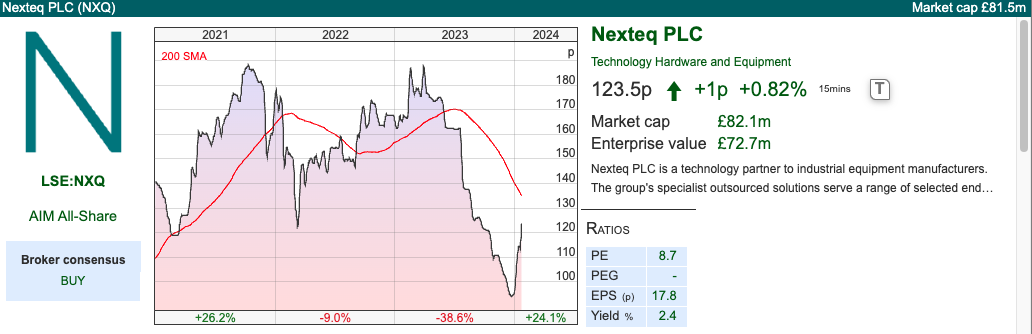

Nexteq FY Dec Trading Update

This technology company, that used to be called Quixant, allows manufacturers of slot machine equipment to outsource their product development, announced group revenues should fall -4% to $115m. Despite the topline going backwards, they also said adj PBT would be “comfortably ahead”. That is driven by improved gross profit margins (34% at H1 to June), they report their Densitron division (39% of revenue at H1) margins are at record levels while Quixant (61% of revenue at H1) margins continue to recover to pre-Covid levels. I went back and looked for FY 2019 gross margin by division, but I could only find the group figure (which was GM of 37%). Net cash at the end of Dec 2023 increased to $27m versus $19m at the end of June.

History: The business was founded in 2005 by Nicholas Jarmany, Gary Mullins and Chen-Tai-Lin. None of the three are still involved in the day to day running of the company from what I can see, but the former still owns 17% of the company and the other two founders own just over 5%.

Since 2007 they’ve had manufacturing facilities in Taiwan, which is a risk factor worth mentioning these days. Management point out that when a slot machine manufacturer develops a new machine, it needs to pass a regulatory approval process in each jurisdiction in which it will be sold or operated. That process is expensive and time consuming, with every subsequent minor variation requiring re-approval in advance and any unauthorised change potentially leading to a manufacturer experiencing regulatory consequences. This means that it is crucial for gaming and slot machine manufacturers to secure a stable source of computer hardware and software from trusted suppliers (presumably NextEq).

They came to market as Quixant in May 2013, at a placing price of 43p giving the company a market cap on admission of £30m. At the time of the IPO, revenues were $24m and PBT was $6m. In November 2015 Quixant acquired Densitron Technologies plc for a total consideration of £8m, which sells electronic display solutions to global industrial markets.

From the date of the IPO the share price ten bagged until late 2018, when they flagged that FY Dec revenues were likely to be $115m versus then market forecasts of $120m. The share price fell -86% to below 70p during the pandemic sell-off in March 2020. They reported a FY Dec 2020 loss of £2m, but every other year they have reported profits.

Outlook: The Board expects the trend of improving margins to continue, but with FY Dec 2024F revenues at this stage anticipated to be broadly in line with FY Dec 2023 revenue levels. The Group starts the new financial year with a good order book at c.5 months of revenues, which they say is consistent with historic levels. Cavendish their broker, have cut FY 2024F revenue forecast by -10% to $115m, however the broker increased their gross profit margin assumption to leave adj EPS unchanged at 16.8c.

Valuation: The shares are trading on less than 10x PER 2024F, and around 1.1x revenue the same year. The cash represents a quarter of the market cap, so this looks very good value, probably because of the declining revenue. It has traded on a valuation above 5x revenue in the past, although that when was when it was growing the topline steeply.

Opinion: It’s unusual to see a company increasing margins while revenue falls. This could be very good if they can begin to grow the top line again. Sharepad’s historic p&l data shows that between 2018 and 2013 management did that by almost 5x to $115m, but since 2018 growth has stalled. Management blame this on a tougher economic backdrop, however that can’t be the full story. It would be interesting to know if there are levers that management can pull to reinvigorate growth in the business.

