Shares in kitchen supplier Howden Joinery have rewarded long-term investors handsomely.

For me, it is one of the highest quality UK businesses in the FTSE 250 index. It is very shareholder friendly, whilst its annual report is one of the best I have read when it comes to explaining how a business works.

Howden has also proven to be very good at coping with tough economic times. Can it be so again?

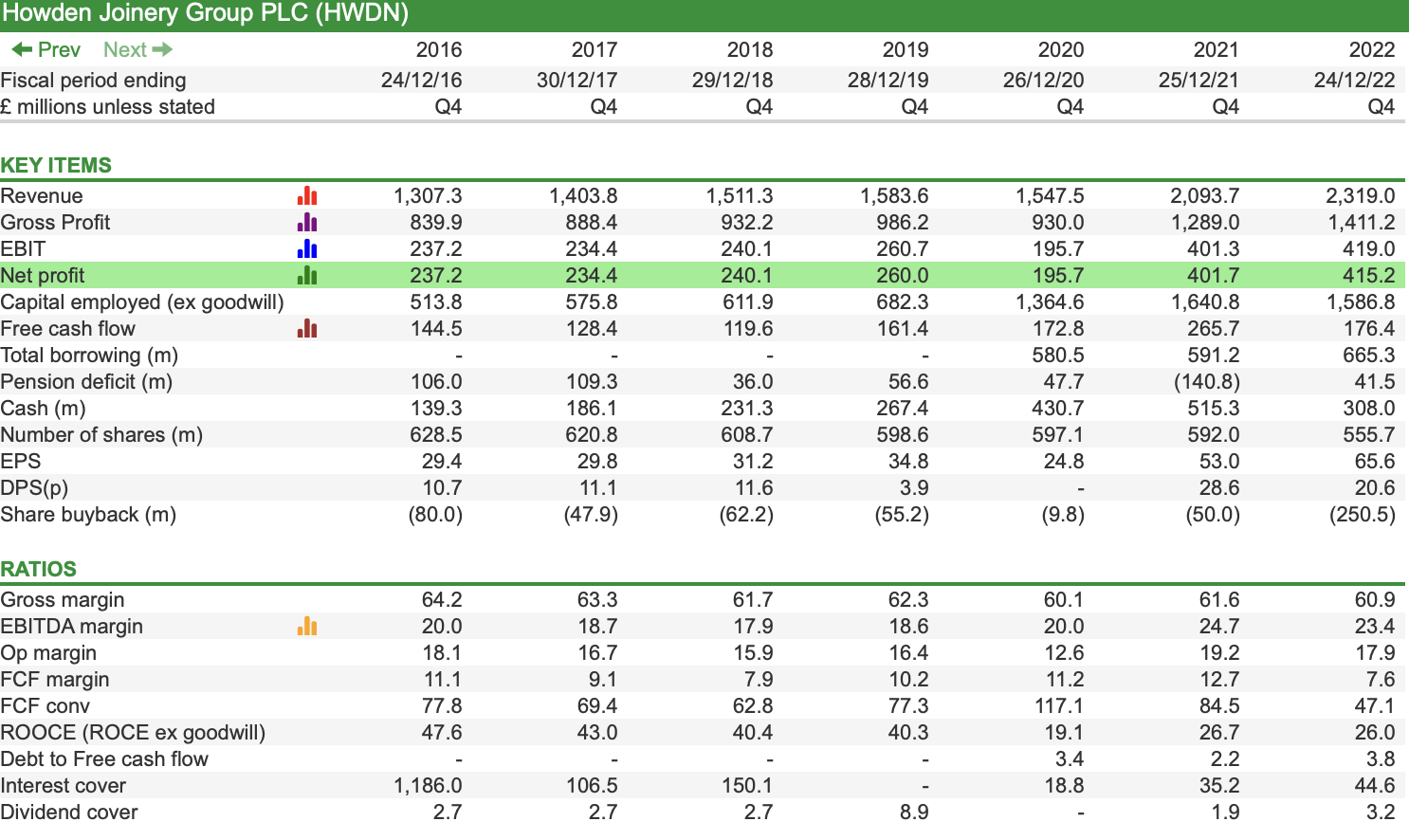

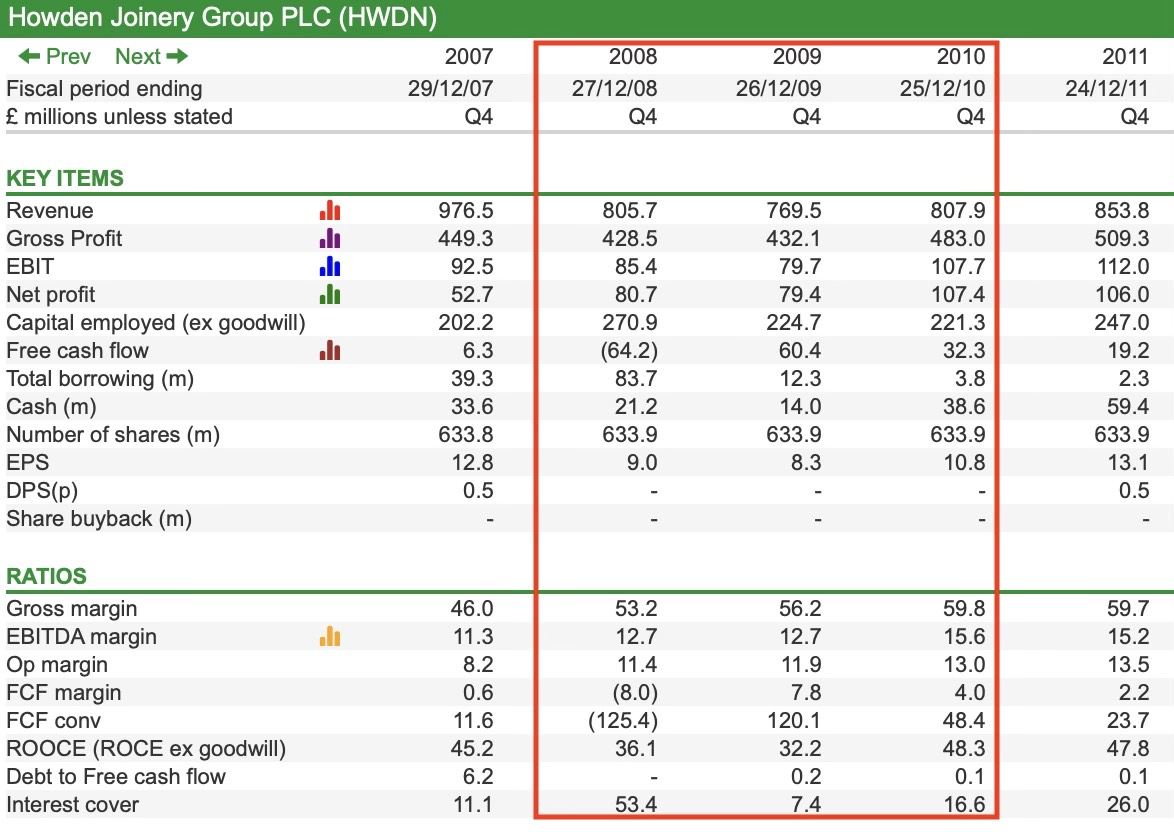

Financial snapshot

Howden Joinery is a company in pretty good shape.

Source: SharePad

You can clearly see the hit to profits from Covid-19 in 2020, but also how strong the growth in revenues and profits have been during the last couple of years. They are materially higher than they were in 2019.

A key positive – 2020 aside – is the stable and high gross profit, EBITDA and operating margins of the company in recent years.

A high gross margin is often a hallmark of a very good business that can either charge high prices for its products or services or is very efficient in making them.

The bigger a company’s gross margin is, the more profit there is available to pay its fixed overheads. High gross margins often feed through to high operating profit margins and big profits for investors.

Howden’s gross margins were slightly lower in 2022 due to the inclusion of sales from solid surface worktops which have lower margins than the bulk of other sales. The cash gross margin from worktops is very attractive though.

Another notable feature of this table is the sudden appearance of borrowings in 2020 from having none beforehand. This reflects a change in accounting standard for Howden’s rented depots (operating leases) rather than a company that has suddenly borrowed a lot of money.

These leases are classed as borrowings and are also added to capital employed. Even when they are included, Howden has very high levels of interest cover which shows us that its debt levels are very comfortable.

Its return on operating capital employed (ROOCE) was still a very impressive 26 per cent in 2022.

A rising number of shares in issue can often be a sign of ongoing dilution of shareholders’ stake in the business. Howden’s share count has been going down which shows the strength of its cash flows and cash position. This is usually a welcome development.

The fact that Howden’s revenues and profits have been growing whilst it has been repurchasing shares is very positive. This is because it has still been able to invest in growing its business at the same time.

Share buybacks do not always make remaining shareholders better off – particularly if a company pays too much for its shares – and can be used to mask weak underlying growth.

A growing earnings per share (EPS) is usually seen as a good thing. However, if it is growing mainly because the shares in issue are shrinking rather than profits increasing you might want to have a closer look at a business.

One area which may concern investors is Howden’s poor free cash flow conversion – especially in 2022.

This can be a worry and sometimes a sign that all is not well with a company’s accounting. I think investors can rest easy in this case.

Howden is very working capital intensive. It sells goods with 8 weeks’ credit and has high stock levels. Both consume cash flow in a growing business but if they are managed well investors can sleep well.

I’ll discuss this issue shortly.

