Buying shares when they are unpopular can be a profitable investing strategy. Phil takes a look at one of the UK’s leading brickmakers, Forterra, to see if now could be a good time to buy its shares.

A good business underpinned by strong long-term demand for new homes

The long-term bull case for buying shares in brickmakers is fairly simple: The UK is not building enough houses and housebuilders will need lots of bricks for many years to meet this challenge.

The UK brickmaking sector also comes with some fairly attractive characteristics which investors tend to like.

To succeed, companies need to have substantial reserves of clay which acts as a substantial barrier to entry and limits competition. If they also have mineral deposits – as Forterra does – then so much the better.

Forterra has clay reserves of 90 million tonnes which is enough to sustain 50 years of production at current rates.

As well as bricks for new build homes, there is also a significant and reasonably steady demand for repairs, maintenance and improvement projects. Forterra also makes and sells precast concrete, concrete block paving, chimney, and roofing products.

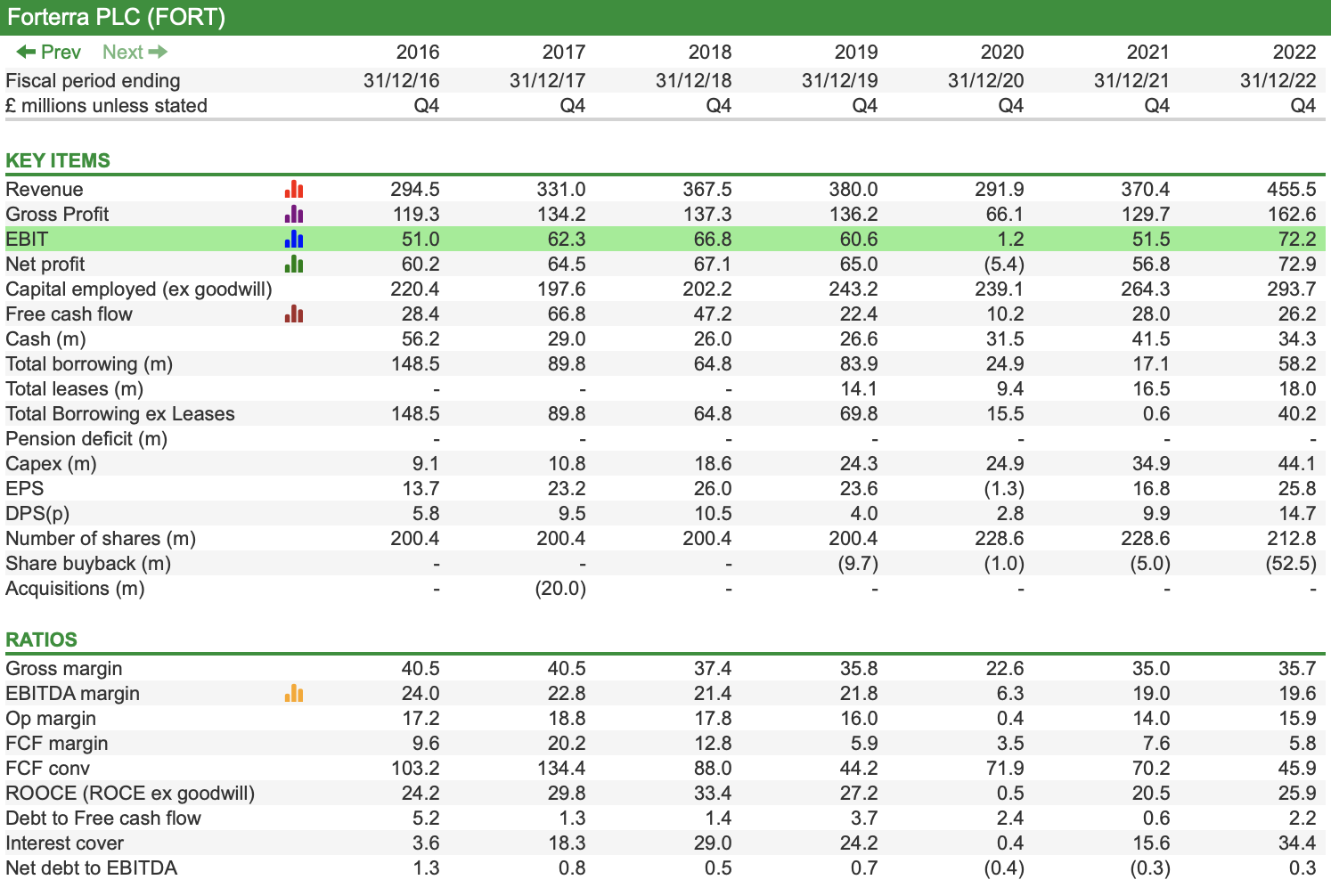

If you open up SharePad and get it to crunch some numbers, Forterra looks like a very solid business.

Although like many businesses it suffered during the Covid-19 pandemic, the business has many attractive characteristics when looking at its financial performance.

First and foremost it has been able to grow its revenues by selling more which is always a good sign. It has been helped by strong growth in the number of new homes its customers have been building.

Its profit margins have been reasonable whilst its return on operating capital (ROOCE) has been consistently good. The business has very little debt whilst last year’s trading profits (EBIT) covered its interest payments by a very comfortable 34 times. In short, the company looks to be in very good health.

