Significant, acquisition-free expansion is prized by many investors. Maynard Paton studies the organic growth record of pay-by-mobile small-cap Fonix Mobile.

Whisper it, but a few UK small-caps are still progressing well and maintaining resilient share prices in this difficult market.

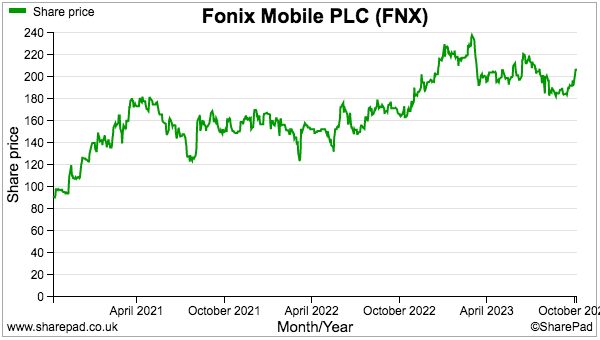

Fonix Mobile is a good example. Recent full-year results from this £206 million business showed revenue up 21%, earnings up 10% and the dividend up 12%, which ensured the shares remain within touching distance of their all-time high:

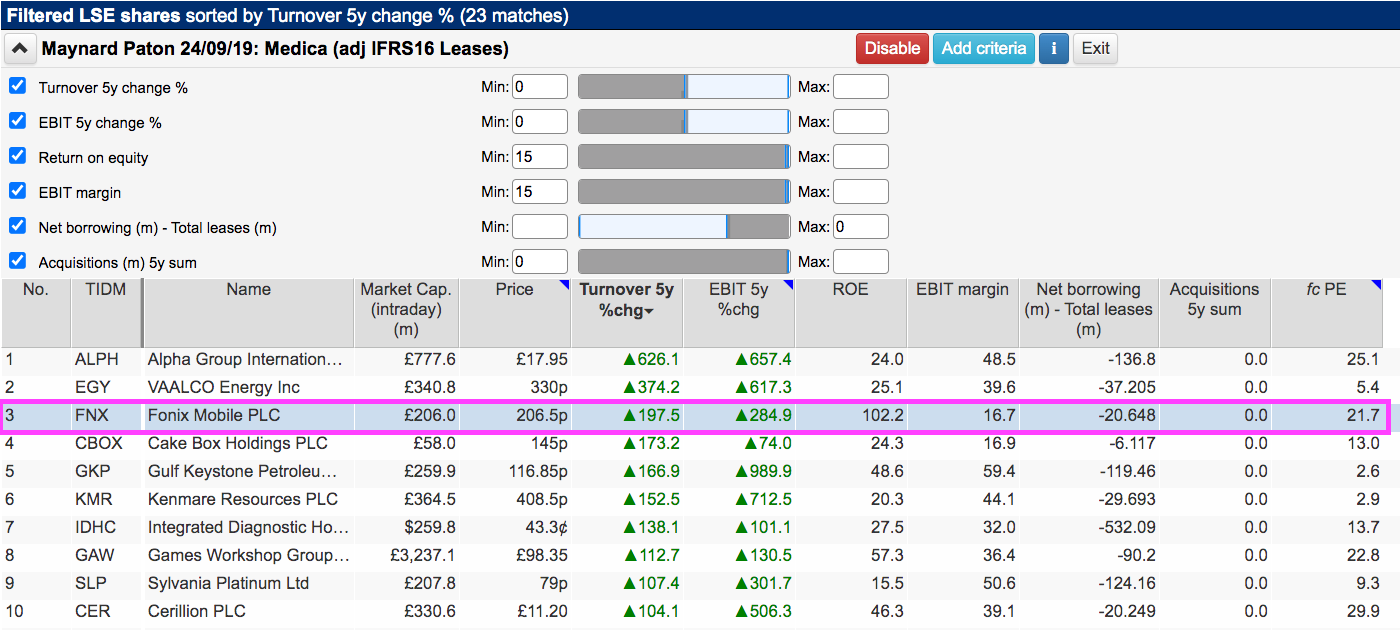

Fonix currently appears on an old SharePad screen of mine that seeks respectable companies that have grown without acquisition. I have always believed the very best companies are those that can expand ‘organically’ and do not rely on purchasing other businesses for higher profit.

