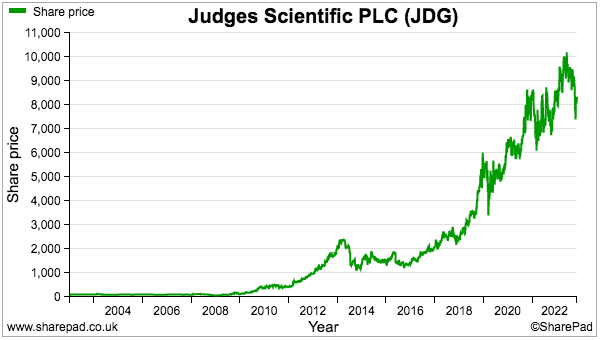

Judges Scientific has delivered mega-bagger returns for its very early shareholders. Maynard Paton studies the growth and success of the ‘buy and build’ operator.

Today’s rough market for small-cap shares could be the exact time to hunt for your next great portfolio winner.

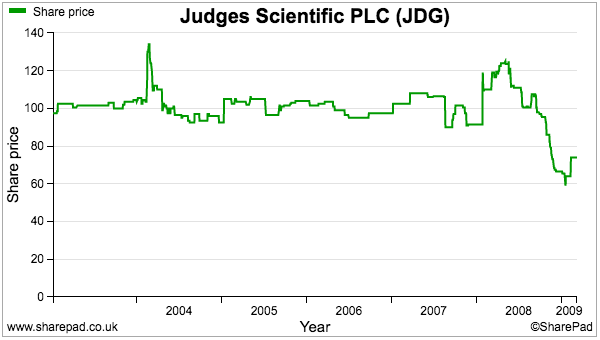

Take Judges Scientific, the £540 million group of scientific instrument manufacturers, which joined AIM at 95p at the bottom of the dotcom crash during early 2003:

These shares topped £100 earlier this year to give initial shareholders a staggering 100-bagger return. What can investors learn from this astonishing performer?

Let’s take a closer look.

Introducing Judges Scientific

Judges Scientific’s route to 100-bagger stardom did not begin with obvious promise.

Founder David Cicurel recounted during 2016 how he struggled to get the group off the ground:

“The original purpose of Judges was to invest in ‘public to private’ targets. I was trying to raise a significant amount of capital for investments, but this proved very difficult. I was raising capital mostly from family, friends and private investors so I chose to invest through a small AIM-listed company instead. This was more cost-effective than having a fund and it is also meant the board of directors would have some freedom and not be tied with fund regulation.”

Making life very difficult for Mr Cicurel was the 2000-2003 bear market. The City back then did not have the appetite to bankroll an activist investor with a flotation prospectus listing only winning investments from the previous seven years:

“David Cicurel spearheaded an early public-to-private transaction in the UK (Continental Foods in 1996) and was involved in a similar transaction in the US. He was an active investor in Shiloh plc, an old-fashioned textile company with an attractive health products division, for approximately three years during which period the share price appreciated 137 per cent. (an internal rate of return of approximately 32 per cent. per annum), and in Izodia plc, a cash-rich, loss-making technology company, for approximately four months, during which period the share price increased 100 per cent.”

Judges eventually floated during January 2003 at 95p after £2 million was raised, of which £0.5 million came from Mr Cicurel.

The flotation’s timing was not great; two months later, markets rebounded strongly…

…and Judges increasingly struggled with its plan to “accumulate strategic stakes in a limited number of small companies and actively pursue appropriate and profitable exit routes.”

The activist strategy was abandoned during 2005, with Judges instead adopting a ‘buy and build’ model.

The new plan focused upon acquiring private businesses that designed and manufactured scientific instruments. Attributes sought included strong overseas sales, solid margins, sustainable cash flow and a lowly 6x (or less) profit valuation.

The first purchase was Fire Testing Technology — a “world leader in the manufacture of instruments designed to measure the reaction of a variety of materials to fire” — for up to £5 million.

