A business that aims to save its customers money should be doing well during a cost of living crisis. Phil looks at Moneysupermarket.com and asks if the recent rally in its shares has further to go.

The business

Moneysupermarket (MSM) is the UK’s largest price comparison website. It aims to save people money on household and personal bills by giving them access to a huge selection of price comparisons with the ability to switch providers and buy products.

It also gives the companies which provide the products and services an easy way to acquire customers. MSM had 11.1m active customers in 2022 and saved them an estimated £1.8bn.

The business trades under several brands on the internet including moneysupermarket.com, moneysavingexpert.com, travelsupermarket.com, icelolly.com, broadbandchoices.com and quidco.com. It also owns a business called Decision Tech which sells price comparison technologies to third-party brands.

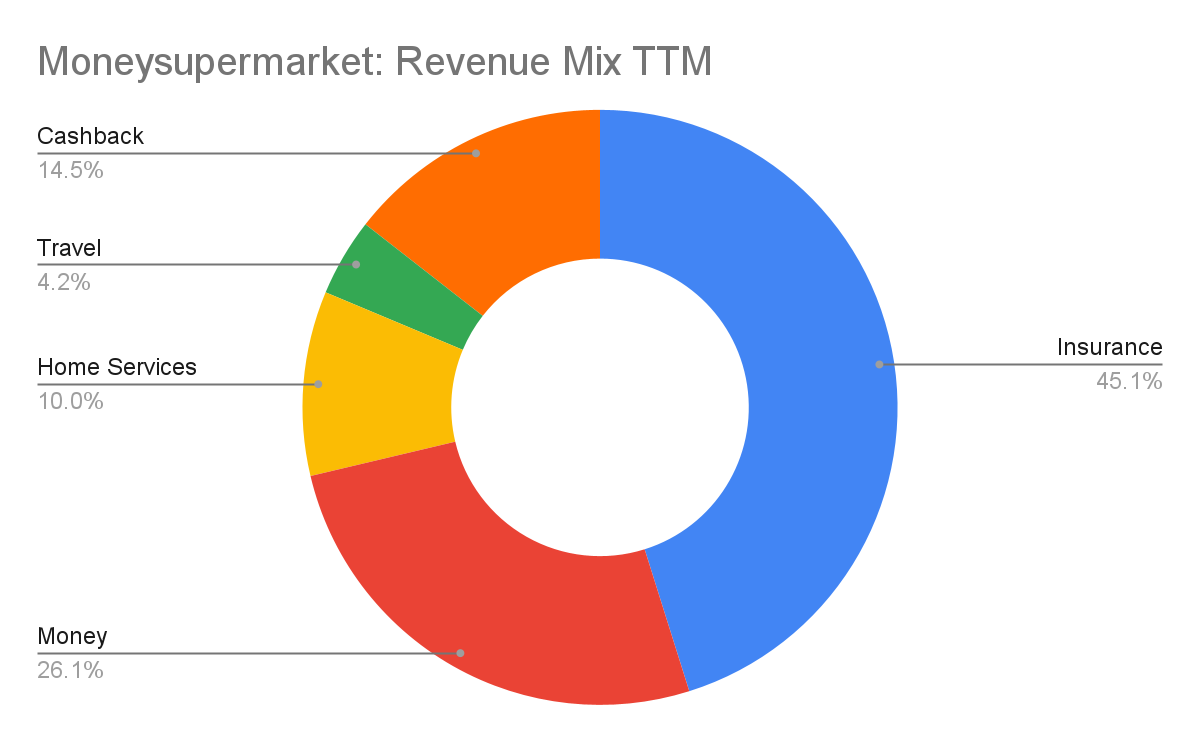

The company generates revenue from five main sources:

Source: Company Reports

- Insurance

This has been the company’s biggest revenue stream for many years. It provides price comparisons on car, home, life and pet insurance.

- Money

The bulk of revenue in this segment comes from customers switching credit card providers. It also provides comparisons on personal loans and mortgages. Registered customers have the ability to monitor changes in their credit score and choose better credit and loan products off the back of it.

- Home Services

This involves comparison services on electricity, gas, broadband and mobile phone providers Customers used to be able to be a member of MoneySavingExpert (MSE) Cheap Energy Club and monitor their energy bills against changing offers from energy providers.

They would receive alerts when they could switch and save significant amounts of money. This service has currently been paused as competition in the energy market has stopped with prices being set by a price cap determined by industry regulator OFGEM.