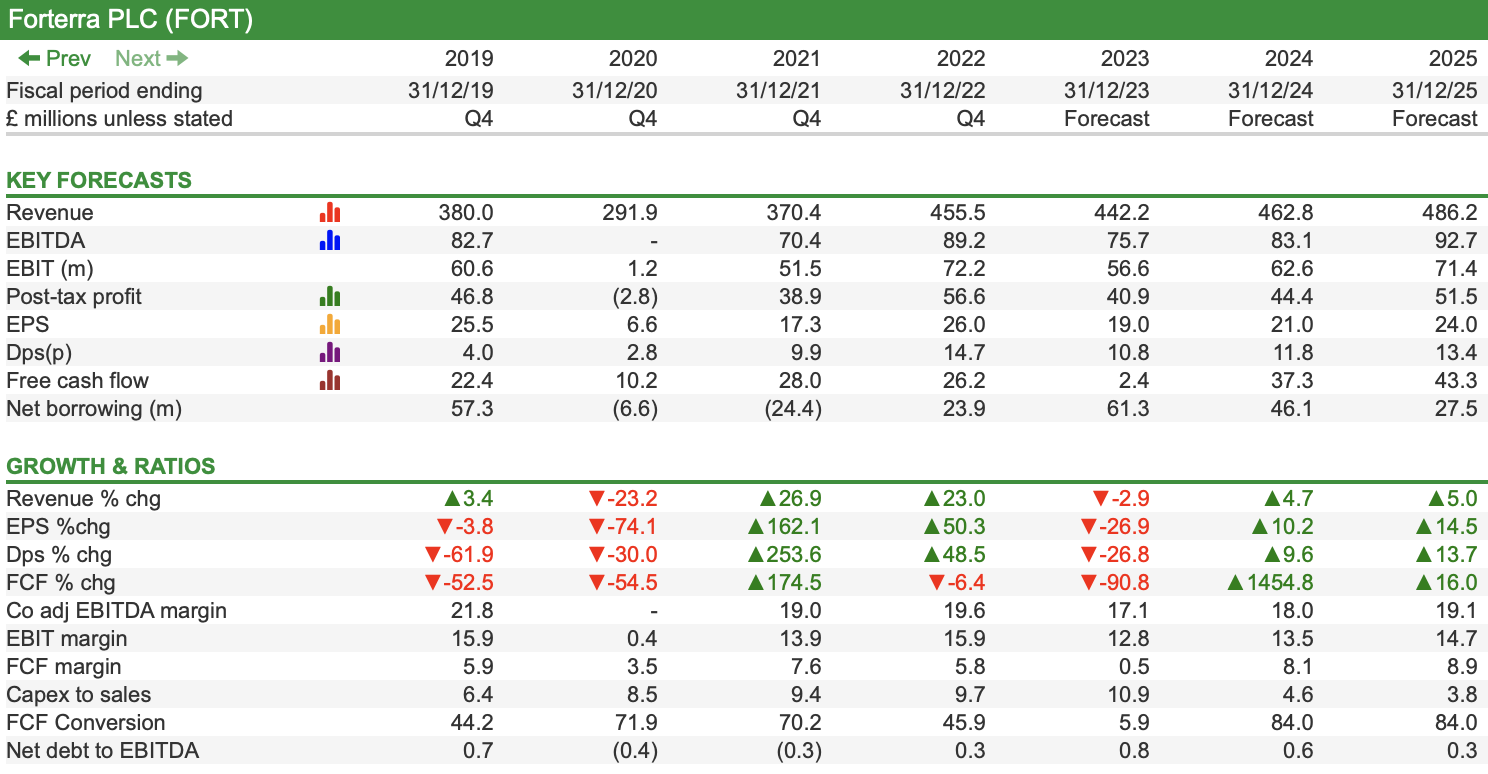

Forterra: Key financials and ratios

Source: SharePad

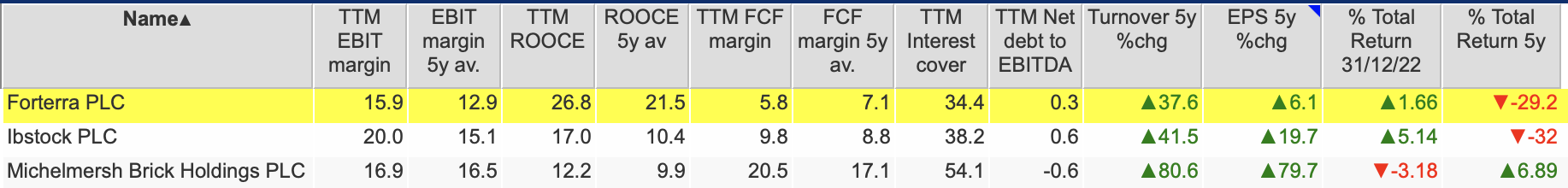

If you compare its performance with its stock market-listed peers Ibstock (LSE:IBST) and Michelmersh Brick (LSE:MBH) Forterra has the highest ROOCE. However, it has underperformed on measures such as free cash flow generation and earnings per share (EPS) growth.

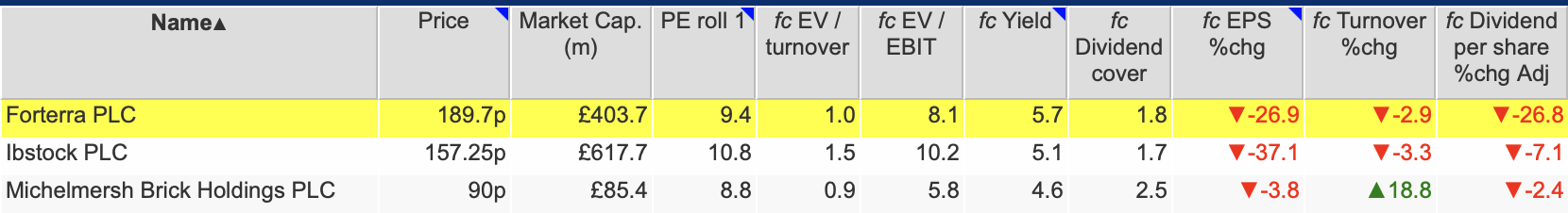

Forterra vs sector peers

Source: SharePad

Forterra’s weak free cash flow conversion – the proportion of a company’s after-tax profits that are converted into free cash flow – can be explained by its large investment in new production capacity which has pushed its capital expenditures to more than 250 per cent of depreciation in recent years.

From 2024, investment spending should fall significantly and lead to a big improvement in free cash flow conversion

That said, brickmakers in general have not treated investors kindly over the last five years with only Michelmersh generating positive total returns. The FTSE-All Share index over the same period has returned 16.9 per cent according to SharePad.

End markets have deteriorated and could get worse

The problem that Forterra and its peers face right now is that the UK housing market is having a tough time.

