With the rally running out of steam, Bruce looks at long-run equity returns. The two banks which compete to publish this data have performed much worse than the average equity. Companies covered SHC, RMV and RCDO.

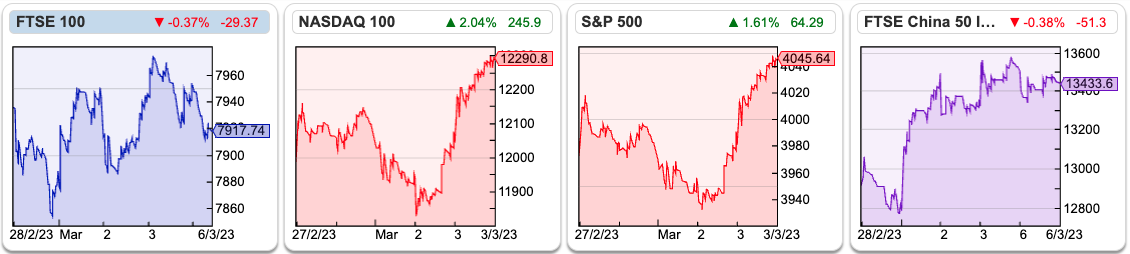

The rally seems to be running out of steam. The FTSE 100 was down -0.2% to 7,917. The Nasdaq 100 and S&P 500 were up +2.7% and +1.9% in the last 5 days, but all 3 indices are down c. -4% over the last month. The FTSE China 50 has fallen -11% since its peak in late January. Meanwhile, Copper, which I like to keep an eye on as a leading indicator of market sentiment has begun to break down recently (though still up +7% YTD).

Credit Suisse Global Returns Yearbook

Last week the Swiss bank published their Global Returns Yearbook.

This document containing long-run global returns has an interesting history. In the mid-1990s Barclay’s investment bank was losing money. Barclays decided to sell its equities and corporate finance business (Barclays de Zoete Wedd) to Credit Suisse. They split BZW in two, with their Fixed Income business becoming Barclays Capital while the BZW equity staff moved a couple of doors down the road to Credit Suisse’s building in Cabot Square, Canary Wharf. It was a friendly deal between the two banks, the only point of contention was the Barclays Equity Gilt study, with data going back over a hundred years. Both sides wanted it.

In 1998 Barclays were shrewd enough to hold firm and keep their valuable Equity Gilt database. So Credit Suisse have had to invest in a new data source of long-run financial returns, compiled by academics Elroy Dimson, Paul Marsh and Mike Staunton. Hence the Global Returns Yearbook, which is what they published last week.

The bank’s research shows that over the long run, equities generate much higher returns than fixed income. After adjusting for inflation, $1 invested in the US equities 123 years ago would now be worth 2024x at the end of 2022. That compares to an 8x real increase for bonds, according to Credit Suisse. In CAGR terms that equates to +6.4% for US equities and +1.7% for US bonds.

In the UK real returns over the same 123-year time period have compounded annually at +5.3% for equities versus +1.4% for bonds. Figures for the last two decades, from 2003, onwards show UK equities have compounded annually at +4.6%, versus less than +1% for bonds.

Barclays management realised in the 1990s that high returns might be true of equities as an asset class, but not of equities divisions run by bankers. The latter tends to be an expensive way to lose money. Barclays decision to sell BZW looked well-judged when the internet bubble burst a couple of years later. Then in 2008, Barclays management forgot this. They bought Lehman Brothers equity business for $250m, two days after the US investment bank had filed for bankruptcy.

Barclays share price has increased on average by c. 1p per share since the mid-1990s versus 172p on Monday. That’s well below the historic rate of equity returns for the stockmarket as a whole. True, BARC share price did peak at over 700p in early 2007, before they launched an unsuccessful bid for ABN Amro. However, the BARC share price troughed below 50p a couple of years later in the depths of the financial crisis. Sharepad shows that the last decade has been even more unkind to the Credit Suisse share price, which has fallen -90% from the high 20s CHF to CHF 2.67.

Marc Rubinstein points out that Credit Suisse’s equities business (where we used to work together) has struggled. In Q4 of last year, Credit Suisse (the old BZW, which merged with the First Boston, Credit Suisse and later DLJ franchise) reported revenues of just $15m in sales and trading. At least that is an improvement on negative revenue in Q2 2021. If you’re pondering how an equities business delivers negative revenue, then the answer is the half a billion dollars derivatives loss to Archegos was marked down through the revenue line.

