Watches of Switzerland shares have been stellar performers since listing on the London market nearly four years ago.

However, since peaking at over £15 at the end of 2021, they have more than halved in value. This is despite profits continuing to grow and forecast guidance being maintained.

The sales of luxury watches boomed during the Covid-19 pandemic which saw Watches’ revenue and profits follow suit. Whilst investors rightly expect the market to calm down, the loss of enthusiasm for Watches’ shares has not been matched by those of the companies that make luxury watches.

Source: SharePad

Granted, Watches of Switzerland is only a retailer or distributor of luxury watches and is not capturing the same value that accrues to the makers of them. That said, it is not unreasonable to think that the long-term future of both are linked.

Perhaps another explanation for the prolonged weakness of the share price is that investors now see the company in a different light. Was the previous valuation of the shares too high for a distributor given an unsustainable boom in its markets?

There has also been a lot of concern about the strength of consumer spending given the current fragile economic backdrop. It is possible that even the wealthy buyers of luxury watches might keep their hands in their pockets.

It is also possible that the stock market has treated Watches of Switzerland too harshly.

The company has a track record of resilience and has a credible growth strategy. This begs the question as to whether now might be a good time to have a closer look at the company.

The business

Watches of Switzerland is the largest retailer of luxury watches in the UK. It also has a growing business in the US and has recently opened showrooms in European markets.

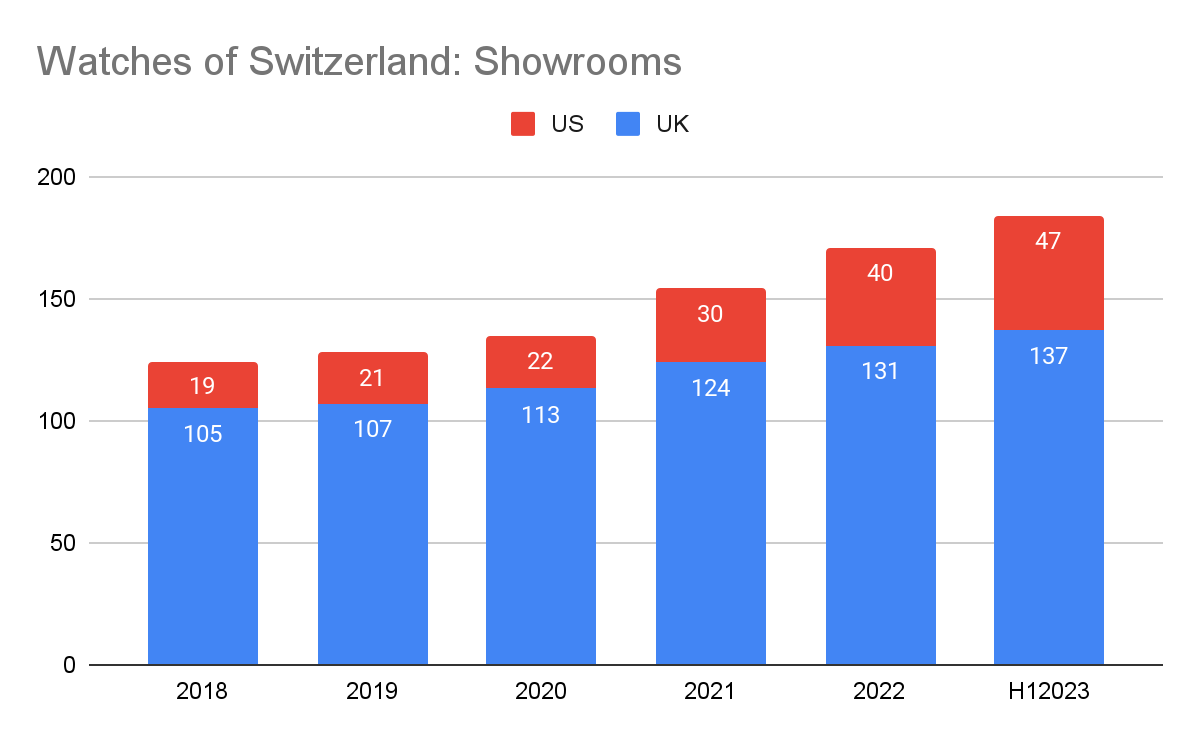

As of October 2022, the company was selling from 184 showrooms (137 in the UK and 47 in the US) of which 115 were multi-brand and 69 were single or mono-brand.

