Bruce remembers a metaphor from the founder of the Georgian Stock Exchange and wonders how it might apply to Chinese financial markets. Companies covered: FEVR, ELCO, FNX, BOKU.

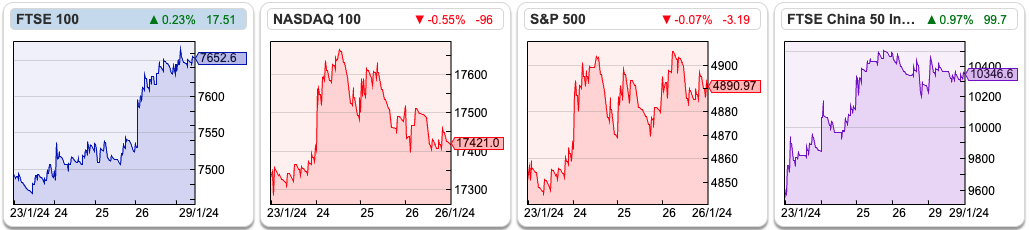

The FTSE 100 was up +2.2% to 7653 last week. The Nasdaq100 and S&P500 rose +2.4% and 1.1%. Brent Crude was up +4% in the last 5 days, most of which was on Monday morning. Chinese stockmarkets have bounced with the FTSE China 50 up +8.3% and the Hang Seng +7.5%.

The FT has reported that the Chinese authorities have tried to halt the sell-off in domestic equities. For instance, institutional investors have been told not to sell equities and short selling has been curbed. That might explain the short-term bounce but the FTSE China 50 is still down -31% in the last 12 months. ETFs tracking US and Japanese markets are becoming increasingly popular among Chinese retail investors, such that mutual funds were hitting limits that were designed to protect capital controls. The Chinese Yuan (CNY on Sharepad) is linked to the US dollar – but allowed to fluctuate around a narrow band. If the CNY continues to weaken, that could also be bad news for commodities and mining shares.

Many years ago I met the founder of the Georgian Stock Exchange, a chap called Gogi Loladze. He cut a dashing figure and was something of a capitalist philosopher, in the style of George Soros. Autocratic leaders, he said, craft their own narratives, and prevent any data that contradict their stories from circulating. However, these autocrats feared financial markets, because liquidity requires buyers and sellers to trade on good (that is, not unfair) information. The financial markets are like a barometer, it tells you what the air pressure is, and if a storm is blowing in, the meteorological instrument will warn you. That’s in contrast to government statistics like GDP which can be manipulated by less scrupulous leaders.

Gogi was keen to develop the Georgian Stock Exchange because i) it would provide an alternative source of capital in competition to the banking system ii) it would strengthen Georgia institutionally, which at the time wanted to be the “Singapore of the Caucasus” iii) it would make him rich. Building any two-sided platform is hard and he couldn’t get to critical mass and benefit from network effects. The Georgian Stock Exchange still exists but is owned by the large banks, which are not keen to develop it for some of the same reasons above. As a generalisation bankers prefer “discretion” (also known as secrecy) to the circulation of financial information.

Since then it has struck me that Gogi’s insight from a former Soviet Union country could apply equally well to China, which is communist, and increasingly autocratic but has a huge stock market. The Chinese GDP figures were announced a couple of weeks ago and were in line with expectations at c. +5%. No one seems to have a convincing narrative on why Chinese equities are selling off, but I would be wary. Below is a chart showing the FTSE China 50 (XINO) has fallen for 3 consecutive years in a row.

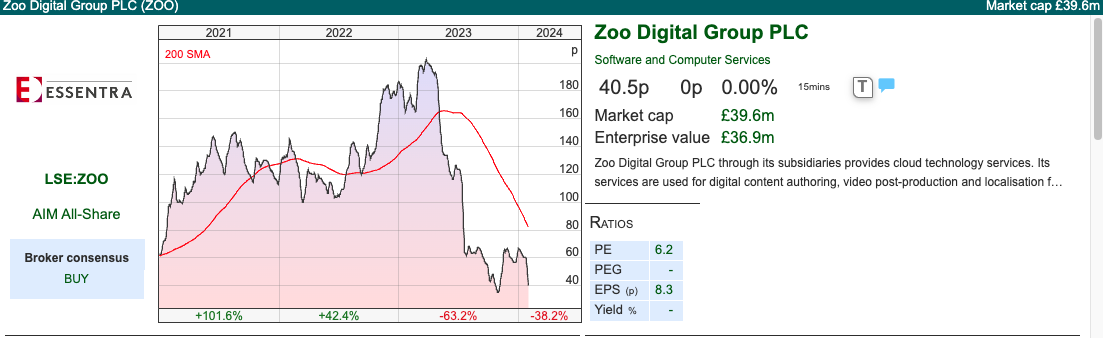

We’ve seen profit warnings from Revolution Bars, Inspecs and Zoo Digital over the last 5 days. The latter had $8.9m of cash at the end of December, whereas Revolution Bars and Inspecs have net debt of £20m and £24m respectively. If I was going to “try to catch a falling knife” I would prefer ZOO because of the cash that they raised in April last year.

