Screening for a growing dividend, lowly valuation, net cash and decent director ownership leads to 40-bagger James Latham. Maynard Paton studies the timber distributor’s history, financials, management and prospects.

I have embarked on further ‘back to basics‘ filtering to unearth a potential long-term winner for my portfolio.

This new screen identifies companies that offer rising dividends, low valuations, robust balance sheets and decent director ownership.

The exact filter criteria I applied for this search were:

- A 5-year annualised dividend growth rate of 10%;

- A forecast 10% dividend increase;

- A trailing 12-month P/E of 15 or less;

- Net borrowings less total leases of no more than 0 (i.e. a net cash position excluding IFRS 16 lease obligations), and;

- A minimum 5% total director shareholding.

I ran the screen the other day and SharePad returned only four matches:

(You can run this screen for yourself by selecting the “Maynard Paton 14/04/23: James Latham” filter within SharePad’s Filter Library. My instructions show you how.)

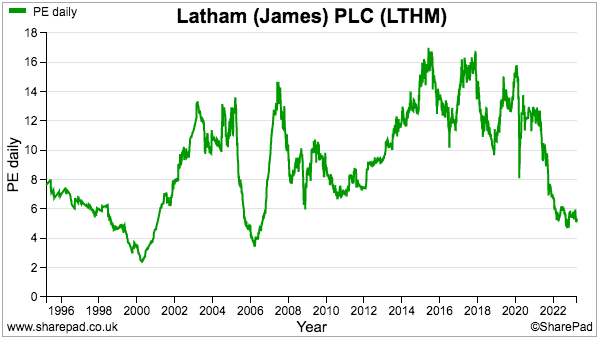

I selected James Latham because it traded on a remarkably low trailing P/E of 6.

SharePad shows Latham’s dividend rising nicely over time with only a couple of setbacks:

SharePad also shows the trailing P/E at its lowest since 2007:

Let’s take a closer look.

The history of James Latham

James Latham may well be the oldest company on the London stock market.

The story commenced during 1757 when founder James Latham began importing joinery hardwoods into Liverpool. The wood proved particularly popular with top furniture makers such as Thomas Chippendale, George Hepplewhite and Thomas Sheraton, and by the 1800s son Henry Latham had opened sites within London importing various exotic timbers.

Latham has since evolved into one of the country’s largest independent timber distributors. These days the group imports, processes and sells a vast range of hardwoods, softwoods and panels such as chipboard and MDF, alongside numerous laminate, veneered and engineered/modified woods:

Sales are made to trade customers and not to the general public. National UK coverage is remarkably achieved through only 13 depots plus storage locations at three ports. Progress boils down to product availability — “having the right stock in the right place at the right time” — alongside tip-top staff expertise and service.

This 1m58s video provides a useful overview of the business:

Latham floated during 1965 and the ninth generation of the Latham family presently leads the business. Nick Latham took charge during 2017 after joining the board during 2007 and joining the company during 1992.

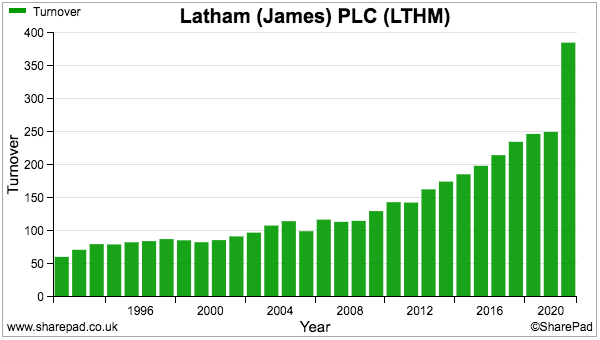

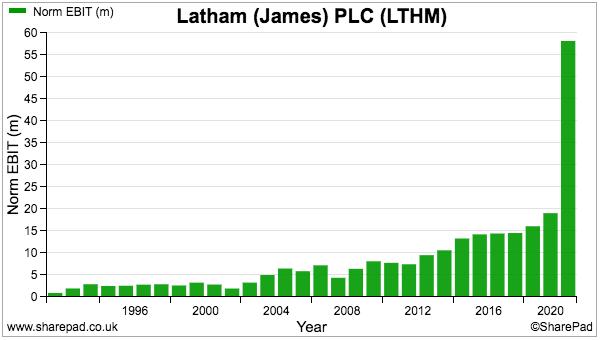

Companies House shows sales of £60 million and a loss of £612k when Nick Latham became an employee. SharePad shows revenue and profit having since surged to £385 million and £58 million respectively:

Those SharePad charts clearly reveal a spectacular 2022, which Latham has itself admitted is not expected to be repeated for 2023. The super one-off performance no doubt explains the aforementioned P/E of 6.