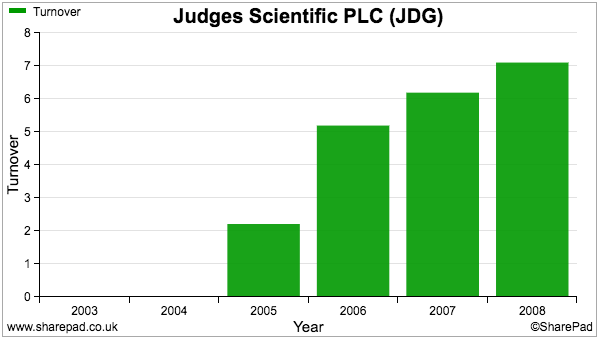

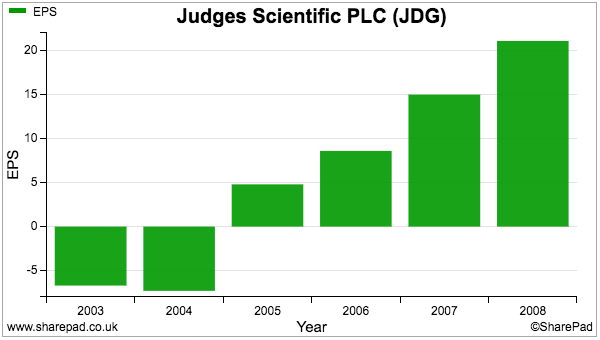

Judges would soon purchase three other businesses and by 2008 revenue had reached £7 million…

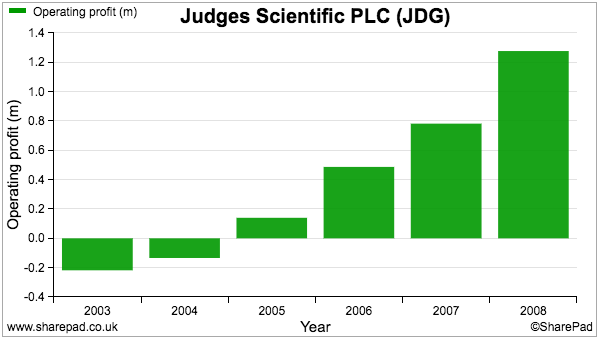

…profit had climbed beyond £1 million…

…adjusted earnings had surpassed 20p per share…

…yet the share price going into 2009 had slipped to 60p, giving a P/E of 3 and market cap of less than £3 million:

The shares were undoubtedly cheap based upon Judges’ progress up to that time… let alone based upon the expansion that would lay ahead.

Acquisitions

Judges has made 22 acquisitions following its flotation, with notable deals including:

- Global Digital Systems (2012: £8 million);

- Scientifica (2013: £13 million);

- Armfield (2014: £10 million);

- Heath Scientific (2020: £7 million), and;

- Geotek (2022: £80 million).

Products supplied by the group today comprise electromechanical shear systems, electrophysiology rigs, homogenisation subsystems, accelerating rate calorimeters and multi-sensor core loggers.

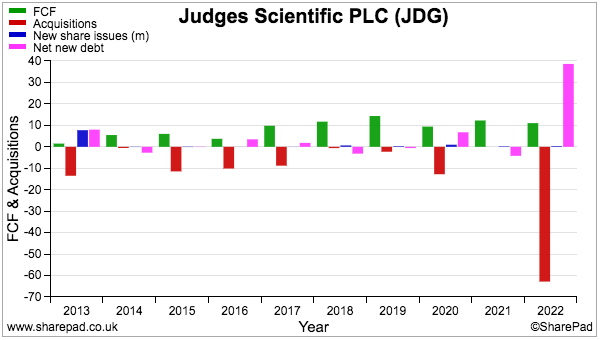

I calculate the total cost of all 22 acquisitions to be up to £150 million, with Geotek purchased last year for an enormous £80 million.

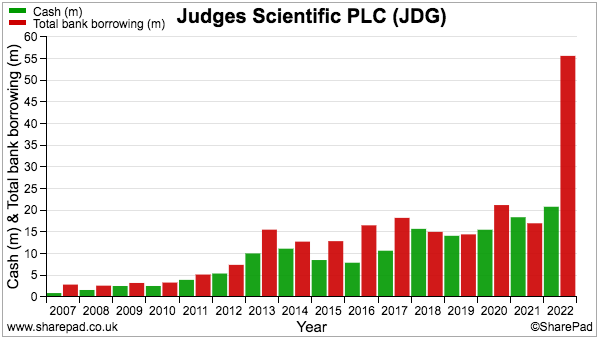

A mixture of shares, free cash flow and borrowings have funded the acquisition spree:

Judges has typically operated with relatively small levels of net debt, although the Geotek deal significantly increased bank borrowings:

Still, the purchases all combined to power the business to 100-bagger prosperity.