On the subject of falling knives, we also saw “inline” trading updates for Sir Martin Sorrell’s S4Capital and Next 15 Group. These have both been hit hard by corporates cutting back on marketing and digital consultancy spend. So, an “inline” update after 18 months of disappointment, could be interpreted as positive? That said, the SFOR chart still looks horrible and reminds me of the old joke: “How do you think about a share that has fallen in value -95%? Imagine a share that has fallen -90% in value – and then the share price halves again.”

On the same theme, Superdry reported revenues down -14% in the 12 weeks to 20th January. The shares have fallen -50% in the month and are now down -99% from their peak. Despite the £46m of cash they raised last summer from selling the Asian business IP and a placing at 76p per share, net debt stood at £29m. The departure of the CFO is a bad omen, in my view.

This week I look at construction project management software company Eleco, payments companies Boku and Fonix, but I start with Fevertree Drinks.

Fevertree Drinks FY Dec Trading Update

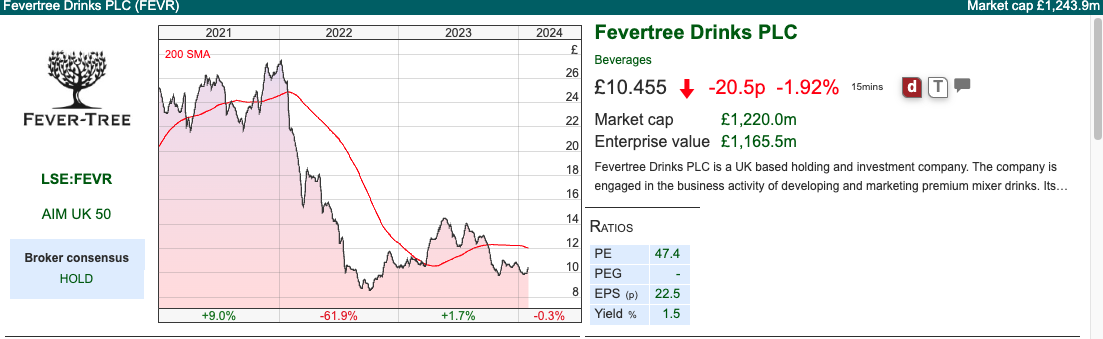

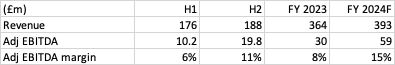

The alcoholic drink mixer company announced group revenue growth up +6% to £364m, around 5% below analyst consensus published on their website. Within that, UK revenue fell by -1% and Europe was up +4%, but the business continued to see strong growth in the US +22%. They reported adj EBITDA of £30m, implying that figure doubled H2 v H1 last year.

Initially the shares opened down, but then recovered to finish up +12%. I think that’s driven by the outlook comments: +8% revenue guidance and they “remain confident of delivering a significant improvement in gross margin in 2024.”

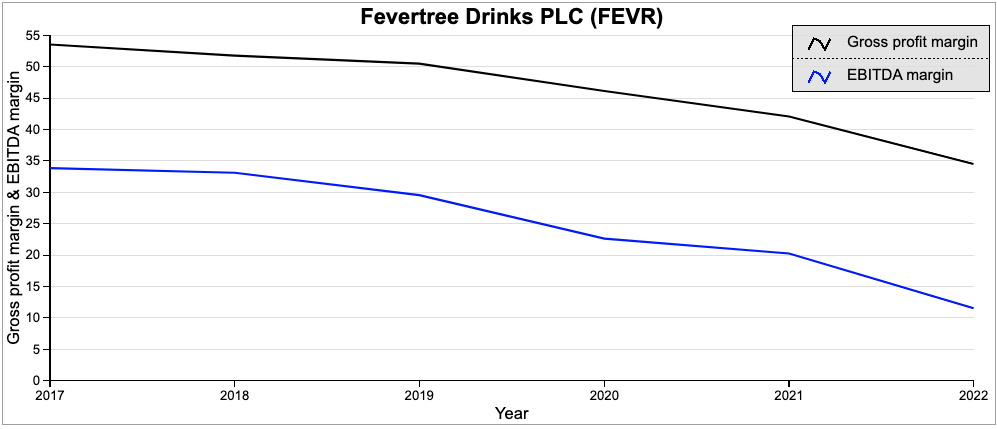

I wrote up the Fevertree margin story here. The group’s gross margin was 55% five years ago but fell to 31% in H1 of last year as management failed to pass on higher energy costs which increased the price of glass.

