Bruce looks at 3 companies on low teens PERs that reported last week: BOWL, BMY and DOCS. But he wonders if copper is suggesting negative macroeconomic news that is not yet priced in.

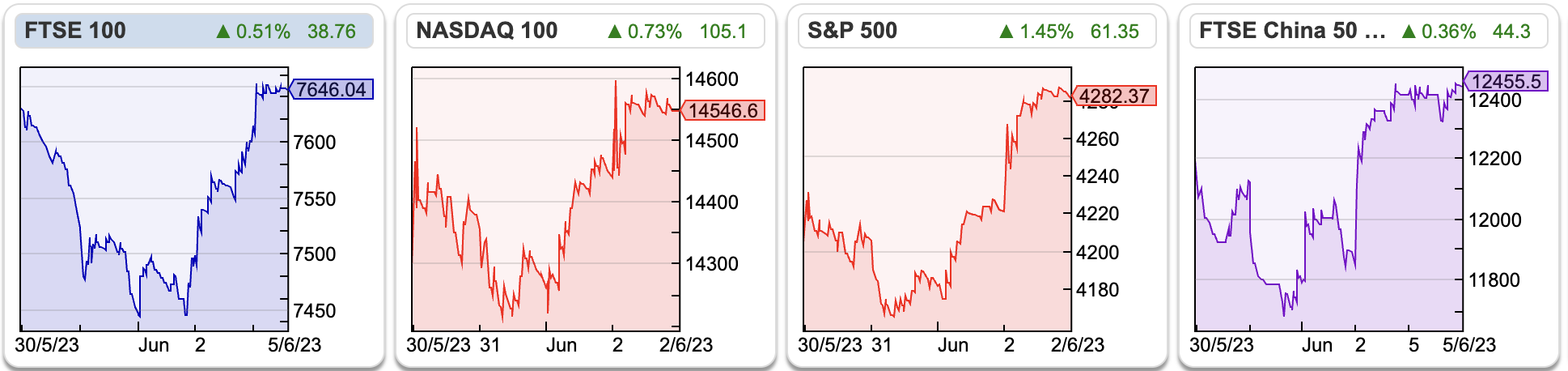

The FTSE 100 was flat at 7646 last week. In the last 5 days, the Nasdaq100 was very strong, up +4.4% and the best-performing major index. The S&P500 and Japan’s Nikkei 225 were the second and third-best performers, both up +3.2%.

Following an OPEC+ meeting in Vienna, Saudi Arabia has announced it will cut oil production by 1m barrels of oil a day over the summer. The IMF estimates that Saudi Arabia needs oil prices above $80 per barrel just to balance its budget – given all the large infrastructure projects they are intending. Brent Crude rose +2% following the news to $75 per barrel, but is still down -13% YTD.

Copper (HG-MT) down -10% since the middle of April has broken through its long-term and short-term moving averages. The industrial metal, which often is viewed as a lead indicator on the global economy, is back to the same levels as November last year. For contrast, the Nasdaq 100 is up +20% since the same point last November.

The “MT” part of Sharepad’s HG-MT ticker shows the most traded future, in other words, the most liquid contract rather than the spot price. Recently copper’s futures discount has blown out versus the spot price to be the widest in 2 decades, so-called “super-contango”. That, in turn, seems to be indicating that China’s economic re-opening is not going to plan while rising interest rates in the US and Europe are also slowing industrial activity. Longer-term copper is likely to play a role in the shift to renewable power, electric vehicles (EVs) and infrastructure spending.

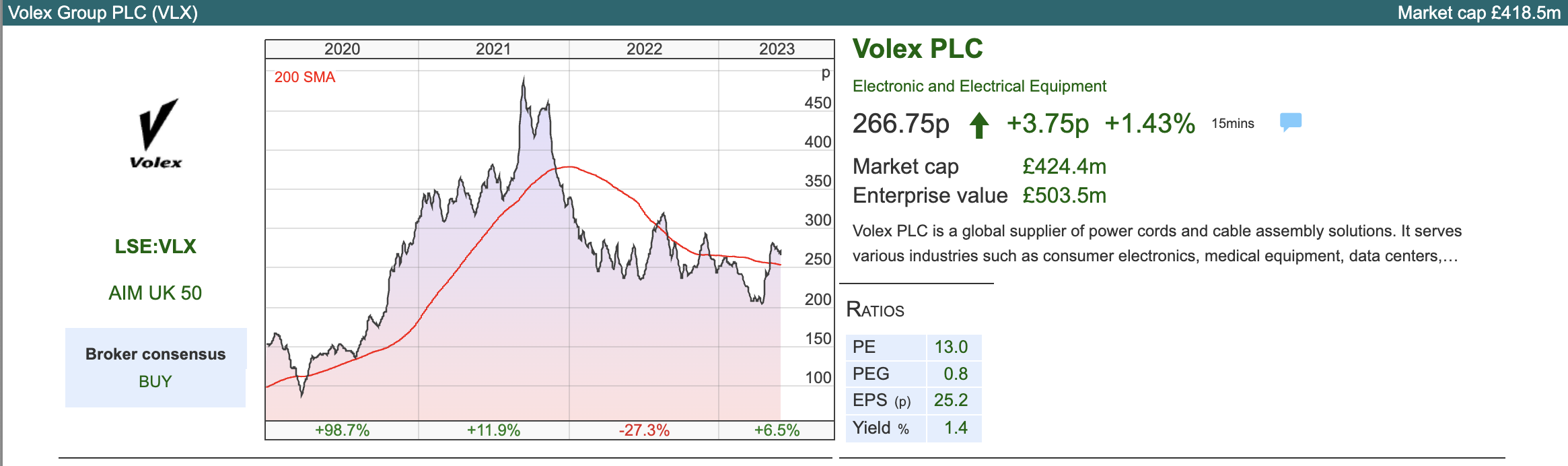

Nat Rothschild’s Volex could be an interesting way to play this theme, though having bought DE-KA in 2021, the company also has considerable country risk exposure to Turkey. The FT says that we may soon have a Turkish soda ash IPO coming to London.

Nat Rothschild’s Volex could be an interesting way to play this theme, though having bought DE-KA in 2021, the company also has considerable country risk exposure to Turkey. The FT says that we may soon have a Turkish soda ash IPO coming to London.