The MoneySavingExpert(MSE) website plays a big role in this business. It benefits from a high-profile and trusted figurehead in Martin Lewis who appears regularly on television. The website is a significant part of the company’s branding and advertising efforts.

- Travel

Travelsupermarket.com provides price comparisons on flights, car rentals, hotels, travel insurance, airport transfers and airport parking. Along with icelolly.com, it also provides price comparisons on package holidays.

- Cashback

Quidco is a website which allows users to get cash back on their purchases when buying from more than 5,000 consumer brands. It has over 10 million members -membership is free – who get part of Quidco’s commission as a reward for shopping with its brand partners.

How the company makes money

MSM gets paid when its customers buy a product or switch providers. It receives a fixed fee based on each product sold. There are no contracted revenues in this business and the size of its revenues is largely dependent on the amount of switching and buying its customers do.

A significant proportion of its revenues are directly influenced by the price of products in certain markets and the promotional strategies of the companies providing them. For example, if energy bills and insurance premiums are rising, there tends to be a lot more switching activity which tends to boost MSM’s revenues.

Money and Travel products are much more sensitive to the ups and down in the economy. In a recession where lenders tend to become more cautious about lending money, there tends to be fewer promotional deals on credit cards and personal loans. People also tend to go on holiday less often which means that there are fewer transactions on packaged holidays and related products.

The company’s revenues have been hit by changes to insurance regulation which has stopped insurance companies offering lower prices to new customers than existing ones. This initially reduced switching activity when it was introduced in 2022 but switching levels have been picking up again.

High sales volumes and large fixed costs create a very profitable business

MSM’s success or otherwise comes down to its ability to scale its website and data technology platforms. Marketing is by far the company’s biggest cost along with wages.

Whilst some of these costs can be flexed in response to changing trading conditions, they are largely fixed if the company wishes to stay competitive. This introduces a lot of operational gearing into the company and makes its profits very sensitive to changes in revenues.