In any case, the conclusion is hard to avoid that investment banks have delivered very poor long-run equity returns. Secondly, this obvious conclusion seems to go unnoticed by investment banks themselves, in Credit Suisse’s Yearbook and Barclay’s Equity Gilt Study.

Below I look at Capital & Counties, the Covent Garden landlord’s FY results and merger with Shaftesbury. I also look at property website Rightmove and Ricardo, the specialist engineering consultancy.

The next Mello Event is on Monday 13th March. So far David has fund manager Rosemary Banyard and a company called Evo, that connects landlords with skilled tradespeople. Reading between the lines, it looks like David is struggling to persuade companies to present to retail investors, which also may be a sign that management teams are generally nervous about being too upbeat and having to revise down guidance a few months later.

Capital & Counties FY Dec Results and Shaftesbury merger

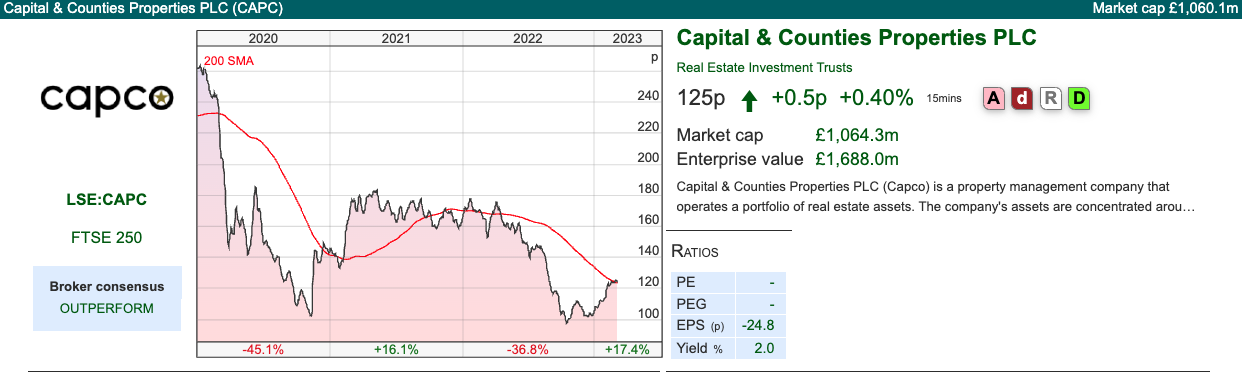

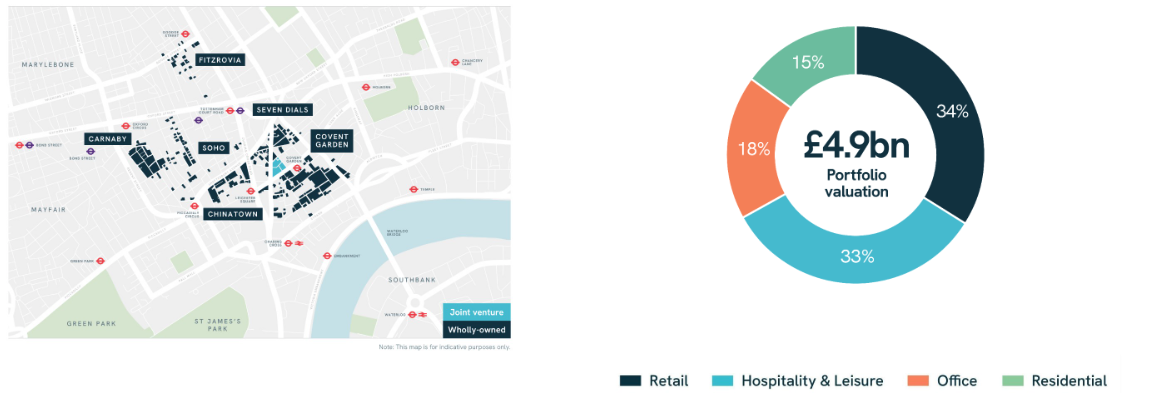

This Covent Garden landlord had a difficult pandemic and in June last year announced it was merging with Shaftesbury (Soho, Chinatown, Carnaby Street) in an all-share deal. The split was 53/47 in favour of Shaftesbury, though Ian Hawksworth Capco’s Chief Exec will become head of the enlarged group, which will be called Shaftesbury Capital.