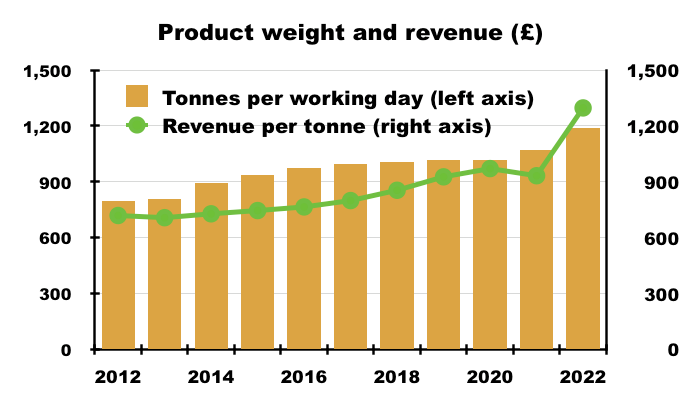

The 2022 results were buoyed by “significant” industry price increases that followed the after-effects of the pandemic. Latham lifted its average product price by 36% last year, with like-for-like volumes up a useful 12%.

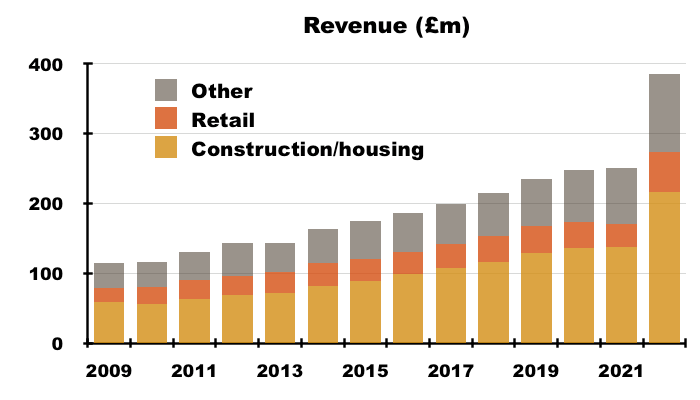

Latham’s annual reports commendably outline the market sectors the group serves. My chart below shows Construction/housing (e.g. joiners, builders, builders’ merchants and kitchen/door manufacturers) growing from 50% to 55% of total revenue between 2012 and 2022:

Another commendable statistic is the weight of wood sold every year. My calculations suggest Latham’s progress has been supported by generating greater revenue per tonne of product sold:

Trading has been helped also by enhancing and relocating existing depots, as well as acquiring two sites in Northern Ireland last year and two locations in the Republic of Ireland during 2019.

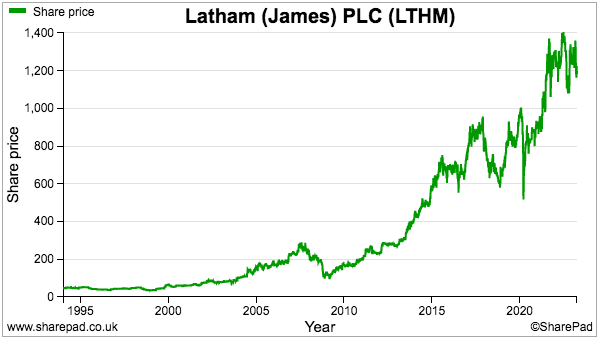

The financial history has translated into a wonderful long-term share price:

Anybody buying at the 35p low during early 1999 would have enjoyed a 40-bagger return when the shares reached £14 last year. The recent £12 price supports a £239m million market cap.

