Visiting an old friend in today’s fast-evolving tech landscape, few sectors remain as untouched by innovation as the world of transportation. At the helm of this transformation, one finds Journeo PLC (AIM: JNEO), a trailblazer in information systems and services explicitly curated for transport and local governments. The company’s recent accomplishment — a £2m purchase order acquisition from a Northern Transport Partnership — is a testament to its ascending trajectory in the market.

When I first spotlighted Journeo on SharePad, it began as a relatively uncharted entity with a modest share price of 122p and a market cap of just £10.7 million. Its evolution, from this humble introduction to its commanding valuation of £33.6 million at 207p today, is a compelling narrative of the transformative power of innovation and strategic alliances. Their growth validates early backers’ foresight and underscores a clear message: in the ever-evolving realm of transport tech, Journeo is undeniably one to watch.

This milestone dovetails perfectly with Journeo’s ongoing endeavours, particularly its cutting-edge Thin-Film Transistor (TFT) and Liquid Crystal Display (LCD) technologies. When harmonized with the company’s advanced content management software, one sees a rapid integration of Journeo’s solutions within a burgeoning nexus of transport systems.

A brief detour into the company’s recent financial figures paints a telling portrait of its health. The six-monthly report concluding in June showcased a 146% augmentation in revenues, reaching £21.8 million from an earlier £8.9 million. Simultaneously, underlying pre-tax profits soared by 277%, culminating at £2.5 million, a leap from the previous £0.7million. By June, the company’s order book notched an unprecedented £27 million further flanked by a sales pipeline approximating £55 million.

Financial headlines

- Group revenue grew by 146% to £21.8million (H1 2022: £8.9m)

- On a like-for-like basis (excluding Infotec) revenues grew 41% to £12.5m

- Fleet revenue increased 61% to £7.9million (H1 2022: £4.9m)

- Passenger revenue increased 16% to £4.6million (H1 2022: £4.0m)

- Infotec revenue contribution of £9.3m since acquisition in January 2023

- Group gross profit increased 77% to £6.4million (H1 2022: £3.3m) and by 35% to £3.9m on a like-for-like basis

- Underlying profit before depreciation and amortisation increased 277% to £2.5million (H1 2022: £0.7m).

- Cash and cash equivalents at the end of the period increased to £11.3million (H1 2022: £1.2m) of which £3.5m was customer payments in advance.

- Basic undiluted profit per share of 9.03p (H1 2022: 1.92p)

Strengthening its European footprint, Journeo recently announced its acquisition of MultiQ, a Denmark-based company. This move isn’t just an addition to its portfolio but serves as a bridgehead into the Nordic market, teeming with possibilities. MultiQ, headquartered in Aarhus, Denmark, is renowned for its public transport information systems expertise. Before its alignment with Journeo, it was part of a conglomerate acquired by Vertiseit in May 2022, only to be restructured in January 2023 to focus solely on ITS.