In 2022, the company’s taxation expense in its income statement was just £31m. This was due to a successful patent box claim from the UK tax authorities for the patent on an adjustable kitchen cabinet leg.

However, its cash tax expense was just over £100m and explains a great deal why free cash flow per share was much lower than EPS. This is not expected to be an issue going forward.

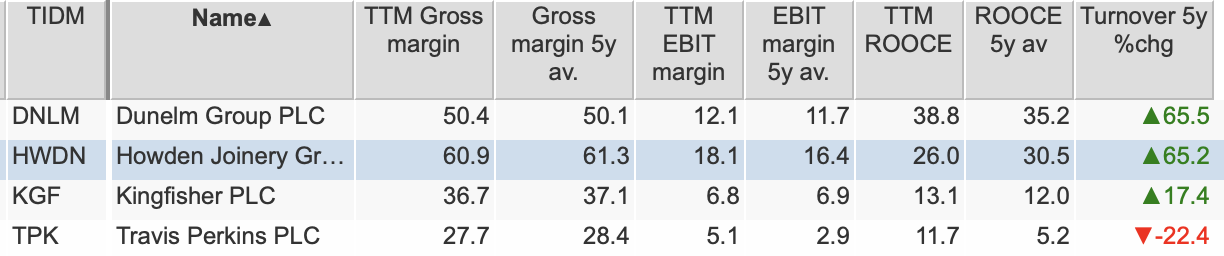

Howden’s financial performance stacks up very well with its sector peers – especially in terms of profit margins and ROOCE.

Source: SharePad

Business model continues to improve

Howden’s business model underpins its market-leading status, and it seems to be getting better.

Its key strengths are:

- Stakeholder focused – the company invests in its relationships with employees, customers and suppliers in order to drive long-term value for shareholders. For example, an in-house kitchen design service helps installers build relationships with their customers. Regular consultations are held with customers and suppliers.

- Local business – each depot is run as a separate local business. Depot managers are encouraged to be entrepreneurial and have discretion over prices and stock levels.

- High stock availability and service levels used as a key competitive edge.

- Vertical integration – Howden makes around one third of what it sells which reduces costs and increases profits. Its manufacturing plants produce doors, cabinets and solid surface worktops. All logistics is provided internally rather than outsourced to third parties.

- Continuous improvement. Depots have been refurbished to make them more efficient. Cross-docking distribution has improved the supply of products to local depots.

- No bank debt – Howden rents all its depots but maintains a big cash balance which funds its working capital cycle throughout the year. It does not need a bank overdraft to do so. This financial strength makes it more resilient than most of its competitors, especially in a tough economic climate.

These characteristics have served the business and its shareholders well. Howden has continued to increase its share of the UK kitchen market.

There is still scope for the company to grow

The good news for investors in Howden Joinery is the outlook here looks to be promising.

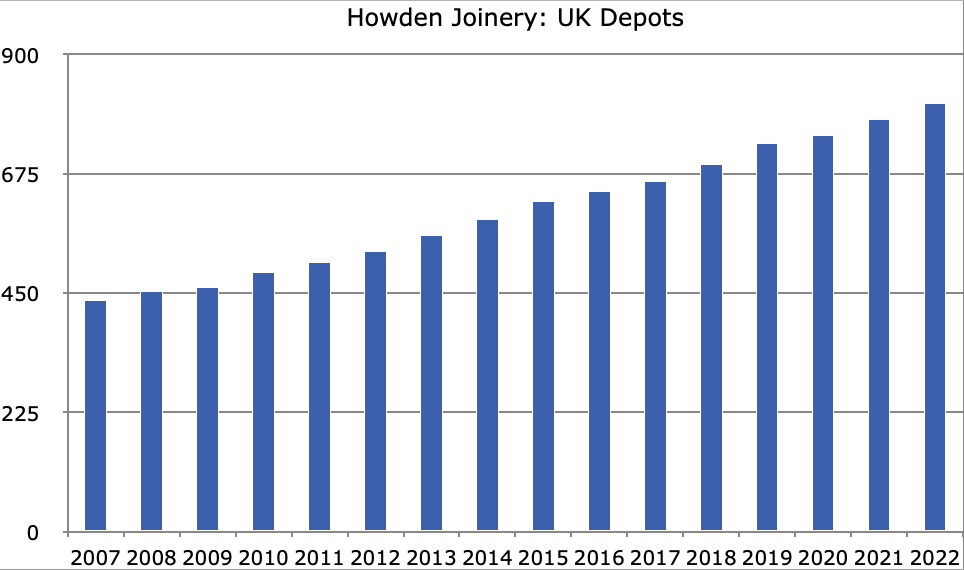

Despite opening lots of depots in recent years, the company has become more optimistic on how many depots it can have in the UK. It currently thinks that 1000 depots are possible.