The merger has cleared the final hurdle, Competition and Markets Authority (“CMA”) approval on 22 Feb 2023, and has now been completed (Shaftesbury shares were cancelled yesterday on 6 Mar). It will take a couple of days for the figures to feed through into Sharepad, but the combined market cap of the organisation is now circa £2.7bn versus £4.9bn portfolio valuation).

The company is structured as a mixed-used REIT, which means 90% of property income must be distributed each year. As they pay out so much income, REITs tend to look expensive on a PER basis, but attractive on a dividend yield basis.

Capco used to have an Earls Court development project. However, they sold this before the pandemic, when it ran into planning difficulties. London does need more affordable accommodation but the boom in luxury properties like Nine Elms (formerly Battersea Power Station, on the cover of Pink Floyd’s Animals album) seems to have ended a few years ago. Earls Court halved in value between 2015 and 2019, when Capco sold the site for £425m. A reminder that expensive London property does not always go up.

Tenants: Unlike the average high street landlord, the West End signings tend to be luxury brands, including jewellery (Mejuri), fragrance (Creed), sportswear (Hoka) and sunglasses (Izipizi). Uniqlo will open its new flagship store, with dual frontage on Long Acre and Floral Street, in spring 2023. I’ve never heard of these brands – but I own Superdry and so I’m not really a dedicated follower of fashion.

Results: On a standalone basis, underlying net rental income for Capco was up +17%, to £57m FY Dec 2022 but the total portfolio value was marked down 17% to £2.2bn, as rising interest rates fed through to reduced asset values. The Covent Garden valuation is 27% below 2019 levels, as Retail and Offices have been marked down -36% and -16% respectively, on a like-for-like basis.

Valuation: Post merger the combined EPRA NTA will be c. 192p per share according to the company, so the combined group is now trading at a discount of 35% to EPRA NTA. With a combined portfolio value of £4.9bn (2.9m square feet of lettable space), the Loan to Value is 31%.

EPRA is the European Real Estate Association standard calculation for Net Tangible Assets. It includes IFRS net assets (property and investments at fair value) but excludes the mark-to-market on derivatives and convertible bonds.

Opinion: I don’t own any REITS because I don’t need the yield. But if I did, I think this could be an interesting one to investigate further. Covent Garden and Carnaby Street are unique assets in my view. Shopping in the West End is much less exposed to the ‘cost of living’ crisis and the shift to online retail, Capco increased in value 4x between 2010 and 2015. Shaftesbury had a difficult financial crisis between 2007-2009 but also did well in the following 5 years.

The investment case is still reliant on tourism and international travel though. There’s also a risk that REITs property valuations see more mark-to-market losses in a rising interest rate environment.

Rightmove FY Dec Results

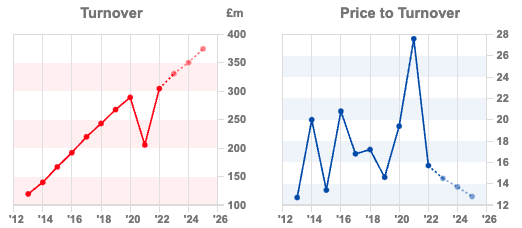

This remarkably profitable property website announced FY Dec results last week. The shares have appeared in Maynard’s filter in this article on excellent cash conversion. Results for last year look reasonably strong, with revenue +9% to £332m and operating PBT +7% to £245m. They returned £198m of cash to shareholders through dividends and a buyback, down from £238m in 2021. The final 2022 dividend of 5.2p still needs to be approved at the AGM, but when it does the total 2022 DPS will be 8.5p (up +9% versus 2021).

They have a new CEO, Johan Svanstrom, who starts this month. His background is consumer online marketplace businesses, like Hotels.com and Expedia. I mention this because I tend to be a little wary of new CEOs talking down numbers for the first 6-12 months of their tenure. Antonio Horta-Osario at Lloyds and Stephen Hester at RBS/NatWest both took over banks when expectations had been set too high by their predecessor. I also think the same phenomenon may be going on an FDEV, where David Braben has been replaced by Jonny Watts and Gooch & Housego which also has a new CEO.

Outlook: The UK housing market has had a difficult start to 2023, with mortgage approvals for house purchases down -44% Jan v Jan 2022, according to the Building Societies Association. Rightmove say that their results are not impacted by the property market cycle, except in the most extreme circumstances. Below we can see the -29% revenue decline at the beginning of the pandemic, although arguably Central Bank rate cuts rescued the property market from “extreme” circumstances; the Bank of England are unlikely to cut rates so aggressively in the next couple of years.