The adj EBITDA margin was just below 6% in H1 last year, so it looks like the story is back on track.

Valuation: The company has not updated analyst consensus on their website. Sharepad has the business trading on 32x Dec 2024F and falling to 25x Dec 2025F. On a price/sales ratio, the shares are on 3x Dec 2024F, which is a considerable derating from above 15x in 2017. I imagine some will still think that’s expensive, but I think this is unlikely ever to be a stock that trades on a low multiple.

Opinion: I think given the choice between i) revenue ahead of expectations but at a cost of lower margin, or ii) lower revenue growth but improving margin; investors are right to prefer the latter. This is a trade-off, most businesses can grow faster by lowering prices, but often that doesn’t create value for shareholders. If Fevertree can grow profitably in the USA, we probably shouldn’t be too concerned with any one year’s revenue growth.

Eleco FY Dec Trading Update

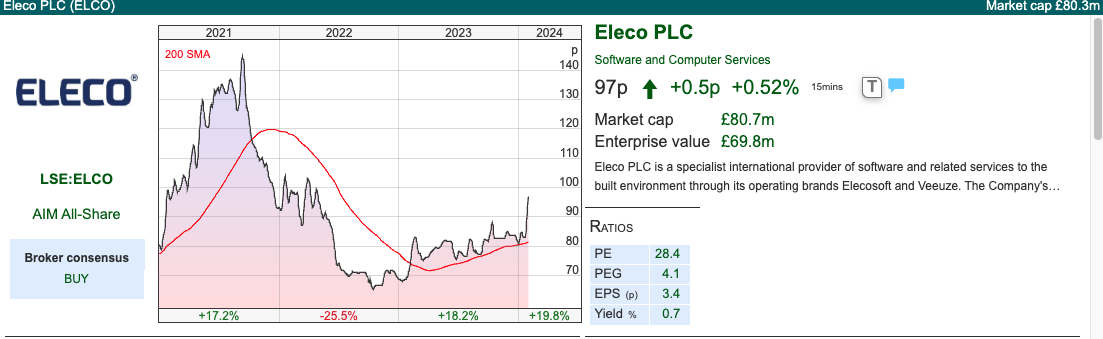

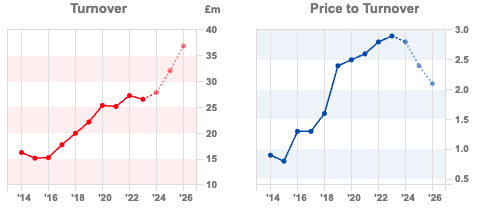

This stock was mentioned by Paul Hill on Mello last week as his top pick for the year. They are a software company focusing on construction and project management. ELCO has been shifting to a SaaS/recurring revenue model, rather than a perpetual license model. In the short term, that’s depressed revenue, but hopefully now, Total Recurring Revenue represents 74% of total revenues, the market should put a higher multiple on their top line. Not all of the revenue has been organic though, in June they bought BestOutcome (also project management software, NHS as a client) for £5m total consideration. Management says that they themselves used the BestOutcome software to manage the integration of the two businesses.

The RNS says FY Dec profits should be ahead of expectations, without giving any numbers. They had £11m of cash at the end of Dec, versus £12.5m the previous December. Cavendish, the broker, raised FY Dec 2023 forecasts by 3%, so not much of a beat. Indeed, the broker has cut 2024F and 2025F revenue both by 2%, but left adj EPS unchanged at 4.6p and 6p.

Last year I commented that companies (ETP, SDI) were using upbeat-sounding language in their RNSs, but then asking their brokers to cut earnings. I’m old-fashioned and believe that investors should be able to read the RNS and have an idea if the results are better or worse than expectations without having to refer to the broker notes.