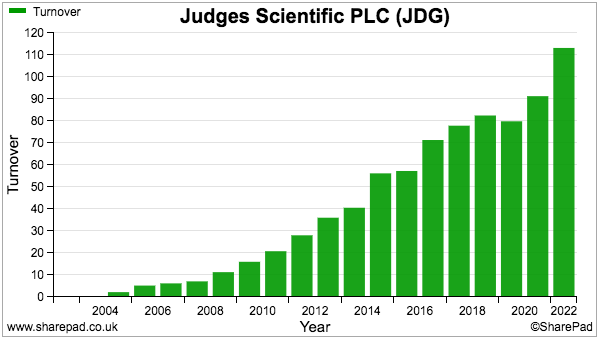

Annual revenue has grown to £113 million…

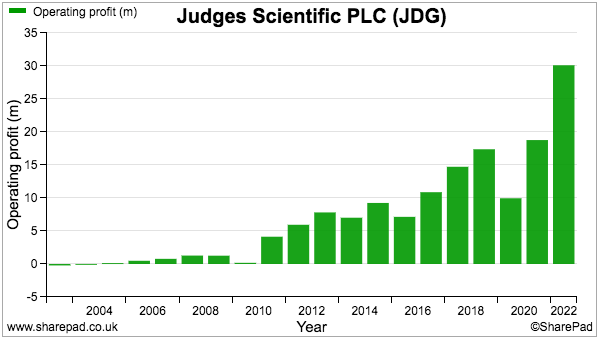

…adjusted profit has advanced to £30 million…

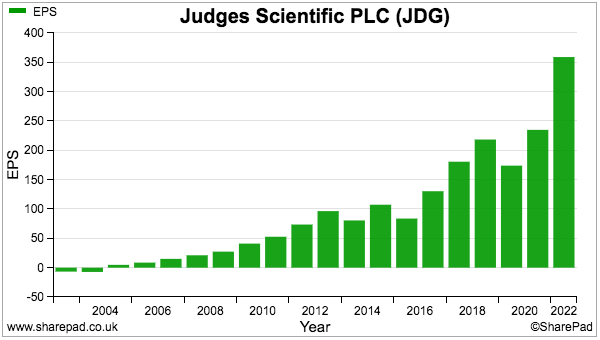

…earnings per share have topped 350p…

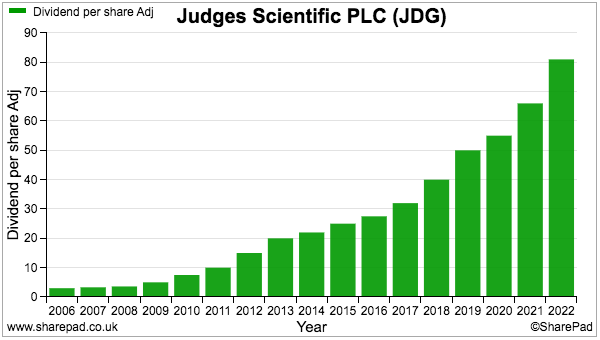

…while the ordinary dividend has reached 81p per share:

The shares that could have been bought for 60p during 2009 now trade at £82 — a 136-bagger for the savvy stock-pickers who foresaw Judges’ immense potential all those years ago.

Buyers at 60p have also ten-bagged on the income front. Total dividends since the low amount to 683p per share, including a jumbo 200p per special payout distributed during 2019.

Return on total invested capital

The mega-bagger share price suggests Judges’ acquisitions have worked extremely well.

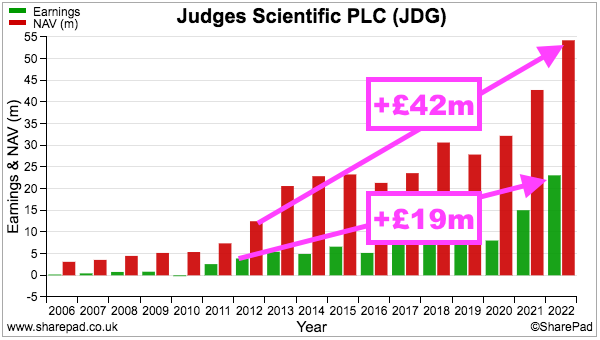

SharePad shows adjusted earnings advancing by £19 million to £23 million and net asset value (i.e. shareholder equity) advancing by £42 million to £54 million between 2012 and 2022:

Generating extra adjusted earnings of £19 million after increasing shareholder equity by £42 million suggests a terrific 46% rate of return during those ten years.