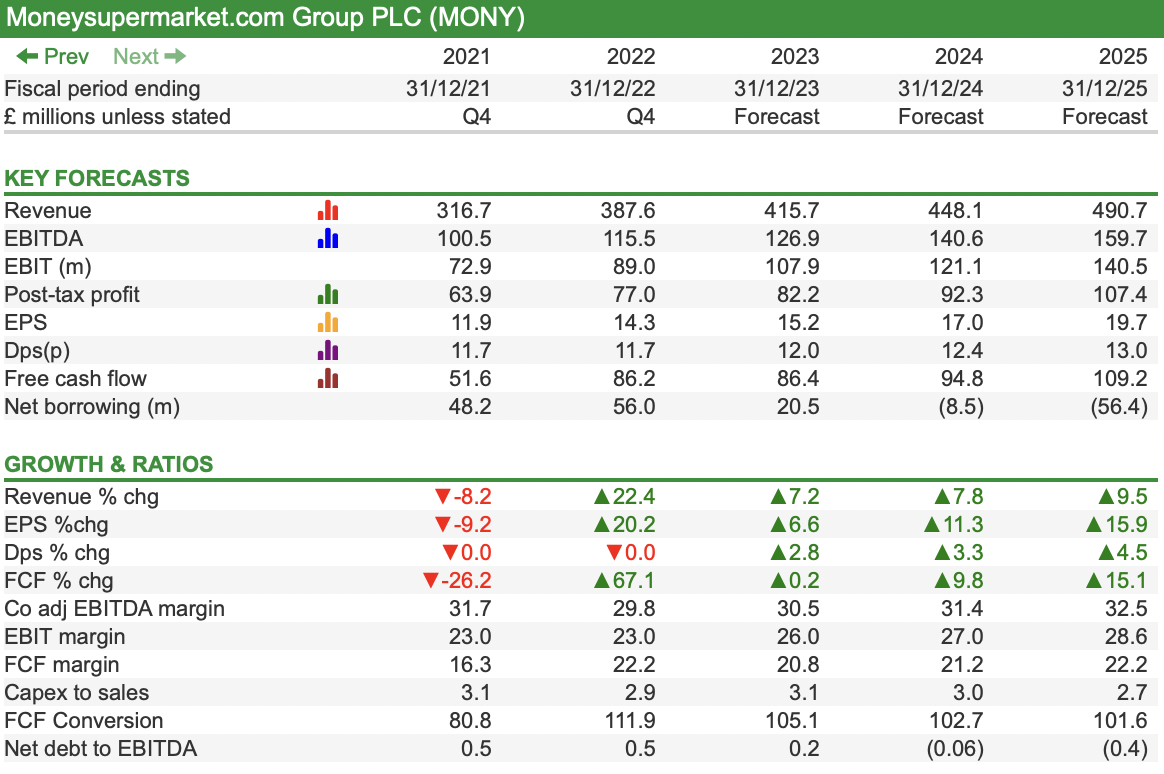

Once these large fixed costs have been covered, the company’s sales volumes have a very high drop-through rate to profits. This is what allows MSM to have some very impressive levels of profitability and cash generation as seen in the table below.

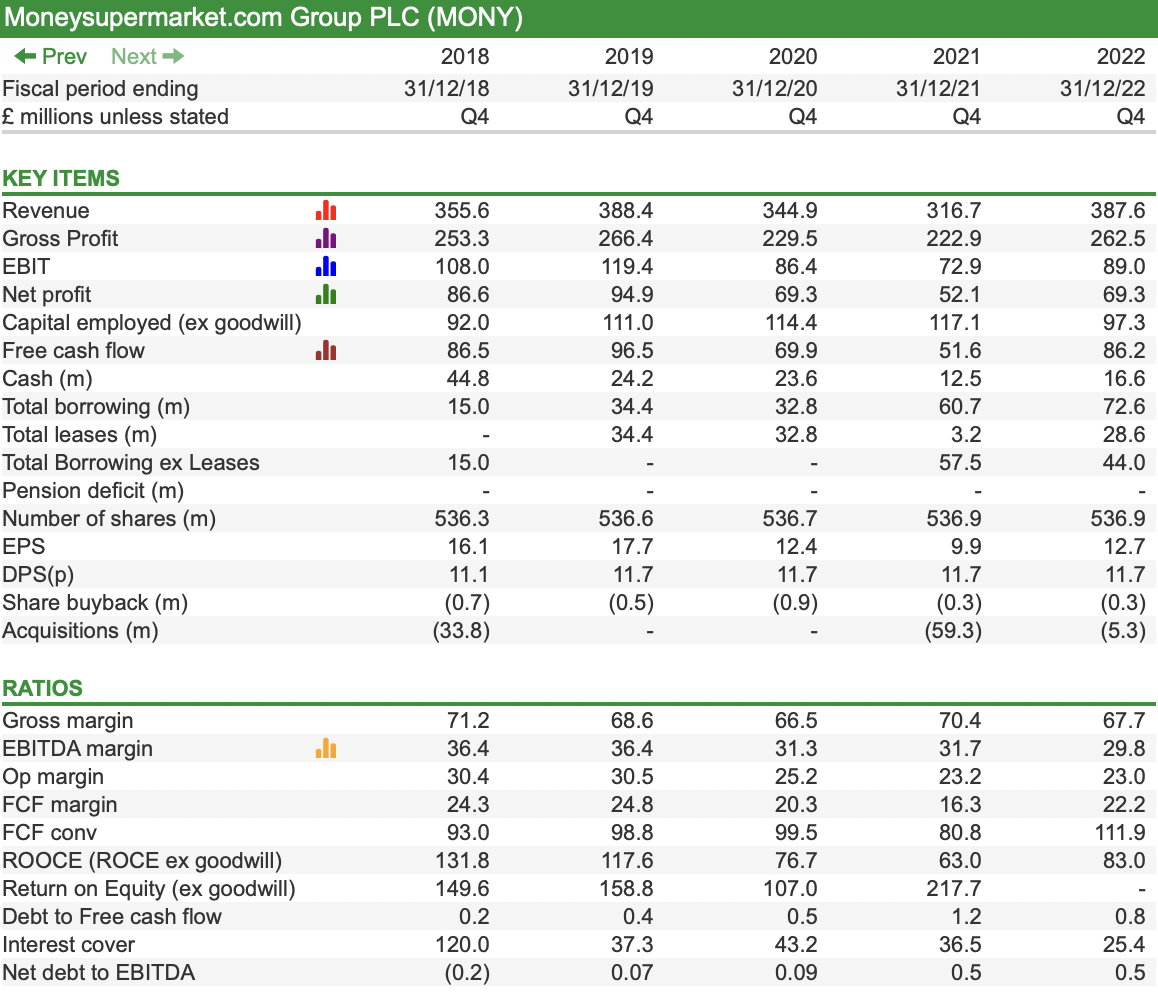

Key financial performance measures

Source: SharePad

You can see the impact of operational gearing in 2020 and 2021 as Covid-19 disruptions saw operating profit (or EBIT) fall by more than the fall in revenues. Cost inflation in 2022 has muted the gearing effect as revenues recovered.