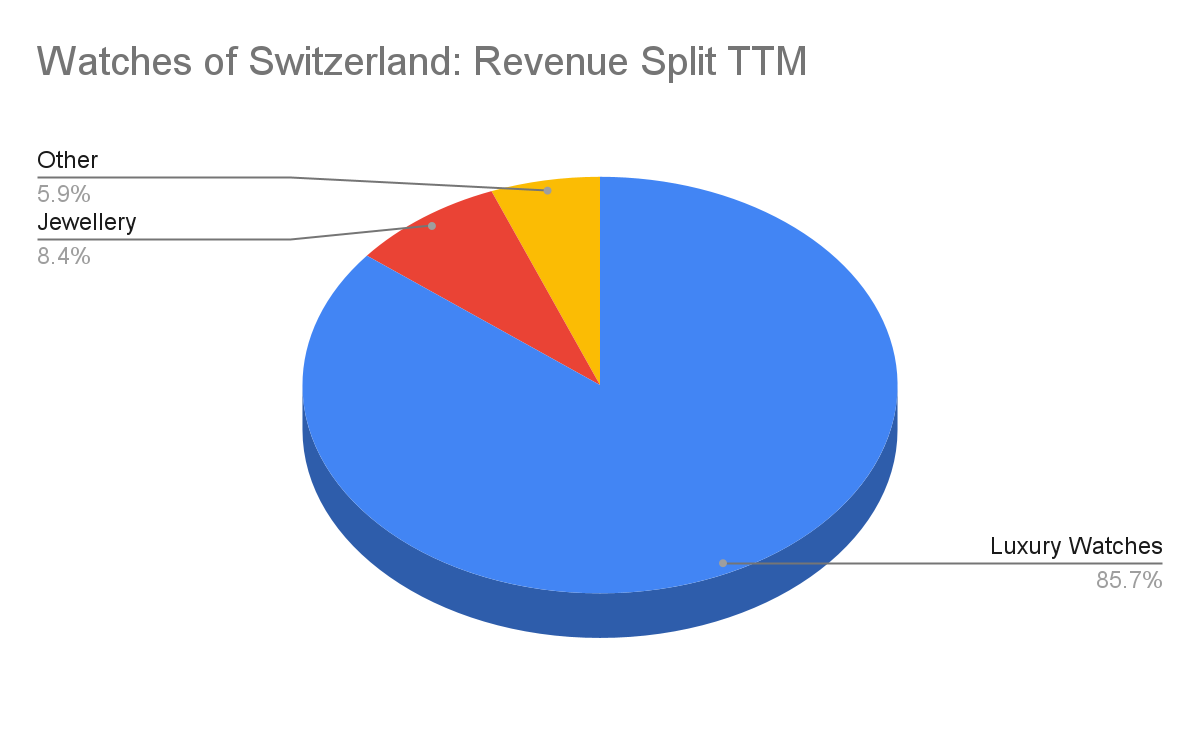

It generates revenue from the following sources:

Source Watches of Switzerland. TTM to end January 2023

In addition to watches and jewellery, the company generates revenue from servicing and repairs, insurance and financing.

By far the main driver of the company’s profits and share price going forward is the retail market for luxury watches. Jewellery has all the characteristics of a mature business and is not expected to deliver meaningful growth.

Luxury watches have been an attractive market for some time. The market is dominated by the following big brands:

- Rolex

- Patek Phillippe

- Tag Heuer

- Omega

- Breitling

- Cartier

- Audemars Piguet

The manufacturers have gone to great lengths to preserve the value and exclusivity of their products. This is evidenced by an ability to raise prices year after year and for pre-owned watches to sell for higher prices than new ones.

One of the keys to maintaining the brand value is controlling who can actually sell the watches. This is done via selective distribution agreements (SDAs) which grant exclusivity to third-party retailers in geographic markets on a store-by-store basis – a barrier to entry which is helpful for the retailers.

Online sales are also tightly controlled by the manufacturers. In order to sell watches over the internet, a physical showroom presence is usually necessary.

The SDAs are not permanent but are usually based on long-term relationships built up over years between the retailer and the supplier. There is a risk that the luxury watch manufacturers could decide to cut out the distributors, but as long as the relationship delivers the sales and brand value they want it is unlikely to happen any time soon.

In return for an SDA, the retailers have to look after the manufacturers’ interests. This includes holding minimum levels of stock, investing in showrooms and training staff.

Demand for luxury watches has exceeded supply for many years. This has led to substantial growth in the market for pre-owned watches. In many cases, these watches have appreciated in value and sell for prices greater than the recommended retail price (RRP) of new models.

The waiting list for prestigious models can be long. This underpins industry volumes and prices and promotes stability in revenues and profits.