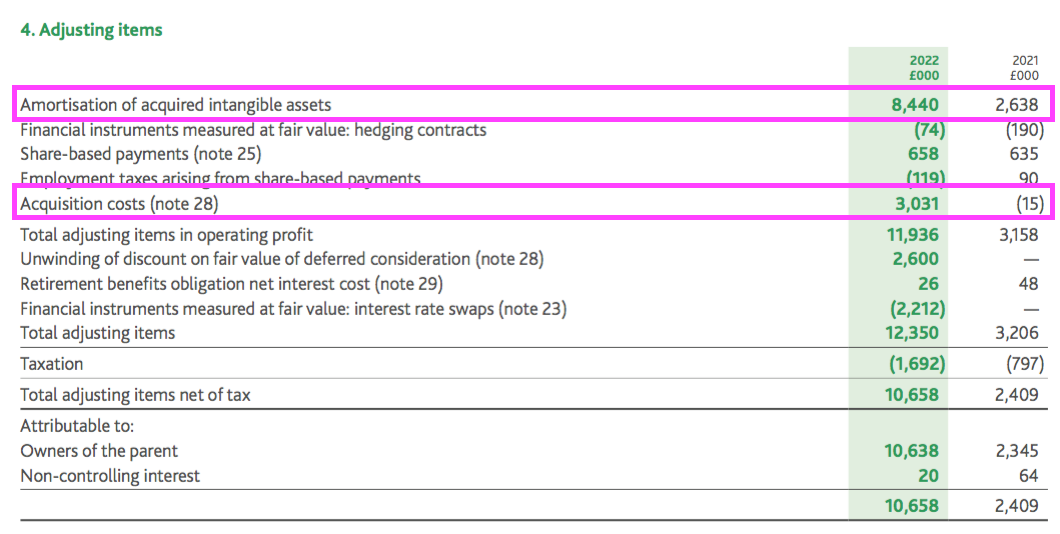

However, acquisition accounting does inflate this calculation and similar return on equity (ROE) ratios.

Companies are obliged to expense the cost of acquired intangibles (such as intellectual property, brand names and customer relationships) through an annual amortisation charge against profit.

Last year Judges charged £8 million for such amortisation, which when combined with other adjustments translated statutory operating profit of £18 million into an adjusted operating profit of £30 million:

But Judges (and all other companies) do not adjust the balance sheet for acquisition-related amortisation, therefore creating a mismatch between the (adjusted) numerator and (non-adjusted) denominator within ROE-type sums.

Judges has amortised acquired intangibles to the tune of £50 million since its flotation, which when added back to the 2022 balance sheet gives shareholder equity of £104m. Add back the £34 million owed to Geotek’s vendors, too, and total invested equity is approximately £138 million.

Adjusted profit last year was £30 million, which gives a return on total invested equity of 21% — a very good performance on my estimated £138 million.

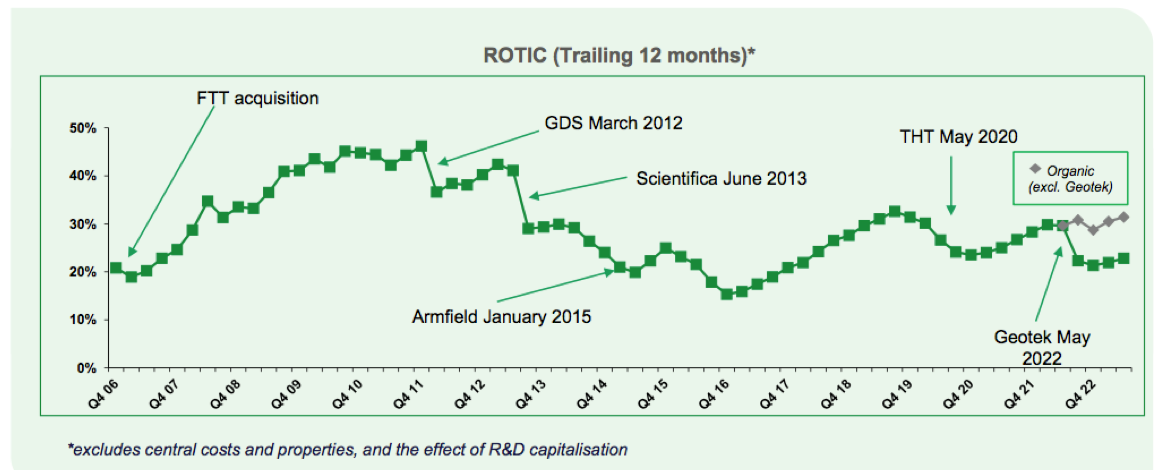

My basic sums correlate with Judges’ own return on total invested capital (ROTIC) measure, which the company reckons was 21.3% last year:

“Partly because the multiple paid of seven times results in an opening ROTIC for Geotek of approximately 14.5%, substantially below the Group’s prevailing ROTIC, and exacerbated by the fact that the acquisition cost of Geotek was close to the total value of the acquisition costs of all our previous businesses. Therefore the overall impact on total ROTIC was significant and resulted in a total ROTIC of 21.3%, down by 7.4% at 31 December 2022.”

(Just so you know, ace SharePad writer Richard Beddard has written extensively about ROTIC and the companies that employ the measure (including Judges)).

Judges’ ROTIC really should be very healthy; after all, the group’s strategy is buying private businesses at up to 6x operating profit — which gives a minimum pre-tax ROTIC of 16.7%.

Judges said ROTIC last year would have been 28% were it not for the Geotek acquisition. ROTIC has fluctuated between 15% and 46% as subsidiaries joined the group and some performed better than others:

Note that Judges adjusts profit for acquisition expenses, which is a debatable policy given such expenses occur almost every year and have totalled £7 million since 2010. Judges’ ROTIC also ignores head-office costs, which now amount to nearly £4 million a year.

Acquisition performances

Despite the amazing share price, not every Judges acquisition has gone to plan.

The small print within the independent auditor’s report for 2022 reveals this interesting text:

“Components that were subject to full and specific scope audit procedures, accounted for 80% of the Group’s revenue, 108% of the Group’s profit before taxation and 75% of the Group’s total assets. All work was completed by the Group audit team and local BDO LLP component teams.”

The auditor’s wording suggests subsidiaries producing 20% of revenue combined to deliver a loss last year.

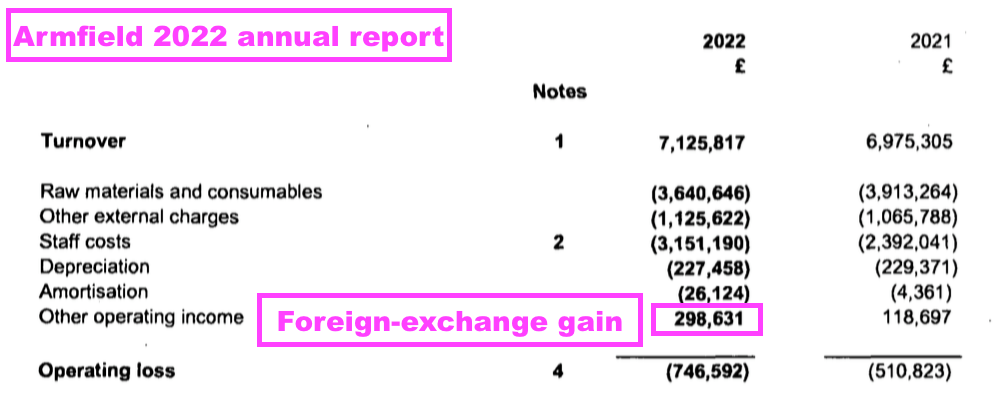

A cursory search through Companies House finds the Armfield subsidiary declaring revenue of £7 million and a £1 million operating loss excluding foreign-exchange gains for 2022:

At the time of its 2015 purchase, Armfield enjoyed revenue of £12 million and an underlying profit of £1.7 million:

“Armfield’s audited accounts for the financial year to 31 December 2013 show revenues of £12.2 million and pre-tax profits of £1.3 million. Operating profit for the same period, adjusted to eliminate non-recurring items and to reflect Armfield’s ongoing cost base within the Judges group, would have totalled £1.66 million.”

I get the impression Armfield has never really performed as expected. During 2016 for example, Judges warned of group profit running substantially below expectations due to lower activity at Armfield:

“Following a very strong year in 2015, Armfield experienced low order intake until the end of May and, although it also recovered in June, it is well below the first half of 2015. Management believes that this reduction in orders has been influenced by the weak price of oil and other commodities and their impact on public funding in many developing economies.”