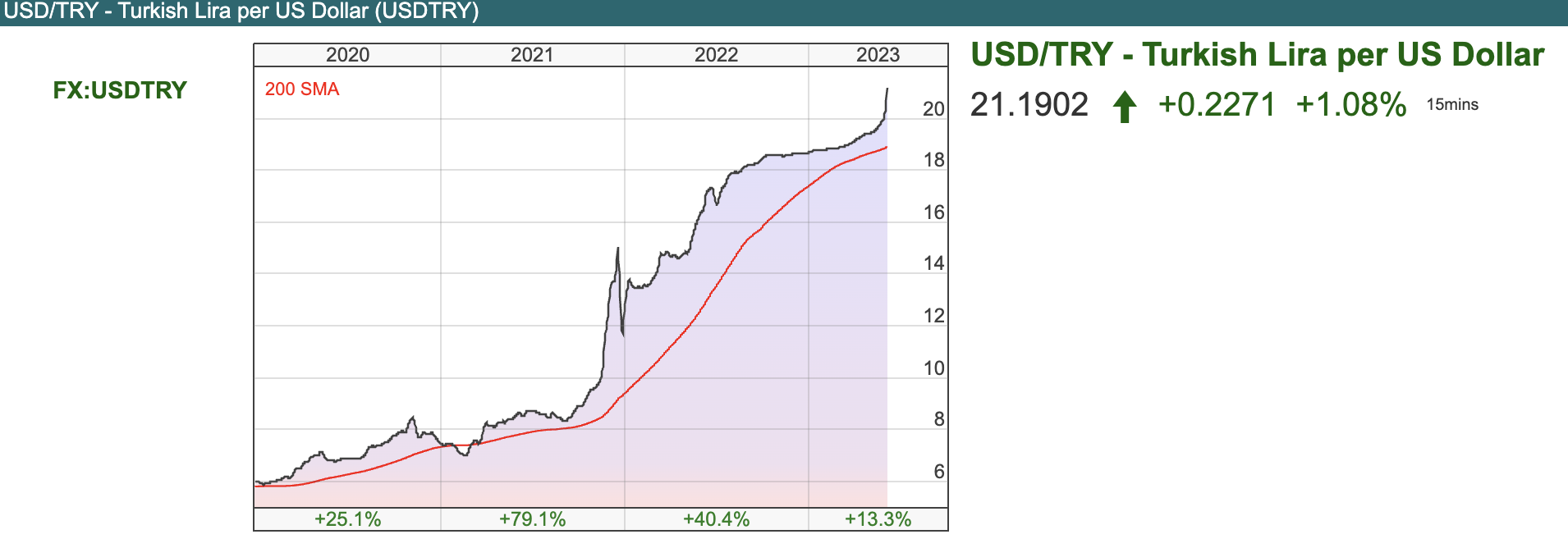

The Turkish Lira continues to be very weak, following Erdogan’s re-election. The currency has halved in value against the US dollar since the start of last year, you could get 6 Lira to the US dollar just before the pandemic, versus over 21 Lira to the dollar now. In the short term, a weak currency may prove a benefit to Turkish exporters and the tourism industry, but not if the country descends into hyperinflation, as it did in the late 1990s and early 2000s.

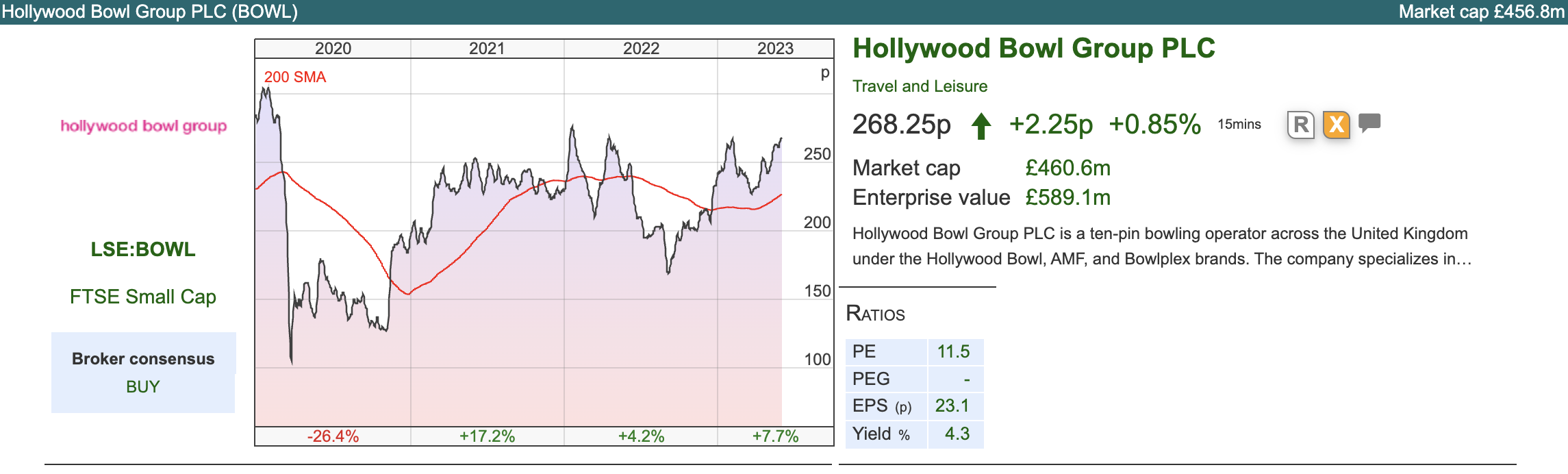

This week I look at Hollywood Bowl, Bloomsbury and Dr Martens. All three look good value (forecast PERs of low teens), but I think BMY could prove more defensive than BOWL and DOCS, which rely on discretionary household spend. BMY’s publishing business ought to be more recession-proof I think.

This week I look at Hollywood Bowl, Bloomsbury and Dr Martens. All three look good value (forecast PERs of low teens), but I think BMY could prove more defensive than BOWL and DOCS, which rely on discretionary household spend. BMY’s publishing business ought to be more recession-proof I think.

