A look at mortgage approvals data trends, and how the Election may impact the UK housing market. Companies covered WISE, YOU and IGP.

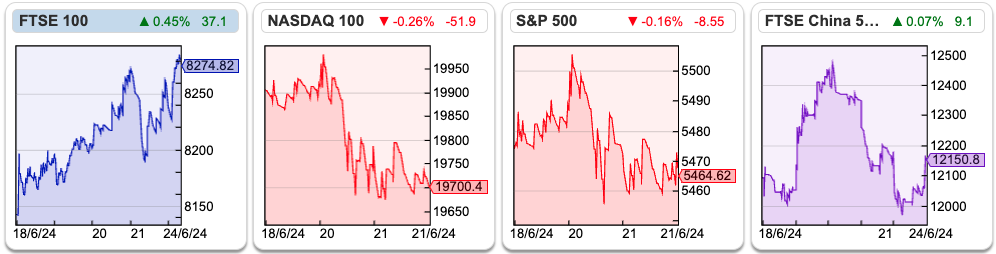

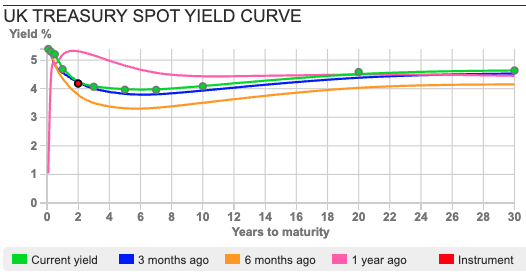

The FTSE 100 rose +1.7% last week to 8,274. The Nasdaq100 and the S&P500 were both up +0.6%. The US 10Y Govt bond yield fell back to 4.25% and yield curves remain inverted in both the US and UK. At the peak of Quantitative Easing, the BoE owned £875bn of government debt, but last September 2023 the MPC committed to £100 bn of QT in the following, which should bring the figure down to £650bn by this coming September.

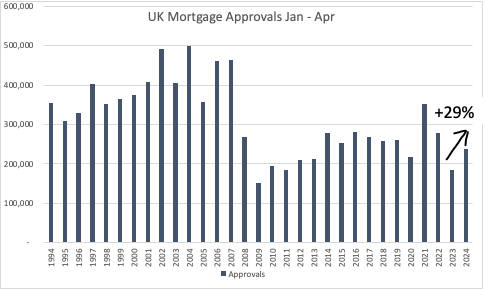

The ability to download macroeconomic data from Sharepad into Excel can be very helpful sometimes. For instance, when the Bank of England publishes mortgage approvals data, newspaper articles often quote the percentage growth rate versus the previous month. I don’t think this sequential comparison is useful, but with Sharepad I can create the chart below, showing the first four months of the year (Jan-Apr), going back to the 1990’s.

There have been 2 years of declines from the recent peak in approvals in 2021 (stamp duty holiday during the pandemic), but now approvals are recovering up +29% versus the first four months of the year in 2023. The UK 2-year fixed rate (UKTSY02), which at 4.2% has already fallen over 100bp from a peak in July last year of 5.3% and is already well below the official Bank of England overnight rate of 5.25%.

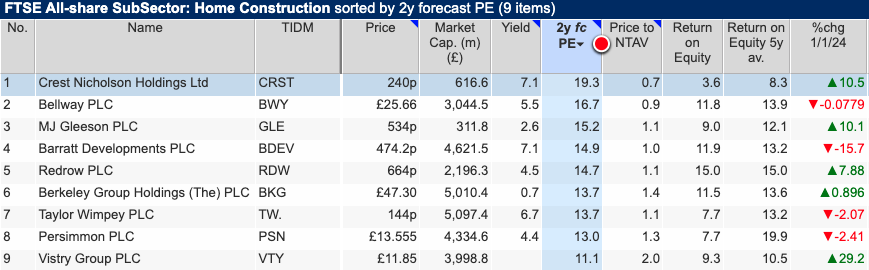

The General Election could mean that we see weakness over the next few months though. Often house hunters are reluctant to commit hundreds of thousands of pounds to buying a house when a change in government can lead to a change in economic priorities. Whatever the long-term prospects for housebuilding in the UK are, a short-term blip in the approvals data may hit the share prices of house builders like BDEV, BKG, PSN, TW or estate agents like WINK or FOXT. Crest Nicholson’s mid-June outlook statement warned:

“Momentum has softened slightly since Easter, reflecting the volatility in mortgage rates and the expectation of a base rate reduction coming later in the year than previously expected. The imminent General Election is creating some short-term uncertainty, but this is anticipated to be alleviated in July once the outcome is known.”

