With equity markets and industrial metals like copper rallying at the start of this year, Bruce looks at some companies geared into the recovery. SDRY, NFC, SAA, BOTB and CWR.

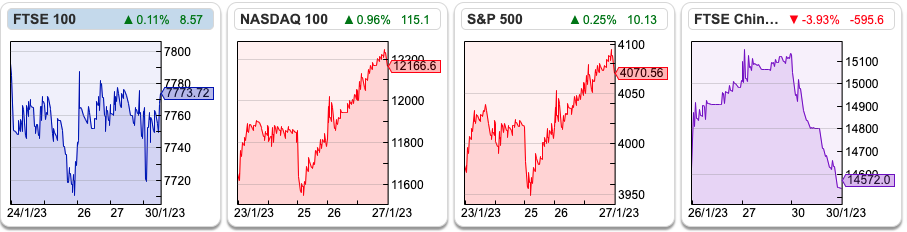

The FTSE 100 was flat at 7,774 in the last 5 trading days. In the US the S&P was up +2.5% and the Nasdaq 100 was up a very strong +4.7% in the last 5 trading days. The FTSE China Index sold off sharply at the start of the week down -3.9% on Monday, but is still up +12.6% since the start of the year, the best performing of Sharepad’s 29 major indices. Sterling continues its recovery against the USD at 1.24, while US 10Y bond yield has begun to rise again from a low in mid-January to 3.54% currently. The yield curve remains inverted, which is normally a recession indicator.

Looking at the best performers in the S&P500, Warner Bros (+57% YTD), Tesla (+44% YTD) and NVIDIA (+39% YTD) and FTSE 100 IAG (the old British Airways +37% YTD), JD Sports (+29% YTD) and Burberry (+20%) it’s hard to discern a trend. The rally seems broad-based and indiscriminate.

Last weekend I was at a gig, to see Klangphonics. There seemed a lot of positivity in the crowd particularly when the band brought their signature instrument, a hoover, onto the stage. My feeling is that consumer confidence is not as low as surveys imply, some people may be struggling with higher mortgage costs but this is not an economy-wide phenomenon.

At times like these I like to keep an eye on the price of copper, as an indicator of economic activity. Similar to equity markets, copper (Sharepad ticker HG-MT) had a weak 2022, down -15% despite being a major component in Electric Vehicles and green energy transition. Then the metal perked up from October onwards and is now +12% YTD. So that is another reason for optimism.

The one area that does seem to be lagging is AIM which is up less than +5% YTD, but if all the other indications are strong, then it seems likely to me that risk appetite will soon return to AIM.

Below I look at Superdry’s profit warning. Marketing companies NextFifteen and M&C Saatchi’s update. Best of the Best and hydrogen company Ceres Power. All these companies are geared into a recovery if the optimism is sustainable.

Superdry H1 Oct Results and December Trading Update

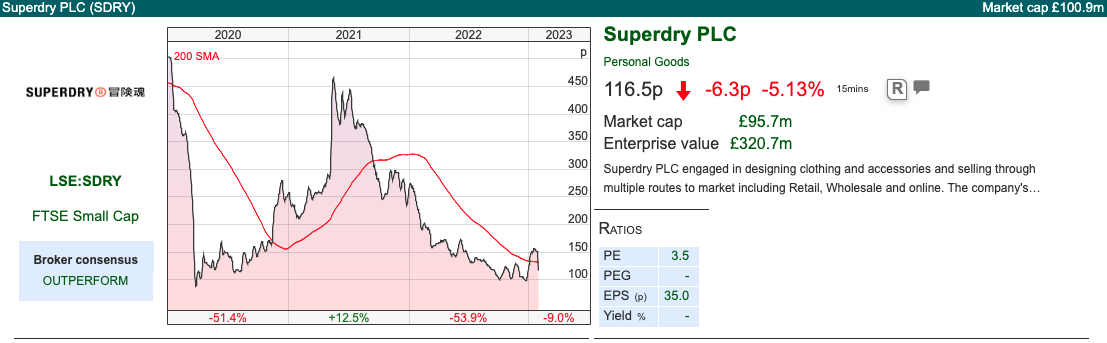

The retailer of Japanese slogan T-shirts and leather jackets announced group revenue +3.6% H1 to Oct, driven by contrasting trends in their own stores +14% but weak wholesale -5%. We already knew those figures from the 22nd Dec trading update, when they also announced the appointment of a new auditor and a loan facility of up to £80m from Bantry Bay.