The screen’s filter criteria are:

- Positive five-year turnover and operating profit growth;

- A minimum of 15% for both return on equity (ROE) and operating margin;

- Net bank borrowing of no more than zero (i.e. a net cash position), and;

- A five-year acquisition spend of zero.

(You can run this screen for yourself by selecting the “Maynard Paton 24/09/19: Medica” filter within SharePad’s fabulous Filter Library. My instructions show you how.)

SharePad returned 23 shares — including familiar names such as Hargreaves Lansdown, Games Workshop, James Halstead, Cerillion and Cake Box.

I selected Fonix as it had exhibited the strongest revenue growth after Alpha Group — which broke its organic-growth history by announcing an acquisition last month — and VAALCO Energy — an American oil explorer that I had no desire to review.

Let’s take a closer look at Fonix.

Introducing Fonix Mobile

Fonix could help you win £1 million!

Just text WINNER to 82248 and for the cost of £2 plus one standard network-rate message, you stand a chance of becoming an instant millionaire courtesy of ITV.

The IT system behind ITV’s different SMS competitions is provided by Fonix, which was established during 2006 and has since become a prominent supplier of smartphone payment services to media organisations for competitions and charity events.

Fonix presently serves 122 clients and notable customers besides ITV include the BBC, Bauer Media, Global Radio, Channel 4 and TNT Sports. Major television fundraisers such as Children In Need, Comic Relief, Stand Up To Cancer and Soccer Aid also employ the group’s services to collect donations via texts.

Beyond media competitions and charity events, Fonix reckons further pay-by-mobile growth could be achieved through online gaming operators and transport groups selling bus, rail and car-parking tickets.

Consumers entering, say, ITV’s competitions, have their payments charged to their mobile phone bills and Fonix takes a commission as revenue. Mobile networks such as Vodafone and EE take a commission for their involvement, too.

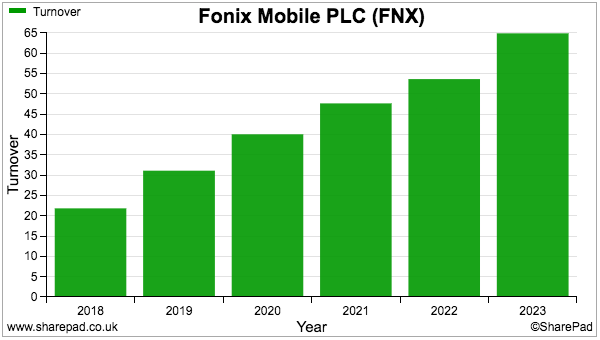

Total payments by consumers using Fonix’s systems advanced from £125 million to £268 million between 2018 and 2023. Revenue during the same time has more than tripled to £65 million:

Excluding revenue earned through messaging and other ancillary services, Fonix’s commission from total consumer payments has improved from 13% to 18% since 2018.

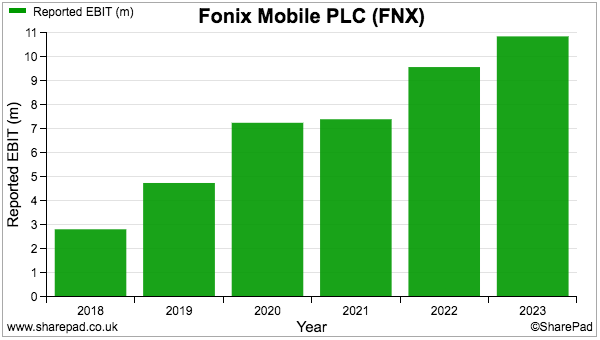

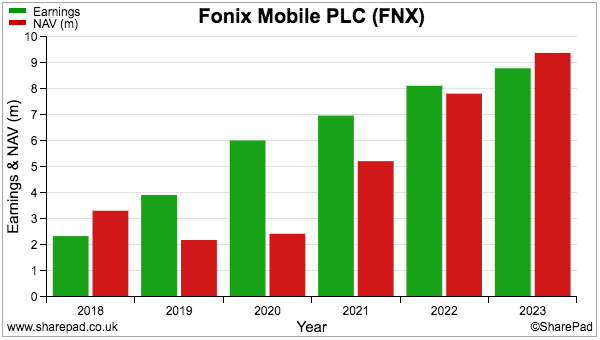

Profit meanwhile has more than tripled from less than £3 million to more than £10 million:

Fonix seems to have hit the big time relatively recently. Companies House shows the business reporting abbreviated accounts up to 2014, and a £1 million profit reported only from 2015.

Fonix’s short financial history within SharePad reflects the group’s 2020 AIM flotation. Unlike most other small-cap IPOs conducted during the pandemic, Fonix’s 206p shares are presently well ahead of their 90p issue price. The flotation did not raise any new capital for the group.

Fonix’s SharePad summary

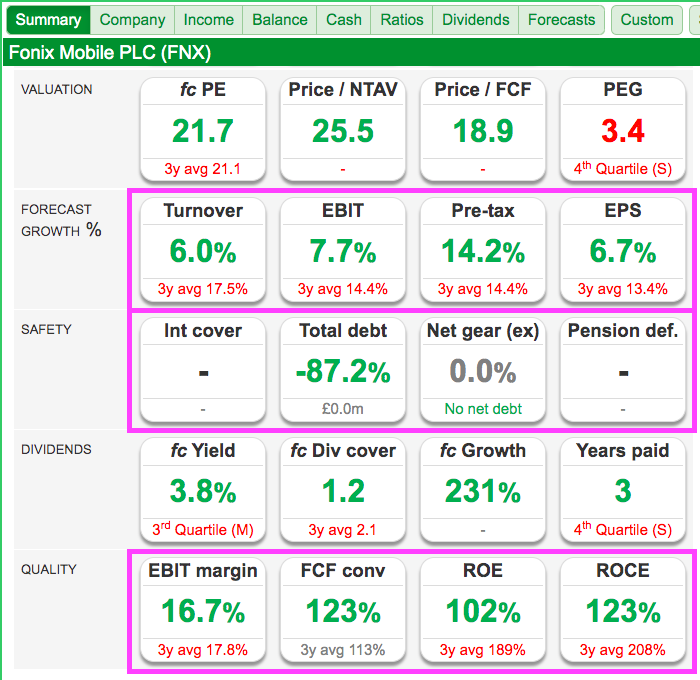

SharePad’s summary for Fonix is shown below:

The second row suggests 2024 will show reasonable progress versus 2023, while the middle row confirms Fonix has no net debt and no pension complications.

The bottom row meanwhile discloses terrific cash flow as well as the decent margin and ROE numbers flagged by my initial SharePad screen.

Let’s start with the ‘quality’ ratios.

ROE and cash flow

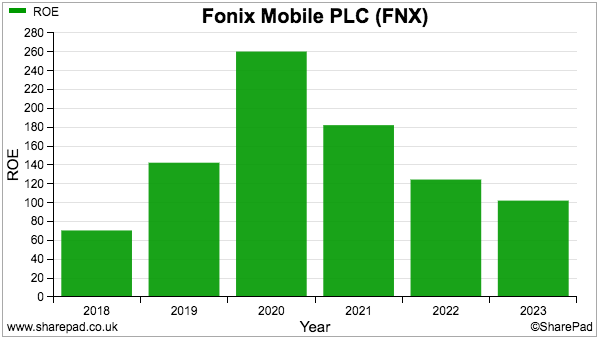

SharePad shows Fonix’s ROE topping 100% for the last five years:

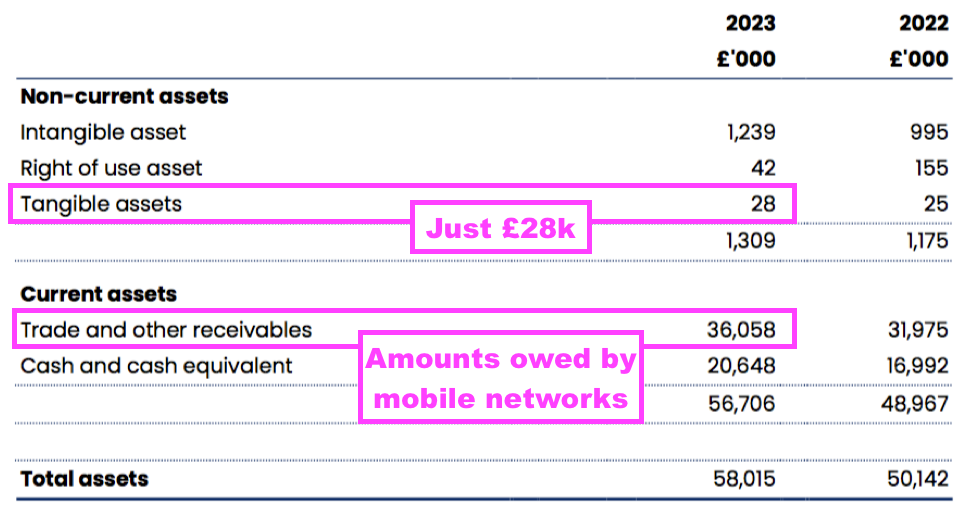

Such impressive returns require double-checking with the actual accounts, and sure enough, Fonix does operate almost on thin air.

Assets comprise mostly amounts owed by the mobile networks alongside cash in the bank:

Note the minuscule tangible assets of only £28,000. The £1.2 million intangible asset reflects capitalised IT costs and has advanced by an insignificant £0.7 million since 2018.

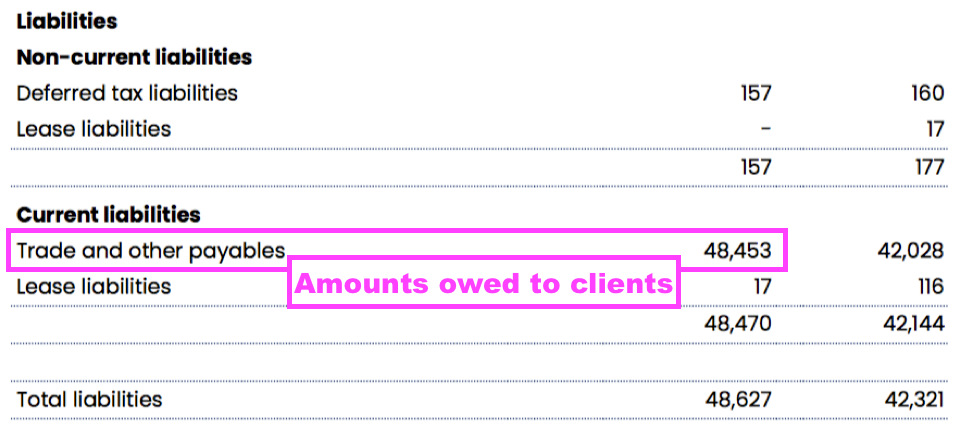

Liabilities are dominated by amounts owed to ITV and other clients:

The sums owed by the mobile networks and owed to the clients are substantial but are ‘inflated’ by including the gross consumer payments (e.g. the £2 entry fee for an ITV competition) that Fonix does not recognise entirely as revenue.

Total assets less total liabilities comes to £9.4 million for 2023 and £7.8 million for 2022, which when compared to 2023 earnings of £8.8 million gives that 100%-plus ROE measure:

Cash in the bank is also complicated by consumer money. Fonix confirmed that ‘underlying’ company cash represented £9.4 million of the £20.6 million cash position for 2023.

