With the recent +67% spike in Natural Gas prices, Bruce wonders if Central Banks might have declared victory over inflation too soon. Companies covered: KLR, FUTR and AVAP.

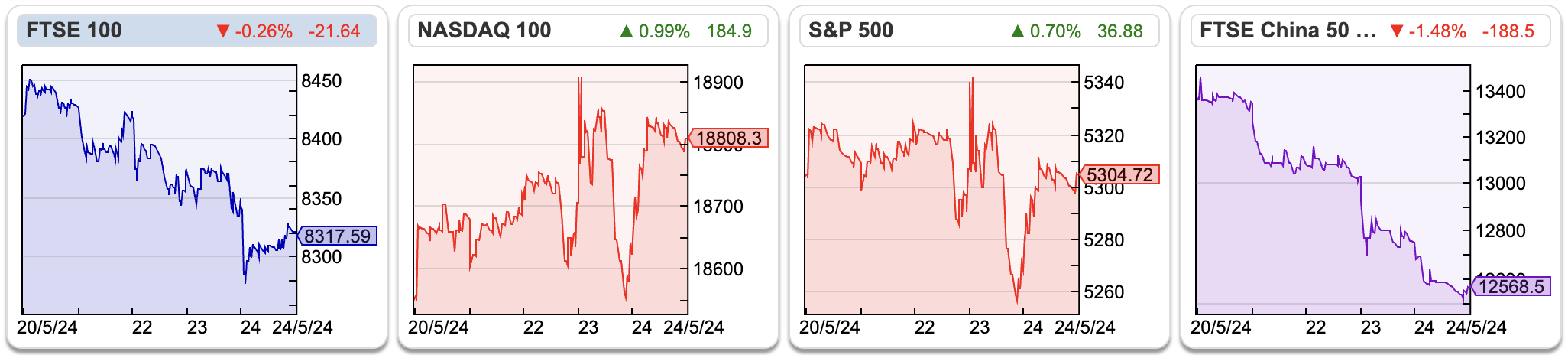

The FTSE 100 was down -1.2% to 8,317 in the last 5 days. The Prime Minister called an election and there will be lots of hot air talked about in the next 6 weeks, most of which will be irrelevant for investing in financial markets. In the US, the Nasdaq100 was up +1.4%, while the S&P500 was flat over the last 5 days. The price of Natural Gas has bounced +68% from its February low this year, and the most traded contract has now risen above its 200-day Simple Moving Average. The price is still well below the peak seen in 2022, but it strikes me that NG-MT is well worth keeping an eye on in H2 this year.

Shipping rates have also spiked. According to the FT, the cost of shipping a 40ft container between the Far East and northern Europe has trebled to $4,343. Central Banks may have declared victory over goods and energy price inflation too soon.

Shipping rates have also spiked. According to the FT, the cost of shipping a 40ft container between the Far East and northern Europe has trebled to $4,343. Central Banks may have declared victory over goods and energy price inflation too soon.

It was great to meet so many readers in person who I had interacted with online at Mello last week. I particularly enjoyed meeting with people who don’t live in London and had taken the trouble to travel down for the face-to-face meetings. The high point of the conference for me was Lord Lee presenting his ideas on what a change of Government might mean for the UK stockmarket, just as a rain-soaked Rishi Sunak was outside 10 Downing Street calling an election. This was then followed by the BASH, when Leon Boros presented the investment case on Hargreaves Lansdown, just as an RNS was released confirming that there had been an approach for the company made by Private Equity.

This week I look at a couple of larger stocks, Keller, the FTSE 250 building contractor and Future, the magazine publisher. Plus a comment on Avation’s “significantly ahead of expectations” trading statement.