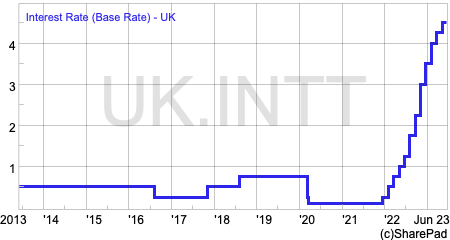

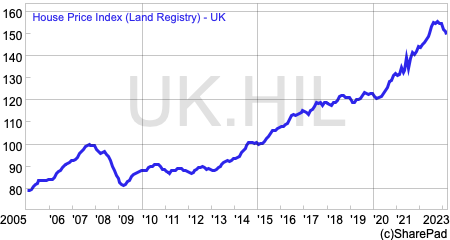

After almost a decade of low-interest rates and huge government support for house building (such as the Help to Buy scheme), the market now faces severe headwinds. Help to Buy has ended and the cost of mortgages has rocketed.

The era of cheap borrowing costs is over. The Bank of England has been aggressively increasing its base interest rate to try and tame inflation. The base rate currently stands at 4.5 per cent and most economic commentators expect it to go higher. No one knows how much higher, but base rates of 5.5 per cent or even 6 per cent over the next year are not unthinkable.

As a result, the cost of mortgages has been soaring, making house purchases more expensive to finance. A year ago, a borrower could get a five-year fixed-rate mortgage with an interest rate of just over 3 per cent. Today, the rate is over 5.5 per cent as mortgage providers pull deals and hike their rates.

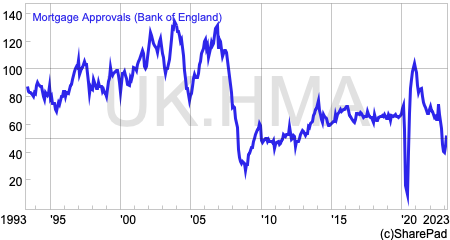

Unsurprisingly, given a continuing cost of living crisis, mortgage approvals have collapsed and are now close to levels – excluding Covid-19 – not seen since the global financial crisis in 2008.

After many years of defying gravity, house prices have started to fall. In response, housebuilders are tightening their belts and building fewer houses.