Source: Howden Joinery

This will be complemented by opening more depots in France and Belgium. However, the UK will be the main driver of the company’s profits and the value of its shares.

Howden reckons that its addressable market in the UK is around £11.5bn of which £7bn is in Kitchens with the remaining £4.5bn in areas such as joinery, doors, flooring and hardware.

The French market is estimated to be around €4.5bn. Howden is optimistic that its business model will allow it to take market share from DIY stores and independents. Whether this really makes a significant contribution to the value of the company overall is debatable in my view.

Depot economics continue to shine

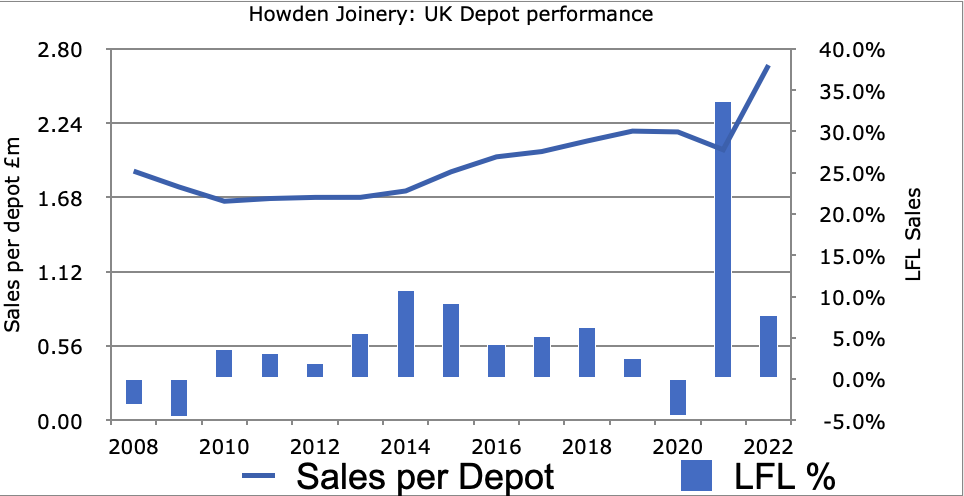

The productivity and efficiency of Howden’s local depot network in the UK continues to excel and drive its impressive levels of profitability.

Howden has an impressive record at increasing its like-for-like (LFL) depot sales. However, you can see that they fell in the 2008-09 recession and during Covid-19.

The surge in sales since 2020 have seen a significant increase in the average sales per depot.

One thing that needs to be considered when looking at Howden’s LFL performance is that its depots have a very long sales maturity profile. In the past, Howden has said that it can take a depot up to seven years to reach its full sales potential.

During their first two years of operation, depots are excluded from LFL sales. Afterwards, the continuing sales maturation tends to keep boosting LFL’s.

There’s nothing wrong with this but it’s important to realise there is a big difference between a depot that has been open ten years growing LFL by 5 per cent and one that has been open for just three years.

Source: Howden Joinery/My estimates. Sales per depot is calculated by dividing depot sales by average depot numbers

The performance from the older depot would be much more impressive as the younger store reflects a maturation process.

Given the number of new depots in recent years, it seems reasonable to assume that Howden is still benefitting from a significant maturation effect in its LFL sales and should continue to do so for a while.

Another plus point is that new depot openings do not seem to be taking sales from existing ones. Sales cannibalisation is a key risk of a depot or store rollout and has caused many companies to come unstuck in the past.

One area of Howden’s business that doesn’t get discussed so much is the economics of its manufacturing sites.

A key factor here is the volume of production in them. High volumes are essential to covering fixed overheads and determining overall company profit margins.

A UK recession could spell trouble here as could the company misreading the market. It is reassuring to know that in 2023, Howden will focus more on producing products for entry-level and mid-market kitchens which are likely to sell better if consumers’ budgets are under pressure.

The addition of solid surface worktops and an increase in door manufacturing should help manufacturing volumes.

How recession resilient is Howden Joinery?

The experience of the 2008-09 recession and Covid-19 suggests that it is a very resilient business. That said, new kitchens and recessions are not a good combination as many small independent kitchen suppliers found out back then and closed.

When times get tough, Howden stops opening new depots and takes stock out of the business. This doesn’t mean that profits won’t fall but cash generation should improve.

Source: SharePad

With no bank debt, the business is usually much stronger than its smaller competitors and this can allow it to gain market share when times get better.

One of the big puzzles when it comes to Howden is the financing of kitchens by households. Many are bought with borrowed money with large kitchens sometimes financed with housing equity.

2008-09 saw governments and central banks throw huge amounts of support to housing markets and borrowers which undoubtedly helped support demand.

In 2023, in a world of higher interest rates and weaker government finances, this might not happen again. How companies such as Howden hold up now might not be as robust.

