Bruce looks at Prof Altman’s credit analysis, going back 4 decades, suggesting US corporate default rates might rise above average, so understanding Sharepad’s Altman Z score could prove valuable. Stocks covered HEIQ, SDRY, LLOY, HL. and KITW.

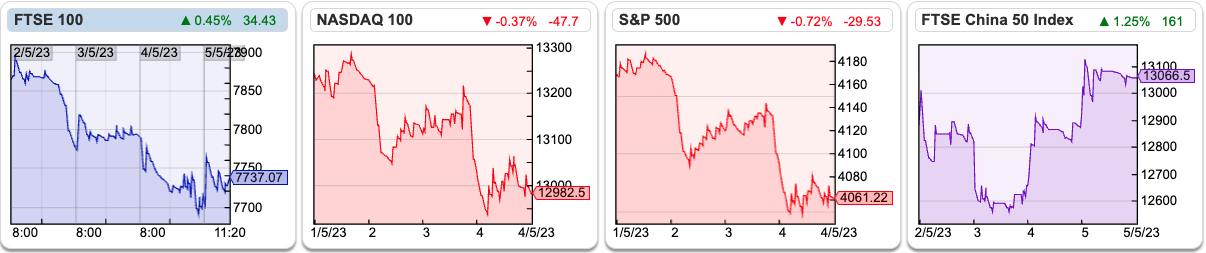

The FTSE 100 fell -1.2% to 7,737 in the last 5 days. The S&P 500 and Nasdaq100 were down -1.8% and -1.4% respectively. The price of gold rose to $2,023 and is now up +11% YTD. Perhaps this year will be gold’s year? In the US the Fed raised interest rates to 5-5.25% range. The ECB lifted rates to 3.25%, and economists now anticipate this rising to 3.75% by July.

The KBW US Regional Banks Index (ticker KRE) was down -14% in the previous 5 days to Friday and is now down -39% YTD.

After First Republic, problems now seem to be focused on PacWest and Western Alliance. I would be surprised if difficulties were contained to US regional banks though. A look at my “Who is next?” table, first published in the middle of March, shows Japanese banks Sumitomo Mitsui and Mitsubishi UFJ both off -7.5% in the last 5 days. Blackstone, the listed Private Equity vehicle is also off -7.5% over that time period.

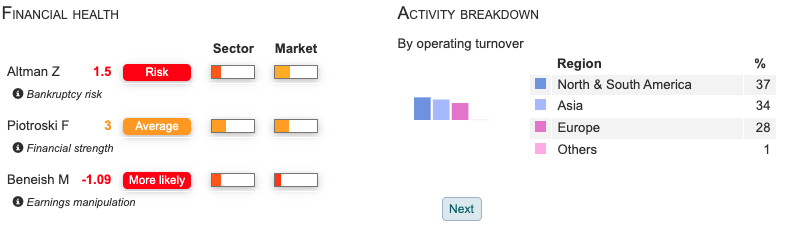

In the UK, HeiQ, the textiles company that IPO’ed at the end of 2020, has seen its shares suspended as management have not been able to publish their FY Dec 2022 results. I drew attention to a number of red flags on this company at the start of this year, and back in May 2021. Note too, that Sharepad’s Altman Z and Beneish M scores (below) have been indicating risk. It’s possible that the shares resume trading, but the price has already fallen more than 80% from the IPO price.

The very same Professor Ed Altman, who came up with the Altman Z score in the 1960s has published an interesting article, including a chart which plots US corporate default rates next to recessions. He notes that a couple of years ago in 2021 default rates were an abnormally low level of 0.5%, aided by government stimulus and Central Bank money printing. Extrapolating 2023 YTD defaults from Q1 this year would give 3.0%, in line with the historic average. For comparison, US corporate default rates peaked above 10% in 1991, 2002 and 2009 recessions.

Altman’s article suggests an average year of defaults in 2023 may be optimistic. For a start, back in the 1970s size of the high-yield bond market was just $10bn, mainly investment grade companies that had been downgraded to junk (known as fallen angels). Now the market has grown to $1.5-$2 trillion high yield bonds, with a further $1 trillion of leveraged bank loans. Many businesses which would not have had access to debt in the 1970s have received funding.

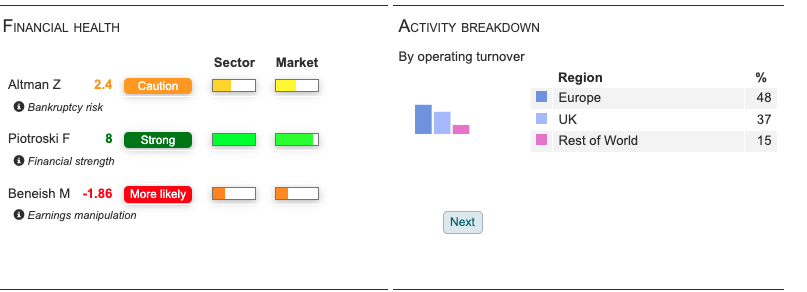

Sharepad has an Altman Z indicator for each company, at the bottom of each company’ single-page company’s view. The calculation is discussed here by Phil Oakley. In a rising interest rate environment, with banks tightening lending criteria, I suggest checking the Altman Z score for companies you are looking at. The figure for HeiQ is 1.5 (indicating risk) and for Superdry below is 2.4 (indicating caution).

