Phil looks at the issue of management in light of the turmoil and changes at JD Sports and asks whether the shares are too cheap despite a tough economic outlook.

Business Overview

JD Sports is one of the leading retailers of sports fashion wear. It has built on its UK roots to become a global force in the sector. At the end of January 2023, it had 3390 stores worldwide with the bulk of them now in Europe and North America.

Source: Company Reports

1922 stores were classified as sports fashion outlets, 1217 other fascias and 251 outdoor stores. The company also owns 87 gyms.

Source: Company Report

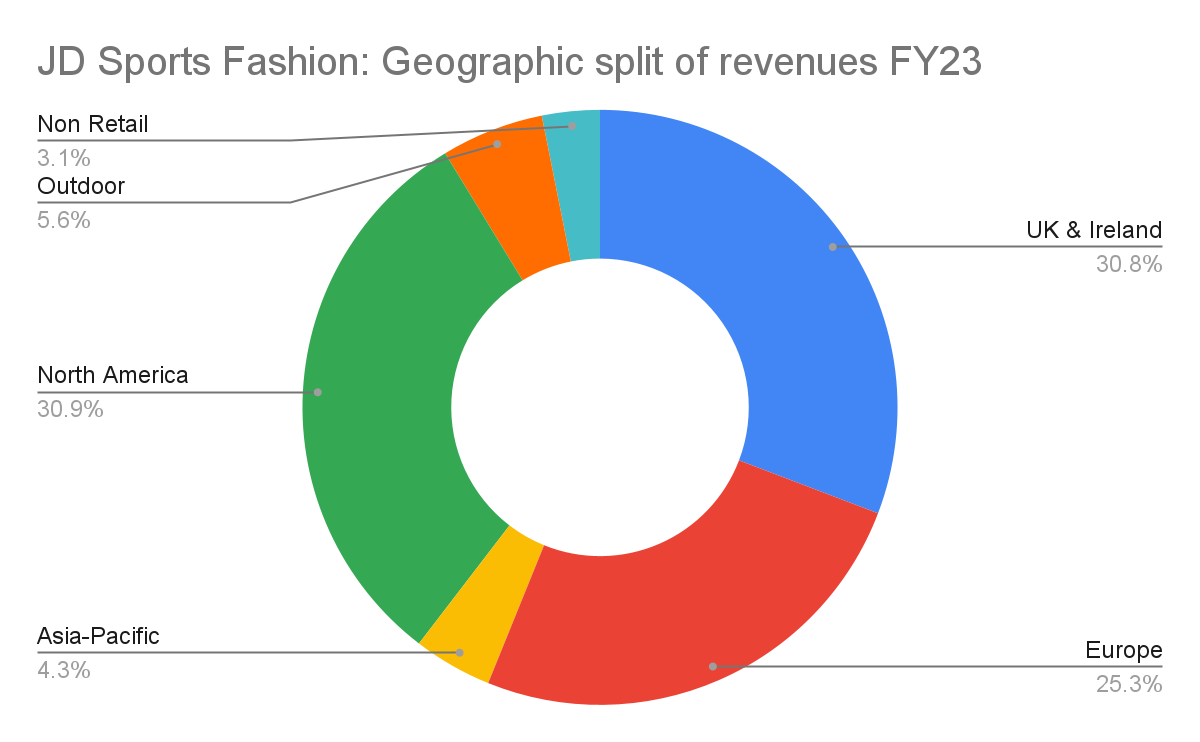

In terms of revenues, the business has three significant regions in the UK & Ireland, North America and Europe. Profits are still dominated by the mature and established UK business which accounted for 46 per cent of total operating profit last year with the US just under 30 per cent.