That is the fifth profit warning from the company since last August. CRST management have rejected a proposed offer from Bellway, worth around 253p per share and a 30% premium to the undisturbed CRST share price. For comparison, most of the sector trades on a mid-teens 2-year forecast PER.

This week I look at currency trader WISE’s FY March results and future guidance on investment and margins. Plus YouGov’s profit warning and cyber security firm Intercede’s contract wins.

WISE FY Mar Results

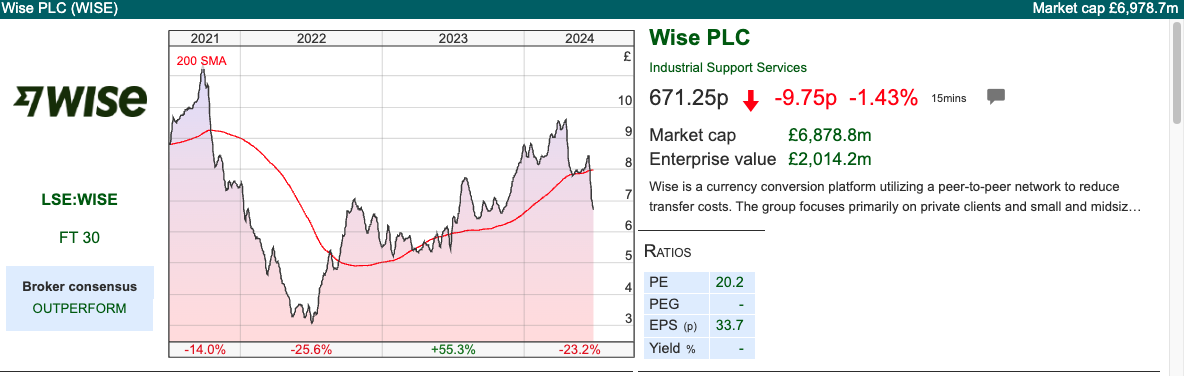

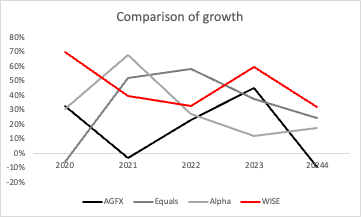

The FX business reported FY Mar underlying revenue (which includes interest income) up +31% to £1.17bn. Statutory PBT was up 3.3x to £482m. Customer numbers were also up strongly +29% to 12.8m. I have updated my chart showing that despite being by far the largest of the FX currency businesses, growth at WISE has compounded at +46% CAGR, well ahead that of smaller rivals (particularly AGFX which is forecasting a revenue decline this year).

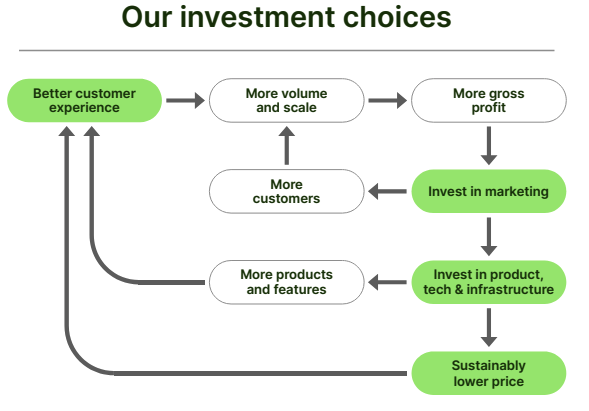

In most businesses, you would expect smaller companies starting from a lower base to grow faster, but it looks like FX is a “winner takes nearly all” business with network effects, with the benefits of scale being shared between shareholders and customers. WISE employs 5,500 staff, meaning it is more than 10x larger than the next biggest (Alpha Group) yet profit per employee is £88K, in line with ALPH and more than 2x larger than the smaller players EQLS and AGFX. However, in the short term management have suggested that they need to invest in marketing to bring in more customers, as well as in technology to give customers a better experience and improved prices.

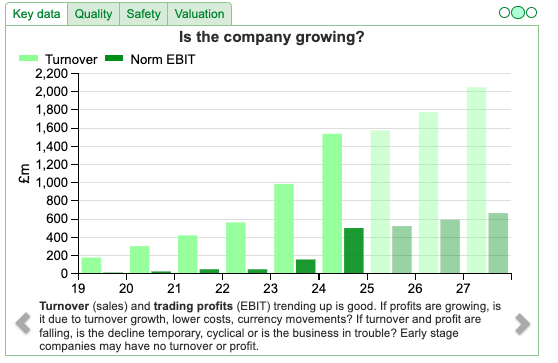

Outlook statement: Management announced a medium-term PBT margin of 13-16% (significantly below i) the 21% just reported and ii) the previous forecast on Sharepad for FY Mar 2026F). They also expect 15-20% CAGR in underlying revenue growth (which is above the +11% level forecast by Sharepad in FY Mar 2026F). The shares responded by falling -23% on the open, before recovering to around -8% by the close.