Other companies covered below include Lloyds Bank Q1 results, Hargreaves Lansdown Q3 results and Kitwave H1 to April trading update.

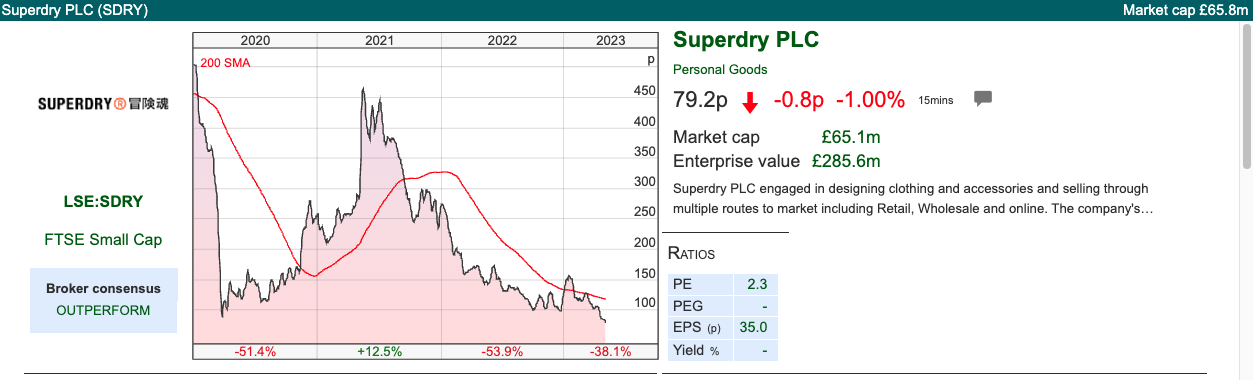

Superdry Capital Raising

Superdry announced a placing at 76.3 pence per share for institutional shareholders and a REX Retail Offer at the same price. The company raised gross proceeds of £11m, which in my view is not enough cash for the retailer to be considered on safe ground. Julian Dunkerton bought 4.5m placing shares for £3.4m and now owns 25.4% of the company.

As the capital raising was a placing, rather than a rights issue, no prospectus was submitted to be approved by the FCA or London Stock Exchange. Investors had to make their own assessment of the company. This may seem a fine distinction, but there are obligations to a prospectus, as the legal action following RBS and HBOS capital raisings in H1 2008 show. Following their publication, shareholders claimed that there were material misstatements and omissions in the banks’ prospectus, for instance, that HBOS was relying on the Bank of England’s Special Liquidity Scheme. If those banks’ shareholders had known the true financial position, which after all had to be rescued by the government six months following the rights issues, then they claimed they would not have invested in the capital raising. I should point out, that apart from publishing a full legal prospectus, there are other reasons (cost, speed of execution) that companies prefer to raise capital with placings rather than rights issues. However, I decided not to average down into the placing without a prospectus.

Similarities with Quarto: In February 2020, just before the pandemic, illustrated book publisher QRT raised £14m in an open offer at 68p, underwritten by a co-founder/major shareholder CK Lau. The publisher was overloaded with $65m of net bank debt, and used the proceeds to stabilise the business. I owned the shares and made a note in my investment diary that it was probably OK to average down but did wonder if they had raised enough money. Then the pandemic hit with the shares falling below 50p and I had too much “cognitive load” dealing with my craft beer bar. That proved an expensive missed opportunity because QRT management executed a successful turnaround and Quarto shares have now recovered to 160p.

I discussed this afterwards with a hedge fund manager friend, he observed with a wry smile that the problem with bad investments is that they end up costing you twice over. First, the money that you lose directly, which is painful enough. Then secondly, bad investments also take up valuable time and attention. That means you often miss out and the indirect cost of missed opportunities can be multiples of the money you lose directly.

Opinion: Lee Freeman-Shore in The Art of Execution, would suggest that now the SDRY share price has fallen by more than a third from my entry price, I should either average down or cut my losses. In this specific instance, there’s an obvious catalyst: SDRY manages to sell their Asian Pacific IP for £34m net of costs. Last week’s £11m is likely not enough cash on its own in my view, but I think that cash AND the AP deal completing would spark a reappraisal of the investment case.