Hollywood Bowl

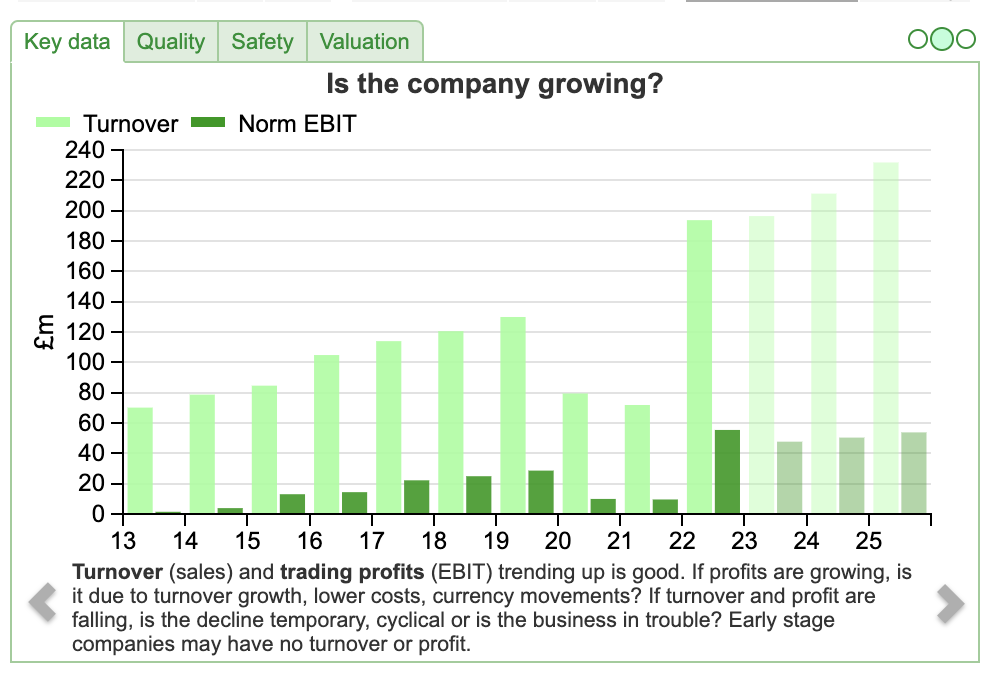

The UK and Canada’s largest ten-pin bowling operator announced revenues up +21% to £110m H1 March. Worth noting though that revenue growth adjusts out the government reducing VAT during the pandemic, which was a benefit in the prior year. Richard wrote this adjustment up here. Hollywood Bowl management correctly defined a VAT gain (when the government helpfully reduced VAT to hospitality businesses during the pandemic) as exceptional, but then chose not to deduct this exceptional item from adjusted profit after tax, which for their FY Sept results gave an increase of +77% in after-tax profits. For contrast, in last week’s RNS profit after tax fell -23% to £20.9m on a statutory basis, on the company’s adjusted basis the increase was +7.5%.

The UK and Canada’s largest ten-pin bowling operator announced revenues up +21% to £110m H1 March. Worth noting though that revenue growth adjusts out the government reducing VAT during the pandemic, which was a benefit in the prior year. Richard wrote this adjustment up here. Hollywood Bowl management correctly defined a VAT gain (when the government helpfully reduced VAT to hospitality businesses during the pandemic) as exceptional, but then chose not to deduct this exceptional item from adjusted profit after tax, which for their FY Sept results gave an increase of +77% in after-tax profits. For contrast, in last week’s RNS profit after tax fell -23% to £20.9m on a statutory basis, on the company’s adjusted basis the increase was +7.5%.

The company reports net cash of £44m ex-finance leases, down from £50m H1 last year and £56m at the end of September. However, the finance leases are related to the properties BOWL operates it sites from and stood at £192m at the end of March. These finance leases are a future obligation, if not strictly speaking debt, so that net debt (inc leases) stood at £148m v £122m March last year.

History: The business was formed in 2010 from the merger of AMF (18 centres) and Hollywood Bowl (24 centres), which at the time was part of Mitchells & Butler, the pub and restaurant operator which struggled with its hedging contracts related to debt. The contracts were supposed to protect the balance sheet in a rising interest rate environment but went against the company when the BoE cut rates during the 2007-8 financial crisis.

History: The business was formed in 2010 from the merger of AMF (18 centres) and Hollywood Bowl (24 centres), which at the time was part of Mitchells & Butler, the pub and restaurant operator which struggled with its hedging contracts related to debt. The contracts were supposed to protect the balance sheet in a rising interest rate environment but went against the company when the BoE cut rates during the 2007-8 financial crisis.

BOWL’s core revenue stream is bowling revenue, effectively renting out lanes either as an “unlimited offer” for groups of 4, 5 or 6 or a package (3-game deal, which might include a meal and/or a drink). Each centre has a bar, offering food and drink, plus other amusements like air hockey or video games. At the time of the IPO, bowling was just under half of revenue, food and drink was just over a quarter and the rest was the amusement machines.

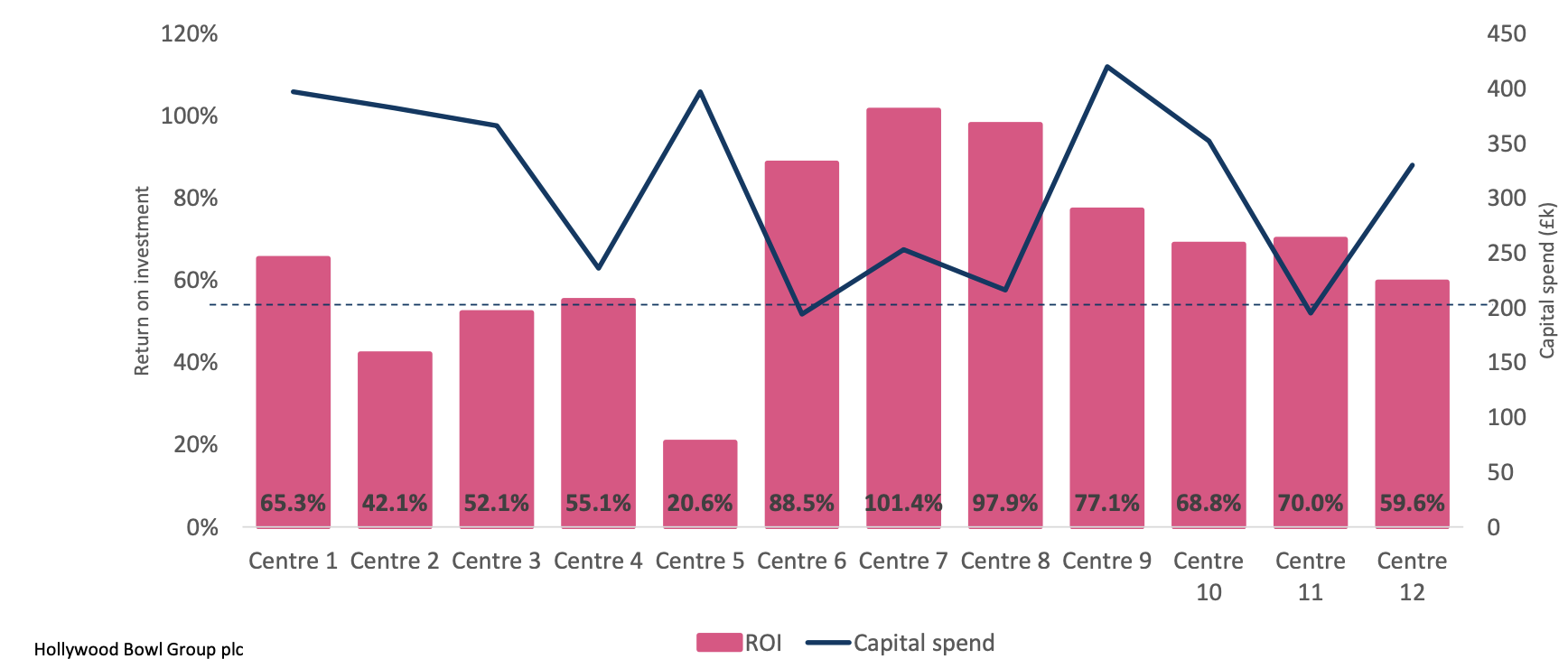

For a physical business, the company reports very high gross profit margin of 83%, because once the bowling centres have been fitted out, the direct cost are minimal. The same is true of a bar with a shuffleboard downstairs, there’s a markup on the food and drink you sell, but considerable operational gearing on the shuffleboard. Once you have covered the cost of installing the physical shuffleboards, each incremental game you sell is pure cashflow! Over the long term however, both shuffleboards and bowling alleys suffer “wear and tear”, so the cashflow does need to be reinvested. BOWL spent £3.9m in H1 refurbishing 8 centres (v depreciation charge of £4.9m and £74m of fixed assets). Based on the H1 figure they refurbish roughly every decade, which sounds about right to me. Management put up this slide, to breakdown RoI of refurbishment spend by individual bowling centres. The average payback (dotted line) is just over 55% on the last 12 refurbishments.

