Cerillion’s shares have five-bagged since their pandemic low and remain near their all-time high. Maynard Paton studies the software group’s revenue profile, cash conversion and current valuation.

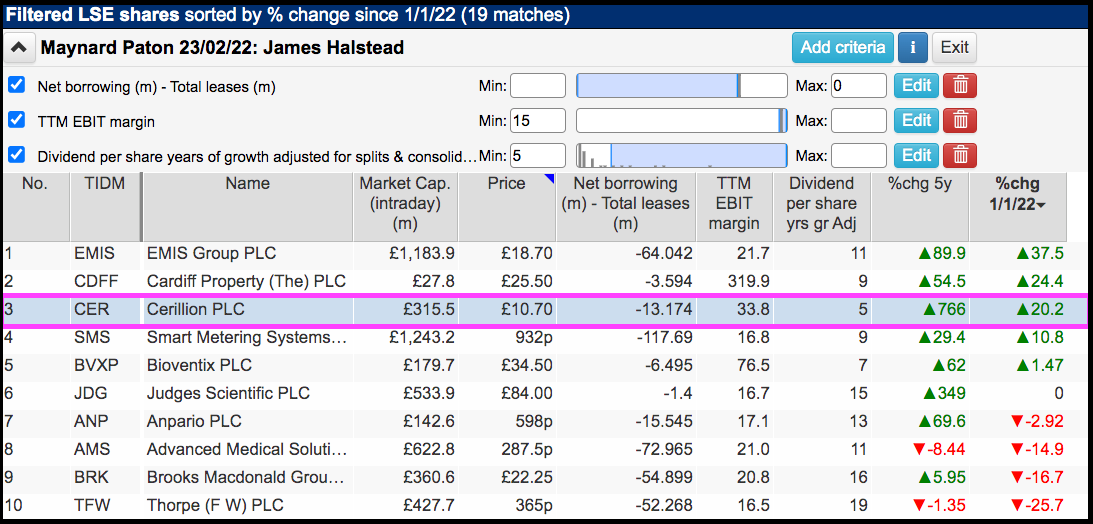

Another month and another round of ‘back to basics’ filtering.

Introduced earlier this year to identify James Halstead, this screen shortlists companies that offer cash-flush balance sheets, robust margins and dependable dividends. SharePad returned 19 matches:

(You can run this screen for yourself by selecting the “Maynard Paton 23/02/22: James Halstead” filter within SharePad’s Filter Library. My instructions show you how.)

The 19 matches included Dotdigital, Fever-Tree Drinks, Focusrite, Hargreaves Lansdown, IMPAX Asset Management, James Halstead, Jarvis Securities and Liontrust Asset Management.

I selected Cerillion because the shares were among the few on the shortlist to have moved higher this year. I passed on EMIS and Cardiff Property because the former was subject to a bid and the latter was too small.

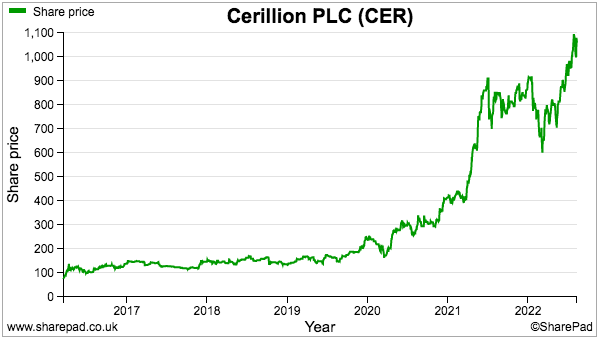

Cerillion’s shares have actually five-bagged since the pandemic lows of March 2020 and remain very close to their £11 all-time high:

Let’s take a closer look.

The history of Cerillion

Cerillion was established during 1999 when Louis Hall and Guy O’Connor led a management buyout of a software division owned by Logica.

Cerillion provides a wide range of customer billing and management systems for telecoms companies. An early milestone client was Manx Telecom, which used Cerillion’s software when it launched the world’s first commercial 3G network on the Isle of Man during 2001.

Cerillion today serves approximately 80 customers operating from more than 40 countries, with clients mostly smaller ‘tier-2’ and ‘tier-3’ telecom operators. The image below lists various names that may not be too familiar to UK investors:

Absent from the list above is Telesur, the Venezuelan state-owned television broadcaster, which signed Cerillion’s largest contract last year worth $18 million.