RMV management says that they expect an underlying operating profit margin of c. 73% for 2023F, the same figure as 2022. Sharepad has revenue growing at +6% in 2023F and 2024F.

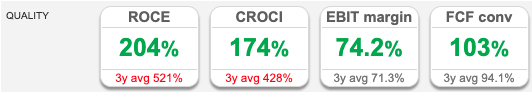

There’s also the risk that rival sites like Zoopla, Prime Location and OnTheMarket make inroads into their business. The point about OTMP is that their model involves issuing shares to estate agents, they are not trying to replicate RMV’s 521% RoCE (3 year average). OTMP was created by estate agents to directly attack RMV’s high level of profitability.

Valuation: RMV shares are trading on 23x PER Dec 2023F and 21x PER Dec 2024F. The shares are trading on 14x 2023F Sales, which is expensive for a company with sales growth in mid-single digits. That valuation implies the model is sustainable and competitors are not going to bridge the company’s “moat”.

Opinion: I think that this is a quality company, but we could see disappointment this year. During the financial crisis housing transactions dropped by -44%. Connell’s, one of the estate agents that set up Rightmove, were a forced seller at 16p in late 2008.

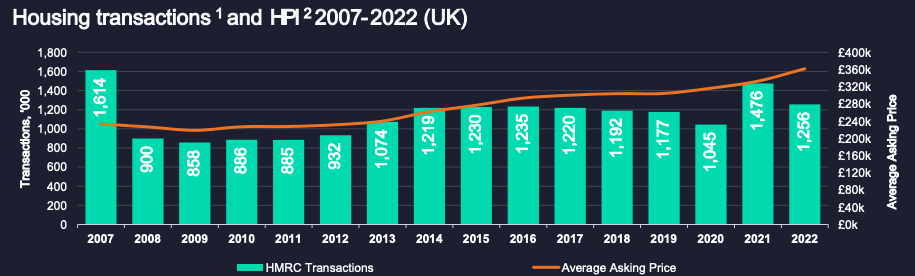

It’s important to remember that transactions, rather than house prices, are the RMV value driver. The company put up this chart showing in 2022 asking prices were still rising, while transaction numbers have been falling. I think that this is likely to remain the trend and transaction volumes will fall significantly in 2023.

The RMV track record is fantastic, but it does seem to me that if investors wait patiently, we might see a better time to buy the shares.

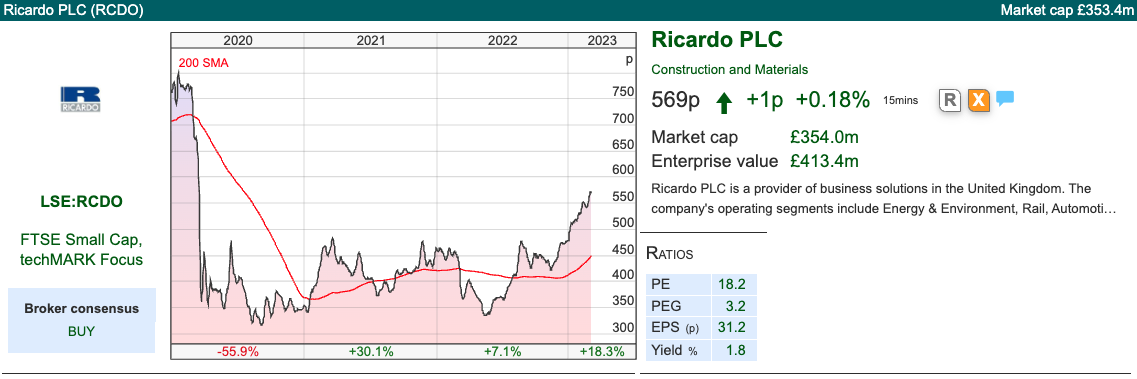

Ricardo H1 Dec Results

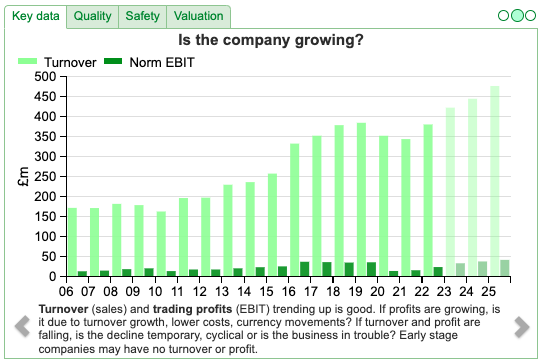

This environmental engineering consultancy that has a history going back to 1915, reported H1 Dec results. Sharepad doesn’t have financials back quite that far, but over 40 years of data back to 1982 is still impressive.