The backdrop for Watches of Switzerland seems to be favourable. With demand underpinned and supply and competition constrained it should be possible to make decent long-term profits. Its business strategy is designed to achieve this.

A strategy for growth

Watches has set out a strategy to grow the business out to 2026.

A big part of the strategy involves diversifying the business away from the UK. At the moment, the UK accounts for just under two-thirds of total revenue. Whilst the UK remains the fifth largest luxury watch market, the potential growth is likely to come from the US – the largest market – and selective targeting of European markets.

By making acquisitions and consolidating distribution in the US, along with an organic rollout of showrooms, Watches wants the UK share of revenues to fall to around 45 per cent, with the US growing to around 47 per cent and Europe 8 per cent.

Source: Watches of Switzerland

Watches now has a presence in 14 US states and continues to grow its presence in key US cities.

This year will see it open six mono-brand boutiques in Europe in locations such as Copenhagen, Stockholm and Dublin.

Increasing the number of showrooms should be positive for long-term revenue growth but there are also other ways for the company to grow.

Showroom refurbishments in the UK and the US are an ongoing cost of having SDAs, but done well they can generate underlying sales increases.

Watches is also investing heavily in customer relationship management and marketing and has been growing its customer lists. This allows it to differentiate itself from its competitors – mainly independent retailers – and increase its sales.

As we can see, the boom in luxury watch sales in recent years has served the company well, and seen it deliver a big improvement in its financial performance.

