Bruce reviews a recent book Chaos Kings, on investors who benefit from financial crises and volatility. Companies covered BUR, STVG, WINK and CVSG.

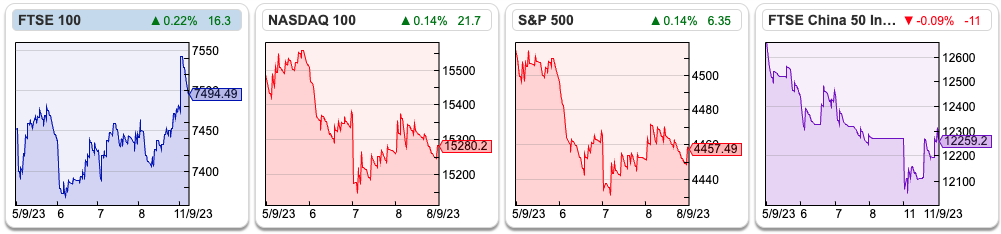

The FTSE 100 was up 0.5% to 7,494 last week and was the best-performing major indices other than the Mumbai S&P BSE +2.1% over that time period. Nasdaq100 and S&P were down -1.4% and -1.11% respectively. The FTSE China 50 sold off even more strongly -3.5%. Brent crude (BZ-MT) rose +5.5% to $90 per barrel and Natural Gas (NG-MT) rose almost +7% as workers at an Australian NG plant began their strike. To put that into context though Natural Gas is still down c. -30% YTD.

I’ve just finished reading Chaos Kings, by Scott Patterson, who looks at the hedge fund strategies that have benefitted from volatility. It begins with Bill Ackman, and his trading through the Covid pandemic at the beginning of 2020, but really focuses on Nassim Taleb’s ideas and Mark Spitznagel’s fund Universa. It is a startling book, suggesting the whole asset allocation industry, full of professionals and consultants, is built on an empty narrative that you can increase returns by i) diversification ii) leverage. Instead, Spitznagel and Taleb believe that investors should own options which expire worthless most of the time, but have strongly positive pay-offs at times of crisis, just when you need them.

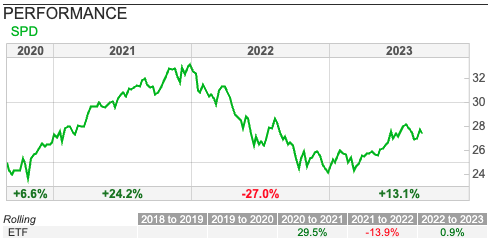

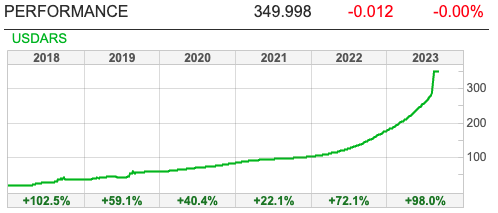

Unfortunately, there’s no easy way for retail investors to benefit from these options strategies. The book does mention one ETF, Simplify US Equity PLUS Downside Convexity (ticker SPD), launched by ex-Pimco ETF manager Paul Kim (chart below).

Spitznagel is sceptical that the SPD ETF can provide cost-effective protection, and I’ve included the chart above to see how it has done since its launch in mid-2020 (after the market disruption in March 2020). In 2022 the SPD ETF fell -27% and has recovered +13% YTD, which suggests that it is too correlated with the S&P500 to be much use as downside protection. Spitznagel says in the book he would like to design a product to help retail investors benefit from his trading strategy but hasn’t done so yet.

This week I look at STVG’s and M Winkworth’s H1 June results, plus the Competition and Markets Authority’s (CMA) investigation into high vet bills, which could injure CVS’s performance. I start with New York Judge Preska’s favourable ruling for litigation funder Burford.

