Nvidia’s share price has risen by 8x in the last 18 months, yet it is not obvious which businesses their GPUs will disrupt. Stocks covered AGFX, JDW and ULTP.

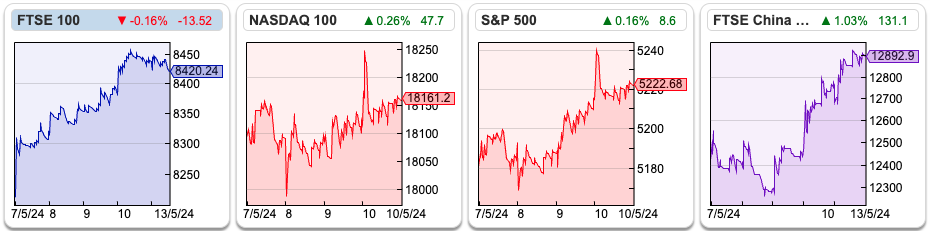

The FTSE 100 rose +2.5% to 8,420 and continues to hit all-time highs. The Nasdaq100 and S&P500 were up +1.5% and +1.8% respectively. Oil was down less than -0.5%, and at $83 per barrel is up +8% YTD. Natural Gas (NG-MT) on the other hand spiked up +16% in the last 5 trading days. Copper continues to rise and is up +20% YTD, suggesting economic activity is picking up across the globe, particularly in China.

Bill Gates said last year that in his lifetime he has only seen two demonstrations of technology that struck him as revolutionary. The first was the Graphical User Interface (GUI) which he went on to develop into the Windows operating system. The second is ChatGPT, which impressed him with its ability to pass a Biology exam. Gates suggests that document handling tasks (like payables, accounting, or insurance claim disputes) which require decision-making but not the ability to learn continuously, could be disrupted. One of my programmer friends, who has just left a large Nasdaq-listed tech firm, is working on using AI too, hoping to develop a personal assistant, to deal with emails, set reminders, minimise distractions and generally help him manage his ADHD.

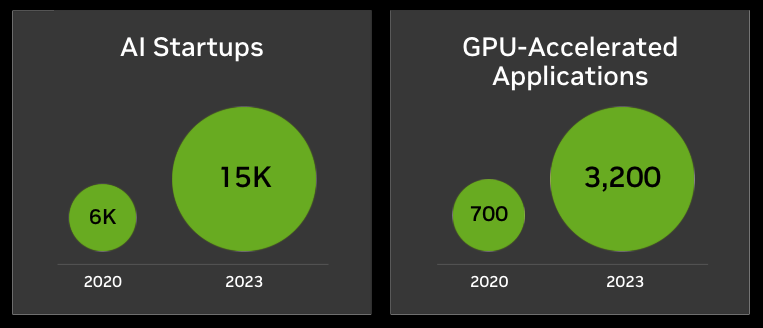

He is not alone. According to a recent Nvidia presentation, between 2020 and 2023 the number of AI Startups has increased by 2.5x to 15K per year, and the number of apps using GPUs has ballooned by 5x 3.2K.

