Cross-border liquidity could be driving the market rally, so it’s worth keeping an eye on Central Banks in China and Japan. Companies covered KAPE, HL. and BGEO.

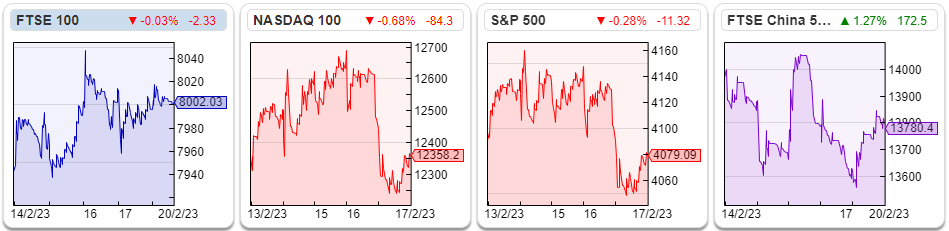

The FTSE traded above 8,000 last week, up +0.7%. The Nasdaq 100 was up +0.4% while the S&P 500 was down -0.3%. The US 10Y bond yield has risen back to 3.82%, having fallen below 3.5% in January. The UK 10Y bond yield remains just below 3.5%. Brent crude composite fell -4% in the last week, to $83 per barrel.

I have a hypothesis that while the financial media focuses on what the US Central Bank (the Fed) is saying and doing, driver of global stockmarkets can often be liquidity from Asia. That means both Japan where there’s a new Central Bank governor and China. I came across this quote from Mike Howell of CrossBorder Capital, who points out that the People’s Bank Of China (PBOC, the Chinese Central Bank) have flooded international markets with liquidity:

Late last year, we predicted that the end of the Covid lockdowns would probably coincide with an easier monetary stance by the PBOC. However, even our optimism has been overtaken by the whopping liquidity injections ploughed into Chinese money markets since late November 2022 through December; the PBOC injected RMB 1.56 trillion ($230bn), adding another RMB 1.45 trillion ($210bn) in January, and so far through February, the rolling 28-day total is a sky-high RMB 1.93 trillion ($280bn). Admittedly, this breakneck pace of impetus will fall off, but in two months the Chinese have added 3-3 ½ times the liquidity they put in, in total, during the prior two years!

There’s also a podcast interview with Mike Howell, by Russell Napier of the Library of Mistakes in Edinburgh. I’ve no idea how long China will keep doing this, but I think we should be paying attention to the PBOC’s actions. I’ve just started following this Finnish academic on Twitter, who is also monitoring the liquidity from China.

This week I look at Tedi Sagi’s bid for Kape. I also look at two very different, but highly profitable financial firms: Hargreaves Lansdown H1 results and Bank of Georgia FY results.

Unikmind bid for Kape

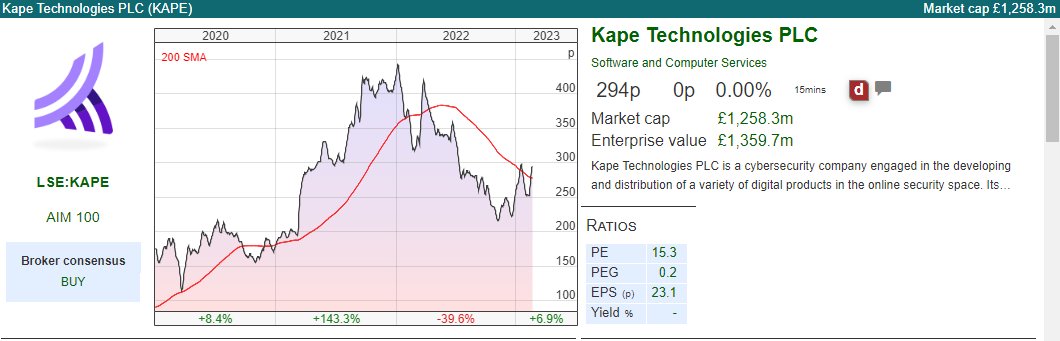

Last week Tedi Sagi’s vehicle Unikmind, which already owns 55% of Kape shares, announced a cash offer of 285p per share for Kape. The RNS said that even if the offer fails, Unikmind will seek to pass a resolution to delist Kape from AIM.

The offer does not look very generous to me, merely 12% above the average price for the previous 3 months to 10th Feb. The Kape board has not recommended the offer, but Unikmind hopes that they will do so following discussions with minority shareholders. If the offer is successful, Unikmind intends to increase the leverage of the company to between 1.0x and 2.6 adj EBITDA. Unikmind is also seeking to de-list the shares, regardless of whether the bid is accepted. That means minority shareholders could end up in an unlisted, more indebted company, without the protection of AIM’s listing requirements.

