Cake Box’s shares have tripled as its franchisees sell more egg-free cakes and open more shops. But Maynard Paton discovers the accounts contain some unusual financial disclosures and alarming remarks from the auditor.

Oh dear. I had expected this article to celebrate a dynamic growth company that had commendably prospered during the pandemic.

I find myself instead relaying some unusual financial reporting after digging deep into a few annual reports.

Read on to discover:

- An erroneous £2 million entry within the cash flow statement;

- The inconsistent disclosure of related-party transactions;

- The delayed reporting of a website breach to the auditor (and customers);

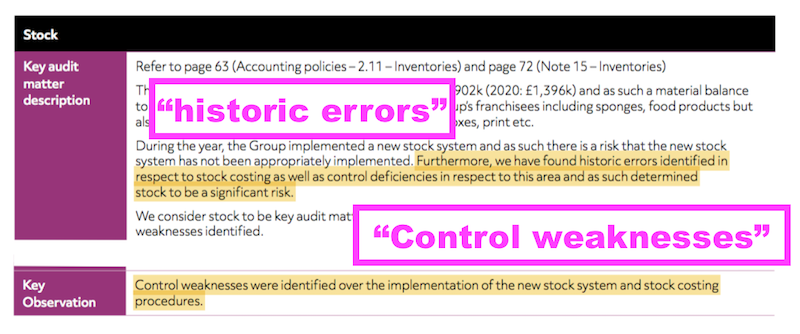

- “Historic errors” with stock control;

- The auditor resigning after becoming “concerned about the robustness of the Company’s control and governance frameworks“;

- The peculiar disclosure of trade payables and receivables, and the level of receivables versus revenue, and;

- Bookkeeping curiosities such as overdue tax, R&D tax credits and regular revaluations of distribution centres.

Let’s take a closer look.

Egg-free cakes sold through 200 Cake Box outlets

The small-cap in question is Cake Box, the owner of a popular brand of fresh cream cakes.

The business operates as a franchisor. It manufactures a “high end, secret recipe” egg-free sponge that is sold to numerous franchisees who in turn use the sponge to make the cakes. The franchisees presently sell the cakes from 200 outlets.

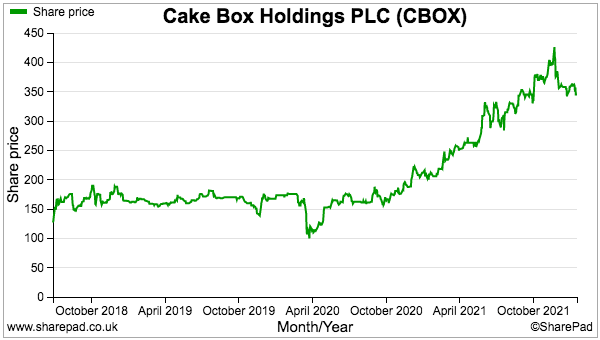

Cake Box floated on AIM during 2018 at 108p and the shares have since tripled to support a market cap of almost £140 million:

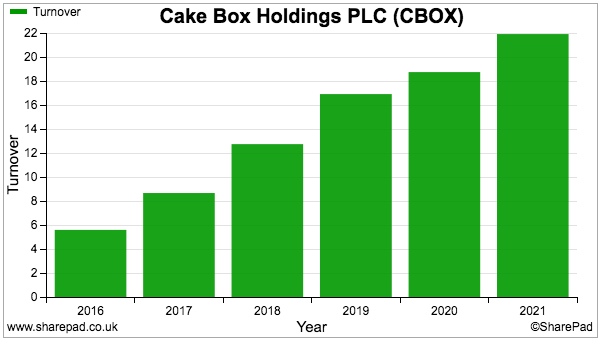

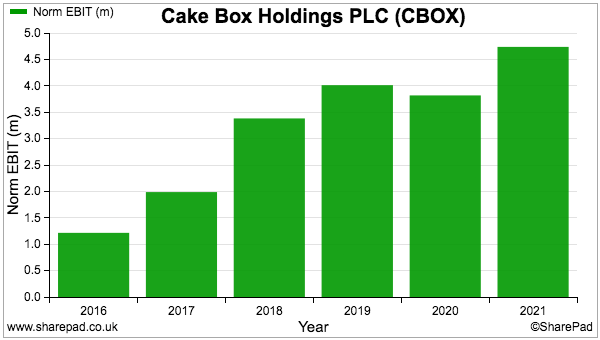

Franchisees opening new shops combined with some impressive like-for-like sales figures have powered revenue and profit higher:

The ‘quality’ ratios also look great:

So far, so good.