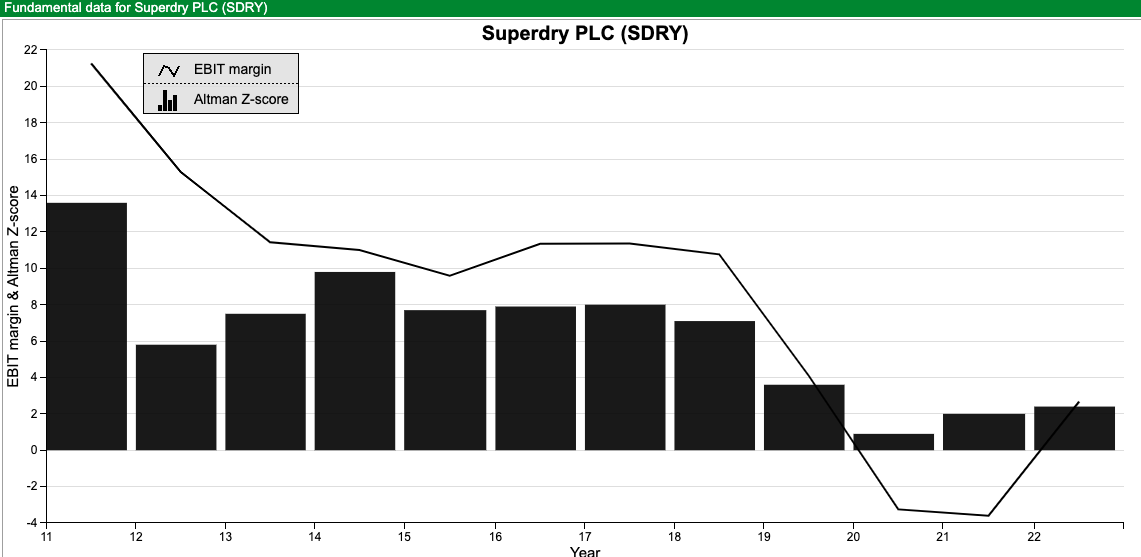

SDRY intend to send a circular on the Asia Pacific disposal to shareholders later this month. The AP sale is very favourable to SDRY, despite the retailer being a distressed seller, with just £66m market cap last week. I’ve noted already that Sharepad’s Altman Z (bankruptcy risk) is indicating caution. Below is a chart which shows the ratio’s deterioration and muted recovery over the last decade (blocks), along with EBIT margin (line).

For now, I will sit on my hands. The risk-reward looks like this to me:

- substantial upside if the turnaround is successful, but

- if trading continues to be difficult the business could fail.

I would emphasise once again, that this weekly commentary is for educational purposes, I am sharing my thought process and this is not a recommendation to buy or sell any share…particularly this one!

Lloyds Bank Q1 to March

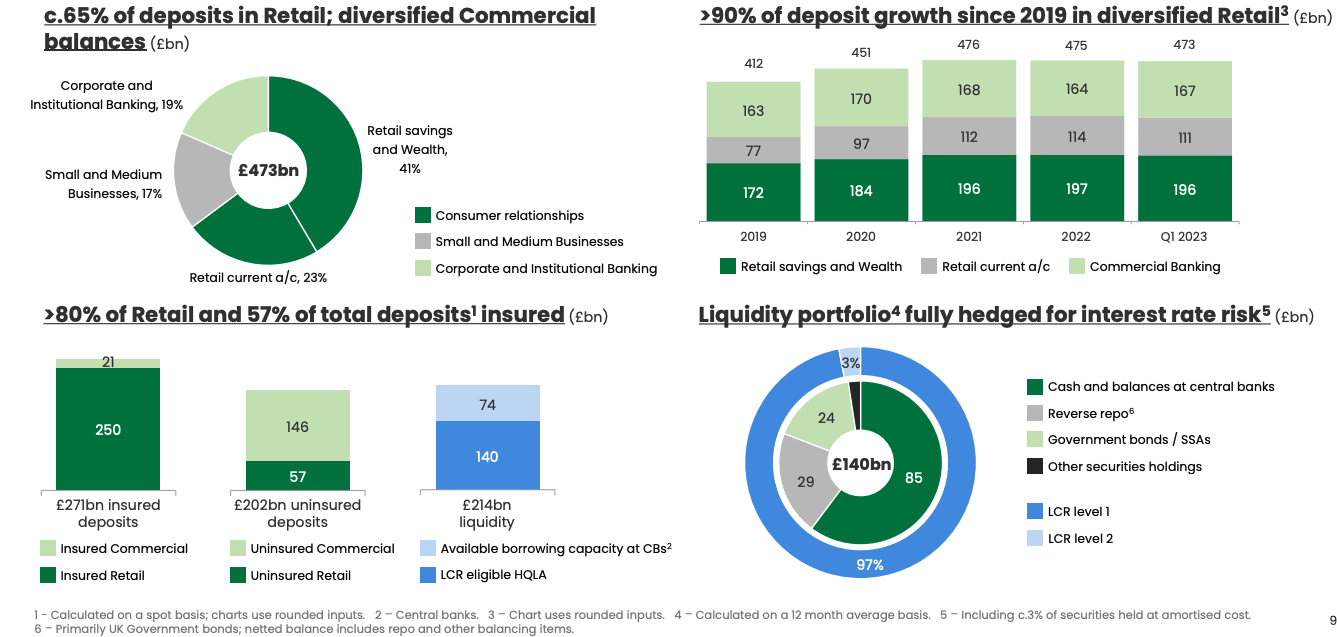

Lloyds Bank reported deposit outflows of £2.2bn in the first 3 months of this year to £473bn. That’s much better than NatWest, who reported £20bn of outflows at a group level. There were contrasting trends within Lloyds, with retail current accounts down -3% and Wealth -10% but offset by Commercial Banking deposits up +2%. LLOY’s wholesale Funding increased just +1% to £101bn.