The company listed on the LSE at 160p, with 75% (or £175m) raised going to selling shareholder, Electra Private Equity and no new money raised. The market cap on admission in September 2016 was £240m. At the time of the IPO, FY 2016 revenues were £105m. The business delivered a couple of years of revenue growth, then the pandemic hit and revenues fell -39%. Impressively management were able to report results around breakeven, helped by government support measures. The number of shares has increased by +14% to 172m, as the company did a placing at 230p per share, raising gross proceeds of approximately £30m in March 2021.

The company listed on the LSE at 160p, with 75% (or £175m) raised going to selling shareholder, Electra Private Equity and no new money raised. The market cap on admission in September 2016 was £240m. At the time of the IPO, FY 2016 revenues were £105m. The business delivered a couple of years of revenue growth, then the pandemic hit and revenues fell -39%. Impressively management were able to report results around breakeven, helped by government support measures. The number of shares has increased by +14% to 172m, as the company did a placing at 230p per share, raising gross proceeds of approximately £30m in March 2021.

In May 2022 they expanded into Canada, buying Teaquinn for £10m. This February they bought three centres in Calgary and have recently exchanged contracts on a site in Ontario. The Canadian business contributed £11m in revenue and £3m of EBITDA (ex IFRS 16 lease costs) in the first half of the year.

Outlook: The outlook statement confirms they are trading in line with the Board’s expectations for FY Sept 2023F. Sharepad shows revenue forecasts of £200m and PBT of £43m, implying +3% top-line growth but a decline in PBT. They are targetting 15-20 new centre openings by the end of FY2025 (current UK estate is 69). They are confident customer demand will continue and believe that they are well-insulated from inflationary pressures with electricity costs hedged to the end of FY2024.

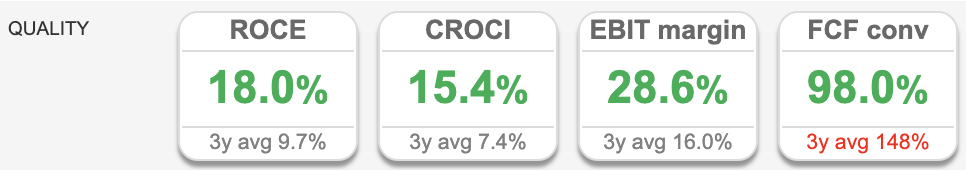

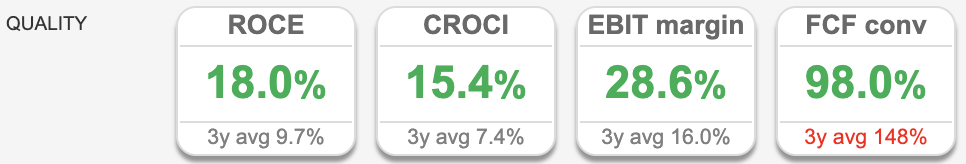

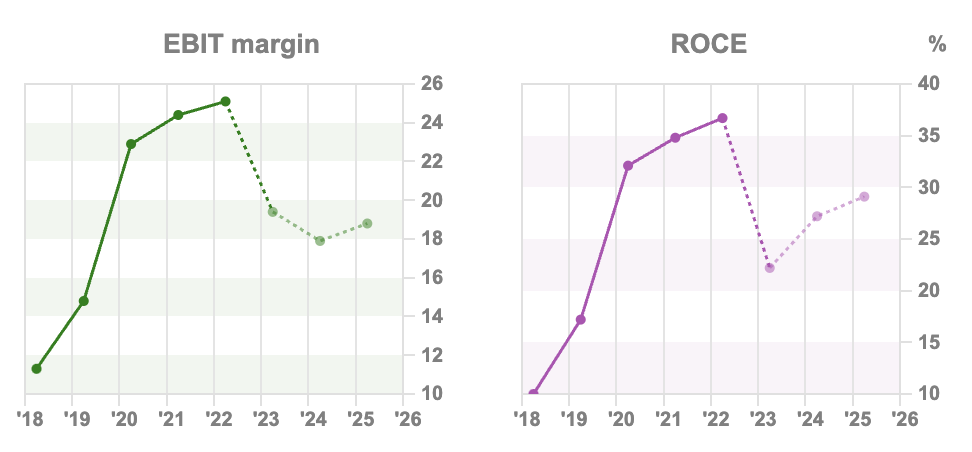

Valuation: BOWL trades on 13.5x PER Sept 2024F, dropping to 12.5x PER the following year. I wouldn’t pay too much attention to the 3-year average RoCE and EBIT, because they’ve obviously been distorted by the pandemic. The most recently reported RoCE of 18% and 29% EBIT margin look impressive if they can be sustained.

Opinion: It’s a shame that management felt the need to apply the VAT adjustment inconsistently in their voluntary disclosure. That’s not quite a “red flag”, but perhaps an orange one? As noted last week, UK consumers have defied both professional economists and the UK media, continuing to spend in the leisure sector. Household spending might not be sustainable as rising interest rates divert money from the economy to cover mortgage debts though, so I think this might be less resilient in a deep recession than management believe. On the watch list though.

Bloomsbury Publishing FY Feb results

The publisher announced FY results to February with organic revenues +9%, or including acquisitions +15% to £264m. Statutory PBT was also up +15% to £25m. The company had net cash of £52m (or 15% of the market cap) at the year-end.

The publisher announced FY results to February with organic revenues +9%, or including acquisitions +15% to £264m. Statutory PBT was also up +15% to £25m. The company had net cash of £52m (or 15% of the market cap) at the year-end.

BMY is best known for its association with Harry Potter, which has been a huge financial windfall. They say that sales of JK Rowling’s books remain strong, 26 years after Harry Potter and the Philosopher’s Stone was first published, it was the second best-selling children’s book in the UK last year. The Hogwarts series is included in BMY’s Children’s Trade division, which showed revenue growth of +17% to £109m and PBT up +9% to £17m.