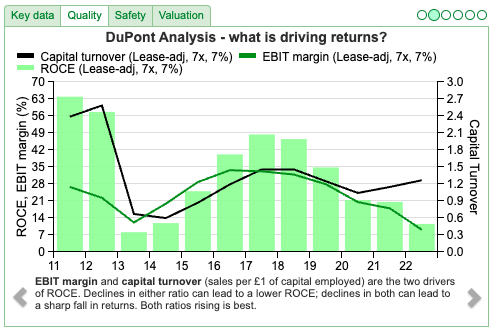

Valuation: Cavendish’s forecast put the shares on a PER of 21x Dec 2024F falling to 16x the following year. For a company with high returning revenue and hopefully operational gearing, that could still represent good value. Historically the RoCE and margins are below their 3-year average, but I can imagine that we might see higher revenue growth on a fixed cost base and so these ratios improve.

Opinion: The construction market has been hit by higher interest rates (Somero, the concrete screed company has fallen -40% from its peak). In response, management of Eleco point to high customer retention rates and winning 40 new clients in the USA last year. However, if the contractors are seeing less work, it’s hard to believe that ELCO won’t be exposed to the downturn. So, I would be a little cautious on how much of the revenue really is recurring if the economy worsens – but other than that looks good.

Boku FY Dec Trading Update

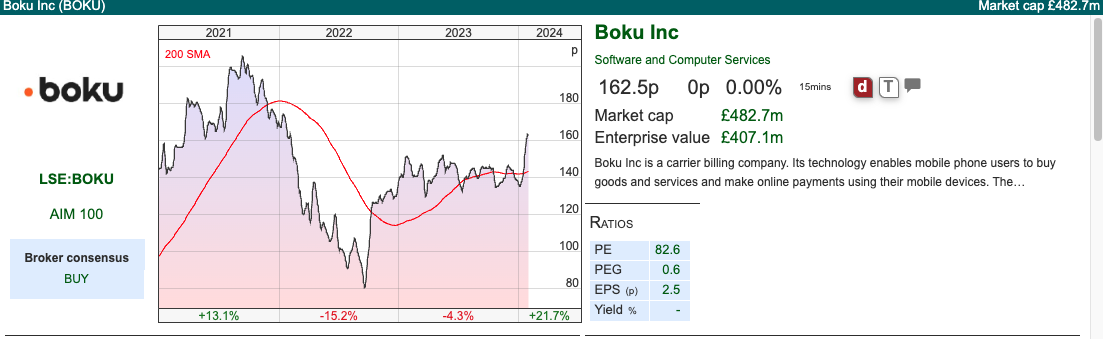

Boku, the Local Payment Methods (LPM) and Direct Carrier Billing (DCB) company reported FY revenues up +30% to $83m. On an H2 v H2 last year basis revenues are up +33%. They don’t give a PBT figure but say that Adj EBITDA is ahead of expectations, to be at least $27m, up +33% versus the previous year. NB last year Adj EBITDA of $20m translated, after various deductions including $5m for share-based payments, into statutory PBT of $4m. I think management are deluding themselves quoting Adj EBITDA, another example of “voluntary disclosure” that harms the investment case.

I wrote up Boku 18 months ago, but I think it’s worth revisiting as the shares have doubled since then, in what’s been a difficult market. Rhomboid on Twitter said he found this company too hard to understand. Frequently though, it’s conceptually hard to analyse companies that can deliver the greatest gains. By that I don’t mean the most complicated companies – they often underperform. Instead, I mean companies where management have spotted a nascent opportunity, which takes time to “get your head around”. Long-term performers Bioventix, YouGov, GlobalData, IQGeo, Eagle Eye and Burford strike me as companies which take time to understand the opportunity management have spotted.

