Richard looks beyond how Christie Group PLC makes money, to how it is going to make more. He examines the challenges it faces and how it plans to overcome them, aka strategy.

My enthusiasm for Christie has diminished in the two weeks since I introduced it to you (see 29 top scorers, and Christie bottled).

You may remember that I left the article on a minor cliff-hanger, or at least standing on a ledge somewhere up the wall of worry we must climb before we have the confidence to invest.

Christie is a group of businesses that provide services to companies in the healthcare, retail and hospitality sectors. Routinely, it provides them with stocktaking services. It also values businesses and property, advises buyers and sellers, and brokers insurance and loans.

It makes good money by cross-selling these services, so a customer of its valuation business might become a customer of its financing business.

Having worked out how the company makes money (its business model), the next step is to work out what challenges it faces and how it plans to overcome them and make even more money (its strategy).

Looking forwards

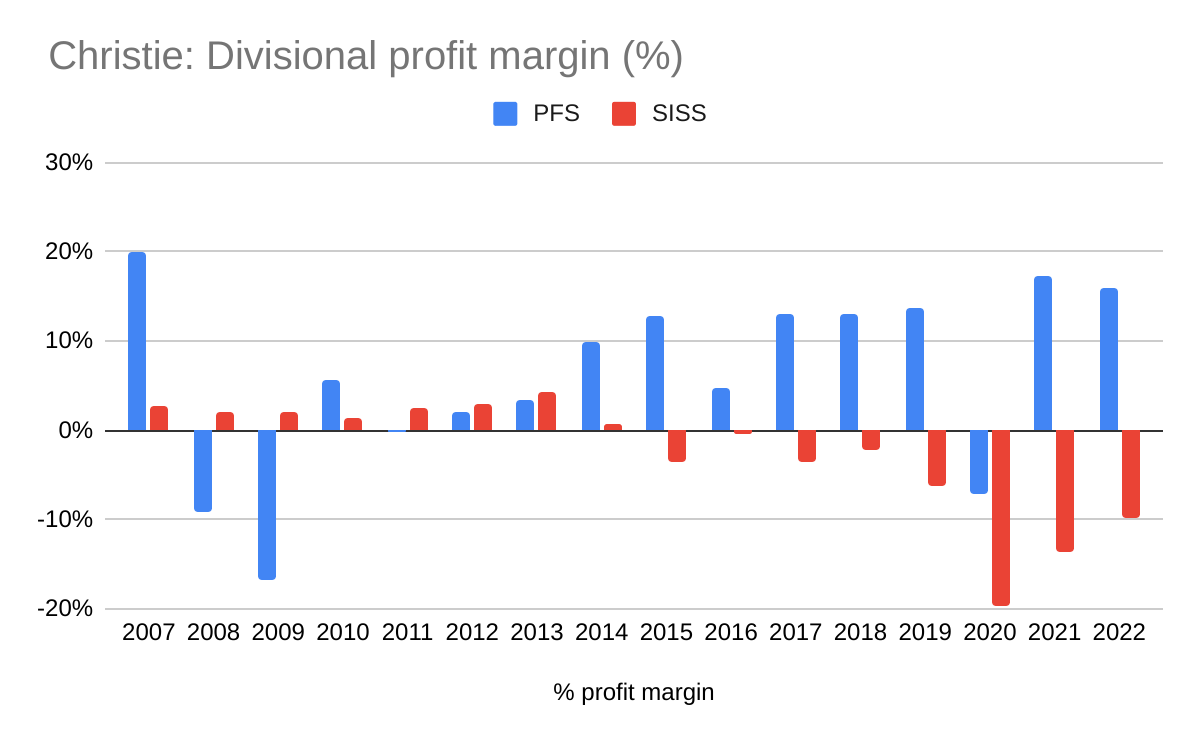

As it happens, there is one big and obvious challenge, the stock-taking division has been losing money:

Source: SharePad > Financials > Company

This may well be Christie’s Crux, a term I have stolen from the title of the latest book by Richard Rumelt, a highly regarded strategist. Unsurprisingly, the book is titled “The Crux”.

By identifying and focusing its action on the Crux, a challenge that is both solvable and promises rich rewards, a company should improve its performance by coherent action.

While the tools of business model analysis tells us how a company makes money, the tools of strategists tell us how that might change.

To understand the problem of Christie’s loss-making Stock and Inventory Systems & Services (SISS) division, I turned to three parts of its annual report:

- The segmental report

- The narrative reports at the front of the annual report

- The risk report

Perhaps the most revealing was the segmental report.