Aside from Unikmind, the only institutional shareholder is Slater Inv Ltd, with 4.1% stake.

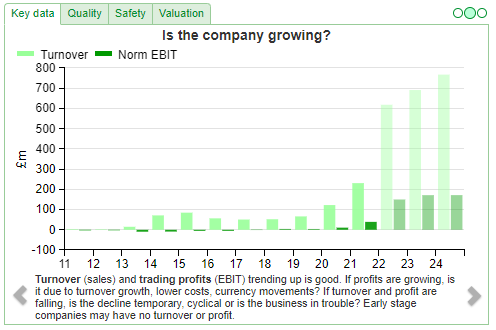

Valuation: The offer values Kape at 1.3x 2023F revenue, or just 8x PER 2023F. It’s unusual to have a stock with gross margins in the 90s, beating expectations (see 17th Jan trading update) with revenue forecast to increase c. 10x FY Dec 2022F versus FY 2019, trading on a low single-digit PER.

One reason for that low valuation could be that the company keeps issuing paper to fund growth: the share count has trebled from 144m in 2018 to 428m today. Intangible assets were $1.4bn at the half year, since then in September 2022 the company raised $222m (£190m) at 265p, which the RNS said would enhance Kape’s ability to accelerate growth through acquisitions. A second reason for the low valuation could be Tedi Sagi’s controversial past. A third reason for the low valuation could be that there have been questions in the past around the cashflow statement, as Maynard pointed out here with some marketing costs capitalised onto the balance sheet, subsequently expensed through the p&l.

Opinion: It’s hard to see how this is a good deal for minority shareholders or how de-listing is in anyone’s interest apart from Unikmind. Here’s a link to a Quoted Companies Alliance (QCA) blog post, which highlights some of the issues around companies de-listing.

If I owned the shares, I would be frustrated that Kape has used public markets to fund acquisitions, then just as the businesses is on a roll and raising guidance the majority shareholder wants to take it private and a single-digit PER multiple. You may disagree with that analysis, but either way, I would encourage shareholders to vote on the deal, rather than just allow the majority shareholder to dictate the outcome.

One ‘readacross’ from this Kape deal is for BOTB, which Sagi’s Globe Invest Ltd (GIL) owns 29.9%. The Israeli billionaire’s influence may not be positive for other minority shareholders. I wrote in January that BOTB and GIL intend to sign a Licensing and Distribution Agreement and a Marketing Agreement, where GIL will provide BOTB with the operational expertise to execute a global strategy. That sounds fine in theory, except that it has been under discussion since September and nothing has been signed. It strikes me that Teddy Sagi is someone who drives a hard bargain, so other minority shareholders need a strong board to make sure that he doesn’t extract too much value, given that GIL is now a BOTB-related party.

Hargreaves Lansdown H1 to December

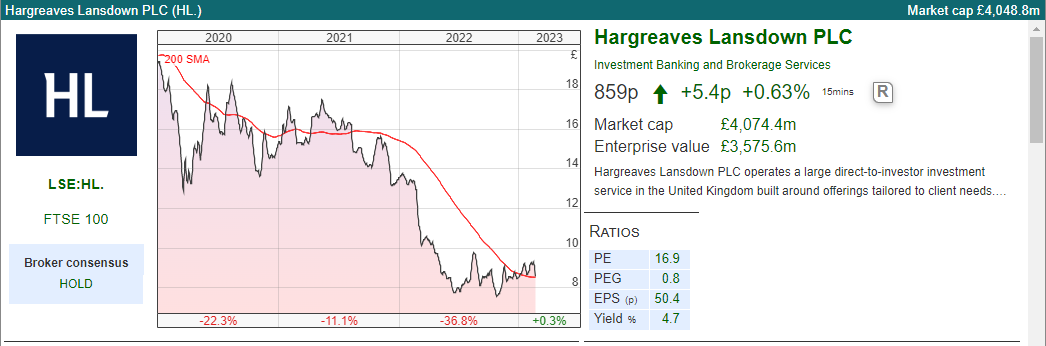

I would imagine that this investment platform will be familiar to most readers. They reported H1 results to December, with revenue +20% to £350m and PBT +31% to £197m. Ironically the sell-off in markets last year seems to have benefited the group financials because customers have been less confident putting money to work in funds and equities, instead saving in cash. That in turn has been good for HL., which has benefited from rising rates on customers’ cash balances.