Keller AGM trading update

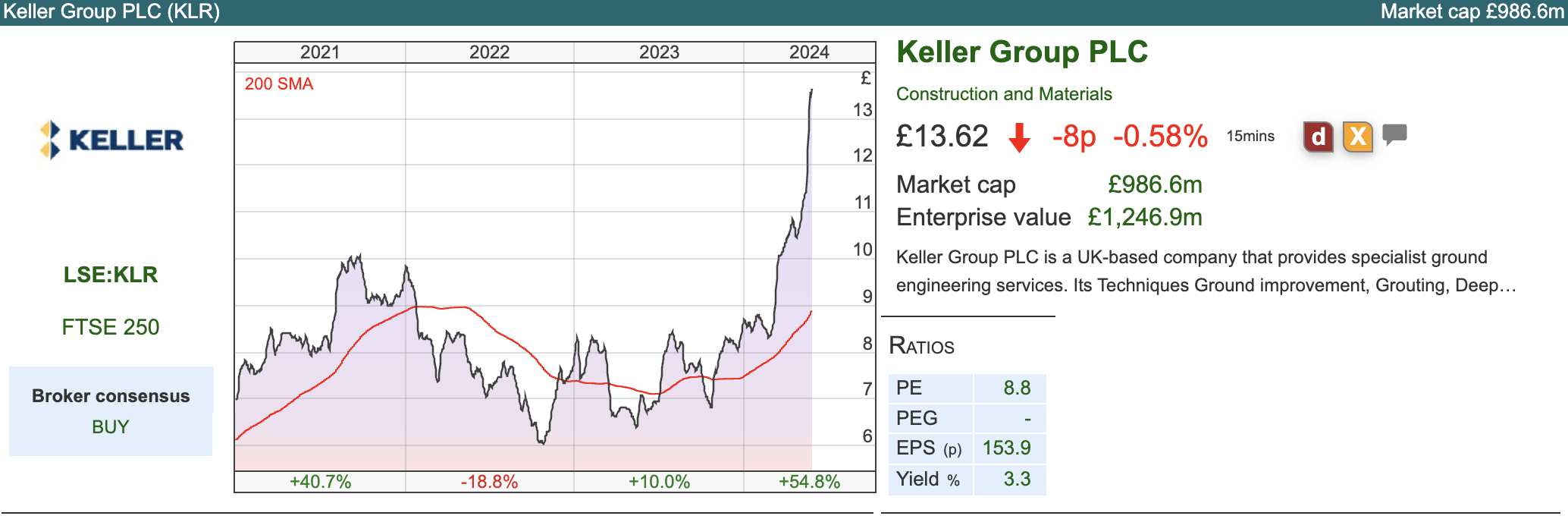

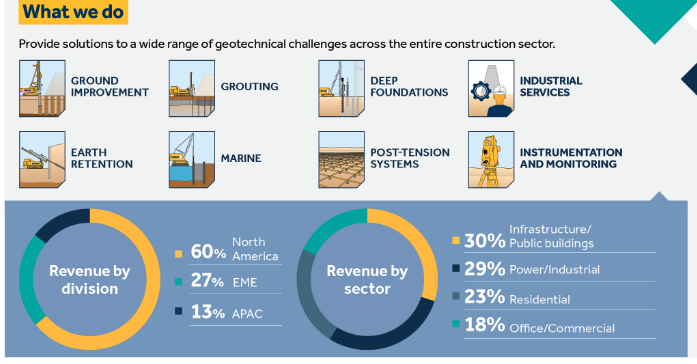

This FTSE 250 geotechnical specialist contractor with a December year-end, put out a trading statement ahead of its AGM. According to their website, at its simplest, what Keller does is prepare ground so that it can be built upon:

The strong momentum continues into FY Dec 2024F, with overall performance “materially ahead of the prior year”. Sharepad was showing turnover forecast to decline by -2% to £2,878m and PBT -13% to £136m – so that’s pleasing that a positive 2023 hasn’t held back the current year.

They say that trading in North America (60% of revenues) continues to be strong, helped by ongoing infrastructure spend. I am wondering if that could have a positive read-across for Somero, the concrete screed company which is down -3% YTD. SOM reported FY Dec 2023 North American sales declined 13.2%, as projects delays impacted purchases of Somero’s equipment.

In Europe and the Middle East (27% of revenues) Keller say that weak demand persisted in residential and commercial sectors. In APAC (13% of revenues) Australia has had a strong start to the year, but there’s been softness in other Asian countries. For the group as a whole, cash performance continued to be strong

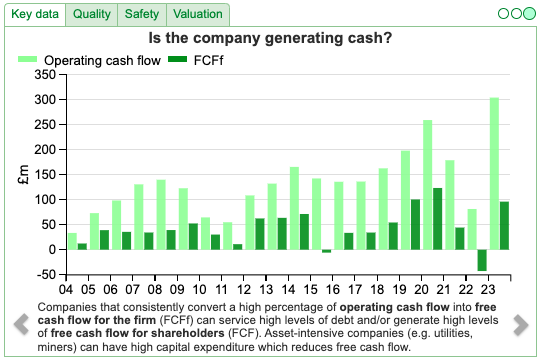

Sharepad shows an operating cash flow of £303m FY Dec 2023 and FCF for the firm of £96m. That equates to FCF per share of 129p, versus Capex per share of 127p.

History: The company’s history goes back to 1860 when it was founded by Johann Keller in Renchen Germany. In 1972 the business was acquired by GKN and later sold to management in an MBO in 1990. In 1994 management then listed on the LSE, and then bought several companies in the US (Case Foundation Company, Suncoast Post-Tension, McKinney Drilling company) over the next decade. The shares performed well from their 1994 listing until the financial crisis. Up until breaking through long-term and short-term moving averages in H2 last year, they haven’t done well over the last decade though.

When they listed in 1994 turnover was £195m and PBT was £9m. That compares to turnover FY Dec 2023 of £3bn and PBT of £126m, so the topline growth has been there, but the margins have been low. Despite numerous acquisitions over the years, intangible assets recorded on the balance sheet are just £114m, versus shareholders equity of £518m, so the balance sheet is strong. Net debt / EBITDA is expected to be towards the bottom end of management’s target range (0.5x-1.5x).

Valuation: The shares are trading on a PER of 8x FY Dec 2025F and an EV/EBITDA of below 4x the same year. That looks like very good value, though this is a sector many investors avoid for good reason, as when things go wrong, share prices can be walloped. That said the sector seems to be benefiting from more favourable market conditions, Galliford Try is up +67% in the last 18 months while Kier is up 2.5x over the same time period.

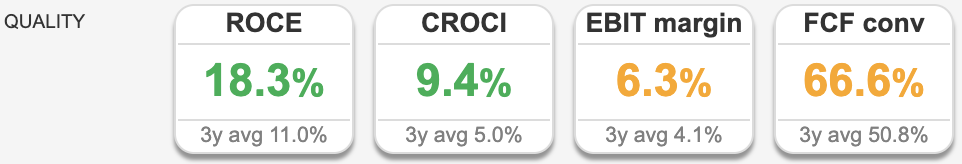

Opinion: I can imagine that these shares could be good to trade in and out of, rather than holding with a 3-5 year time horizon. Building contractors are often lower-margin, indebted and cyclical. Not a great combination. KLR’s 3-year average EBIT margin is just 4.1%, however, profitability measures like CashRoCI of 9.4% and RoCE of 18.3% tell a more positive story. The share price has enjoyed a strong bounce and may be benefitting from expectations of increased infrastructure spending. I would sell on the first sign of trouble though. I prefer Somero, which trades on a similar single-digit PER, but which has a much better EBIT margin and Return on Capital Employed.