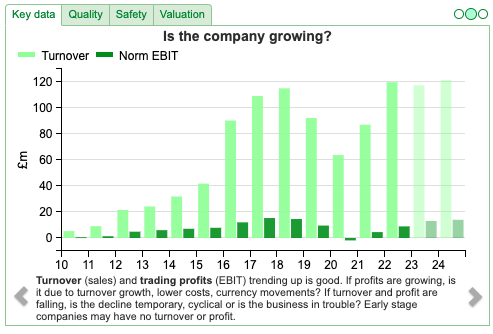

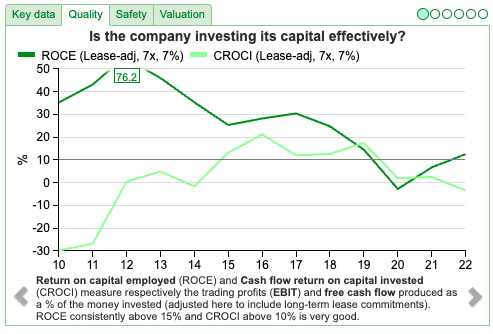

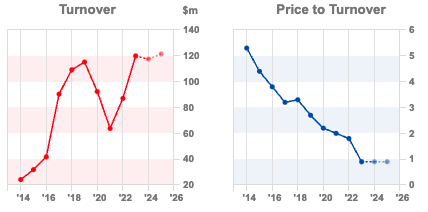

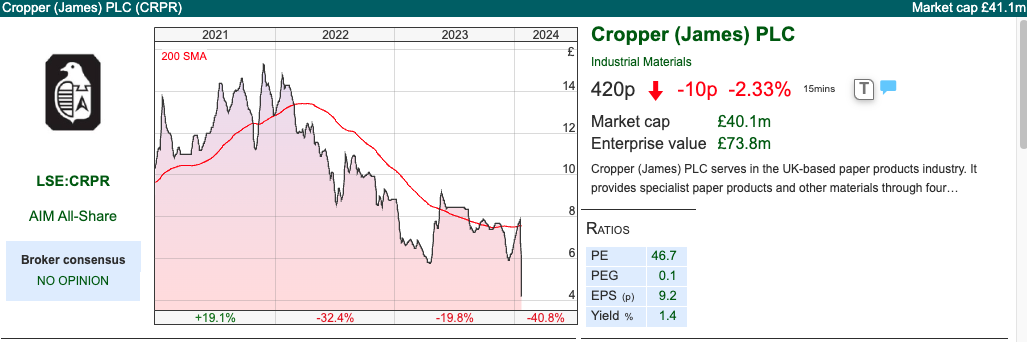

James Cropper Q3 Dec Trading Update

This family owned paper and packaging business with a March year announced a slow down in Nov and Dec last year. Around 2/3 of revenue comes from the Paper Products division, but they’ve also been trying to benefit from advanced materials 1/3 of revenues (Future Energy and Technical Fibres). Some of that is medical, insulation, aerospace and defence sectors materials but the most exciting part of that division is seeking to benefit from money flowing into the hydrogen sector, developing materials for fuel cells. The latter has suffered as projects have been delayed, partly as costs have risen due to inflation and partly as governments have delayed making funding decisions. That sounds similar to the reasons that ITM Power has given for missing estimates in the past. On the other hand Ceres share price was up +28% last week as they signed a £43m deal with Delta Electronics, a $23bn market cap Taiwan stock exchange listed electronics company.

Back to James Cropper, they now expect FY revenues to be not lower than £103m, implying a -22% fall versus FY Mar 2023. That’s also a -16% miss versus previous expectations according to SharePad’s forecast tab. Adj PBT is expected to be materially below previous expectations, which aren’t given but SharePad shows £5.9m. On the positive side they do expect to report a small FY 2024F adj profit, working capital has been well managed and net debt (£13m Sep 2023) should be slightly better than expected.

Ownership: Cropper was established in 1845 and has been built by six generations of family. The two largest shareholders are Cropper Family 33% and Mark Cropper (Chairman) 20%. The largest institutional shareholder is Liontrust AM with 13%, which reported continuing outflows last week: £1.7bn in the Sept-Dec quarter versus AuM of £28bn at the end of December. So there is a risk of redemptions causing an institutional manager to sell – which may present an opportunity to us amateurs who aren’t facing redemptions…if we can get the timing right!