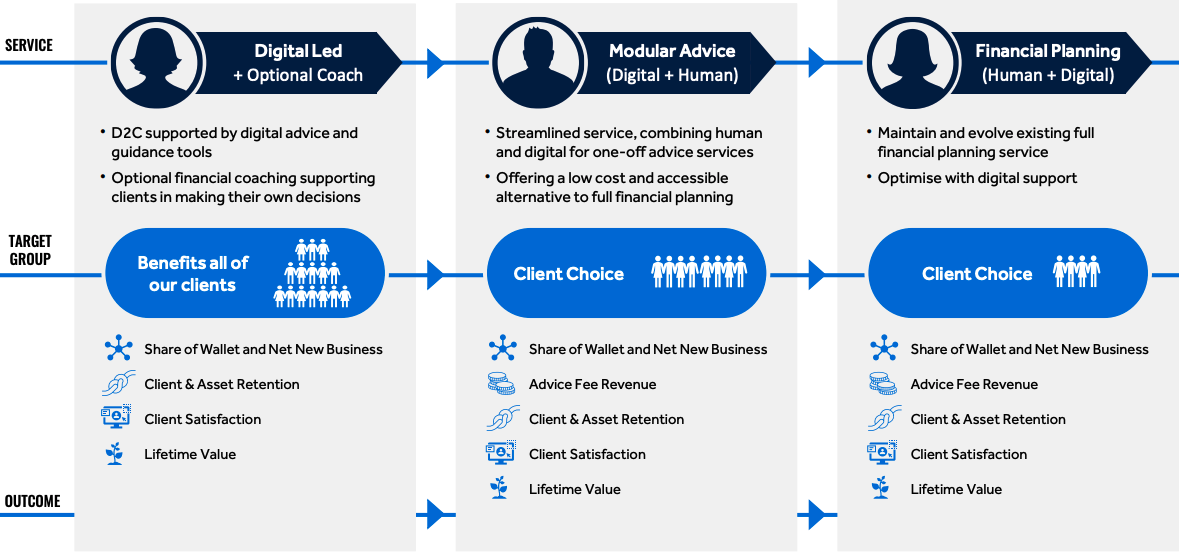

There’s been a public disagreement with co-founder Peter Hargreaves criticising Chris Hill, the current CEO for allowing costs to rise and implementing a new strategy offering ‘hybrid’ advice: a combination of automated guidance with personalised help from human advisors. Perhaps related to this disagreement the Chief Exec informed the board in October that he wished to step down. Dan Olley, who joined HL. in 2019 and has a background in data analytics from Dunnhumby (Tesco’s club card analysis business) will take over later in the year but is expected to continue with the strategy.

Ownership: The co-founder’s Peter Hargreaves (32% stake) and Stephen Lansdown (20% stake) still own the majority of the shares. Other large institutions on the shareholder register are Lindsell Train 12%, BlackRock 7.4%, Baillie Gifford 4.95%.

Outlook: Management expect an FY 2023F revenue margin of 50-55 basis points, which reflects the benefit of higher cash balances and favourable interest rates. However underlying cost growth is expected to be towards the top end of the range (9.5%-11.5%).

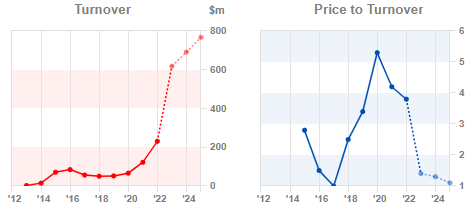

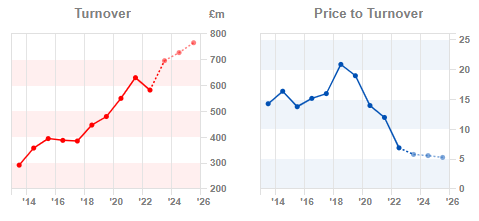

Valuation: The shares are trading on 14x PER both Jun 2023F and Jun 2024F. There’s been persistent de-rating over the last few years from above 20x revenue before the pandemic down to 5x revenue (see chart below), so it’s worth thinking about whether the future prospects are as rosy as the past track record.

Opinion: To me, it looks like competition is increasing and regulation keeps moving the goalposts. As a rule of thumb, when a founder steps down but maintains a large shareholding then criticises the Chief Exec, I tend to side with the founder. The situation has some parallels with Superdry, although given that Peter Hargreaves is in his late 70’s, I think it unlikely he will make a full return to the CEO role as Julian Dunkerton has done.

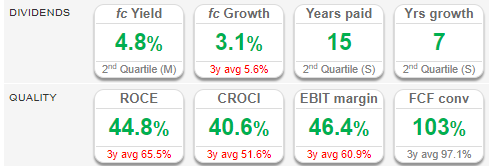

Investment platforms ought to enjoy operational gearing, with relatively fixed costs but growing revenue. That’s the theory, but it’s not what we’re seeing with HL.’s operating cost growing from £90m H1 Dec 2019 to £160m just reported H1 Dec 2022. The very high levels of Return on Capital Employed (3-year average RoCE 65.5%) have been falling, albeit still impressively above 40% ROCE and CROCI.