At a group level, the loans/deposit ratio was 96%, the Net Stable Funding Ratio (NSFR) and Liquidity Coverage Ratios (LCR) were 129% and 143% respectively. That LCR of 129% is slightly below both BARC and NWG reported LCR of 139%. The LCR measures a bank’s ability to meet its short-term obligations over a 30-day stress period, the measure is not perfect though: Credit Suisse reported a LCR of 150% in the middle of March, just before the bank failed!

I’m assuming that when customers move their money out of banks’ deposit accounts and transfer to cash Money Market funds managed by the likes of ABDN, Fidelity, Blackrock and Vanguard this counts as wholesale funding, not Commercial Bank deposits. In 2007-8 some banks did play games with the definitions – counting Certificates of Deposits (CDs) which weren’t covered by the government guarantees as “customer deposits”.

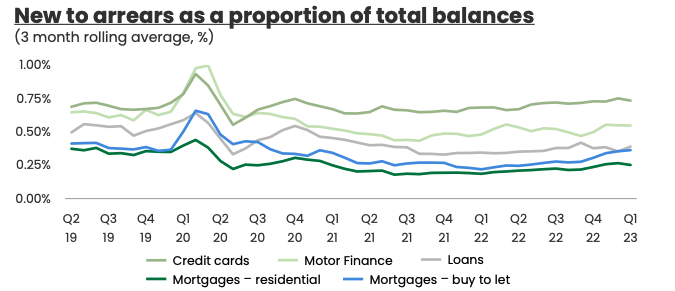

LLOY management kept guidance for FY Dec 2023F unchanged: banking Net Interest Margin 3.05%, impairments of c. 30 basis points. Management point out that the average Loan To Value (LTV) on their mortgage book is 42% and just 7% of their book (£21bn in absolute terms) is over 80% LTV. One area to watch is the Buy to Let book, (in blue below, a legacy from their 2008 HBOS acquisition) and which seems to be deteriorating faster than the standard mortgage book (in green, below), but still below pandemic peak arrears.

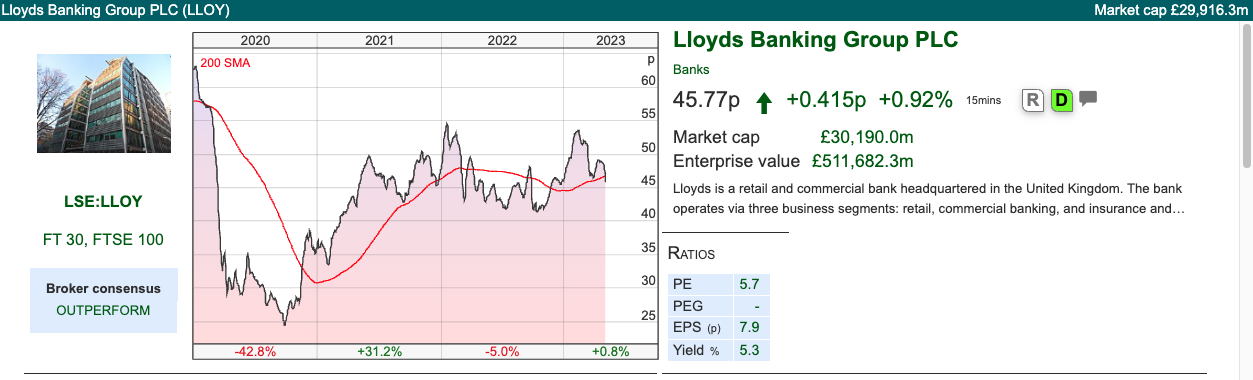

Valuation: Tangible book value is 50p, so the shares are currently trading around 1x book. Management have guided to a Return on Tangible Equity of 13%, which if that level of returns is sustainable through the cycle implies, the shares ought to trade on 1.4x to 1.7x book value (depending on your growth and cost of equity assumptions). Sharepad shows a 2023F dividend yield of just below 6%.

Opinion: I was expecting LLOY results to be worse, with evidence of greater deposit outflows or perhaps management guiding down net interest margin and RoTE expectations for the FY. We should remember though that Credit Suisse failed in the middle of March, just two weeks before the end of Q1 – there may be more bad news to come from banks in this quarter between April-June.

