Bruce looks at the prospects for the UK Buy-to-Let market in the BoE’s Financial Stability Review, and wonders if rising interest rates are driving higher rents, which could be causing an inflationary feedback loop. Companies covered SHOE, MEGP and ZOO.

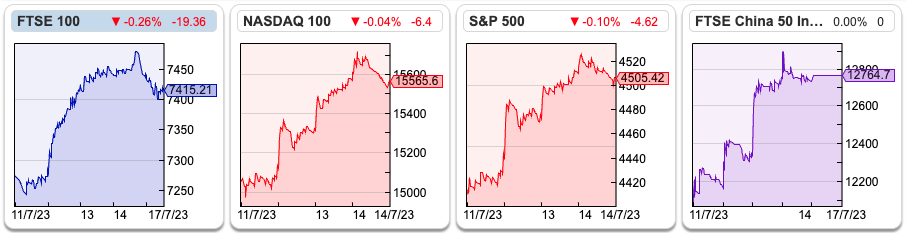

The FTSE 100 enjoyed a positive week up +1.9% to 7,415, while the Nasdaq100 was up +3.5% and S&P500 +2.4% were even stronger. That seems to have been caused by benign US inflation data. The US 10Y government bond yield fell back to 3.78%, versus 4.07% during the first week of July. The FTSE China 50 was up a very strong +5.9% last week and was the best-performing major indices globally. That’s despite falling exports, weak retail sales and lacklustre property sector in China. Year on year the Chinese economy grew +6.3% in the second quarter of this year. I would imagine that investors might anticipate that the Chinese govt engages in some sort of liquidity creation to try to engineer growth.

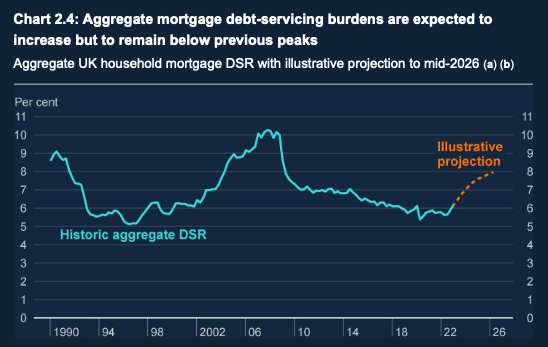

The Bank of England published its Financial Stability Report last week. The document has become significantly more boring in the last few years, I think as the BoE has worried about losing credibility. The most interesting section is on the Buy to Let market (p31), and the impact of rising rates. In the 1980s and 1990s, lower-income groups tended to live in council houses, however now that these properties have been sold off by the government of the time, many of these ex-council houses have ended up as BTL properties. The private rental sector is now 19% of households and around 18% of the £1.7 trillion UK mortgage market (or £300bn BTL mortgages outstanding in absolute terms). Private sector landlords are keen to pass on the costs of higher interest rates to their tenants, with the BoE saying that rent inflation is between 5-10% in the first half of this year. The BoE doesn’t say this, but higher interest rates could be driving a feedback loop, where landlords put up rent which causes workers to ask for pay rises, which feeds through to the inflation figures, which means higher interest rates. The Central Bank also points out that aggregate mortgage debt service burdens should remain at their peak in 2008 and early 1990s.

