Bruce looks at how the warm weather in Europe has been affecting financial markets. Companies covered NXT and CNC, plus profit warnings from HEIQ and FDEV.

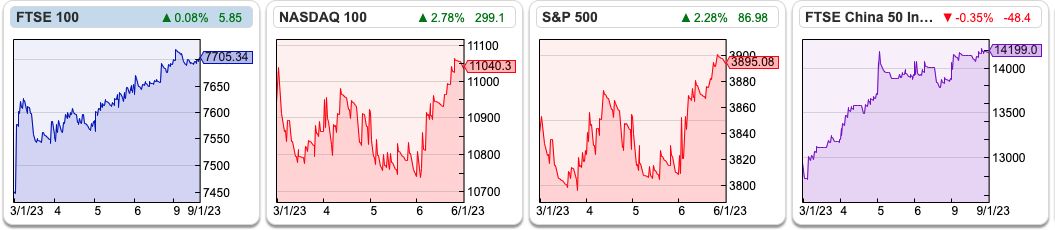

The FTSE 100 has enjoyed a strong early January, up +3.4% to 7,705. OCDO was up +20%, while IAG (the old British Airways) and BT were up +17% and +15%. The S&P500 and Nasdaq100 indices were both up too, but only +1.2% and +0.8% respectively. The US 10Y government bond yield is declined to 3.6% and the UK 10Y is 3.5%, down roughly 100 basis points since early October. Falling bond yields imply risk aversion versus fears over inflation running too hot.

I’m a big fan of the systemic way that Sharepad labels bond yields. The first two letters are country (so UK, US for America, and DE for Germany). The next two letters: “TS” is for treasury (ie government bond). The fifth letter is either a “M” for month or “Y” for year. The final number is the maturity. This works for Germany (DETSY10), UK (UKTSY10) and the US (USTSY10) government bonds. Below is the yield on the German 10Y bond yield back to the start of 2013, so you can see it’s been quite a move over the last year from -40bp in Dec 2021 to just below 2.3% currently.

In the short term, the unseasonably warm and windy weather has been very helpful to households and inflation expectations, as energy prices have fallen back. Sharepad shows the Natural Gas contract (NG-MT) is down -60% since its peak in September last year. We’ve never really seen how markets in Euro-denominated government debt react to an environment of sharply rising inflation, so yields (and the weather) are worth keeping an eye on.

Traditionally retailers are also reliant on the weather, to help sell overcoats in the October-December months. Below I look at Next’s trading update, showing colder weather in December was very helpful to the retail sector. Plus Frontier Developments and HeiQ’s profit warnings. Then a positive update from Concurrent Technologies.

Next Trading Update FY Jan 2023

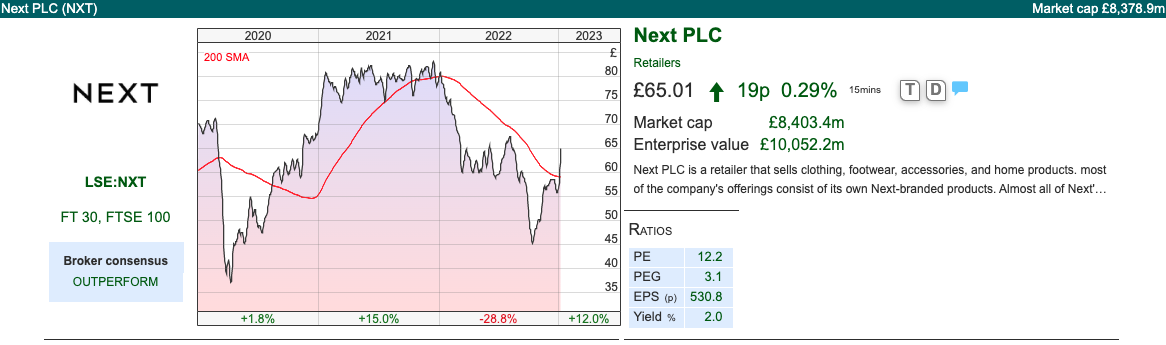

I wouldn’t normally cover this large-cap retailer, because it’s a simple business, with a straightforward communication style. However, NXT has around £5bn of annual sales, so is large enough to give a good idea of what’s happening in the whole retail sector (with the caveat, that it tends to report better trends than less well-managed retailers).