Shareholder returns have of course included the (generally) rising ordinary dividend, with special payouts also declared during 2000 (2.5p per share), 2005 (7.5p), 2006 (7p) and 2022 (8p).

Latham’s SharePad summary

SharePad’s summary for Latham is shown below:

The second row emphasises 2023 will not repeat the spectacular 2022 performance, while the middle row confirms Latham has no net debt and a pension-scheme surplus. The bottom row discloses weak cash flow conversion as well as decent margin and ROE/ROCE numbers.

Let’s start with the cash conversion.

Cash conversion and working capital

Latham does not have the best record of translating reported profit into free cash. The chart below shows earnings converting at an average 47% (black line, right axis) into free cash during the last ten years:

Earnings often convert into low levels of cash flow due to:

1) Significant cash absorbed by additional working capital (i.e. through increased stock, late customer payments and early supplier payments), and;

2) Expenditure on tangible assets (i.e. property, plant and equipment) and intangible assets (e.g. capitalised development costs) substantially exceeding the associated depreciation and amortisation charged against profit.

The chart below compares Latham’s earnings to the additional working-capital cash and ‘excess’ capital expenditure:

Latham’s additional working capital (red bars) appears to be the main culprit. SharePad shows £71 million invested into extra working capital during the last decade, of which a huge £28 million was invested during 2022 alone.

I calculate extra working-capital requirements have absorbed more than 30% of aggregate reported earnings since 2012 — which may be another reason the trailing P/E is only 6.

Still, Latham’s working capital appears under good control. SharePad shows the level of stock, trade debtors and trade creditors to revenue to be reasonably consistent:

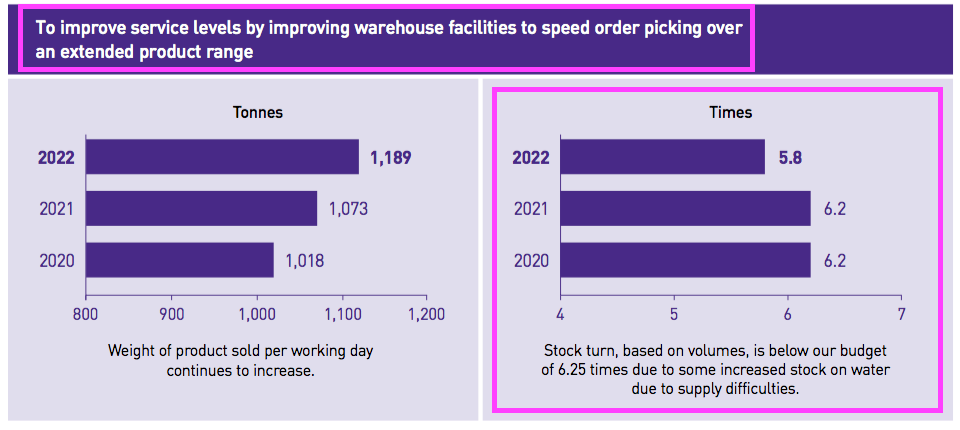

Stock at £74 million was the largest balance-sheet item for 2022, and Latham reassuringly monitors ‘stock turn’ — that is, how quickly stock is held before being sold — as a formal key performance indicator:

I suppose Latham’s stock levels will always be high given the aforementioned desire to have “the right stock in the right place at the right time“. The 2022 results explained how supply problems prompted extra stock buying:

“Supply Chains across the globe have struggled to recover from the effects of the COVID-19 pandemic, which combined with the increase in economic activity, has led to shortages and longer lead times for imported products. We made the decision to invest in additional inventory levels to ensure that we could continue to consistently supply as many of our traditional customers as possible.”

The 2022 annual report shows stock valued at £279 million was expensed during the year. Carrying stock of £74 million, therefore, suggests goods wait in the depots for a reasonable three months (74/279*12 months):

A stock provision at typically less than 2% suggests Latham’s wood rarely becomes obsolete.

Trade receivables at £63 million last year was another sizeable balance-sheet item. But the 2022 results did not indicate customers becoming late (or non-) payers:

“Control of cash flow from customers is closely monitored. Average debtors days, taking into account our credit terms, has reduced from 52.3 days to 49.6 days. Bad debts this year were 0.1% against a budget of 0.4%, and a minimal charge last year.”