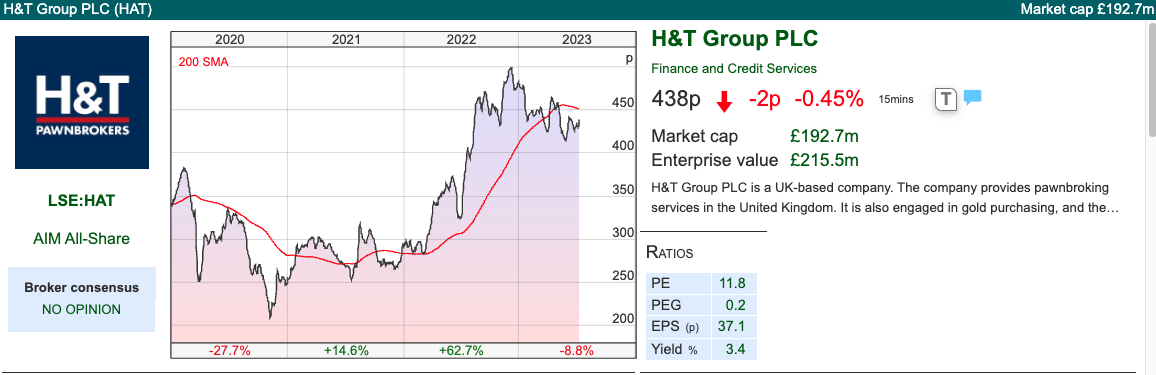

The BoE suggests that renters, who have lower incomes (and also face housing costs as a higher percentage of those lower incomes) and low savings might not be in a strong enough wage bargaining position to receive a pay rise. Instead, the Central Bank says tenants are borrowing money unsecured to pay the rent. Thus, one investment theme could be that rising interest rates turn out to be a benefit to pawnbrokers like H&T and Ramsdens.

Alternatively, higher interest rates and legislation changes (tax treatment of BTL, but also some newspaper pieces floating the idea of rent controls) may encourage landlords to sell. It’s clear that the government would prefer to see more investment in equities and is trying to discourage the BTL market, which may cause landlords to exit the market.

This strikes me as an interesting area to watch, owner-occupiers tend not to sell their houses just because the value has fallen. BTL’ers may be more influenced by falling prices, particularly if they see the “smart money” that went into BTL decades ago also exit early. Meanwhile, the “dumb money” (Lloyds Bank) thinks it is a good time to become a private sector landlord, aiming to buy 50,000 homes in the next decade.

This week I look at Shoe’s profit upgrade, Me Group (previously Photo-Me) successful diversification away from photo booths and Zoo Digital’s profit warning.

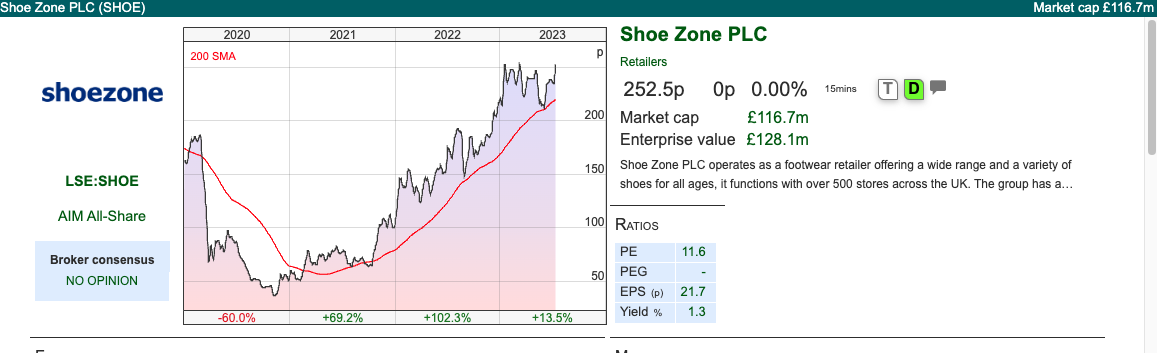

SHOE FY Oct profit upgrade

It’s good to see a retailer currently “significantly exceeding expectations”. Volumes are up double digits versus the same month last year, combined with margin improvement. That margin improvement hasn’t come from price increases, but lower container rate shipping costs and favourable exchange rates. The average selling price for a pair of shoes is £12, which suggests that their customer demographics are likely to be the most impacted by higher food, energy prices and also rent rises. Mark Simpson, at Small Caps Life has an interesting theory that the one-off bonus paid to approximately 1m NHS workers at the end of June may have played a role.