Secondly, I think there’s been some long-term brand damage from Hargreaves Lansdown recommending Neil Woodford’s fund in their ‘best buy’ list. More than 130,000 HL. clients were invested in Woodford’s fund in June 2019 and note 2.6 mentions that they have received a ‘letter before action’ from a law firm. Customers would have been better off in a low-cost index tracker or perhaps investing directly in shares they selected themselves, using Sharepad to filter out anything too speculative. HL. has also experienced tech problems when volumes are high, not being able to trade is frustrating.

The other threat is from competition such as Interactive Investor which bought TD Direct Investing in 2017 and Alliance Trust in 2018, is now a credible lower cost alternative to HL. I moved my SIPP from HL. to Alliance Trust a few years ago. I will follow developments but don’t intend to take a position this year because I think there’s a chance that the new Chief Exec talks down expectations when he takes over.

Bank of Georgia FY to December

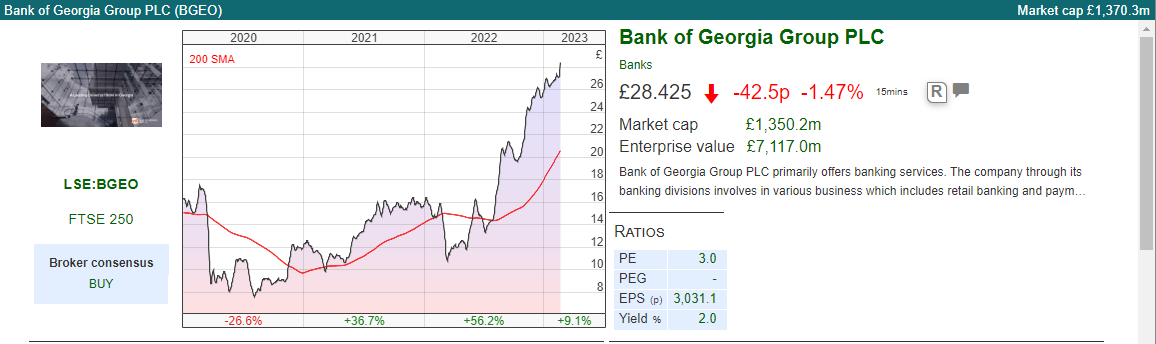

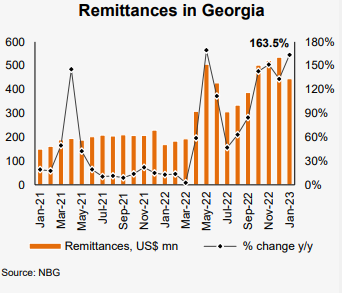

This Tbilisi headquartered bank which is listed in London and sits in the FTSE 350 reported strong FY results despite the war in Ukraine. The shares are actually up +71% since the start of last year, as the Georgian economy is being boosted by inbound migration from its Northern neighbour. According to official figures, there are over 100,000 Russians that have recently moved to Georgia, which has a total population of around 4m. I’m not sure if these anti-war digital nomadski are taking out bank loans, but the data shows that they are certainly transferring cross-border remittances and spending money in shops, renting accommodation and generally providing a boost to the economy.