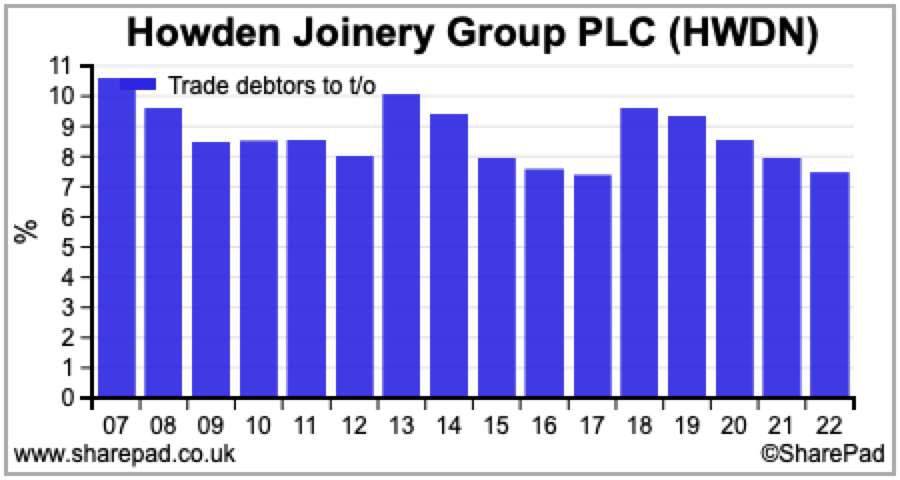

A closer look at trade debtors and stock levels

Trade debtors

As most of Howden’s sales are on credit, investors need to keep a close eye on the risk that some bills don’t get paid. Bad customer debts reduce profits and the scope for a big hit to profits is a real risk in a weak economy.

Howden’s track record here is good. Bad debts have not blown a big hole in its profits over the last 15 years. The average annual hit is a mere 0.1 per cent of revenues.

A rising ratio of trade debtors to revenues can be a sign of deteriorating customer credit quality or that a company is trading too aggressively by offering too much credit.

On this measure, Howden looks to be in a healthy position with its ratio declining every year since 2018 and at the lower end of its historic range.

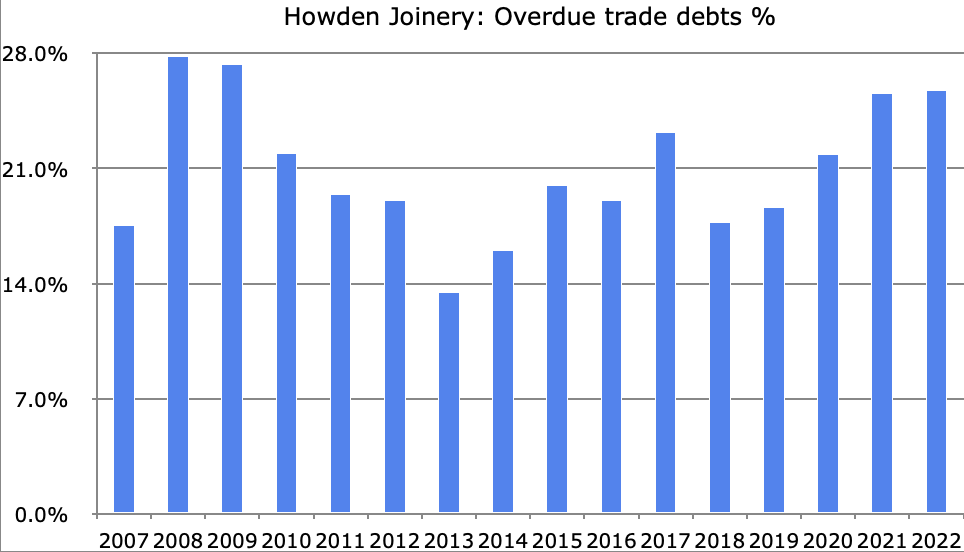

This is very reassuring but often the devil is in the detail. If you want to dig a bit deeper, you can do a further health check by comparing the number of overdue debtors as a percentage of total trade debtors.

Source: Howden Joinery/My calculations

Here things do not look as healthy. Overdue debtors are at their highest levels since the

2008-09 recession.

This doesn’t mean that Howden’s profits are going to be hit by a rising bad debt expense, but investors should be mindful of the risk.