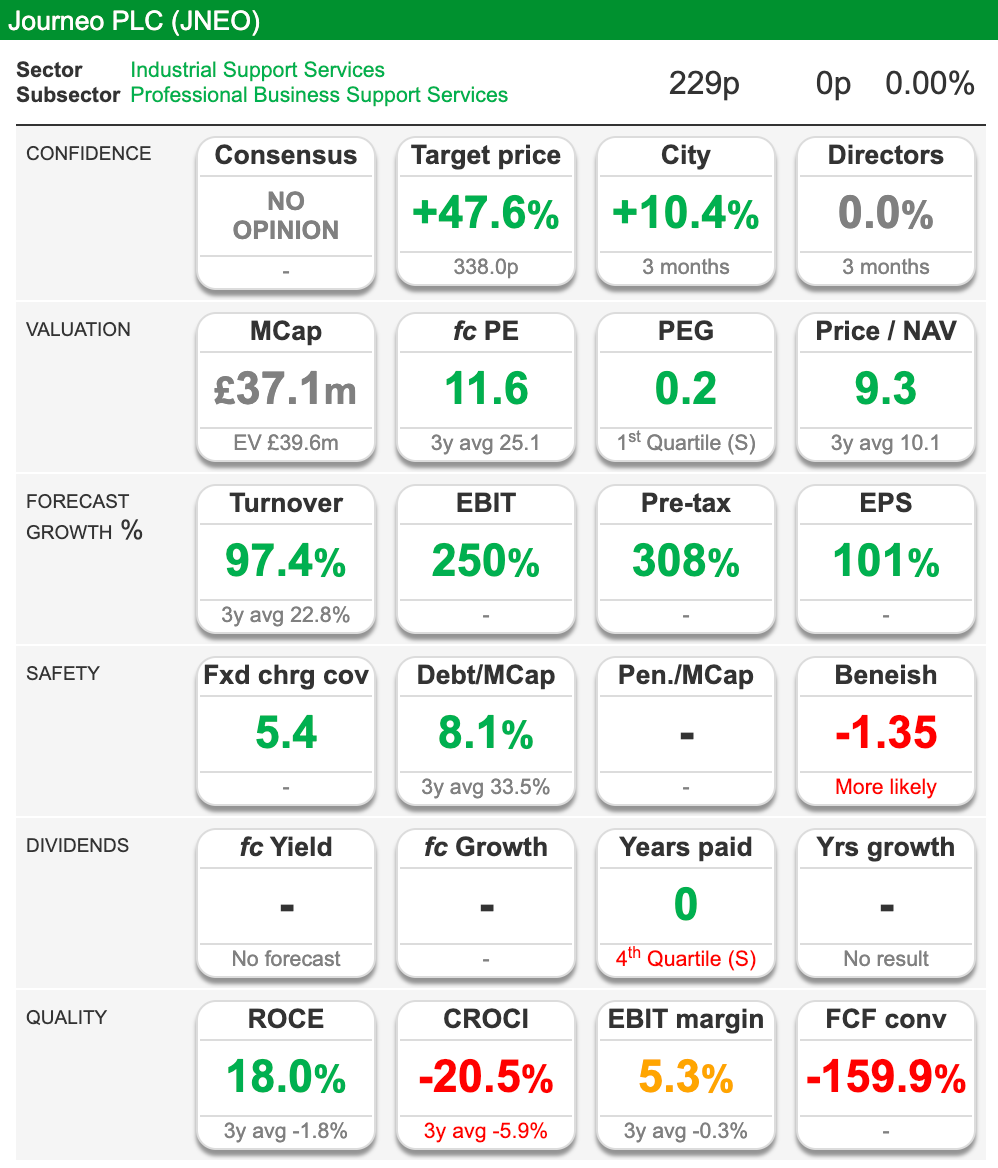

Financial specialists, notably Andrew Renton from Cavendish Capital, have begun viewing Journeo through an optimistic prism. Renton’s assessments for the firm indicate a Price Objective of 338p on the shares, with revenue projections nearing £41.7million by year-end. If these projections hold, we’re looking at nearly double the preceding year’s figures. His anticipated pre-tax profits touch £3.7million, showcasing a threefold growth trajectory.

Indeed, the stock market remains a volatile terrain, punctuated with ebbs and flows. Journeo’s shares, now oscillating around 230p, indicate this capricious dance. Yet, juxtaposed against its contemporaries and the broader FTSE, the company’s stellar performance stands out.

Pioneering Through Strategic Investments

A retrospective glance at Journeo’s journey reveals a deliberate emphasis on innovation. Over the years, the company has channelled significant resources to birth a cloud-based modular hardware agnostic SaaS platform. For those less familiar with tech jargon, “agnostic SaaS” might be puzzling. It denotes a cloud-agnostic platform adept at interfacing seamlessly with any public cloud provider. This ensures businesses experience minimal disruptions, granting them the agility to scale and pivot based on market demands.

This emphasis on tech isn’t just insular. Journeo’s strategic positioning in the UK market has yielded exclusive collaborations with specialist equipment manufacturers, partnerships ripe with revenue-generating potential. The broader SaaS market also holds promise. As per McKinsey & Company, the sector might burgeon to a whopping $200 billion by 2024.

Business Model & Clientele

Journeo’s foundation is built on providing tech solutions. It delivers a gamut of services from design to on-site support through partnerships with global and local specialists. The company operates in a niche characterized by high barriers to entry — a blend of technical nuance, unique solutions, and managing expansive assets.

The company’s clientele is a diverse mix from the transport sector, including fleet operators, vehicle manufacturers, and local authorities.

In Summation: Journeo witnessed remarkable growth, recently securing a £2m purchase order from a Northern Transport Partnership. Highlighted for its potential when introduced on SharePad, its valuation has since soared to £33.6 million at 207p. The company’s advancements, particularly in TFT and LCD technologies, are further complemented by financial successes and strategic acquisitions like Denmark’s MultiQ. This acquisition strengthens its presence in the Nordic market. Financial experts like Andrew Renton project a bright future for Journeo. Over the years, the company’s investments in a cloud-based agnostic SaaS platform and partnerships with equipment manufacturers set it apart. The SaaS market is expected to reach $200 billion by 2024. Journeo’s diverse offerings and clientele make it a significant player in the transport tech sector.

Summary Snapshot

Elric Langton of Small Company Champion & Lemming Investor Research Newsletter

Twitter: @LEMMINGINVESTOR

Do you have some thoughts on this week’s article from Elric? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.