Burford favourable YPF ruling

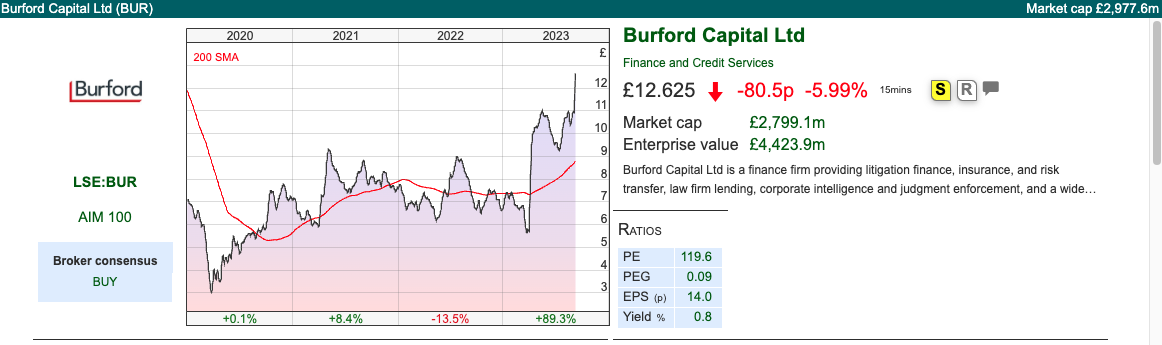

Judge Preska in New York has awarded $16bn in damages from Argentina to plaintiffs funded by Burford. This sum includes $8.4bn (the high end of estimates) for the expropriation of the oil company YPF, plus about $7.6bn in interest (8% from May 2012). The shares rose almost +20% on Friday afternoon, then sold off -6% on Monday morning. I wrote up some initial comments first thing on Monday morning in the Sharepad chat. In theory, Burford will receive over $6bn from the judgement; however, getting Argentina to pay may prove problematic as a Burford representative is quoted in the FT saying they will :

“either need to negotiate a resolution of the matter with Argentina, which would certainly result in what would likely be a substantial discount to the judgment amount in exchange for agreed payment, or engage in an enforcement campaign against Argentina which would likely be of extended duration.”

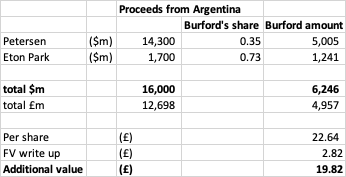

This Reuters article says that analysts at Jefferies have estimated that Burford might be entitled to $6.3 billion from the verdict. That agrees with my calculations, which I first published in April this year and which I have updated below:

The left-hand column shows the amounts awarded to the two plaintiffs that Burford have been representing i) the shareholders of Petersen, who owned a 25% stake in YPF ii) Eton Park, the hedge fund which acquired shares in YPF. Burford’s share of the Petersen entitlement is lower because they sold 38.75% to third-party investors (and controversially marked up the fair value of the claim in their balance sheet), they also shared some of the upside from Petersen with other law firms. Hence, BUR expect to receive 35% of Petersen’s $14.3bn entitlement, but 73% of Eton Park’s $1.7bn entitlement. In total, this comes to c. $6.2b (£5.0bn), on a per share basis almost £23. However, Burford have also written up the value of these claims to roughly a ¾ of billion on its balance sheet, equating to 282p per share, so deducting that amount gives 1982p per share.

Burford hasn’t received the money yet though, and the Argentine Govt has said they will appeal the ruling. Furthermore, the country is close to bankruptcy, so they might not be able to pay even if they wanted to. Sharepad has the Argentine Peso (ticker ARS) is competing fiercely with the Turkish Lira (ticker TRY) to be the worst-performing currency over the last few years.

Opinion: This is good news, even if they don’t receive the full £20 per share from Argentina, perhaps more importantly the judgement in New York also validates the litigation finance business model. BUR is a business that the market really struggles to value, but assuming that the news continues to be positive, this ought to be a source of returns uncorrelated with whatever the rest of the stockmarket is doing. I own the shares.

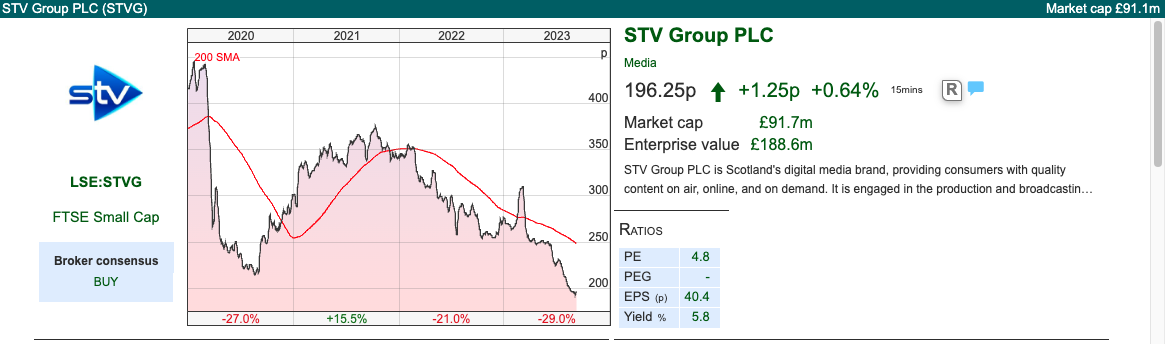

STV H1 June 2023

This company presented at Mello in May, but since then the share price has fallen by around a quarter, due to the difficult advertising market. The results themselves show impressive top-line growth, with revenue +23% to £75m. There was a statutory loss before tax (not included in the headline bulletpoints at the top of the RNS) of £2.3m, mainly due to exceptional items of £2.8m, related to a deal with ITV over digital content. There’s a further £5.2m adjustment related to a tax credit for High-End Television (HETV), which seems to be because the TV station produces quality dramas, which the government wants to incentivise. There’s also an IAS 19 charge of £1.3m related to the group’s £55m pension obligations. There are more “one-off” costs coming in H2 with the acquisition of Greenbird Media (£24m in cash total consideration). In other words, the results are rather messy.