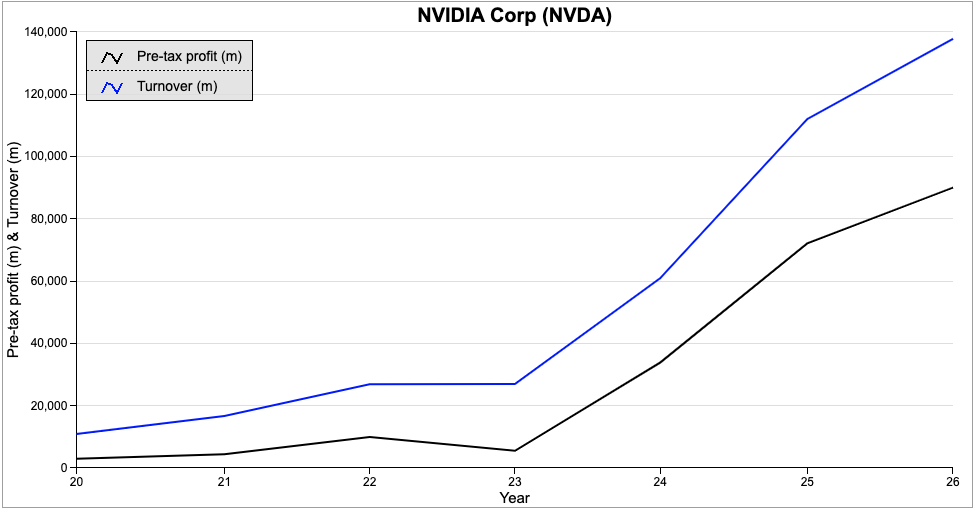

The Nvidia share price is up by almost 8x since October 2022, so there are plenty of people who believe that generative AI will create huge profits for some companies. Notably, the NVDA share price isn’t just a speculative bubble of meme stock traders, with no support from underlying financial data. Sharepad shows that NVDA’s revenue is forecast to increase 10x from $11bn in FY Jan 2020 to $112bn in FY Jan 2025F. Group PBT is forecast to rise by 24x to $72bn over the same time period.

And yet, I also found an interesting piece by Ben Evans, who suggests that Large Language Models (LLMs) have few proven “use cases” at the moment. Unlike a word processor or a spreadsheet, which lawyers and accountants could immediately see would make their lives easier, ChatGPT and similar have few obvious use cases outside developers who use them as a tool to write computer code more efficiently and by students cheating on their homework. There are still many “simple” tasks the models can’t do. Ben Evans uses the example of finding data on the number of people employed as elevator attendants from the US Census website, which is still difficult for AI.

It’s hard to think of a company or a profession that is currently being automated out of existence by the new technology, the equivalent of the elevator attendant which employers came to realise wasn’t necessary, ordinary people could simply push the button themselves to select a floor. We didn’t need elevator attendants as professional button pushers – perhaps all these people retrained as DJs?

I will be attending Mello at Chiswick on Wed & Thursday 22nd and 23rd of May, so looking forward to catching up with many of you. David has worked really hard to get companies to present face-to-face to investors. I am sceptical of the value of online-only presentations as it is not possible to know which investor questions management ignores – it’s interesting that many company management teams are keen for workers to return to the office so that they gain the intangible benefits of unplanned interactions, yet when it comes to engaging with investors the same management teams behave as if we are still back in the pandemic.

This week I look at results from FX currency trader Argentex and pub operator JD Wetherspoons, followed by a comment on Ultimate Products’ profit warning.

Argentex FY Dec Results and Capital Raising

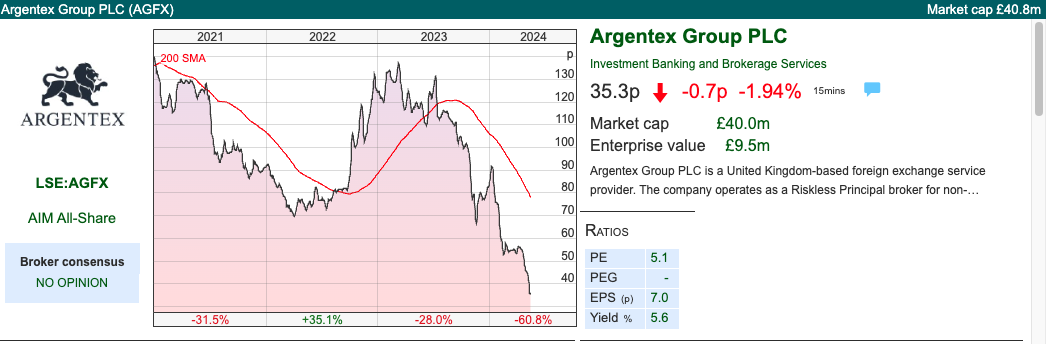

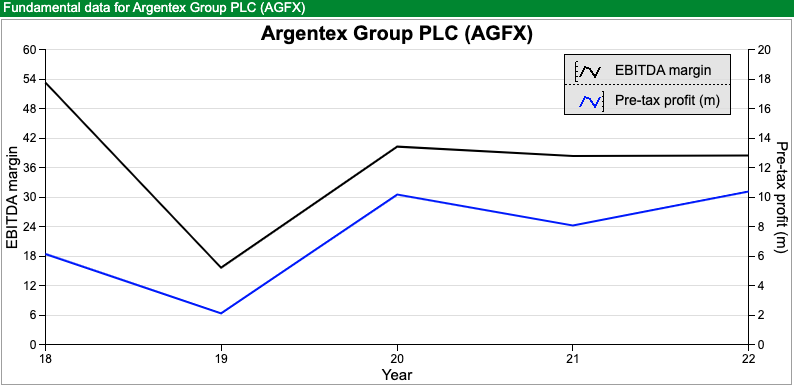

This FX currency trader announced FY results with revenues down -1% to £50m and statutory PBT down -6% to £7.3m. That’s a disappointing result given the company also reported £18m of net cash at the end of December, the group should be benefiting from higher interest rates received on balances. Management had already given revenue and operating profit guidance in January – however, the shares fell -22% following the RNS as management also warned that adverse market conditions (clients trading less) had continued into Q1 of 2024 and that they intended to raise capital. They also cut the dividend.