Last week’s RNS revealed a statutory LBT was £18m v £4m PBT H1 2022. However, that includes a £17m forex trading gain, so presumably, without this benefit, the loss would have been £35m in H1. I can see that would worry investors and cause a sharp sell-off last week. Net debt was £38m at the end of October but recovered to £10m net debt at the end of December as the seasonal cashflow from sales came in.

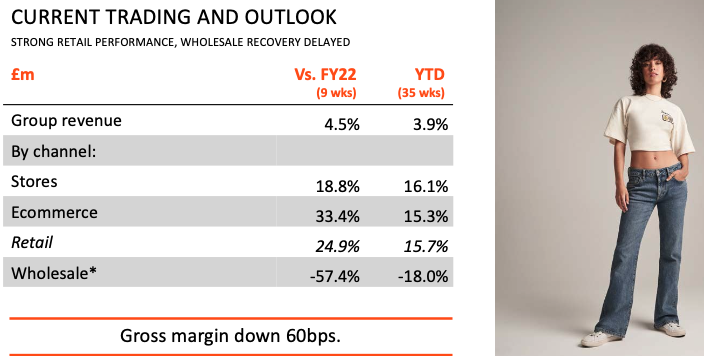

We also learned 9-week sales trends to the end of December and outlook for 2023 from last week’s RNS. There are contrasting trends: Stores +19% and Ecommerce +33% doing well but Wholesale -57% continuing to do very badly. Summarised on this slide:

Management have revised down their FY Apr guidance from £10m-£20m to “broadly breakeven” – ie a small loss. They attribute this to a weak Spring, as consumers remain under pressure, plus continued underperformance in Wholesale (37% of revenue, but much lower gross margin than reported in their own stores and ecommerce so 22% of gross PBT). Even if they fail to fix Wholesale, and it continues to shrink at that rate but we see sustainable double-digit revenue growth in Retail then the problem fixes itself (Wholesale becomes far less important). The business is not above break-even currently, but for context, Sharepad shows peak PBT of £66m in FY Apr 2017 (or £53m average over 3 years back then), so the current market cap is less than 1.5x peak profits. Back then SDRY were also paying a dividend of c. 30p v current share price of 115p.

Valuation: The shares are trading on a PER 7.9x Apr 2024F, dropping to below PER 6.0x Apr 2025F. That’s a bargain if management can turn things around.

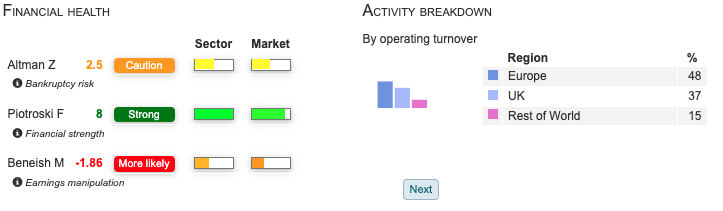

On the downside, Sharepad’s Beneish M earnings manipulation score is flashing red, perhaps reflecting the problems in the past with accounting, while the Altman Z bankruptcy risk is also showing caution. One red flag to keep an eye out for is if the founder, Julian Dunkerton (currently owns 23.9% of the shares) or if institutions like Schroders (4.8% of the company) begin selling.

Opinion: I bought this for the turnaround potential a couple of months ago and can see the upside if things go well. My view is that if clothes are selling well through their own stores and website, then the problems in Wholesale are fixable. The PBT downward revision this Spring is not enough for me to change my mind, so I am going to stick with it, and have actually increased my position size. That’s not without risk, so please decide if this fits your own risk appetite.