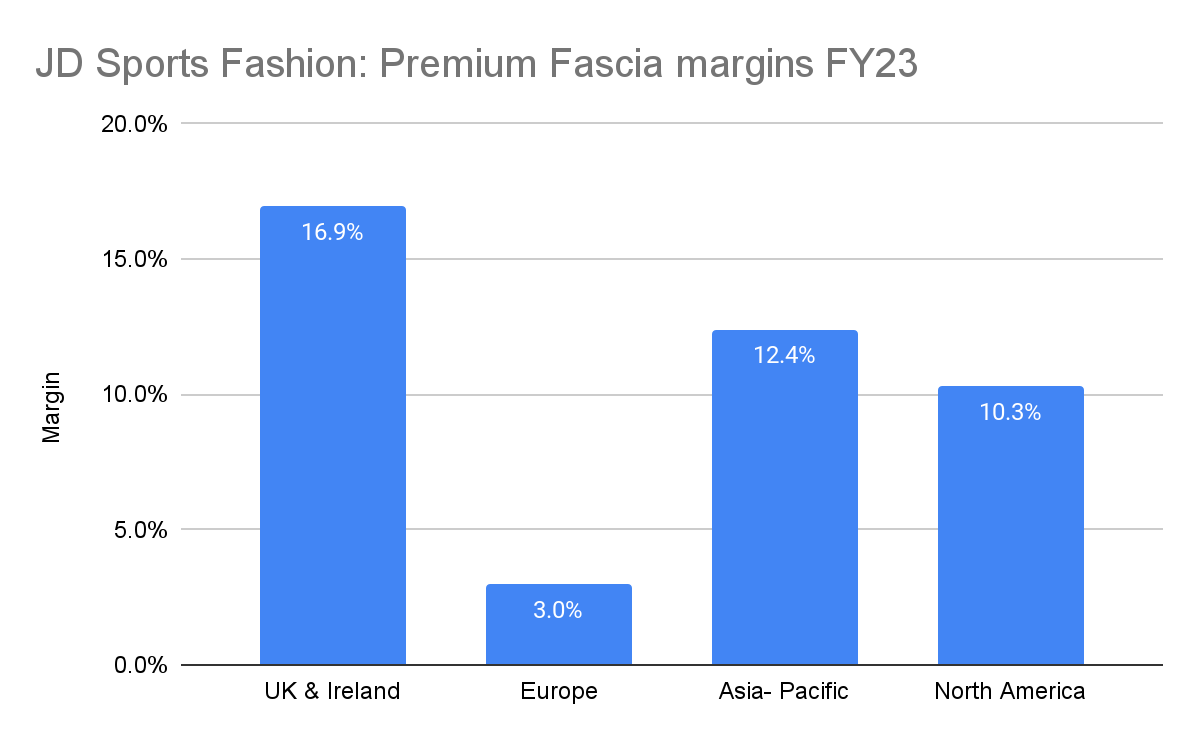

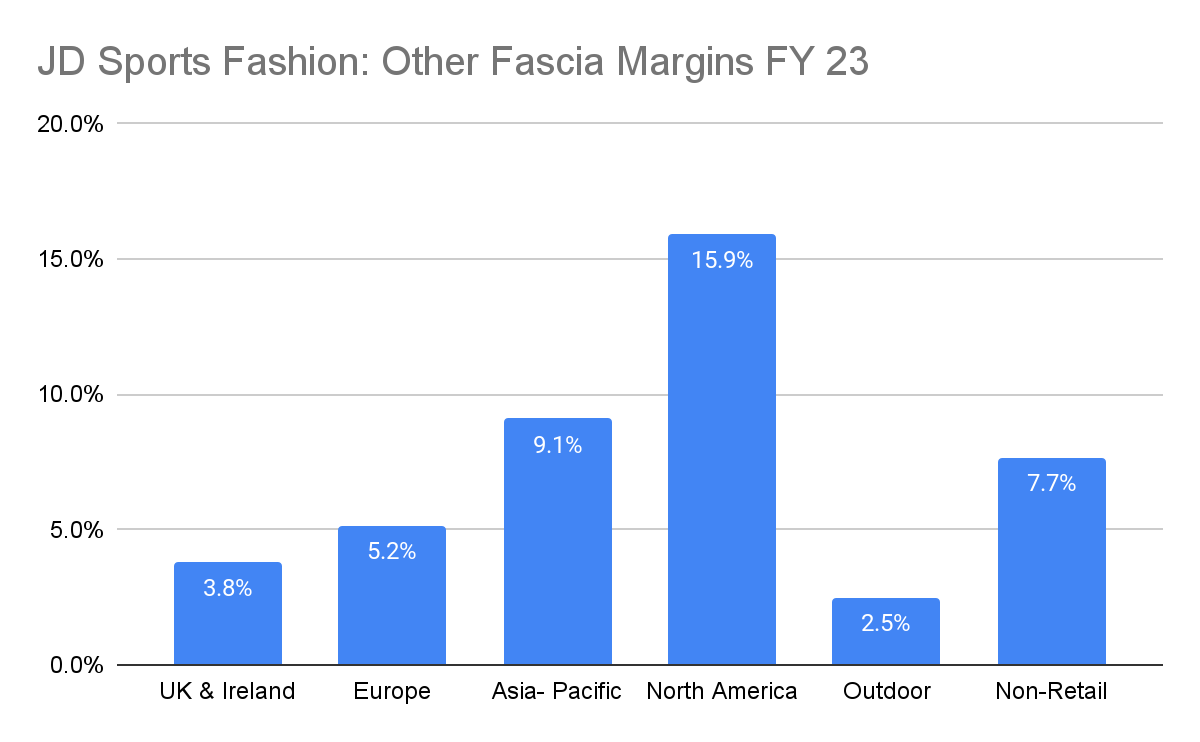

If you dig a little deeper into the company’s profit performance, you can see that the different regions and fascias have big differences in profit margins.

Source: Company Reports/My analysis

JD’s overall operating profit margin last year was 9.8 per cent. Within that, you can see that the mature UK and Ireland premium business (branded JD Sports stores) is very profitable whilst European stores had very low margins.

The other fascias are typically less profitable from a profit margin perspective. The exception here is the US where the neighbourhood and community-located fascias of Shoe Palace and DTLR are currently more profitable than the JD/Finish Line stores found in the big shopping malls.

Source: Company Reports/My analysis

JD’s revenues and profits have boomed in recent years. The company has successfully tapped into the surging demand for sports fashion or athleisure from young people. This has been achieved by a combination of impressive rates of growth from its existing stores (organic growth), a strong rollout of new stores and acquisitions.

The returns to long-term shareholders have been nothing short of stunning. Over the last 10 years, the shares have returned 1550 per cent according to SharePad. This compares with the FTSE-All Share Index which over the same period has returned 76.7 per cent.

However, for much of 2022, the company’s business performance was overshadowed by concerns about management and corporate governance. These now look to have been sorted out but it does beg the question as to whether the issues concerned were very important or a storm in a teacup.

Management turmoil and changes

Between 2004 and May 2022, JD Sports was run by Peter Cowgill. Based on the company’s financial performance and shareholder returns there can be no doubt that he did a brilliant job for the company’s investors.

Whilst results are the ultimate judge of a company’s performance it does not mean that beneath the surface there cannot be problems.

In the case of Mr Cowgill, it seems that there was growing concern that he was too dominant in holding the roles of both chairman and chief executive. The board of directors also contained people with very little retail or big company experience to challenge his decisions.

Key person risk is often a big issue for very small companies. It should not be for a FTSE 100 company. Whilst it’s difficult to argue with Mr Cowgill’s business success over the long haul, his dominance was arguably a very big risk.

There were also concerns about his handling of the aborted Footasylum deal and the controversy surrounding the company’s fine for alleged price fixing of Rangers’ football kits. Added to this was a view that the company had become too complicated with too many reporting lines.

