Aerospace and Defence Giant Rolls-Royce Bounces Back with Impressive Interim Performance. This is excellent news for investors and me too, as I did suggest better times ahead for the renowned aerospace and defence company when I featured it for Sharescope back in January 2022. The share price was in a tailspin for a while, dropping as low as 66p and threatening to splash into the proverbial. But as always, I am looking well ahead into the future and rarely concern myself with short-term movements in the share price unless it is a profit warning. At the time of my first Rolls-Royce feature for Sharescope, I was enthusiastic to see where Rolls-Royce’s small module reactors would progress and if our government would react quickly enough.

Before I delve into recent developments, including the most recent financial reporting, it is worth highlighting significant attention from investors following a string of positive recommendations from brokers who suggest that there is still room for growth in the Company’s restructuring efforts under the leadership of CEO Warren East.

UBS is among the most optimistic of these City firms, which recently bolstered interest in Rolls shares by substantially raising its price target. The bank’s “base case” price target surged by an impressive 175% to 350p, generating substantial excitement among investors.

In an even more bullish scenario, UBS envisions Rolls achieving margins comparable to its industry peer Safran by 2026, resulting in a fair value estimate of 600p. While acknowledging the inherent risks and rewards associated with such projections, UBS also provides a downside scenario, suggesting that if recent improvements prove unsustainable, the share price could plummet to 100p.

UBS reiterated its estimates in a subsequent note, stating, “Feedback on our Rolls-Royce price target upgrade to 350p suggests we are on the higher end of investor expectations on free cash flow, surpassing even some of the more optimistic projections. Nevertheless, we maintain confidence in our estimates.”

According to UBS’s analysis, Rolls-Royce is expected to achieve civil aerospace engine margins of 15% by 2028, which still lags behind Safran’s 18-20% and MTU’s OEM business at 20-22%.

Erginbilgic, the CEO of Rolls-Royce’s power systems division, is expected to unveil his plans for addressing the Company’s performance gap compared to its peers on November 28. During the strategy review, he will also outline medium-term goals for the business.

In the short term, Rolls-Royce anticipates an operating profit between £1.2 billion and £1.4 billion in 2023, with free cash flow projected to range from £900 million to £1 billion. However, despite recent upgrades, UBS believes this guidance remains conservative given the robust first-half results and historical seasonal patterns.

UBS estimates that Rolls-Royce could achieve £2 billion of free cash flow as early as 2024, with the potential to further increase to £2.8 billion by 2026. The analysis points to positive recent trends, indicating that Rolls-Royce may already generate an average of $380 per flying hour, compared to $300 in 2019.

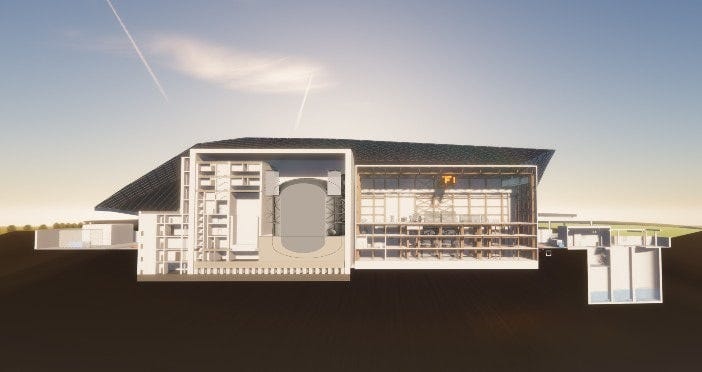

Small Modular Reactors: Providing Accessible and Clean Energy for Everyone

Unprecedented demand has emerged amid the pressing need for clean energy solutions to guide the global journey towards achieving net-zero emissions. This demand centres around a constant and emission-free energy source capable of meeting the diverse needs of various markets.

Nuclear energy is at the forefront of this quest, recognised as the most potent provider of uninterrupted clean power. However, for it to gain widespread acceptance, nuclear energy must become accessible, adaptable to varying scales, and competitively priced. Addressing this need, Rolls-Royce SMR Ltd has ingeniously developed a factory-constructed nuclear power plant poised to deliver clean and affordable energy accessible to all, thus providing the UK with the reliable 24/7 energy independence we lack today.

Shares Jet Off

The Company has delivered a robust interim financial performance that suggests a significant recovery from a turbulent period marked by engine recalls and the adverse impact of the global pandemic. The latest figures indicate that the engineering giant may have successfully navigated through its most challenging times, setting the stage for a promising future.