But then I opened the accounts and was not impressed.

An extra £2 million and inconsistent related-party transactions

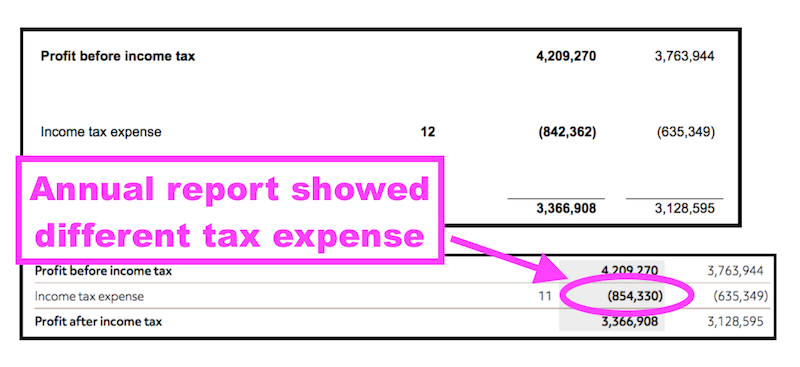

The story starts with the 2021 annual report and a small error within the income statement.

The entries did not add up, and I discovered the declared £854k tax charge differed to the £842k reported within the earlier results RNS:

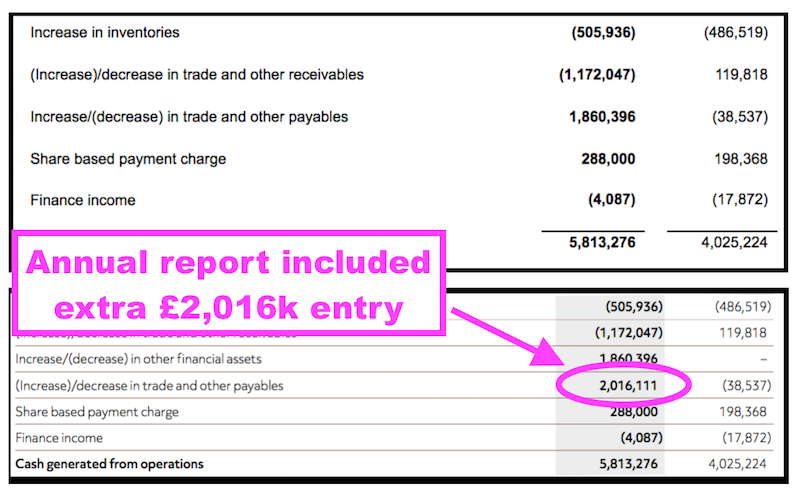

The cash flow statement contained a larger error: the insertion of a phantom £2 million entry:

Such mistakes may seem minor when the original RNS was correct. But double-checking the rest of the report felt in order, just in case.