Future H1 to March

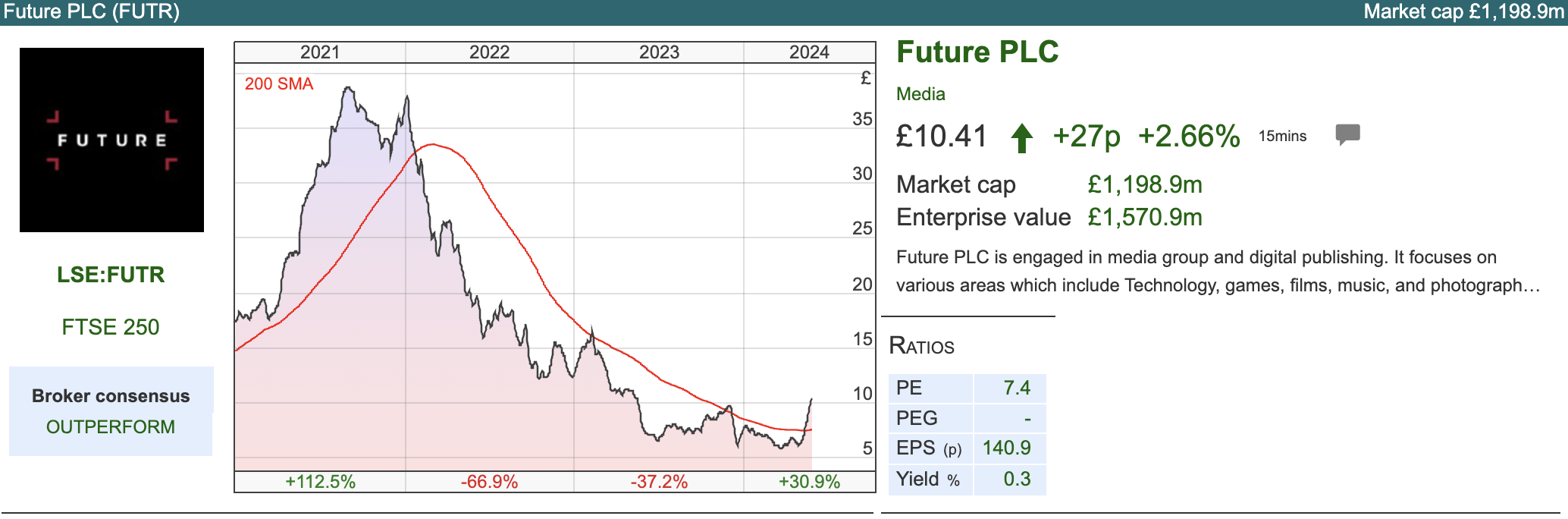

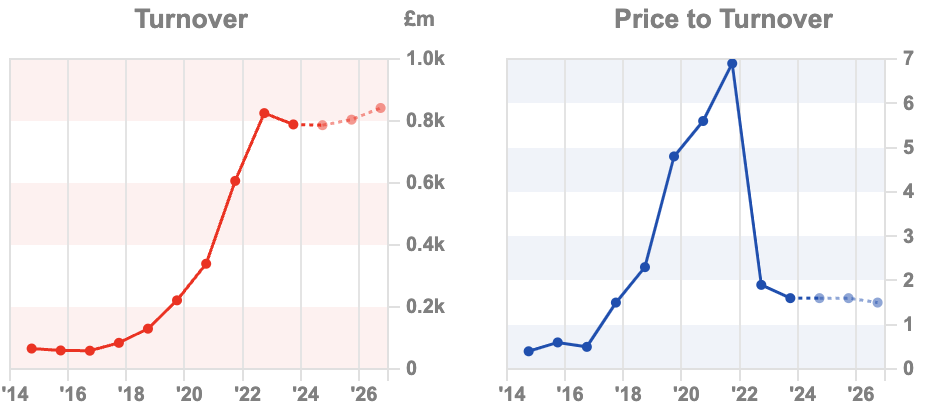

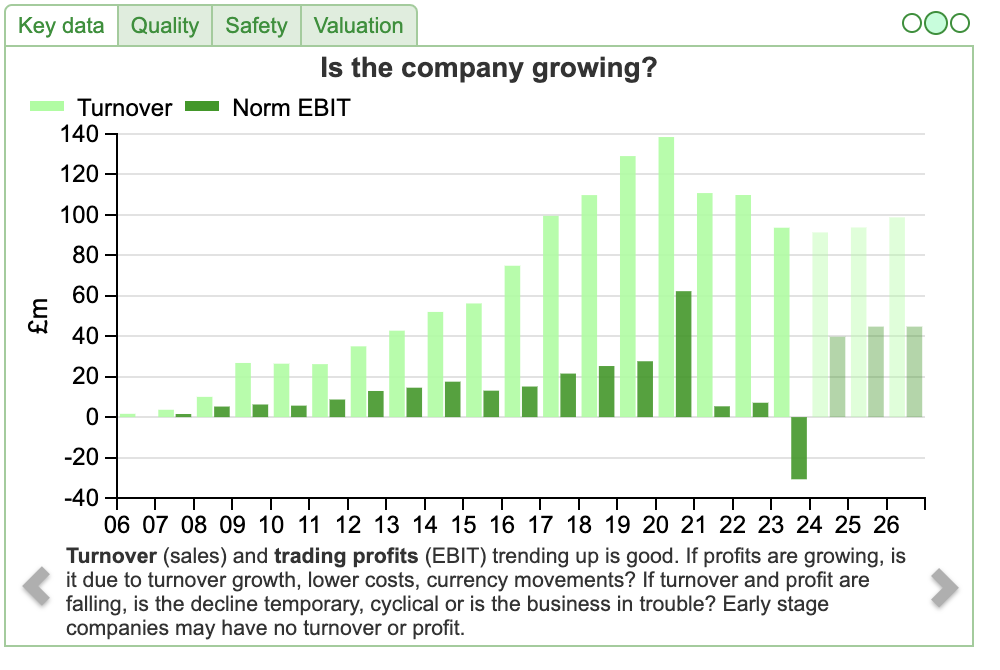

This media company that publishes magazines like Country Life, and Marie Claire, as well as MoneyWeek and online review sites Techradar and Tom’s Guide, announced H1 results to March. They have been buying titles and then converting readers to an online audience, making money from affiliate marketing. They also bought price comparison website GoCompare in 2020 for £600m. The shares had been on a downward trend falling from a peak of close to £40 per share at the end of 2021 to below £6 in March this year. The price to turnover has de-rated from 7x to 1.5x over the same time period. That decline was caused by falling reader numbers, as well as the less money being spent on advertising for tech products, as consumers have reined in their spending.

However, the market reacted very positively to the H1 results, sending the shares up +20% following the RNS. Revenue was down -2% on an organic basis to £391m and statutory PBT was down -36% to £47m. They did see an improvement in Q2, with organic growth +3%, and said they were confident of achieving FY Sep 2024F expectations, both of which they had already flagged in an early April trading statement. Management also said they were confident of achieving FY adj operating margin of 28% (actually bottom end of FY Sept 2023 guidance 28-30%). Longer-term guidance was for mid-single-digit compound revenue growth.

So it looks to me that expectations were for further disappointment, which is understandable given the previous 2 years of RNS announcements. There are analyst forecasts in the market, however, investors also tend to make decisions based on whether the company has a track record of beating or disappointing forecasts – that seems to be the case here.