There is more to Bloomsbury than Harry Potter though. Richard wrote up the strategy here, before the pandemic. Ironically, even though they struck gold with Harry Potter, Bloomsbury management doesn’t like the Pareto distribution of returns from the fiction publishing industry. Most books lose money, but the expected returns from the few that are successful can make up for the losses. Understandably this hit-or-miss nature of returns means that management doesn’t want future profits to be heavily reliant on finding the next blockbuster.

There is more to Bloomsbury than Harry Potter though. Richard wrote up the strategy here, before the pandemic. Ironically, even though they struck gold with Harry Potter, Bloomsbury management doesn’t like the Pareto distribution of returns from the fiction publishing industry. Most books lose money, but the expected returns from the few that are successful can make up for the losses. Understandably this hit-or-miss nature of returns means that management doesn’t want future profits to be heavily reliant on finding the next blockbuster.

So they have sought to balance the risky world of publishing fiction, through buying more dependable non-consumer titles and investing heavily, particularly Academic and Professional (currently 37% of turnover). Non-consumer revenue growth was +19%, of which just +3% was organic. The profit margin on Academic and Professional was 16%, better than 12% for the group as a whole.

That looks to be a strategy market to Nick Train’s favourite RELX (market cap £48bn). Bloomsbury announced this digital investment programme in 2016, and since then Bloomsbury Digital Resources (BDR) revenue has grown to £26m, and organic revenue growth of +18% in these results. Effectively BDR is digital subscription products for academic libraries. Management have announced a BDR target: to achieve further +40% organic revenue growth over the five years to 2027/28, implying turnover of c. £37m for the division.

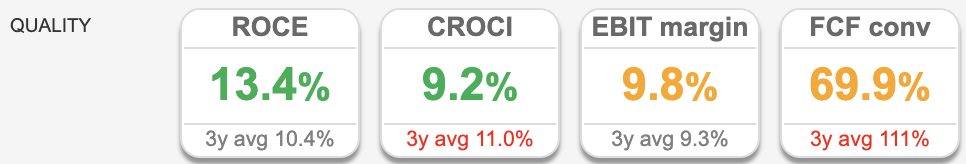

Valuation: The shares are trading on PER 13.5x Feb 2025F and 1.2x sales the same year. That compares to over 20x PER for RELX and 5x forecast sales. However, at 10.4% ROCE and 9.3% EBIT margin (both 3 year average) BMY profitability is well below that of RELX.

Valuation: The shares are trading on PER 13.5x Feb 2025F and 1.2x sales the same year. That compares to over 20x PER for RELX and 5x forecast sales. However, at 10.4% ROCE and 9.3% EBIT margin (both 3 year average) BMY profitability is well below that of RELX.

Opinion: Historically investors have tended to undervalue cashflows from database and subscription businesses like RELX. I can see what BMY management are trying to do, and it seems to be working to some extent.

I can think of a couple of points on the downside: i) the strategy seems unoriginal. I’m not sure the world needs two legal databases, and RELX’s LexisNexis contains 144bn legal documents and news items. Why would anyone also need to use Bloomsbury Professional? ii) BMY are buying Academic and Professional titles, but the organic growth was just +3% in non-consumer titles. This reminds me of SDI a couple of weeks ago, acquisitive companies need to demonstrate double-digit organic growth if they are to achieve a premium rating. Otherwise, it looks like management are using investors’ money to buy growth, rather than make progress by generating returns internally.