Divisions: The group is split into three divisions, Broadcast 53% of revenue, which saw a -54% decline in operating PBT to £4.9m. That decline was caused by advertising revenue down -14%, previously they had benefited from the Scottish Government spending on public health advertising during the pandemic and also the World Cup football last year. The September Rugby World Cup should be positive for advertising revenue but likely won’t offset the benefit last year from the more widely viewed Football WC.

Digital 13% of revenue, which saw operating PBT +25% to £5.0m. This is the streaming service, where they have an agreement with ITV for exclusive Scottish rights for a range of original and premiere content. The advantage of selling advertising through a streaming service is that it can be programmatically targeted, and can attract digital-only advertisers who haven’t advertised on TV before.

Then Studios, a third of revenue, which saw operating PBT of £0.1m (versus negative £0.1m H1 last year). Revenues quadrupled in this division versus H1 last year. This is producing their own content, like the police drama Blue Lights, which can then be sold to other broadcasters.

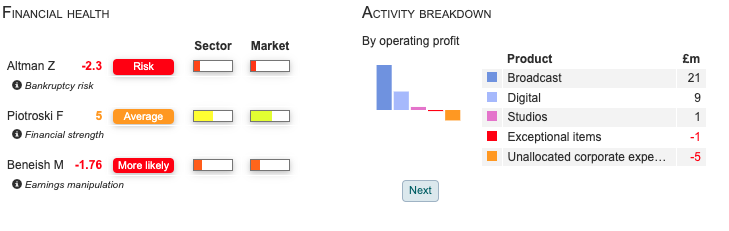

Financial position: The company had net debt of £16.3m, however, this will have increased to close to £40m with the acquisition of Greenbird Media, versus shareholders equity of minus £4.5m. There was just £1.2m of cash generated by operating activities. That doesn’t leave much margin for error, particularly with the pension deficit (see below). Sharepad’s financial health metrics (above) are indicating caution.

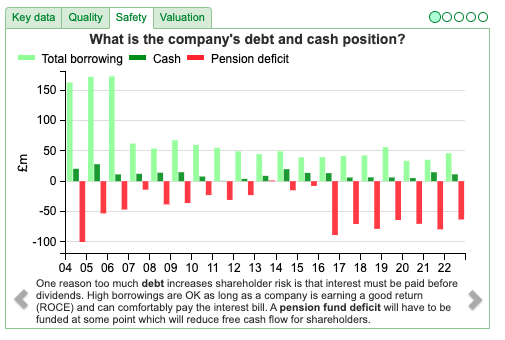

Pension deficit: The most recent actuary’s triennial valuation was December 2020, the next one is scheduled to be concluded in 2024. That 2020 triennial pension valuation resulted in a deficit of £116m on a pre-tax basis at 30 September 2021, versus £63m Dec 2022 recorded on the balance sheet using IAS19 methodology. So, there’s a chance that the pension contributions might increase, but actually, recent movements in bond yields ought to be helpful in reducing the size of their deficit. There was a £2.7m charge through the income statement FY Dec 2022, but then a £6.5m gain below the line through the statement of Other Comprehensive Income. That means we are seeing a more optimistic revision of financial assumptions (presumably the benefit of long bond yields rising, reducing future liabilities) in the IAS19 numbers at least.

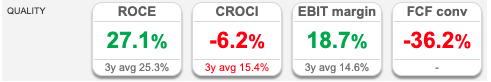

Valuation: The shares are trading on 5x PER Dec 2024F, and the dividend yield is 6.0% the same year, indicating that this may be a “value trap”. The RoCE is very attractive, but the cash ROCI generated and FCF conversion looks far less impressive.

Opinion: I tend to be suspicious of companies with many adjustments to “underlying” earnings, after having followed Lloyds Bank during the “noughties”. Lloyds Investor Relations made so many adjustments to their statutory PBT before the financial crisis, that it became a running joke among analysts and investors. At least STVG is not going to “rescue” HBOS though.

Aside from that this does seem to be an interesting way to play a recovery in advertising budgets. The valuation suggests we may see further disappointment, so if the company can deliver a couple of “in-line” RNS’s then there’s a potential re-rating. I think STVG could make sense as part of a diversified portfolio, but the investment could also go badly wrong. Not a high-conviction idea for me, so I will avoid and revisit in 2024.