These issues now look to have been sorted out. The board of directors is packed full of quality retail experience, whilst a new chief executive comes with a good reputation for improving the performance of the retail companies he has managed.

Mr Cowgill has also been retained as a consultant to the company and is not allowed to poach staff from it. This should reassure investors, at least in the short term.

Investors are right to place a lot of emphasis on the quality of company management, but sometimes they can be obsessed with it. The quality of the company’s business strategy, its assets and growth prospects can get overlooked at times of management issues.

It is interesting to note that at no time prior to Mr Cowgill’s departure were profit forecasts downgraded- quite the reverse in fact. Yet the share price fell heavily.

There was also nothing to suggest that Mr Cowgill’s good work had been undone or was under threat.

Arguably, his greatest success has been making JD Sports almost indispensable to the mega brands of athleisure by creating a great retail brand with an increasing global scale. In a time when many brands were cutting out retailers and moving to a direct-to-consumer business model, this is a fine achievement.

Yes, pay close attention to management, but don’t ignore the business quality behind the scenes and the numbers it produces. Mr Cowgill has left a business that a competent successor should be able to do well with.

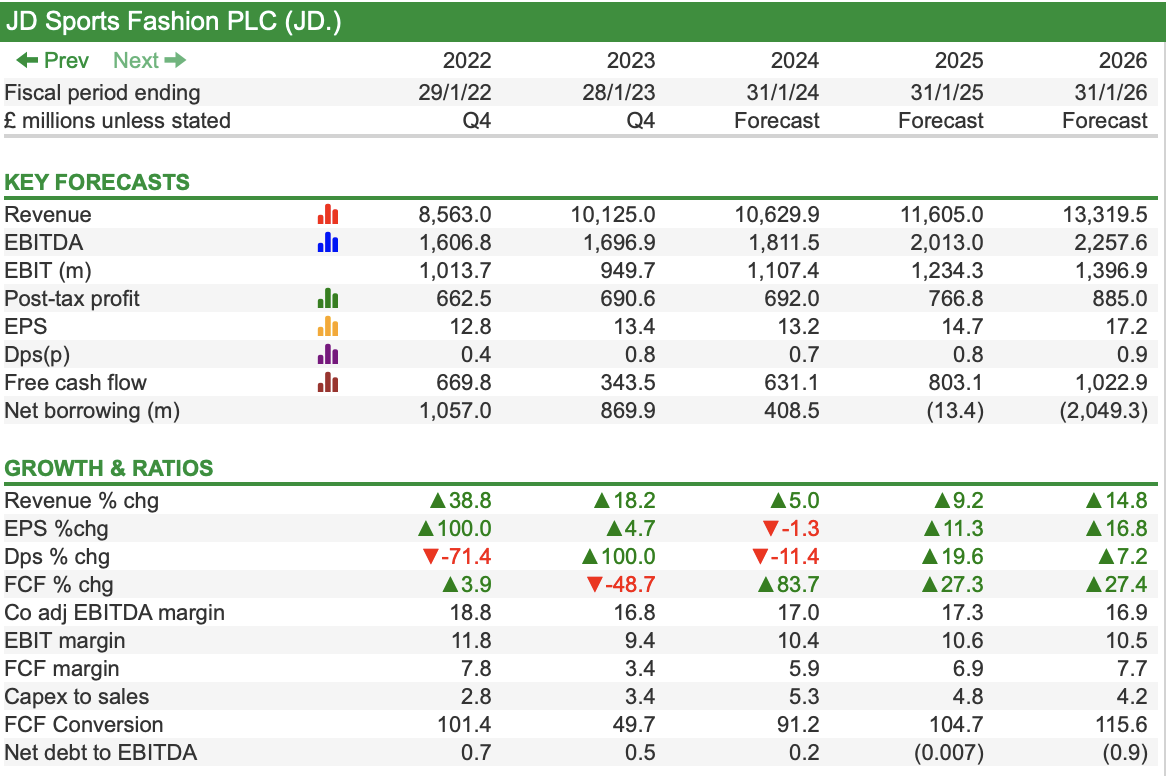

Key Financials and Ratios

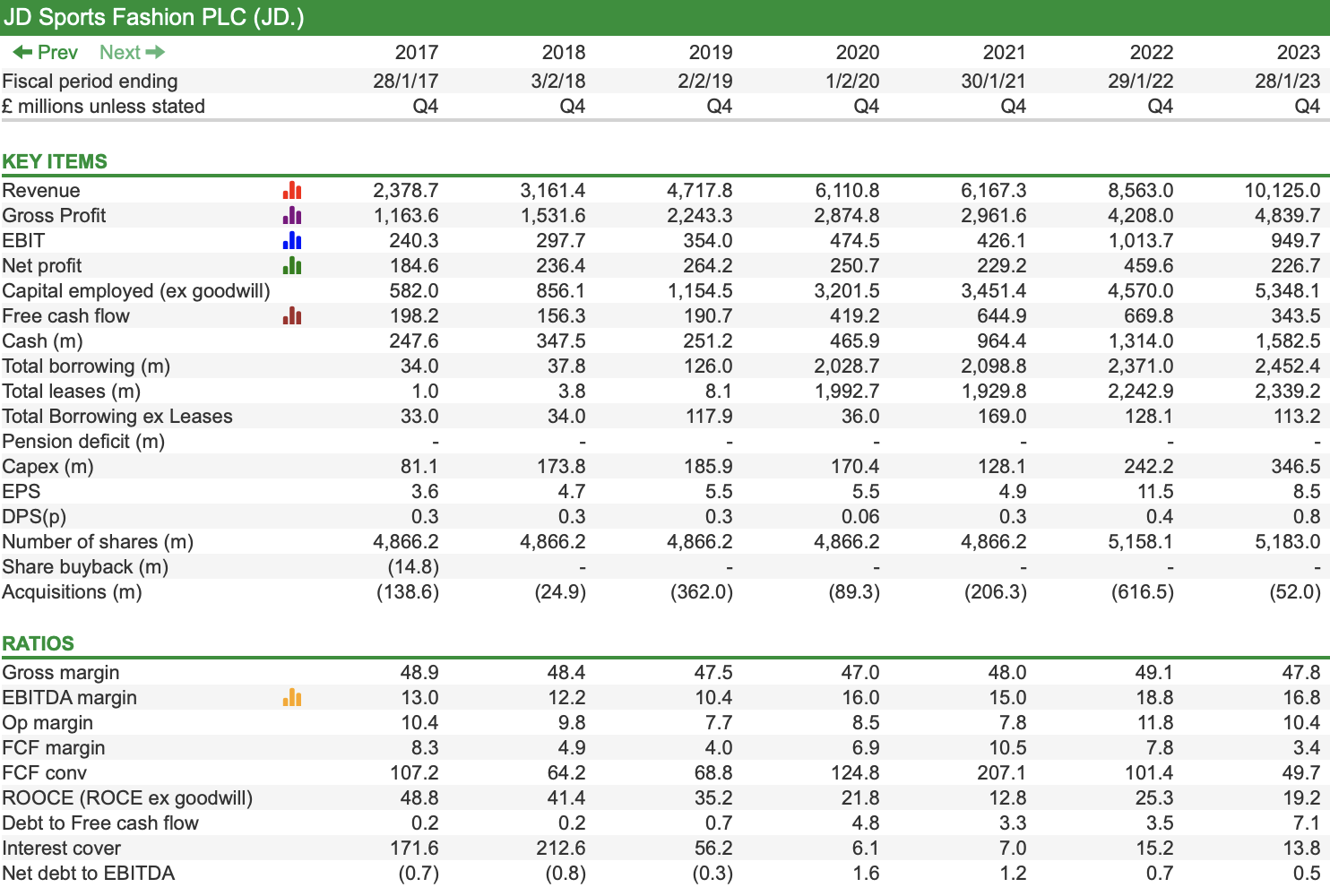

Source: SharePad

If you look at the recent financial history of the company you can see that JD Sports is a business in very good health.