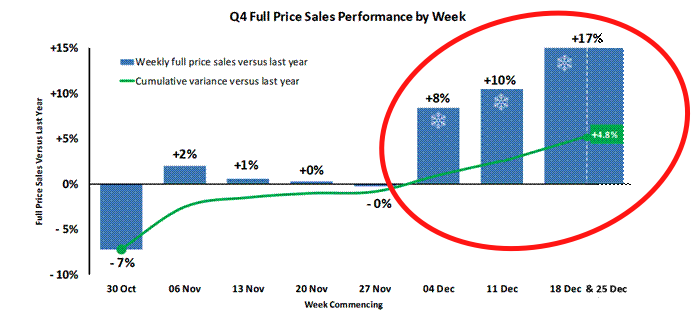

The 9 weeks to 30 Dec, full-priced sales were up +4.8%, versus previous guidance of -2.0% for that period and FY Jan 2023 PBT guidance was increased by £20m to £860m. However, despite a strong finish to the year, the outlook statement sounded a note of caution. For FY Jan 2024, they expect full-priced sales to be down -1.5% and PBT down -7.6% to £795m.

There’s a chart of weekly full-price sales performance, so investors could see how the warm weather was bad for sales in November, but from the first week of December (with the snowflake symbol, that I’ve circled in red) sales really picked up and saved the quarter.

Valuation: the shares are trading on 12.9x Jan 2024F and 12.0x Jan 2025F PER. That’s a significant premium to SDRY (which I own), which trades on just below 10x April 2024F and 7.4x April 2025F PER.

Opinion: This is a quality company with a great long-term track record. However, if you think that the sector is past the worst, then it’s better to buy into a company that is more geared into a recovery. This is a common rule of thumb, if you think that the banking sector will do well, there’s less upside buying JP Morgan, than more marginal players like NatWest, or even Metro Bank, whose profits (and share prices) are more sensitive to improving trends. Hence, I own Superdry, up +48% in the last month.

Frontier Developments Trading Update FY May 2023

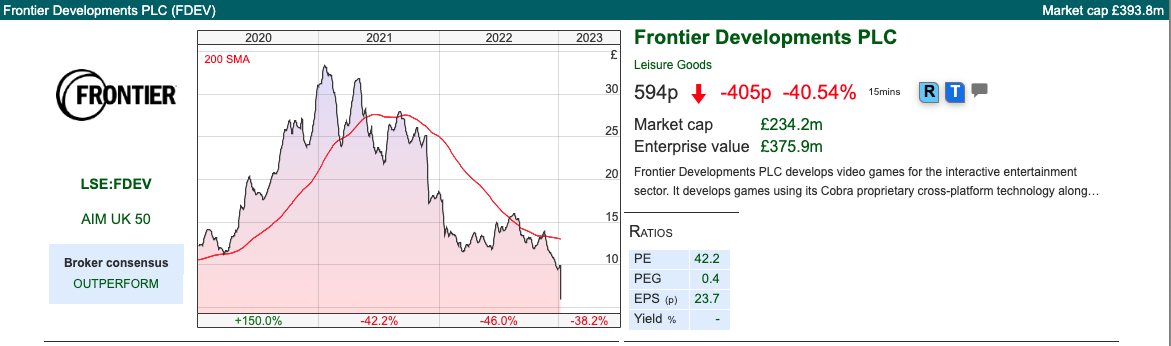

Aside from retailers, the holiday season is also an important quarter for computer game publishers. Unfortunately, FDEV has reported lower than expected sales for F1® Manager 2022, and more generally sales falling short across their whole portfolio of games over the festive season. They no longer expect to achieve FY May 2023F consensus of £135m revenue or £19m operating PBT. The shares fell -41% on the morning of the RNS.

There seems to be genuine uncertainty here over the final 5 months of their financial year, with management revising down revenue expectations to “not less than £100m” FY May 2023, but saying that they could still surpass the historic FY May 2022 revenue figure of £114m, particularly if one of their Foundry titles (designed by third parties, but published by Frontier) is a success.