Following the book build for its placing they raised gross proceeds of approximately £3.25m (before expenses) at 45p per share. That compares to £5m if AGFX had achieved a full take-up of their offer (limited by 10% of the total shares outstanding). It might seem odd that a company with £18m of net cash has come back to investors to ask for more money, at a time when market conditions are difficult and the share price has fallen -82% from its peak in early 2020.

The reasons given were i) drive operational efficiency ii) develop more products in Alternative Banking iii) geographical expansion. Without additional financing management expect FY Dec 2024F revenues to be in the mid £40s million (that is implying a -10% decline), with an EBITDA margin in the low single digits (suggesting a statutory loss for the current year). With the capital raising, management anticipates that revenue growth in FY 2026F should be within the range of 15-20% per annum, with EBITDA margins in the mid-teens. The Company also intends to raise £10-15m of debt financing, via a Revolving Credit Facility.

I think it’s worth looking at what has happened, as it highlights a couple of issues around “voluntary disclosure” that management made in the past.

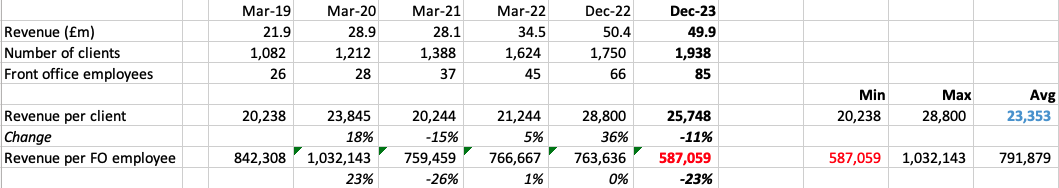

Growth story: In 2019, when the company raised £12.5m through an IPO, the plan was to use the money to double sales headcount to 50 people. Management suggested that sales staff tended to generate more revenue the longer they stayed at the company. So in the first year, a salesperson would, on average, generate £42,000 in revenue, which would later grow to £1.8m in year five. AGFX reported 85 sales and dealing staff in FY Dec 2023, an increase of 3.3x since 2019. However back-office staff (operations) has increased by almost 7x to 74 over the same time period. Management invested for growth, then discovered that they needed back-office support functions and revenue has disappointed.

The table below shows, that FY Dec 2023 average revenue per client of £25.7K, though down 11% is still above the average since 2019 of £23.4K (in blue). However, revenue per front office employee has been on an unsteady decline and is now down -43% since the £1m figure for FY Mar 2020 to £587K (in red). Given the 7x increase in back office staff, the trend will look even worse for total employees.

Change of year-end: In 2022 management decided to change its year-end to December, “in line with the Group’s transition to a global financial solutions provider” – as if this goal could not be achieved with a March year end. At the time there was some speculation on Twitter that this allowed management to re-base expectations down – although as the Truss/Kwarteng mini-budget created significant volatility AGFX ended up reporting revenue growth of +54% in 2022. Before the change of year-end, Numis, who IPO’ed the company were forecasting 12p of EPS for FY Mar 2022, which compares to 7.1p of EPS just reported FY Dec 2023.

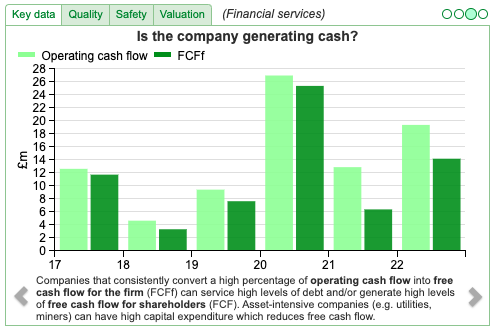

Cash: Similar to TP ICAP, AGFX’s global banking counterparties require collateral to be posted to deal in forward contracts. Hence, although the £21m of net cash after the fundraising represents around half the market cap, the bulk of this cash isn’t available to be distributed to shareholders. AGFX’s business model relies on the group running with a large cash balance.