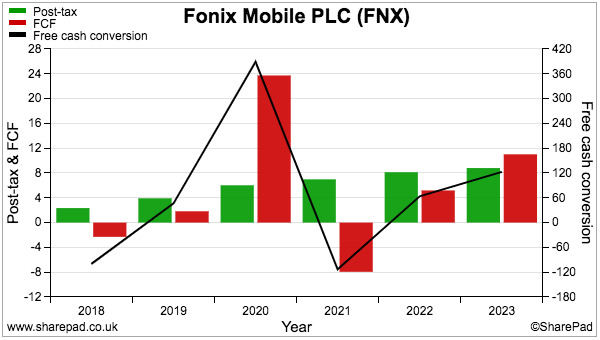

Consumer cash mixing with company cash has made cash conversion somewhat volatile (black line, right axis):

Fonix admits cash flow can “vary substantially from period to period and is particularly sensitive to the timing of passthrough out payments for customer charity campaigns“.

Mind you, the ‘underlying’ cash position has advanced from £2 million to £9.4 million since 2020, suggesting Fonix is indeed converting earnings into cash on its own behalf.

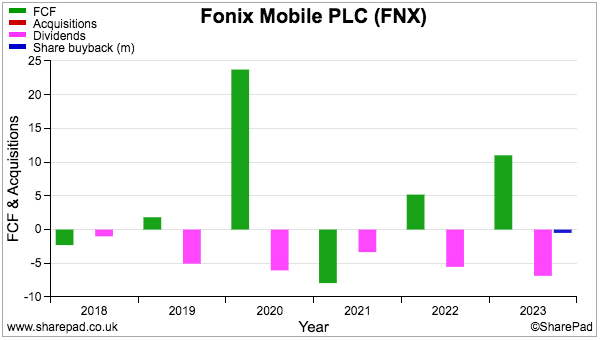

Surplus cash not retained on the balance sheet has been commendably distributed as dividends and nothing has been spent on acquisitions. A small buyback was also undertaken during the last financial year:

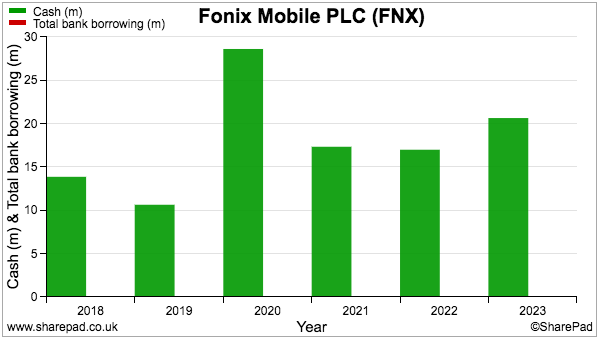

Although reported cash and cash flow are both influenced by significant sums not due to Fonix, one accounting certainty is the absence of any bank debt:

Margin, employee productivity and clients

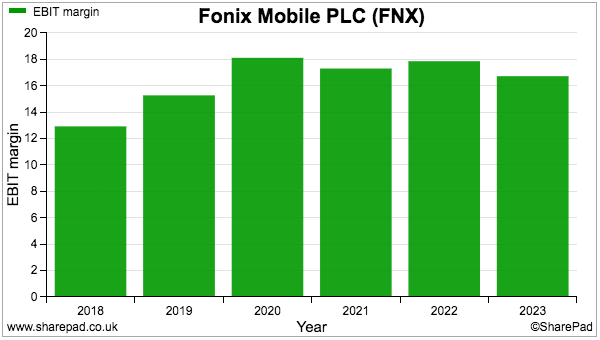

The chart below confirms Fonix has enjoyed a handy 15%-plus operating margin since 2019:

Payments to mobile networks such as Vodafone and EE typically absorb 75% of revenue, with employee costs the next largest expense at approximately 6%.

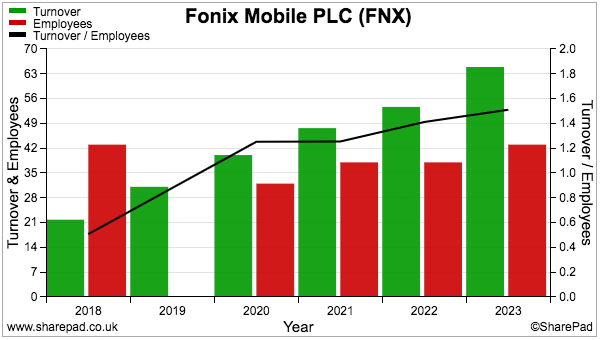

SharePad shows Fonix employing a relatively small but very productive workforce:

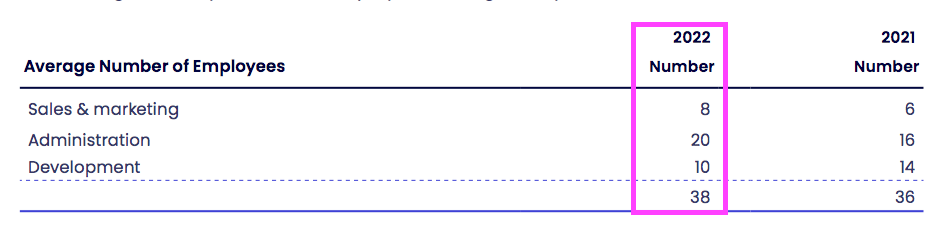

The 2022 accounts disclosed 38 employees generating average revenue per head at a superb £1.4 million and average gross profit per head at a very high £348,000:

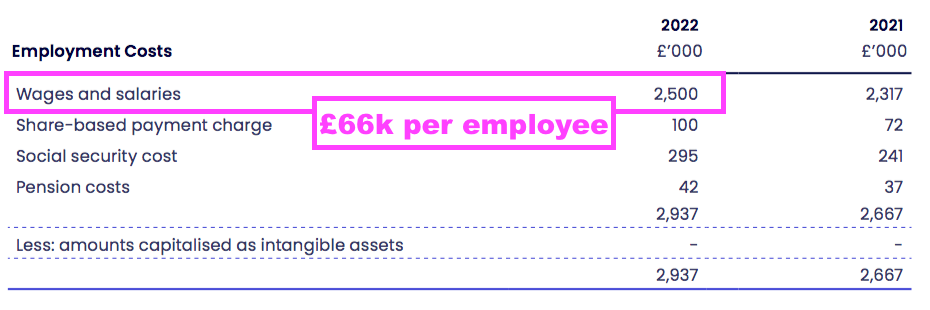

Gross profit per head at £348,000 leaves ample room for profit given aggregate staff wages during 2022 were £2.5 million or £66,000 per employee:

Somewhat astoundingly, Fonix employed only eight sales and marketing staff during 2022. That team must have performed exceptionally well to have bagged the aforementioned 122 clients that include many powerful broadcasters.

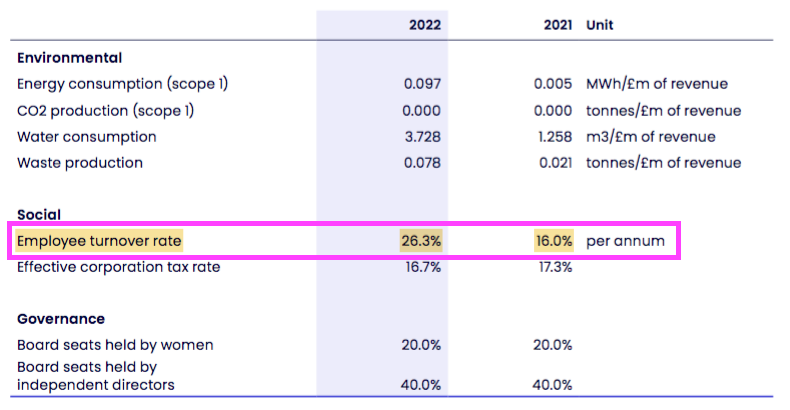

Slightly unnerving is staff turnover at a significant 26% for 2022:

Losing one in four employees that year does not suggest everyone is particularly happy with the way the business is run.

Fonix appears very dependent on a handful of high-spending clients during any given year — the group’s ten largest customers have represented at least 80% of gross profit since 2019.

I also wonder among those ten largest clients whether ITV in particular has become a very important partner. ITV is after all the predominant case study on Fonix’s website and presentations:

Clients can be very small, too. ‘Active’ clients are in fact defined as contributing gross profit of only £500 or more. The average client-generated revenue during 2023 of £532,000 — up 30% over the previous three years.