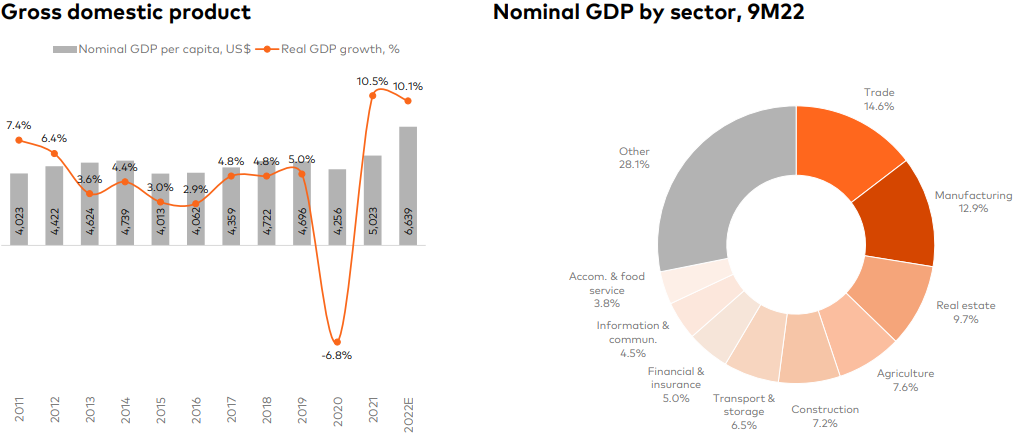

Macro Economy: Georgian FY 2022F Real GDP grew +10.1% according to GeoStat, though forecast to slow to +5% growth in two years’ time. CPI Inflation dropped below 10% in December, while Central Bank interest rates have been 11.0% since March 2022. Food price inflation has been a contributor to higher inflation, but this is not necessarily bad news because agriculture is still a reasonably large proportion of the economy (7.6% of nominal GDP but almost 20% of employment) and given the rich volcanic soil Georgian farmers are less reliant on imported fertilisers like potash. The Georgian government also reported tax revenues rising +37% last year, and public debt fell below 40% of GDP (versus above 90% for the same figure in the UK). That supported the Lari currency, up +12.5% against the dollar and +22% against the sterling in 2022.

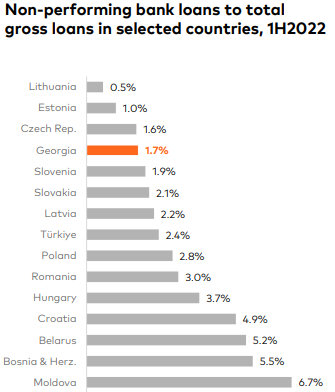

The bank’s FY results themselves were impressive with total income up +47% to £2bn GEL (c. £630m). Costs have grown more slowly, with the cost-income ratio falling from 37% in FY 2021 to 32% FY 2022. Bad debt impairments are up almost 2.5x to 119m GEL, which is a p&l charge of 80 basis points. The bank’s Non-Performing Loans (NPLs) as a percentage of the gross loan book were 2.7%, and for the Georgian economy as a whole the ratio is 1.7% which is in the lower quarter of international comparisons, as this slide which BGEO source from IMF data shows:

PBT grew +55% to 1.2bn GEL (£380m) FY 2022, and the bank reported an eye-catching 32% RoE (versus a target of 20% RoE). Note that high Return on Equity has not been achieved by leveraging up the balance sheet, core equity tier 1 ratio was 14.7% Dec 2022, ahead of most UK banks’ core equity tier 1 ratios (eg NatWest 14.2%, Barclays 13.9%). There’s also a buyback of 148m GEL (just under £50m) planned for 2023.

Ownership: There’s a 20.6% cross-shareholding with Georgia Capital (CGEO, all the businesses that the bank acquired in the 2008-9 financial crisis, which the Central Bank then politely suggested that they spin off into a separate entity). Other than that some solid UK and US institutions are on the shareholder register: M&G 4.1%, Dimensional 4.1%, BlackRock 3.8%, Vanguard 3.8%, Fidelity 3.6%.

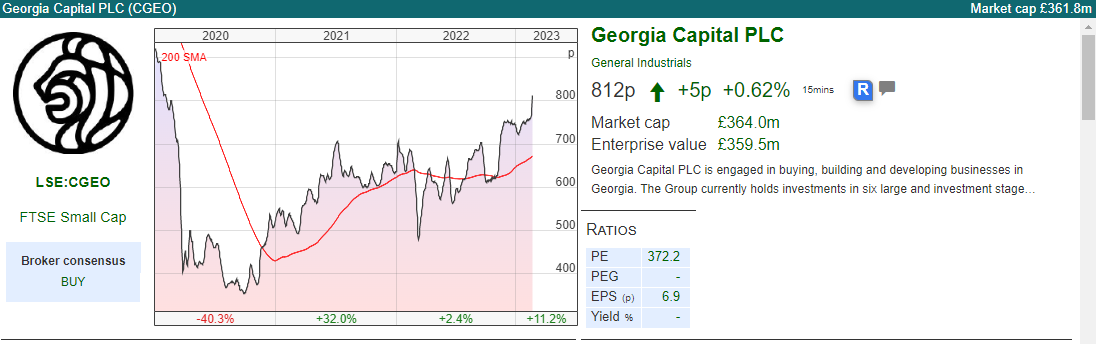

Georgia Capital: CGEO has also reported positive FY Dec results, with total portfolio revenue +7.6% to 1.9bn GEL (£600m). Adj EBITDA and net operating cashflow did fall -14%, as they sold a hospital and temporarily closed a second one. Unusually CGEO management have put forward a proposal to shareholders to migrate from a FTSE premium listing to a standard listing. They suggest that this will enable them to buyback more than 15% of their share capital and also facilitate further disposals of businesses. Last year they sold 80% of their water utility for $180m, which was 6% of the total portfolio value.

CGEO Valuation: NAV per share is 2012p, so the conglomerate is trading on a 60% discount to NAV. As of Q4 they had $152m (£126m) of cash and liquid funds, versus a total portfolio value of 3.2bn GEL (£1bn) market cap of £364m.