The company has seen stellar growth in revenues and profits with improving operating margins.

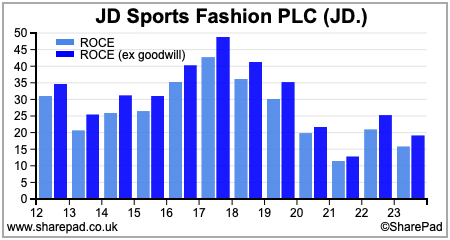

One striking feature has been the £1.5bn of cash spent on acquisitions since 2017. This has increased the money invested in the business (capital employed) substantially and has dragged down the company’s return on capital employed (ROCE) as profits have not increased as fast.

If we look at returns on operating capital employed (ROOCE) which excludes the goodwill paid on acquisitions (over £1bn) it was still a very healthy 19 per cent last year. Given that JD can arguably improve the financial performance of its acquired businesses, there’s every reason to believe that ROOCE can start moving up again.

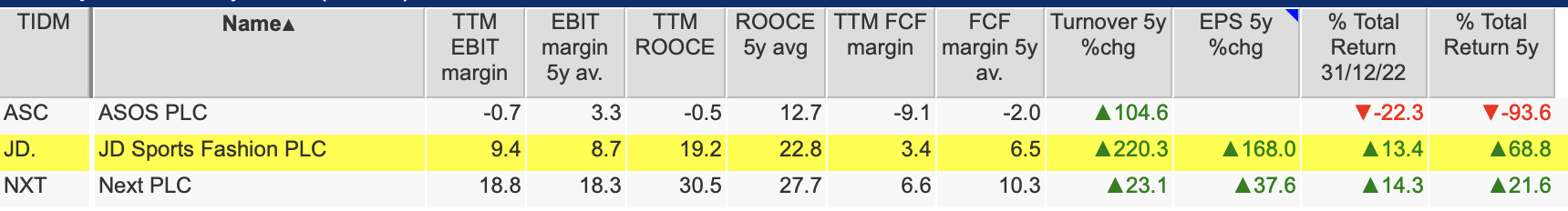

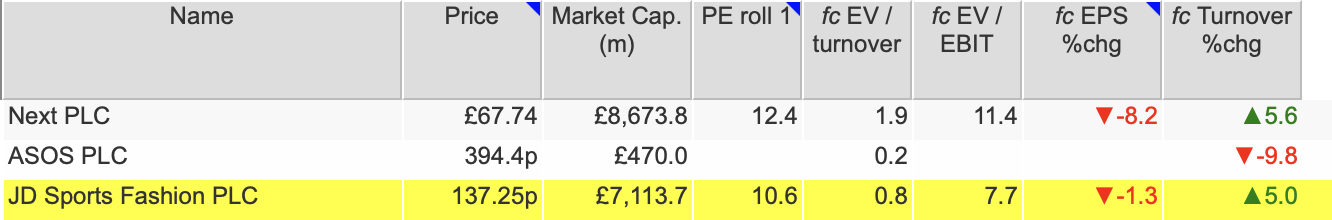

Checking out the company against other fashion companies such as ASOS and Next reads well. Whilst JD is not as profitable as Next on measures such as profit (EBIT) margin or ROOCE, its revenues and earnings per share (EPS) growth have been much better as has its total shareholder returns.

This goes to show that when it comes to selecting good investments growth is all important. When combined with high ROOCE – which means a company gets more profit back for each £1 it invests – then so much the better.