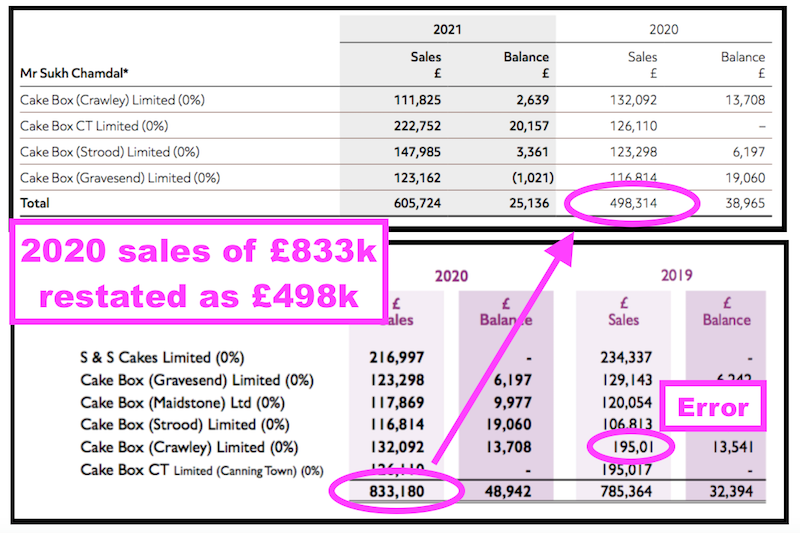

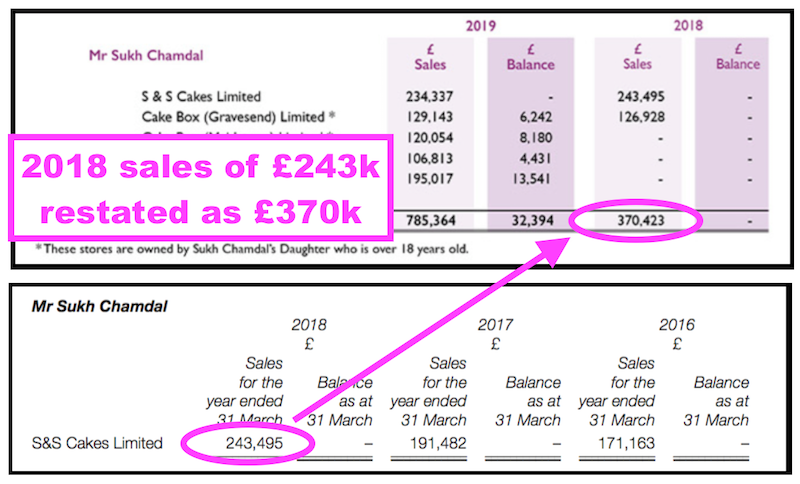

I found inconsistencies within the reporting of related-party transactions.

Certain numbers for 2020 were restated lower within the 2021 annual report…

…while certain numbers for 2018 were restated higher within the 2019 annual report:

Cake Box’s related-party transactions reflect the sale of goods to the franchisee companies controlled by members of the directors’ families.

Taking the 2020 restatement, S & S Cakes and Cake Box (Maidstone) were included in the 2020 annual report but then excluded in the 2021 report.

Companies House shows S & S Cakes changing ownership during March 2020 but does not show any similar ownership change for Cake Box (Maidstone).

(Note: The 2020 numbers for Cake Box (Gravesend) and Cake Box (Strood) were swapped within the 2021 report)

Again, this inconsistent reporting could be seen as a minor administrative issue. But my concerns over sloppy disclosure were mounting up.

I now wondered how diligent the auditor had been when checking these entries within the 2021 report. I discovered the auditor had been pre-occupied with other matters.

Website hack went undisclosed for more than a year

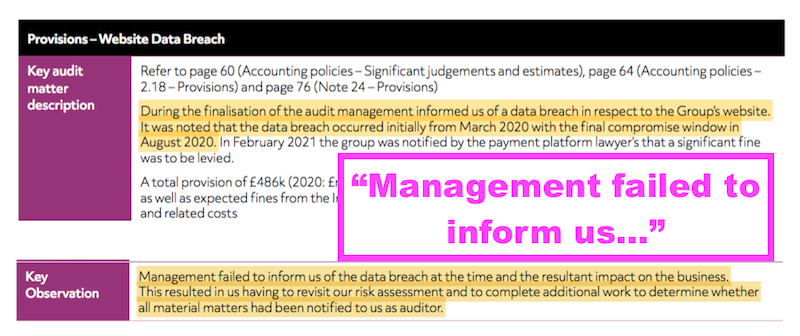

The audit report within Cake Box’s 2021 annual report contains some remarkable text.

Cake Box’s website was hacked during March 2020, but management only told the auditor about the data breach during the full-year audit process more than one year later:

No wonder the auditor had to “complete additional work to determine whether all material matters had been notified“.

The audit report noted “the final compromise window” relating to the breach occurred during August 2020, although Cake Box’s payments processor informed the company of the problem on 27 April 2020. Those dates suggest Cake Box took at least three months to rectify the website.

(Note: Customers (and shareholders) were informed of the data breach during June 2021 — fifteen months after the hackers first struck!)