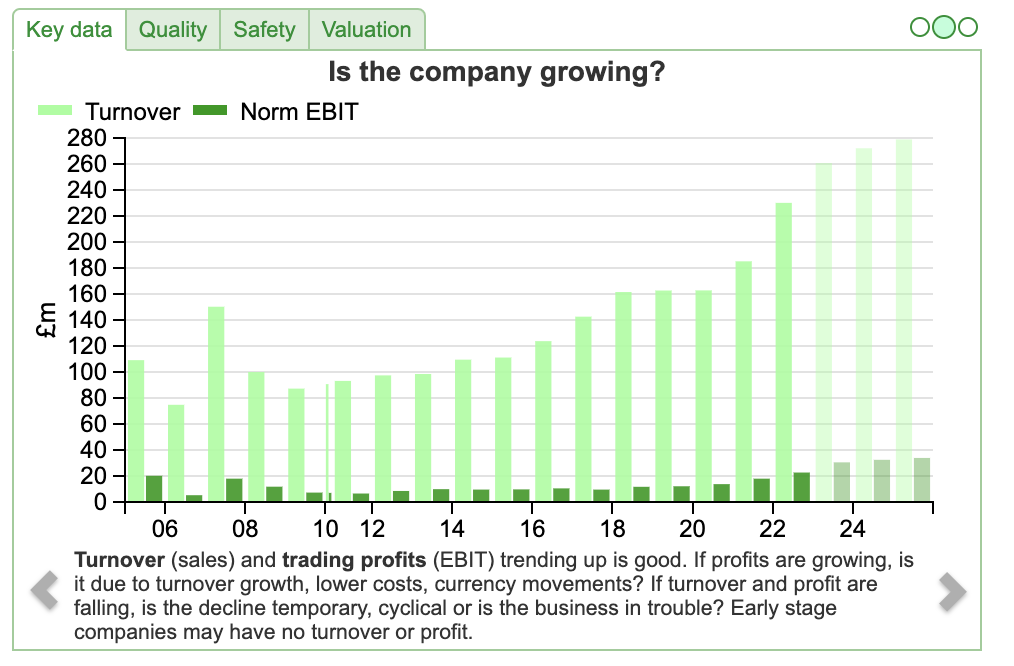

Dr Martens FY March results

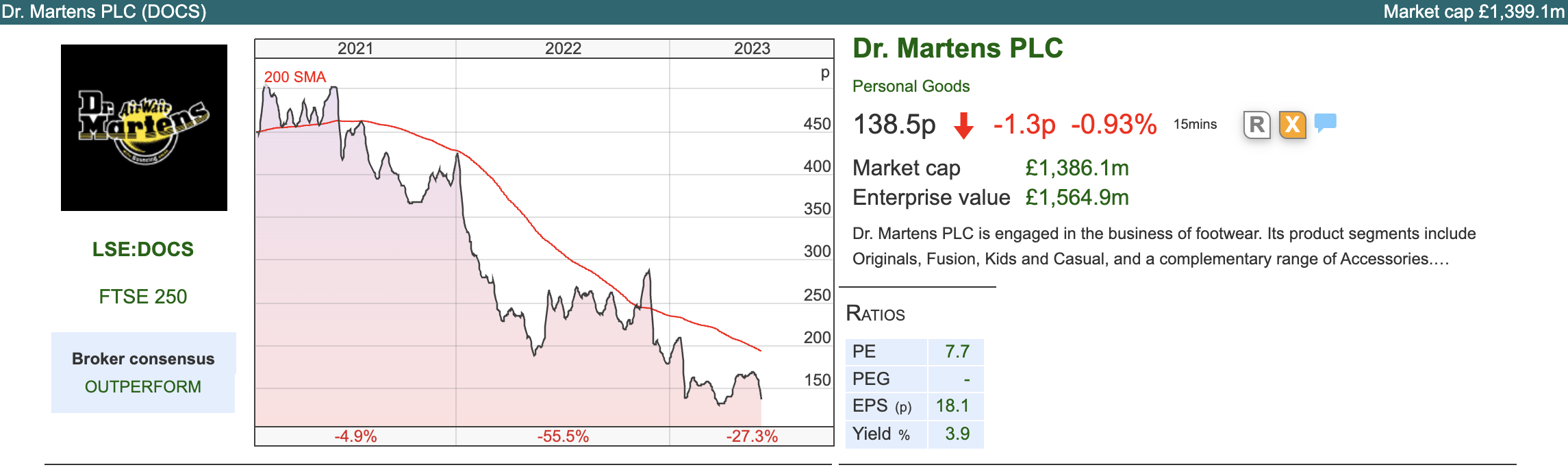

The shoe brand was an early 2021 “It’s Probably Overpriced” Private Equity (Permira) IPO; share price performance has been disappointing since then. There’s a good background article in The Sunday Times, pointing out that Permira have trebled their money from their initial investment, but investors who bought into the IPO at 370p have seen an almost 2/3 share price decline. The only mystery is why professional fund managers continue to fall for the same Private Equity sales pitch, I have yet to meet an amateur investor who speaks highly of Private Equity backed IPOs.

The shoe brand was an early 2021 “It’s Probably Overpriced” Private Equity (Permira) IPO; share price performance has been disappointing since then. There’s a good background article in The Sunday Times, pointing out that Permira have trebled their money from their initial investment, but investors who bought into the IPO at 370p have seen an almost 2/3 share price decline. The only mystery is why professional fund managers continue to fall for the same Private Equity sales pitch, I have yet to meet an amateur investor who speaks highly of Private Equity backed IPOs.

That said, I think the shares could be worth a look as much of the bad news could now be in the price. I’ve also noticed that my trendy female friends, who work in PR or design and who go to music festivals on abandoned Soviet nuclear bases, wear the classic Dr Martens boot. These elegant friends tend to avoid “fast fashion” for environmental reasons and instead buy their clothes from vintage second-hand shops. So I think DOCS should be insulated against the demise of fast fashion. Dr Martens also makes vegan DMs, appealing to those who want to avoid leather products for ethical reasons.

Again this is a share that Richard wrote up almost a year ago when he looked at the strategy in depth. Since he published that article there’s been a problem with DM’s American warehouses, which has cost around £30m to fix. The share price fell -25% on the day of that warning at the start of this year.

DOCS reported revenue +4% on a constant currency basis but helped by the strong pound +10% on a reported basis to £1bn. They report average prices up +5%, but volumes down -3% and a currency benefit of +6%. The gross margin was down slightly to 62%, but PBT was down steeply -26% to £159m on a reported basis.

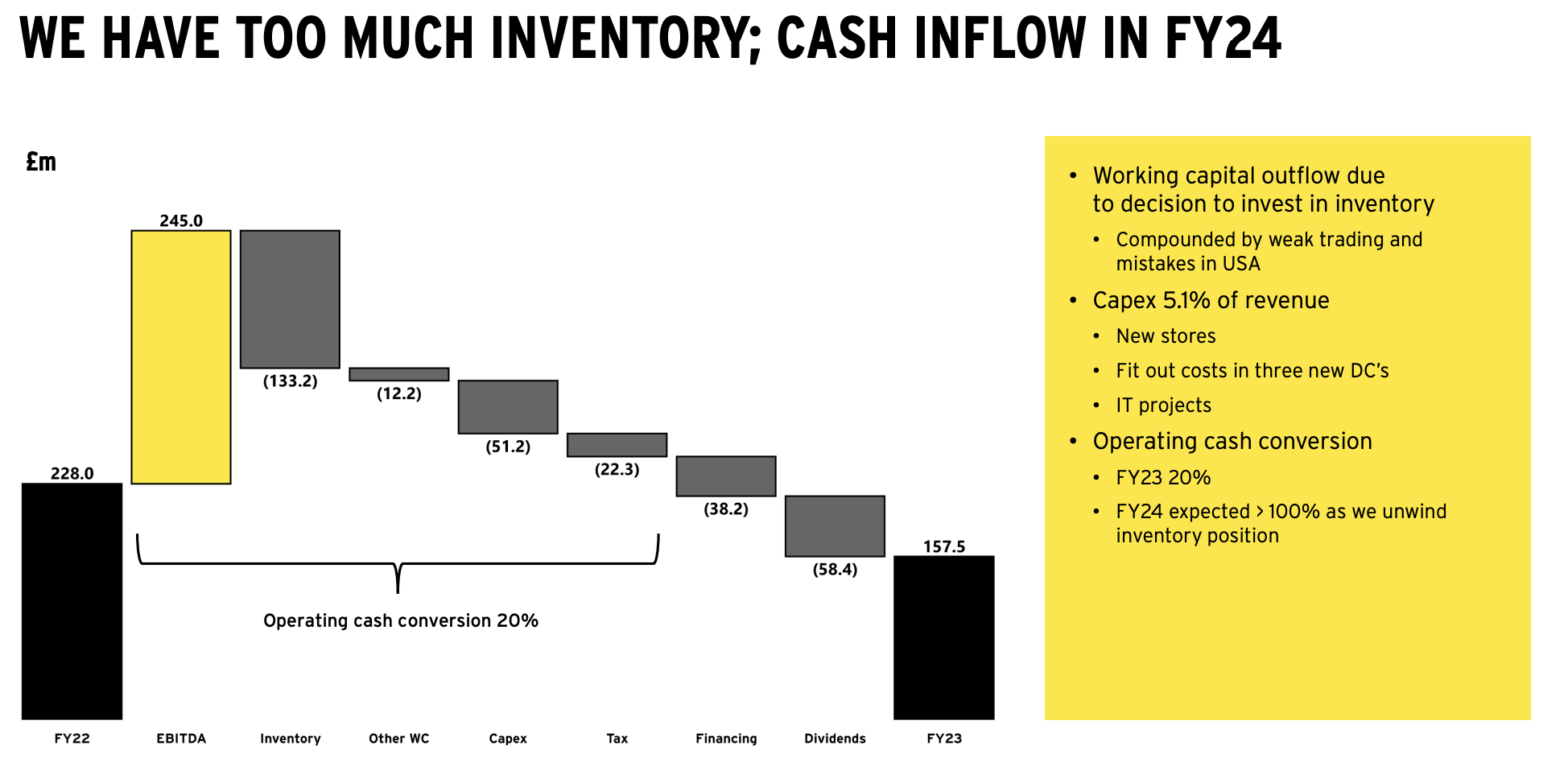

That was caused partly by a £14m negative swing on a forex loss on Euro-denominated bank debt. The company also reported a +47% increase in depreciation and amortisation charge, the former was up due to new store fit outs which are expected to last 5 years, while the latter almost doubled to £8.4m from investment in an IT system. The other adjustment is a £4m impairment charge (intangible asset write-down as opposed to charge taken against inventory). In their slide deck, management are very clear that they also have too much inventory, though I would have thought that there’s less risk of marking down the value of DM shoes than last season’s hoodies and suchlike.