That uncertainty highlights the importance of operational gearing (in both directions), FDEV fixed costs but uncertain revenue. Assuming £100m of revenues expect to see a lower profit margin of 2% (ie operating PBT of £2m). But assuming £114m, of revenue that mostly drops straight through to the bottom line, so a margin of 9% or c. £10m of operating PBT.

Note that this is a digital company where revenue can treble year-on-year, but also fall c. -20% when things don’t go so well. The forecasts in the chart below haven’t been updated for the new guidance yet, because it takes a couple of days for the data to filter through.

Outlook: Looking ahead to FY May 2024F, management expects revenue growth of around +5% above the eventual revenue outcome for FY23. They point to the release of Warhammer Age of Sigmar a real-time strategy game that they’ve developed internally (ie not a Foundry title) and F1® Manager 2023.

They explain that the games published from Foundry, their third-party publishing business, have enjoyed mixed financial success so far. They are going to re-assess their strategy, and are reviewing the return on investment achieved by Foundry.

Valuation: If operating PBT could be £2m, that sounds like statutory PBT could see a loss this year. Assuming £100m of sales FY May 2023F, growing to £105m the following year, that puts the shares on 2.2x sales. The share price is back to the 2017 levels, which could be a bargain if the company starts to produce hits again, but not if it doesn’t.

Cash RoCI has been as high as 46% when it listed, but the most recent 3-year average is 12.2%, and less than 1% in the FY May 2022.

Ownership: David Braben, the founder who recently stepped down as Chief Exec still owns 33% of the shares, and Tencent, the Chinese super-app that has bought other video games companies, owns 8.6%.

Opinion: I’ve followed this company for several years, and have always liked what I’ve seen, but felt the shares were too expensive. I last wrote about them here. They are now down -82% from their peak of £34 in early 2021. The company has had a couple of disappointing releases in the last 18 months, Jurassic World Evolution 2 and Elite Dangerous: Odyssey. We can now add F1® Manager 2022 to that list.

It’s hard to know if this is a trend forming, with the company losing touch with customers, games becoming harder to develop, more competition or simply customers less willing to buy games. On the same day, there was also a Devolver Digital profit warning, which is down -68% from 180p, when it listed on AIM at the end of 2021. But in the US, Electronic Arts (market cap $34bn) is only down -14% from its peak. Activision Blizzard (market cap $61bn) is down -25%, though is also subject to a take over from Microsoft. Before Christmas, I posted a link to the chat, to an interesting analysis of the background of the MSFT / ATVI deal.