Nor was the auditor enamoured by Cake Box’s stock-keeping. “Historic errors” and “control weaknesses” were unearthed:

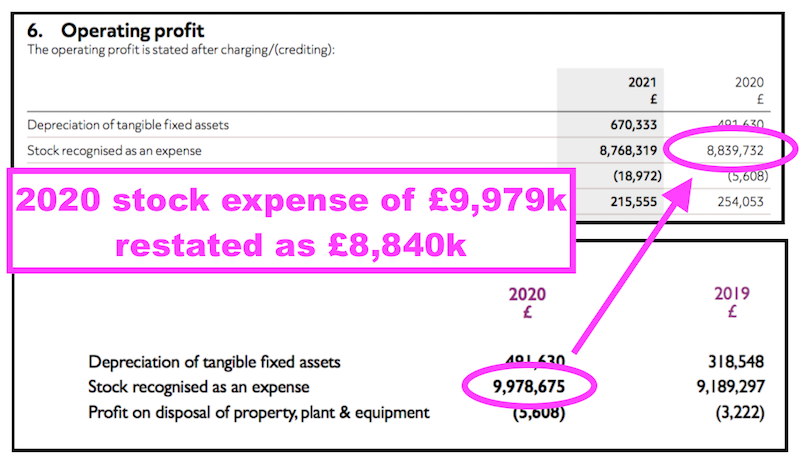

Interestingly enough, Cake Box restated the amount of stock recorded as an expense for 2020…

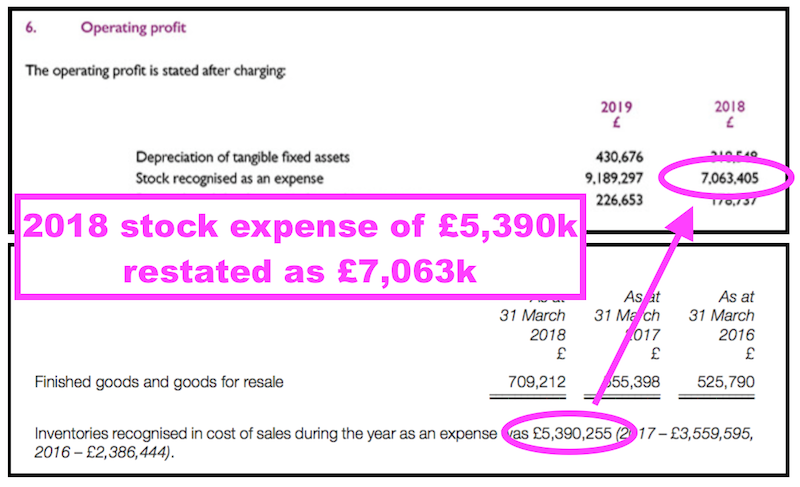

…and for 2018:

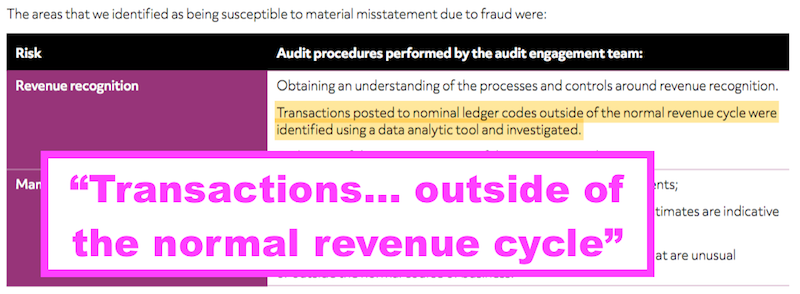

The audit report also contained this line: “Transactions posted to nominal ledger codes outside of the normal revenue cycle were identified using a data analytic tool and investigated.”

My earlier concerns of sloppy disclosure had now shifted to wider doubts about the company’s financial controls.

And then I realised the auditor had resigned.

The auditor’s letter of resignation

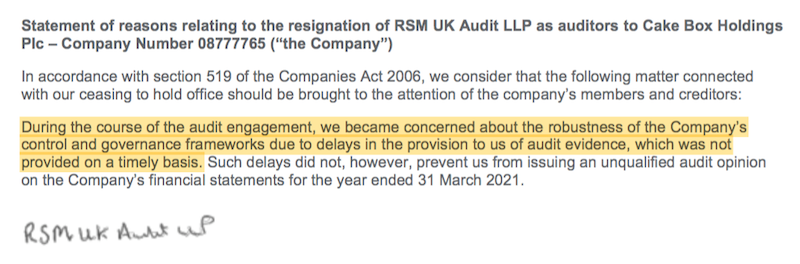

Relations with the auditor were severed completely last September.

An RNS at the time said:

“Cake Box, the specialist retailer of fresh cream cakes, is pleased to announce that following a competitive and comprehensive tender process, overseen by the Audit Committee, it has appointed MacIntyre Hudson LLP (“MacIntyre Hudson”) as the Company’s auditor with immediate effect. The Company intends to put the appointment to a vote of shareholders at the Company’s next Annual General Meeting.