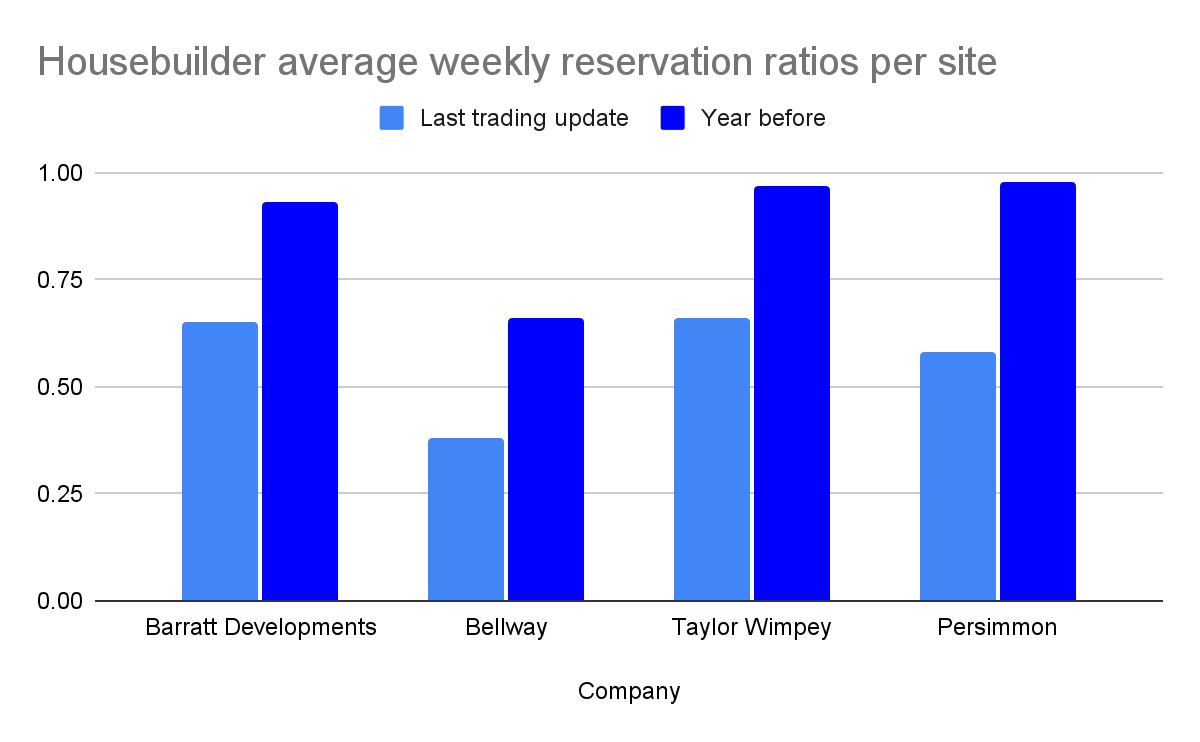

Looking at current levels of buyer interest amongst some of Forterra’s biggest customers, we can see that reservation rates of homes per site are substantially below where they were a year ago.

Source: Company reports

Source: Company reports

Housebuilders expect to see a substantial fall in their revenues and profits in 2023. Some companies such as Bellway and Barratt Developments expect more pain into 2024.

Forterra is feeling the pain of this backdrop too.

Revenues in the first four months of 2023 fell by 24 per cent as the number of bricks leaving its factories fell by nearly a third. Housebuilders’ stocks of bricks are high and therefore they don’t need to buy as many as they were a year ago.

To make matters worse, Forterra has been expanding its production capacity with the opening of its new factory at Desford in Leicestershire. It doesn’t have enough orders to keep all its factories busy.

This is a big problem given that brickmaking sites have a large amount of fixed overheads – around 60 per cent of operating costs are fixed – and high operational gearing. A big falloff in revenues as has been seen so far this year can therefore decimate Forterra’s profits.

To cope with this threat, Forterra has mothballed its Howley Park factory and expects to save £10m of fixed costs in 2023 to limit the hit to its profits. It is shifting its production to its more efficient Desford site.

The final kick in the teeth has been rising energy costs. Brickmaking is very energy intensive – energy accounts for around a quarter of costs – and has been hit by rising prices over the last eighteen months.

Forterra was protected for a while having locked itself into some cheaper energy contracts. The benefits of this have now gone as Forterra has bought 80 percent of its energy needs for 2023 at higher prices than it paid in 2022.