If you are using SharePad to screen for very profitable companies using ratios such as operating margins, return on operating capital employed (ROOCE) or free cash flow margins, MSM is probably going to be on your list of results.

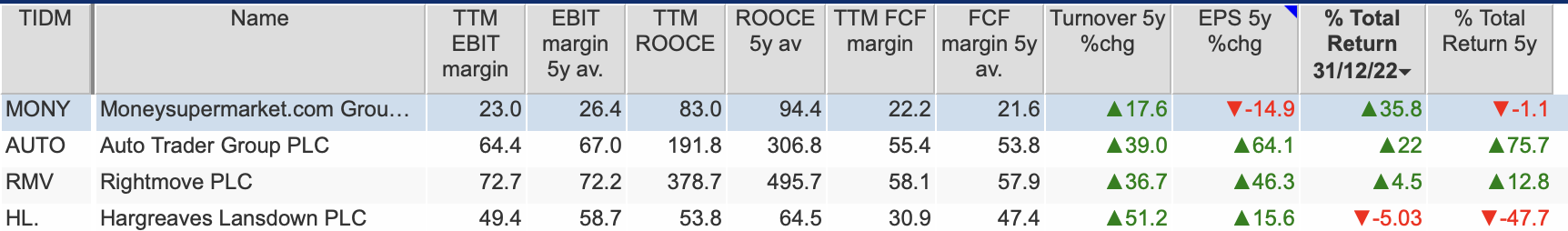

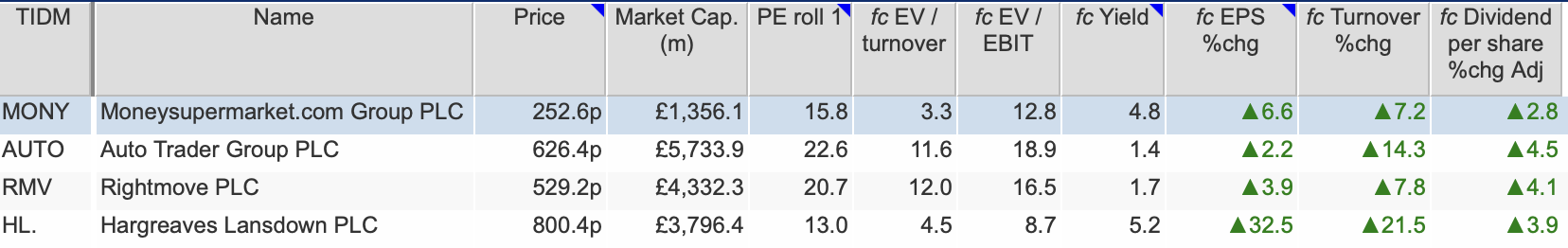

The company has much in common with similar leading online platform/portal businesses in other industries such as Rightmove (LSE:RMV), Autotrader (LSE:AUTO) and Hargreaves Lansdown (LSE:HL).

They are generating levels of profitability and cash generation that make them standout as exceptional companies – especially if they can keep on growing.

Growth has been the problem for MSM in recent years. Profits are still some way below pre-Covid 19 levels and are not expected to exceed them until 2024 at the earliest. This can explain a great deal of MSM’s poor performance over the last five years.

Moneysupermarket vs other platform businesses

Source: SharePad

Market leadership underpins strong competitive positioning

The price comparison market is very competitive. You only have to watch television for a short time to see the likes of MSM, ComparetheMarket, Confused.com and Go.compare with their very prominent adverts telling you how much money you can save by visiting their websites.

Competition also comes from insurance companies such as Direct Line and Aviva who are not on comparison websites.

MSM’s key competitive advantage is its size and its large customer base. As the market leader, it means that service providers who want to win customers see it as essential to be on the platform. Size also gives MSM significant bargaining power in the form of exclusive deals with providers that make its customer offer more competitive.