The Company’s previous auditor, RSM UK Audit LLP, submitted its letter of resignation to the Board of Directors on 16 September 2021. In accordance with the relevant Companies Act 2006 requirements, a copy of the resignation letter and statement of reasons will be sent to shareholders of the Company.“

The statement seemed innocuous enough, until I read the copy of the auditor’s resignation letter:

An auditor becoming “concerned about the robustness of the Company’s control and governance frameworks” seems very alarming to me.

Note that the RNS announcing the change of auditor referred to a “competitive and comprehensive tender process“.

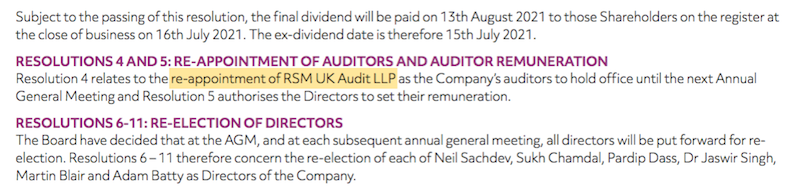

But Cake Box did not mention an audit tender process within its 2021 annual report. Cake Box was in fact happy to recommend the re-appointment of the auditor at the AGM just six weeks before the resignation:

The wording of the auditor’s resignation letter — in particular, “we consider that the following matter connected with our ceasing to hold office should be brought to the attention of the company’s members and creditors” — does not suggest (at least to me) the departure was due entirely to a tender process.

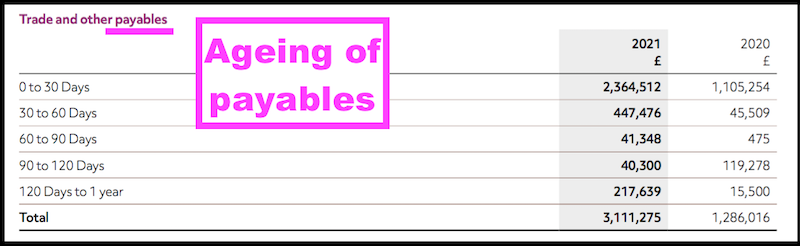

The peculiar disclosure of trade payables and receivables

The auditor’s departure prompted me to look closer at the 2021 annual report.

The following accounting note is perhaps the most peculiar. I cannot recall ever seeing another company provide the ageing profile of its trade and other payables:

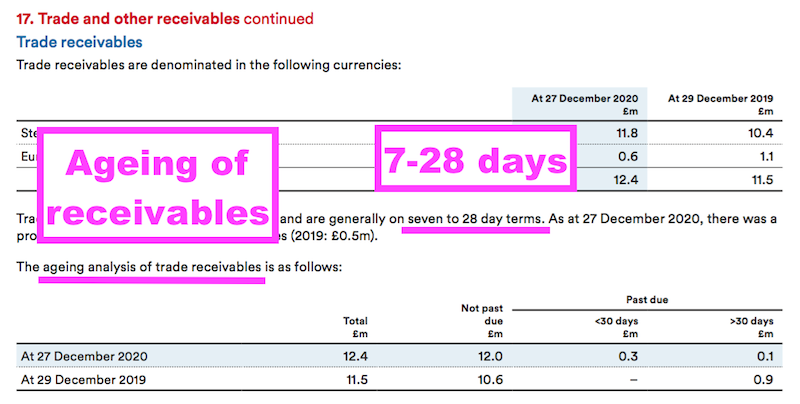

The reporting standard is to disclose the ageing profile of trade receivables, as demonstrated by fellow high-street franchisor Domino’s Pizza below:

Domino’s says its trade receivables — i.e. money owed to the group by the franchisees — are “generally on seven to 28 day terms“.

A comparison between Domino’s trade receivables and revenue bears this payment arrangement out. Trade receivables of £12 million represented 2.5% — or 9 days’ worth — of its revenue of £505 million.