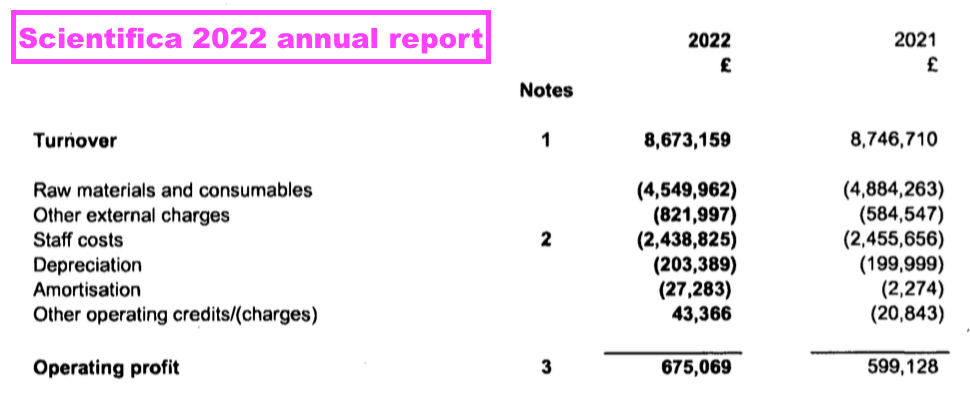

Scientifica is another example where progress may be questionable. The subsidiary was acquired with revenue of £9 million and underlying profit of £2 million:

“Scientifica’s unaudited accounts for the financial year to 31 March 2013 show revenues of £9.2 million and pre-tax profits of £2.2 million. Operating profit adjusted to eliminate non-recurring items and to reflect Judges’ practices would have totalled £2.1 million.”

Companies House shows Scientifica reporting revenue of less than £9 million and a profit of only £0.7 million for 2022:

Nonetheless, given the share-price performance, I think it fair to assume Judges’ acquisitions on a collective basis have performed very positively.

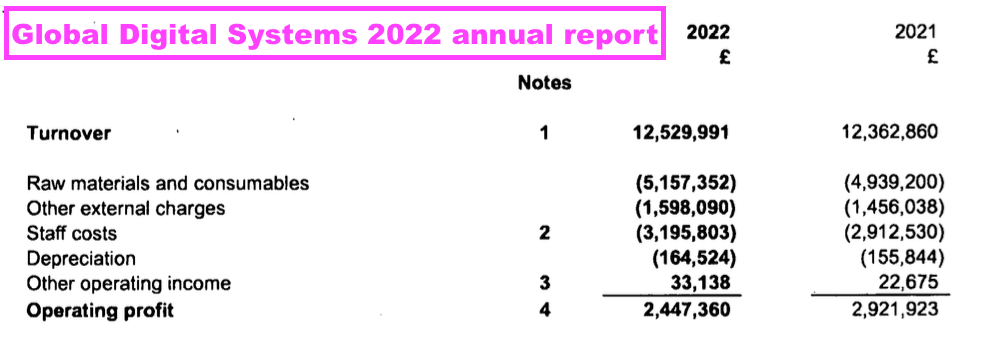

Global Digital Systems for instance was acquired with revenue of nearly £5 million and underlying profit of £1.3 million:

“GDS’s unaudited accounts for the year ended 31 October 2011 show revenues of £4.9 million and pre-tax profits of £879,000. Operating profit adjusted to eliminate non-recurring items and to reflect Judges’ practices would have amounted to £1.27 million.”

By 2022, Global’s revenue was £12 million and profit topped £2 million:

Global was acquired for £7.7 million, suggesting a current ROTIC of approximately 30% from that particular purchase. I do wonder where Judges’ share price would be if every acquisition boasted a 30% ROTIC!

What could now go wrong at this 100-bagger?

One danger is the need for larger deals to sustain the growth rate.

The £80 million Geotek purchase of last year certainly dwarfs all the other acquisitions, and a mishap at this new subsidiary could have a material impact on the group’s performance.

So far at least, Geotek’s progress looks very encouraging. The full earn-out was paid after the subsidiary reached its £11.4 million profit target, which ensured Judges’ purchase price equated to a very reasonable 7x profit multiple (or a 14% ROTIC).

Mind you, that 7x multiple exceeded the 6x limit Judges had previously abided by. As the purchases become larger, so the multiple being paid may climb higher and in turn push the group’s ROTIC lower.

Too much debt and/or rising interest rates could also cause trouble, but for now, borrowings appear under control.

At the latest half-year, bank loans stood at £63 million, with an adjusted £14 million six-month operating profit amply covering interest payments of only £1.5 million. Judges has confirmed its debt costs are effectively fixed at approximately 5% until 2026.