Broker forecasts: Following the previous EPS miss when Numis were forecasting 12p of EPS for FY Mar 2022, the company switched brokers with Singers publishing a note forecasting 10p of EPS for FY Dec 2024F, assuming £57m of revenue (compared to c. £45m just announced by management). It looks like this is a company where management have no idea what EPS or revenue will be in 18 months time, so I think we should treat broker forecasts with particular caution for this company.

Valuation: SharePad is not showing any forecasts currently. That leaves the company trading on around 2x cash or 1x revenue. That appears good value if management can turn things around – but they haven’t explained what has gone wrong or what levers they can pull to improve performance. It could just be the revenue in this sector is inherently unpredictable, or they could be losing market share to competitors.

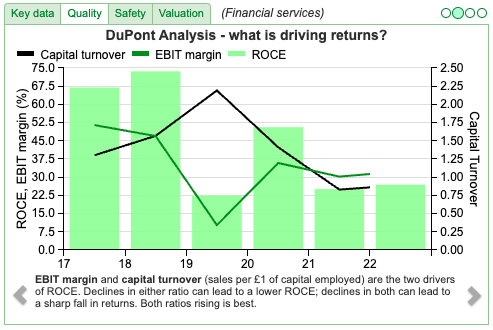

Opinion: Unfortunately I bought into the story at the wrong price, attracted by the historically high RoCE and over-optimistic forecasts. That high level of profitability now looks like an artefact of favourable market conditions rather than any structural advantage versus competitors. I’m tempted to average down, as I think that it’s now more likely that revenue might surprise on the upside, following all the hiring that has gone on. However, that is by no means a given. The previous Chief Exec and Finance Director made several presentations on Investormeetcompany; the new management haven’t scheduled any presentations, which is a shame.

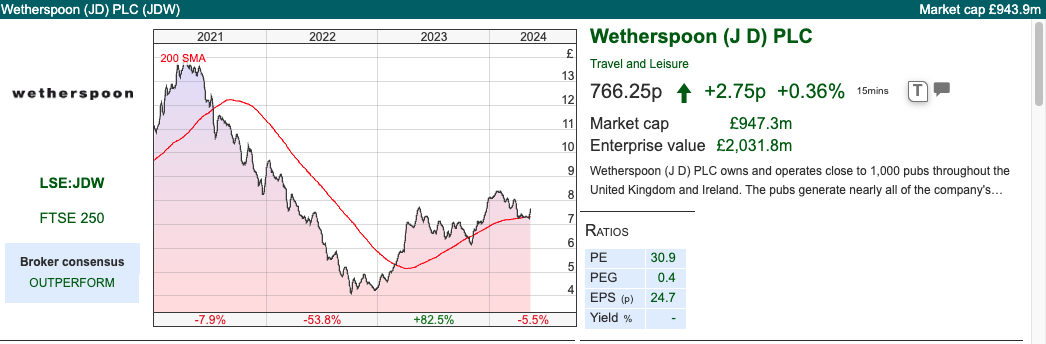

Wetherspoons Q3 Trading Update

This well-known pub company with a 30 July year-end announced Q3 trading update, with like-for-like sales up by +5% in the quarter versus Q3 last year. The company currently has a trading estate of 809 pubs.

Total sales are up +6.5% YTD. Net debt was £685m at the end of April, a -7% reduction versus April last year. That net debt figure is also £120m lower than the Jan H1 2020 results, just before the pandemic, but still equates to 2.8x FY July 2024F EBITDA. The net debt figure has been helped by £240m of equity raised over 2020 and 2021.

Pubs have not been a good sector to invest in since the financial crisis. Many problems in the sector pre-dated the pandemic, for instance, Wetherspoons pointed out over a decade ago that:

“The pub trade has lost 50% of its beer sales, for example, in the last 30 years, to supermarkets. We believe that supermarkets have been increasingly able to undercut pubs’ prices, as a result of the

tax disparity between these types of businesses. In particular, pubs pay 20% VAT in respect of food sales, while supermarkets pay virtually nothing. This enables supermarkets to cross-subsidise their alcoholic drinks’ prices, resulting in large numbers of pub closures and also applying enormous pressure to those pubs which remain open.”

Lockdowns and then the cost of living struggles that consumers have faced in the last 18 months have also been unhelpful to the pub sector. According to a Deloitte survey of 3,200 UK consumers, we have been spending less money in pubs than at any time since lockdowns.