Balance sheet: The company has grown by acquisition, buying GoCompare for £600m in 2020, but also the publisher Dennis, for £300m in 2021, and TI Media, publisher of Horse & Hound and Wallpaper, for £140m. Hence there’s £1.6bn of intangible assets on the balance sheet, meaning around £500m of negative tangible assets. Some of the publishing assets are valuable, but they own over 100 magazine titles, a fifth of which are just being managed for cash. Management have segmented their portfolio into i) Hero Brands, c. 50% of revenue, ii) Halo Brands c. 30% of revenue and iii) Cash Generators 20% of revenue. Interestingly they don’t tell investors which titles are in which category, they say because the definitions are not hard and fast: they move titles between categories. That sounds like firing an arrow, seeing where it lands, and then drawing the target around it.

Net debt was £297m, which costs around 7% interest to service and looks comfortable given £126m of Adjusted Free Cash Flow. Management are aiming to get to 1.0x leverage versus 1.25x currently. Management announced a £45m buyback

Valuation: FUTR is trading on a PER of 8x FY Sept 2025F and EV/EBITDA of 5x the same year. That still looks cheap after the +70% share price bounce.

Opinion: I last wrote about this FUTR two years ago when the price was £19 and highlighted the downside. Jamie wrote about them more recently when the price was below £7, and remained negative. The chart has broken out decisively but I can’t see much in the most recent statement that has changed from early April.

Longer term I am concerned about the threat from AI, I’ve already been asking Perplexity.ai to help me choose a new mobile phone, so I would imagine both techradar and GoCompare revenues might be at risk from AI. That implies that the intangible assets on the balance sheet could see significant writedowns at some point and the impressive cashflow at the moment may not be sustainable. So short term this looks like the bounce might continue, support coming from the buyback, but longer term there are still question marks.