Rolls-Royce had already hinted at a positive outlook by raising its estimate for full-year underlying profit to a range of £1.2 billion to £1.4 billion, surpassing its previous projection of £800 million to £1 billion. The recently released half-year results confirm the Company’s upward trajectory, with adjusted operating profit reaching an impressive £673 million, compared to £125 million during the same period last year. Moreover, the underlying margin quadrupled to 9.7%, signifying a significant improvement in operational efficiency. The return to positive free cash flow further underscores the strengthening of Rolls-Royce’s financial position.

The turnaround story is perhaps most striking in the civil aerospace business, where the operating margin soared to an impressive 12.4%, starkly contrasting the negative 3.4% reported previously. This remarkable achievement can be attributed to increased sales of large spare engines and the successful implementation of cost efficiencies. The positive momentum also extended to other segments, with the defence and power systems sectors experiencing growth rates of 15% and 24%, respectively, at constant currencies. Additionally, the defence division secured new orders worth £2.7 billion during the period under review.

Under the leadership of new Chief Executive Tufan Erginbilgic, Rolls-Royce has undertaken practical measures that appear to have galvanised the Company’s performance. As air travel passenger numbers approach pre-pandemic levels, large engine flying hours have surged from 65% of 2019 levels in the first quarter to an impressive 83%. The Company maintains its full-year guidance, expecting engine flying hours to land between 80 and 90% of the 2019 levels. Lifting travel restrictions in China has significantly influenced this upward trend.

Rolls-Royce’s sales figures have also outpaced analyst forecasts, with 240 large engine orders recorded in the first half of the year, compared to 96 during the same period in 2022. This includes a substantial deal with Air India for 68 Trent XWB-97 engines, highlighting the Company’s ability to secure significant contracts. The order book currently stands at 1,405 machines, and the Company aims to deliver between 400 and 500 engines through 2023.

Investors and the public are anticipating Rolls-Royce’s strategic plans, which will be released in November after their ongoing strategy review. Additionally, there is much interest in the UK government’s decision to implement small modular nuclear reactors, which could significantly affect the Company’s future plans. We need a dependable alternative to supplement solar and wind energy, which are known to be inconsistent. While traditional fossil fuels are finite, moving forward and progressing towards better energy sources is necessary.

The half-year figures have prompted a reassessment of analyst guidance, but the focus now lies on the unfolding narrative rather than short-term ratings. With the recent strong performance and encouraging signs of recovery, investors may find Rolls-Royce an attractive proposition. While challenges undoubtedly remain, the Company’s resilience and ability to adapt to changing market dynamics provide a compelling case for investors who wish to have a stake in energy security.

Detailed Breakdown

Financial Recovery: Rolls-Royce’s interim figures have exceeded market expectations, instilling renewed confidence in thweek’sany’s prospects. Adjusted operating profit soared to £673 million, starkly contrasting the £125 million reported during the same period last year. The underlying margin quadrupled to an impressive 9.7%, showcasing the effectiveness of the strategic measures implemented by new CEO Tufan Erginbilgic. Additionally, the return to positive free cash flow further solidifies the strengthening financial performance displayed by Rolls-Royce.

Civil Aerospace: A Sector on the Rise: One area that highlights Rolls-Royce’s recovery is its civil aerospace business. The Company’s focus on commercial optimisation is paying off with an operating margin of 12.4%, a notable improvement from the negative 3.4% in the previous year. Increased sales of large spare engines and cost efficiencies have contributed to this positive trend. Notably, the lifting of travel restrictions in China has had a significant impact, further bolstering the recovery of the civil aerospace segment.

Defence and Power Systems: Rolls-Royce’s defence and power systems segments have also experienced robust growth. Underlying revenue in these sectors increased by 15% and 24%, respectively, at constant currencies. Moreover, the defence business witnessed new orders worth £2.7 billion during the period under review. These encouraging figures reflect the Company’s ability to capitalise on emerging aerospace and defence industry opportunities.

Outlook and Future Prospects: Rolls-Royce’s interim figures have prompted a reassessment of analyst guidance, as the Company now anticipates full-year underlying profit to range between £1.2 billion and £1.4 billion. The management’s strategy review, scheduled for November, is eagerly awaited as it promises to shed more light on the Company’s long-term plans. Additionally, the potential roll-out of small modular nuclear reactors in the UK, pending government clarity, presents further opportunities for growth.