Financial performance snapshot

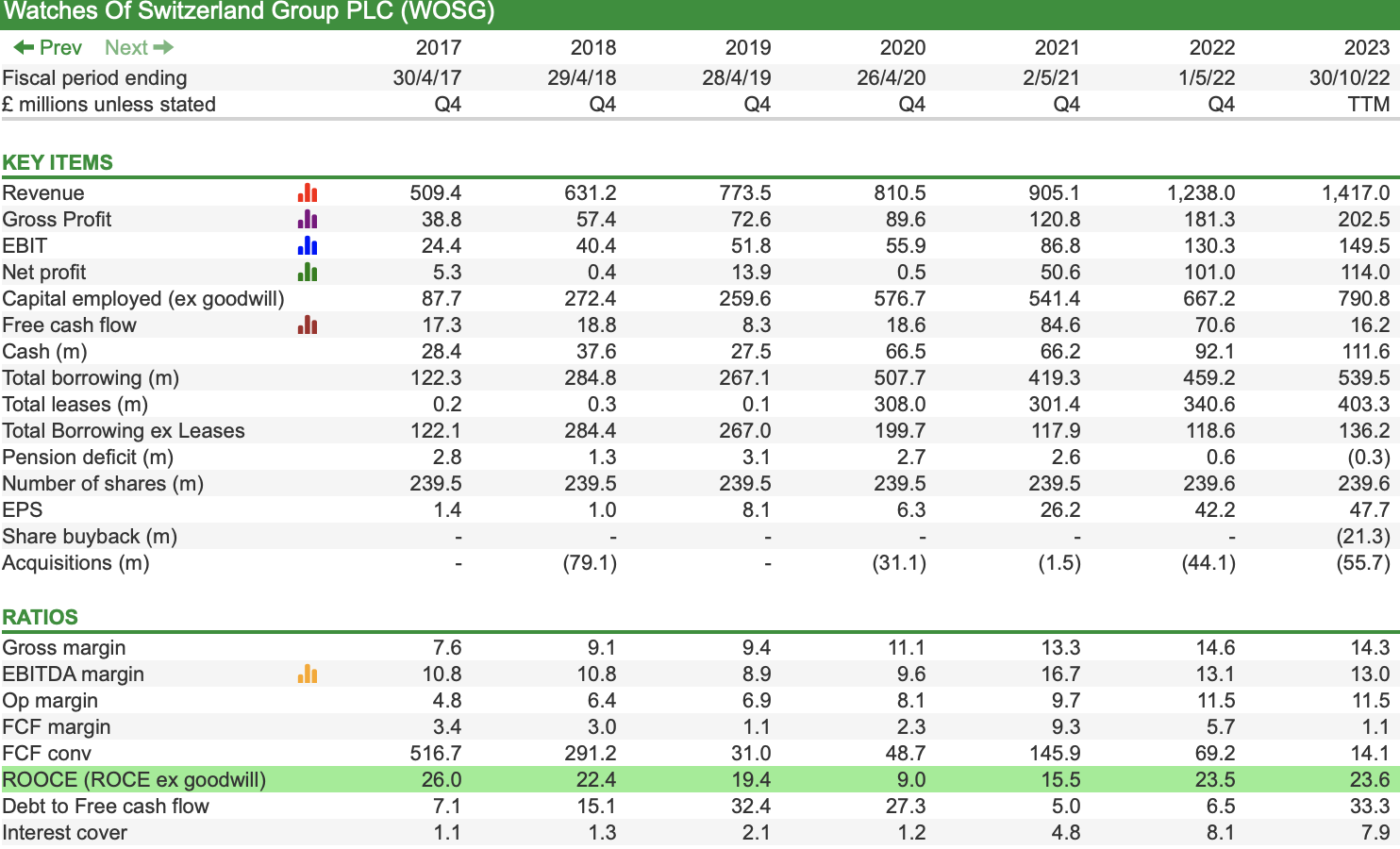

Source: SharePad

Retailing is not usually a high-profit margin business and this is the case here. That said, operating margins have almost doubled over the last five years. Return on operating capital employed (ROOCE) is currently running at a very respectable 23.6 per cent.

Debt levels are not excessive with interest cover -based on current operating profits – a very comfortable 7.9 times.

One area of Watches’ financial performance which doesn’t look too great is its free cash flow generation. Free cash flow margins are virtually non-existent at the moment, whereas the conversion of earnings per share (EPS) into free cash flow per share (FCFps) is a poor 14 per cent on a trailing twelve-month (TTM) basis.

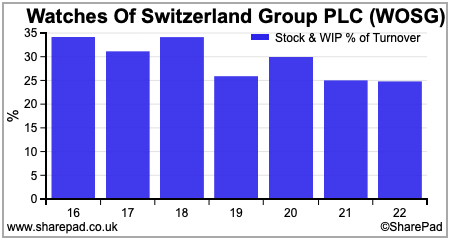

The chief reason for the poor free cash flow performance has been sharply rising stock levels. Rising stocks have consumed cash flow but have actually fallen as a percentage of revenue.

For most retailers, a high stock-to-turnover ratio would be a cause for concern as it raises the risk that unsold stock will have to be discounted heavily – at the expense of profits – in order to sell it.

In the case of Watches of Switzerland, there’s probably not a lot to worry about.

First and foremost, luxury watches don’t tend to sell as quickly as other retail items such as clothing. For example, a business such as Next (LSE: NXT) or JD Sports (LSE: JD.) tends to have a stock-to-turnover ratio of 10 – 14 per cent.

High stock levels are also a requirement of SDAs and are needed to maintain high levels of customer service. However, this has not been a problem for Watches as luxury watches have been appreciating in value in recent years which means that the risk of obsolescence and a big hit to profits is normally low.

This is backed up by very small stock losses expensed to the income statement in recent years.

Should the luxury watch market enter a prolonged slump then clearly the company would face a sizable risk to its profits. This is not expected at the moment.

Weak share price despite resilient profits

Watches of Switzerland looks to be a business in pretty good shape. The stock market does not seem to share this view given the poor share price performance over the last year.