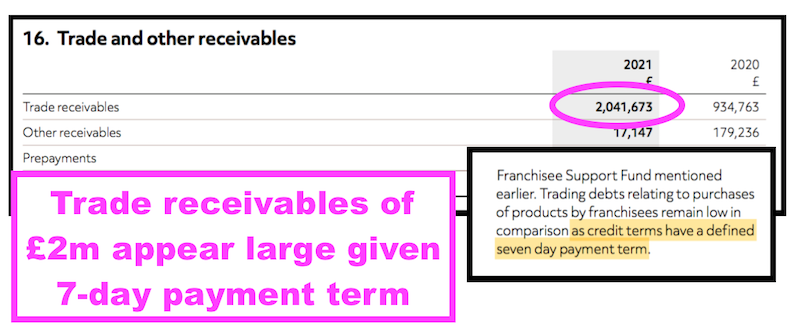

In contrast, Cake Box’s trade receivables of £2 million represented 9.3% — or 34 days’ worth — of its £21 million revenue for 2021.

That level of receivables does seem large given Cake Box’s annual report says franchisees have a “defined seven day payment term“:

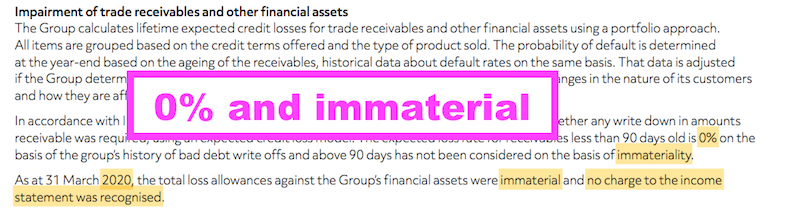

Cake Box strangely does not include an ageing profile of its trade receivables within its annual reports. But the company did confirm bad debt write-offs were zero for 2021 (albeit using the wrong date):

Overdue tax, R&D and property revaluations

My studying of Cake Box’s annual reports revealed these interesting snippets.

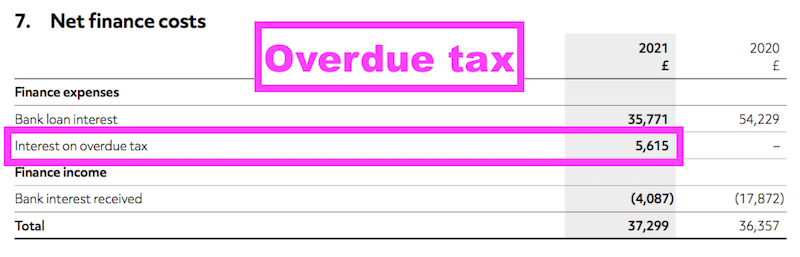

Having to pay interest on overdue tax (during 2021 and 2019) does not suggest timely bookkeeping:

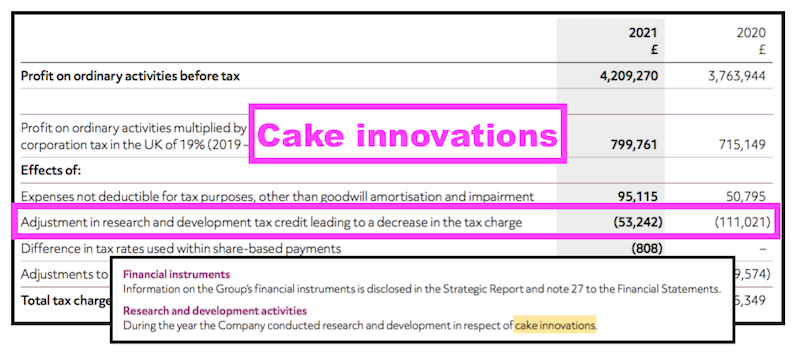

The company’s “cake innovations” have attracted R&D tax credits that have reduced the tax charge every year since at least 2016:

(I was not aware the creation of new cream cakes met HMRC’s definition of R&D.)

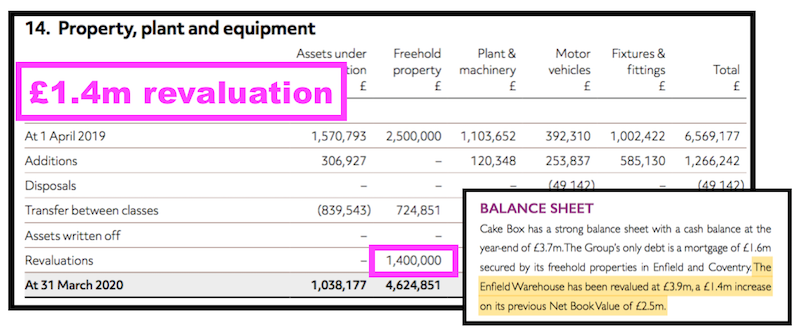

And freehold properties have been revalued upwards three times during the last five years, including this £1.4 million — or 43% — uplift for 31 March 2020:

Cake Box carries its warehouses, distribution centres and bakeries at fair value, which is entirely legitimate but does require regular revaluations.