The other key competitive battleground is with the website or mobile app experience. MSM has spent a lot of time making the online buying process simpler and faster as well as saving customers money.

MSM has huge amounts of customer data which allows it to offer bespoke offers to consenting customers such as financial products based on credit ratings. It can also use this data to help service providers offer better products.

The company has invested in moving data to the Google Cloud and combining it with the Braze customer relationship management system in order to improve the effectiveness of its marketing.

Should MSM investors be worried about Amazon?

Last year, Amazon announced that it was going to enter the UK price comparison market. It has set up the Amazon insurance store website and has started to offer home insurance price comparisons.

Source: Amazon.co.uk

Its offer to consumers is selling simplicity, peace of mind and ease of use. It has created an Amazon standard and will provide star ratings and information on claims acceptance rates to help customers make better choices.

Every insurance price comparison will start with the same level of cover in order to give users meaningful like-for-like prices.

The prospect of a retail and technology giant such as Amazon entering your market might cause the price comparison companies a few sleepless nights.

But do they really have anything to worry about?

There’s no doubt that Amazon has a huge customer base and enviable brand recognition. It has the IT infrastructure to manage a price comparison business.

This doesn’t mean it will automatically succeed. Google tried to muscle into the sector a few years ago with price comparisons on credit cards, mortgages and car insurance. It didn’t work out well and the company exited the market in 2016.

Amazon’s current offer is also very thin with just four insurance partners. Whilst this number will grow over the coming months, it is a long way from threatening the choice and range of services offered by the major price comparison sites.

Where’s the growth going to come from?

Having high-profit margins and returns on capital are all well and good, but investors are unlikely to make money from owning the shares unless future revenues and profits can grow.

If current analysts’ forecasts are anything to go by, then the outlook for the next three years looks pretty decent.

Revenues are expected to grow in the 7-9 per cent range with an improvement in profit margins giving an extra boost to profits. If analysts are right – and they often are not- then earnings per share (EPS) is expected to increase from 14.3p in 2022 to 19.7p in 2025.

Forecasts

Source: SharePad Note: Turnover has been renamed as Revenue by editing available in SharePad

2023 has started well with a strong recovery in car insurance switching and travel products. Higher interest rates have also seen Money revenues grow by 9 per cent in the first quarter of the year. These trends are expected to continue for the rest of 2023.