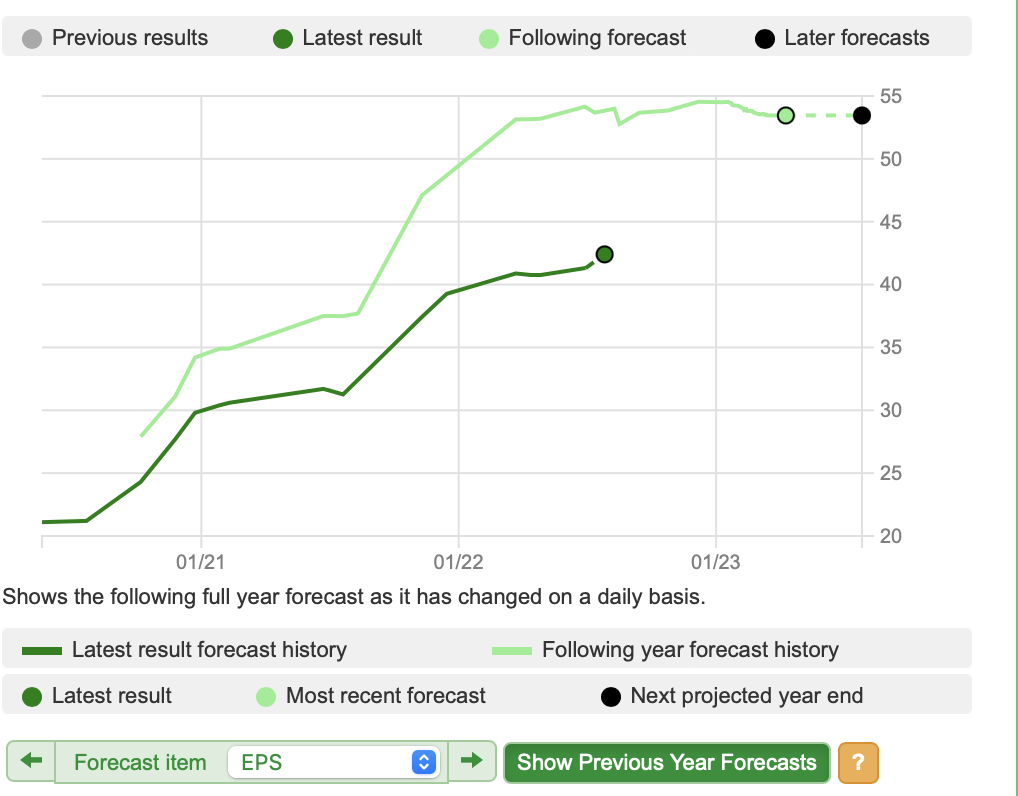

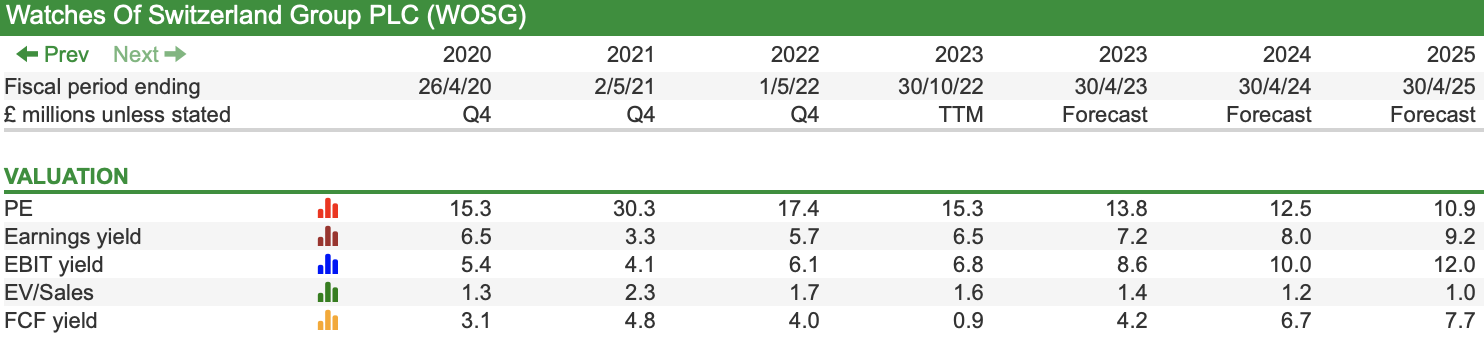

Analysts’ forecasts are often wrong and slow to recognise turning points in a company’s fortunes. At the moment, they are currently predicting some fairly reasonable profit growth.

Forecasts

Source: SharePad

What’s also reassuring is that consensus EPS forecasts for the year to April 2023 have held up remarkably well.

Watches of Switzerland: Trend in FY2023 Consensus EPS estimates

Source: SharePad

Looking at the annual revenue run rate based on the nine months to the end of January, it is on track to hit company guidance for the full year.

Watches of Switzerland: Revenues

| Group £m | 2018 | 2019 | 2020 | 2021 | 2022 | TTM |

| Luxury Watches | 492.3 | 631.4 | 679.9 | 788.5 | 1046.5 | 1264.5 |

| Jewellery | 68.9 | 74.7 | 69.1 | 60.7 | 108.8 | 123.8 |

| Other | 70 | 67.4 | 61.5 | 55.9 | 82.7 | 87.7 |

| Total | 631.2 | 773.5 | 810.5 | 905.1 | 1238 | 1476 |

Source: Company Reports

There has been some chatter that weak jewellery sales at the Q3 update in January was behind the subsequent share price fall. I’m not convinced given the dominance of watch sales in the revenue mix which have continued to grow.

In recent weeks, management of luxury watch brands such as Patek Phillipe and Oris have commented that they are seeing signs of softness in sales according to an article on the Bloomberg website.

If this feeds through to Watches of Switzerland then there are grounds for thinking that current 2024 consensus forecasts for 12 per cent revenue growth and 10 per cent EPS growth might be too optimistic.

The company will release a full-year trading update on 17th May. If it downgrades guidance for 2024 then the shares are unlikely to do well in the near term. If they are maintained, then the current valuation of 12.4 times one year forecast rolling EPS looks reasonably attractive for what appears to be a very solid business.

Source: SharePad

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.