Despite the substantial working-capital requirements, Latham’s cash had piled up to £37 million by 2022:

Conventional bank debt was last seen during 2015 and the business has enjoyed a net cash position since 2007.

Aside from the bumper 2022, Latham’s significant stock, debtor and cash positions have led to rather average 10-15% returns on equity (ROE):

Influencing the ROE sums as well is Latham’s £25 million freehold estate.

The freeholds were last revalued during 1997 and those purchased since are carried at cost. Latham could increase its ROE by renting all of its premises, but freehold ownership probably gives greater operational flexibility and their values ought to increase over time.

Pension scheme, margin and revenue per employee

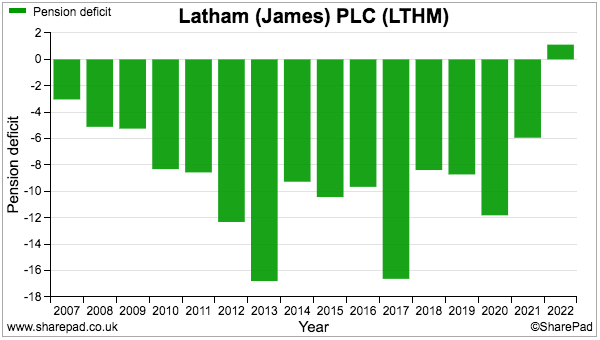

Perhaps befitting a company that is 266 years old, Latham’s balance sheet is saddled with defined-benefit pension obligations. The 2022 results showed a scheme surplus for the first time since Latham adopted the IFRS accounting standards 15 years ago:

The peculiarities of pension reporting mean a scheme boasting an accounting surplus can still be a drain on cash flow.

Latham paid £4 million into its scheme during 2022, of which £3 million was not charged to the income statement:

The last five years have witnessed a total £10 million injected into the scheme that was not included as an operating expense. I calculate Latham’s aggregate reported operating profit during the same time would have been 8% less were all the pension contributions recognised as an operating expense.

The 2022 results admitted £3 million would again bypass the income statement during both 2023 and 2024:

“The company continued to pay in £3.4m of deficit recovery funding which will continue until March 2024 when the deficit recovery funding payment will be recalculated following the next triennial valuation.”

Latham’s pension funding appears manageable using the approach described in my Norcros article. Plan assets of £76 million appear appropriate with benefits running at less than £3m a year and total company contributions running at £4 million a year:

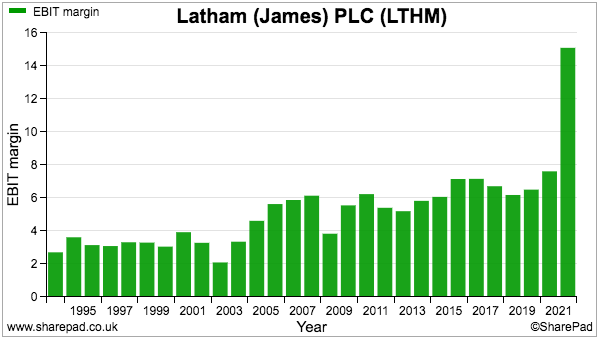

Perhaps the weakest SharePad chart for Latham reveals the group’s operating margin:

Ignoring the bumper 2022, Latham converting only 6% (or less) of revenue into profit implies distributing timber is a competitive activity without much of an operational ‘moat’.

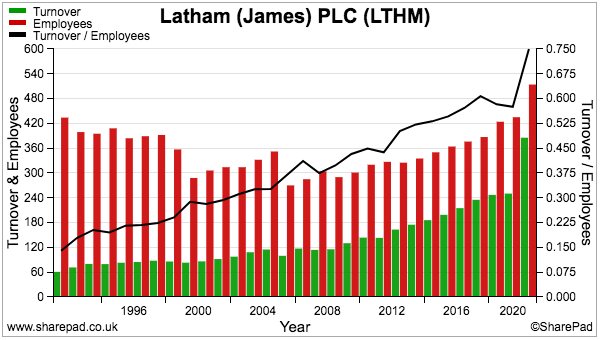

Mind you, perhaps the most impressive SharePad chart for Latham shows revenue per employee (black line, right axis):

During the last 30 years, Latham’s workforce has increased by almost 100 to 498 while revenue has surged more than six-fold.