More recently, RCDO’s headline numbers have looked poor at first glance, while the share price has been strong. On looking closer, the poor statutory results are mainly due to an £18m goodwill writedown in H1, so operating loss was £10m, which is neither a good reflection of cash or ongoing operations. Instead, it seems fair enough to focus on revenue from continuing operations, which was up between +12% and +17% to £211m depending on which of the company’s four growth calculations you prefer: i) total, ii) continuing operations, iii) continuing organic or iv) continuing constant currency. PBT was £9.4m, up between +16% and +20% on the same basis.

Group net debt reduced from £35m Dec 2021 to £31m Dec 2022. That was helped by £12m of cash received on the disposal of Ricardo Software. The net gain on disposal was £7.5m. Excluding restructuring charges, fees to external advisors etc there was a cash outflow of £3.5m during the year. There’s a large pension scheme, with assets of £109m, but the scheme has a surplus of £13m (ie £96m of obligations).

Outlook: The company re-iterates FY expectations, without saying what they are. They point to a record-high order book of £414m, +33% driven by the strong demand for Environmental and Energy-Transition portfolio. That division represents 55% of revenue from continuing operations. They expect the A&I Established business, which is 7% of revenue to be challenging. I feel that management could do a better job at explaining their business, A&I (Automotive & Industrial), EE (Energy and Environment) and PP (Performance Products) abbreviations are scattered around the Annual Report, without a clear explanation of what the divisions actually do.

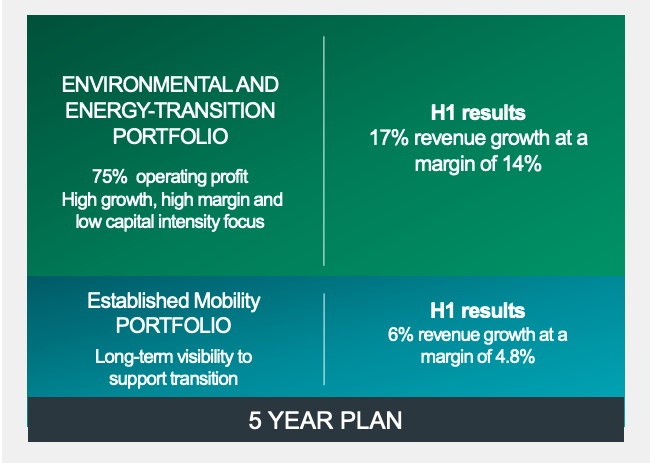

Management has a sensible sounding 5 year plan, focusing on the higher revenue growth and higher margin Environmental and Energy Transition Portfolio. This plan has included selling high capital intensity businesses like Ricardo Software (sold Aug 2022) and paying a higher valuation multiple to buy more attractive businesses like E3 modelling, with operating profit margin of 45% (bought Jan 2023).

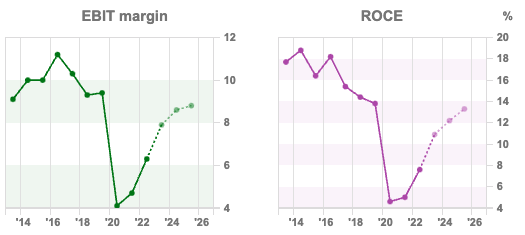

Valuation: The shares are trading on a PER 15x Jun 2024F and 13.5x Jun 2025 PER. Given the disposals, I’m not sure how relevant the historic RoCE 7.5% (3 year average) is. If management can grow the higher margin division to become ¾ of operating PBT, then that suggests we should see improving financial measures. Sharepad shows forecast RoCE rising towards 14% in a couple of years time and high single digit EBIT margin.

Opinion: At first glance, there’s a lot going on in these numbers, but often disposing of non-core operations and writing down goodwill on previous acquisitions is a catalyst for shares to begin performing. I also think ESG consulting is a growth area.