Outlook: Current trading appears to be mixed. The company reports “very good” Direct to Consumer (DTC) growth (52% of revenue, and higher margin) but lower wholesale revenue (48% of revenue) than last year. That’s a similar trend to Superdry, which also has been reporting good performance through their own stores and online, but sales to wholesale going backwards. Dr Martens management attribute disappointment in wholesale to problems with US distribution (particularly Los Angeles) and halting supply to a China distributor.

DOCS expect to report mid to high single-digit revenue growth on a constant currency basis. There’s a dreaded H2 weighting in the outlook statement (ie Sept-Mar next year), which probably explains why the shares were off -12% on the morning of last week’s RNS.

Valuation: DOCS are trading on PER of 10x Mar 2025F. That looks good value assuming that there’s no further disappointment. Similar to BOWL though, I do wonder how defensive the shares would prove to be in a recession.

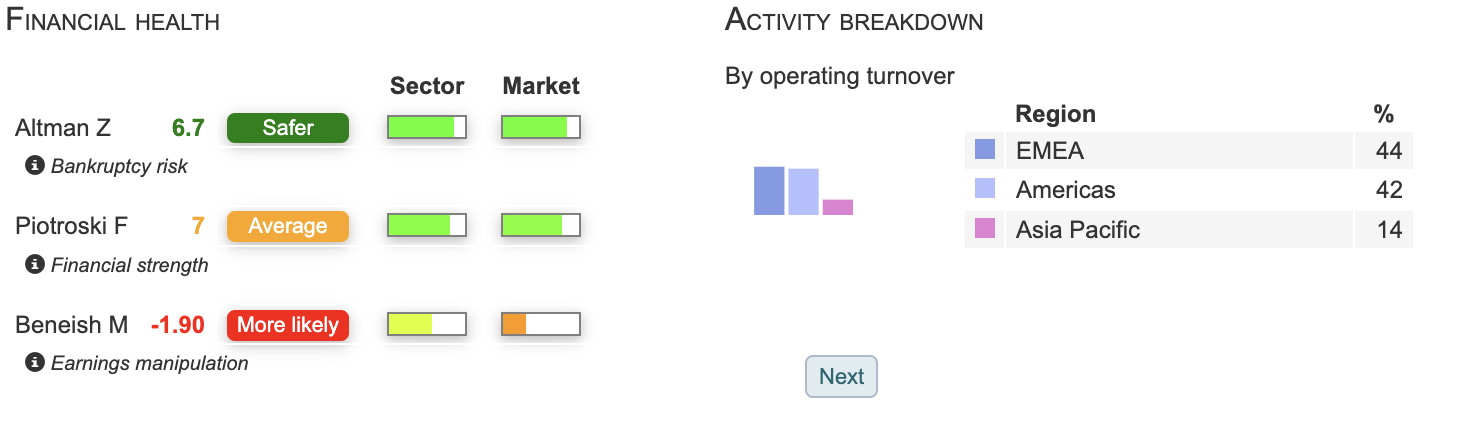

Opinion: Again a fundamentally sound business, in my view. Sharepad’s Altman Z and Piotriski F scores are reassuring. As readers can guess from my introduction, I am expecting another downward lurch in markets over the summer, so I am not looking to deploy large sums of cash at the moment. I also tend to avoid companies mentioning an H2 weighting, because if their H2 is weaker than management anticipate, then that can cause a profit warning. DOCS goes on my watch list though, and I will revisit later in the year.

Opinion: Again a fundamentally sound business, in my view. Sharepad’s Altman Z and Piotriski F scores are reassuring. As readers can guess from my introduction, I am expecting another downward lurch in markets over the summer, so I am not looking to deploy large sums of cash at the moment. I also tend to avoid companies mentioning an H2 weighting, because if their H2 is weaker than management anticipate, then that can cause a profit warning. DOCS goes on my watch list though, and I will revisit later in the year.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 06/06/23 | BOWL, BMY, DOCS | Copper’s super contango

Bruce looks at 3 companies on low teens PERs that reported last week: BOWL, BMY and DOCS. But he wonders if copper is suggesting negative macroeconomic news that is not yet priced in.

The FTSE 100 was flat at 7646 last week. In the last 5 days, the Nasdaq100 was very strong, up +4.4% and the best-performing major index. The S&P500 and Japan’s Nikkei 225 were the second and third-best performers, both up +3.2%.

Following an OPEC+ meeting in Vienna, Saudi Arabia has announced it will cut oil production by 1m barrels of oil a day over the summer. The IMF estimates that Saudi Arabia needs oil prices above $80 per barrel just to balance its budget – given all the large infrastructure projects they are intending. Brent Crude rose +2% following the news to $75 per barrel, but is still down -13% YTD.

Copper (HG-MT) down -10% since the middle of April has broken through its long-term and short-term moving averages. The industrial metal, which often is viewed as a lead indicator on the global economy, is back to the same levels as November last year. For contrast, the Nasdaq 100 is up +20% since the same point last November.

The “MT” part of Sharepad’s HG-MT ticker shows the most traded future, in other words, the most liquid contract rather than the spot price. Recently copper’s futures discount has blown out versus the spot price to be the widest in 2 decades, so-called “super-contango”. That, in turn, seems to be indicating that China’s economic re-opening is not going to plan while rising interest rates in the US and Europe are also slowing industrial activity. Longer-term copper is likely to play a role in the shift to renewable power, electric vehicles (EVs) and infrastructure spending.

The Turkish Lira continues to be very weak, following Erdogan’s re-election. The currency has halved in value against the US dollar since the start of last year, you could get 6 Lira to the US dollar just before the pandemic, versus over 21 Lira to the dollar now. In the short term, a weak currency may prove a benefit to Turkish exporters and the tourism industry, but not if the country descends into hyperinflation, as it did in the late 1990s and early 2000s.

Hollywood Bowl

The company reports net cash of £44m ex-finance leases, down from £50m H1 last year and £56m at the end of September. However, the finance leases are related to the properties BOWL operates it sites from and stood at £192m at the end of March. These finance leases are a future obligation, if not strictly speaking debt, so that net debt (inc leases) stood at £148m v £122m March last year.