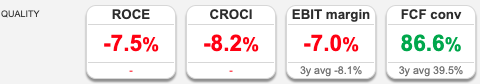

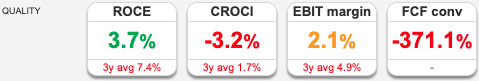

Valuation: The question is whether this is a blip and profitability can recover in FY Mar 2025 and 2026. Assuming they can get back to 50p of earnings then the shares are on less than 10x. Even before last week’s profit warning RoCE, margins and FCF conversion were unimpressive.

Opinion: I think we need to be careful about timing – the chart looks terrible. That doesn’t make it a bad company if you can buy at the right point in the cycle though. The share price fell -75% during the financial crisis, but then was up 30x from early 2009 to 2017. Richard has written it up here, because he liked the “voluntary disclosure” decision not to mess around with silly adjustments to profits. I agree, and while I don’t think there’s any hurry to buy into the story now, I’d suggest revisiting the investment case in H2 of this year.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 23/01/2024 | DPP, NXQ, CRPR | Following the fund flows

While active fund managers are seeing redemptions, platforms like AJB and IHP have been reporting healthy quarterly inflows. Other stocks covered DPP, NXQ, CRPR.

The FTSE 100 fell -1.7% last week to 7,466. The Nasdaq100 and S&P500 rose +2.9% and 1.25% respectively. US markets are enjoying a reasonably strong start to the year, and are the second best performing major indices behind Japan’s Nikkei 225 up a remarkable +7.5%. Contrast that with the FTSE China 50 Index which was down -8.7% in the last 5 days, and is down -13% since the start of the year.

I wrote about red flags in the Chinese property sector in mid 2021, and that proved prescient. I have a theory that Financial Times is too US centric, and that what’s happening in China gets relatively little attention compared to the impact on markets.

As the inverted yield curve in the US is no longer a reliable predictor of recessions, I’m keeping an eye on the copper chart (HG-MT below). This can be a good proxy for the strength / weakness of the global economy particularly China. Copper at the moment is forming a “wedge”, making lower highs, and higher lows – I’m not sure in which direction it eventually breaks out into – but I think well worth following over the coming weeks.

January is a busy month for RNS’s. I’m trying to strike the right balance between recovery stocks that are bouncing (TMG, FDEV), ahead of expectations (Nexteq, IQG, CWK, GMS, CNC), contract wins (CWR, CODE), quality long term outperformers (JDG), profit warnings (WOSG, BGO, CRPR, MUL, TRI), and stocks that look undervalued and are reporting solid in line results (too many to list).

I’ve started with Domino’s Pizza Poland, because it now looks to be a viable business that should – finally – breakeven in FY Dec 2024F, but I find the voluntary disclosure around “cash at bank” a red flag. I’ve also written up Nexteq, which used to be called Quixant, and is reporting “comfortably ahead” PBT, despite revenue falling -4% y-o-y. James Cropper has been around since 1845, so I don’t think there’s much chance that it will fail but I would wait 3-6 months following their profit warning before re-evaluating the investment case.

Fund flows

I talked about active fund manager redemptions last week. It’s worth noting though that platforms like AJ Bell and IntegraFin have both been reporting inflows through-out 2023. I’ve updated my table showing quarterly fund flows, to show that AJB and IHP (in blue) have seen in flows each quarter last year. NB their Funds under Direction/Assets under Administration are not quite the same thing as Assets under Management, as active fund managers tend to charge 50-100bp of AuM for managing your money, whereas AJB and IHP charges in the region of 20bp and 26bp for custody (ie providing the platform).

So, it looks to me as if investors are asking for their money back from active fund managers. Perhaps some of this is going to pay higher mortgage costs, but a significant amount of investors are using platforms to put their money into i) cash funds that are now earning around 5% ii) into low cost passive index trackers and probably iii) self directed share dealing. That’s what I have been doing anyway, and it looks like I am not alone. AJB £4.7bn of inflows in 2023 is a remarkable contrast to the active fund managers who are a sea of red.

I wrote up the investment platforms (HL., AJB, ABDN, PBEE) in December, also SharePad user Paul Bryant has started a substack looking at both the fund managers and platforms, so I recommend subscribing to that if you want to follow these sectors in more depth.

