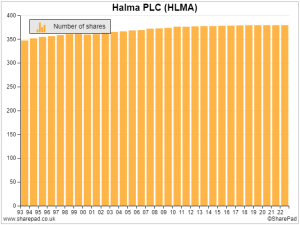

The latest haul of 5 strikes shares includes Halma and RS, proof perhaps that big companies can gallop, or at least trot. Richard also doffs his cap to Bloomsbury Publishing and works out how profitable Next 15 really is. We’re in a low period for annual report publishing as the large number of companies that […]