The second point to note is that in May SHOE suggested H1 results to 1st April 2023 were “slightly ahead of expectations”, yet the share price fell -15% on the day. I put this down to the cautious outlook statement where management warned about higher wage costs coming through from the National Living Wage increases. One explanation could be that management have been overly cautious with their broker guidance and are now having to positively revise backup forecasts. There was a trading update on 9th June where management talked about strong recent trading and FY October adj PBT of “not less than £10.5m” versus “not less than £13.5m” in last week’s RNS guidance. Unlike the May RNS, the market liked this update and sent the shares +10% higher on the day of the announcement.

Valuation: Following last week’s announcement broker Zeus have forecast 21.8p of EPS for FY Oct 2023F and have also increased FY Oct 2024F by 14%, giving 19.6p. That puts the shares on 11.6x Oct 2023F and 12.9x Oct 2024F.

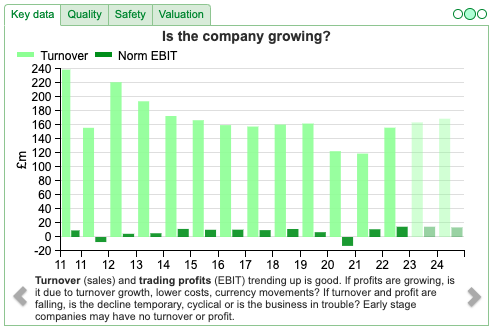

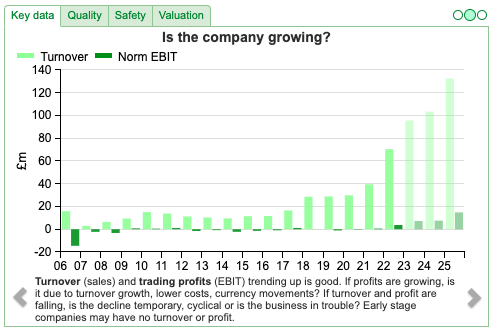

Opinion: Looks good. When the outlook is uncertain with consumer discretionary income it is understandable that management would be cautious with their guidance. I think the investment case is simply a post-pandemic/supply chain recovery, rather than a secular growth story. Sharepad’s Turnover and EBIT chart doesn’t fill me with optimism: FY revenues were £221m a decade ago, and were falling even before the pandemic. Well done to anyone who bought the shares in 2020 or 2021, I don’t think I would chase them higher at these levels though.

ME Group H1 to April

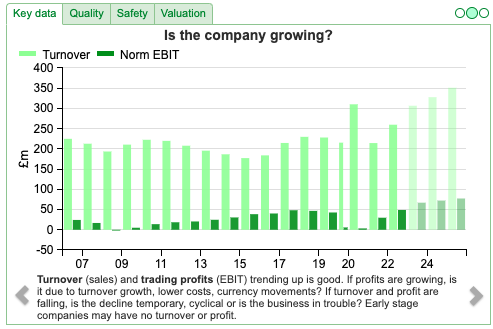

This group that used to be called Photo-Me and specialised in passport photo machines, but has since diversified into laundry, print and food announced H1 to April revenue +25% to £143m and PBT +37% to £27m. Net cash fell -42% to £24m, as the group increased borrowing from £54m April last year to £88m April this year.