DPP FY Dec Trading Update

This Domino’s franchise that operates 116 stores in Poland and Croatia announced it was profitable on a pre-IFRS 16 (ie before the costs of leasehold property) EBITDA level. So not actually profitable, but performance is improving with Like-for-Like System Sales in Poland +20% on a FY Dec 2023 v FY Dec 2022 basis. Pleasingly the same measure improved on a Q4 v Q4 basis to +28%. I focus on the Like-for-Like numbers because during the year, they opened three stores, refurbished five stores and closed two stores in Poland. NB the company reports Polish sales in Polish Zloty, and Poland has seen 17 months of double digit inflation.

Below is a brief history of DPP which I have taken from the website, but I’ve added a comment in red, because management seem to have forgotten to mention lack of profits.

In Croatia they are growing L-f-L at +3%, and have opened 2 stores last year to bring the total for the country to 5. In other words, they are still subscale, but looking to expand quickly. The Croatian stores report in Euros. Group system sales reported in last week’s RNS were £46m. Checking back to their FY 2022 results, implies that is +25% growth – historically system sales and revenue have tracked each other closely.

The group had £2.2m of “cash at bank”. Alarm bells should be ringing whenever readers come across this phrase, it doesn’t mean the same as “net cash”. Again, we need to check back to their FY 2022 results released in June last year, when the shares came close to being suspended for failing to publish an Annual Report within 6 months of the year end. That RNS shows that tucked away in note 27 on page 64, there is Eu7.5m of loan note outstanding to Malaccan Holdings. Malaccan is a 39% shareholder of DPP and was the previous owner of Dominium, who operated 57 pizza restaurants across Poland and reversed into DPP in early 2021. The loan to Malaccan is repayable by 31 Dec 2024 – ie they have less than 12 months to pay this outstanding liability.

So £2.2m of cash at bank in December effectively translates to £4.3m of net debt, repayable in the coming months. Despite the “EBITDA level profitability” in H2, cash has fallen by £0.5m in the last 6 months. There’s no mention of the Malaccan debt in last week’s RNS, but I think that it is a significant omission. It is quite likely that we could see further dilution or risk the shareholder loan disadvantaging other minority shareholders.

Valuation: The shares are forecast to just break even FY Dec 2024F, and are trading on 1.5x sales that year. That compares to DOM, the UK business, which is trading on 2x sales and has a couple of decades of profitable growth behind it.

Opinion: The bull case is that now the business has scale, DPP can compound returns over many years as the UK and US franchises have done. Dominos Pizza UK has increased in value from less than 3.5p per share in December 2000 to 355p. A hundred bagger! The bear case is that Seymour Pierce IPO’ed DPP in July 2010 at 50p per share and the group has never made a profit.

My view is investors have to be careful not to be too early, but once it is clear that the business can self fund growth, it could work out well. I’m trying to keep an open mind, but highlight the “voluntary disclosure” – what management choose to disclose, rather than the mandatory disclosure they are required to share with investors – could be improved.

Nexteq FY Dec Trading Update

This technology company, that used to be called Quixant, allows manufacturers of slot machine equipment to outsource their product development, announced group revenues should fall -4% to $115m. Despite the topline going backwards, they also said adj PBT would be “comfortably ahead”. That is driven by improved gross profit margins (34% at H1 to June), they report their Densitron division (39% of revenue at H1) margins are at record levels while Quixant (61% of revenue at H1) margins continue to recover to pre-Covid levels. I went back and looked for FY 2019 gross margin by division, but I could only find the group figure (which was GM of 37%). Net cash at the end of Dec 2023 increased to $27m versus $19m at the end of June.

History: The business was founded in 2005 by Nicholas Jarmany, Gary Mullins and Chen-Tai-Lin. None of the three are still involved in the day to day running of the company from what I can see, but the former still owns 17% of the company and the other two founders own just over 5%.

Since 2007 they’ve had manufacturing facilities in Taiwan, which is a risk factor worth mentioning these days. Management point out that when a slot machine manufacturer develops a new machine, it needs to pass a regulatory approval process in each jurisdiction in which it will be sold or operated. That process is expensive and time consuming, with every subsequent minor variation requiring re-approval in advance and any unauthorised change potentially leading to a manufacturer experiencing regulatory consequences. This means that it is crucial for gaming and slot machine manufacturers to secure a stable source of computer hardware and software from trusted suppliers (presumably NextEq).