All I can say is I cannot recall looking at another non-property company with the same regular revaluation policy. And ensuring warehouses are valued properly does seem odd when the auditor has highlighted various reporting deficiencies.

Cake Box’s actions to improve and enhance

I should stress that Cake Box’s 2021 annual report was signed off by the auditor with an unqualified audit opinion.

What’s more, the company has taken steps to improve its administration.

June’s annual results mentioned “strengthening our internal audit function“:

“This includes the recruitment of an IT Director, a Commercial/Managing Director with responsibility for Group marketing and supply chain management, a Financial Analyst and strengthening our internal audit function to ensure that stronger ongoing controls are operated across the group particularly in light of the data breach and increased online sales.”

September’s letter to shareholders then referred to “actions to enhance the Company’s control and governance framework“:

“In order to support the growth of the business, in recent months we have taken a number of actions to enhance the Company’s control and governance framework. These include appointing an additional new Non-Executive Director, Alison Green, the appointment of BDO LLP to fulfil an internal audit function and hiring additional senior staff.“

And the latest interim results stated “improved internal audit practices“:

“We have strengthened our internal IT capabilities by appointing an experienced IT Director and further invested in our IT systems. We have also appointed BDO to assist with implementing improved internal audit practices.“

The recruitment of extra senior staff was also touched upon during three results webinars (here, here and here) during November.

Perhaps the company’s actions alongside a fresh auditor will now combine to prevent any further reporting mishaps.

Judging by the share price, the market certainly believes the growth story will continue.

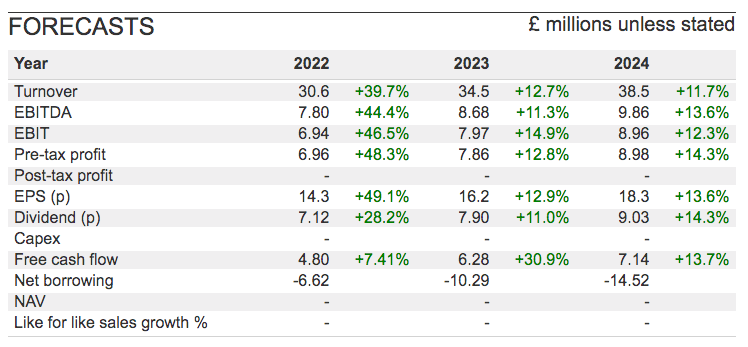

A lot of the webinar talk was of expanding the franchisee estate from 200 locations to beyond 400 during the years ahead. Such projections have fed through to the positive forecasts below:

Financial risks and unusual disclosures

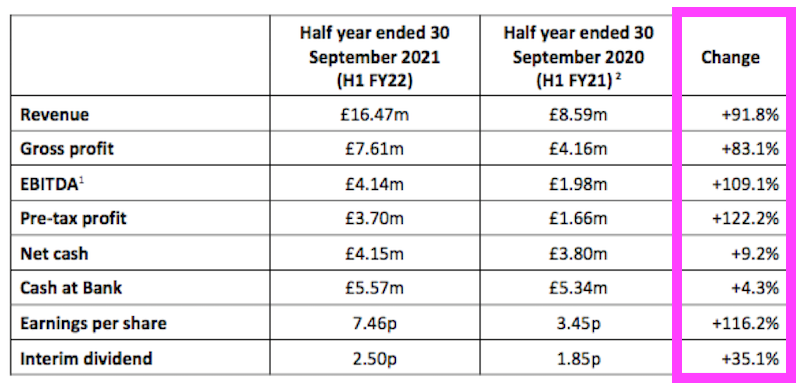

Maybe the market is right. Cake Box has after all exhibited very respectable growth during recent years, which continued with November’s impressive half-year performance:

I therefore admit I could be acting far too sceptically here, and I may be missing out on an exceptional growth stock if my worries prove unfounded.

But I have learnt over time not to take financial risks with shares where I have any doubts about unusual disclosures. Inspecting annual reports and raising awkward points (e.g. LoopUp and Purplebricks) have helped protect my portfolio from rash investments, and I intend to keep things that way.