This is not the first time WISE shares have sold off aggressively following a company RNS. In April 2023 management announced that they would share more of the benefit of rising interest rates with customers, and pay interest on client balances. Given the FCA’s “Dear CEO” letters to investment platforms and wealth managers in H2 last year, WISE management look, well: wise. They have executed the right strategy all along, even if initially investor reaction was negative.

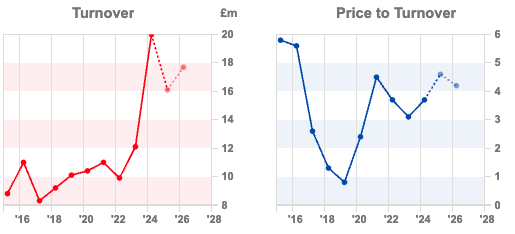

Valuation: The shares are trading on a PER of 20x FY Mar 2025F and 2026F, only dropping to 19x FY Mar 2027F. WISE is supposed to be an exciting growth story, but the investment costs mean that there’s not much progress in the bottom line. Revenues are forecast to grow at mid-teens growth rates, and the company trades on 4.7x FY Mar 2024 just reported, dropping to 4.0x in two years’ time.

Opinion: I am a customer and a big fan of the business model, however in the past, I have been put off by the valuation and refused to pay more than 5x revenue, as a general rule of thumb. Particularly in the case of WISE, where management openly shares the benefits of scale with their customers. For comparison, Amazon follows a similar strategy, and has seen phenomenal CAGR revenue growth, yet only trades on 3x revenue as customers enjoy the benefits of scale as much as the shareholders. The LSEG, which as a stock exchange is a financial business with network effects trades on 6x revenues, however, the LSEG has a forecast mid 30% PBT margin, around twice the level of WISE’s medium-term target. Now the share price has fallen by a third since mid-March, and WISE is on less than 5x forecast revenue this is now within my target valuation so I may re-cycle some of my gains from HL. into the shares.

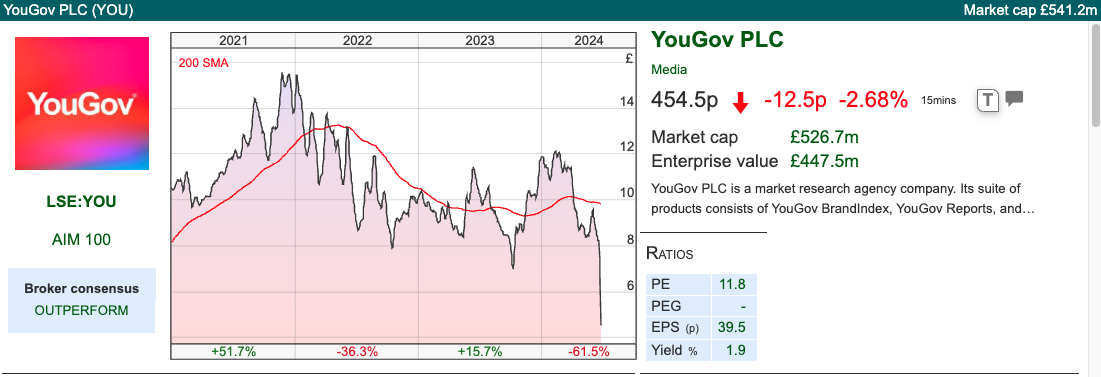

YouGov FY July Profit Warning

This long-term multi-bagger fell -40% last week, after saying that sales would be lower than expected: now £324m-£327m, and adj op profit £44-£41m. That equates to c. 5% miss versus Sharepad’s previous sales forecast and -35% below Sharepad’s previous EBIT forecast. There’s no mention of net debt in last week’s RNS, but at the H1 stage, net debt was £163m, or 1.6x EBITDA.