WINK H1 June 2023

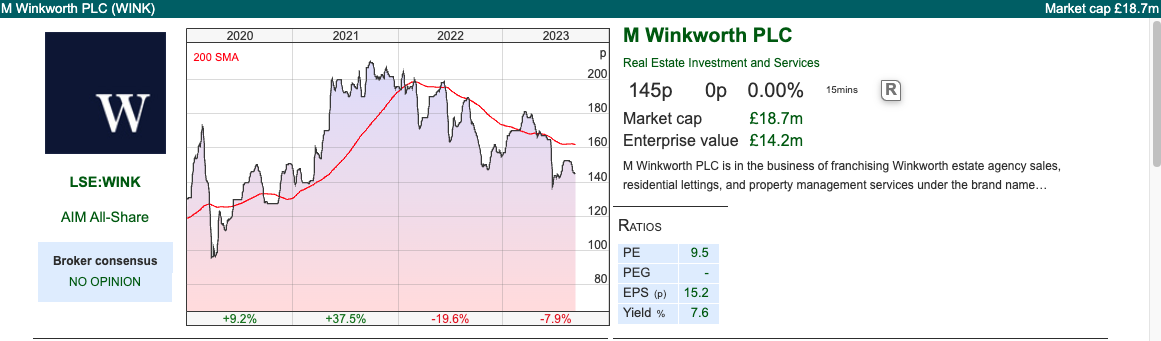

Maynard owns this estate agent franchise which reported H1 results last week. He wrote it up in July here and we discuss it on our podcast, along with Solid State and Kitwave. WINK’s franchisee network consists of 102 estate-agency branches located throughout London and the South East. Franchisees pay WINK a straight 8% of their sales and letting income, plus variable sums towards IT, training, landlord/tenant referrals and other services. That translates as c. 10% of gross commissions earned by estate agent franchisees being converted into WINK revenue.

There are two contrasting trends for all estate agents and M Winkworth is no exception: weaker house sales revenue -18% to £12m offset by stronger lettings revenue +10% to £14m. That means Wink’s total network revenues fell -5% to £26m. The revenue split between sales/lettings is currently 47/53 versus 60/40 in FY 2021 when the housing market was benefitting from stamp duty cuts and low interest rates.

WINK PBT was down -24% to £0.8m H1 this year. The company has £4m of cash on its balance sheet and actually raised their dividend +7% to 5.8p.

Outlook: Management think that the new era of structurally higher interest rates means that buyers are unlikely to delay buying a house. That is putting a positive spin on things, because the most recent mortgage approvals data for July, released two weeks ago, showed that approvals for new home purchases had fallen to around 49,400, down from more than 54,000 in June. On a rolling 3-month basis (July, June, May v the same months last year) that’s a -19% y-o-y reduction. If anything I think we might see a greater percentage decline in the coming months, because in August last year approvals were over 74,000. The effects of the Truss/Kwarteng budget were only seen in the November and December mortgage approvals data last year.

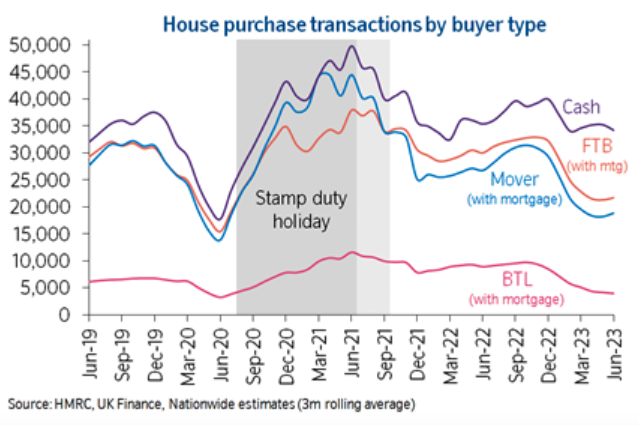

Separately Nationwide reported house prices down -5.3% Aug 2023 versus August last year, which is the worst fall since July 2009. I’ve included this Nationwide chart of home buyers’ transactions. According to Nationwide Buy To Let (BTL) purchases are down almost -30% versus pre-pandemic levels.

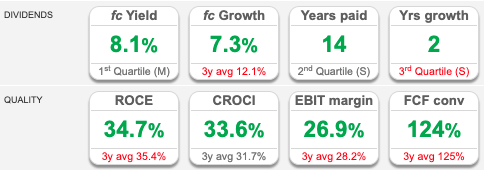

Valuation: M Winkworth trades on a PER of 11.5x Dec 2024F and 2.0x sales. The real attraction though is the high RoCE (35% 3-year average) combined with the dividend yield which is currently above 8%, and to my mind looks sustainable.