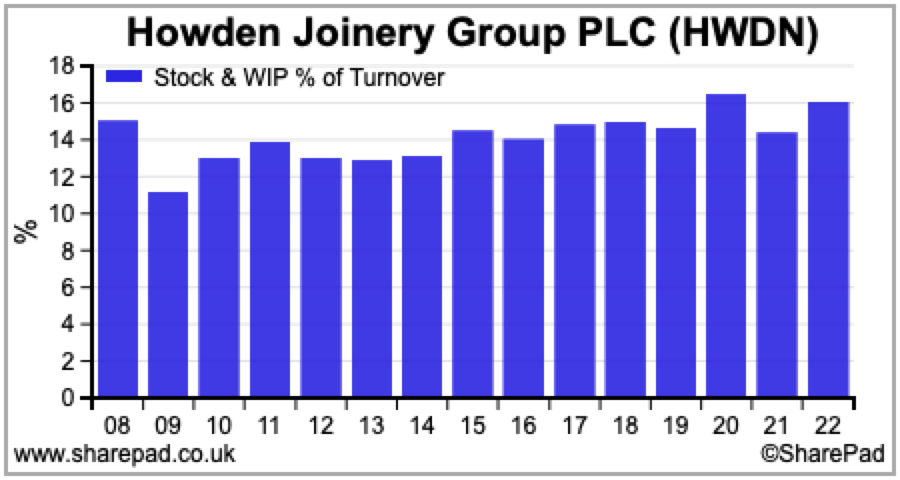

Stock levels

Stock losses are arguably a greater risk to Howden’s profits.

This is because the company’s business model is based on high levels of stock availability for customers as well as holding buffer stocks to protect it against supply disruptions.

The other risk comes from the fact that the lifecycle of kitchen ranges continues to get shorter. This increases the possibility that Howden could be left with stock it cannot sell or must discount heavily to do so.

Howden makes provision for stock losses which reduce the balance sheet value of stocks at the end of the year. The change in the provision is expensed in the income statement.

As with trade debtors, a rising level of stocks to turnover can be a red flag of slowing sales. However, it’s also common practice to build up stocks before a sales increase. The company will usually tell you if this is the case.

Howden’s stock-to-turnover ratio has been very stable over the years. There doesn’t seem a lot to worry about here.

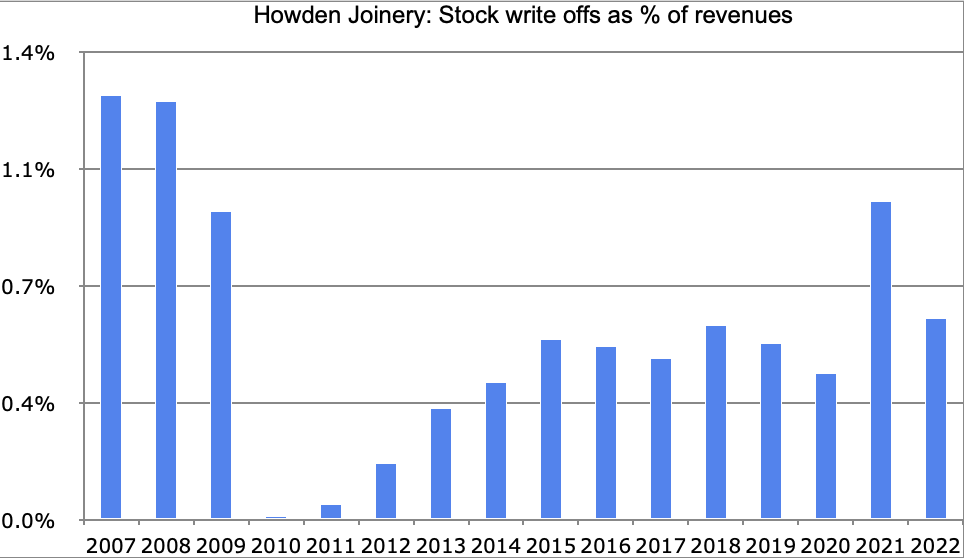

If you want to do a bit more analysis using the annual report, you can look at stock write offs as a percentage of revenues.

This is currently quite healthy but, in a recession, stock losses may cost Howden more than a percentage point of profit margin.