BGEO Valuation: BGEO shares are trading on below 5x Dec 2023F PER according to Galt & Taggart’s the bank’s own broker, and less than 3x 2022A just reported. That seems exceptional value, for comparison, Hungarian Bank OTP currently trades on 9x Dec 2023F and Polish Bank PKO trades on 6x the same year, according to G&T.

NB there seems to be a problem with Sharepad’s figures in the ‘ratios’ tab…I suspect this is a currency conversion issue with Lari, so I have asked Support to query this with the data provider. The forecast dividend yield is 6.8%.

Opinion: I’m a long-term bull of both companies having listed BGEO in London over a decade ago. I think that the shares ought to re-rate higher given the track record of growth and credit quality. I can see that Georgia is unfamiliar and proximity to Russia is a concern, but investors are being more than compensated for the risks, in my view.

Khvicha Kvaratskhelia was bought by Napoli FC for a reported fee of Eu12m, from Dinamo Batumi. The young Georgian winger is currently making Italian Serie A and Champions League defenders look very ordinary. In the same way, Georgian financials make UK banks look rather like Dele Alli.

Conclusion

The author owns shares in Bank of Georgia and Georgia Capital

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Weekly Market Commentary | 21/02/23 | KAPE, HL., BGEO | Cross border liquidity

Cross-border liquidity could be driving the market rally, so it’s worth keeping an eye on Central Banks in China and Japan. Companies covered KAPE, HL. and BGEO.

The FTSE traded above 8,000 last week, up +0.7%. The Nasdaq 100 was up +0.4% while the S&P 500 was down -0.3%. The US 10Y bond yield has risen back to 3.82%, having fallen below 3.5% in January. The UK 10Y bond yield remains just below 3.5%. Brent crude composite fell -4% in the last week, to $83 per barrel.

I have a hypothesis that while the financial media focuses on what the US Central Bank (the Fed) is saying and doing, driver of global stockmarkets can often be liquidity from Asia. That means both Japan where there’s a new Central Bank governor and China. I came across this quote from Mike Howell of CrossBorder Capital, who points out that the People’s Bank Of China (PBOC, the Chinese Central Bank) have flooded international markets with liquidity:

Late last year, we predicted that the end of the Covid lockdowns would probably coincide with an easier monetary stance by the PBOC. However, even our optimism has been overtaken by the whopping liquidity injections ploughed into Chinese money markets since late November 2022 through December; the PBOC injected RMB 1.56 trillion ($230bn), adding another RMB 1.45 trillion ($210bn) in January, and so far through February, the rolling 28-day total is a sky-high RMB 1.93 trillion ($280bn). Admittedly, this breakneck pace of impetus will fall off, but in two months the Chinese have added 3-3 ½ times the liquidity they put in, in total, during the prior two years!

There’s also a podcast interview with Mike Howell, by Russell Napier of the Library of Mistakes in Edinburgh. I’ve no idea how long China will keep doing this, but I think we should be paying attention to the PBOC’s actions. I’ve just started following this Finnish academic on Twitter, who is also monitoring the liquidity from China.

This week I look at Tedi Sagi’s bid for Kape. I also look at two very different, but highly profitable financial firms: Hargreaves Lansdown H1 results and Bank of Georgia FY results.

Unikmind bid for Kape

Last week Tedi Sagi’s vehicle Unikmind, which already owns 55% of Kape shares, announced a cash offer of 285p per share for Kape. The RNS said that even if the offer fails, Unikmind will seek to pass a resolution to delist Kape from AIM.

The offer does not look very generous to me, merely 12% above the average price for the previous 3 months to 10th Feb. The Kape board has not recommended the offer, but Unikmind hopes that they will do so following discussions with minority shareholders. If the offer is successful, Unikmind intends to increase the leverage of the company to between 1.0x and 2.6 adj EBITDA. Unikmind is also seeking to de-list the shares, regardless of whether the bid is accepted. That means minority shareholders could end up in an unlisted, more indebted company, without the protection of AIM’s listing requirements.

Aside from Unikmind, the only institutional shareholder is Slater Inv Ltd, with 4.1% stake.

Valuation: The offer values Kape at 1.3x 2023F revenue, or just 8x PER 2023F. It’s unusual to have a stock with gross margins in the 90s, beating expectations (see 17th Jan trading update) with revenue forecast to increase c. 10x FY Dec 2022F versus FY 2019, trading on a low single-digit PER.