Opinion: Estate agents are a play on transactions, rather than house prices themselves. I think the outlook for transactions will remain poor into next year as the UK Government and BoE have done everything to avoid a housing market crash before the coming Election. That means though, that I think we will see a slow grind down over several years. At some point, WINK could be worth a look for their dividends and track record of RoCE 35% (3-year average) and 27% EBIT margin (3-year average), but it strikes me that we could see some disappointment over the next 6-12 months.

CVS Group CMA Review

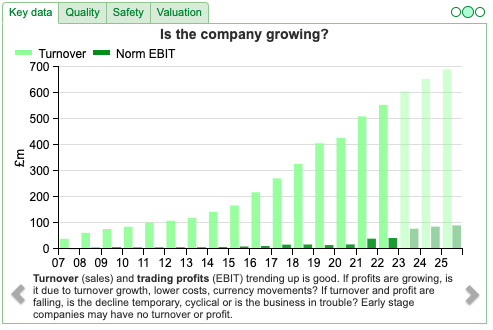

This veterinary surgery company sold off heavily last week, as the Competition and Markets Authority (CMA) has launched a review into the veterinary services market for household pets. They are currently asking for responses from pet owners, vets and third-party suppliers. They will then update the market in early 2024. CVSG shares fell -18% in response last week. The company released a terse RNS saying: “As the CMA have recognised, there continues to be a significant shortage of vets in the UK and employment costs represent the most significant proportion of our cost base. Our pricing reflects this and other inflationary pressures experienced in recent years.”

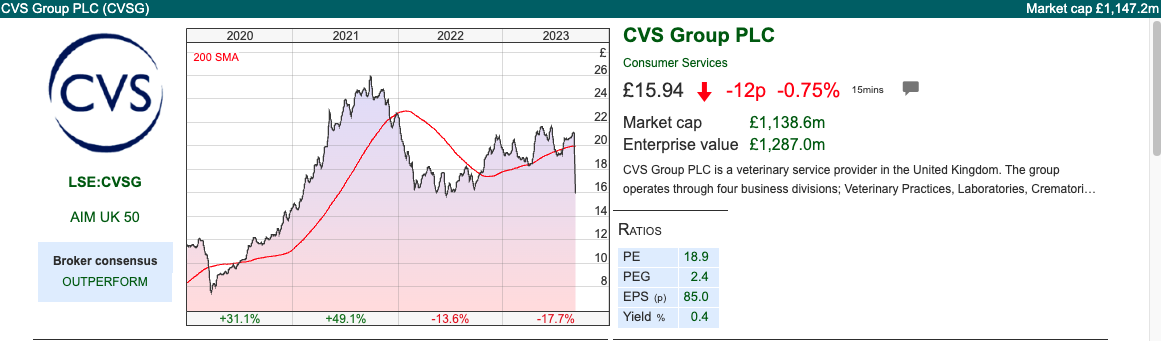

The most recent trading statement we have from the company was on the 27th of July for FY June. CVSG reported organic revenue growth of +7.3% in in like-for-like sales (FY22: + 8.0%), and reiterated their organic revenue growth ambition of between 4% and 8%. That implies sales +9% to £606m and PBT up more strongly to £83m according to Sharepad’s forecasts:

Management also said adj EBITDA was “comfortably in-line” in their July RNS (implying £118m FY Jun 2023 according to Sharepad).

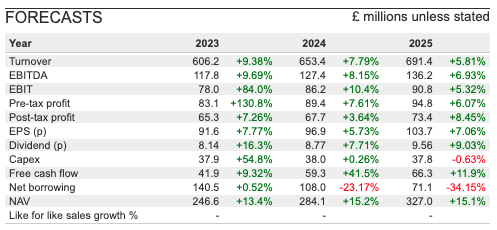

They also announced their expansion into Australia, which they say is in accordance with the plans outlined in their November 2022 Capital Markets Day. Below is the key slide from the CMD, with financial targets such as doubling Adj EBITDA over the next five years (implying c. £180m) through a combination of organic revenue growth and margin expansion. I wonder if management may come to regret having an explicit plan to expand adj margin from 13% in 2019 to 23% in 5 years time (see CMD slide deck below) if the CMA feel that is not delivering value for customers.

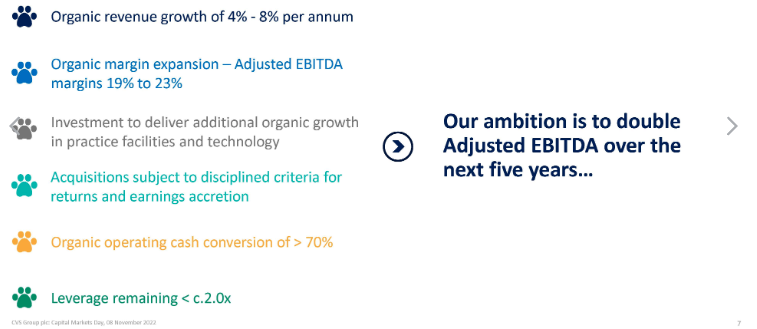

Valuation: The shares are trading on 16.5x PER Jun 2024F and 1.8x sales the same year. The long-term track record of profitable growth is impressive (see chart below) and the shares have risen +550% over the last decade.