A reasonable question to ask might be: if the EE portfolio is both higher revenue growth and higher margin, why keep the Established Mobility portfolio at all? However, if EE is more cyclical, it could make sense for management to keep the more stable, less attractive business. In summary, I think there could be an interesting investment case here, but at the moment it’s a little hard to see the wood from the trees.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Weekly Market Commentary | 07/03/23 | CAPC, RMV, RCDO | Banking on Equity Returns

With the rally running out of steam, Bruce looks at long-run equity returns. The two banks which compete to publish this data have performed much worse than the average equity. Companies covered SHC, RMV and RCDO.

The rally seems to be running out of steam. The FTSE 100 was down -0.2% to 7,917. The Nasdaq 100 and S&P 500 were up +2.7% and +1.9% in the last 5 days, but all 3 indices are down c. -4% over the last month. The FTSE China 50 has fallen -11% since its peak in late January. Meanwhile, Copper, which I like to keep an eye on as a leading indicator of market sentiment has begun to break down recently (though still up +7% YTD).

Credit Suisse Global Returns Yearbook

Last week the Swiss bank published their Global Returns Yearbook.

This document containing long-run global returns has an interesting history. In the mid-1990s Barclay’s investment bank was losing money. Barclays decided to sell its equities and corporate finance business (Barclays de Zoete Wedd) to Credit Suisse. They split BZW in two, with their Fixed Income business becoming Barclays Capital while the BZW equity staff moved a couple of doors down the road to Credit Suisse’s building in Cabot Square, Canary Wharf. It was a friendly deal between the two banks, the only point of contention was the Barclays Equity Gilt study, with data going back over a hundred years. Both sides wanted it.

In 1998 Barclays were shrewd enough to hold firm and keep their valuable Equity Gilt database. So Credit Suisse have had to invest in a new data source of long-run financial returns, compiled by academics Elroy Dimson, Paul Marsh and Mike Staunton. Hence the Global Returns Yearbook, which is what they published last week.

The bank’s research shows that over the long run, equities generate much higher returns than fixed income. After adjusting for inflation, $1 invested in the US equities 123 years ago would now be worth 2024x at the end of 2022. That compares to an 8x real increase for bonds, according to Credit Suisse. In CAGR terms that equates to +6.4% for US equities and +1.7% for US bonds.

In the UK real returns over the same 123-year time period have compounded annually at +5.3% for equities versus +1.4% for bonds. Figures for the last two decades, from 2003, onwards show UK equities have compounded annually at +4.6%, versus less than +1% for bonds.

Barclays management realised in the 1990s that high returns might be true of equities as an asset class, but not of equities divisions run by bankers. The latter tends to be an expensive way to lose money. Barclays decision to sell BZW looked well-judged when the internet bubble burst a couple of years later. Then in 2008, Barclays management forgot this. They bought Lehman Brothers equity business for $250m, two days after the US investment bank had filed for bankruptcy.

Barclays share price has increased on average by c. 1p per share since the mid-1990s versus 172p on Monday. That’s well below the historic rate of equity returns for the stockmarket as a whole. True, BARC share price did peak at over 700p in early 2007, before they launched an unsuccessful bid for ABN Amro. However, the BARC share price troughed below 50p a couple of years later in the depths of the financial crisis. Sharepad shows that the last decade has been even more unkind to the Credit Suisse share price, which has fallen -90% from the high 20s CHF to CHF 2.67.

Marc Rubinstein points out that Credit Suisse’s equities business (where we used to work together) has struggled. In Q4 of last year, Credit Suisse (the old BZW, which merged with the First Boston, Credit Suisse and later DLJ franchise) reported revenues of just $15m in sales and trading. At least that is an improvement on negative revenue in Q2 2021. If you’re pondering how an equities business delivers negative revenue, then the answer is the half a billion dollars derivatives loss to Archegos was marked down through the revenue line.

In any case, the conclusion is hard to avoid that investment banks have delivered very poor long-run equity returns. Secondly, this obvious conclusion seems to go unnoticed by investment banks themselves, in Credit Suisse’s Yearbook and Barclay’s Equity Gilt Study.

Below I look at Capital & Counties, the Covent Garden landlord’s FY results and merger with Shaftesbury. I also look at property website Rightmove and Ricardo, the specialist engineering consultancy.

The next Mello Event is on Monday 13th March. So far David has fund manager Rosemary Banyard and a company called Evo, that connects landlords with skilled tradespeople. Reading between the lines, it looks like David is struggling to persuade companies to present to retail investors, which also may be a sign that management teams are generally nervous about being too upbeat and having to revise down guidance a few months later.