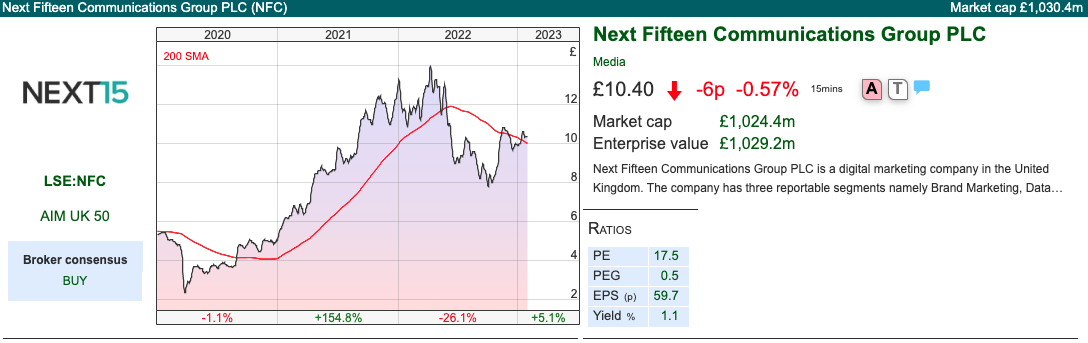

NextFifteen FY Jan Trading Update

This management consultancy specialising in data analysis and marketing released a trading update for 12M to Jan. As a reminder, NFC were involved in a bidding war for M&C Saatchi last year. In January last year, M&C received an approach from AdvancedAdvT (Vin Murria, an M&C Saatchi non-exec), followed by a revised offer in February. They then extended the “Put Up or Shut Up” deadline a couple of times. The eventual AdvancedAdvT final offer valued M&C Saatchi (ticker: SAA) at 209p but this was for owning 54-59% of a cash shell, not a cash offer. Vin Murria and AdancedAdvT owned 22.3% of SAA.

Then last May NextFifteen launched a counteroffer for M&C Saatchi. NFC’s bid was originally at a 19% premium to AdvancedAdvT’s SAA offer at the time, however, it was 40p in cash and 0.1637 in NFC shares. The NFC shares promptly collapsed in value by 40%. As NFC’s shares fell in value, the Board withdrew their recommendation of the NFC offer. The Board also removed Vin Murria as a Non-Exec, after calling her AdvancedAdvT offer “derisory”.

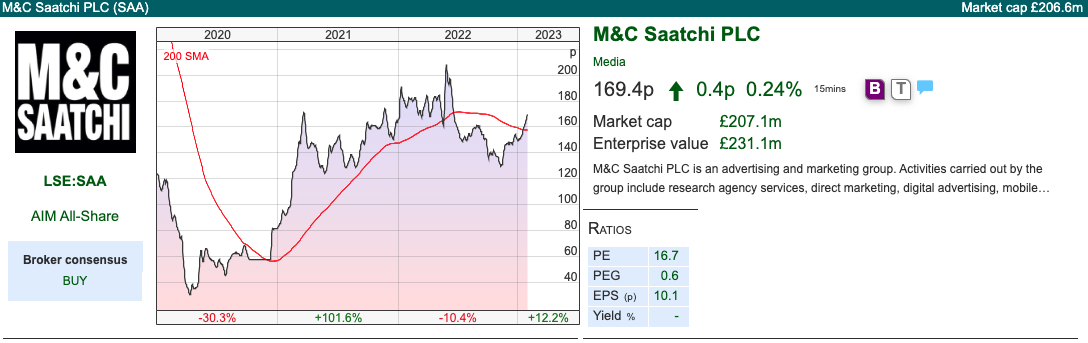

Ultimately, the market sell-off resulted in neither side winning SAA, with AdvancedAdvT’s offer lapsing on the 30th September and NFC’s offer lapsing on the 31st October. The SAA share price is currently 169p, below the level of both offers when they were first made. Based on the current NFC share price, their bid would have been worth 210p.

Add to this that last year NFC had already raised £50m in March 2022 in a placing at 1160p to buy Engine UK (a digital transformation, communications and creative business with approximately 600 staff and 300 UK and international clients) for £77m Enterprise Value. It’s understandable that NFC might have taken their eye off the ball with all the M&A activity going on.

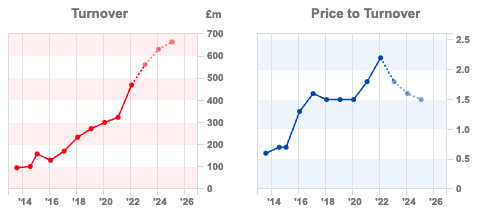

Last week’s NFC RNS showed organic revenue growth of +20% FY Jan 2023F, though slowing down in H2 v H2 to +12%. Including acquisitions, FY Jan 2023F revenue was up +55%. There is no mention of PBT, but they expect to have net cash of £20m at the end of January (v £18m net debt, ex-lease liabilities H1 end of July last year). They say these results are in-line with expectations, which seems a good result given everything that’s gone on.

Valuation: The shares are trading on a PER Jan 2024F 11.5x dropping to a PER Jan 2024F 10.5x. That compares to M&C Saatchi, which also released a trading update last week, on a PER 9.5x Dec 2023F and 8.0x Dec 2024F.

Opinion: Similar to the retail sector, consultancy and marketing stocks had a torrid 2022. NFC management certainly have an impressive track record, going back two decades. Not overpaying for SAA shows good discipline and something that shareholders ought to reward, in my view. Billions in shareholder value have been destroyed by bad deals, so it’s refreshing to see a management team not prepared to increase their offer at a time of great uncertainty. The one reason I wouldn’t buy NFC shares is that the market cap is over £1bn and it’s already been a ten-bagger.