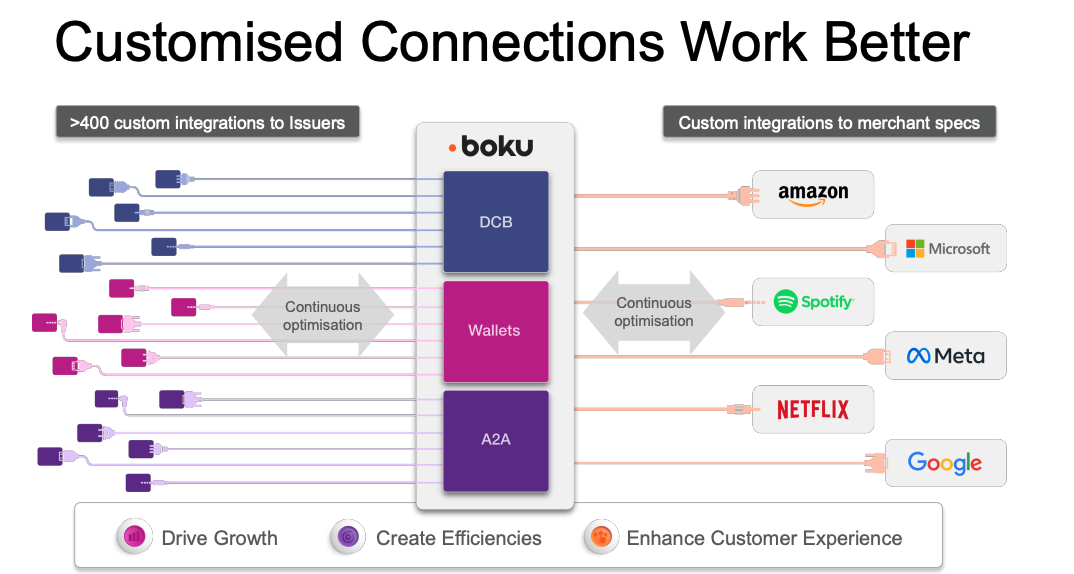

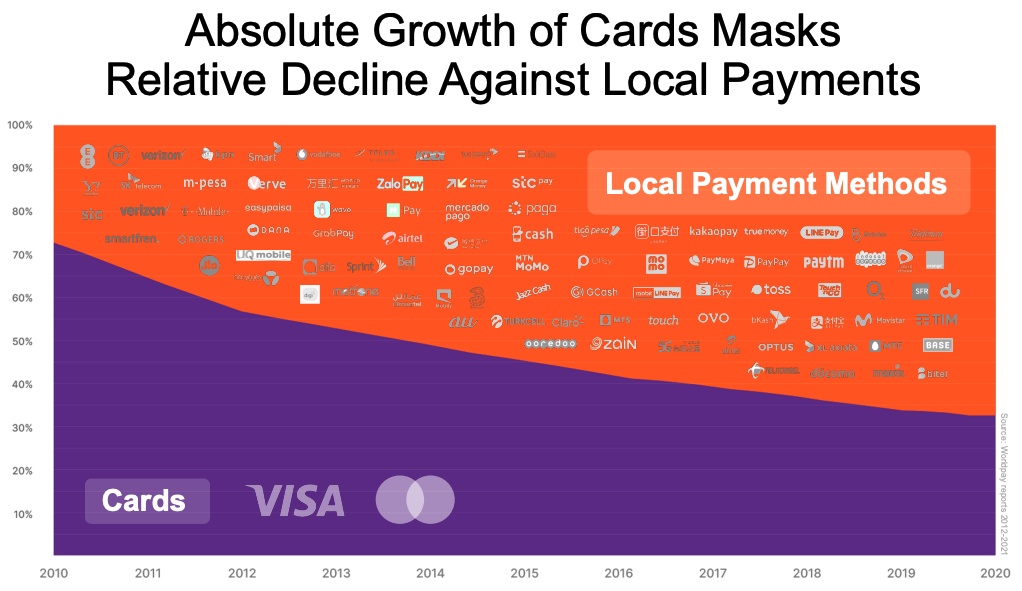

Boku is a mix of stable DCB (80% of revenue, but slow growing) and LPM (20% of revenue, growing at +153% y-o-y). A couple of years ago management identified that DCB, their core business of letting people pay online and adding the cost to the monthly phone bill, had a ceiling. The majority of people who buy online entertainment products (Spotify, Netflix, games etc) are not going to charge the payment through their phone bill. They believe the opportunity is Local Payment Methods, such as e-wallets, and Account-to-account payments. Although Visa and Mastercard have roughly doubled Total Payment Volume in the last decade to $20 trillion, the card companies have actually lost market share to LPMs. However, there are hundreds of LPMs which are all incompatible: no technical standards, or even settlement and reporting standards. Boku builds the connections between these payment methods.