BOWL’s core revenue stream is bowling revenue, effectively renting out lanes either as an “unlimited offer” for groups of 4, 5 or 6 or a package (3-game deal, which might include a meal and/or a drink). Each centre has a bar, offering food and drink, plus other amusements like air hockey or video games. At the time of the IPO, bowling was just under half of revenue, food and drink was just over a quarter and the rest was the amusement machines.

For a physical business, the company reports very high gross profit margin of 83%, because once the bowling centres have been fitted out, the direct cost are minimal. The same is true of a bar with a shuffleboard downstairs, there’s a markup on the food and drink you sell, but considerable operational gearing on the shuffleboard. Once you have covered the cost of installing the physical shuffleboards, each incremental game you sell is pure cashflow! Over the long term however, both shuffleboards and bowling alleys suffer “wear and tear”, so the cashflow does need to be reinvested. BOWL spent £3.9m in H1 refurbishing 8 centres (v depreciation charge of £4.9m and £74m of fixed assets). Based on the H1 figure they refurbish roughly every decade, which sounds about right to me. Management put up this slide, to breakdown RoI of refurbishment spend by individual bowling centres. The average payback (dotted line) is just over 55% on the last 12 refurbishments.

In May 2022 they expanded into Canada, buying Teaquinn for £10m. This February they bought three centres in Calgary and have recently exchanged contracts on a site in Ontario. The Canadian business contributed £11m in revenue and £3m of EBITDA (ex IFRS 16 lease costs) in the first half of the year.

Outlook: The outlook statement confirms they are trading in line with the Board’s expectations for FY Sept 2023F. Sharepad shows revenue forecasts of £200m and PBT of £43m, implying +3% top-line growth but a decline in PBT. They are targetting 15-20 new centre openings by the end of FY2025 (current UK estate is 69). They are confident customer demand will continue and believe that they are well-insulated from inflationary pressures with electricity costs hedged to the end of FY2024.

Valuation: BOWL trades on 13.5x PER Sept 2024F, dropping to 12.5x PER the following year. I wouldn’t pay too much attention to the 3-year average RoCE and EBIT, because they’ve obviously been distorted by the pandemic. The most recently reported RoCE of 18% and 29% EBIT margin look impressive if they can be sustained.

Opinion: It’s a shame that management felt the need to apply the VAT adjustment inconsistently in their voluntary disclosure. That’s not quite a “red flag”, but perhaps an orange one? As noted last week, UK consumers have defied both professional economists and the UK media, continuing to spend in the leisure sector. Household spending might not be sustainable as rising interest rates divert money from the economy to cover mortgage debts though, so I think this might be less resilient in a deep recession than management believe. On the watch list though.

Bloomsbury Publishing FY Feb results

BMY is best known for its association with Harry Potter, which has been a huge financial windfall. They say that sales of JK Rowling’s books remain strong, 26 years after Harry Potter and the Philosopher’s Stone was first published, it was the second best-selling children’s book in the UK last year. The Hogwarts series is included in BMY’s Children’s Trade division, which showed revenue growth of +17% to £109m and PBT up +9% to £17m.

So they have sought to balance the risky world of publishing fiction, through buying more dependable non-consumer titles and investing heavily, particularly Academic and Professional (currently 37% of turnover). Non-consumer revenue growth was +19%, of which just +3% was organic. The profit margin on Academic and Professional was 16%, better than 12% for the group as a whole.

That looks to be a strategy market to Nick Train’s favourite RELX (market cap £48bn). Bloomsbury announced this digital investment programme in 2016, and since then Bloomsbury Digital Resources (BDR) revenue has grown to £26m, and organic revenue growth of +18% in these results. Effectively BDR is digital subscription products for academic libraries. Management have announced a BDR target: to achieve further +40% organic revenue growth over the five years to 2027/28, implying turnover of c. £37m for the division.

Opinion: Historically investors have tended to undervalue cashflows from database and subscription businesses like RELX. I can see what BMY management are trying to do, and it seems to be working to some extent.

I can think of a couple of points on the downside: i) the strategy seems unoriginal. I’m not sure the world needs two legal databases, and RELX’s LexisNexis contains 144bn legal documents and news items. Why would anyone also need to use Bloomsbury Professional? ii) BMY are buying Academic and Professional titles, but the organic growth was just +3% in non-consumer titles. This reminds me of SDI a couple of weeks ago, acquisitive companies need to demonstrate double-digit organic growth if they are to achieve a premium rating. Otherwise, it looks like management are using investors’ money to buy growth, rather than make progress by generating returns internally.

Dr Martens FY March results

That said, I think the shares could be worth a look as much of the bad news could now be in the price. I’ve also noticed that my trendy female friends, who work in PR or design and who go to music festivals on abandoned Soviet nuclear bases, wear the classic Dr Martens boot. These elegant friends tend to avoid “fast fashion” for environmental reasons and instead buy their clothes from vintage second-hand shops. So I think DOCS should be insulated against the demise of fast fashion. Dr Martens also makes vegan DMs, appealing to those who want to avoid leather products for ethical reasons.

Again this is a share that Richard wrote up almost a year ago when he looked at the strategy in depth. Since he published that article there’s been a problem with DM’s American warehouses, which has cost around £30m to fix. The share price fell -25% on the day of that warning at the start of this year.

DOCS reported revenue +4% on a constant currency basis but helped by the strong pound +10% on a reported basis to £1bn. They report average prices up +5%, but volumes down -3% and a currency benefit of +6%. The gross margin was down slightly to 62%, but PBT was down steeply -26% to £159m on a reported basis.

That was caused partly by a £14m negative swing on a forex loss on Euro-denominated bank debt. The company also reported a +47% increase in depreciation and amortisation charge, the former was up due to new store fit outs which are expected to last 5 years, while the latter almost doubled to £8.4m from investment in an IT system. The other adjustment is a £4m impairment charge (intangible asset write-down as opposed to charge taken against inventory). In their slide deck, management are very clear that they also have too much inventory, though I would have thought that there’s less risk of marking down the value of DM shoes than last season’s hoodies and suchlike.

Outlook: Current trading appears to be mixed. The company reports “very good” Direct to Consumer (DTC) growth (52% of revenue, and higher margin) but lower wholesale revenue (48% of revenue) than last year. That’s a similar trend to Superdry, which also has been reporting good performance through their own stores and online, but sales to wholesale going backwards. Dr Martens management attribute disappointment in wholesale to problems with US distribution (particularly Los Angeles) and halting supply to a China distributor.

DOCS expect to report mid to high single-digit revenue growth on a constant currency basis. There’s a dreaded H2 weighting in the outlook statement (ie Sept-Mar next year), which probably explains why the shares were off -12% on the morning of last week’s RNS.

Valuation: DOCS are trading on PER of 10x Mar 2025F. That looks good value assuming that there’s no further disappointment. Similar to BOWL though, I do wonder how defensive the shares would prove to be in a recession.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.