Concurrent Technologies Trading Update FY Dec

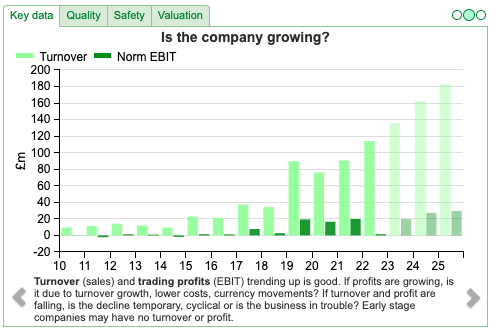

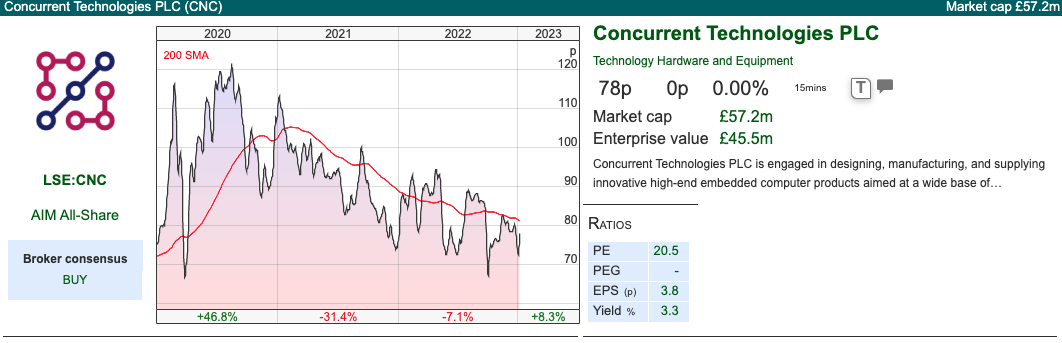

This maker of rugged computer processor boards announced they expect revenues c. 10% ahead of market expectations (£16m) and PBT “at least in line” (£0.1m). It sounds like there’s been a surge in activity in Q4, and management mention that they’ve put on a double shift, with record revenues in November and December. This has put some stress on working capital though, combined with supply chain problems meaning higher inventory. According to the RNS the low point for cash was c. £4m last year. I assume the Dec 2022 cash figure will be close to that £4m low point, versus £9.3m Jun 2022, down from £11.8m Dec 2021. Management expect strong cash generation in Q1 next year and they intend to run a double shift in Q1 this year.

History: CNC has been going since 1985 with products like Single Board Computers (SBC’s) based on Intel® CPU technology. More recently the product range has expanded to include other Plug in Cards in addition to SBC’s, as well as offering System level products. Their technology is used in satellites, missiles, telco and transport sectors. There’s an introductory film on their website of them testing a computer in what looks like a giant washing machine because the products will be deployed in harsh conditions. Below are some pictures of their products on their website, which may mean more to people who know about hardware.

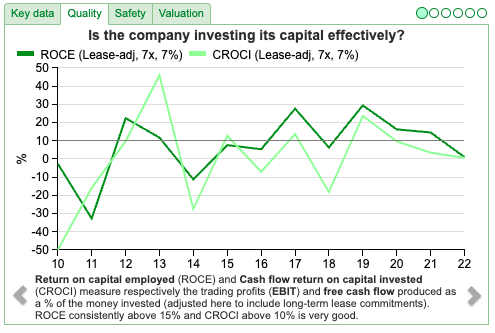

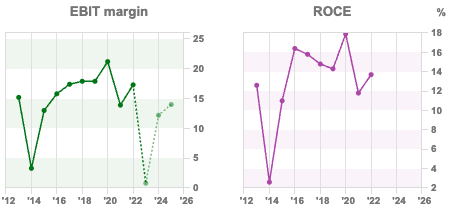

There’s no Admission Document because they’ve been listed for several decades, but Sharepad has financial data going back to 1992. It’s perhaps a bit disappointing that revenue has only reached £16m by FY Dec 2022 (or a peak of £21m in FY Dec 2020). The group has been profitable though and up until this year paid a dividend of 2.5p. The number of shares has stayed the same level since 1998, so there have been no dilutive equity raisings to fund growth. RoCE has ranged between a high of 17.9% (FY Dec 2019) and a low of 11.8% (FY Dec 2020), although the figure is likely to be close to zero for FY Dec 2022.

The balance sheet is solid, with shareholders’ equity of £23.7m Dec 2021, no long-term borrowing, and £7.7m of intangible assets. Those intangible assets are mainly Development costs (ie not acquisitions), which have been capitalised on to their balance sheet gross at £25.5m, of which £18m has then been amortised or impaired. That does suggest a considerable amount of ‘know how’ that they have accumulated in this specialist area over the years.

Ownership: Miton owns 16%, but the other large stakes are Nominee accounts, which I presume are connected parties or wealthy individuals.

Valuation: The shares are trading on 22x Dec 2023F. On a price/sales basis, they’re on 2.7x, which looks expensive in this market for a company close to break even unless the company can demonstrate a sustainable profitable growth.

Opinion: I think investors will overlook the poor year-end cash position given the recent growth. The key is to decide the growth prospects beyond 2023 though, with the long-term track record suggesting some caution. It could be that the strong Q4 and Q1 this year, is merely a catch-up from disappointment earlier in 2022, which has seen revenue decline -22% versus FY Dec 2021.

On the other hand, if management can take advantage of the current trends of reshoring and rising defence spending, then this looks like it could be a decent story about medium-term growth. Given their size is less than £100m market cap, they really ought to be presenting in front of private investors.