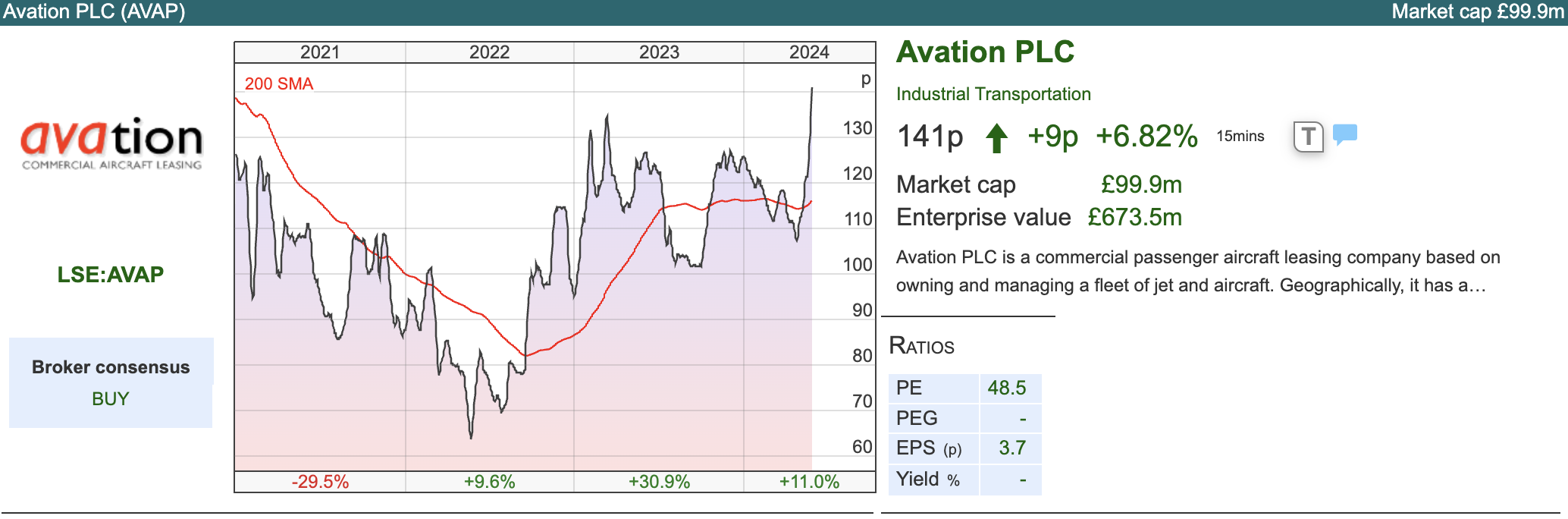

Avation FY to July Trading Statement

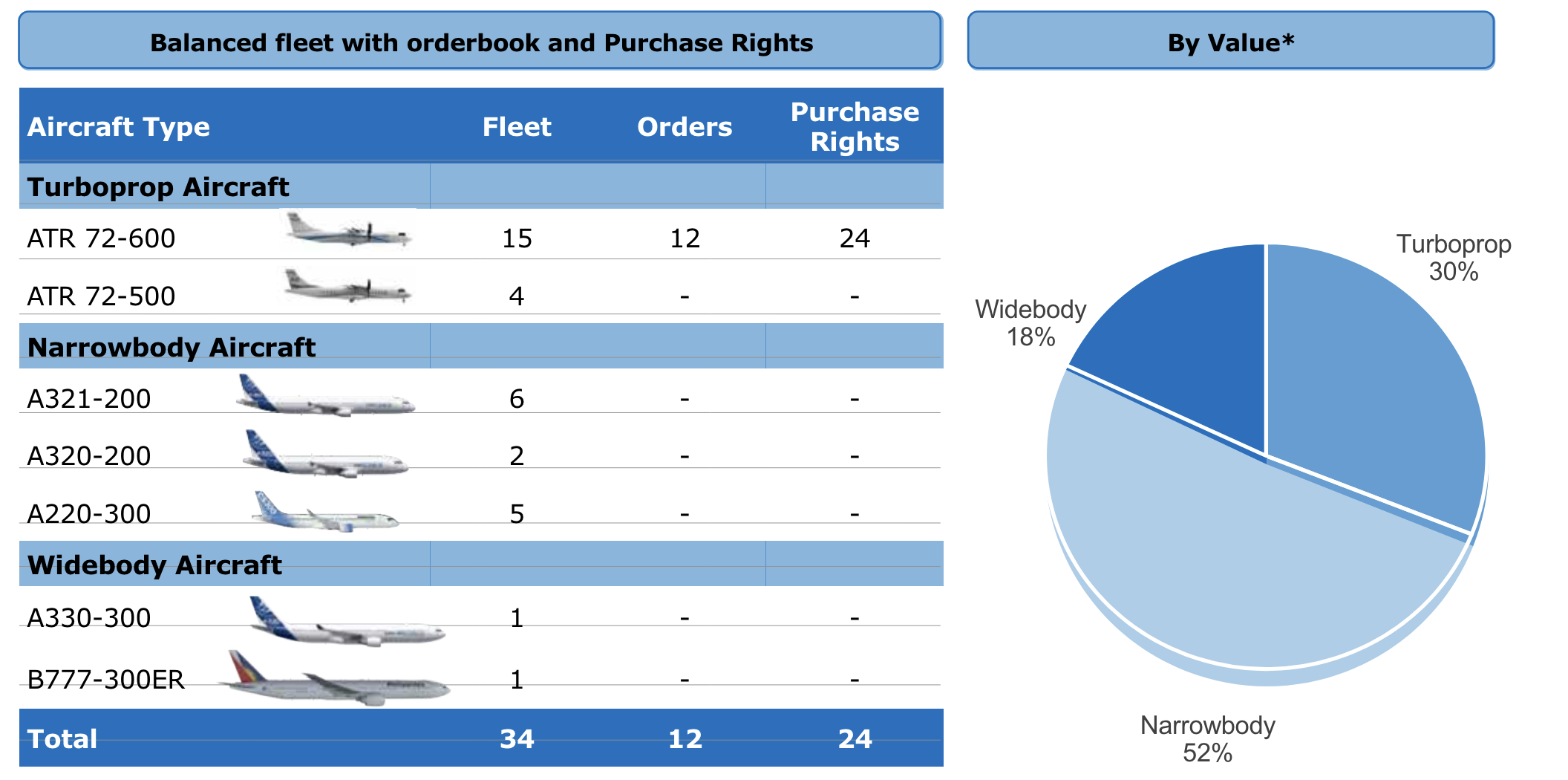

At the suggestion of Carcosa on Twitter, I wrote about this aircraft leasing business at the beginning of the year. Avation owns 34 aircraft leased to 16 airlines in 14 countries. The fleet includes 19 ATR turboprops, 13 narrowbody jet and 2 widebody jet aircraft. The aircraft are all being leased out at the moment, which means Avation is receiving $7.9m a month (so $95m annualised versus $94m reported FY June last year, and $91m forecast for FY June 2024F).

Notably the company expects to report profit “significantly ahead” of FY Jun 2024F expectations. Clearly, that’s good news, but it is worth pointing out that WH Ireland were forecasting a $7m loss, translating to an EPS of -10c. Secondly, management have repurchased $18m of face value 2026 debt, and assuming that they have bought back at a discount to face value, that may result in an accounting gain. In addition, Avation announced the sale of two ATR 72-600, resulting in $10m of cash proceeds that AVAP should receive in FY Jun 2025F.