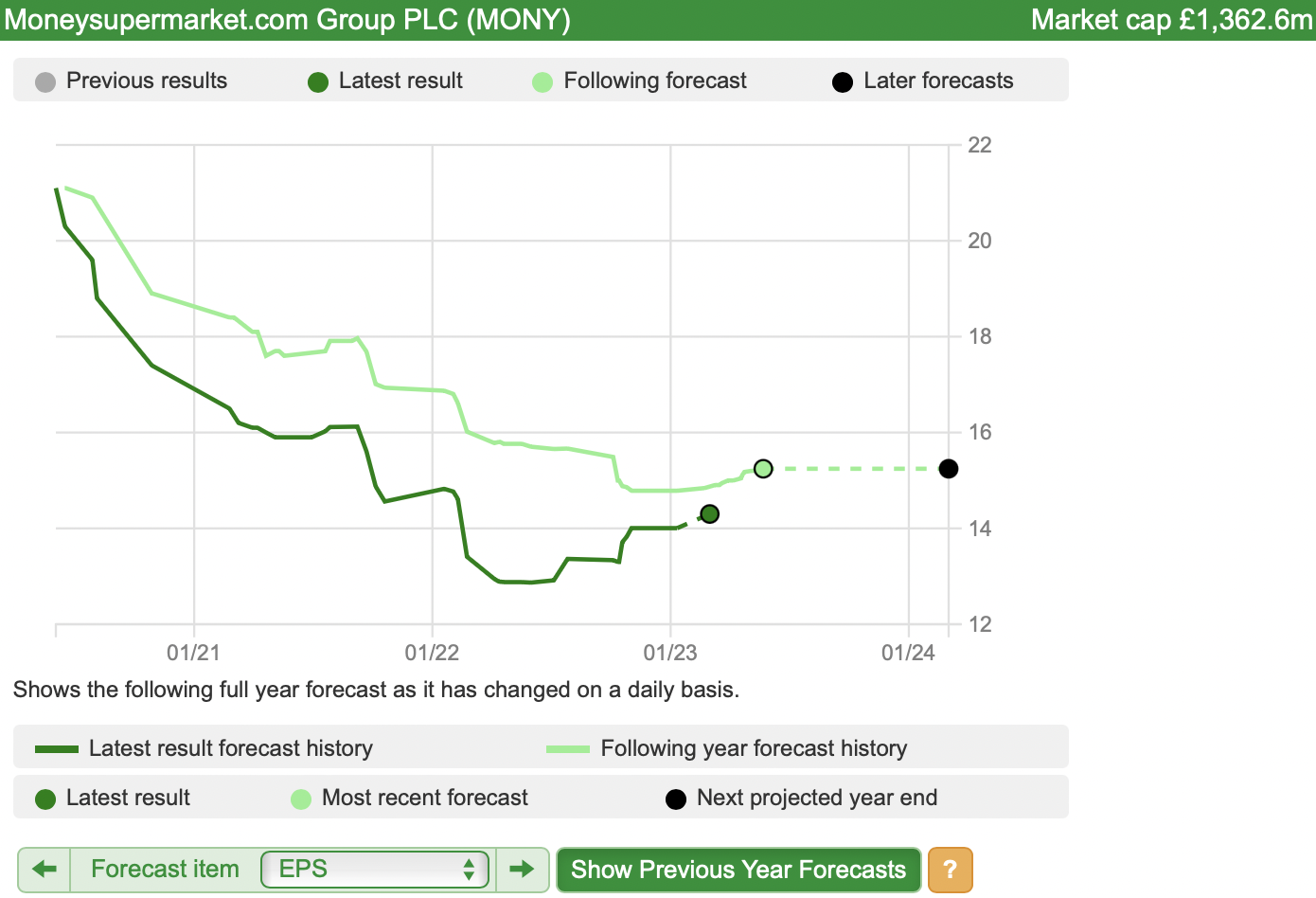

After a long period of analysts downgrading their EPS forecasts, they have now stabilised and slightly improved. If this is a turning point, then it is possible that further forecast upgrades could be forthcoming given the current revenue momentum and operational gearing in the business.

2023 EPS downgrades have ended – will upgrades follow?

Source: SharePad

The company is attempting to make the business more efficient in its use of customer data and its search engine optimisation (SEO). There is a big focus on paid SEO in order to gain website traffic in the most cost-effective way as well as getting more free traffic. This has the potential to improve margins and offset underlying cost inflation in the business.

MSM is countering the threat of Amazon by using its data to simplify and shorten the buying process on its websites. This should help it retain customers and improve the ability to cross-sell products.

The Quidco business also has the potential to bring on more brand partners and with it more customers to MSM. The current pressure on living costs provides MSM with a great opportunity to do this.

The big unknown is when the energy market will re-open to competition and what expectations are baked into analysts’ forecasts.

MSM has said that it does not expect any meaningful switching activity revenues from energy products in 2023. In a radio interview last week, Martin Lewis said that he expected energy companies to make offers to existing customers rather than trying to obtain switching customers.

Falling wholesale gas prices are expected to see household energy bills falling below OFGEM’s price cap which will be a spur to more competition eventually.

Depending on the scale of recovery factored into 2024 and 2025 forecasts, returning energy competition is likely and could support future profit forecast upgrades.

MSM looks to be in good shape with a better outlook than it has faced for some time. The stock market is well aware of this with MSM shares delivering total returns of nearly 36 per cent year-to-date.

Have the shares got any further to run?

Valuation does not look excessive

Source: SharePad

The shares may pause for breath without further EPS upgrades but the current valuation of them does not look excessive. At 252p, they are trading on a one-year forecast rolling PE of 15.8 times which even in a world of higher interest rates – which reduces stock market valuations – looks alright for a quality business with expectations for some growth.

You can argue that Auto Trader and Rightmove have better track records when it comes to earnings stability and growth and therefore warrants higher valuations than MSM. That said, the valuation premiums are significant.

If MSM shares remain on a PE of around 15.8 times then the share price could continue to rise over the next few years from earnings growth alone. If 2025 forecasts were realised – or expected to be- then a share price of 311p (15 x 19.7p) is possible.

A forecast dividend yield of 4.8 per cent is an added attraction, although dividend growth is expected to be modest.

Investors could be forgiven for thinking that the opportunity in MSM shares has passed for now. That said, the brighter outlook for the business in the current economic climate could also keep on rewarding them.

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.