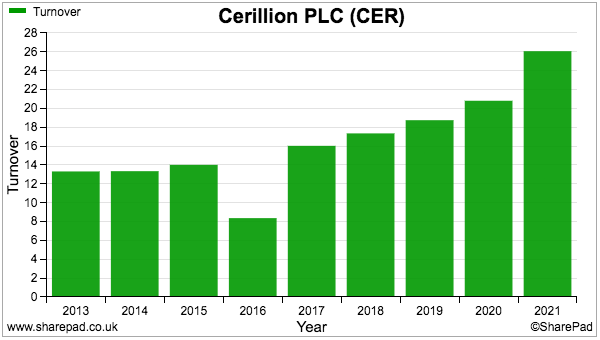

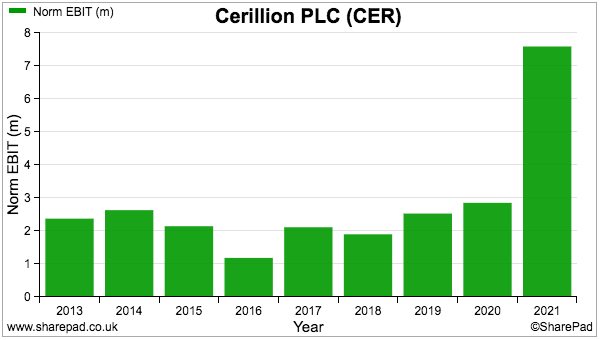

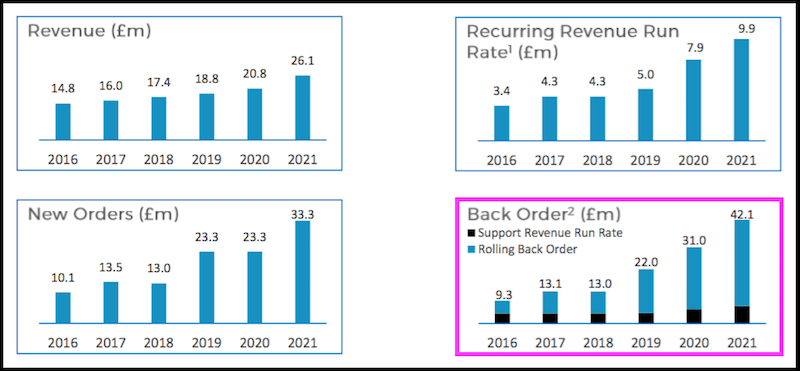

Swift implementation, product flexibility alongside the implications of 5G have started to attract larger customers and have helped Cerillion deliver a respectable financial record that includes an exceptional 2021:

After bobbing around the £2-3 million mark for a few years, profit suddenly surging to £7 million explains why the share price remains close to its £11 peak.

Note that the 2016 figures within the charts above are technically correct but are somewhat misleading; a corporate re-jig for the flotation left the statutory accounts for that year covering only 6.5 months. The underlying 2016 results in fact showed a modest improvement on the 2015 effort.

The shares joined AIM six years ago at 76p and are a 13-bagger for anyone who bought on the first day of trading. The current market cap is £316 million.

Revenue and customers

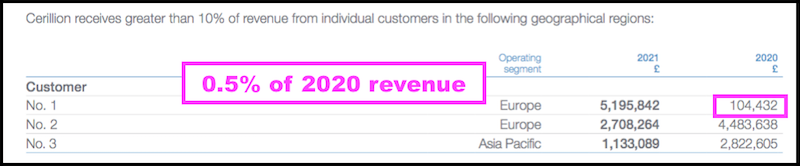

Cerillion’s headline progress has been dependent on winning significant contracts from relatively few customers.

Cerillion’s top client has provided approximately 20% of total revenue for each of the last three years:

Note that the identity of the top client is not the same from year to year. The largest customer for 2021 for example represented just 0.5% of total revenue for 2020:

The top client for 2019 meanwhile represented 3% of total revenue for 2018, and the top client for 2018 represented 1% of total revenue for 2017.

Cerillion claims the bulk of revenue each year comes from existing customers…

…but that claim seems very ambiguous to me.

True, the largest customer for 2021 was indeed an existing customer — but in reality that customer contributed very little to revenue for 2020 and perhaps even zero for 2019 and before.