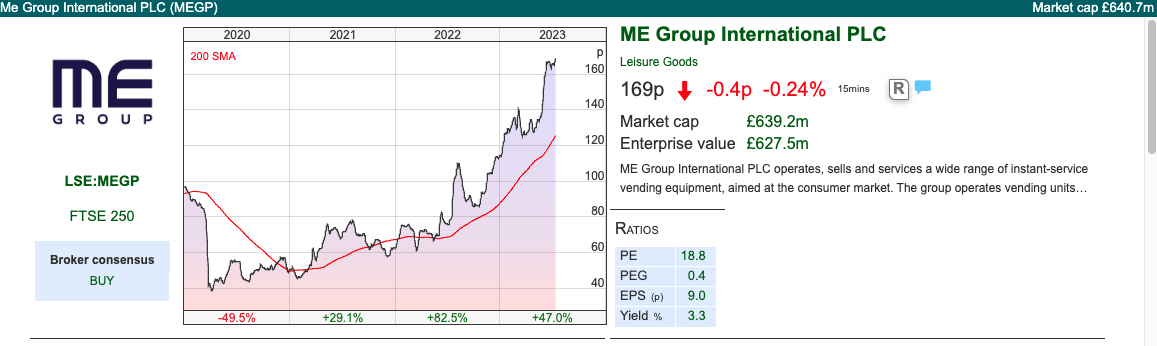

The core photobooth business was under pressure as in 2017 the UK government allowed people to take passport photos as selfies on their phone. Initially, investors expected other governments around the world to follow, which would have been even more negative for the investment case, however, that hasn’t happened (so far). The shares sold off -80% from close to 200p at the end of 2017 to a pandemic low of 40p per share, as shown by the blue arrow in the chart below. The pandemic compounded the problems because people didn’t renew their passports, and so we’re seeing some catch-up in 2022 and 2023.

In response, the company has invested in “next generation” photo booths, with features like metallic paper, large 20×30 pictures and biometric systems. This has paid off with revenue up +25% to £84m, and revenue per photo booth is up by a similar amount to £6,152.

I was initially sceptical when management suggested their expansion into automatic laundry services would compensate for the lost revenue from passport photos. Nowadays most people own a washing machine. However, the laundry division seems to be going well and they now have over 6,000 laundry units deployed and revenue is growing at +37% to £38m. Maynard discusses the investment case on a podcast here and suggests contractors, travelling salesmen, as well as people who wash kits for sports teams are all users of MEGP’s laundry services in supermarkets and petrol stations. Average revenue per machine rose by +18.2% to £15,226 per year. The other diversification projects are at an earlier stage, with print and food (fruit juice and pizzas) vending machines representing less than 10% of revenue.

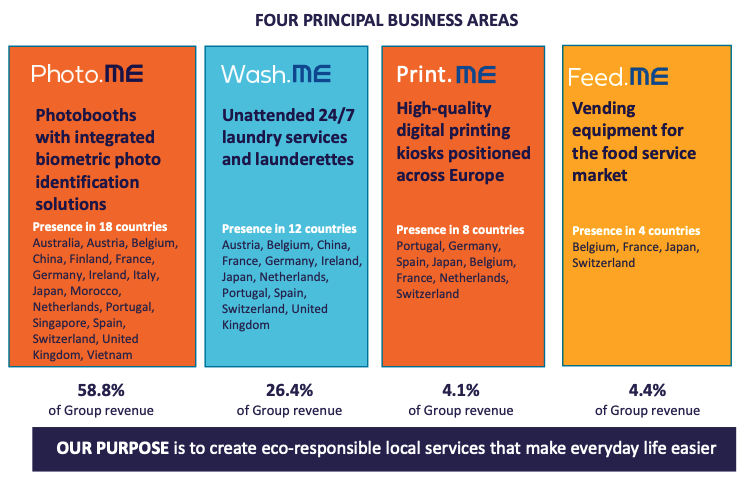

Management have included this useful overview of the business in their interim slide deck.

Outlook: Management confirmed FY Oct 2023F expectations, of revenue between £300m and £320m, and PBT between £64m and £67m. The Group aims to install between 1,000 and 1,500 next#-generation photobooth machines in France by the end of Oct 2023F, rising to 10,000 globally by the end of FY Oct 2025F (versus over 27,000 currently). They will keep going with the roll-out of laundry units at between 50-60 per month.

Investors: Serge Crasnianski, who has been CEO since the 1990s and is close to 80 years old, owns 36% of the stock. He has been buying more shares over the last couple of years, and his daughter Tania (a lawyer), is on the Board too. There was a shareholder revolt in 2007, when he was ousted, and then returned a couple of years later. Large institutional shareholders on their register include Schroders, who own 11% and Fidelity just under 10%.