It is possible we see another bid emerge for SAA. Gareth Davis, the SAA Chairman announced he would step down, so they are currently looking for a new Chairman. Last week’s inline trading update is impressive given all the turmoil over the last few years, with shares collapsing to 30p in early 2020. This was due to suspect accounting disclosure for deferred compensation and prior years statutory PBT being revised down by £28m in total. SAA will hold a Capital Markets Day (M&C Saatchi: Moving Forward) on 8 February 2023.

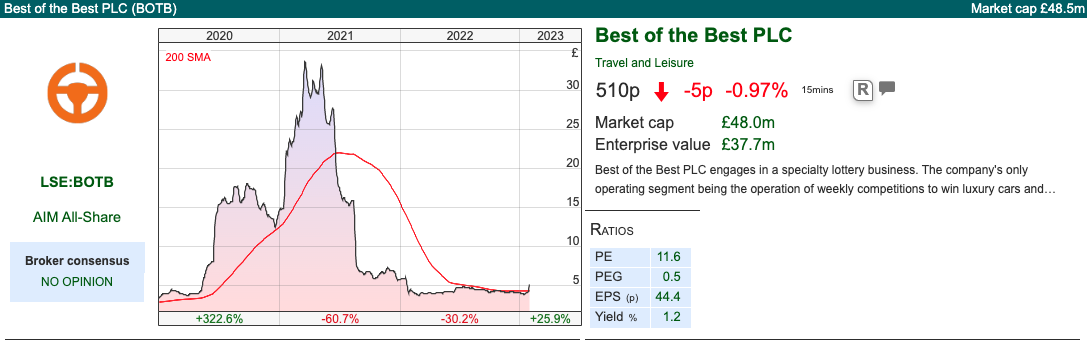

Best of the Best H1 to October

This company that does online competitions to win ‘dream cars’, was a huge beneficiary of lockdown boredom a couple of years ago. Then they struggled to maintain performance, suffering from competitors bidding up the price of online advertising and the share price fell from a peak of over £33 to below £4. They announced encouraging H1 results last week. Revenues for H1 Oct were £13.65, down -29%. PBT was £2.7m -11%. Despite returning almost £7m to shareholders via a tender offer and a dividend, they still had £5.3m of cash at the end of October.

In September last year, they announced that Teddy Sagi’s (Israeli billionaire of Camden Market, Playtech and Kape fame) Globe Invest Ltd (GIL) had bought a 29.9% stake from founders William Hindmarch and Rupert Garton at a price of £4. That’s a less attractive price (for the sellers) than the £24 placing price in March 2021 when management sold 2.5m shares, including around 10% of the company to Mark Slater. Slater still owns 8.1% according to Sharepad’s DD tab. William Hindmarch and Rupert Garton have now sold down their stakes to 10% and 3% respectively.

BOTB and GIL have said that they intend to enter into a Licensing and Distribution Agreement and a Marketing and Collaboration Agreement through which GIL will provide the business with the operational expertise to execute a global strategy, whilst further leveraging BOTB’s existing database. That sounds fine in theory, except that it has been under discussion since September and nothing has been signed. It strikes me that Teddy Sagi is someone who drives a hard bargain, so other minority shareholders need a strong board to make sure that he doesn’t extract too much value, given that GIL is now a related party.

Outlook: Although revenue is down -29% v H1 last year, it is still running at twice the level when they exited their physical airport locations and became fully online. Management say trading since Oct has continued in line with expectations. FinnCap, their broker, has actually reduced revenue forecast slightly but kept EPS of 53.9p Apr 2023F and 59.5p Apr 2024F.

Valuation: The shares are trading on a PER of 9x Apr 2024F. That does seem good value given the demonstrable operational gearing, if they can deliver revenue growth. I think it will take some time to build back trust though.

Opinion: Now that management have sold down their shareholdings, it’s only natural that they will feel less incentivised. That said, they do seem to have stabilised the situation; I like the operational gearing, and the quirkiness. But haven’t yet bought into the story.