HeiQ profit warning

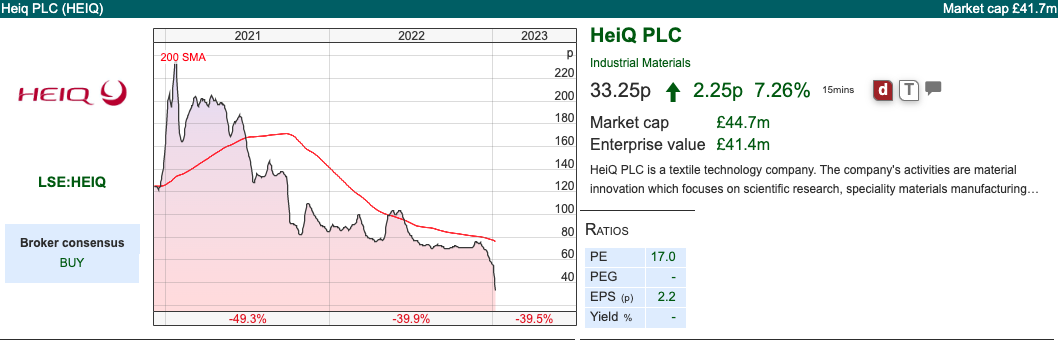

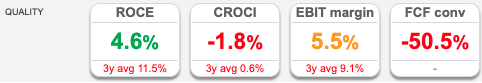

A brief comment on this Swiss headquartered materials and textiles company, that announced a profit warning and fell over -50% last week. Back in May 2021 I highlighted a number of concerns, i) lack of explanation why it doesn’t qualify for a Premium Listing ii) why is the company listed on the London Stock Exchange not Zurich? iii) they describe themselves as cash generative, but that was contradicted by the cashflow statement. The 3-year Cash RoCI is below 1% according to Sharepad.

This is the equivalent of companies claiming in their text they have a strong balance sheet, but which is not supported by the numbers they report. iv) back then the lack of an Annual Report in May 2021 was also a concern.

I concluded that none of these by themselves seem significant, but cumulatively they do suggest ‘caveat emptor’. Note too that Sharepad shows the Altman Z score, Piortroski score and Beneish M score are all indicating caution.

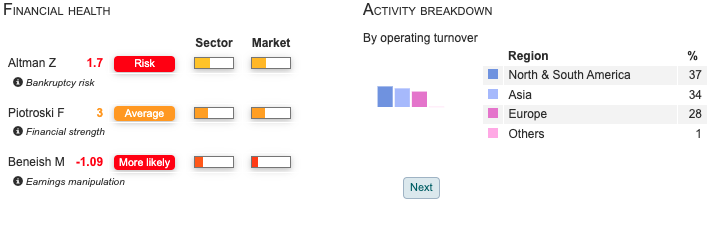

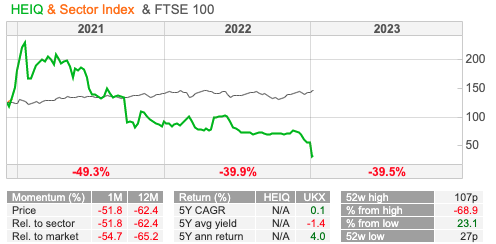

The shares are now 33p, versus a listing price of 112p in November 2020, and a peak of almost 240p in early 2021 following the IPO. So it’s down -86% from its peak. Last week’s profit warning was driven by deteriorating performance in the second half, particularly Q4. Management now expect revenues for the FY to be $54-$55m, that equates to 20% below market expectations of $69m (versus achieving $30m in H1). In 2021 there was a strong H2 weighting, though with the benefit of hindsight that may just have been distortions caused by the pandemic.

Institutions: Amati own 8.3%, Miton 4.9% and Fidelity 3.8%. I really don’t understand why professional fund managers backed the IPO or bought into this later.

Valuation: The shares are trading on 15x Dec 2023F falling to 5x 2024F PER. That’s very attractive if it can be achieved. As of June 2022, the company had £1.9m of net debt, versus shareholders’ equity of £71m (of which around half is intangible assets). That means management likely have some time to turn things around.