I should add that Fonix claims to have “never lost a significant customer to a competitor“.

Directors and shareholdings

Fonix’s positive post-flotation progress may not be too surprising given the board’s owner-orientated directors.

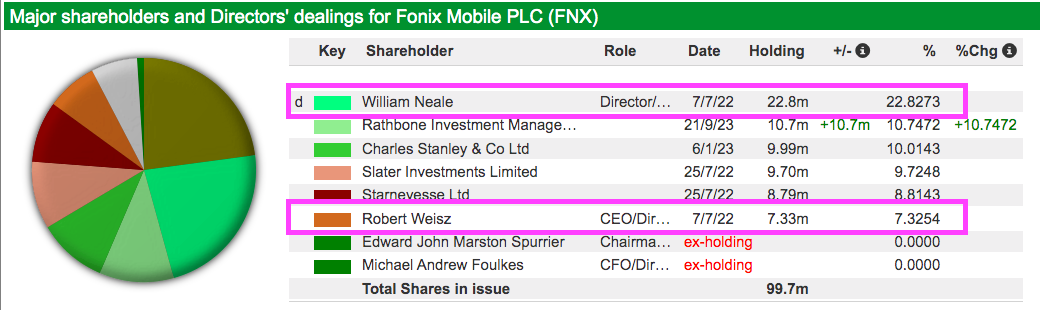

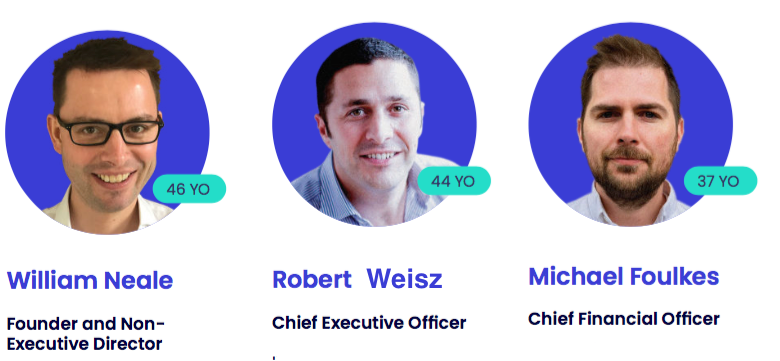

Chief executive Robert Weisz owns a useful 7% (£14m) while company founder and non-exec William Neale owns a substantial 23% (£45m):

Both Mr Weisz and Mr Neale are deemed by the Takeover Panel to be members of a ‘concert party’ alongside a number of other investors who represent a further 10% (£20m).

Mr Weisz, Mr Neale and other concert-party members sold half of their shareholdings at the flotation and then reduced their remaining stakes by 14% at 150p during 2022. But they still control a collective 40% (£80m).

The 2022 annual report encouragingly reveals the chief executive does not participate in the annual bonus scheme nor does he own any options. Fonix says Mr Weisz is instead “rewarded through annual salary and growth in the value of [his] existing shareholding“. The annual bonus for the finance director is limited to £40k.

Mr Weisz was appointed chief executive during 2014 and his arrival appeared to kick-start the group’s aforementioned growth to a £1 million profit and beyond. Mr Weisz was formerly the commercial partnership manager at O2, which suggests he is very familiar with mobile networks and the industry generally.

Both Mr Weisz and Mr Neale are still in their 40s, so may have a longer-term perspective on Fonix’s future progress. This interview with Mr Weisz provides a useful insight into Fonix and its flotation.