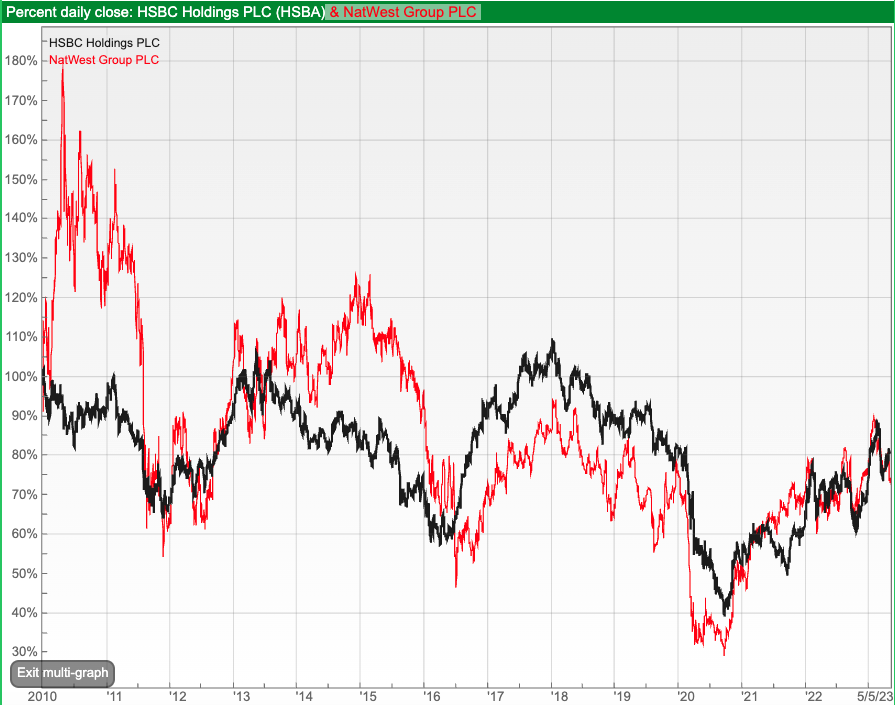

My rule of thumb for banks is that the sector tends to move homogeneously but within that, a wide spectrum of volatility (HSBC the lowest volatility, NatWest the highest). There’s little advantage in owning HSBC ‘through the cycle’, as the 20-year track record shows. Instead, it is better to wait for favourable conditions for the whole sector, timing the market and then buying the worst bank (NatWest), which should rally hardest. The chart (using Sharepad’s multi-graph feature) below shows that since the financial crisis, NatWest achieved higher highs (2010, 2015) but lower lows (2012, 2016, 2020) than HSBC.

Alternatively, there is the Bank of Georgia, which is a faster-growing and more profitable bank than those headquartered in London, but not without risk.

Kitwave H1 to April Trading Update

This wholesaler specialises in supplying “impulse products” (soft drinks, sweets and ice cream), fresh food, alcohol and tobacco to 42,000 retailers. They listed at 150p in May two years ago. Since then, the shares have done surprisingly well for an IPO from a Private Equity seller and last week they put out an encouraging trading update.

There’s an H2 weighting, but they expect FY results to October to be slightly ahead of market expectations. They bought a fresh produce wholesale, Westcountry Foods in December last year, for £29m in cash (or 1x revenues, or 4x EBITDA). They say that this has now been integrated and is performing in line with expectations.

History: Kitwave was founded in 1987 in North Shields, Tyne and Wear when management bought a single-site confectionery wholesaler. The founder is Paul Young, the current Chief Exec. In 2011 they secured an investment from NVM Private Equity, to support the group’s ‘buy and build’ expansion. Over the following years, they made six acquisitions, growing revenues from £86m in 2009 to £228m in 2015. In 2016 NVM exited, refinancing the group and raising a further £25m from Pricoa and Allstate (also PE firms). In May 2021 they raised £82m of which £60m went to pay down debt while selling shareholders received £18m via a secondary placing. As of Oct 2022, the business had £44m of net debt, of which just over half was IFRS16 lease liabilities. As they have grown by acquisition, £44m of goodwill is carried on the balance sheet, which following the acquisition of WestCountry in January, grows to £63m versus book value of £72m.

Shareholders: The Chief Exec/Founder still owns 16%. Other larger shareholders include Liontrust 16%, Threadneedle 9%, Chelverton and Miton both 5%.

Valuation: As you would expect for a wholesale distributor, margins are very low (Sharepad shows 3 year average EBIT margin of 1.1%, improving to 3.7% most recently). Surprisingly the company has reported last year a RoCE and CRoCI of 16.9% though, perhaps demonstrating that they now have achieved economies of scale. The shares are trading on a PER 10x Oct 2024F and Sharepad shows a dividend yield of 4.1%, neither of those measures suggest KITW is expensive.

Opinion: Management seem to be navigating the current environment well. I’m a little wary of the acquisition-led growth, net debt and low margins. I will steer clear for that reason, but I can understand if readers think that KITW is worthy of further research.

HL Q3 results to March

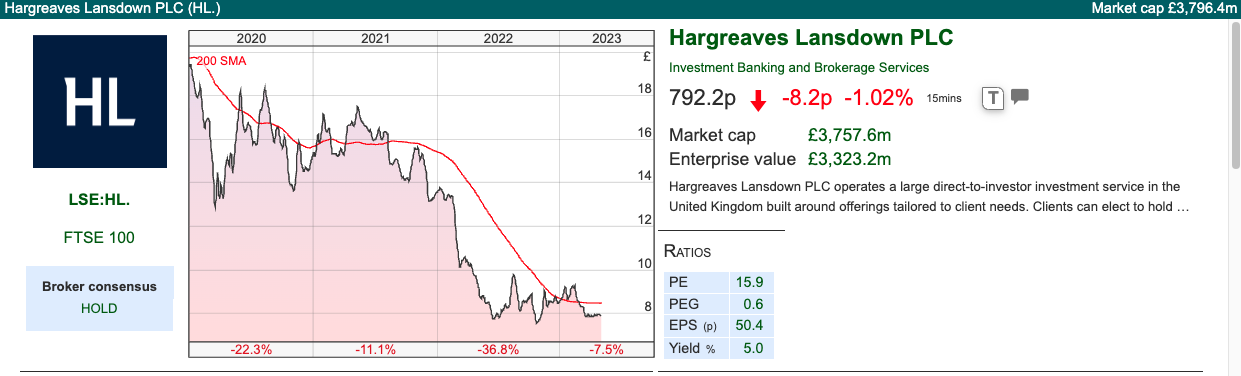

A brief comment on HL. Q3 results out last week, because I have changed my mind. I last wrote up HL. in Feb here. At the time I was unimpressed with the investment case. However, the shares then fell below 770p, and I also reconsidered whether the problems in the banking sector were providing a tailwind.