Source:Howden Joinery/My calculations

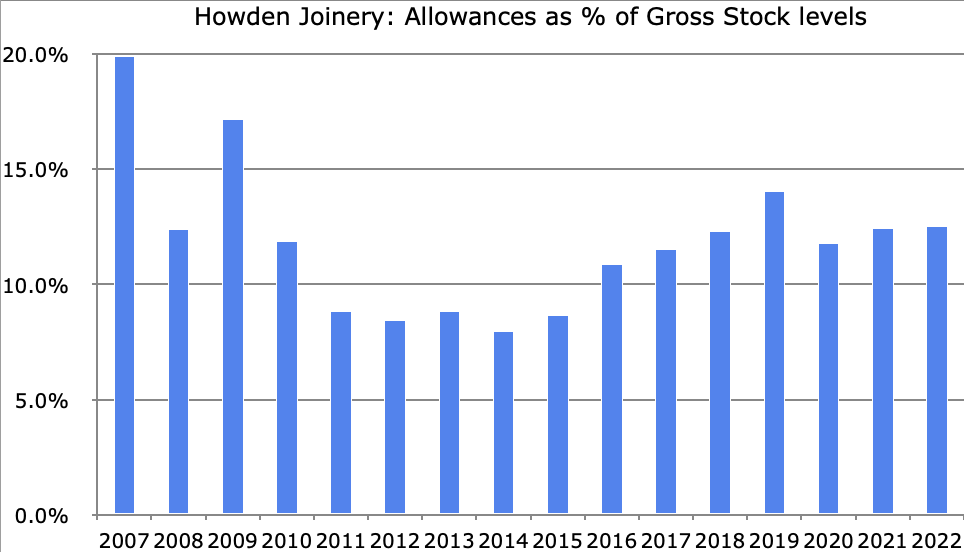

You can also calculate what percentage of gross stock levels have allowances against them.

To calculate gross stock levels, you simply add the allowances back to the balance sheet figure.

Source: Howden Joinery/My calculations

Things look ok here, but the ratio is higher than a decade ago.

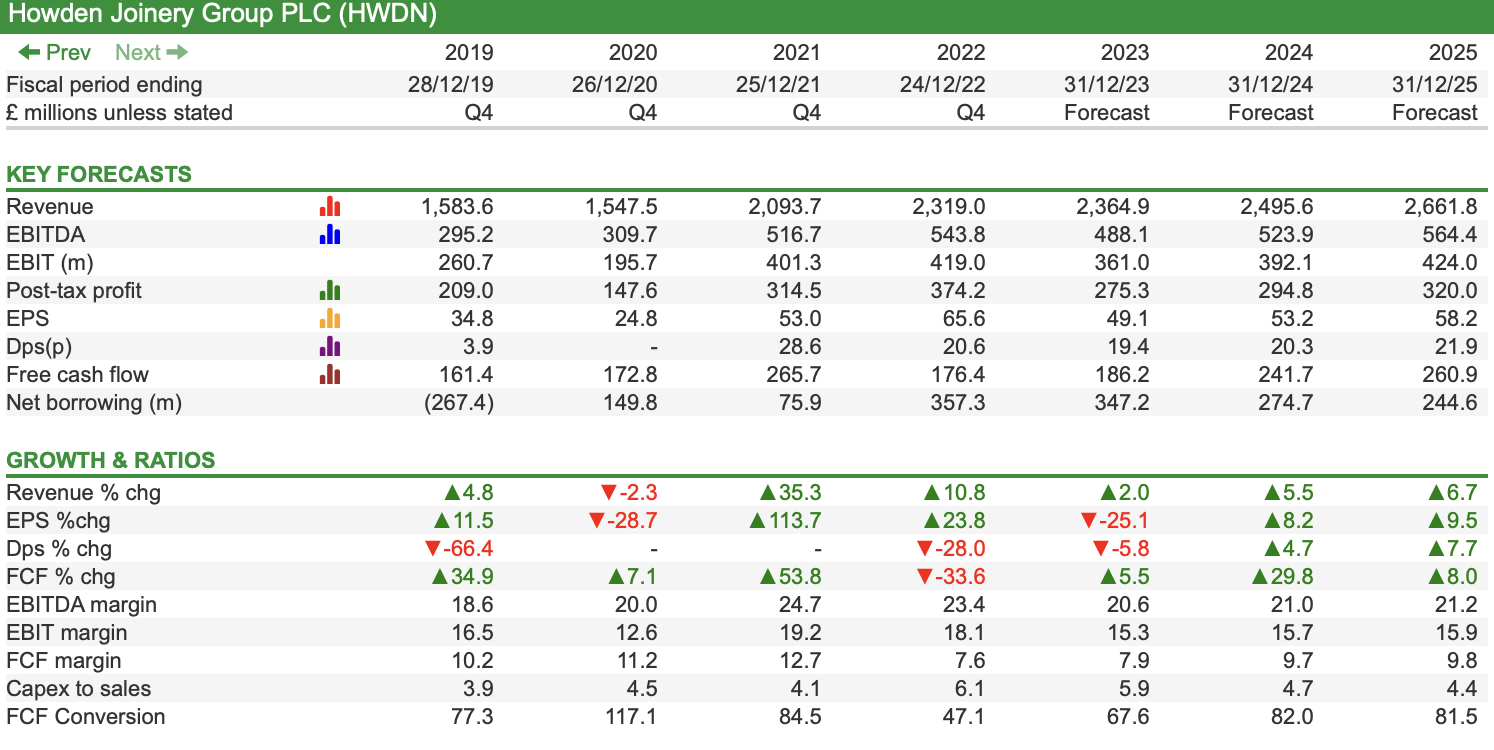

Forecasts look ok – for now

Analysts’ forecasts should always be taken with a pinch of salt. What you want to try and work out as an investor is if they are too high or too low.

If they are too high and are then revised down, then the shares are unlikely to perform well. If they are too low, then now could be a good time to consider buying some shares.