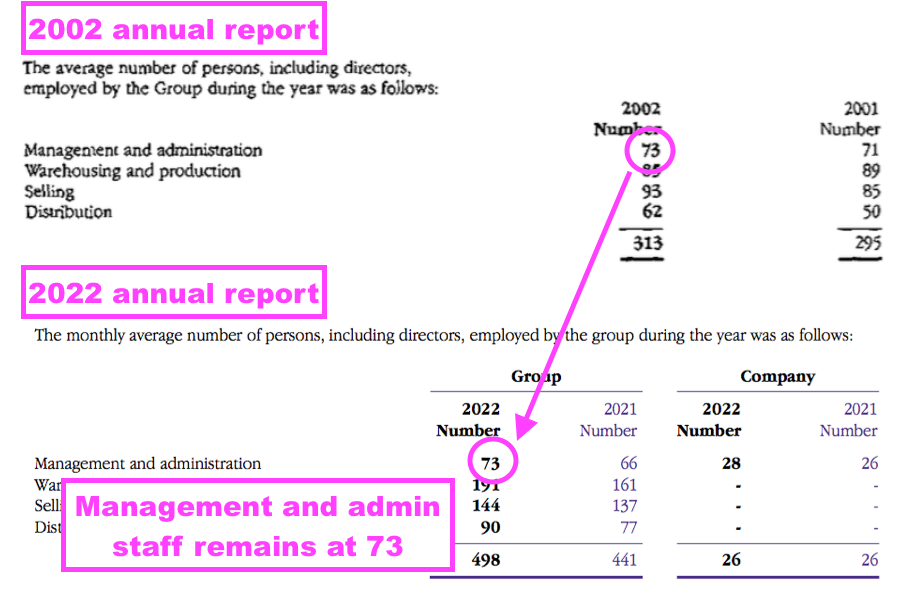

Revenue per employee at £774k is extremely impressive, and Latham has clearly discovered regular productivity efficiencies. I note management and administrative employees numbered 73 for 2002 and 2022:

Management

Quoted ‘family’ firms tend to overlook many boardroom ‘best practices’ and Latham is no exception. In particular, the aforementioned Nick Latham acts as executive chairman while he and his three fellow executives outnumber the two non-execs.

One of the other executives is Piers Latham (an employee since 1993 and board member since 2014), so top management is very much a family affair.

Still, Nick Latham did earn his place on the board. The 2007 annual report said:

“Nick Latham joined the Board on 5 April 2007. He started and runs our very successful Hemel Hempstead panels depot which has produced the best return on sales and scored extremely well on the various other key performance indicators that we use. We are looking to him to help replicate this performance throughout the business.”

Board pay appears good value for a business that last year reported profit rising £39 million to £58 million.

Nick Latham collected a £225k salary during 2022, with bonus payments averaging only 30% of salary since 2018. I note pension contributions during the same time were a chunky 16%-of-salary average. But board options are minimal.

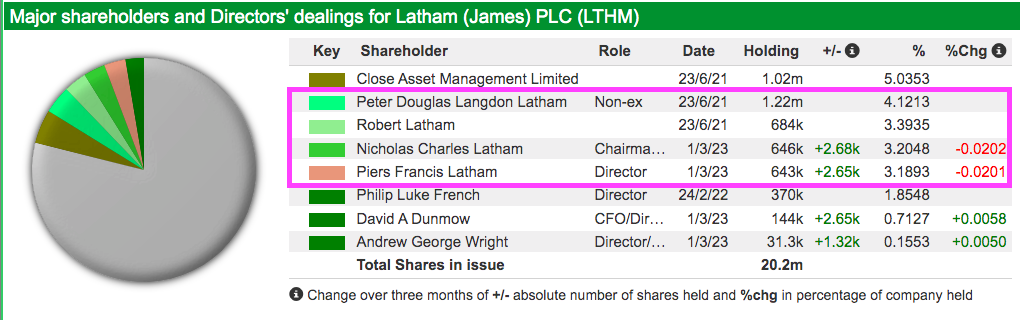

Both Nick and Piers Latham enjoy 3% shareholdings while one of the non-execs owns 2%. Other Latham family members with disclosable holdings own a combined 7%:

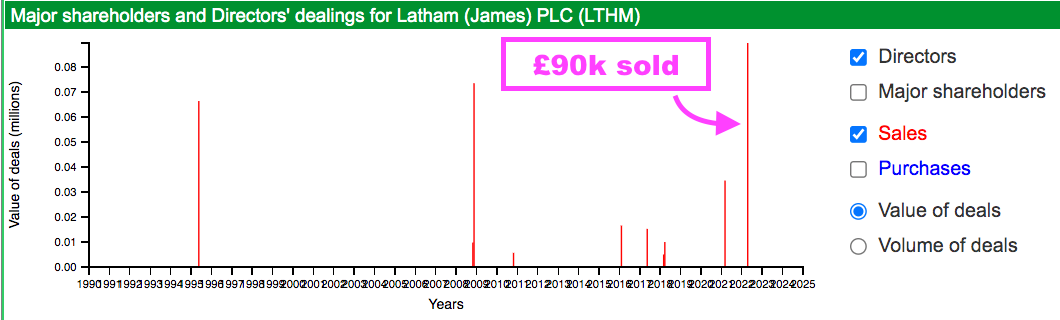

SharePad shows director selling to be very infrequent, with the last £90,000 disposal prompted by a non-exec’s wife selling some inherited shares:

Past annual reports indicate the entire Latham family owns more than half of the business, which at £12 a share gives a wider family investment of at least £120 million. I am convinced the significant family ownership and the terrific long-term performance of Latham’s shares are not a coincidence.

Nick and Piers Latham are both in their 50s, so succession planning is not an immediate concern. The long employment tenures of Nick and Piers Latham are encouragingly mirrored by those of the two other executives. The finance director took on his present role in 2000 while the operations director has served at Latham since 2001.

Emphasising perhaps the board’s low-cost mindset, the finance director’s annual-report picture has not changed since at least 2006.

Valuation and summary

December’s half-year results confirmed the bumper 2022 would not be repeated during 2023.

Although first-half revenue gained 10% to £213 million, first-half operating profit dived 31% to £24 million. Latham cited its margin had returned to “expected levels“, and reading between the lines, the group no longer benefits from stock purchased at (retrospectively) very low prices being suddenly sold at very high prices.

The second-half outlook was cagey, referring to “slightly weaker volumes” and “margins also slightly lower”.

At least the interim dividend was lifted 12% to 7.25p per share. And an update last month said 2023 annual revenue would be “slightly ahead” of market expectations while pre-tax profit would be in line with market expectations.

The following broker forecasts place the £12 shares on a forecast P/E of 8:

A P/E of 8 is not the P/E of 6 returned by my filter results, but is still lowly by wider market standards…

…although the cash conversion and those pension contributions may well justify the multiple.

The key question of course is whether Latham can maintain its post-pandemic performance and regularly generate the forecast profit of £36 million.

Or will the group simply revert to its pre-pandemic performance and earn regular profits of £15 million? Believe this reversion scenario and the £12 shares could actually be priced at 20x earnings.

For now, the omens seem positive with Latham claiming “[industry] prices have stabilised and there are few signs of price weakness in the immediate future.”

The balance sheet loaded with stock, debtors, cash and freeholds provides another view on valuation. December’s interims showed a net tangible asset value (NTAV) of £178 million — equivalent to almost £9 share.

Latham’s price to NTAV is therefore 1.3x, which does not seem outrageous given the share price has bounced between 1x and 2x NTAV during the last decade:

While Latham may not offer the very best financials, the business feels extremely well managed by an old-school board that seems to really care about its outside shareholders. Buy and hold this stock for the next five or ten years, and I suspect the returns will outpace many more ‘exciting’ alternatives.

True, the market has good reason to apply the single-digit P/E. And notable exposure to builders and retailers may cause a setback if the broader economy falters. But the balance sheet ought to provide good support if earnings really start to wobble.

All told, I like Latham and will now set a SharePad alarm to notify me if the price drops towards £10.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Private Investor’s Podcast with Roland Head. He does not own shares in James Latham.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.