One reason for that low valuation could be that the company keeps issuing paper to fund growth: the share count has trebled from 144m in 2018 to 428m today. Intangible assets were $1.4bn at the half year, since then in September 2022 the company raised $222m (£190m) at 265p, which the RNS said would enhance Kape’s ability to accelerate growth through acquisitions. A second reason for the low valuation could be Tedi Sagi’s controversial past. A third reason for the low valuation could be that there have been questions in the past around the cashflow statement, as Maynard pointed out here with some marketing costs capitalised onto the balance sheet, subsequently expensed through the p&l.

Opinion: It’s hard to see how this is a good deal for minority shareholders or how de-listing is in anyone’s interest apart from Unikmind. Here’s a link to a Quoted Companies Alliance (QCA) blog post, which highlights some of the issues around companies de-listing.

If I owned the shares, I would be frustrated that Kape has used public markets to fund acquisitions, then just as the businesses is on a roll and raising guidance the majority shareholder wants to take it private and a single-digit PER multiple. You may disagree with that analysis, but either way, I would encourage shareholders to vote on the deal, rather than just allow the majority shareholder to dictate the outcome.

One ‘readacross’ from this Kape deal is for BOTB, which Sagi’s Globe Invest Ltd (GIL) owns 29.9%. The Israeli billionaire’s influence may not be positive for other minority shareholders. I wrote in January that BOTB and GIL intend to sign a Licensing and Distribution Agreement and a Marketing Agreement, where GIL will provide BOTB with the operational expertise to execute a global strategy. That sounds fine in theory, except that it has been under discussion since September and nothing has been signed. It strikes me that Teddy Sagi is someone who drives a hard bargain, so other minority shareholders need a strong board to make sure that he doesn’t extract too much value, given that GIL is now a BOTB-related party.

Hargreaves Lansdown H1 to December

I would imagine that this investment platform will be familiar to most readers. They reported H1 results to December, with revenue +20% to £350m and PBT +31% to £197m. Ironically the sell-off in markets last year seems to have benefited the group financials because customers have been less confident putting money to work in funds and equities, instead saving in cash. That in turn has been good for HL., which has benefited from rising rates on customers’ cash balances.

There’s been a public disagreement with co-founder Peter Hargreaves criticising Chris Hill, the current CEO for allowing costs to rise and implementing a new strategy offering ‘hybrid’ advice: a combination of automated guidance with personalised help from human advisors. Perhaps related to this disagreement the Chief Exec informed the board in October that he wished to step down. Dan Olley, who joined HL. in 2019 and has a background in data analytics from Dunnhumby (Tesco’s club card analysis business) will take over later in the year but is expected to continue with the strategy.

Ownership: The co-founder’s Peter Hargreaves (32% stake) and Stephen Lansdown (20% stake) still own the majority of the shares. Other large institutions on the shareholder register are Lindsell Train 12%, BlackRock 7.4%, Baillie Gifford 4.95%.

Outlook: Management expect an FY 2023F revenue margin of 50-55 basis points, which reflects the benefit of higher cash balances and favourable interest rates. However underlying cost growth is expected to be towards the top end of the range (9.5%-11.5%).

Valuation: The shares are trading on 14x PER both Jun 2023F and Jun 2024F. There’s been persistent de-rating over the last few years from above 20x revenue before the pandemic down to 5x revenue (see chart below), so it’s worth thinking about whether the future prospects are as rosy as the past track record.

Opinion: To me, it looks like competition is increasing and regulation keeps moving the goalposts. As a rule of thumb, when a founder steps down but maintains a large shareholding then criticises the Chief Exec, I tend to side with the founder. The situation has some parallels with Superdry, although given that Peter Hargreaves is in his late 70’s, I think it unlikely he will make a full return to the CEO role as Julian Dunkerton has done.

Investment platforms ought to enjoy operational gearing, with relatively fixed costs but growing revenue. That’s the theory, but it’s not what we’re seeing with HL.’s operating cost growing from £90m H1 Dec 2019 to £160m just reported H1 Dec 2022. The very high levels of Return on Capital Employed (3-year average RoCE 65.5%) have been falling, albeit still impressively above 40% ROCE and CROCI.

Secondly, I think there’s been some long-term brand damage from Hargreaves Lansdown recommending Neil Woodford’s fund in their ‘best buy’ list. More than 130,000 HL. clients were invested in Woodford’s fund in June 2019 and note 2.6 mentions that they have received a ‘letter before action’ from a law firm. Customers would have been better off in a low-cost index tracker or perhaps investing directly in shares they selected themselves, using Sharepad to filter out anything too speculative. HL. has also experienced tech problems when volumes are high, not being able to trade is frustrating.

The other threat is from competition such as Interactive Investor which bought TD Direct Investing in 2017 and Alliance Trust in 2018, is now a credible lower cost alternative to HL. I moved my SIPP from HL. to Alliance Trust a few years ago. I will follow developments but don’t intend to take a position this year because I think there’s a chance that the new Chief Exec talks down expectations when he takes over.