Source: SharePad

Howden gave a subdued outlook statement at the time of its full year results in February but remained confident in its long-term prospects.

Given the strength of sales in recent years it doesn’t expect much growth in 2023. This seems to be reflected in the current consensus forecast of 2 per cent revenue growth.

Higher investment, input and energy costs will not be fully offset by higher prices. This is expected to lead to lower margins and profits than in 2022. The lack of a big tax credit means that EPS is expected to be meaningfully lower.

Now, I’d say that these forecasts look quite reasonable for now. The UK depots’ LFL sales for the first two months of 2023 increased by 4.7 per cent with Europe increasing by 7.8 per cent. Given the strong prior-year comparatives this is a good start.

However, Howden is a very seasonal business with the bulk of its sales and profits made in the second half of the year with October and November sales having a big say on the outcome for full-year profits.

A lot can happen between now and then.

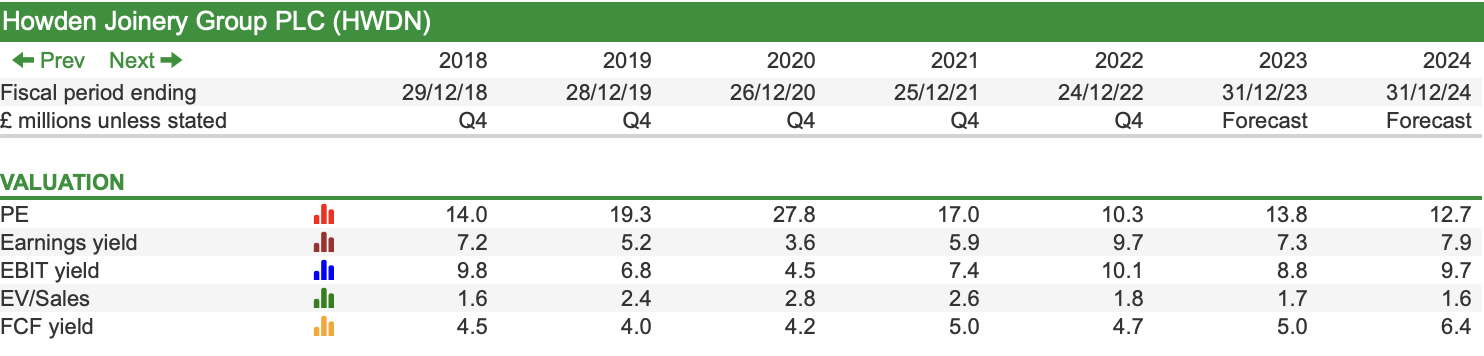

Are the shares attractively valued?

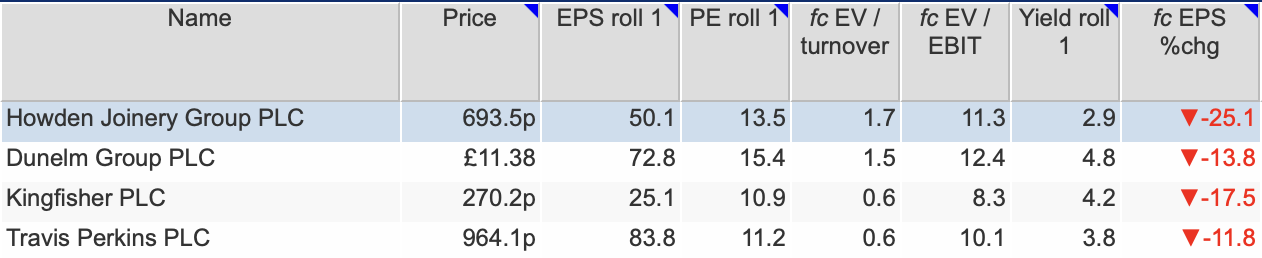

At the time of writing, Howden shares are trading at 694p. This puts them on a rolling one-year forecast PE of 13.5 times. That’s a lot cheaper than you would have paid a year ago but it’s not a bargain basement or distressed valuation either – and nor should it be.

Source: SharePad

However. it doesn’t look bad value for a business of Howden’s quality and robustness. It also compares favourably with a sector peer Dunelm.

Source: SharePad

Whether you would consider buying the shares now largely depends on your confidence in current forecasts being met. Not only that, but inflation and interest rates will need to start coming down in order to allow the valuation of the shares to move upwards.

It is also worth bearing in mind that the shares have rallied by 44 per cent since their lows of last September and might not have further to rally in the short term.

The September 2021 high of 975p would equate to a one-year forecast rolling PE of 19.5 times. I’m not sure that kind of valuation is going to come back anytime soon.

That said, Howden retains the hallmarks of a very high-quality business with an ability to keep growing. This suggests the shares warrant a place on investors’ watchlists at the very least.

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.