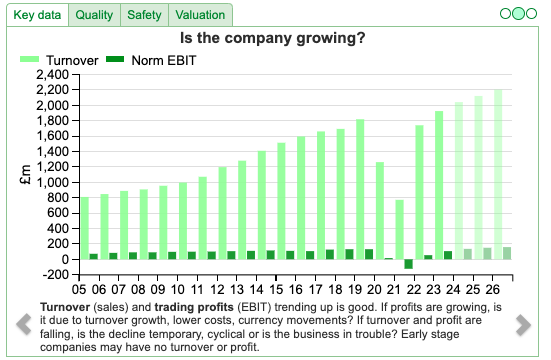

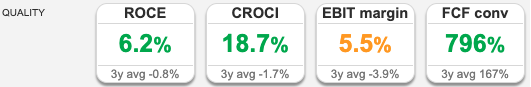

Sharepad has financial data on the company going back to 1993 when turnover was £31m and PBT £4.2m, versus £2bn and £70m forecast for FY July 2024F. Before the pandemic JDW achieved a low teens RoCE and an EBIT margin in high single digits, so there’s an opportunity to recover back to those levels versus recent history, when/if conditions do improve.

There’s some interesting commentary on what drinks have become popular with traditional ales like Abbot Ale, Ruddles and Doom Bar showing good growth, having been “very slow in the aftermath of the lockdowns”. I wonder if this means that confidence is returning to the older demographic, who are becoming more willing to go out and spend. As well as increasing Guinness and New Zealand wine, Tim Martin, the entertainingly garrulous, Chairman says:

“Sales of Lavazza coffee are also increasing. Free refills are thought to be responsible for spontaneous exhibitions of breakdancing among retired customers.”

Valuation: The shares are trading on a PER of 15x FY Jul 2025F and an EV/EBITDA of 7.5x the same year. The shares were a strong performer in the late 1990s, with the share price rising 6x inline with the increasing number of pubs that they were opening at the time. Those days are long gone though, they now have 809 pubs today, implying that this is no longer a growth company.

Opinion: This seems a relatively lower-risk way to benefit from rising consumer confidence, versus smaller names such as Loungers, Revolution Bars or XP Factory. The latter could see more upside if things go well, but it feels like we can be more confident about the longevity of JDW’s offering, especially if they keep serving free refills of coffee to retired customers.

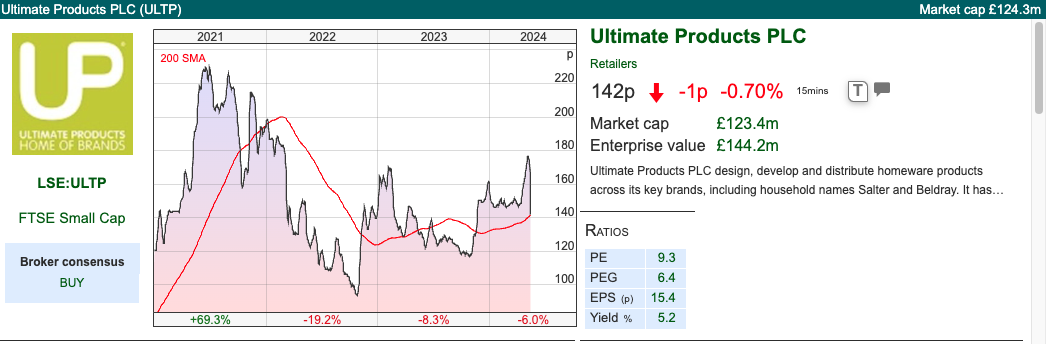

Ultimate Products Q3 Trading Update

This owner of homeware brands (Salter, Beldray) with a 31 July year-end, announced that trading in Q3 to end of April was disappointing. Revenue is down -7% versus the same quarter last year.

Forecasts: Cavendish downgraded their EPS forecasts by -22% to 12.5p for FY July 2024F. In the RNS management make positive noises about FY July 2025F:

“We are continuing to see the gradual resumption of normal ordering patterns from our retailer

customers as the overstocking issues brought about by the pandemic subside. The increase in forward ordering by retailers has primarily been benefitting our forward order book for FY25, and as a result, we are already seeing significant growth over the FY24 order book. The Directors therefore have confidence in the Group’s prospects for FY25.”

However, Cavendish also cut EPS that year by 15% to 14.8p and the following year FY July 2026F by 13% to 16.6p.