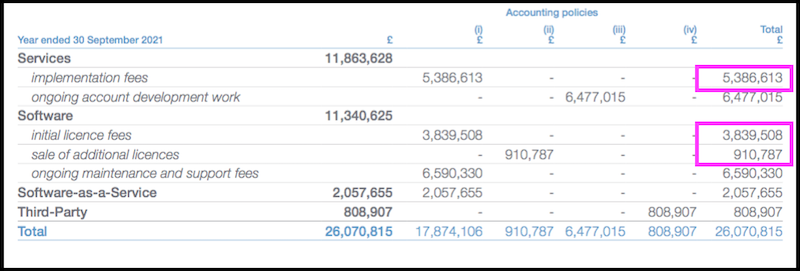

The significant fluctuations to individual customer revenue reflect Cerillion’s old-school sales model, whereby hefty implementation and licence fees are then followed by much lower support income.

Last year implementation and licence fees combined to represent almost 40% of total revenue:

A further 25% was represented by “ongoing account development work“, which I presume involves bespoke projects for particular customers.

That leaves about a third of revenue as ‘recurring’ through support, maintenance and subscription payments.

The risk to shareholders of course is the hefty contract work arrives in a haphazard manner that one day leaves revenue very light and earnings even lighter.

Mind you, Cerillion’s ‘back order’ book has quadrupled during the last five years to approximately £40 million…

… and the small print suggests back orders of £25 million will be converted into revenue during the next 12-18 months. The immediate sales outlook therefore does not seem too alarming.

Revenue recognition and accrued income

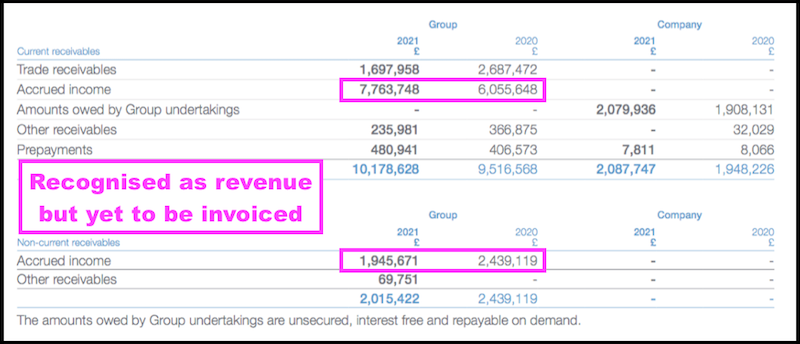

Companies that conduct substantial contract work should always have their accounting scrutinised. Shareholder problems often arise when earnings are booked well before the contracts are finished and customers settle up.

Cerillion’s annual report contains this small print:

“Relatively large levels of accrued income have built up in the past, whereby the Group has incurred considerable effort and expense in relation to certain projects that it is yet to receive payment for.”

Accrued income relates to revenue that has been recognised in the accounts but the associated work has yet to be invoiced to the customer.

Such income inherently involves management guesswork that may not prove to be accurate once the invoice is eventually raised and the payment is actually received.

The 2021 annual report shows accrued income to be almost £10 million, which is very significant versus revenue of £26 million:

By contrast, trade receivables — which represent services performed where the customer has been invoiced — were less than £2 million.

The upshot is a substantial part of Cerillion’s declared revenue is derived from management estimates prior to any customer invoicing — which does not seem ideal.

Note as well the accrued income of £2 million within non-current receivables. This entry indicates Cerillion has booked revenue for 2021 where the customer will not pay for at least another twelve months.

The small print also admits “certain” customers may enjoy “longer” payment terms:

“In addition, certain customers have historically been offered longer payment terms, based on instalments over a number of years.”

And this small print talks of Cerillion effectively “providing financing to the customer“:

“When a contract includes a significant financing component as a result of payments to be made in arrears, the accounting effect of the financing component decreases the amount of revenue recognised with a corresponding increase to interest income as Cerillion is providing financing to the customer.”

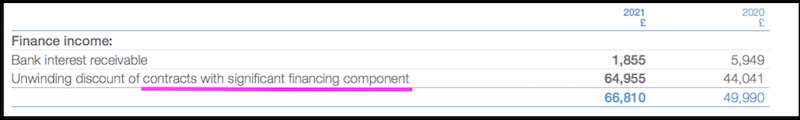

The (small) figures below have begun to appear in the accounts, and should be monitored to detect whether more customers start paying “in arrears“:

Deferred income, cash flow and other financials

Not every Cerillion customer enjoys generous payment terms. Some in fact pay upfront for their software.