Opinion: In the late 1990’s the CMA launched a review into excess profits the UK banks were making from their SME customers. Ultimately this proved toothless, so just because there is a competition inquiry doesn’t mean that the remedy will be bad news for shareholders. In the end, it was the leverage in banks’ business model that destroyed UK banks’ shareholder returns, not regulation. I would imagine that a severe downturn might mean owners face some tough decisions on how much to spend on their pets, and that could be bad news for CVS shareholders. In the short term though the inquiry will likely represent an overhang, and we may see management walk back their margin expansion guidance, so I will avoid for now.

Conclusion

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

He owns shares in Burford

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 12/09/23 | BUR, STVG, WINK, CVSG | Chaos Kings

Bruce reviews a recent book Chaos Kings, on investors who benefit from financial crises and volatility. Companies covered BUR, STVG, WINK and CVSG.

The FTSE 100 was up 0.5% to 7,494 last week and was the best-performing major indices other than the Mumbai S&P BSE +2.1% over that time period. Nasdaq100 and S&P were down -1.4% and -1.11% respectively. The FTSE China 50 sold off even more strongly -3.5%. Brent crude (BZ-MT) rose +5.5% to $90 per barrel and Natural Gas (NG-MT) rose almost +7% as workers at an Australian NG plant began their strike. To put that into context though Natural Gas is still down c. -30% YTD.

I’ve just finished reading Chaos Kings, by Scott Patterson, who looks at the hedge fund strategies that have benefitted from volatility. It begins with Bill Ackman, and his trading through the Covid pandemic at the beginning of 2020, but really focuses on Nassim Taleb’s ideas and Mark Spitznagel’s fund Universa. It is a startling book, suggesting the whole asset allocation industry, full of professionals and consultants, is built on an empty narrative that you can increase returns by i) diversification ii) leverage. Instead, Spitznagel and Taleb believe that investors should own options which expire worthless most of the time, but have strongly positive pay-offs at times of crisis, just when you need them.

Unfortunately, there’s no easy way for retail investors to benefit from these options strategies. The book does mention one ETF, Simplify US Equity PLUS Downside Convexity (ticker SPD), launched by ex-Pimco ETF manager Paul Kim (chart below).

Spitznagel is sceptical that the SPD ETF can provide cost-effective protection, and I’ve included the chart above to see how it has done since its launch in mid-2020 (after the market disruption in March 2020). In 2022 the SPD ETF fell -27% and has recovered +13% YTD, which suggests that it is too correlated with the S&P500 to be much use as downside protection. Spitznagel says in the book he would like to design a product to help retail investors benefit from his trading strategy but hasn’t done so yet.

This week I look at STVG’s and M Winkworth’s H1 June results, plus the Competition and Markets Authority’s (CMA) investigation into high vet bills, which could injure CVS’s performance. I start with New York Judge Preska’s favourable ruling for litigation funder Burford.

Burford favourable YPF ruling

Judge Preska in New York has awarded $16bn in damages from Argentina to plaintiffs funded by Burford. This sum includes $8.4bn (the high end of estimates) for the expropriation of the oil company YPF, plus about $7.6bn in interest (8% from May 2012). The shares rose almost +20% on Friday afternoon, then sold off -6% on Monday morning. I wrote up some initial comments first thing on Monday morning in the Sharepad chat. In theory, Burford will receive over $6bn from the judgement; however, getting Argentina to pay may prove problematic as a Burford representative is quoted in the FT saying they will :

“either need to negotiate a resolution of the matter with Argentina, which would certainly result in what would likely be a substantial discount to the judgment amount in exchange for agreed payment, or engage in an enforcement campaign against Argentina which would likely be of extended duration.”

This Reuters article says that analysts at Jefferies have estimated that Burford might be entitled to $6.3 billion from the verdict. That agrees with my calculations, which I first published in April this year and which I have updated below:

The left-hand column shows the amounts awarded to the two plaintiffs that Burford have been representing i) the shareholders of Petersen, who owned a 25% stake in YPF ii) Eton Park, the hedge fund which acquired shares in YPF. Burford’s share of the Petersen entitlement is lower because they sold 38.75% to third-party investors (and controversially marked up the fair value of the claim in their balance sheet), they also shared some of the upside from Petersen with other law firms. Hence, BUR expect to receive 35% of Petersen’s $14.3bn entitlement, but 73% of Eton Park’s $1.7bn entitlement. In total, this comes to c. $6.2b (£5.0bn), on a per share basis almost £23. However, Burford have also written up the value of these claims to roughly a ¾ of billion on its balance sheet, equating to 282p per share, so deducting that amount gives 1982p per share.