The RNS also talks about using a Black-Scholes model to value purchase rights for aircraft. A small change in assumptions can result in a large gain or loss using their model. As of H1 Dec 2023, there was a $2m unrealised gain in the value of purchase rights recorded through the 6M P&L, and the purchase rights were valued at $88m on the face of the balance sheet. I assume the vast majority of the balance sheet value was invested cost rather than fair value markups from previous years, but it would have been helpful if management could have made that split explicit. Management said in last week’s RNS that the estimated value of purchase rights in the current market conditions (that is, mark to market, not marked to their Black-Scholes model presumably) was $115m, representing a $27m increase on the last reported value on the face of their Dec 2023 balance sheet.

The RNS also talks about using a Black-Scholes model to value purchase rights for aircraft. A small change in assumptions can result in a large gain or loss using their model. As of H1 Dec 2023, there was a $2m unrealised gain in the value of purchase rights recorded through the 6M P&L, and the purchase rights were valued at $88m on the face of the balance sheet. I assume the vast majority of the balance sheet value was invested cost rather than fair value markups from previous years, but it would have been helpful if management could have made that split explicit. Management said in last week’s RNS that the estimated value of purchase rights in the current market conditions (that is, mark to market, not marked to their Black-Scholes model presumably) was $115m, representing a $27m increase on the last reported value on the face of their Dec 2023 balance sheet.

The underlying market environment is improving, with air travel growing at +14% year-on-year and new aircraft deliveries constrained by supply chain problems, this means purchase rights are likely to be more valuable. AVAP points to IATA data in their RNS, saying that 1,600 new aircraft deliveries are expected in 2024, equivalent to 4.6% of the global fleet. That compares to a fleet renewal rate of 5.8% in 2018.

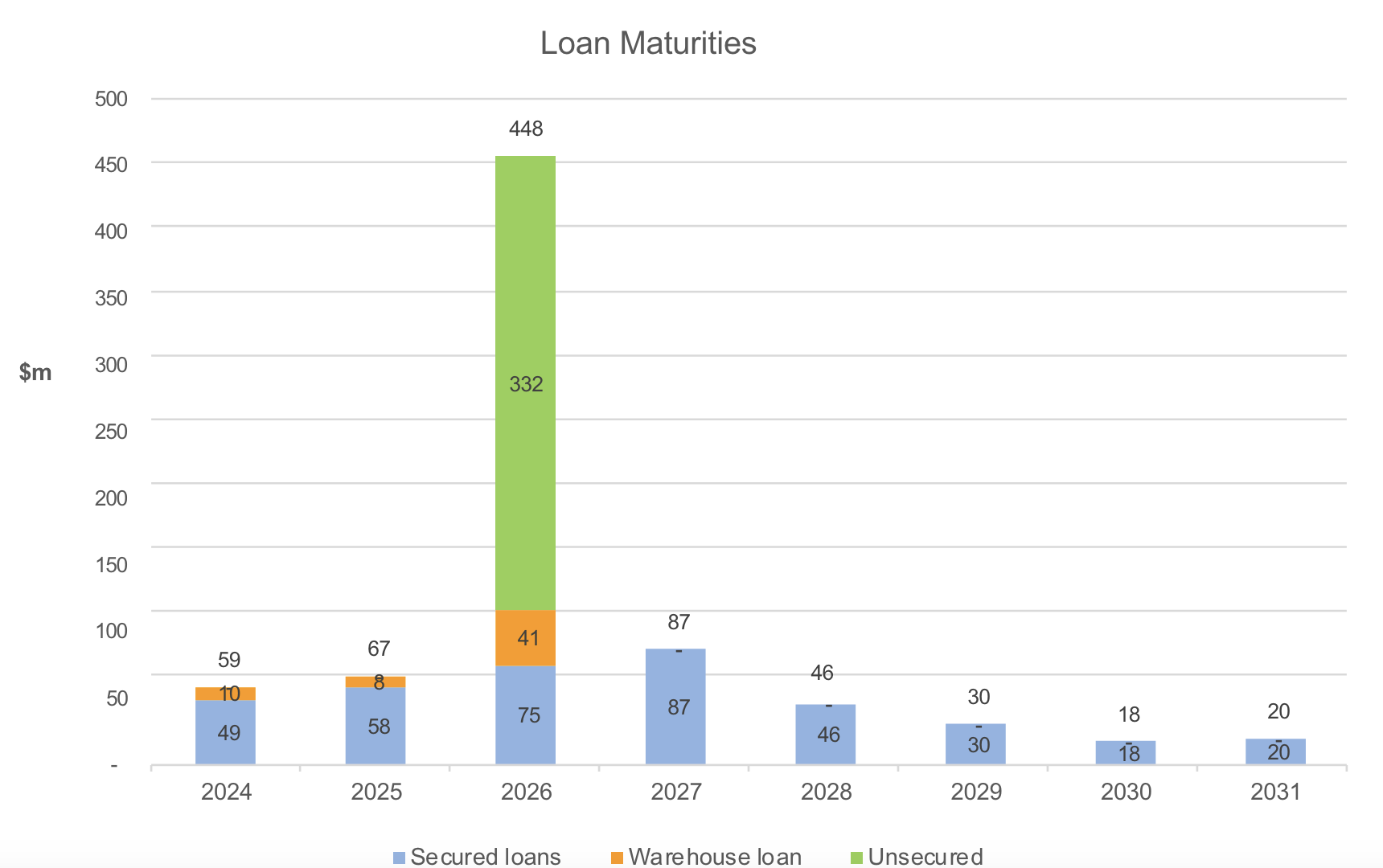

We will know more when management releases their FY results, and I would urge readers interested in the investment case to look at the cashflow, not just accounting profits. In 2026 they need to refinance almost half a billion dollars of debt, which in the current market conditions should be possible, and hopefully, management can announce progress on this ahead of schedule. Last year management put out two trading statements (May then July) before releasing FY Jun results in September.