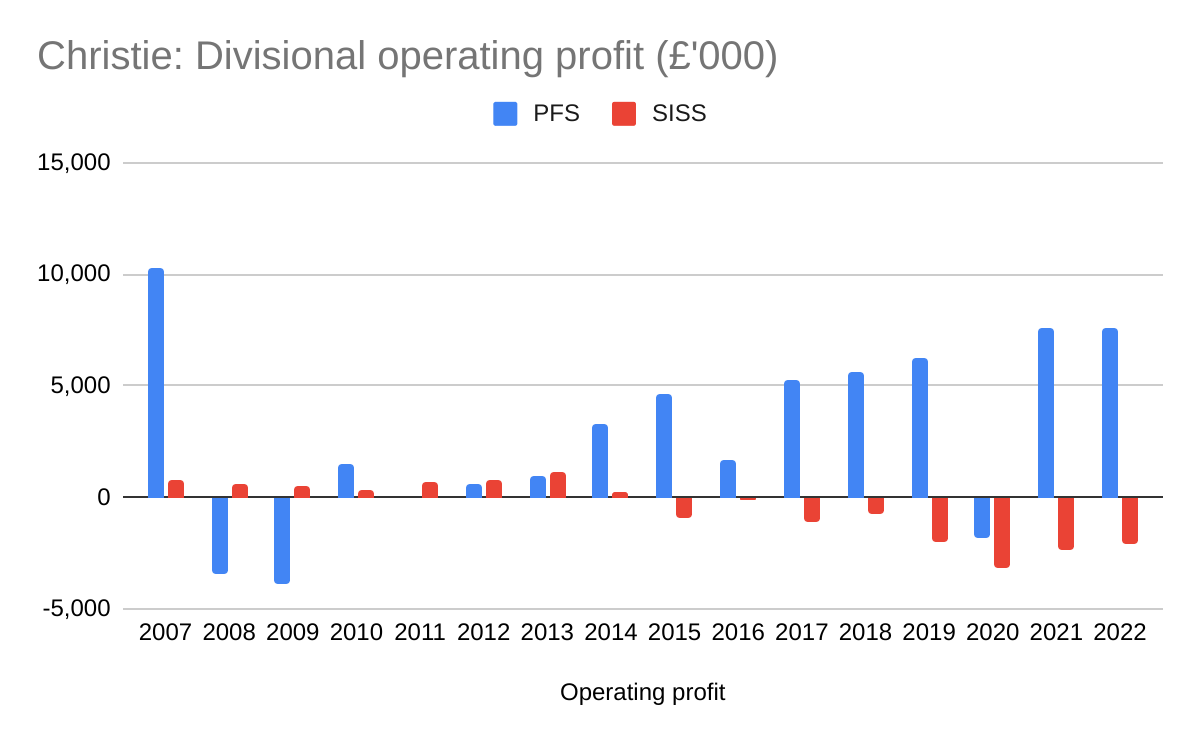

By plotting the performance of the company’s two divisions (Stocktaking and everything else – aka Professional and Financial Services (PFS)) over time, we can see that the problems at SISS are not just because Christie’s employees could not enter the shops, warehouses and restaurants of its customers during the lockdown to perform stocktakes.

The division has been loss-making since 2015 (red bars):