Opinion: Are the shares a buy now? The market cap is below £50m, so it has fallen below the radar of most institutional fund managers, even if the share price doubles, it’s unlikely to make much difference to a portfolio manager’s overall performance.

Hence, I think we need to see HeiQ management present to private investors, explain what’s gone wrong, answer the difficult questions and tell a good story about the future. But it will take time to regain credibility, so I will avoid and revisit in 6 months’ time. Following the sell-off in 2022 there are plenty of stocks that are down more than 50%, which I think are better opportunities. To my mind, I prefer FDEV if I was going to go fishing for bargains.

Conclusion

The author owns shares in Superdry.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 10/01/23 | NXT, CNC, HEIQ, FDEV | Weathering the stormy markets

Bruce looks at how the warm weather in Europe has been affecting financial markets. Companies covered NXT and CNC, plus profit warnings from HEIQ and FDEV.

The FTSE 100 has enjoyed a strong early January, up +3.4% to 7,705. OCDO was up +20%, while IAG (the old British Airways) and BT were up +17% and +15%. The S&P500 and Nasdaq100 indices were both up too, but only +1.2% and +0.8% respectively. The US 10Y government bond yield is declined to 3.6% and the UK 10Y is 3.5%, down roughly 100 basis points since early October. Falling bond yields imply risk aversion versus fears over inflation running too hot.

I’m a big fan of the systemic way that Sharepad labels bond yields. The first two letters are country (so UK, US for America, and DE for Germany). The next two letters: “TS” is for treasury (ie government bond). The fifth letter is either a “M” for month or “Y” for year. The final number is the maturity. This works for Germany (DETSY10), UK (UKTSY10) and the US (USTSY10) government bonds. Below is the yield on the German 10Y bond yield back to the start of 2013, so you can see it’s been quite a move over the last year from -40bp in Dec 2021 to just below 2.3% currently.

In the short term, the unseasonably warm and windy weather has been very helpful to households and inflation expectations, as energy prices have fallen back. Sharepad shows the Natural Gas contract (NG-MT) is down -60% since its peak in September last year. We’ve never really seen how markets in Euro-denominated government debt react to an environment of sharply rising inflation, so yields (and the weather) are worth keeping an eye on.

Traditionally retailers are also reliant on the weather, to help sell overcoats in the October-December months. Below I look at Next’s trading update, showing colder weather in December was very helpful to the retail sector. Plus Frontier Developments and HeiQ’s profit warnings. Then a positive update from Concurrent Technologies.

Next Trading Update FY Jan 2023

I wouldn’t normally cover this large-cap retailer, because it’s a simple business, with a straightforward communication style. However, NXT has around £5bn of annual sales, so is large enough to give a good idea of what’s happening in the whole retail sector (with the caveat, that it tends to report better trends than less well-managed retailers).

The 9 weeks to 30 Dec, full-priced sales were up +4.8%, versus previous guidance of -2.0% for that period and FY Jan 2023 PBT guidance was increased by £20m to £860m. However, despite a strong finish to the year, the outlook statement sounded a note of caution. For FY Jan 2024, they expect full-priced sales to be down -1.5% and PBT down -7.6% to £795m.

There’s a chart of weekly full-price sales performance, so investors could see how the warm weather was bad for sales in November, but from the first week of December (with the snowflake symbol, that I’ve circled in red) sales really picked up and saved the quarter.

Valuation: the shares are trading on 12.9x Jan 2024F and 12.0x Jan 2025F PER. That’s a significant premium to SDRY (which I own), which trades on just below 10x April 2024F and 7.4x April 2025F PER.

Opinion: This is a quality company with a great long-term track record. However, if you think that the sector is past the worst, then it’s better to buy into a company that is more geared into a recovery. This is a common rule of thumb, if you think that the banking sector will do well, there’s less upside buying JP Morgan, than more marginal players like NatWest, or even Metro Bank, whose profits (and share prices) are more sensitive to improving trends. Hence, I own Superdry, up +48% in the last month.

Frontier Developments Trading Update FY May 2023

Aside from retailers, the holiday season is also an important quarter for computer game publishers. Unfortunately, FDEV has reported lower than expected sales for F1® Manager 2022, and more generally sales falling short across their whole portfolio of games over the festive season. They no longer expect to achieve FY May 2023F consensus of £135m revenue or £19m operating PBT. The shares fell -41% on the morning of the RNS.