Opinion: There are some similarities between the litigation finance business and companies like Burford. AVAP is a debt-funded leasing business using Fair Value accounting, so when things go wrong, they are likely to go badly wrong: like BUR the AVAP share price fell around -80% over the pandemic but have since recovered some of those losses.

At the moment, Avation has a tailwind, so it’s legitimate for management to buy back debt and mark up the value of their purchase rights. I can imagine that as the business de-levers they could well start paying a dividend again (10.5p in 2019) so AVAP receives a cautious endorsement from me. As I mentioned at the start of the year, Carcosa, a former airline pilot who I met up with in Kuala Lumpur, posts frequently and knowledgeably on Avation, so I would urge readers to have a look at his most recent comments.

Notes

Bruce Packard

I own shares in Somero and Burford

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 28/05/2024 | KLR, FUTR, AVAP | Natural Gas and Hot Air Rising

With the recent +67% spike in Natural Gas prices, Bruce wonders if Central Banks might have declared victory over inflation too soon. Companies covered: KLR, FUTR and AVAP.

The FTSE 100 was down -1.2% to 8,317 in the last 5 days. The Prime Minister called an election and there will be lots of hot air talked about in the next 6 weeks, most of which will be irrelevant for investing in financial markets. In the US, the Nasdaq100 was up +1.4%, while the S&P500 was flat over the last 5 days. The price of Natural Gas has bounced +68% from its February low this year, and the most traded contract has now risen above its 200-day Simple Moving Average. The price is still well below the peak seen in 2022, but it strikes me that NG-MT is well worth keeping an eye on in H2 this year.

It was great to meet so many readers in person who I had interacted with online at Mello last week. I particularly enjoyed meeting with people who don’t live in London and had taken the trouble to travel down for the face-to-face meetings. The high point of the conference for me was Lord Lee presenting his ideas on what a change of Government might mean for the UK stockmarket, just as a rain-soaked Rishi Sunak was outside 10 Downing Street calling an election. This was then followed by the BASH, when Leon Boros presented the investment case on Hargreaves Lansdown, just as an RNS was released confirming that there had been an approach for the company made by Private Equity.

This week I look at a couple of larger stocks, Keller, the FTSE 250 building contractor and Future, the magazine publisher. Plus a comment on Avation’s “significantly ahead of expectations” trading statement.

Keller AGM trading update

This FTSE 250 geotechnical specialist contractor with a December year-end, put out a trading statement ahead of its AGM. According to their website, at its simplest, what Keller does is prepare ground so that it can be built upon:

The strong momentum continues into FY Dec 2024F, with overall performance “materially ahead of the prior year”. Sharepad was showing turnover forecast to decline by -2% to £2,878m and PBT -13% to £136m – so that’s pleasing that a positive 2023 hasn’t held back the current year.

They say that trading in North America (60% of revenues) continues to be strong, helped by ongoing infrastructure spend. I am wondering if that could have a positive read-across for Somero, the concrete screed company which is down -3% YTD. SOM reported FY Dec 2023 North American sales declined 13.2%, as projects delays impacted purchases of Somero’s equipment.

In Europe and the Middle East (27% of revenues) Keller say that weak demand persisted in residential and commercial sectors. In APAC (13% of revenues) Australia has had a strong start to the year, but there’s been softness in other Asian countries. For the group as a whole, cash performance continued to be strong

Sharepad shows an operating cash flow of £303m FY Dec 2023 and FCF for the firm of £96m. That equates to FCF per share of 129p, versus Capex per share of 127p.

History: The company’s history goes back to 1860 when it was founded by Johann Keller in Renchen Germany. In 1972 the business was acquired by GKN and later sold to management in an MBO in 1990. In 1994 management then listed on the LSE, and then bought several companies in the US (Case Foundation Company, Suncoast Post-Tension, McKinney Drilling company) over the next decade. The shares performed well from their 1994 listing until the financial crisis. Up until breaking through long-term and short-term moving averages in H2 last year, they haven’t done well over the last decade though.

When they listed in 1994 turnover was £195m and PBT was £9m. That compares to turnover FY Dec 2023 of £3bn and PBT of £126m, so the topline growth has been there, but the margins have been low. Despite numerous acquisitions over the years, intangible assets recorded on the balance sheet are just £114m, versus shareholders equity of £518m, so the balance sheet is strong. Net debt / EBITDA is expected to be towards the bottom end of management’s target range (0.5x-1.5x).

Valuation: The shares are trading on a PER of 8x FY Dec 2025F and an EV/EBITDA of below 4x the same year. That looks like very good value, though this is a sector many investors avoid for good reason, as when things go wrong, share prices can be walloped. That said the sector seems to be benefiting from more favourable market conditions, Galliford Try is up +67% in the last 18 months while Kier is up 2.5x over the same time period.

Opinion: I can imagine that these shares could be good to trade in and out of, rather than holding with a 3-5 year time horizon. Building contractors are often lower-margin, indebted and cyclical. Not a great combination. KLR’s 3-year average EBIT margin is just 4.1%, however, profitability measures like CashRoCI of 9.4% and RoCE of 18.3% tell a more positive story. The share price has enjoyed a strong bounce and may be benefitting from expectations of increased infrastructure spending. I would sell on the first sign of trouble though. I prefer Somero, which trades on a similar single-digit PER, but which has a much better EBIT margin and Return on Capital Employed.