Ceres Power FY Dec Trading Update

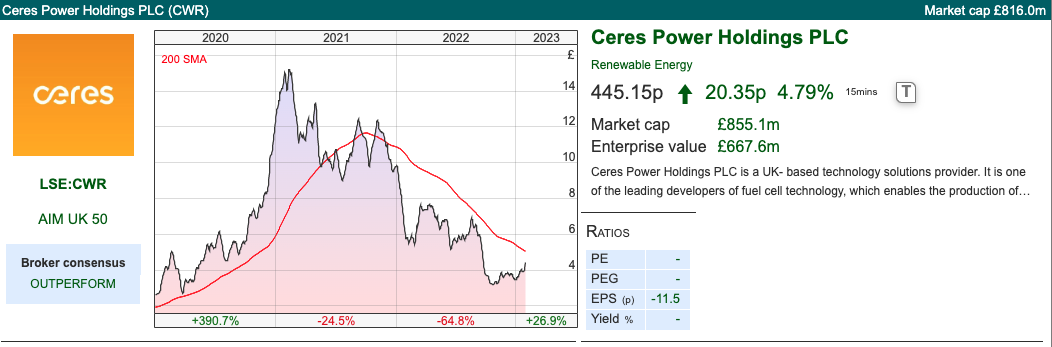

This is a hydrogen stock, so comes with a “caveat emptor” in the first sentence. However, it has been listed since Nov 2004 (raising £15m at 120p, implying a market cap of £60m on admission) and it released an “inline” trading update last week, which resulted in a +6% share price reaction on the morning of the RNS. The shares are up +27% YTD and I think hydrogen and fuel cells is a fascinating areas, so worth following even if you think it’s too risky at the moment.

Ceres makes fuel cells for power generation, electrolysis (green hydrogen) and energy storage. They have an asset-light, licensing model partnering with established companies Weichai in China, Bosch in Germany, Miura in Japan, and Doosan in Korea. For more background, there’s an electrolysis solid oxide teach-in from July 2021 and H1 2022 presentation from Sept 2022.

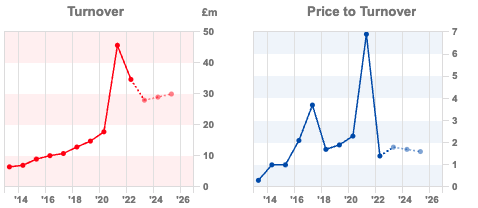

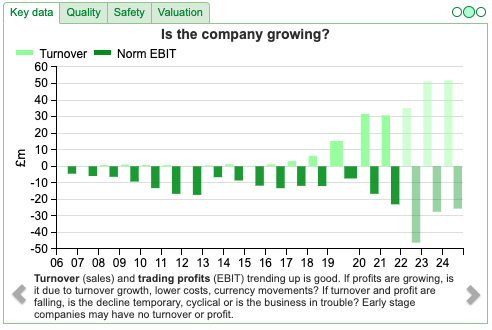

FY Dec revenue is in line, at £21m, implying a -33% fall versus last year’s number. Gross margin is expected to be c. 60% (down from 66% FY Dec 2021). Cash is £182m at the end of Dec 2022, a £68m decrease versus £250m Dec 2021.

They have already announced a Chinese joint venture with Bosch GmbH (18% shareholder) and Weichai Power (20% shareholder), although some of the small print has yet to be finalised. At the interims in Sept, they said they expected to sign the agreements in Q4, but the regulatory approvals could then take up to 4 months. Originally they had expected to recognise half (£15m) of the licence fee in H2 2022, but in September said the whole (£30m) licence fee ought to be recognised in H1 2023. Reading between the lines, I think there’s a risk that the timing slips once again. It’s also worth noting that while revenue can be recognised upfront, the cash will take longer to arrive. They expect to receive cash payments of 3x £10m spread over the next 3 years.

Also from last week’s RNS: they are testing their first 100kW electrolyser module before scaling into a 1MW demonstrator. They say that initial results are positive and believe it can deliver green hydrogen at <40kWh/kg, around 25% more efficiently than incumbent lower-temperature technologies.

Key risks from the Annual Report: i) they may not be able to develop the technology in the anticipated timeframe; ii) they may not be able to deliver it to partners in the timeframe; iii) partners may choose not to use their technology; iv) the value proposition could be eroded; v) there could be challenges to their patents and Intellectual Property; vi) they might not be able to scale up. Add to that they have been reporting negative cash from both operating activities (£20m 2021, £5.8m 2022) and investing activities (£32m 2021 £25m 2020). These losses have been funded by issuing shares, most recently raising £181m of proceeds at 1060p per share in a well-timed March 2021 placing. The share count has increased from 5.5m in 2004 (AIM Admission) to 192m this year.

Valuation: Revenue growth is forecast to be +45% to £51m FY Dec 2023 however losses of just under £30m and forecast in 2023F and 2024F. The shares have fallen -70% from their peak of 1550p in Feb 2021. More recently CWR has enjoyed a +43% strong bounce following the market melt-up since September last year.