Source: Christie annual reports, 2008 to 2022

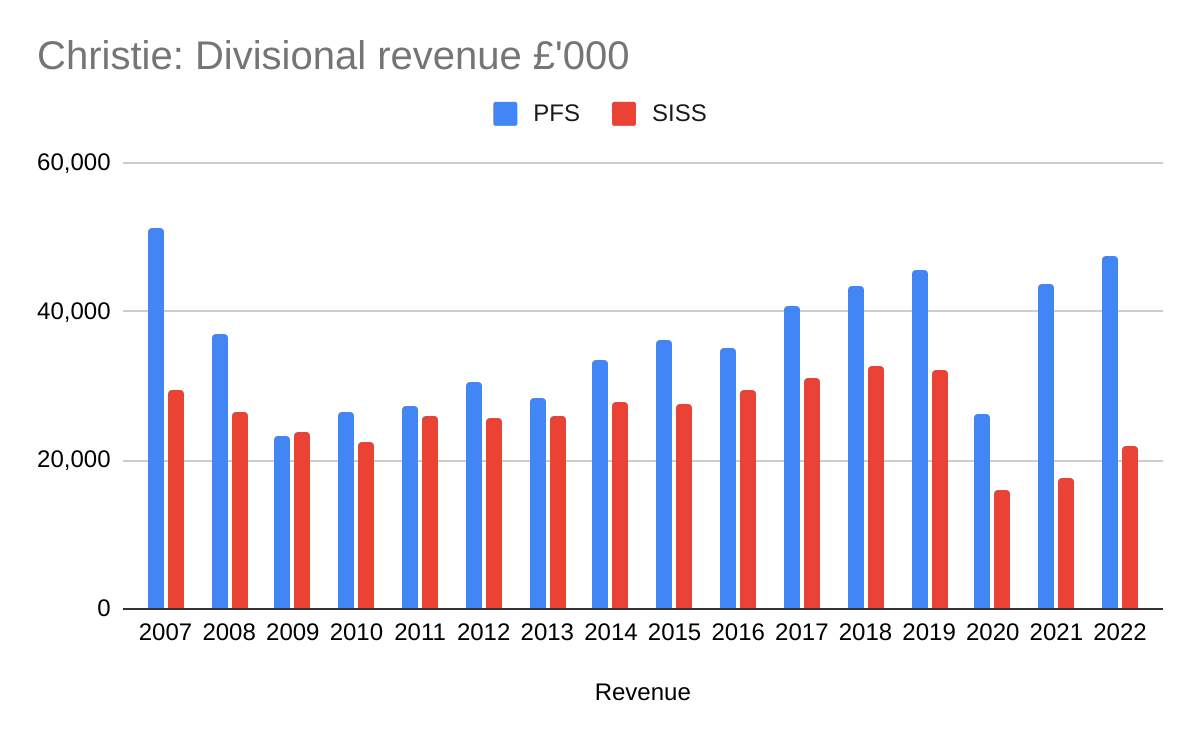

Losses intensified during the pandemic, when revenue fell dramatically (red bars):

Source: Christie annual reports, 2008 to 2022

So the pandemic only explains some of the losses, and the SISS division’s incomplete recovery may be explained by some other factor, perhaps the same one that caused it to lose money before the pandemic.

Technological disruption

My theory is technological disruption.

The SISS division is made up of two venerable stocktaking businesses, Orridge and Venners. They made their reputations periodically checking and counting the stock on the shelves and in the warehouses of pharmacies and retailers.

Today, these customers are increasingly using online stocktaking, which tracks and manages stock in real-time using barcodes, Radio Frequency Identification (RFIC) tags or mobile apps connected to the cloud. These systems are more efficient and less error-prone than human stocktaking.

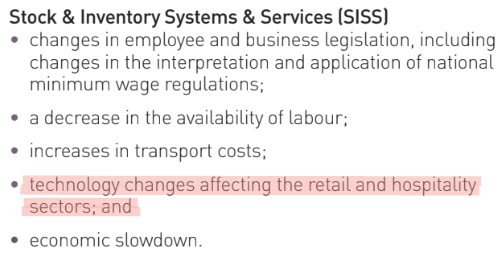

Christie recognises the risk tersely. Its risk reports simply states:

Source: Christie annual report 2022

And Christie’s recovery strategy for the SISS division is to drum up more business and invest in its own online stocktaking platform, data storage, and security.

To my feverish mind, the popularity of online stocktaking raises a number of risks.

The company faces new competitors, software companies selling accounting or enterprise resource planning software with inventory management capabilities for example.

Christie is creating new capabilities in technology as it seeks to develop software products that it can monetise, but it may not be building on existing strengths.

And many of the new ecommerce and hybrid internet/high street retailers that are prospering, perhaps at the expense of Christie’s more traditional customer base, will have developed or adopted other online stocktaking systems.

There are probably other challenges too. They are not necessarily insurmountable but it is conceivable that we are witnessing a shuffling of the deck, challenging Christie, and providing opportunities for competitors.

Third way

In the past I have taken a pretty simplistic view towards profitable companies with loss making divisions: either they will sort out the division or they will shed it.

Christie looks profitable enough even while it shoulders SISS. Just think how profitable it would be without it, or with a profitable SISS.

But a finer appreciation of the business model leads to a third possibility. Perhaps Christie cannot afford to shed the division even though it loses money.

Stocktaking is a regular activity. Working with customers every month, or quarter, or at least every year might be a great opportunity to cross-sell other services, required less frequently and less regularly.

But if stocktaking is reduced to being a component of a software platform, perhaps this opportunity is diminished.

This is doubly important, because Christie’s other division, PFS, has not always been capable of carrying the group’s performance.

You have to go back to the period of the Great Financial Crisis to see that PFS has made dramatic losses (blue bars) when economic conditions are dire:

Source: Christie annual reports, 2008 to 2022

The annual report says PFS performs strongly when the economy is doing well because that is when companies want to buy the assets of other companies. The corollary, presumably, is that it underperforms when the economy is challenged.

Before 2015, the SISS division was more stable, acting as ballast for the group, but I do not think that can be taken for granted in future.

On the day I drafted this punchline, Christie announced that profits in 2023 would be markedly lower than anticipated. Although recovery continues at SISS, deals in the PFS division have been delayed.

I do not know whether that is a harbinger, but by looking back at the distant past and staring into the future, what seemed to be a strong and stable business now seems to have significant cruxes to overcome.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.