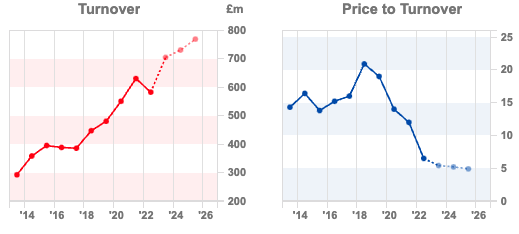

HL. reported Q3 revenue up +28% to £188m. They are continuing to benefit from rising interest rates on clients’ cash balances, which has more than offset a reduction in share dealing volumes -20% versus Q3 last year. They have £132bn of Assets under Administration (AuA), up by £3.3bn because of positive market movements and inflows of £1.6bn.

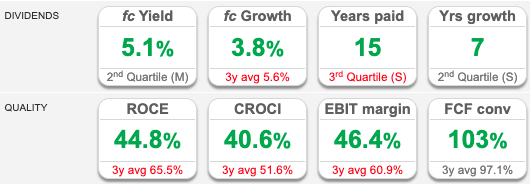

Valuation: The shares are trading on a PER Jun 2024F of 13.4x, and a price/sales of 5.2x the same year. RoCE and EBIT margins have been falling, but are still well remarkably high at 44.8% and 46.4%. Meanwhile, the dividend yield is above 5% (1.5x covered), which qualifies it as a ‘value’ stock in my book.

Opinion: It’s tempting to suggest HL. share price ought to be driven by client trading activity, but a brief look at the chart over the last 5 years suggests otherwise. The shares didn’t benefit from the liquidity fuelled vaccine rally, halving in value from £18 share price in mid-2020. Similarly, the shares held up well as the sell-off gathered pace last year between June and September.

So I bought some HL. shares at below 770p at the beginning of April. Many readers will be familiar with HL. as a platform, and can use Sharepad to do further research and make their own mind up.

Notes

The author owns shares in SDRY, QRT, HL. and Bank of Georgia

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Weekly Market Commentary | 09/05/23 | HEIQ, SDRY, LLOY, HL., KITW | Professor Altman’s Average

Bruce looks at Prof Altman’s credit analysis, going back 4 decades, suggesting US corporate default rates might rise above average, so understanding Sharepad’s Altman Z score could prove valuable. Stocks covered HEIQ, SDRY, LLOY, HL. and KITW.

The FTSE 100 fell -1.2% to 7,737 in the last 5 days. The S&P 500 and Nasdaq100 were down -1.8% and -1.4% respectively. The price of gold rose to $2,023 and is now up +11% YTD. Perhaps this year will be gold’s year? In the US the Fed raised interest rates to 5-5.25% range. The ECB lifted rates to 3.25%, and economists now anticipate this rising to 3.75% by July.

The KBW US Regional Banks Index (ticker KRE) was down -14% in the previous 5 days to Friday and is now down -39% YTD.

After First Republic, problems now seem to be focused on PacWest and Western Alliance. I would be surprised if difficulties were contained to US regional banks though. A look at my “Who is next?” table, first published in the middle of March, shows Japanese banks Sumitomo Mitsui and Mitsubishi UFJ both off -7.5% in the last 5 days. Blackstone, the listed Private Equity vehicle is also off -7.5% over that time period.

In the UK, HeiQ, the textiles company that IPO’ed at the end of 2020, has seen its shares suspended as management have not been able to publish their FY Dec 2022 results. I drew attention to a number of red flags on this company at the start of this year, and back in May 2021. Note too, that Sharepad’s Altman Z and Beneish M scores (below) have been indicating risk. It’s possible that the shares resume trading, but the price has already fallen more than 80% from the IPO price.

The very same Professor Ed Altman, who came up with the Altman Z score in the 1960s has published an interesting article, including a chart which plots US corporate default rates next to recessions. He notes that a couple of years ago in 2021 default rates were an abnormally low level of 0.5%, aided by government stimulus and Central Bank money printing. Extrapolating 2023 YTD defaults from Q1 this year would give 3.0%, in line with the historic average. For comparison, US corporate default rates peaked above 10% in 1991, 2002 and 2009 recessions.

Altman’s article suggests an average year of defaults in 2023 may be optimistic. For a start, back in the 1970s size of the high-yield bond market was just $10bn, mainly investment grade companies that had been downgraded to junk (known as fallen angels). Now the market has grown to $1.5-$2 trillion high yield bonds, with a further $1 trillion of leveraged bank loans. Many businesses which would not have had access to debt in the 1970s have received funding.