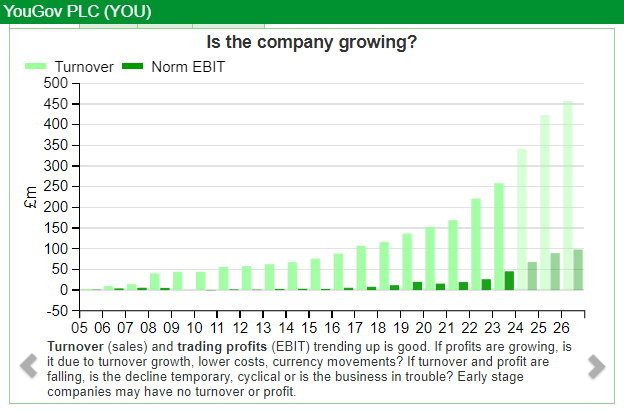

History: founded at the peak of the first internet bubble in May 2000 by the joint Chief Executives, Nadhim Zahawi and Stephan Shakespeare (the latter is now the Non-Exec Chair, but has sold down his stake to less than 2%). YouGov built its initial panel of online respondents through joint projects with Freeserve (remember them? They were once a FTSE 100 company.) 5 years later YouGov listed on AIM through a placing at 135p (implying a market cap for the company of £18m) in 2005. Though the company started off in the business of polling respondents on their political voting intentions, the largest source of revenue is market research for corporate brands. That is asking their panel of 26m registered consumers, what they think of a product and hence monitor marketing campaign performance and benchmark perceptions versus competitors. Despite the disappointing guidance of £324m-£327m for FY July 2024F, revenue has grown more than 100x over the last couple of decades, from less than £3m FY July 2005.

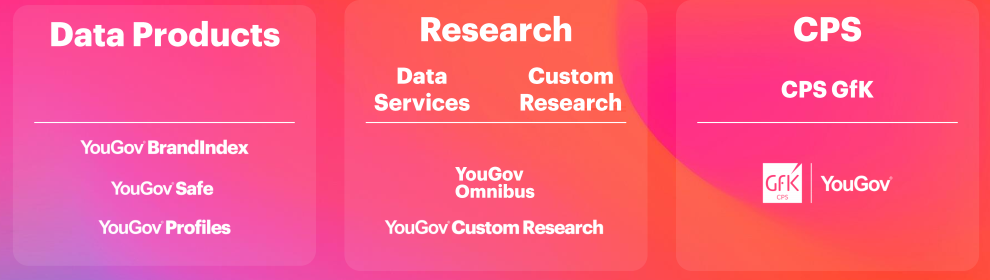

What has gone wrong? The RNS highlights that sales in the Data Products division (29% of revenues, but higher margin so 57% of adj op profits at H1) have remained slow. Data Products include YouGov BrandIndex and YouGov Profiles as well as newer behavioural products, such as YouGov Safe. They also mention challenges in the EMEA, particularly the German-speaking DACH (Germany, Austria and Switzerland) region.

The other divisions are Research (over 60% of revenue, but with a margin of 19%, half that of Data Products) and CPS, which is the highest margin (60% adj op PBT margin) business but only recently acquired earlier this year. CPS is a leading European provider of data intelligence, particularly the fast-moving consumer goods (FMCG) industry. The company tracks household FMCG purchases through a panel consisting of approximately 100,000 households across 18 countries, providing customer purchasing data. They paid £270m, of which £176m was goodwill and just £8.5m of tangible assets. They say that CPS is performing in line with expectations following, but aligning CPS’s accounting treatment of revenue recognition with YouGov’s means some contribution from CPS will be delayed into FY 2025F. The £270m consideration was funded through the drawdown of £215m in bank loans and existing cash on the balance sheet, so the business has swung from £107m net cash in July 2023 (year-end) to £163m of net debt Jan 2024 (H1 period end).

The other divisions are Research (over 60% of revenue, but with a margin of 19%, half that of Data Products) and CPS, which is the highest margin (60% adj op PBT margin) business but only recently acquired earlier this year. CPS is a leading European provider of data intelligence, particularly the fast-moving consumer goods (FMCG) industry. The company tracks household FMCG purchases through a panel consisting of approximately 100,000 households across 18 countries, providing customer purchasing data. They paid £270m, of which £176m was goodwill and just £8.5m of tangible assets. They say that CPS is performing in line with expectations following, but aligning CPS’s accounting treatment of revenue recognition with YouGov’s means some contribution from CPS will be delayed into FY 2025F. The £270m consideration was funded through the drawdown of £215m in bank loans and existing cash on the balance sheet, so the business has swung from £107m net cash in July 2023 (year-end) to £163m of net debt Jan 2024 (H1 period end).

I also can’t resist pointing out that YouGov also uses the words ‘platform’ and ‘virtuous circle’ in their results presentation.