Navigating Evolving Dynamics in the Aviation Engine Market

Rolls-Royce is facing a strategic crossroads as it charts its course for the future. With a legacy spanning decades, the Company’s recent trajectory has raised compelling questions about its positioning in the aviation domain, particularly concerning vital commercial airliner segments.

The success revolves around Rolls-Royce’s potential to introduce an engine for potential successors to the Boeing 727 or Airbus A320 models. The Company aims to position itself as a robust competitor against rivals like CFM’s forthcoming Rise Open fan and Pratt & Whitney’s Gear turbofan. The spotlight is now on whether the touted Ultra Fan could emerge as the catalyst for this strategic move.

Critics of Rolls-Royce argue the Company has overlooked a significant niche within the airline market. While Rolls-Royce has carved its name with successful turbofan models, including transformative designs akin to the Orbit 211, a glaring gap remains. The Company’s turbofan engines cater primarily to long-haul wide-body aircraft such as the Boeing 777, Boeing 787, Airbus A330, A340, A350, and even the A380. Nevertheless, single-aisle aircraft like the Boeing 737 and Airbus A320 family outsell wide-bodies by significant margins – something of a strategic gaff.

Rolls-Royce’s engagement with the single-aisle aircraft market has been selective, focusing on specific instances such as the Boeing 717 and its collaboration in the AI EV 2500 engine project for the Airbus A320 family. This partnership showcased its adeptness in strategic alliances, enabling it to contribute to over 7,600 AI EV 2500 engines. While Rolls-Royce previously shared a stake in this venture, it severed ties in 2011, inadvertently impacting its consistent revenue stream from servicing and maintenance.

In the intricate landscape of engine manufacturing, sustainable revenue streams hinge on long-term service, repair, and overhaul activities rather than immediate returns on the substantial investments required for engine development. Rolls-Royce’s innovative “Power by the Hour” service contracts mirror this paradigm, enabling airlines to pay for engine usage through predictable, fixed per-flight-hour payments. This model ensures stability for airlines and yields a steady revenue flow for the manufacturer.

However, the road has been bumpy for Rolls-Royce. The Trent 1000 engine, which powered Boeing 787s, experienced premature corrosion and cracks, leading to grounded aircraft and substantial financial losses. The COVID-19 pandemic further strained the aviation industry, disproportionately impacting long-haul flights central to Rolls-Royce’s portfolio.

The anticipated Ultra Fan engine was poised to realign Rolls-Royce’s fortunes, initially pegged to power Boeing’s mid-sized NMA aircraft. However, the project’s postponement due to the Boeing 737 Max crisis altered the trajectory. With the industry’s recovery on the horizon, Rolls-Royce now has the opportunity to refine its Ultra Fan offering.

Comparing Rolls-Royce’s technological contributions to its competitors reveals a fusion of lightweight materials, advanced ceramic matrix composites for higher operating temperatures, and innovations like the Ultra Fan gearbox and variable pitch fan system. The prototype of the Ultra Fan engine, boasting remarkable pressure and bypass ratios, underscores the Company’s prowess in advancing engine efficiency.

Remarkably, Rolls-Royce’s prototype Ultra Fan engine features an unprecedented size, outpacing even the world’s largest operational jet engine, the General Electric GE 9X. While this demonstrates Rolls-Royce’s audacity and technical capacity, the viability of such expansive engines in the long-haul, wide-body segment remains uncertain. Still, it demonstrates Rolls-Royce has a vision for the future that may require such a beast of an engine.

Rolls-Royce is diligently assessing its position in an ever-evolving aviation landscape. As it leverages innovation and strategic alliances, time will reveal if the Ultra Fan could propel the Company back into the glory days of its iconic Trent engines.

Summary Conclusion: The recent interim figures from Rolls-Royce show that the Company is on the upswing after a challenging period. The new CEO’s strategic measures positively impact the Company’s performance, with solid results in civil aerospace volumes, defence, and power systems. The Company is optimistic about the future and is positioning itself for a promising recovery. While Rolls-Royce is still on its journey towards complete restoration, investors and industry observers eagerly await further updates from this engineering giant. Additionally, the government could benefit from Rolls-Royce’s efforts to boost the country’s energy independence, such as the potential roll-out of nuclear modules.

Elric Langton of Small Company Champion & Lemming Investor Research Newsletter

Twitter: @LEMMINGINVESTOR

Do you have some thoughts on this week’s article from Elric? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.