Valuation: The shares are trading on 12.5x Oct 2024F, dropping to 11.7x Oct 2025F. That does seem attractive if the RoCE at just above 20% and EBIT margin of just below 20% can be maintained.

Opinion: Interesting quirky company. The shares rallied in 2021, but unlike many other stocks have continued to do well in 2022 (+83%) and YTD (+47%). Sharepad’s quality metrics suggest that this is an attractive business, trading on a reasonable valuation.

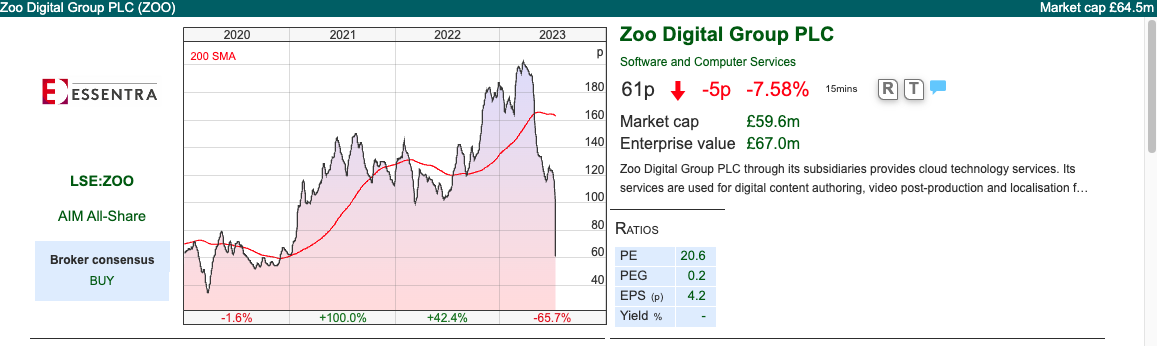

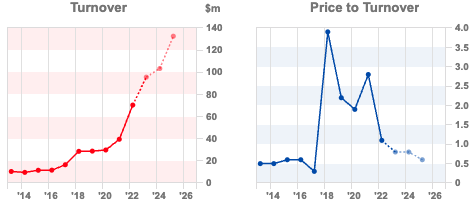

Zoo Digital profit warning FY Mar 2024

This localisation and translation services group for the streaming industry announced an accounting change and profit warning. The profit warning was driven by major clients (Netflix, Hollywood studios like Disney, NBCUniversal, HBO and Paramount) who have been cutting back and saving costs after the pandemic boom in streaming led to an “arms race” of over-investment. They also mention the Writers Guild in the USA has been striking for the last few months. The group has yet to publish FY Mar 2023 results, so it seems very early in the year for the company to put out a profit warning for Q1 this financial year (Mar 2024F). They do say however that they expect revenue growth to return in H2.

Accounting policy change: they also highlight that their auditors require them to recognise third-party costs when they are invoiced, rather than smooth them over several reporting periods as revenue is recognised. Revenue is unaffected, but EBITDA for FY Mar 2023 will be adjusted upwards by $2m (previously $12m) and FY Mar 2022 adjusted downwards by $1.2m (previously $8m).

Placing: In April the company raised £12.5m at 160p per share, at the time a 13.5% discount to the market price. This represented just under 9% of the share capital. Following the raise, at the end of June they have £17m of cash ($23m June v $5m end of March 2022) so they ought to be able to survive a loss-making year. However, in April the reason given for the placing was to buy out shareholders in their Japanese media localisation partner. This deal was expected to complete in Q3 this year, the RNS doesn’t give a price for the acquisition but worth knowing that ZOO’s cash position is likely to be considerably reduced.