Opinion: Only for the brave, but if you like trading volatile stocks there could be an opportunity to make money both on the long and the short side. One concern I have with hydrogen stocks is that even if the technology works, it may not generate an economic return for shareholders. Ceres does report high gross margins because of their licensing/asset-light model – so that should be less of a concern if the technology does gain acceptance. One to keep an eye on, I think.

Notes

The author owns shares in Superdry.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 31/01/23 | SDRY, NFC, SAA, BOTB, CWR | An indiscriminate rally

With equity markets and industrial metals like copper rallying at the start of this year, Bruce looks at some companies geared into the recovery. SDRY, NFC, SAA, BOTB and CWR.

The FTSE 100 was flat at 7,774 in the last 5 trading days. In the US the S&P was up +2.5% and the Nasdaq 100 was up a very strong +4.7% in the last 5 trading days. The FTSE China Index sold off sharply at the start of the week down -3.9% on Monday, but is still up +12.6% since the start of the year, the best performing of Sharepad’s 29 major indices. Sterling continues its recovery against the USD at 1.24, while US 10Y bond yield has begun to rise again from a low in mid-January to 3.54% currently. The yield curve remains inverted, which is normally a recession indicator.

Looking at the best performers in the S&P500, Warner Bros (+57% YTD), Tesla (+44% YTD) and NVIDIA (+39% YTD) and FTSE 100 IAG (the old British Airways +37% YTD), JD Sports (+29% YTD) and Burberry (+20%) it’s hard to discern a trend. The rally seems broad-based and indiscriminate.

Last weekend I was at a gig, to see Klangphonics. There seemed a lot of positivity in the crowd particularly when the band brought their signature instrument, a hoover, onto the stage. My feeling is that consumer confidence is not as low as surveys imply, some people may be struggling with higher mortgage costs but this is not an economy-wide phenomenon.

At times like these I like to keep an eye on the price of copper, as an indicator of economic activity. Similar to equity markets, copper (Sharepad ticker HG-MT) had a weak 2022, down -15% despite being a major component in Electric Vehicles and green energy transition. Then the metal perked up from October onwards and is now +12% YTD. So that is another reason for optimism.

The one area that does seem to be lagging is AIM which is up less than +5% YTD, but if all the other indications are strong, then it seems likely to me that risk appetite will soon return to AIM.

Below I look at Superdry’s profit warning. Marketing companies NextFifteen and M&C Saatchi’s update. Best of the Best and hydrogen company Ceres Power. All these companies are geared into a recovery if the optimism is sustainable.

Superdry H1 Oct Results and December Trading Update

The retailer of Japanese slogan T-shirts and leather jackets announced group revenue +3.6% H1 to Oct, driven by contrasting trends in their own stores +14% but weak wholesale -5%. We already knew those figures from the 22nd Dec trading update, when they also announced the appointment of a new auditor and a loan facility of up to £80m from Bantry Bay.

Last week’s RNS revealed a statutory LBT was £18m v £4m PBT H1 2022. However, that includes a £17m forex trading gain, so presumably, without this benefit, the loss would have been £35m in H1. I can see that would worry investors and cause a sharp sell-off last week. Net debt was £38m at the end of October but recovered to £10m net debt at the end of December as the seasonal cashflow from sales came in.

We also learned 9-week sales trends to the end of December and outlook for 2023 from last week’s RNS. There are contrasting trends: Stores +19% and Ecommerce +33% doing well but Wholesale -57% continuing to do very badly. Summarised on this slide:

Management have revised down their FY Apr guidance from £10m-£20m to “broadly breakeven” – ie a small loss. They attribute this to a weak Spring, as consumers remain under pressure, plus continued underperformance in Wholesale (37% of revenue, but much lower gross margin than reported in their own stores and ecommerce so 22% of gross PBT). Even if they fail to fix Wholesale, and it continues to shrink at that rate but we see sustainable double-digit revenue growth in Retail then the problem fixes itself (Wholesale becomes far less important). The business is not above break-even currently, but for context, Sharepad shows peak PBT of £66m in FY Apr 2017 (or £53m average over 3 years back then), so the current market cap is less than 1.5x peak profits. Back then SDRY were also paying a dividend of c. 30p v current share price of 115p.

Valuation: The shares are trading on a PER 7.9x Apr 2024F, dropping to below PER 6.0x Apr 2025F. That’s a bargain if management can turn things around.

On the downside, Sharepad’s Beneish M earnings manipulation score is flashing red, perhaps reflecting the problems in the past with accounting, while the Altman Z bankruptcy risk is also showing caution. One red flag to keep an eye out for is if the founder, Julian Dunkerton (currently owns 23.9% of the shares) or if institutions like Schroders (4.8% of the company) begin selling.