JD Sports Fashion vs peers

Source: SharePad

Quick Analysis Point: Stock Levels

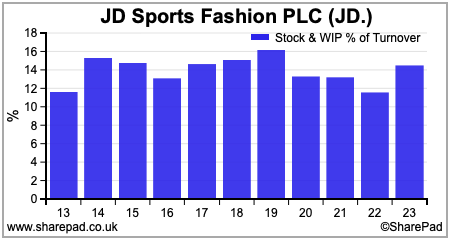

When you are researching any retail company it’s a good idea to pay attention to its stock levels relative to its revenues or turnover.

A rising stock-to-turnover ratio can be a sign of slowing demand for a company’s products. If this is the case, then it might have to cut selling prices – and reduce profits – in order to get rid of them. On a more positive note, sometimes a rising ratio can be a sign of stock building in anticipation of stronger sales in the future.

A build-up in stocks will often show up in a company’s cash flow statement as a large cash outflow. This can have a big negative impact on a company’s free cash flow, a number that many investors pay a lot of attention to.

Last year, JD Sports saw a £501m – a huge number – cash outflow due to increases in stocks. When you see a number like this, the company should comment on it within its annual report or results press release. If it doesn’t you should worry that something might be wrong.

JD Sports explains the increase down to a normalisation of stock levels in its US business:

“Inventories, net of provisions, across the Group at the end of the period were £1,466.4 million (2022: £989.4 million). Within this, inventories, net of provisions, in our businesses in North America increased to $581.7 million (2022: $262.9 million) as the flow of product reverted to normal levels.”

Also, if you look at the historic range of stock to turnover on SharePad, you can see that the level at the end of January 2023 was not exceptional which is always reassuring.

Cleaning up the business and going for growth

The new management team has a strategy which could deliver very good rates of profit growth over the next few years.

First of all, it has set about cleaning up the business. It had to sell Footasylum for a loss but has also closed down its South Korean operations and sold its non-core sports brands.

Now the focus is on growing the JD brand with an ambitious plan between 2023 and 2028. This will see a big focus on the US but also the rest of the world with around 250-350 new stores per year. This will come from new openings, acquisitions, conversions and franchising.

Significant investments are also being made in the company’s logistics and supply chain to cope with the expected growth.

If all goes well then JD Sports should be able to deliver double-digit percentage sales growth with double-digit profit margins over the next few years

Investors should take heart that when it comes to acquisitions – DTLR aside – JD has paid sensible prices and got reasonable starting returns on their investments (the acquired operating profit divided by the price paid for it).

To put things into more perspective, since 2018, JD has made three major acquisitions in the US with acquired profits of $127m (about £100m at current exchange rates). Last year the US business made operating profits of £338m.

JD Sports Fashion: Major Acquisitions

| Date | Company | Amount Paid | Annual Profit | Starting ROI |

| March 2018 | Finish Line | $558m | $54m | 9.7% |

| December 2020 | Shoe Palace | $681m | $52m | 7.6% |

| February 2021 | DTLR | $495m | $20.9m | 4.2% |

| May 2023 | Courir | €520m | €47.4m | 9.1% |

Source: Company Reports/My Analysis

The most recent acquisition of French company Courir looks interesting. Apart from the fact that it was bought from a private equity seller – who have a deserved reputation for leaving very little value on the table for buyers – the price paid looks reasonable.

Courir takes JD into a different market with a differentiated brand targeted towards female customers. The hope is that this format can be rolled out successfully internationally.

Why are JD Sports shares so lowly valued?