Capital & Counties FY Dec Results and Shaftesbury merger

This Covent Garden landlord had a difficult pandemic and in June last year announced it was merging with Shaftesbury (Soho, Chinatown, Carnaby Street) in an all-share deal. The split was 53/47 in favour of Shaftesbury, though Ian Hawksworth Capco’s Chief Exec will become head of the enlarged group, which will be called Shaftesbury Capital.

The merger has cleared the final hurdle, Competition and Markets Authority (“CMA”) approval on 22 Feb 2023, and has now been completed (Shaftesbury shares were cancelled yesterday on 6 Mar). It will take a couple of days for the figures to feed through into Sharepad, but the combined market cap of the organisation is now circa £2.7bn versus £4.9bn portfolio valuation).

The company is structured as a mixed-used REIT, which means 90% of property income must be distributed each year. As they pay out so much income, REITs tend to look expensive on a PER basis, but attractive on a dividend yield basis.

Capco used to have an Earls Court development project. However, they sold this before the pandemic, when it ran into planning difficulties. London does need more affordable accommodation but the boom in luxury properties like Nine Elms (formerly Battersea Power Station, on the cover of Pink Floyd’s Animals album) seems to have ended a few years ago. Earls Court halved in value between 2015 and 2019, when Capco sold the site for £425m. A reminder that expensive London property does not always go up.

Tenants: Unlike the average high street landlord, the West End signings tend to be luxury brands, including jewellery (Mejuri), fragrance (Creed), sportswear (Hoka) and sunglasses (Izipizi). Uniqlo will open its new flagship store, with dual frontage on Long Acre and Floral Street, in spring 2023. I’ve never heard of these brands – but I own Superdry and so I’m not really a dedicated follower of fashion.

Results: On a standalone basis, underlying net rental income for Capco was up +17%, to £57m FY Dec 2022 but the total portfolio value was marked down 17% to £2.2bn, as rising interest rates fed through to reduced asset values. The Covent Garden valuation is 27% below 2019 levels, as Retail and Offices have been marked down -36% and -16% respectively, on a like-for-like basis.

Valuation: Post merger the combined EPRA NTA will be c. 192p per share according to the company, so the combined group is now trading at a discount of 35% to EPRA NTA. With a combined portfolio value of £4.9bn (2.9m square feet of lettable space), the Loan to Value is 31%.

EPRA is the European Real Estate Association standard calculation for Net Tangible Assets. It includes IFRS net assets (property and investments at fair value) but excludes the mark-to-market on derivatives and convertible bonds.

Opinion: I don’t own any REITS because I don’t need the yield. But if I did, I think this could be an interesting one to investigate further. Covent Garden and Carnaby Street are unique assets in my view. Shopping in the West End is much less exposed to the ‘cost of living’ crisis and the shift to online retail, Capco increased in value 4x between 2010 and 2015. Shaftesbury had a difficult financial crisis between 2007-2009 but also did well in the following 5 years.

The investment case is still reliant on tourism and international travel though. There’s also a risk that REITs property valuations see more mark-to-market losses in a rising interest rate environment.

Rightmove FY Dec Results

This remarkably profitable property website announced FY Dec results last week. The shares have appeared in Maynard’s filter in this article on excellent cash conversion. Results for last year look reasonably strong, with revenue +9% to £332m and operating PBT +7% to £245m. They returned £198m of cash to shareholders through dividends and a buyback, down from £238m in 2021. The final 2022 dividend of 5.2p still needs to be approved at the AGM, but when it does the total 2022 DPS will be 8.5p (up +9% versus 2021).

They have a new CEO, Johan Svanstrom, who starts this month. His background is consumer online marketplace businesses, like Hotels.com and Expedia. I mention this because I tend to be a little wary of new CEOs talking down numbers for the first 6-12 months of their tenure. Antonio Horta-Osario at Lloyds and Stephen Hester at RBS/NatWest both took over banks when expectations had been set too high by their predecessor. I also think the same phenomenon may be going on an FDEV, where David Braben has been replaced by Jonny Watts and Gooch & Housego which also has a new CEO.

Outlook: The UK housing market has had a difficult start to 2023, with mortgage approvals for house purchases down -44% Jan v Jan 2022, according to the Building Societies Association. Rightmove say that their results are not impacted by the property market cycle, except in the most extreme circumstances. Below we can see the -29% revenue decline at the beginning of the pandemic, although arguably Central Bank rate cuts rescued the property market from “extreme” circumstances; the Bank of England are unlikely to cut rates so aggressively in the next couple of years.