They came to market as Quixant in May 2013, at a placing price of 43p giving the company a market cap on admission of £30m. At the time of the IPO, revenues were $24m and PBT was $6m. In November 2015 Quixant acquired Densitron Technologies plc for a total consideration of £8m, which sells electronic display solutions to global industrial markets.

From the date of the IPO the share price ten bagged until late 2018, when they flagged that FY Dec revenues were likely to be $115m versus then market forecasts of $120m. The share price fell -86% to below 70p during the pandemic sell-off in March 2020. They reported a FY Dec 2020 loss of £2m, but every other year they have reported profits.

Outlook: The Board expects the trend of improving margins to continue, but with FY Dec 2024F revenues at this stage anticipated to be broadly in line with FY Dec 2023 revenue levels. The Group starts the new financial year with a good order book at c.5 months of revenues, which they say is consistent with historic levels. Cavendish their broker, have cut FY 2024F revenue forecast by -10% to $115m, however the broker increased their gross profit margin assumption to leave adj EPS unchanged at 16.8c.

Valuation: The shares are trading on less than 10x PER 2024F, and around 1.1x revenue the same year. The cash represents a quarter of the market cap, so this looks very good value, probably because of the declining revenue. It has traded on a valuation above 5x revenue in the past, although that when was when it was growing the topline steeply.

Opinion: It’s unusual to see a company increasing margins while revenue falls. This could be very good if they can begin to grow the top line again. Sharepad’s historic p&l data shows that between 2018 and 2013 management did that by almost 5x to $115m, but since 2018 growth has stalled. Management blame this on a tougher economic backdrop, however that can’t be the full story. It would be interesting to know if there are levers that management can pull to reinvigorate growth in the business.

James Cropper Q3 Dec Trading Update

This family owned paper and packaging business with a March year announced a slow down in Nov and Dec last year. Around 2/3 of revenue comes from the Paper Products division, but they’ve also been trying to benefit from advanced materials 1/3 of revenues (Future Energy and Technical Fibres). Some of that is medical, insulation, aerospace and defence sectors materials but the most exciting part of that division is seeking to benefit from money flowing into the hydrogen sector, developing materials for fuel cells. The latter has suffered as projects have been delayed, partly as costs have risen due to inflation and partly as governments have delayed making funding decisions. That sounds similar to the reasons that ITM Power has given for missing estimates in the past. On the other hand Ceres share price was up +28% last week as they signed a £43m deal with Delta Electronics, a $23bn market cap Taiwan stock exchange listed electronics company.

Back to James Cropper, they now expect FY revenues to be not lower than £103m, implying a -22% fall versus FY Mar 2023. That’s also a -16% miss versus previous expectations according to SharePad’s forecast tab. Adj PBT is expected to be materially below previous expectations, which aren’t given but SharePad shows £5.9m. On the positive side they do expect to report a small FY 2024F adj profit, working capital has been well managed and net debt (£13m Sep 2023) should be slightly better than expected.

Ownership: Cropper was established in 1845 and has been built by six generations of family. The two largest shareholders are Cropper Family 33% and Mark Cropper (Chairman) 20%. The largest institutional shareholder is Liontrust AM with 13%, which reported continuing outflows last week: £1.7bn in the Sept-Dec quarter versus AuM of £28bn at the end of December. So there is a risk of redemptions causing an institutional manager to sell – which may present an opportunity to us amateurs who aren’t facing redemptions…if we can get the timing right!

Valuation: The question is whether this is a blip and profitability can recover in FY Mar 2025 and 2026. Assuming they can get back to 50p of earnings then the shares are on less than 10x. Even before last week’s profit warning RoCE, margins and FCF conversion were unimpressive.

Opinion: I think we need to be careful about timing – the chart looks terrible. That doesn’t make it a bad company if you can buy at the right point in the cycle though. The share price fell -75% during the financial crisis, but then was up 30x from early 2009 to 2017. Richard has written it up here, because he liked the “voluntary disclosure” decision not to mess around with silly adjustments to profits. I agree, and while I don’t think there’s any hurry to buy into the story now, I’d suggest revisiting the investment case in H2 of this year.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.