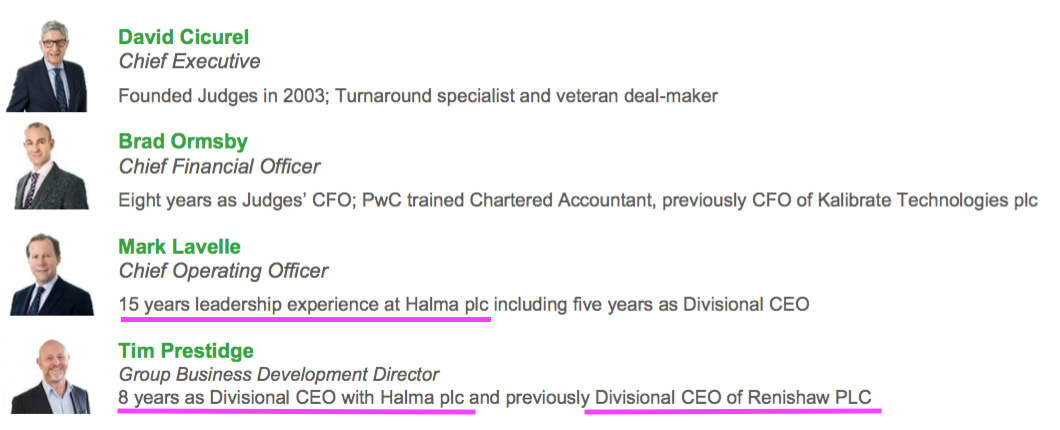

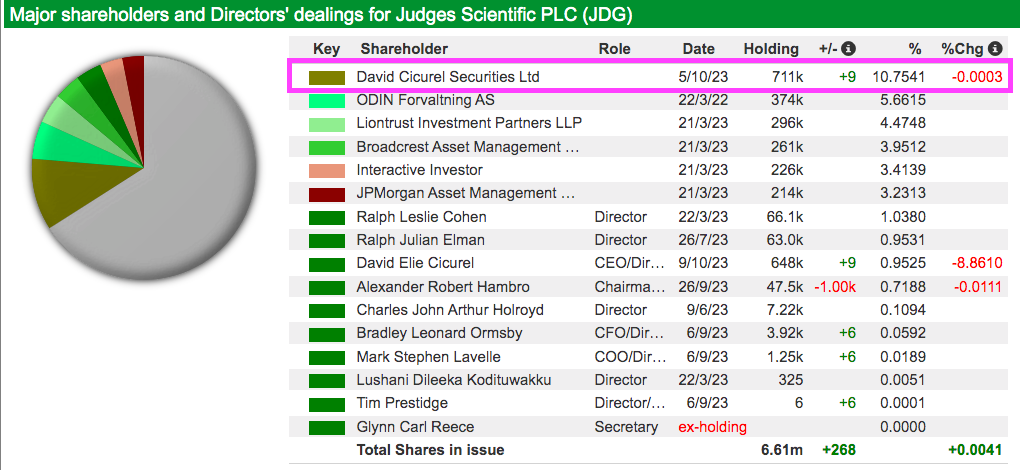

Possibly the greatest worry for veteran shareholders is a leadership change. The aforementioned David Cicurel is 74 years old and will not oversee acquisitions as chief executive forever:

Succession planning looks in place, though. Two executives from first-class engineers Halma and Renishaw indicate Judges will remain in good hands when the founder calls it a day. The pair already enjoy higher salaries than Mr Cicurel.

Mr Cicurel continues to boast an 11% shareholding (£58 million), which I calculate has been reduced by just 22% since the flotation and suggests Mr Cicurel could remain a board fixture for some time to come. Notable share sales by Mr Cicurel have occurred during only 2017 (at £19) and 2021 (at £63):

The board contravenes various corporate governance best practices, but I dare say Judges’ share-price performance has now extinguished all doubts about the non-exec’s extended tenures and previous Judges’ employment.

I must highlight the non-execs can collect a 1% ‘finders fee’ for identifying acquisitions that eventually complete.

One non-exec was paid £800,000 for his work in the Geotek deal, and you can decide for yourself whether such payments ensure — as the 2022 annual report claims — the non-execs “act independently of the Executive management and police adherence to the Group’s enduring buy and build strategy… act as guardians to the Group’s culture…[and] appropriately challenge the Executive Directors.”