Future H1 to March

This media company that publishes magazines like Country Life, and Marie Claire, as well as MoneyWeek and online review sites Techradar and Tom’s Guide, announced H1 results to March. They have been buying titles and then converting readers to an online audience, making money from affiliate marketing. They also bought price comparison website GoCompare in 2020 for £600m. The shares had been on a downward trend falling from a peak of close to £40 per share at the end of 2021 to below £6 in March this year. The price to turnover has de-rated from 7x to 1.5x over the same time period. That decline was caused by falling reader numbers, as well as the less money being spent on advertising for tech products, as consumers have reined in their spending.

However, the market reacted very positively to the H1 results, sending the shares up +20% following the RNS. Revenue was down -2% on an organic basis to £391m and statutory PBT was down -36% to £47m. They did see an improvement in Q2, with organic growth +3%, and said they were confident of achieving FY Sep 2024F expectations, both of which they had already flagged in an early April trading statement. Management also said they were confident of achieving FY adj operating margin of 28% (actually bottom end of FY Sept 2023 guidance 28-30%). Longer-term guidance was for mid-single-digit compound revenue growth.

So it looks to me that expectations were for further disappointment, which is understandable given the previous 2 years of RNS announcements. There are analyst forecasts in the market, however, investors also tend to make decisions based on whether the company has a track record of beating or disappointing forecasts – that seems to be the case here.

Balance sheet: The company has grown by acquisition, buying GoCompare for £600m in 2020, but also the publisher Dennis, for £300m in 2021, and TI Media, publisher of Horse & Hound and Wallpaper, for £140m. Hence there’s £1.6bn of intangible assets on the balance sheet, meaning around £500m of negative tangible assets. Some of the publishing assets are valuable, but they own over 100 magazine titles, a fifth of which are just being managed for cash. Management have segmented their portfolio into i) Hero Brands, c. 50% of revenue, ii) Halo Brands c. 30% of revenue and iii) Cash Generators 20% of revenue. Interestingly they don’t tell investors which titles are in which category, they say because the definitions are not hard and fast: they move titles between categories. That sounds like firing an arrow, seeing where it lands, and then drawing the target around it.

Net debt was £297m, which costs around 7% interest to service and looks comfortable given £126m of Adjusted Free Cash Flow. Management are aiming to get to 1.0x leverage versus 1.25x currently. Management announced a £45m buyback

Valuation: FUTR is trading on a PER of 8x FY Sept 2025F and EV/EBITDA of 5x the same year. That still looks cheap after the +70% share price bounce.

Opinion: I last wrote about this FUTR two years ago when the price was £19 and highlighted the downside. Jamie wrote about them more recently when the price was below £7, and remained negative. The chart has broken out decisively but I can’t see much in the most recent statement that has changed from early April.

Longer term I am concerned about the threat from AI, I’ve already been asking Perplexity.ai to help me choose a new mobile phone, so I would imagine both techradar and GoCompare revenues might be at risk from AI. That implies that the intangible assets on the balance sheet could see significant writedowns at some point and the impressive cashflow at the moment may not be sustainable. So short term this looks like the bounce might continue, support coming from the buyback, but longer term there are still question marks.

Avation FY to July Trading Statement

At the suggestion of Carcosa on Twitter, I wrote about this aircraft leasing business at the beginning of the year. Avation owns 34 aircraft leased to 16 airlines in 14 countries. The fleet includes 19 ATR turboprops, 13 narrowbody jet and 2 widebody jet aircraft. The aircraft are all being leased out at the moment, which means Avation is receiving $7.9m a month (so $95m annualised versus $94m reported FY June last year, and $91m forecast for FY June 2024F).

Notably the company expects to report profit “significantly ahead” of FY Jun 2024F expectations. Clearly, that’s good news, but it is worth pointing out that WH Ireland were forecasting a $7m loss, translating to an EPS of -10c. Secondly, management have repurchased $18m of face value 2026 debt, and assuming that they have bought back at a discount to face value, that may result in an accounting gain. In addition, Avation announced the sale of two ATR 72-600, resulting in $10m of cash proceeds that AVAP should receive in FY Jun 2025F.

The underlying market environment is improving, with air travel growing at +14% year-on-year and new aircraft deliveries constrained by supply chain problems, this means purchase rights are likely to be more valuable. AVAP points to IATA data in their RNS, saying that 1,600 new aircraft deliveries are expected in 2024, equivalent to 4.6% of the global fleet. That compares to a fleet renewal rate of 5.8% in 2018.

We will know more when management releases their FY results, and I would urge readers interested in the investment case to look at the cashflow, not just accounting profits. In 2026 they need to refinance almost half a billion dollars of debt, which in the current market conditions should be possible, and hopefully, management can announce progress on this ahead of schedule. Last year management put out two trading statements (May then July) before releasing FY Jun results in September.

Opinion: There are some similarities between the litigation finance business and companies like Burford. AVAP is a debt-funded leasing business using Fair Value accounting, so when things go wrong, they are likely to go badly wrong: like BUR the AVAP share price fell around -80% over the pandemic but have since recovered some of those losses.

At the moment, Avation has a tailwind, so it’s legitimate for management to buy back debt and mark up the value of their purchase rights. I can imagine that as the business de-levers they could well start paying a dividend again (10.5p in 2019) so AVAP receives a cautious endorsement from me. As I mentioned at the start of the year, Carcosa, a former airline pilot who I met up with in Kuala Lumpur, posts frequently and knowledgeably on Avation, so I would urge readers to have a look at his most recent comments.

Notes

Bruce Packard

I own shares in Somero and Burford

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.