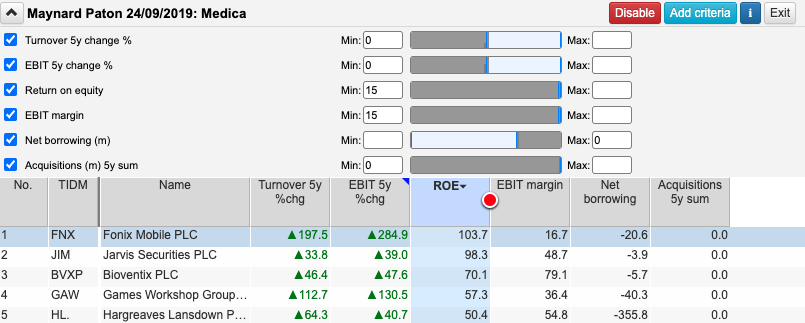

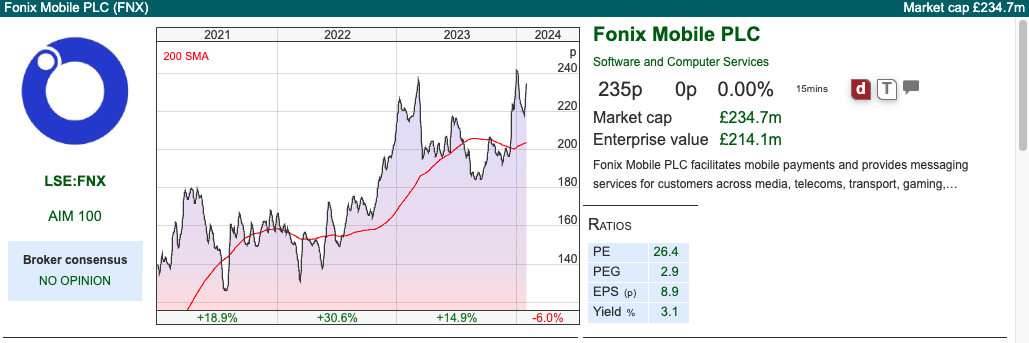

Comparison with Fonix: DCB payments company Fonix also reported “ahead of management’s expectations” results last week, with Total Payments Volume (TPV) up +15% and adj EBITDA up +18% to £7m. Maynard wrote it up here, as it appeared on his filter showing positive 5-year turnover and profit growth, plus RoE and EBIT margin above 15% and net cash. There are currently 20 companies on the LSE that appear on this filter, but FNX is top when sorted by RoE.

Fonix focuses on television fundraises and charities (ITV and BBC, Children in Need and Comic Relief) which is a more niche area than Boku. For comparison Boku is forecast to achieve RoE of 14.8% in 2023 and EBIT margin of 25%.

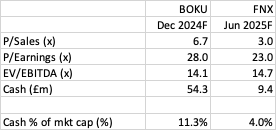

Valuation: Although Boku trades on a premium, when you adjust for the different year ends and that Boku has almost 6x more cash than Fonix, then the ratings look similar.

I don’t think Boku needs that amount of cash to operate the business. It’s there because they sold their digital identity division and now have $69m (£54m) of their own cash on the balance sheet. I had expected them to deploy that making acquisitions, but instead in 2023, they spent $10m on share buybacks.

Opinion: Earlier in the month Bango, which operates in a similar space, announced a profit warning, so I can understand some readers putting this in the “too hard” pile. Unfortunately, despite being keen on BOKU, I didn’t invest 18 months ago. I thought that management would use their excess cash to “buy marketshare” either by acquiring a competitor or running the business at a loss for a year or two, which wasn’t in the broker forecasts. Instead, they’ve managed to grow revenue +30% and bought back shares. Kudos to them. I may swallow my pride and take a position.

Notes

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 30/01/2024 | FEVR, ELCO, FNX, BOKU | Gogi’s barometer

Bruce remembers a metaphor from the founder of the Georgian Stock Exchange and wonders how it might apply to Chinese financial markets. Companies covered: FEVR, ELCO, FNX, BOKU.

The FTSE 100 was up +2.2% to 7653 last week. The Nasdaq100 and S&P500 rose +2.4% and 1.1%. Brent Crude was up +4% in the last 5 days, most of which was on Monday morning. Chinese stockmarkets have bounced with the FTSE China 50 up +8.3% and the Hang Seng +7.5%.

The FT has reported that the Chinese authorities have tried to halt the sell-off in domestic equities. For instance, institutional investors have been told not to sell equities and short selling has been curbed. That might explain the short-term bounce but the FTSE China 50 is still down -31% in the last 12 months. ETFs tracking US and Japanese markets are becoming increasingly popular among Chinese retail investors, such that mutual funds were hitting limits that were designed to protect capital controls. The Chinese Yuan (CNY on Sharepad) is linked to the US dollar – but allowed to fluctuate around a narrow band. If the CNY continues to weaken, that could also be bad news for commodities and mining shares.

Many years ago I met the founder of the Georgian Stock Exchange, a chap called Gogi Loladze. He cut a dashing figure and was something of a capitalist philosopher, in the style of George Soros. Autocratic leaders, he said, craft their own narratives, and prevent any data that contradict their stories from circulating. However, these autocrats feared financial markets, because liquidity requires buyers and sellers to trade on good (that is, not unfair) information. The financial markets are like a barometer, it tells you what the air pressure is, and if a storm is blowing in, the meteorological instrument will warn you. That’s in contrast to government statistics like GDP which can be manipulated by less scrupulous leaders.