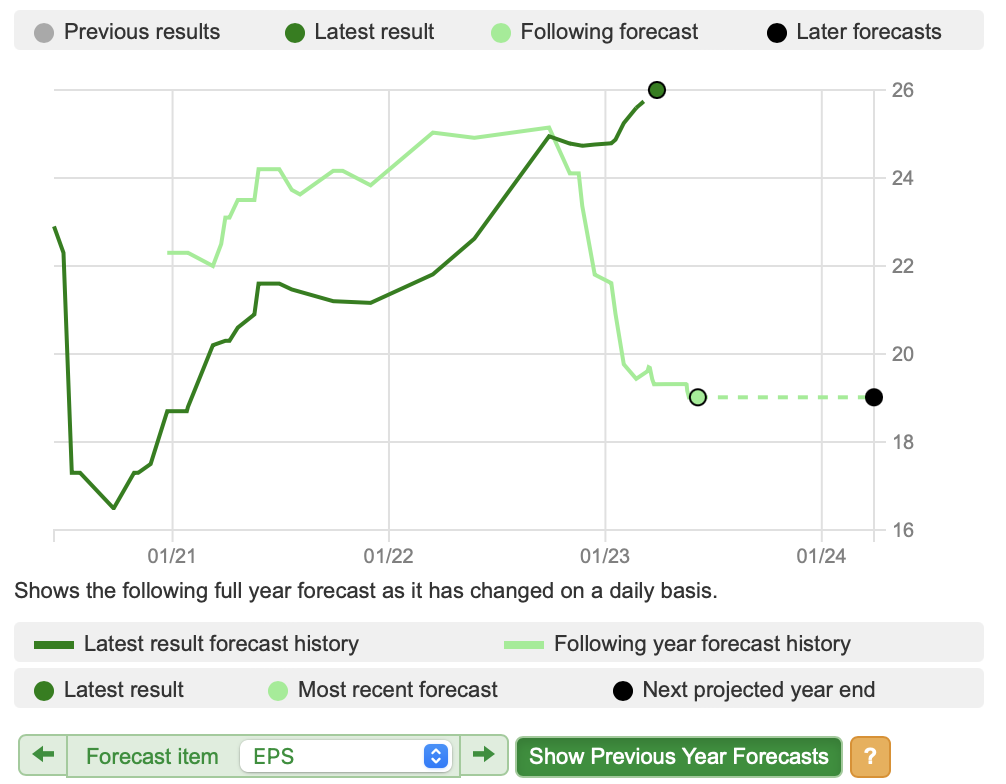

As we can see, City analysts’ expectations for Forterra’s 2023 EPS have come down sharply over the last year.

Given how tough end markets are right now, have they stopped coming down?

Forterra: Trend in 2023 EPS Forecasts

Source: SharePad

Should investors be selling Forterra shares rather than buying them?

Forterra hopes that trading will improve in the second half of the year as house builders rebuild their stocks.

Will this be strong enough to improve a revenue trend that is down by nearly a quarter in the first four months of 2023 to be down by around just 3 per cent for the year as a whole based on current forecasts?

Forterra Forecasts

Source: SharePad

There are grounds for thinking that this is too optimistic given what’s going on with the UK housing market at the moment.

In fact, you could be forgiven for thinking that things could get worse for Forterra and that more forecast downgrades are possible.

However, looking at shorttracker.co.uk shows that there are currently no investors betting on Forterra’s share price falling from its current level. Only 1.3 per cent of Ibstock’s shares have been loaned to short sellers.

Perhaps all the bad news is currently factored into Forterra’s share price?

The bull case: Forterra shares are cheap. New Desford site significantly improves its competitive position

If you believe that current profit forecasts are safe, then there’s a strong case for arguing that Forterra’s and other brickmakers’ stock market valuations are cheap on measures such as a price-to-earnings (PE) ratio.

They also offer chunky dividend yields with reasonable dividend cover – the number of times EPS covers the dividend per share – which pays investors to wait before hopefully trading conditions and profits recover.

Brickmaker shares look cheap

Source: SharePad Note Forterra shares trade ex-dividend 10.1p on 15/6/2023

In the case of Forterra, the opening of its new Desford plant could transform the company’s future growth potential and profitability

The plant has cost £95m to build and is capable of producing 180 million bricks per year. It increases Forterra’s production capacity by 22 per cent.

The big bonus is that the plant is much more efficient than the company’s existing ones. Compared with Howley Park, Desford uses around half the amount of gas, 17 per cent less electricity and two-thirds fewer labour hours per 1,000 bricks made.

With the capacity utilised in more normal market conditions, Desford is expected to contribute an incremental £25m in EBITDA to Forterra and earn an attractive ROCE of 22 per cent from 2025 onwards.

The efficiency of the plant represents a big improvement in Forterra’s competitive position. This gives it a good opportunity to take market share from its competitors and especially from imported brick sales.

Before the financial crisis in 2008, very little of the UK brick market was supplied by imports. The crisis saw some UK capacity close with imports taking up the slack to meet demand.

Of the 2.3 billion bricks supplied to the UK market last year, around 550 million (24 per cent) came from imports. Taking into account the specialised nature of some of these imported bricks, Forterra reckons that 350 million of them are due to a shortage in domestic capacity.

Desford can cater for some of this. Not only are the bricks that are made there well-liked by its customers they also have lower and faster transportation costs. It, therefore, makes sense for builders to buy them.

It will take time for Forterra to win its slice of this market but it seems that its current stock market valuation doesn’t reflect this possibility.

For investors with plenty of patience, Forterra shares look worthy of consideration.

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.