Valuation and summary

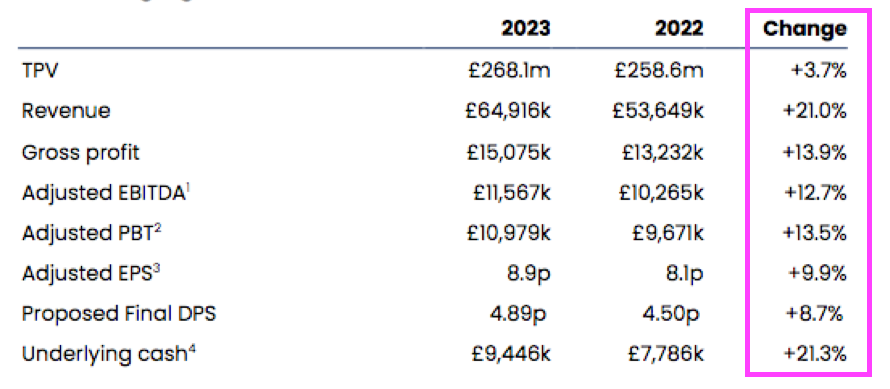

Full-year results published last month showed upbeat progress:

The slower growth to TPV (total payment volume) reflected lower donations to charity events. Fonix charges charities fixed fees for handling events, and so levels of donations have only a mild effect on revenue and profit.

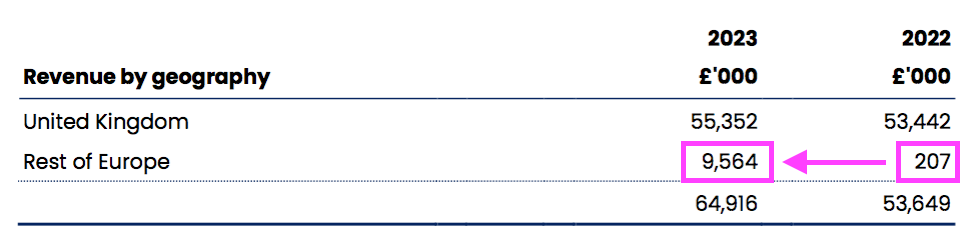

The results were notable for Fonix’s expansion beyond the UK into Ireland.

Early contracts with RTE, Bauer Ireland and Wireless Radio Ireland took non-UK revenue from £207k to £9.6 million during 2023…

…which Fonix intriguingly stated required “minimal customisation of our cloud platform” and so “clearly demonstrated the business’s ability to scale internationally, with minimal incremental cost“.

Fonix already has a small presence in Germany and Austria and, following the sudden Irish success, other international markets are currently being considered.

The outlook for 2024 was positive:

“The first few months of the new financial year have started strongly, with a robust run-rate of consumer activity with our key customers. We continue to make great progress on our strategic goals and recognise that by delivering on these objectives and nurturing recent client wins we have a great opportunity to exceed expectations.“

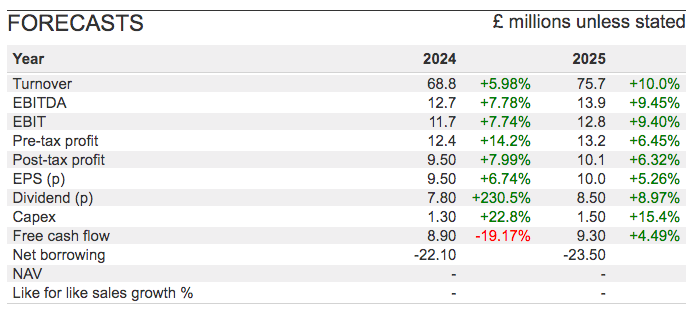

Brokers translate that optimism into single-digit growth rates:

I dare say another Ireland-type success could indeed give Fonix a “great opportunity to exceed expectations“. The prospect of additional international clients being won at “minimal incremental cost” could one day lead to some very tantalising profit and margin projections.

Right now, the resilient share price may not offer a bargain at approximately 20x near-term earnings. But the group’s policy of paying 75% of profit as dividends does support a prospective 4% income.

All told, Fonix shows that not all UK small-caps are currently doomed to suffer in a recession… and some may even be able to expand during any downturn.

Fonix is not without downsides though, and the major risks I would cite are:

- A dependence on a handful of major clients;

- Adverse regulatory changes to television competition rules, and;

- Additional revenue and profit requiring a lot more than tangible assets of £28,000 and eight sales and marketing people.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Investor’s Roundtable Podcast with Roland Head, Mark Simpson and Bruce Packard. Maynard does not own shares in Fonix Mobile.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.