Opinion: I bought this for the turnaround potential a couple of months ago and can see the upside if things go well. My view is that if clothes are selling well through their own stores and website, then the problems in Wholesale are fixable. The PBT downward revision this Spring is not enough for me to change my mind, so I am going to stick with it, and have actually increased my position size. That’s not without risk, so please decide if this fits your own risk appetite.

NextFifteen FY Jan Trading Update

This management consultancy specialising in data analysis and marketing released a trading update for 12M to Jan. As a reminder, NFC were involved in a bidding war for M&C Saatchi last year. In January last year, M&C received an approach from AdvancedAdvT (Vin Murria, an M&C Saatchi non-exec), followed by a revised offer in February. They then extended the “Put Up or Shut Up” deadline a couple of times. The eventual AdvancedAdvT final offer valued M&C Saatchi (ticker: SAA) at 209p but this was for owning 54-59% of a cash shell, not a cash offer. Vin Murria and AdancedAdvT owned 22.3% of SAA.

Then last May NextFifteen launched a counteroffer for M&C Saatchi. NFC’s bid was originally at a 19% premium to AdvancedAdvT’s SAA offer at the time, however, it was 40p in cash and 0.1637 in NFC shares. The NFC shares promptly collapsed in value by 40%. As NFC’s shares fell in value, the Board withdrew their recommendation of the NFC offer. The Board also removed Vin Murria as a Non-Exec, after calling her AdvancedAdvT offer “derisory”.

Ultimately, the market sell-off resulted in neither side winning SAA, with AdvancedAdvT’s offer lapsing on the 30th September and NFC’s offer lapsing on the 31st October. The SAA share price is currently 169p, below the level of both offers when they were first made. Based on the current NFC share price, their bid would have been worth 210p.

Add to this that last year NFC had already raised £50m in March 2022 in a placing at 1160p to buy Engine UK (a digital transformation, communications and creative business with approximately 600 staff and 300 UK and international clients) for £77m Enterprise Value. It’s understandable that NFC might have taken their eye off the ball with all the M&A activity going on.

Last week’s NFC RNS showed organic revenue growth of +20% FY Jan 2023F, though slowing down in H2 v H2 to +12%. Including acquisitions, FY Jan 2023F revenue was up +55%. There is no mention of PBT, but they expect to have net cash of £20m at the end of January (v £18m net debt, ex-lease liabilities H1 end of July last year). They say these results are in-line with expectations, which seems a good result given everything that’s gone on.

Valuation: The shares are trading on a PER Jan 2024F 11.5x dropping to a PER Jan 2024F 10.5x. That compares to M&C Saatchi, which also released a trading update last week, on a PER 9.5x Dec 2023F and 8.0x Dec 2024F.

Opinion: Similar to the retail sector, consultancy and marketing stocks had a torrid 2022. NFC management certainly have an impressive track record, going back two decades. Not overpaying for SAA shows good discipline and something that shareholders ought to reward, in my view. Billions in shareholder value have been destroyed by bad deals, so it’s refreshing to see a management team not prepared to increase their offer at a time of great uncertainty. The one reason I wouldn’t buy NFC shares is that the market cap is over £1bn and it’s already been a ten-bagger.

It is possible we see another bid emerge for SAA. Gareth Davis, the SAA Chairman announced he would step down, so they are currently looking for a new Chairman. Last week’s inline trading update is impressive given all the turmoil over the last few years, with shares collapsing to 30p in early 2020. This was due to suspect accounting disclosure for deferred compensation and prior years statutory PBT being revised down by £28m in total. SAA will hold a Capital Markets Day (M&C Saatchi: Moving Forward) on 8 February 2023.

Best of the Best H1 to October

This company that does online competitions to win ‘dream cars’, was a huge beneficiary of lockdown boredom a couple of years ago. Then they struggled to maintain performance, suffering from competitors bidding up the price of online advertising and the share price fell from a peak of over £33 to below £4. They announced encouraging H1 results last week. Revenues for H1 Oct were £13.65, down -29%. PBT was £2.7m -11%. Despite returning almost £7m to shareholders via a tender offer and a dividend, they still had £5.3m of cash at the end of October.

In September last year, they announced that Teddy Sagi’s (Israeli billionaire of Camden Market, Playtech and Kape fame) Globe Invest Ltd (GIL) had bought a 29.9% stake from founders William Hindmarch and Rupert Garton at a price of £4. That’s a less attractive price (for the sellers) than the £24 placing price in March 2021 when management sold 2.5m shares, including around 10% of the company to Mark Slater. Slater still owns 8.1% according to Sharepad’s DD tab. William Hindmarch and Rupert Garton have now sold down their stakes to 10% and 3% respectively.