Sharepad has an Altman Z indicator for each company, at the bottom of each company’ single-page company’s view. The calculation is discussed here by Phil Oakley. In a rising interest rate environment, with banks tightening lending criteria, I suggest checking the Altman Z score for companies you are looking at. The figure for HeiQ is 1.5 (indicating risk) and for Superdry below is 2.4 (indicating caution).

Other companies covered below include Lloyds Bank Q1 results, Hargreaves Lansdown Q3 results and Kitwave H1 to April trading update.

Superdry Capital Raising

Superdry announced a placing at 76.3 pence per share for institutional shareholders and a REX Retail Offer at the same price. The company raised gross proceeds of £11m, which in my view is not enough cash for the retailer to be considered on safe ground. Julian Dunkerton bought 4.5m placing shares for £3.4m and now owns 25.4% of the company.

As the capital raising was a placing, rather than a rights issue, no prospectus was submitted to be approved by the FCA or London Stock Exchange. Investors had to make their own assessment of the company. This may seem a fine distinction, but there are obligations to a prospectus, as the legal action following RBS and HBOS capital raisings in H1 2008 show. Following their publication, shareholders claimed that there were material misstatements and omissions in the banks’ prospectus, for instance, that HBOS was relying on the Bank of England’s Special Liquidity Scheme. If those banks’ shareholders had known the true financial position, which after all had to be rescued by the government six months following the rights issues, then they claimed they would not have invested in the capital raising. I should point out, that apart from publishing a full legal prospectus, there are other reasons (cost, speed of execution) that companies prefer to raise capital with placings rather than rights issues. However, I decided not to average down into the placing without a prospectus.

Similarities with Quarto: In February 2020, just before the pandemic, illustrated book publisher QRT raised £14m in an open offer at 68p, underwritten by a co-founder/major shareholder CK Lau. The publisher was overloaded with $65m of net bank debt, and used the proceeds to stabilise the business. I owned the shares and made a note in my investment diary that it was probably OK to average down but did wonder if they had raised enough money. Then the pandemic hit with the shares falling below 50p and I had too much “cognitive load” dealing with my craft beer bar. That proved an expensive missed opportunity because QRT management executed a successful turnaround and Quarto shares have now recovered to 160p.

I discussed this afterwards with a hedge fund manager friend, he observed with a wry smile that the problem with bad investments is that they end up costing you twice over. First, the money that you lose directly, which is painful enough. Then secondly, bad investments also take up valuable time and attention. That means you often miss out and the indirect cost of missed opportunities can be multiples of the money you lose directly.

Opinion: Lee Freeman-Shore in The Art of Execution, would suggest that now the SDRY share price has fallen by more than a third from my entry price, I should either average down or cut my losses. In this specific instance, there’s an obvious catalyst: SDRY manages to sell their Asian Pacific IP for £34m net of costs. Last week’s £11m is likely not enough cash on its own in my view, but I think that cash AND the AP deal completing would spark a reappraisal of the investment case.

SDRY intend to send a circular on the Asia Pacific disposal to shareholders later this month. The AP sale is very favourable to SDRY, despite the retailer being a distressed seller, with just £66m market cap last week. I’ve noted already that Sharepad’s Altman Z (bankruptcy risk) is indicating caution. Below is a chart which shows the ratio’s deterioration and muted recovery over the last decade (blocks), along with EBIT margin (line).

For now, I will sit on my hands. The risk-reward looks like this to me:

I would emphasise once again, that this weekly commentary is for educational purposes, I am sharing my thought process and this is not a recommendation to buy or sell any share…particularly this one!

Lloyds Bank Q1 to March

Lloyds Bank reported deposit outflows of £2.2bn in the first 3 months of this year to £473bn. That’s much better than NatWest, who reported £20bn of outflows at a group level. There were contrasting trends within Lloyds, with retail current accounts down -3% and Wealth -10% but offset by Commercial Banking deposits up +2%. LLOY’s wholesale Funding increased just +1% to £101bn.

At a group level, the loans/deposit ratio was 96%, the Net Stable Funding Ratio (NSFR) and Liquidity Coverage Ratios (LCR) were 129% and 143% respectively. That LCR of 129% is slightly below both BARC and NWG reported LCR of 139%. The LCR measures a bank’s ability to meet its short-term obligations over a 30-day stress period, the measure is not perfect though: Credit Suisse reported a LCR of 150% in the middle of March, just before the bank failed!

I’m assuming that when customers move their money out of banks’ deposit accounts and transfer to cash Money Market funds managed by the likes of ABDN, Fidelity, Blackrock and Vanguard this counts as wholesale funding, not Commercial Bank deposits. In 2007-8 some banks did play games with the definitions – counting Certificates of Deposits (CDs) which weren’t covered by the government guarantees as “customer deposits”.

LLOY management kept guidance for FY Dec 2023F unchanged: banking Net Interest Margin 3.05%, impairments of c. 30 basis points. Management point out that the average Loan To Value (LTV) on their mortgage book is 42% and just 7% of their book (£21bn in absolute terms) is over 80% LTV. One area to watch is the Buy to Let book, (in blue below, a legacy from their 2008 HBOS acquisition) and which seems to be deteriorating faster than the standard mortgage book (in green, below), but still below pandemic peak arrears.