Burford hasn’t received the money yet though, and the Argentine Govt has said they will appeal the ruling. Furthermore, the country is close to bankruptcy, so they might not be able to pay even if they wanted to. Sharepad has the Argentine Peso (ticker ARS) is competing fiercely with the Turkish Lira (ticker TRY) to be the worst-performing currency over the last few years.

Opinion: This is good news, even if they don’t receive the full £20 per share from Argentina, perhaps more importantly the judgement in New York also validates the litigation finance business model. BUR is a business that the market really struggles to value, but assuming that the news continues to be positive, this ought to be a source of returns uncorrelated with whatever the rest of the stockmarket is doing. I own the shares.

STV H1 June 2023

This company presented at Mello in May, but since then the share price has fallen by around a quarter, due to the difficult advertising market. The results themselves show impressive top-line growth, with revenue +23% to £75m. There was a statutory loss before tax (not included in the headline bulletpoints at the top of the RNS) of £2.3m, mainly due to exceptional items of £2.8m, related to a deal with ITV over digital content. There’s a further £5.2m adjustment related to a tax credit for High-End Television (HETV), which seems to be because the TV station produces quality dramas, which the government wants to incentivise. There’s also an IAS 19 charge of £1.3m related to the group’s £55m pension obligations. There are more “one-off” costs coming in H2 with the acquisition of Greenbird Media (£24m in cash total consideration). In other words, the results are rather messy.

Divisions: The group is split into three divisions, Broadcast 53% of revenue, which saw a -54% decline in operating PBT to £4.9m. That decline was caused by advertising revenue down -14%, previously they had benefited from the Scottish Government spending on public health advertising during the pandemic and also the World Cup football last year. The September Rugby World Cup should be positive for advertising revenue but likely won’t offset the benefit last year from the more widely viewed Football WC.

Digital 13% of revenue, which saw operating PBT +25% to £5.0m. This is the streaming service, where they have an agreement with ITV for exclusive Scottish rights for a range of original and premiere content. The advantage of selling advertising through a streaming service is that it can be programmatically targeted, and can attract digital-only advertisers who haven’t advertised on TV before.

Then Studios, a third of revenue, which saw operating PBT of £0.1m (versus negative £0.1m H1 last year). Revenues quadrupled in this division versus H1 last year. This is producing their own content, like the police drama Blue Lights, which can then be sold to other broadcasters.

Financial position: The company had net debt of £16.3m, however, this will have increased to close to £40m with the acquisition of Greenbird Media, versus shareholders equity of minus £4.5m. There was just £1.2m of cash generated by operating activities. That doesn’t leave much margin for error, particularly with the pension deficit (see below). Sharepad’s financial health metrics (above) are indicating caution.

Pension deficit: The most recent actuary’s triennial valuation was December 2020, the next one is scheduled to be concluded in 2024. That 2020 triennial pension valuation resulted in a deficit of £116m on a pre-tax basis at 30 September 2021, versus £63m Dec 2022 recorded on the balance sheet using IAS19 methodology. So, there’s a chance that the pension contributions might increase, but actually, recent movements in bond yields ought to be helpful in reducing the size of their deficit. There was a £2.7m charge through the income statement FY Dec 2022, but then a £6.5m gain below the line through the statement of Other Comprehensive Income. That means we are seeing a more optimistic revision of financial assumptions (presumably the benefit of long bond yields rising, reducing future liabilities) in the IAS19 numbers at least.

Valuation: The shares are trading on 5x PER Dec 2024F, and the dividend yield is 6.0% the same year, indicating that this may be a “value trap”. The RoCE is very attractive, but the cash ROCI generated and FCF conversion looks far less impressive.

Opinion: I tend to be suspicious of companies with many adjustments to “underlying” earnings, after having followed Lloyds Bank during the “noughties”. Lloyds Investor Relations made so many adjustments to their statutory PBT before the financial crisis, that it became a running joke among analysts and investors. At least STVG is not going to “rescue” HBOS though.

Aside from that this does seem to be an interesting way to play a recovery in advertising budgets. The valuation suggests we may see further disappointment, so if the company can deliver a couple of “in-line” RNS’s then there’s a potential re-rating. I think STVG could make sense as part of a diversified portfolio, but the investment could also go badly wrong. Not a high-conviction idea for me, so I will avoid and revisit in 2024.