The accounts show deferred income (i.e. upfront customer payments) of £5 million:

Advance client payments plus significant accrued expenses (most likely staff wages) have counterbalanced the upfront revenue recognition to underpin a remarkably healthy rate of cash conversion.

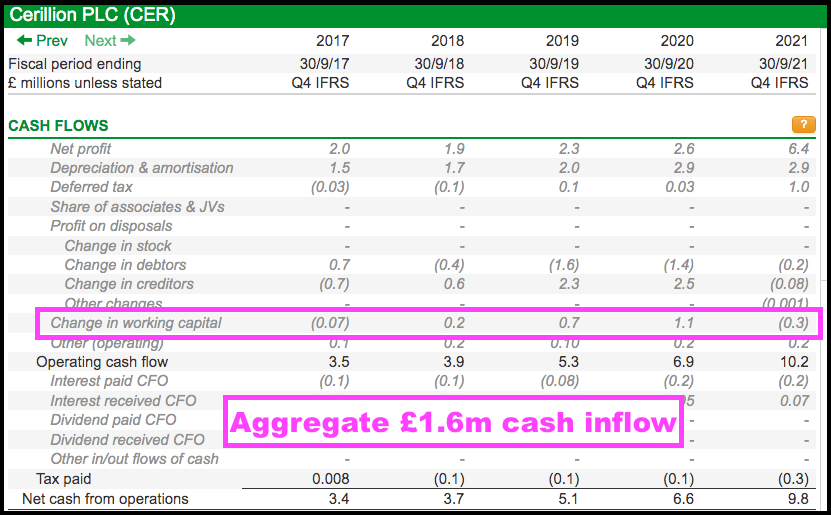

SharePad shows a positive £1.6 million cash working-capital movement during the last five years:

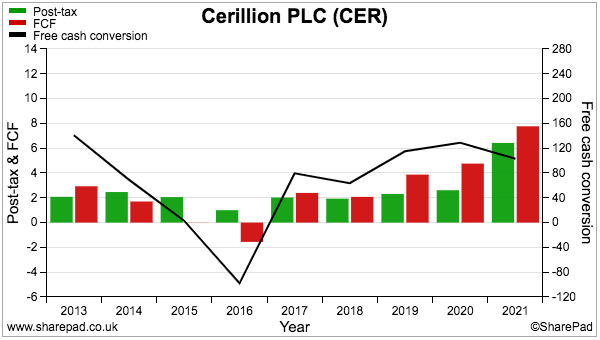

Cash generation is assisted by very prudent depreciation and amortisation charges, leading to free cash flow exceeding reported earnings during each of the last five years:

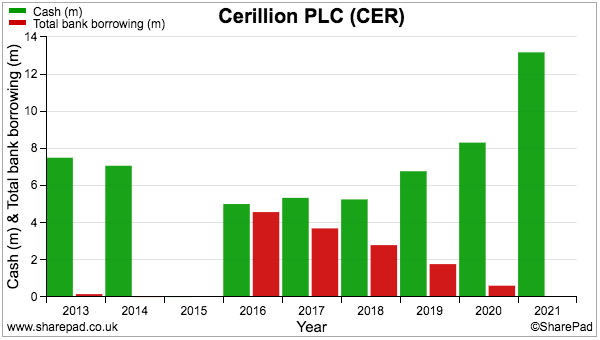

The cash flow has allowed the bank balance to expand while clearing all debt:

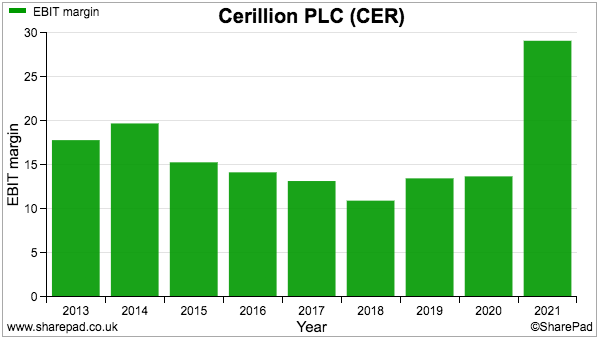

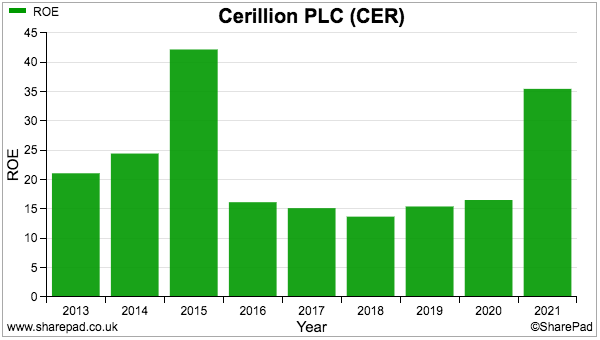

Cerillion’s healthy cash flow is backed by a robust margin that last year approached 30%…

…and a useful return on equity that surpassed 30%:

I must add the post-flotation accounting is supplemented by a welcome absence of acquisitions, exceptional items and restatements.

Management and employees

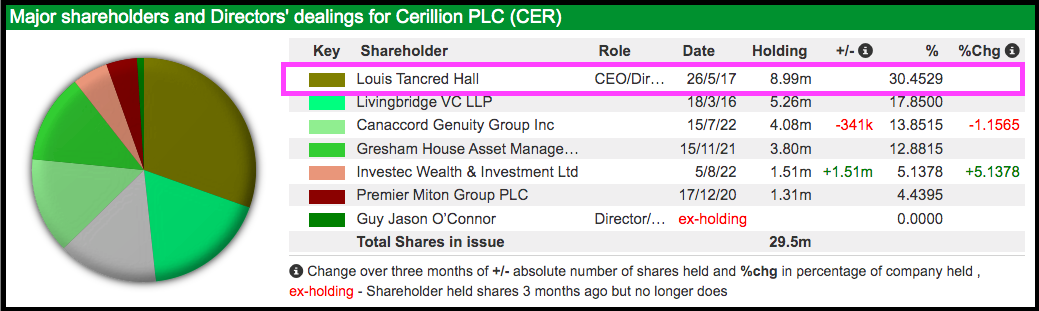

The aforementioned Louis Hall and Guy O’Connor both remain on Cerillion’s board.

Mr Hall continues as chief executive and looks to have the ‘owner’s eye’ through a 30%/£96m shareholding:

Mr Hall has cut his shareholding only once since the flotation, during 2017 at 120p. Mr O’Connor meanwhile retired as an executive — and sold his entire 8% stake at 255p a share — during 2020. He currently sits as a non-exec.

Another non-exec is Mike Dee, who spent 29 years working at Manx Telecom of which four were as chief exec. No doubt Mr Dee had some involvement with that pioneering 3G launch.

A skim of the board’s remuneration does not unearth anything obviously outrageous, although the pay arrangements did attract a 14% protest vote at the February AGM.

AGM protest votes were also submitted against the group’s new articles of association (10%) and the (rather unusual) proposed authority to incur political expenditure (26%). I assume the concerns related to possible online-only AGMs and the chance certain charitable donations could be viewed as political.

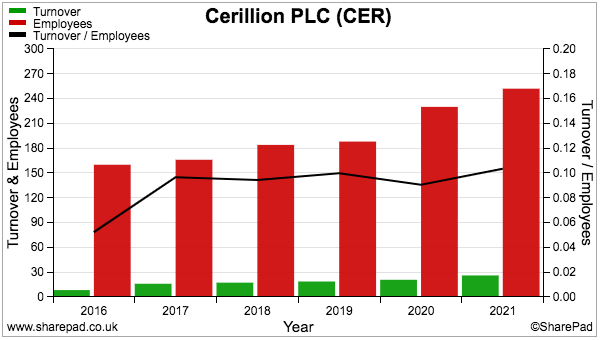

Revenue per employee provides an interesting insight:

The last five years have witnessed sales at a consistent £100k or so per head, which seems low for a software business.

More than half of Cerillion’s workers are in fact based in India, and the average cost per employee runs at approximately £50k — which again seems low for a software business.

A blunt interpretation of these staff measures could be Cerillion’s tier-2 and tier-3 customers are able to pay only tier-2 and tier-3 prices for their software, and the group has to employ tier-2 and tier-3 workers to make a suitable profit.