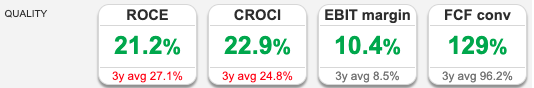

Valuation: That puts the shares on a 10x PER FY July 2025F and 9x PER the following year. Looks like good value for a company with a 3-year average RoCE of 27%, but possibly some scepticism that results may disappoint again.

Opinion: I looked at this six months ago, but worried that if UK housing market transactions slow, then this could be exposed as people tend to buy new pots and pans, kitchenware etc when they move house. As it happens, the housing market hasn’t done too badly, with agreed sales were up +12% in April versus a year ago. UK mortgage approvals are at an 18-month high. That hasn’t helped Ultimate Products though, as Cavendish are forecasting a -5% decline in revenue to FY July 2024F. Management are presenting live at Mello on Wednesday 22nd and Thursday 23rd of this month, so I am looking forward to hearing them set out their investment case to investors.

Notes

Bruce Packard

Bruce owns shares in Argentex

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 14/05/2024 | AGFX, JDW, ULTP | Professional button pushers

Nvidia’s share price has risen by 8x in the last 18 months, yet it is not obvious which businesses their GPUs will disrupt. Stocks covered AGFX, JDW and ULTP.

The FTSE 100 rose +2.5% to 8,420 and continues to hit all-time highs. The Nasdaq100 and S&P500 were up +1.5% and +1.8% respectively. Oil was down less than -0.5%, and at $83 per barrel is up +8% YTD. Natural Gas (NG-MT) on the other hand spiked up +16% in the last 5 trading days. Copper continues to rise and is up +20% YTD, suggesting economic activity is picking up across the globe, particularly in China.

Bill Gates said last year that in his lifetime he has only seen two demonstrations of technology that struck him as revolutionary. The first was the Graphical User Interface (GUI) which he went on to develop into the Windows operating system. The second is ChatGPT, which impressed him with its ability to pass a Biology exam. Gates suggests that document handling tasks (like payables, accounting, or insurance claim disputes) which require decision-making but not the ability to learn continuously, could be disrupted. One of my programmer friends, who has just left a large Nasdaq-listed tech firm, is working on using AI too, hoping to develop a personal assistant, to deal with emails, set reminders, minimise distractions and generally help him manage his ADHD.

He is not alone. According to a recent Nvidia presentation, between 2020 and 2023 the number of AI Startups has increased by 2.5x to 15K per year, and the number of apps using GPUs has ballooned by 5x 3.2K.

The Nvidia share price is up by almost 8x since October 2022, so there are plenty of people who believe that generative AI will create huge profits for some companies. Notably, the NVDA share price isn’t just a speculative bubble of meme stock traders, with no support from underlying financial data. Sharepad shows that NVDA’s revenue is forecast to increase 10x from $11bn in FY Jan 2020 to $112bn in FY Jan 2025F. Group PBT is forecast to rise by 24x to $72bn over the same time period.

And yet, I also found an interesting piece by Ben Evans, who suggests that Large Language Models (LLMs) have few proven “use cases” at the moment. Unlike a word processor or a spreadsheet, which lawyers and accountants could immediately see would make their lives easier, ChatGPT and similar have few obvious use cases outside developers who use them as a tool to write computer code more efficiently and by students cheating on their homework. There are still many “simple” tasks the models can’t do. Ben Evans uses the example of finding data on the number of people employed as elevator attendants from the US Census website, which is still difficult for AI.

It’s hard to think of a company or a profession that is currently being automated out of existence by the new technology, the equivalent of the elevator attendant which employers came to realise wasn’t necessary, ordinary people could simply push the button themselves to select a floor. We didn’t need elevator attendants as professional button pushers – perhaps all these people retrained as DJs?

I will be attending Mello at Chiswick on Wed & Thursday 22nd and 23rd of May, so looking forward to catching up with many of you. David has worked really hard to get companies to present face-to-face to investors. I am sceptical of the value of online-only presentations as it is not possible to know which investor questions management ignores – it’s interesting that many company management teams are keen for workers to return to the office so that they gain the intangible benefits of unplanned interactions, yet when it comes to engaging with investors the same management teams behave as if we are still back in the pandemic.

This week I look at results from FX currency trader Argentex and pub operator JD Wetherspoons, followed by a comment on Ultimate Products’ profit warning.