Valuation and summary

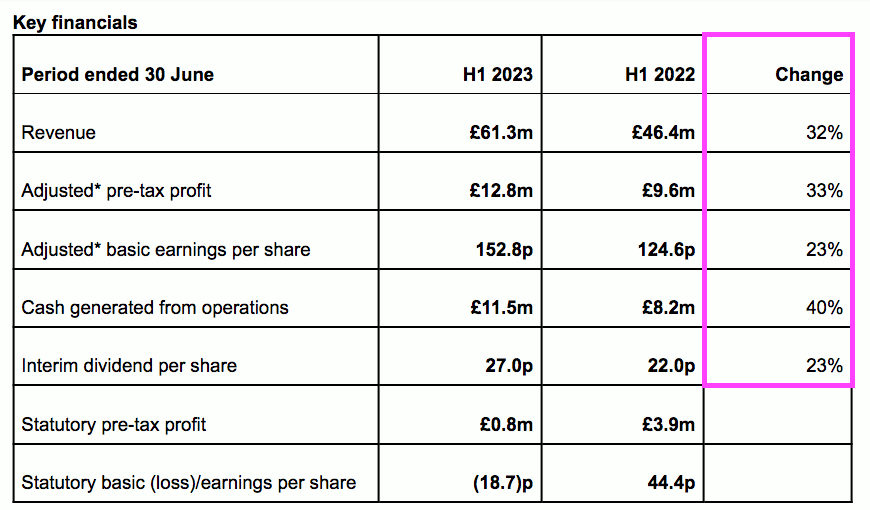

Judges’ latest interim figures did not imply the group’s growth story had now concluded. Bolstered by the Geotek purchase, revenue, profit, cash flow and the dividend all advanced significantly:

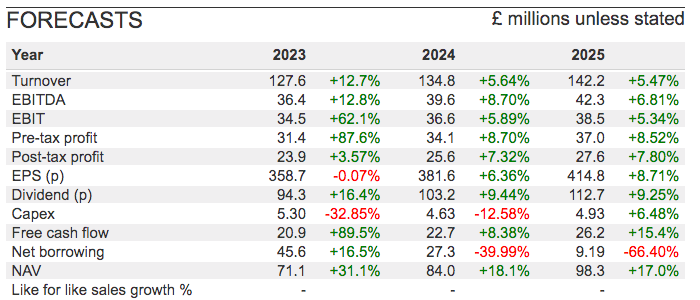

Mr Cicurel expressed confidence the group would meet full-year market expectations, which SharePad shows below:

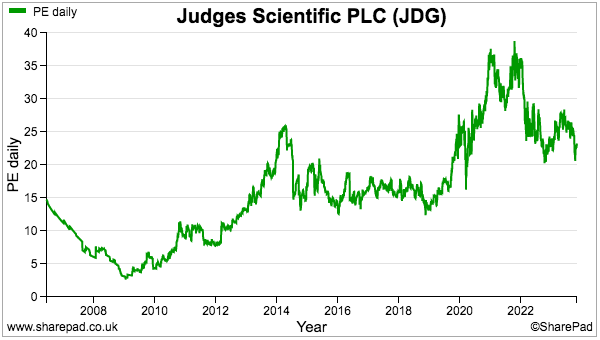

The £82 shares trade at approximately 22x near-term earnings…

…which is below the 38x achieved during 2021, but well above the 3x rating that should have tempted bargain hunters during 2009.

But should you be tempted by Judges today?

If the group can continually reinvest its surplus cash flow through buying attractive companies at up to 7x multiples — and therefore enjoy consistent 14% or more ROTICs — then the share-price journey should not terminate at £82.

But perhaps the more pressing question is ‘Where is the next Judges?’

The group’s history suggests tomorrow’s mega-baggers could be:

- Very small;

- Owner-led;

- Able to consistently generate high returns on shareholders’ funds;

- Sensibly financed, and;

- Valued at a bonkers-cheap rating.

At least the market’s current despondency towards small-cap shares may provide greater opportunities for unearthing future Judges-like gains:

“Small mature quoted companies are largely ignored by the investment community and the Directors believe that many are trading at low multiples and/or at a substantial discount to the realisable value of their constituent parts. Liquidity in their shares is often minimal.”

That text could have easily been written today but was in fact extracted from Judges’ 2003 flotation document.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Investor’s Roundtable Podcast with Roland Head, Mark Simpson and Graham Neary. Maynard does not own shares in Judges Scientific.

Got some thoughts on this week’s article from Maynard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.