Gogi was keen to develop the Georgian Stock Exchange because i) it would provide an alternative source of capital in competition to the banking system ii) it would strengthen Georgia institutionally, which at the time wanted to be the “Singapore of the Caucasus” iii) it would make him rich. Building any two-sided platform is hard and he couldn’t get to critical mass and benefit from network effects. The Georgian Stock Exchange still exists but is owned by the large banks, which are not keen to develop it for some of the same reasons above. As a generalisation bankers prefer “discretion” (also known as secrecy) to the circulation of financial information.

Since then it has struck me that Gogi’s insight from a former Soviet Union country could apply equally well to China, which is communist, and increasingly autocratic but has a huge stock market. The Chinese GDP figures were announced a couple of weeks ago and were in line with expectations at c. +5%. No one seems to have a convincing narrative on why Chinese equities are selling off, but I would be wary. Below is a chart showing the FTSE China 50 (XINO) has fallen for 3 consecutive years in a row.

We’ve seen profit warnings from Revolution Bars, Inspecs and Zoo Digital over the last 5 days. The latter had $8.9m of cash at the end of December, whereas Revolution Bars and Inspecs have net debt of £20m and £24m respectively. If I was going to “try to catch a falling knife” I would prefer ZOO because of the cash that they raised in April last year.

On the subject of falling knives, we also saw “inline” trading updates for Sir Martin Sorrell’s S4Capital and Next 15 Group. These have both been hit hard by corporates cutting back on marketing and digital consultancy spend. So, an “inline” update after 18 months of disappointment, could be interpreted as positive? That said, the SFOR chart still looks horrible and reminds me of the old joke: “How do you think about a share that has fallen in value -95%? Imagine a share that has fallen -90% in value – and then the share price halves again.”

On the same theme, Superdry reported revenues down -14% in the 12 weeks to 20th January. The shares have fallen -50% in the month and are now down -99% from their peak. Despite the £46m of cash they raised last summer from selling the Asian business IP and a placing at 76p per share, net debt stood at £29m. The departure of the CFO is a bad omen, in my view.

This week I look at construction project management software company Eleco, payments companies Boku and Fonix, but I start with Fevertree Drinks.

Fevertree Drinks FY Dec Trading Update

The alcoholic drink mixer company announced group revenue growth up +6% to £364m, around 5% below analyst consensus published on their website. Within that, UK revenue fell by -1% and Europe was up +4%, but the business continued to see strong growth in the US +22%. They reported adj EBITDA of £30m, implying that figure doubled H2 v H1 last year.

Initially the shares opened down, but then recovered to finish up +12%. I think that’s driven by the outlook comments: +8% revenue guidance and they “remain confident of delivering a significant improvement in gross margin in 2024.”

I wrote up the Fevertree margin story here. The group’s gross margin was 55% five years ago but fell to 31% in H1 of last year as management failed to pass on higher energy costs which increased the price of glass.

The adj EBITDA margin was just below 6% in H1 last year, so it looks like the story is back on track.

Valuation: The company has not updated analyst consensus on their website. Sharepad has the business trading on 32x Dec 2024F and falling to 25x Dec 2025F. On a price/sales ratio, the shares are on 3x Dec 2024F, which is a considerable derating from above 15x in 2017. I imagine some will still think that’s expensive, but I think this is unlikely ever to be a stock that trades on a low multiple.

Opinion: I think given the choice between i) revenue ahead of expectations but at a cost of lower margin, or ii) lower revenue growth but improving margin; investors are right to prefer the latter. This is a trade-off, most businesses can grow faster by lowering prices, but often that doesn’t create value for shareholders. If Fevertree can grow profitably in the USA, we probably shouldn’t be too concerned with any one year’s revenue growth.

Eleco FY Dec Trading Update

This stock was mentioned by Paul Hill on Mello last week as his top pick for the year. They are a software company focusing on construction and project management. ELCO has been shifting to a SaaS/recurring revenue model, rather than a perpetual license model. In the short term, that’s depressed revenue, but hopefully now, Total Recurring Revenue represents 74% of total revenues, the market should put a higher multiple on their top line. Not all of the revenue has been organic though, in June they bought BestOutcome (also project management software, NHS as a client) for £5m total consideration. Management says that they themselves used the BestOutcome software to manage the integration of the two businesses.

The RNS says FY Dec profits should be ahead of expectations, without giving any numbers. They had £11m of cash at the end of Dec, versus £12.5m the previous December. Cavendish, the broker, raised FY Dec 2023 forecasts by 3%, so not much of a beat. Indeed, the broker has cut 2024F and 2025F revenue both by 2%, but left adj EPS unchanged at 4.6p and 6p.