BOTB and GIL have said that they intend to enter into a Licensing and Distribution Agreement and a Marketing and Collaboration Agreement through which GIL will provide the business with the operational expertise to execute a global strategy, whilst further leveraging BOTB’s existing database. That sounds fine in theory, except that it has been under discussion since September and nothing has been signed. It strikes me that Teddy Sagi is someone who drives a hard bargain, so other minority shareholders need a strong board to make sure that he doesn’t extract too much value, given that GIL is now a related party.

Outlook: Although revenue is down -29% v H1 last year, it is still running at twice the level when they exited their physical airport locations and became fully online. Management say trading since Oct has continued in line with expectations. FinnCap, their broker, has actually reduced revenue forecast slightly but kept EPS of 53.9p Apr 2023F and 59.5p Apr 2024F.

Valuation: The shares are trading on a PER of 9x Apr 2024F. That does seem good value given the demonstrable operational gearing, if they can deliver revenue growth. I think it will take some time to build back trust though.

Opinion: Now that management have sold down their shareholdings, it’s only natural that they will feel less incentivised. That said, they do seem to have stabilised the situation; I like the operational gearing, and the quirkiness. But haven’t yet bought into the story.

Ceres Power FY Dec Trading Update

This is a hydrogen stock, so comes with a “caveat emptor” in the first sentence. However, it has been listed since Nov 2004 (raising £15m at 120p, implying a market cap of £60m on admission) and it released an “inline” trading update last week, which resulted in a +6% share price reaction on the morning of the RNS. The shares are up +27% YTD and I think hydrogen and fuel cells is a fascinating areas, so worth following even if you think it’s too risky at the moment.

Ceres makes fuel cells for power generation, electrolysis (green hydrogen) and energy storage. They have an asset-light, licensing model partnering with established companies Weichai in China, Bosch in Germany, Miura in Japan, and Doosan in Korea. For more background, there’s an electrolysis solid oxide teach-in from July 2021 and H1 2022 presentation from Sept 2022.

FY Dec revenue is in line, at £21m, implying a -33% fall versus last year’s number. Gross margin is expected to be c. 60% (down from 66% FY Dec 2021). Cash is £182m at the end of Dec 2022, a £68m decrease versus £250m Dec 2021.

They have already announced a Chinese joint venture with Bosch GmbH (18% shareholder) and Weichai Power (20% shareholder), although some of the small print has yet to be finalised. At the interims in Sept, they said they expected to sign the agreements in Q4, but the regulatory approvals could then take up to 4 months. Originally they had expected to recognise half (£15m) of the licence fee in H2 2022, but in September said the whole (£30m) licence fee ought to be recognised in H1 2023. Reading between the lines, I think there’s a risk that the timing slips once again. It’s also worth noting that while revenue can be recognised upfront, the cash will take longer to arrive. They expect to receive cash payments of 3x £10m spread over the next 3 years.

Also from last week’s RNS: they are testing their first 100kW electrolyser module before scaling into a 1MW demonstrator. They say that initial results are positive and believe it can deliver green hydrogen at <40kWh/kg, around 25% more efficiently than incumbent lower-temperature technologies.

Key risks from the Annual Report: i) they may not be able to develop the technology in the anticipated timeframe; ii) they may not be able to deliver it to partners in the timeframe; iii) partners may choose not to use their technology; iv) the value proposition could be eroded; v) there could be challenges to their patents and Intellectual Property; vi) they might not be able to scale up. Add to that they have been reporting negative cash from both operating activities (£20m 2021, £5.8m 2022) and investing activities (£32m 2021 £25m 2020). These losses have been funded by issuing shares, most recently raising £181m of proceeds at 1060p per share in a well-timed March 2021 placing. The share count has increased from 5.5m in 2004 (AIM Admission) to 192m this year.

Valuation: Revenue growth is forecast to be +45% to £51m FY Dec 2023 however losses of just under £30m and forecast in 2023F and 2024F. The shares have fallen -70% from their peak of 1550p in Feb 2021. More recently CWR has enjoyed a +43% strong bounce following the market melt-up since September last year.

Opinion: Only for the brave, but if you like trading volatile stocks there could be an opportunity to make money both on the long and the short side. One concern I have with hydrogen stocks is that even if the technology works, it may not generate an economic return for shareholders. Ceres does report high gross margins because of their licensing/asset-light model – so that should be less of a concern if the technology does gain acceptance. One to keep an eye on, I think.

Notes

The author owns shares in Superdry.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.