Argentex FY Dec Results and Capital Raising

This FX currency trader announced FY results with revenues down -1% to £50m and statutory PBT down -6% to £7.3m. That’s a disappointing result given the company also reported £18m of net cash at the end of December, the group should be benefiting from higher interest rates received on balances. Management had already given revenue and operating profit guidance in January – however, the shares fell -22% following the RNS as management also warned that adverse market conditions (clients trading less) had continued into Q1 of 2024 and that they intended to raise capital. They also cut the dividend.

Following the book build for its placing they raised gross proceeds of approximately £3.25m (before expenses) at 45p per share. That compares to £5m if AGFX had achieved a full take-up of their offer (limited by 10% of the total shares outstanding). It might seem odd that a company with £18m of net cash has come back to investors to ask for more money, at a time when market conditions are difficult and the share price has fallen -82% from its peak in early 2020.

The reasons given were i) drive operational efficiency ii) develop more products in Alternative Banking iii) geographical expansion. Without additional financing management expect FY Dec 2024F revenues to be in the mid £40s million (that is implying a -10% decline), with an EBITDA margin in the low single digits (suggesting a statutory loss for the current year). With the capital raising, management anticipates that revenue growth in FY 2026F should be within the range of 15-20% per annum, with EBITDA margins in the mid-teens. The Company also intends to raise £10-15m of debt financing, via a Revolving Credit Facility.

I think it’s worth looking at what has happened, as it highlights a couple of issues around “voluntary disclosure” that management made in the past.

Growth story: In 2019, when the company raised £12.5m through an IPO, the plan was to use the money to double sales headcount to 50 people. Management suggested that sales staff tended to generate more revenue the longer they stayed at the company. So in the first year, a salesperson would, on average, generate £42,000 in revenue, which would later grow to £1.8m in year five. AGFX reported 85 sales and dealing staff in FY Dec 2023, an increase of 3.3x since 2019. However back-office staff (operations) has increased by almost 7x to 74 over the same time period. Management invested for growth, then discovered that they needed back-office support functions and revenue has disappointed.

The table below shows, that FY Dec 2023 average revenue per client of £25.7K, though down 11% is still above the average since 2019 of £23.4K (in blue). However, revenue per front office employee has been on an unsteady decline and is now down -43% since the £1m figure for FY Mar 2020 to £587K (in red). Given the 7x increase in back office staff, the trend will look even worse for total employees.

Change of year-end: In 2022 management decided to change its year-end to December, “in line with the Group’s transition to a global financial solutions provider” – as if this goal could not be achieved with a March year end. At the time there was some speculation on Twitter that this allowed management to re-base expectations down – although as the Truss/Kwarteng mini-budget created significant volatility AGFX ended up reporting revenue growth of +54% in 2022. Before the change of year-end, Numis, who IPO’ed the company were forecasting 12p of EPS for FY Mar 2022, which compares to 7.1p of EPS just reported FY Dec 2023.

Cash: Similar to TP ICAP, AGFX’s global banking counterparties require collateral to be posted to deal in forward contracts. Hence, although the £21m of net cash after the fundraising represents around half the market cap, the bulk of this cash isn’t available to be distributed to shareholders. AGFX’s business model relies on the group running with a large cash balance.

Broker forecasts: Following the previous EPS miss when Numis were forecasting 12p of EPS for FY Mar 2022, the company switched brokers with Singers publishing a note forecasting 10p of EPS for FY Dec 2024F, assuming £57m of revenue (compared to c. £45m just announced by management). It looks like this is a company where management have no idea what EPS or revenue will be in 18 months time, so I think we should treat broker forecasts with particular caution for this company.

Valuation: SharePad is not showing any forecasts currently. That leaves the company trading on around 2x cash or 1x revenue. That appears good value if management can turn things around – but they haven’t explained what has gone wrong or what levers they can pull to improve performance. It could just be the revenue in this sector is inherently unpredictable, or they could be losing market share to competitors.

Opinion: Unfortunately I bought into the story at the wrong price, attracted by the historically high RoCE and over-optimistic forecasts. That high level of profitability now looks like an artefact of favourable market conditions rather than any structural advantage versus competitors. I’m tempted to average down, as I think that it’s now more likely that revenue might surprise on the upside, following all the hiring that has gone on. However, that is by no means a given. The previous Chief Exec and Finance Director made several presentations on Investormeetcompany; the new management haven’t scheduled any presentations, which is a shame.

Wetherspoons Q3 Trading Update

This well-known pub company with a 30 July year-end announced Q3 trading update, with like-for-like sales up by +5% in the quarter versus Q3 last year. The company currently has a trading estate of 809 pubs.