Bank of Georgia FY to December

This Tbilisi headquartered bank which is listed in London and sits in the FTSE 350 reported strong FY results despite the war in Ukraine. The shares are actually up +71% since the start of last year, as the Georgian economy is being boosted by inbound migration from its Northern neighbour. According to official figures, there are over 100,000 Russians that have recently moved to Georgia, which has a total population of around 4m. I’m not sure if these anti-war digital nomadski are taking out bank loans, but the data shows that they are certainly transferring cross-border remittances and spending money in shops, renting accommodation and generally providing a boost to the economy.

Macro Economy: Georgian FY 2022F Real GDP grew +10.1% according to GeoStat, though forecast to slow to +5% growth in two years’ time. CPI Inflation dropped below 10% in December, while Central Bank interest rates have been 11.0% since March 2022. Food price inflation has been a contributor to higher inflation, but this is not necessarily bad news because agriculture is still a reasonably large proportion of the economy (7.6% of nominal GDP but almost 20% of employment) and given the rich volcanic soil Georgian farmers are less reliant on imported fertilisers like potash. The Georgian government also reported tax revenues rising +37% last year, and public debt fell below 40% of GDP (versus above 90% for the same figure in the UK). That supported the Lari currency, up +12.5% against the dollar and +22% against the sterling in 2022.

The bank’s FY results themselves were impressive with total income up +47% to £2bn GEL (c. £630m). Costs have grown more slowly, with the cost-income ratio falling from 37% in FY 2021 to 32% FY 2022. Bad debt impairments are up almost 2.5x to 119m GEL, which is a p&l charge of 80 basis points. The bank’s Non-Performing Loans (NPLs) as a percentage of the gross loan book were 2.7%, and for the Georgian economy as a whole the ratio is 1.7% which is in the lower quarter of international comparisons, as this slide which BGEO source from IMF data shows:

PBT grew +55% to 1.2bn GEL (£380m) FY 2022, and the bank reported an eye-catching 32% RoE (versus a target of 20% RoE). Note that high Return on Equity has not been achieved by leveraging up the balance sheet, core equity tier 1 ratio was 14.7% Dec 2022, ahead of most UK banks’ core equity tier 1 ratios (eg NatWest 14.2%, Barclays 13.9%). There’s also a buyback of 148m GEL (just under £50m) planned for 2023.

Ownership: There’s a 20.6% cross-shareholding with Georgia Capital (CGEO, all the businesses that the bank acquired in the 2008-9 financial crisis, which the Central Bank then politely suggested that they spin off into a separate entity). Other than that some solid UK and US institutions are on the shareholder register: M&G 4.1%, Dimensional 4.1%, BlackRock 3.8%, Vanguard 3.8%, Fidelity 3.6%.

Georgia Capital: CGEO has also reported positive FY Dec results, with total portfolio revenue +7.6% to 1.9bn GEL (£600m). Adj EBITDA and net operating cashflow did fall -14%, as they sold a hospital and temporarily closed a second one. Unusually CGEO management have put forward a proposal to shareholders to migrate from a FTSE premium listing to a standard listing. They suggest that this will enable them to buyback more than 15% of their share capital and also facilitate further disposals of businesses. Last year they sold 80% of their water utility for $180m, which was 6% of the total portfolio value.

CGEO Valuation: NAV per share is 2012p, so the conglomerate is trading on a 60% discount to NAV. As of Q4 they had $152m (£126m) of cash and liquid funds, versus a total portfolio value of 3.2bn GEL (£1bn) market cap of £364m.

BGEO Valuation: BGEO shares are trading on below 5x Dec 2023F PER according to Galt & Taggart’s the bank’s own broker, and less than 3x 2022A just reported. That seems exceptional value, for comparison, Hungarian Bank OTP currently trades on 9x Dec 2023F and Polish Bank PKO trades on 6x the same year, according to G&T.

NB there seems to be a problem with Sharepad’s figures in the ‘ratios’ tab…I suspect this is a currency conversion issue with Lari, so I have asked Support to query this with the data provider. The forecast dividend yield is 6.8%.

Opinion: I’m a long-term bull of both companies having listed BGEO in London over a decade ago. I think that the shares ought to re-rate higher given the track record of growth and credit quality. I can see that Georgia is unfamiliar and proximity to Russia is a concern, but investors are being more than compensated for the risks, in my view.

Khvicha Kvaratskhelia was bought by Napoli FC for a reported fee of Eu12m, from Dinamo Batumi. The young Georgian winger is currently making Italian Serie A and Champions League defenders look very ordinary. In the same way, Georgian financials make UK banks look rather like Dele Alli.

Conclusion

The author owns shares in Bank of Georgia and Georgia Capital

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.