Valuation and summary

Interim figures published during May appeared strong. Revenue gained 26% to £16 million, adjusted profit before tax surged 65% to £6 million while the dividend was lifted 24% to 2.6p per share.

The performance was boosted by major new contracts and Mr Hall supplied an optimistic outlook:

“We see excellent opportunities for continuing growth and the new customer sales pipeline has grown significantly. Given the Company’s progress, and its strong financial and operational position, we continue to view prospects very positively.”

Quibbles may have included annual recurring revenue climbing only 9% to £10 million and the back-order book slipping 6% to £40 million.

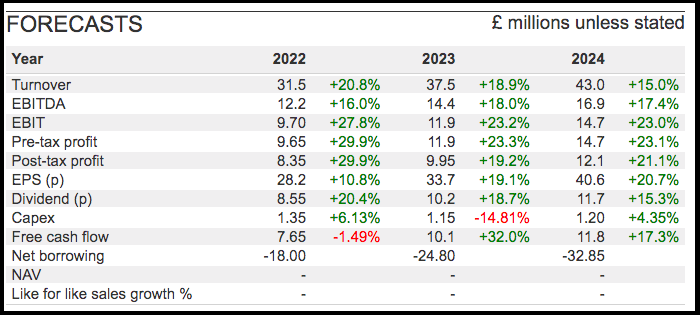

SharePad shows the following upbeat forecasts:

The projections put the shares on a near-term earnings multiple of almost 40x, which drops to 26x based upon the 2024 estimates. Bear in mind the current-year forecasts imply the second half will show a lower profit than the first, and a lower profit than the second half of the previous year.

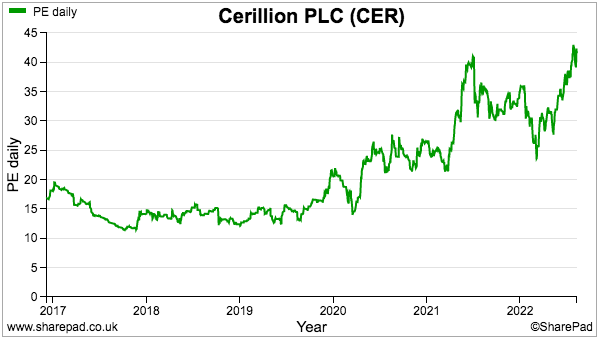

Cerillion’s rising share price has been supported by a favourable re-rating. The market had applied a more modest 15x multiple until the larger contracts started to emerge the other year:

The buoyant share price is very understandable given Cerillion’s recent progress and those upbeat forecasts. But does the present valuation already reflect the higher earnings expected during the next few years?

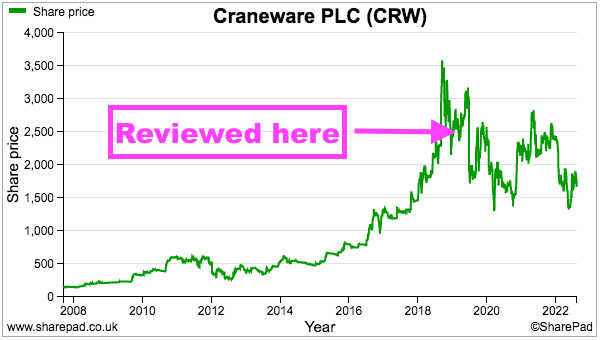

Craneware provides a useful comparison.

I reviewed this other software business three years ago and, similar to Cerillion, the company then exhibited fast-growing contracted income from a seemingly dependable customer base (American hospitals) that led to attractive financials.

The shares at the time were £25 and are now £17:

Craneware investors have suffered because the shares were then valued very highly (49x earnings), and subsequent earnings growth (approximately 5% per annum) was well below earlier expectations (of 15-20% per annum).

Cerillion could easily endure the same share-price fate if its contract momentum falters and growth rate suddenly subsides. I have to conclude the risk-to-reward opportunity seems quite poor with Cerillion, especially when other cash-rich, high-margin shares have been yielding 8%.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Got some thoughts on Cerillion or Maynard’s analysis? Share these in the SharePad “Cerillion’ chat and join the discussion. Login to SharePad – select or search for “Cerillion plc” – click on the chat icon in the top right – scroll down to the Current Share section and click on the Cerillion plc chat.

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Cerillion.