Total sales are up +6.5% YTD. Net debt was £685m at the end of April, a -7% reduction versus April last year. That net debt figure is also £120m lower than the Jan H1 2020 results, just before the pandemic, but still equates to 2.8x FY July 2024F EBITDA. The net debt figure has been helped by £240m of equity raised over 2020 and 2021.

Pubs have not been a good sector to invest in since the financial crisis. Many problems in the sector pre-dated the pandemic, for instance, Wetherspoons pointed out over a decade ago that:

“The pub trade has lost 50% of its beer sales, for example, in the last 30 years, to supermarkets. We believe that supermarkets have been increasingly able to undercut pubs’ prices, as a result of the

tax disparity between these types of businesses. In particular, pubs pay 20% VAT in respect of food sales, while supermarkets pay virtually nothing. This enables supermarkets to cross-subsidise their alcoholic drinks’ prices, resulting in large numbers of pub closures and also applying enormous pressure to those pubs which remain open.”

Lockdowns and then the cost of living struggles that consumers have faced in the last 18 months have also been unhelpful to the pub sector. According to a Deloitte survey of 3,200 UK consumers, we have been spending less money in pubs than at any time since lockdowns.

Sharepad has financial data on the company going back to 1993 when turnover was £31m and PBT £4.2m, versus £2bn and £70m forecast for FY July 2024F. Before the pandemic JDW achieved a low teens RoCE and an EBIT margin in high single digits, so there’s an opportunity to recover back to those levels versus recent history, when/if conditions do improve.

There’s some interesting commentary on what drinks have become popular with traditional ales like Abbot Ale, Ruddles and Doom Bar showing good growth, having been “very slow in the aftermath of the lockdowns”. I wonder if this means that confidence is returning to the older demographic, who are becoming more willing to go out and spend. As well as increasing Guinness and New Zealand wine, Tim Martin, the entertainingly garrulous, Chairman says:

“Sales of Lavazza coffee are also increasing. Free refills are thought to be responsible for spontaneous exhibitions of breakdancing among retired customers.”

Valuation: The shares are trading on a PER of 15x FY Jul 2025F and an EV/EBITDA of 7.5x the same year. The shares were a strong performer in the late 1990s, with the share price rising 6x inline with the increasing number of pubs that they were opening at the time. Those days are long gone though, they now have 809 pubs today, implying that this is no longer a growth company.

Opinion: This seems a relatively lower-risk way to benefit from rising consumer confidence, versus smaller names such as Loungers, Revolution Bars or XP Factory. The latter could see more upside if things go well, but it feels like we can be more confident about the longevity of JDW’s offering, especially if they keep serving free refills of coffee to retired customers.

Ultimate Products Q3 Trading Update

This owner of homeware brands (Salter, Beldray) with a 31 July year-end, announced that trading in Q3 to end of April was disappointing. Revenue is down -7% versus the same quarter last year.

Forecasts: Cavendish downgraded their EPS forecasts by -22% to 12.5p for FY July 2024F. In the RNS management make positive noises about FY July 2025F:

“We are continuing to see the gradual resumption of normal ordering patterns from our retailer

customers as the overstocking issues brought about by the pandemic subside. The increase in forward ordering by retailers has primarily been benefitting our forward order book for FY25, and as a result, we are already seeing significant growth over the FY24 order book. The Directors therefore have confidence in the Group’s prospects for FY25.”

However, Cavendish also cut EPS that year by 15% to 14.8p and the following year FY July 2026F by 13% to 16.6p.

Valuation: That puts the shares on a 10x PER FY July 2025F and 9x PER the following year. Looks like good value for a company with a 3-year average RoCE of 27%, but possibly some scepticism that results may disappoint again.

Opinion: I looked at this six months ago, but worried that if UK housing market transactions slow, then this could be exposed as people tend to buy new pots and pans, kitchenware etc when they move house. As it happens, the housing market hasn’t done too badly, with agreed sales were up +12% in April versus a year ago. UK mortgage approvals are at an 18-month high. That hasn’t helped Ultimate Products though, as Cavendish are forecasting a -5% decline in revenue to FY July 2024F. Management are presenting live at Mello on Wednesday 22nd and Thursday 23rd of this month, so I am looking forward to hearing them set out their investment case to investors.

Notes

Bruce Packard

Bruce owns shares in Argentex

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.