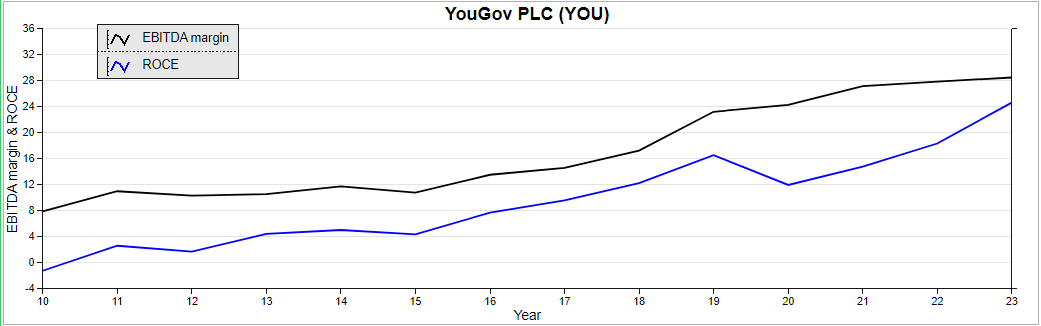

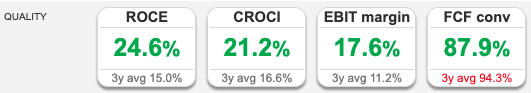

To be fair though, Sharepad’s quality metrics do point to above-average returns. Rising EBITDA margins and RoCE combined with revenue growth does suggest that in this case, YOU has a platform with operating leverage.

To be fair though, Sharepad’s quality metrics do point to above-average returns. Rising EBITDA margins and RoCE combined with revenue growth does suggest that in this case, YOU has a platform with operating leverage.

Valuation: At the time of writing YouGov’s consensus forecasts had not been updated, but taking a 40% cut to EPS FY July 2025F would imply a PER of 16x. That could be too harsh if business recovers next year, we just don’t know because management haven’t given guidance for the coming year. On a price/sales basis, the shares are on 1.3x July 2025F, which seems attractive if RoCE and EBIT margins can recover to last year’s levels.

Opinion: It looks like management have invested in growing the business, and the revenue hasn’t come through as expected. I don’t think I would rush to buy this immediately, as there is always the possibility that a second profit warning follows, particularly as net debt was £163m at the H1 stage. But YOU is a quality company so in the next 6 to 12 months there could be a good opportunity to buy into the story at a reasonable price. So this goes on my watchlist.

Intercede FY Mar Results

This digital identity and credential management company announced FY revenue +65% to £20m, and statutory PBT up 9x to £5.6m. Net cash also more than doubled to £17m (there’s no debt, so that figure is also the gross cash position). These impressive results follow a couple of contract wins announced around December last year and January this year. With the benefit of hindsight, it might have appeared obvious that contract wins would lead to strong results, however, I did write up this company in April 2022 when management announced contract wins but also a profit warning at the same time.

Outlook: The outlook statement talks about good visibility on the pipeline and a clear roadmap on their acquisition strategy. Cavendish, their broker, have left their forecasts unchanged. That implies a fall in revenue of -20% to £16m FY Mar 2025F, followed by a recovery to £18m the following year. The broker points out that the year just reported saw uncharacteristically large contract wins, but excluding that topline growth would be +18% FY Mar 2025F, falling to +10% the following year.

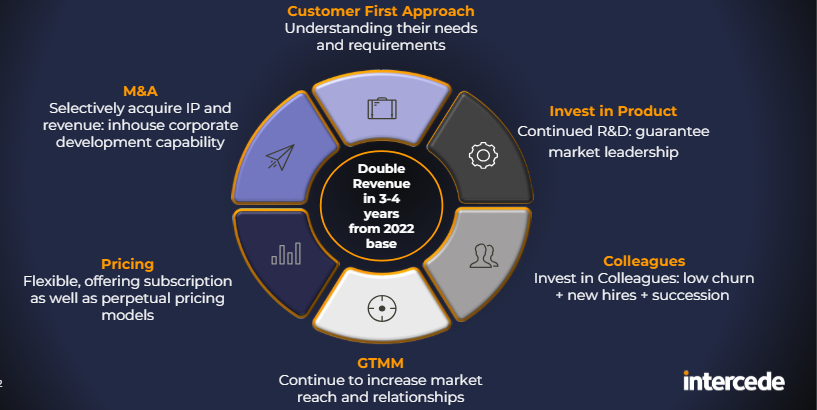

For readers wishing to understand the company better, there is a 100-page slide deck and recording of Capital Markets Day on InvestorMeetCompany. The company has a target to double revenue over the next 3 to 4 years, from FY Mar 2022 (£10m), which seems feasible.