While Cake Box does not convince me, you can of course download the accounts, double-check what I have written and then make up your own mind.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and hosts an investment discussion forum at quidisq.com. He does not own shares in Cake Box.

Additional UPDATE note: Cake Box issued a statement on 24/01/22 following the publication of this article. The full statement is below:

“Cake Box notes the movement in its share price this morning and also notes recent commentary from a retail investor blogger.

“The Company acknowledges some transcription errors between its 2021 Full Year Results announcement published on 30 June 2021 (the “Results Announcement”) and the 2021 Annual Report and Accounts (the “Annual Report”). It also notes inconsistencies in prior period inventory reporting and comparative period disclosures relating to director interests in franchise stores. Where such discrepancies exist between the Annual Report and the Results Announcement, investors should refer to the Results Announcement.

“The errors noted have no impact on the Group’s reported profits, cash flows or balance sheet and the Company received a clean audit opinion for the year.

“As previously announced and as we continue to grow the business, a key priority for the Board remains underpinning growth with the appropriate level of experience and expertise for the Group’s central functions, internal controls and processes. BDO has also been appointed to assist with implementing improved internal audit practices.

“The Board confirms that, since the Company updated the market with its half year results in November, trading in H2 has continued strongly and in line with expectations for the full year.”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Many thanks for the write up, Maynard. I’ve been wondering about this company for some time and a recent director buy has me further intrigued. Those points you’ve highlighted though – thank you so much.

What an excellent investigation, good analysis Maynard.

Great work Maynard and thanks for the trade idea.

You’ve knocked a good chunk off the market cap with this – someone has suggested you now be renamed ‘Muddy Maynard’!

Excellent analysis and write-up, thank you

Having worked at several large firms, number discrepancies are far more common than one might assume. As for small companies, it’s up to them to staff up as best as they can.

As a past investor in Pat Val I see the similarities in product but hope the story does differ.

The high ROCE and high demand for stores means it should weather storms.

The R and D is probably for vegan cakes and vegan creams which are not easy.

Overall I think Cakebox has a higher chance of a national roll out than going under. By a large margin. I continue to hold and am adding under current market conditions

But that’s just me

Jake

Thanks everyone for the kind words about the article. Glad you found it useful.

Maynard

Hi Maynard,

This is exceptional investigative work!

I have never thought to check RNS v annual report….clearly this episode suggests its worth doing, as well as looking at prior year changes (had they disclosed the latter in the notes? If not then it suggests accounting fraud).

Blimey Maynard, you knocked about £25m off the market cap.

This is why I tend to stick with mature large and mid-caps. Obviously they’re not perfect, but at least they have lots of people looking at this sort of thing. And lots of analysts poking around in the weeds.

Looks like the co-founder and CFO has left after a “financial blogger” (I wonder who?) identified accounting issues…

I would insert a link but that always causes comments to await moderation, so just search the web.

Yes, you did a good job in reading between the lines…..and forensically trashed a company that has excelled financially in a short space of time…..you must be proud of yourself.I too have kept an eye on CB, and you’d be a fool not to invest….They will have the last laugh.

Now you have a claim to fame, wiping £25m off shares?

If it were me that found issues with a company’s spreadsheet, I’d be a Gentleman about it; let the company know of their faults/failings…, encourage a better practice so that they might learn from their mistakes.

You’ve just pissed in your own back garden. Not a definition of a Gentleman Mr Patton!

I don’t get the anger.

If the company is legit, they shouldn’t have many worries as the price will reflect its value over the long run. This would be just a great buy opportunity (also for the management).

Hi Michael,

The company already knew about its failings — the auditor published them within the audit report and within its resignation letter.

I suspect the article has accelerated any better practices the company was going to adopt versus the Gentleman approach. Certainly the departure of the FD suggests that is the case.

Maynard

Thanks for the analysis, do you know where we can find the annual report with the accounting issues? appreciate it

Hi eduardoq

Annual report has since been corrected, but can be found here:

https://investors.eggfreecake.co.uk/documents/

Auditor resignation letter is within the ‘shareholder documents’ section

Maynard

This is a fantastic write up.

Thanks Maynard.

Thanks Adam, glad you liked it

Maynard

This post is really in-depth, revealing hidden issues behind the company’s finances. The author’s analysis is very professional and worth learning from for all investors.