Valuation: Tangible book value is 50p, so the shares are currently trading around 1x book. Management have guided to a Return on Tangible Equity of 13%, which if that level of returns is sustainable through the cycle implies, the shares ought to trade on 1.4x to 1.7x book value (depending on your growth and cost of equity assumptions). Sharepad shows a 2023F dividend yield of just below 6%.

Opinion: I was expecting LLOY results to be worse, with evidence of greater deposit outflows or perhaps management guiding down net interest margin and RoTE expectations for the FY. We should remember though that Credit Suisse failed in the middle of March, just two weeks before the end of Q1 – there may be more bad news to come from banks in this quarter between April-June.

My rule of thumb for banks is that the sector tends to move homogeneously but within that, a wide spectrum of volatility (HSBC the lowest volatility, NatWest the highest). There’s little advantage in owning HSBC ‘through the cycle’, as the 20-year track record shows. Instead, it is better to wait for favourable conditions for the whole sector, timing the market and then buying the worst bank (NatWest), which should rally hardest. The chart (using Sharepad’s multi-graph feature) below shows that since the financial crisis, NatWest achieved higher highs (2010, 2015) but lower lows (2012, 2016, 2020) than HSBC.

Alternatively, there is the Bank of Georgia, which is a faster-growing and more profitable bank than those headquartered in London, but not without risk.

Kitwave H1 to April Trading Update

This wholesaler specialises in supplying “impulse products” (soft drinks, sweets and ice cream), fresh food, alcohol and tobacco to 42,000 retailers. They listed at 150p in May two years ago. Since then, the shares have done surprisingly well for an IPO from a Private Equity seller and last week they put out an encouraging trading update.

There’s an H2 weighting, but they expect FY results to October to be slightly ahead of market expectations. They bought a fresh produce wholesale, Westcountry Foods in December last year, for £29m in cash (or 1x revenues, or 4x EBITDA). They say that this has now been integrated and is performing in line with expectations.

History: Kitwave was founded in 1987 in North Shields, Tyne and Wear when management bought a single-site confectionery wholesaler. The founder is Paul Young, the current Chief Exec. In 2011 they secured an investment from NVM Private Equity, to support the group’s ‘buy and build’ expansion. Over the following years, they made six acquisitions, growing revenues from £86m in 2009 to £228m in 2015. In 2016 NVM exited, refinancing the group and raising a further £25m from Pricoa and Allstate (also PE firms). In May 2021 they raised £82m of which £60m went to pay down debt while selling shareholders received £18m via a secondary placing. As of Oct 2022, the business had £44m of net debt, of which just over half was IFRS16 lease liabilities. As they have grown by acquisition, £44m of goodwill is carried on the balance sheet, which following the acquisition of WestCountry in January, grows to £63m versus book value of £72m.

Shareholders: The Chief Exec/Founder still owns 16%. Other larger shareholders include Liontrust 16%, Threadneedle 9%, Chelverton and Miton both 5%.

Valuation: As you would expect for a wholesale distributor, margins are very low (Sharepad shows 3 year average EBIT margin of 1.1%, improving to 3.7% most recently). Surprisingly the company has reported last year a RoCE and CRoCI of 16.9% though, perhaps demonstrating that they now have achieved economies of scale. The shares are trading on a PER 10x Oct 2024F and Sharepad shows a dividend yield of 4.1%, neither of those measures suggest KITW is expensive.

Opinion: Management seem to be navigating the current environment well. I’m a little wary of the acquisition-led growth, net debt and low margins. I will steer clear for that reason, but I can understand if readers think that KITW is worthy of further research.

HL Q3 results to March

A brief comment on HL. Q3 results out last week, because I have changed my mind. I last wrote up HL. in Feb here. At the time I was unimpressed with the investment case. However, the shares then fell below 770p, and I also reconsidered whether the problems in the banking sector were providing a tailwind.

HL. reported Q3 revenue up +28% to £188m. They are continuing to benefit from rising interest rates on clients’ cash balances, which has more than offset a reduction in share dealing volumes -20% versus Q3 last year. They have £132bn of Assets under Administration (AuA), up by £3.3bn because of positive market movements and inflows of £1.6bn.

Valuation: The shares are trading on a PER Jun 2024F of 13.4x, and a price/sales of 5.2x the same year. RoCE and EBIT margins have been falling, but are still well remarkably high at 44.8% and 46.4%. Meanwhile, the dividend yield is above 5% (1.5x covered), which qualifies it as a ‘value’ stock in my book.

Opinion: It’s tempting to suggest HL. share price ought to be driven by client trading activity, but a brief look at the chart over the last 5 years suggests otherwise. The shares didn’t benefit from the liquidity fuelled vaccine rally, halving in value from £18 share price in mid-2020. Similarly, the shares held up well as the sell-off gathered pace last year between June and September.

So I bought some HL. shares at below 770p at the beginning of April. Many readers will be familiar with HL. as a platform, and can use Sharepad to do further research and make their own mind up.

Notes

The author owns shares in SDRY, QRT, HL. and Bank of Georgia

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.