Comparison with GB Group: For comparison, the much larger GB group (which does identity and location verification) reported flat revenue at £277m and a loss of £50m, including a goodwill impairment charge of £55m. GB doesn’t operate in quite the same area as IGP seem to have a very high specification suite of products that allows customers to choose the level of security that best fits their needs, from Secure Registration and ID Verification to Password Security Management, One-Time Passwords, FIDO (Fast Identity Online) and PKI (Public Key Infrastructure). The latter are both asymmetric key cryptographical methods that eliminate the need for passwords. Customers tend to be governments, federal agencies, defence firms and similar.

GB Group, on the other, helps companies onboard new customers and also helps to reduce fraud. They benefited significantly in FY Mar 2022 from cryptocurrency companies registering customers, but have struggled in the last 18 months.

Valuation: The shares are trading on just 12x historic PER, however, that rises to a PER of 26x FY Mar 2026F, as the year just reported has benefitted from lumpy contract wins. On a price/sales basis, they are on 4.2x FY Mar 2026F. Cash is currently a quarter of the market cap, so adjusting for that would reduce the PER to just below 20x.

Opinion: IGP strikes me as a good story, this ought to be a growth area, but the execution until this year has been poor. Sharepad shows that between FY Mar 2016 and FY Mar 2023, revenue grew by just £1m to £12m. Despite reporting a gross margin in the high 90s, the company has failed to generate much in the way of RoCE or EBIT margin until the year just reported. That could present an opportunity, as if management can grow the business on a fixed cost base, then we could see impressive operational gearing. I commented on DARK a few months ago, that it is difficult to know how good enterprise software (ie large corporations, rather than individual customers) and cybersecurity solutions are unless you’re an expert in the field. I think that this has the potential to be very good, but the track record until recently has been patchy.

Notes

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 25/06/2024 | WISE, YOU, IGP | Approvals rising

A look at mortgage approvals data trends, and how the Election may impact the UK housing market. Companies covered WISE, YOU and IGP.

The FTSE 100 rose +1.7% last week to 8,274. The Nasdaq100 and the S&P500 were both up +0.6%. The US 10Y Govt bond yield fell back to 4.25% and yield curves remain inverted in both the US and UK. At the peak of Quantitative Easing, the BoE owned £875bn of government debt, but last September 2023 the MPC committed to £100 bn of QT in the following, which should bring the figure down to £650bn by this coming September.

The ability to download macroeconomic data from Sharepad into Excel can be very helpful sometimes. For instance, when the Bank of England publishes mortgage approvals data, newspaper articles often quote the percentage growth rate versus the previous month. I don’t think this sequential comparison is useful, but with Sharepad I can create the chart below, showing the first four months of the year (Jan-Apr), going back to the 1990’s.

There have been 2 years of declines from the recent peak in approvals in 2021 (stamp duty holiday during the pandemic), but now approvals are recovering up +29% versus the first four months of the year in 2023. The UK 2-year fixed rate (UKTSY02), which at 4.2% has already fallen over 100bp from a peak in July last year of 5.3% and is already well below the official Bank of England overnight rate of 5.25%.

The General Election could mean that we see weakness over the next few months though. Often house hunters are reluctant to commit hundreds of thousands of pounds to buying a house when a change in government can lead to a change in economic priorities. Whatever the long-term prospects for housebuilding in the UK are, a short-term blip in the approvals data may hit the share prices of house builders like BDEV, BKG, PSN, TW or estate agents like WINK or FOXT. Crest Nicholson’s mid-June outlook statement warned:

“Momentum has softened slightly since Easter, reflecting the volatility in mortgage rates and the expectation of a base rate reduction coming later in the year than previously expected. The imminent General Election is creating some short-term uncertainty, but this is anticipated to be alleviated in July once the outcome is known.”

That is the fifth profit warning from the company since last August. CRST management have rejected a proposed offer from Bellway, worth around 253p per share and a 30% premium to the undisturbed CRST share price. For comparison, most of the sector trades on a mid-teens 2-year forecast PER.

This week I look at currency trader WISE’s FY March results and future guidance on investment and margins. Plus YouGov’s profit warning and cyber security firm Intercede’s contract wins.

WISE FY Mar Results

The FX business reported FY Mar underlying revenue (which includes interest income) up +31% to £1.17bn. Statutory PBT was up 3.3x to £482m. Customer numbers were also up strongly +29% to 12.8m. I have updated my chart showing that despite being by far the largest of the FX currency businesses, growth at WISE has compounded at +46% CAGR, well ahead that of smaller rivals (particularly AGFX which is forecasting a revenue decline this year).