FY March 2023 results: As noted above the company has yet to release FY Mar 2023 results, but they did release headline figures at the time of the placing. FY Mar revenue was expected to be at least $90m +28% on the prior year, of which +25% is organic. Adj EBITDA was expected to be materially ahead of the prior year and at least $14m (previously $12m), an increase of +75% (around half of which is the accounting change). Net cash on 31 March 2023 was $11.8m. FY results are expected early August, originally they had been scheduled for mid-July but it sounds like the accounting change, rather than the profit warning, has caused the delay.

Valuation: Sharepad shows PBT forecast for 2024F was slashed by 28% to $7.5m. That gives a PER on downgraded forecasts of 10x Oct 2024F. The price/sales ratio has fallen to 0.8x, versus close to 4x pre-pandemic. That could be good value, assuming no further problems to come.

Opinion: The share price is down -66% YTD, but I think investors need to ponder whether this profit warning is a ‘one-off’ in nature, and then revenue growth will return. Or whether there’s a retracement in streaming spend will last a long time, and whether localisation/translation might be threatened by AI. This hasn’t happened with Keywords Studios, but I would imagine that localisation of computer games might be more sophisticated than dubbing with foreign actors. There are plenty of bargain small-cap shares around at the moment and I think I would wait and see with the investment case on this one.

Notes

Bruce Packard

brucepackard.com

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 18/07/23 | SHOE, MEGP, ZOO | The Buy-to-Let burden

Bruce looks at the prospects for the UK Buy-to-Let market in the BoE’s Financial Stability Review, and wonders if rising interest rates are driving higher rents, which could be causing an inflationary feedback loop. Companies covered SHOE, MEGP and ZOO.

The FTSE 100 enjoyed a positive week up +1.9% to 7,415, while the Nasdaq100 was up +3.5% and S&P500 +2.4% were even stronger. That seems to have been caused by benign US inflation data. The US 10Y government bond yield fell back to 3.78%, versus 4.07% during the first week of July. The FTSE China 50 was up a very strong +5.9% last week and was the best-performing major indices globally. That’s despite falling exports, weak retail sales and lacklustre property sector in China. Year on year the Chinese economy grew +6.3% in the second quarter of this year. I would imagine that investors might anticipate that the Chinese govt engages in some sort of liquidity creation to try to engineer growth.

The Bank of England published its Financial Stability Report last week. The document has become significantly more boring in the last few years, I think as the BoE has worried about losing credibility. The most interesting section is on the Buy to Let market (p31), and the impact of rising rates. In the 1980s and 1990s, lower-income groups tended to live in council houses, however now that these properties have been sold off by the government of the time, many of these ex-council houses have ended up as BTL properties. The private rental sector is now 19% of households and around 18% of the £1.7 trillion UK mortgage market (or £300bn BTL mortgages outstanding in absolute terms). Private sector landlords are keen to pass on the costs of higher interest rates to their tenants, with the BoE saying that rent inflation is between 5-10% in the first half of this year. The BoE doesn’t say this, but higher interest rates could be driving a feedback loop, where landlords put up rent which causes workers to ask for pay rises, which feeds through to the inflation figures, which means higher interest rates. The Central Bank also points out that aggregate mortgage debt service burdens should remain at their peak in 2008 and early 1990s.

The BoE suggests that renters, who have lower incomes (and also face housing costs as a higher percentage of those lower incomes) and low savings might not be in a strong enough wage bargaining position to receive a pay rise. Instead, the Central Bank says tenants are borrowing money unsecured to pay the rent. Thus, one investment theme could be that rising interest rates turn out to be a benefit to pawnbrokers like H&T and Ramsdens.

Alternatively, higher interest rates and legislation changes (tax treatment of BTL, but also some newspaper pieces floating the idea of rent controls) may encourage landlords to sell. It’s clear that the government would prefer to see more investment in equities and is trying to discourage the BTL market, which may cause landlords to exit the market.

This strikes me as an interesting area to watch, owner-occupiers tend not to sell their houses just because the value has fallen. BTL’ers may be more influenced by falling prices, particularly if they see the “smart money” that went into BTL decades ago also exit early. Meanwhile, the “dumb money” (Lloyds Bank) thinks it is a good time to become a private sector landlord, aiming to buy 50,000 homes in the next decade.