There seems to be genuine uncertainty here over the final 5 months of their financial year, with management revising down revenue expectations to “not less than £100m” FY May 2023, but saying that they could still surpass the historic FY May 2022 revenue figure of £114m, particularly if one of their Foundry titles (designed by third parties, but published by Frontier) is a success.

That uncertainty highlights the importance of operational gearing (in both directions), FDEV fixed costs but uncertain revenue. Assuming £100m of revenues expect to see a lower profit margin of 2% (ie operating PBT of £2m). But assuming £114m, of revenue that mostly drops straight through to the bottom line, so a margin of 9% or c. £10m of operating PBT.

Note that this is a digital company where revenue can treble year-on-year, but also fall c. -20% when things don’t go so well. The forecasts in the chart below haven’t been updated for the new guidance yet, because it takes a couple of days for the data to filter through.

Outlook: Looking ahead to FY May 2024F, management expects revenue growth of around +5% above the eventual revenue outcome for FY23. They point to the release of Warhammer Age of Sigmar a real-time strategy game that they’ve developed internally (ie not a Foundry title) and F1® Manager 2023.

They explain that the games published from Foundry, their third-party publishing business, have enjoyed mixed financial success so far. They are going to re-assess their strategy, and are reviewing the return on investment achieved by Foundry.

Valuation: If operating PBT could be £2m, that sounds like statutory PBT could see a loss this year. Assuming £100m of sales FY May 2023F, growing to £105m the following year, that puts the shares on 2.2x sales. The share price is back to the 2017 levels, which could be a bargain if the company starts to produce hits again, but not if it doesn’t.

Cash RoCI has been as high as 46% when it listed, but the most recent 3-year average is 12.2%, and less than 1% in the FY May 2022.

Ownership: David Braben, the founder who recently stepped down as Chief Exec still owns 33% of the shares, and Tencent, the Chinese super-app that has bought other video games companies, owns 8.6%.

Opinion: I’ve followed this company for several years, and have always liked what I’ve seen, but felt the shares were too expensive. I last wrote about them here. They are now down -82% from their peak of £34 in early 2021. The company has had a couple of disappointing releases in the last 18 months, Jurassic World Evolution 2 and Elite Dangerous: Odyssey. We can now add F1® Manager 2022 to that list.

It’s hard to know if this is a trend forming, with the company losing touch with customers, games becoming harder to develop, more competition or simply customers less willing to buy games. On the same day, there was also a Devolver Digital profit warning, which is down -68% from 180p, when it listed on AIM at the end of 2021. But in the US, Electronic Arts (market cap $34bn) is only down -14% from its peak. Activision Blizzard (market cap $61bn) is down -25%, though is also subject to a take over from Microsoft. Before Christmas, I posted a link to the chat, to an interesting analysis of the background of the MSFT / ATVI deal.

Concurrent Technologies Trading Update FY Dec

This maker of rugged computer processor boards announced they expect revenues c. 10% ahead of market expectations (£16m) and PBT “at least in line” (£0.1m). It sounds like there’s been a surge in activity in Q4, and management mention that they’ve put on a double shift, with record revenues in November and December. This has put some stress on working capital though, combined with supply chain problems meaning higher inventory. According to the RNS the low point for cash was c. £4m last year. I assume the Dec 2022 cash figure will be close to that £4m low point, versus £9.3m Jun 2022, down from £11.8m Dec 2021. Management expect strong cash generation in Q1 next year and they intend to run a double shift in Q1 this year.

History: CNC has been going since 1985 with products like Single Board Computers (SBC’s) based on Intel® CPU technology. More recently the product range has expanded to include other Plug in Cards in addition to SBC’s, as well as offering System level products. Their technology is used in satellites, missiles, telco and transport sectors. There’s an introductory film on their website of them testing a computer in what looks like a giant washing machine because the products will be deployed in harsh conditions. Below are some pictures of their products on their website, which may mean more to people who know about hardware.