Last year I commented that companies (ETP, SDI) were using upbeat-sounding language in their RNSs, but then asking their brokers to cut earnings. I’m old-fashioned and believe that investors should be able to read the RNS and have an idea if the results are better or worse than expectations without having to refer to the broker notes.

Valuation: Cavendish’s forecast put the shares on a PER of 21x Dec 2024F falling to 16x the following year. For a company with high returning revenue and hopefully operational gearing, that could still represent good value. Historically the RoCE and margins are below their 3-year average, but I can imagine that we might see higher revenue growth on a fixed cost base and so these ratios improve.

Opinion: The construction market has been hit by higher interest rates (Somero, the concrete screed company has fallen -40% from its peak). In response, management of Eleco point to high customer retention rates and winning 40 new clients in the USA last year. However, if the contractors are seeing less work, it’s hard to believe that ELCO won’t be exposed to the downturn. So, I would be a little cautious on how much of the revenue really is recurring if the economy worsens – but other than that looks good.

Boku FY Dec Trading Update

Boku, the Local Payment Methods (LPM) and Direct Carrier Billing (DCB) company reported FY revenues up +30% to $83m. On an H2 v H2 last year basis revenues are up +33%. They don’t give a PBT figure but say that Adj EBITDA is ahead of expectations, to be at least $27m, up +33% versus the previous year. NB last year Adj EBITDA of $20m translated, after various deductions including $5m for share-based payments, into statutory PBT of $4m. I think management are deluding themselves quoting Adj EBITDA, another example of “voluntary disclosure” that harms the investment case.

I wrote up Boku 18 months ago, but I think it’s worth revisiting as the shares have doubled since then, in what’s been a difficult market. Rhomboid on Twitter said he found this company too hard to understand. Frequently though, it’s conceptually hard to analyse companies that can deliver the greatest gains. By that I don’t mean the most complicated companies – they often underperform. Instead, I mean companies where management have spotted a nascent opportunity, which takes time to “get your head around”. Long-term performers Bioventix, YouGov, GlobalData, IQGeo, Eagle Eye and Burford strike me as companies which take time to understand the opportunity management have spotted.

Boku is a mix of stable DCB (80% of revenue, but slow growing) and LPM (20% of revenue, growing at +153% y-o-y). A couple of years ago management identified that DCB, their core business of letting people pay online and adding the cost to the monthly phone bill, had a ceiling. The majority of people who buy online entertainment products (Spotify, Netflix, games etc) are not going to charge the payment through their phone bill. They believe the opportunity is Local Payment Methods, such as e-wallets, and Account-to-account payments. Although Visa and Mastercard have roughly doubled Total Payment Volume in the last decade to $20 trillion, the card companies have actually lost market share to LPMs. However, there are hundreds of LPMs which are all incompatible: no technical standards, or even settlement and reporting standards. Boku builds the connections between these payment methods.

Comparison with Fonix: DCB payments company Fonix also reported “ahead of management’s expectations” results last week, with Total Payments Volume (TPV) up +15% and adj EBITDA up +18% to £7m. Maynard wrote it up here, as it appeared on his filter showing positive 5-year turnover and profit growth, plus RoE and EBIT margin above 15% and net cash. There are currently 20 companies on the LSE that appear on this filter, but FNX is top when sorted by RoE.

Fonix focuses on television fundraises and charities (ITV and BBC, Children in Need and Comic Relief) which is a more niche area than Boku. For comparison Boku is forecast to achieve RoE of 14.8% in 2023 and EBIT margin of 25%.

Valuation: Although Boku trades on a premium, when you adjust for the different year ends and that Boku has almost 6x more cash than Fonix, then the ratings look similar.

I don’t think Boku needs that amount of cash to operate the business. It’s there because they sold their digital identity division and now have $69m (£54m) of their own cash on the balance sheet. I had expected them to deploy that making acquisitions, but instead in 2023, they spent $10m on share buybacks.

Opinion: Earlier in the month Bango, which operates in a similar space, announced a profit warning, so I can understand some readers putting this in the “too hard” pile. Unfortunately, despite being keen on BOKU, I didn’t invest 18 months ago. I thought that management would use their excess cash to “buy marketshare” either by acquiring a competitor or running the business at a loss for a year or two, which wasn’t in the broker forecasts. Instead, they’ve managed to grow revenue +30% and bought back shares. Kudos to them. I may swallow my pride and take a position.

Notes

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.