In most businesses, you would expect smaller companies starting from a lower base to grow faster, but it looks like FX is a “winner takes nearly all” business with network effects, with the benefits of scale being shared between shareholders and customers. WISE employs 5,500 staff, meaning it is more than 10x larger than the next biggest (Alpha Group) yet profit per employee is £88K, in line with ALPH and more than 2x larger than the smaller players EQLS and AGFX. However, in the short term management have suggested that they need to invest in marketing to bring in more customers, as well as in technology to give customers a better experience and improved prices.

Outlook statement: Management announced a medium-term PBT margin of 13-16% (significantly below i) the 21% just reported and ii) the previous forecast on Sharepad for FY Mar 2026F). They also expect 15-20% CAGR in underlying revenue growth (which is above the +11% level forecast by Sharepad in FY Mar 2026F). The shares responded by falling -23% on the open, before recovering to around -8% by the close.

This is not the first time WISE shares have sold off aggressively following a company RNS. In April 2023 management announced that they would share more of the benefit of rising interest rates with customers, and pay interest on client balances. Given the FCA’s “Dear CEO” letters to investment platforms and wealth managers in H2 last year, WISE management look, well: wise. They have executed the right strategy all along, even if initially investor reaction was negative.

Valuation: The shares are trading on a PER of 20x FY Mar 2025F and 2026F, only dropping to 19x FY Mar 2027F. WISE is supposed to be an exciting growth story, but the investment costs mean that there’s not much progress in the bottom line. Revenues are forecast to grow at mid-teens growth rates, and the company trades on 4.7x FY Mar 2024 just reported, dropping to 4.0x in two years’ time.

Opinion: I am a customer and a big fan of the business model, however in the past, I have been put off by the valuation and refused to pay more than 5x revenue, as a general rule of thumb. Particularly in the case of WISE, where management openly shares the benefits of scale with their customers. For comparison, Amazon follows a similar strategy, and has seen phenomenal CAGR revenue growth, yet only trades on 3x revenue as customers enjoy the benefits of scale as much as the shareholders. The LSEG, which as a stock exchange is a financial business with network effects trades on 6x revenues, however, the LSEG has a forecast mid 30% PBT margin, around twice the level of WISE’s medium-term target. Now the share price has fallen by a third since mid-March, and WISE is on less than 5x forecast revenue this is now within my target valuation so I may re-cycle some of my gains from HL. into the shares.

YouGov FY July Profit Warning

This long-term multi-bagger fell -40% last week, after saying that sales would be lower than expected: now £324m-£327m, and adj op profit £44-£41m. That equates to c. 5% miss versus Sharepad’s previous sales forecast and -35% below Sharepad’s previous EBIT forecast. There’s no mention of net debt in last week’s RNS, but at the H1 stage, net debt was £163m, or 1.6x EBITDA.

History: founded at the peak of the first internet bubble in May 2000 by the joint Chief Executives, Nadhim Zahawi and Stephan Shakespeare (the latter is now the Non-Exec Chair, but has sold down his stake to less than 2%). YouGov built its initial panel of online respondents through joint projects with Freeserve (remember them? They were once a FTSE 100 company.) 5 years later YouGov listed on AIM through a placing at 135p (implying a market cap for the company of £18m) in 2005. Though the company started off in the business of polling respondents on their political voting intentions, the largest source of revenue is market research for corporate brands. That is asking their panel of 26m registered consumers, what they think of a product and hence monitor marketing campaign performance and benchmark perceptions versus competitors. Despite the disappointing guidance of £324m-£327m for FY July 2024F, revenue has grown more than 100x over the last couple of decades, from less than £3m FY July 2005.

What has gone wrong? The RNS highlights that sales in the Data Products division (29% of revenues, but higher margin so 57% of adj op profits at H1) have remained slow. Data Products include YouGov BrandIndex and YouGov Profiles as well as newer behavioural products, such as YouGov Safe. They also mention challenges in the EMEA, particularly the German-speaking DACH (Germany, Austria and Switzerland) region.

I also can’t resist pointing out that YouGov also uses the words ‘platform’ and ‘virtuous circle’ in their results presentation.

Valuation: At the time of writing YouGov’s consensus forecasts had not been updated, but taking a 40% cut to EPS FY July 2025F would imply a PER of 16x. That could be too harsh if business recovers next year, we just don’t know because management haven’t given guidance for the coming year. On a price/sales basis, the shares are on 1.3x July 2025F, which seems attractive if RoCE and EBIT margins can recover to last year’s levels.