This week I look at Shoe’s profit upgrade, Me Group (previously Photo-Me) successful diversification away from photo booths and Zoo Digital’s profit warning.

SHOE FY Oct profit upgrade

It’s good to see a retailer currently “significantly exceeding expectations”. Volumes are up double digits versus the same month last year, combined with margin improvement. That margin improvement hasn’t come from price increases, but lower container rate shipping costs and favourable exchange rates. The average selling price for a pair of shoes is £12, which suggests that their customer demographics are likely to be the most impacted by higher food, energy prices and also rent rises. Mark Simpson, at Small Caps Life has an interesting theory that the one-off bonus paid to approximately 1m NHS workers at the end of June may have played a role.

The second point to note is that in May SHOE suggested H1 results to 1st April 2023 were “slightly ahead of expectations”, yet the share price fell -15% on the day. I put this down to the cautious outlook statement where management warned about higher wage costs coming through from the National Living Wage increases. One explanation could be that management have been overly cautious with their broker guidance and are now having to positively revise backup forecasts. There was a trading update on 9th June where management talked about strong recent trading and FY October adj PBT of “not less than £10.5m” versus “not less than £13.5m” in last week’s RNS guidance. Unlike the May RNS, the market liked this update and sent the shares +10% higher on the day of the announcement.

Valuation: Following last week’s announcement broker Zeus have forecast 21.8p of EPS for FY Oct 2023F and have also increased FY Oct 2024F by 14%, giving 19.6p. That puts the shares on 11.6x Oct 2023F and 12.9x Oct 2024F.

Opinion: Looks good. When the outlook is uncertain with consumer discretionary income it is understandable that management would be cautious with their guidance. I think the investment case is simply a post-pandemic/supply chain recovery, rather than a secular growth story. Sharepad’s Turnover and EBIT chart doesn’t fill me with optimism: FY revenues were £221m a decade ago, and were falling even before the pandemic. Well done to anyone who bought the shares in 2020 or 2021, I don’t think I would chase them higher at these levels though.

ME Group H1 to April

This group that used to be called Photo-Me and specialised in passport photo machines, but has since diversified into laundry, print and food announced H1 to April revenue +25% to £143m and PBT +37% to £27m. Net cash fell -42% to £24m, as the group increased borrowing from £54m April last year to £88m April this year.

The core photobooth business was under pressure as in 2017 the UK government allowed people to take passport photos as selfies on their phone. Initially, investors expected other governments around the world to follow, which would have been even more negative for the investment case, however, that hasn’t happened (so far). The shares sold off -80% from close to 200p at the end of 2017 to a pandemic low of 40p per share, as shown by the blue arrow in the chart below. The pandemic compounded the problems because people didn’t renew their passports, and so we’re seeing some catch-up in 2022 and 2023.

In response, the company has invested in “next generation” photo booths, with features like metallic paper, large 20×30 pictures and biometric systems. This has paid off with revenue up +25% to £84m, and revenue per photo booth is up by a similar amount to £6,152.

I was initially sceptical when management suggested their expansion into automatic laundry services would compensate for the lost revenue from passport photos. Nowadays most people own a washing machine. However, the laundry division seems to be going well and they now have over 6,000 laundry units deployed and revenue is growing at +37% to £38m. Maynard discusses the investment case on a podcast here and suggests contractors, travelling salesmen, as well as people who wash kits for sports teams are all users of MEGP’s laundry services in supermarkets and petrol stations. Average revenue per machine rose by +18.2% to £15,226 per year. The other diversification projects are at an earlier stage, with print and food (fruit juice and pizzas) vending machines representing less than 10% of revenue.

Management have included this useful overview of the business in their interim slide deck.