RMV management says that they expect an underlying operating profit margin of c. 73% for 2023F, the same figure as 2022. Sharepad has revenue growing at +6% in 2023F and 2024F.

There’s also the risk that rival sites like Zoopla, Prime Location and OnTheMarket make inroads into their business. The point about OTMP is that their model involves issuing shares to estate agents, they are not trying to replicate RMV’s 521% RoCE (3 year average). OTMP was created by estate agents to directly attack RMV’s high level of profitability.

Valuation: RMV shares are trading on 23x PER Dec 2023F and 21x PER Dec 2024F. The shares are trading on 14x 2023F Sales, which is expensive for a company with sales growth in mid-single digits. That valuation implies the model is sustainable and competitors are not going to bridge the company’s “moat”.

Opinion: I think that this is a quality company, but we could see disappointment this year. During the financial crisis housing transactions dropped by -44%. Connell’s, one of the estate agents that set up Rightmove, were a forced seller at 16p in late 2008.

It’s important to remember that transactions, rather than house prices, are the RMV value driver. The company put up this chart showing in 2022 asking prices were still rising, while transaction numbers have been falling. I think that this is likely to remain the trend and transaction volumes will fall significantly in 2023.

The RMV track record is fantastic, but it does seem to me that if investors wait patiently, we might see a better time to buy the shares.

Ricardo H1 Dec Results

This environmental engineering consultancy that has a history going back to 1915, reported H1 Dec results. Sharepad doesn’t have financials back quite that far, but over 40 years of data back to 1982 is still impressive.

More recently, RCDO’s headline numbers have looked poor at first glance, while the share price has been strong. On looking closer, the poor statutory results are mainly due to an £18m goodwill writedown in H1, so operating loss was £10m, which is neither a good reflection of cash or ongoing operations. Instead, it seems fair enough to focus on revenue from continuing operations, which was up between +12% and +17% to £211m depending on which of the company’s four growth calculations you prefer: i) total, ii) continuing operations, iii) continuing organic or iv) continuing constant currency. PBT was £9.4m, up between +16% and +20% on the same basis.

Group net debt reduced from £35m Dec 2021 to £31m Dec 2022. That was helped by £12m of cash received on the disposal of Ricardo Software. The net gain on disposal was £7.5m. Excluding restructuring charges, fees to external advisors etc there was a cash outflow of £3.5m during the year. There’s a large pension scheme, with assets of £109m, but the scheme has a surplus of £13m (ie £96m of obligations).

Outlook: The company re-iterates FY expectations, without saying what they are. They point to a record-high order book of £414m, +33% driven by the strong demand for Environmental and Energy-Transition portfolio. That division represents 55% of revenue from continuing operations. They expect the A&I Established business, which is 7% of revenue to be challenging. I feel that management could do a better job at explaining their business, A&I (Automotive & Industrial), EE (Energy and Environment) and PP (Performance Products) abbreviations are scattered around the Annual Report, without a clear explanation of what the divisions actually do.

Management has a sensible sounding 5 year plan, focusing on the higher revenue growth and higher margin Environmental and Energy Transition Portfolio. This plan has included selling high capital intensity businesses like Ricardo Software (sold Aug 2022) and paying a higher valuation multiple to buy more attractive businesses like E3 modelling, with operating profit margin of 45% (bought Jan 2023).

Valuation: The shares are trading on a PER 15x Jun 2024F and 13.5x Jun 2025 PER. Given the disposals, I’m not sure how relevant the historic RoCE 7.5% (3 year average) is. If management can grow the higher margin division to become ¾ of operating PBT, then that suggests we should see improving financial measures. Sharepad shows forecast RoCE rising towards 14% in a couple of years time and high single digit EBIT margin.

Opinion: At first glance, there’s a lot going on in these numbers, but often disposing of non-core operations and writing down goodwill on previous acquisitions is a catalyst for shares to begin performing. I also think ESG consulting is a growth area.

A reasonable question to ask might be: if the EE portfolio is both higher revenue growth and higher margin, why keep the Established Mobility portfolio at all? However, if EE is more cyclical, it could make sense for management to keep the more stable, less attractive business. In summary, I think there could be an interesting investment case here, but at the moment it’s a little hard to see the wood from the trees.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.