Opinion: It looks like management have invested in growing the business, and the revenue hasn’t come through as expected. I don’t think I would rush to buy this immediately, as there is always the possibility that a second profit warning follows, particularly as net debt was £163m at the H1 stage. But YOU is a quality company so in the next 6 to 12 months there could be a good opportunity to buy into the story at a reasonable price. So this goes on my watchlist.

Intercede FY Mar Results

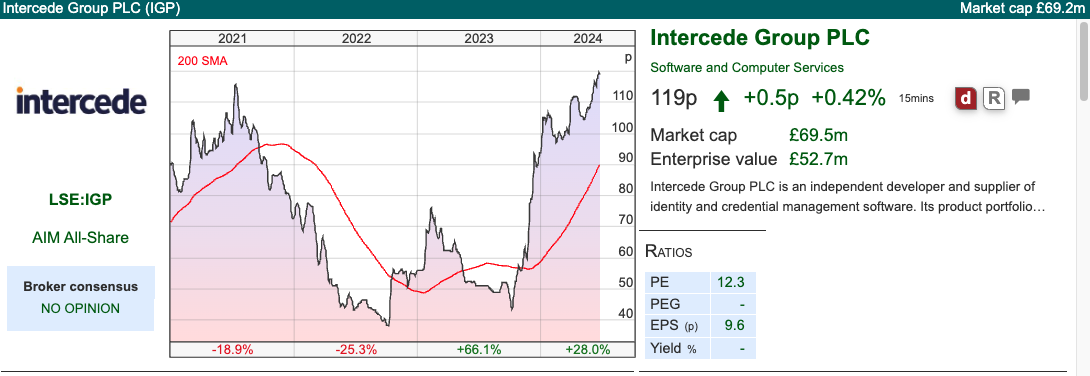

This digital identity and credential management company announced FY revenue +65% to £20m, and statutory PBT up 9x to £5.6m. Net cash also more than doubled to £17m (there’s no debt, so that figure is also the gross cash position). These impressive results follow a couple of contract wins announced around December last year and January this year. With the benefit of hindsight, it might have appeared obvious that contract wins would lead to strong results, however, I did write up this company in April 2022 when management announced contract wins but also a profit warning at the same time.

Outlook: The outlook statement talks about good visibility on the pipeline and a clear roadmap on their acquisition strategy. Cavendish, their broker, have left their forecasts unchanged. That implies a fall in revenue of -20% to £16m FY Mar 2025F, followed by a recovery to £18m the following year. The broker points out that the year just reported saw uncharacteristically large contract wins, but excluding that topline growth would be +18% FY Mar 2025F, falling to +10% the following year.

For readers wishing to understand the company better, there is a 100-page slide deck and recording of Capital Markets Day on InvestorMeetCompany. The company has a target to double revenue over the next 3 to 4 years, from FY Mar 2022 (£10m), which seems feasible.

Comparison with GB Group: For comparison, the much larger GB group (which does identity and location verification) reported flat revenue at £277m and a loss of £50m, including a goodwill impairment charge of £55m. GB doesn’t operate in quite the same area as IGP seem to have a very high specification suite of products that allows customers to choose the level of security that best fits their needs, from Secure Registration and ID Verification to Password Security Management, One-Time Passwords, FIDO (Fast Identity Online) and PKI (Public Key Infrastructure). The latter are both asymmetric key cryptographical methods that eliminate the need for passwords. Customers tend to be governments, federal agencies, defence firms and similar.

GB Group, on the other, helps companies onboard new customers and also helps to reduce fraud. They benefited significantly in FY Mar 2022 from cryptocurrency companies registering customers, but have struggled in the last 18 months.

Valuation: The shares are trading on just 12x historic PER, however, that rises to a PER of 26x FY Mar 2026F, as the year just reported has benefitted from lumpy contract wins. On a price/sales basis, they are on 4.2x FY Mar 2026F. Cash is currently a quarter of the market cap, so adjusting for that would reduce the PER to just below 20x.

Opinion: IGP strikes me as a good story, this ought to be a growth area, but the execution until this year has been poor. Sharepad shows that between FY Mar 2016 and FY Mar 2023, revenue grew by just £1m to £12m. Despite reporting a gross margin in the high 90s, the company has failed to generate much in the way of RoCE or EBIT margin until the year just reported. That could present an opportunity, as if management can grow the business on a fixed cost base, then we could see impressive operational gearing. I commented on DARK a few months ago, that it is difficult to know how good enterprise software (ie large corporations, rather than individual customers) and cybersecurity solutions are unless you’re an expert in the field. I think that this has the potential to be very good, but the track record until recently has been patchy.

Notes

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.