Outlook: Management confirmed FY Oct 2023F expectations, of revenue between £300m and £320m, and PBT between £64m and £67m. The Group aims to install between 1,000 and 1,500 next#-generation photobooth machines in France by the end of Oct 2023F, rising to 10,000 globally by the end of FY Oct 2025F (versus over 27,000 currently). They will keep going with the roll-out of laundry units at between 50-60 per month.

Investors: Serge Crasnianski, who has been CEO since the 1990s and is close to 80 years old, owns 36% of the stock. He has been buying more shares over the last couple of years, and his daughter Tania (a lawyer), is on the Board too. There was a shareholder revolt in 2007, when he was ousted, and then returned a couple of years later. Large institutional shareholders on their register include Schroders, who own 11% and Fidelity just under 10%.

Valuation: The shares are trading on 12.5x Oct 2024F, dropping to 11.7x Oct 2025F. That does seem attractive if the RoCE at just above 20% and EBIT margin of just below 20% can be maintained.

Opinion: Interesting quirky company. The shares rallied in 2021, but unlike many other stocks have continued to do well in 2022 (+83%) and YTD (+47%). Sharepad’s quality metrics suggest that this is an attractive business, trading on a reasonable valuation.

Zoo Digital profit warning FY Mar 2024

This localisation and translation services group for the streaming industry announced an accounting change and profit warning. The profit warning was driven by major clients (Netflix, Hollywood studios like Disney, NBCUniversal, HBO and Paramount) who have been cutting back and saving costs after the pandemic boom in streaming led to an “arms race” of over-investment. They also mention the Writers Guild in the USA has been striking for the last few months. The group has yet to publish FY Mar 2023 results, so it seems very early in the year for the company to put out a profit warning for Q1 this financial year (Mar 2024F). They do say however that they expect revenue growth to return in H2.

Accounting policy change: they also highlight that their auditors require them to recognise third-party costs when they are invoiced, rather than smooth them over several reporting periods as revenue is recognised. Revenue is unaffected, but EBITDA for FY Mar 2023 will be adjusted upwards by $2m (previously $12m) and FY Mar 2022 adjusted downwards by $1.2m (previously $8m).

Placing: In April the company raised £12.5m at 160p per share, at the time a 13.5% discount to the market price. This represented just under 9% of the share capital. Following the raise, at the end of June they have £17m of cash ($23m June v $5m end of March 2022) so they ought to be able to survive a loss-making year. However, in April the reason given for the placing was to buy out shareholders in their Japanese media localisation partner. This deal was expected to complete in Q3 this year, the RNS doesn’t give a price for the acquisition but worth knowing that ZOO’s cash position is likely to be considerably reduced.

FY March 2023 results: As noted above the company has yet to release FY Mar 2023 results, but they did release headline figures at the time of the placing. FY Mar revenue was expected to be at least $90m +28% on the prior year, of which +25% is organic. Adj EBITDA was expected to be materially ahead of the prior year and at least $14m (previously $12m), an increase of +75% (around half of which is the accounting change). Net cash on 31 March 2023 was $11.8m. FY results are expected early August, originally they had been scheduled for mid-July but it sounds like the accounting change, rather than the profit warning, has caused the delay.

Valuation: Sharepad shows PBT forecast for 2024F was slashed by 28% to $7.5m. That gives a PER on downgraded forecasts of 10x Oct 2024F. The price/sales ratio has fallen to 0.8x, versus close to 4x pre-pandemic. That could be good value, assuming no further problems to come.

Opinion: The share price is down -66% YTD, but I think investors need to ponder whether this profit warning is a ‘one-off’ in nature, and then revenue growth will return. Or whether there’s a retracement in streaming spend will last a long time, and whether localisation/translation might be threatened by AI. This hasn’t happened with Keywords Studios, but I would imagine that localisation of computer games might be more sophisticated than dubbing with foreign actors. There are plenty of bargain small-cap shares around at the moment and I think I would wait and see with the investment case on this one.

Notes

Bruce Packard

brucepackard.com

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.