There’s no Admission Document because they’ve been listed for several decades, but Sharepad has financial data going back to 1992. It’s perhaps a bit disappointing that revenue has only reached £16m by FY Dec 2022 (or a peak of £21m in FY Dec 2020). The group has been profitable though and up until this year paid a dividend of 2.5p. The number of shares has stayed the same level since 1998, so there have been no dilutive equity raisings to fund growth. RoCE has ranged between a high of 17.9% (FY Dec 2019) and a low of 11.8% (FY Dec 2020), although the figure is likely to be close to zero for FY Dec 2022.

The balance sheet is solid, with shareholders’ equity of £23.7m Dec 2021, no long-term borrowing, and £7.7m of intangible assets. Those intangible assets are mainly Development costs (ie not acquisitions), which have been capitalised on to their balance sheet gross at £25.5m, of which £18m has then been amortised or impaired. That does suggest a considerable amount of ‘know how’ that they have accumulated in this specialist area over the years.

Ownership: Miton owns 16%, but the other large stakes are Nominee accounts, which I presume are connected parties or wealthy individuals.

Valuation: The shares are trading on 22x Dec 2023F. On a price/sales basis, they’re on 2.7x, which looks expensive in this market for a company close to break even unless the company can demonstrate a sustainable profitable growth.

Opinion: I think investors will overlook the poor year-end cash position given the recent growth. The key is to decide the growth prospects beyond 2023 though, with the long-term track record suggesting some caution. It could be that the strong Q4 and Q1 this year, is merely a catch-up from disappointment earlier in 2022, which has seen revenue decline -22% versus FY Dec 2021.

On the other hand, if management can take advantage of the current trends of reshoring and rising defence spending, then this looks like it could be a decent story about medium-term growth. Given their size is less than £100m market cap, they really ought to be presenting in front of private investors.

HeiQ profit warning

A brief comment on this Swiss headquartered materials and textiles company, that announced a profit warning and fell over -50% last week. Back in May 2021 I highlighted a number of concerns, i) lack of explanation why it doesn’t qualify for a Premium Listing ii) why is the company listed on the London Stock Exchange not Zurich? iii) they describe themselves as cash generative, but that was contradicted by the cashflow statement. The 3-year Cash RoCI is below 1% according to Sharepad.

This is the equivalent of companies claiming in their text they have a strong balance sheet, but which is not supported by the numbers they report. iv) back then the lack of an Annual Report in May 2021 was also a concern.

I concluded that none of these by themselves seem significant, but cumulatively they do suggest ‘caveat emptor’. Note too that Sharepad shows the Altman Z score, Piortroski score and Beneish M score are all indicating caution.

The shares are now 33p, versus a listing price of 112p in November 2020, and a peak of almost 240p in early 2021 following the IPO. So it’s down -86% from its peak. Last week’s profit warning was driven by deteriorating performance in the second half, particularly Q4. Management now expect revenues for the FY to be $54-$55m, that equates to 20% below market expectations of $69m (versus achieving $30m in H1). In 2021 there was a strong H2 weighting, though with the benefit of hindsight that may just have been distortions caused by the pandemic.

Institutions: Amati own 8.3%, Miton 4.9% and Fidelity 3.8%. I really don’t understand why professional fund managers backed the IPO or bought into this later.

Valuation: The shares are trading on 15x Dec 2023F falling to 5x 2024F PER. That’s very attractive if it can be achieved. As of June 2022, the company had £1.9m of net debt, versus shareholders’ equity of £71m (of which around half is intangible assets). That means management likely have some time to turn things around.

Opinion: Are the shares a buy now? The market cap is below £50m, so it has fallen below the radar of most institutional fund managers, even if the share price doubles, it’s unlikely to make much difference to a portfolio manager’s overall performance.

Hence, I think we need to see HeiQ management present to private investors, explain what’s gone wrong, answer the difficult questions and tell a good story about the future. But it will take time to regain credibility, so I will avoid and revisit in 6 months’ time. Following the sell-off in 2022 there are plenty of stocks that are down more than 50%, which I think are better opportunities. To my mind, I prefer FDEV if I was going to go fishing for bargains.

Conclusion

The author owns shares in Superdry.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.