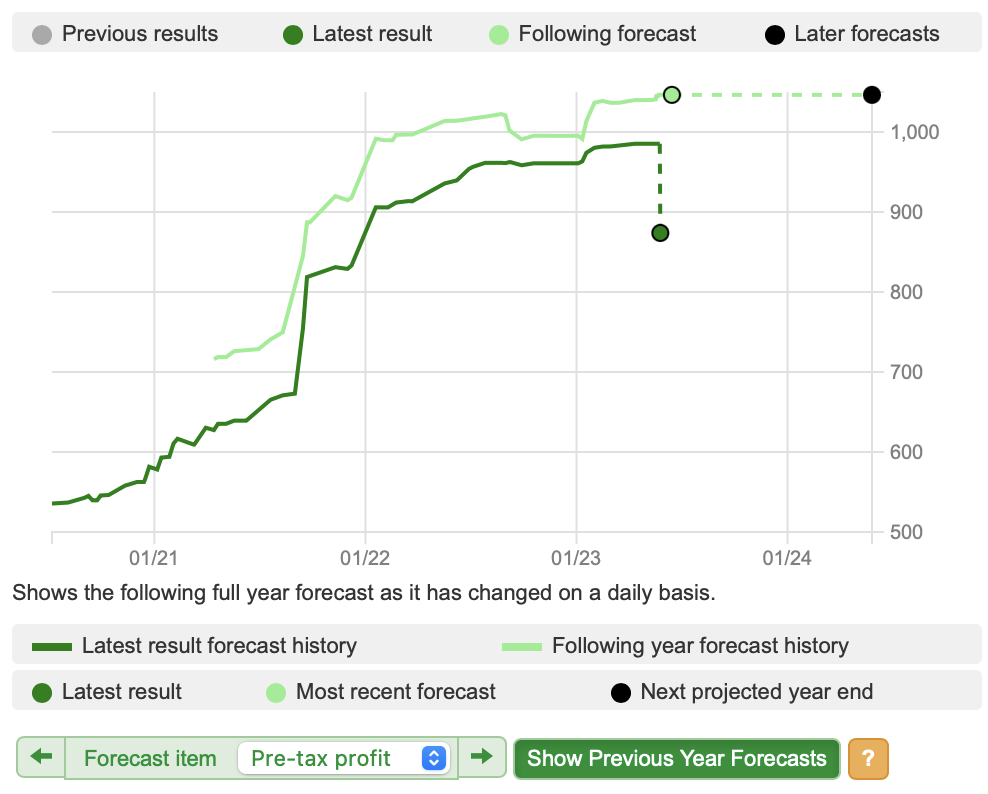

The company has started 2023 with 15 per cent like-for-like sales growth in the first 13 weeks of its new financial year. Profit guidance has not been upgraded recently with full-year pre-tax profit to January 2024 expected to be around £1.03bn.

This week’s AGM trading statement said that like-for-like sales growth in May had slowed to 8 per cent but guidance for the full year remained unchanged.

Source: SharePad

Looking at consensus forecasts from City analysts shows that they are expecting robust revenue, operating profit and free cash flow growth.

Source: SharePad

So why are the shares only trading on 10.6 times the next twelve months (PE roll 1) EPS?

For much of the last decade, the shares have traded on a rolling one-year forecast PE of anything from high teens to the high twenties.

Valuation

Source: SharePad

Granted, higher interest rates and higher inflation bring down PE ratios but it looks as if the market is discounting little, if any further growth in profits from JD Sports.

However, given the impact that higher mortgage rates, food and energy costs are having on consumers’ disposable incomes it is no surprise that investors are worried that some might not be buying new trainers for a while.

A profit warning from Puma in April has done little to settle nerves, while profit forecasts for Adidas and Nike have been on a downward trend.

It is possible that many 16-24 year olds who have jobs and might still be living at home could have plenty of cash to spend and prevent JD from a profit warning.

The AGM statement this week did not result in a profit warning. However, bears will point to a slowing in sales growth – apparently expected due to tough prior-year comparatives – and more importantly, signs of softness in the US market.

Despite the shares rallying by 9 per cent so far in 2023, at 137p they are more than 40 per cent below their all-time high of 234p from November 2021. At 234p, the shares would trade on a one-year forecast rolling PE of 17 times which would not be unreasonable for a business of this quality and growth potential.

Perhaps the fears of a sales crunch will be well-founded. If they are not then the shares look very cheap and have the potential to command a much higher valuation.

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.