WINK H1 June 2023

Maynard owns this estate agent franchise which reported H1 results last week. He wrote it up in July here and we discuss it on our podcast, along with Solid State and Kitwave. WINK’s franchisee network consists of 102 estate-agency branches located throughout London and the South East. Franchisees pay WINK a straight 8% of their sales and letting income, plus variable sums towards IT, training, landlord/tenant referrals and other services. That translates as c. 10% of gross commissions earned by estate agent franchisees being converted into WINK revenue.

There are two contrasting trends for all estate agents and M Winkworth is no exception: weaker house sales revenue -18% to £12m offset by stronger lettings revenue +10% to £14m. That means Wink’s total network revenues fell -5% to £26m. The revenue split between sales/lettings is currently 47/53 versus 60/40 in FY 2021 when the housing market was benefitting from stamp duty cuts and low interest rates.

WINK PBT was down -24% to £0.8m H1 this year. The company has £4m of cash on its balance sheet and actually raised their dividend +7% to 5.8p.

Outlook: Management think that the new era of structurally higher interest rates means that buyers are unlikely to delay buying a house. That is putting a positive spin on things, because the most recent mortgage approvals data for July, released two weeks ago, showed that approvals for new home purchases had fallen to around 49,400, down from more than 54,000 in June. On a rolling 3-month basis (July, June, May v the same months last year) that’s a -19% y-o-y reduction. If anything I think we might see a greater percentage decline in the coming months, because in August last year approvals were over 74,000. The effects of the Truss/Kwarteng budget were only seen in the November and December mortgage approvals data last year.

Separately Nationwide reported house prices down -5.3% Aug 2023 versus August last year, which is the worst fall since July 2009. I’ve included this Nationwide chart of home buyers’ transactions. According to Nationwide Buy To Let (BTL) purchases are down almost -30% versus pre-pandemic levels.

Valuation: M Winkworth trades on a PER of 11.5x Dec 2024F and 2.0x sales. The real attraction though is the high RoCE (35% 3-year average) combined with the dividend yield which is currently above 8%, and to my mind looks sustainable.

Opinion: Estate agents are a play on transactions, rather than house prices themselves. I think the outlook for transactions will remain poor into next year as the UK Government and BoE have done everything to avoid a housing market crash before the coming Election. That means though, that I think we will see a slow grind down over several years. At some point, WINK could be worth a look for their dividends and track record of RoCE 35% (3-year average) and 27% EBIT margin (3-year average), but it strikes me that we could see some disappointment over the next 6-12 months.

CVS Group CMA Review

This veterinary surgery company sold off heavily last week, as the Competition and Markets Authority (CMA) has launched a review into the veterinary services market for household pets. They are currently asking for responses from pet owners, vets and third-party suppliers. They will then update the market in early 2024. CVSG shares fell -18% in response last week. The company released a terse RNS saying: “As the CMA have recognised, there continues to be a significant shortage of vets in the UK and employment costs represent the most significant proportion of our cost base. Our pricing reflects this and other inflationary pressures experienced in recent years.”

The most recent trading statement we have from the company was on the 27th of July for FY June. CVSG reported organic revenue growth of +7.3% in in like-for-like sales (FY22: + 8.0%), and reiterated their organic revenue growth ambition of between 4% and 8%. That implies sales +9% to £606m and PBT up more strongly to £83m according to Sharepad’s forecasts:

Management also said adj EBITDA was “comfortably in-line” in their July RNS (implying £118m FY Jun 2023 according to Sharepad).

They also announced their expansion into Australia, which they say is in accordance with the plans outlined in their November 2022 Capital Markets Day. Below is the key slide from the CMD, with financial targets such as doubling Adj EBITDA over the next five years (implying c. £180m) through a combination of organic revenue growth and margin expansion. I wonder if management may come to regret having an explicit plan to expand adj margin from 13% in 2019 to 23% in 5 years time (see CMD slide deck below) if the CMA feel that is not delivering value for customers.

Valuation: The shares are trading on 16.5x PER Jun 2024F and 1.8x sales the same year. The long-term track record of profitable growth is impressive (see chart below) and the shares have risen +550% over the last decade.

Opinion: In the late 1990’s the CMA launched a review into excess profits the UK banks were making from their SME customers. Ultimately this proved toothless, so just because there is a competition inquiry doesn’t mean that the remedy will be bad news for shareholders. In the end, it was the leverage in banks’ business model that destroyed UK banks’ shareholder returns, not regulation. I would imagine that a severe downturn might mean owners face some tough decisions on how much to spend on their pets, and that could be bad news for CVS shareholders. In the short term though the inquiry will likely represent an overhang, and we may see management walk back their margin expansion guidance, so I will avoid for now.

Conclusion

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

He owns shares in Burford

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.