Bruce shares some thoughts on averaging down when a share price falls versus supporting a company that needs to raise capital. Companies covered AGFX, JTC, SIS, and SDRY.

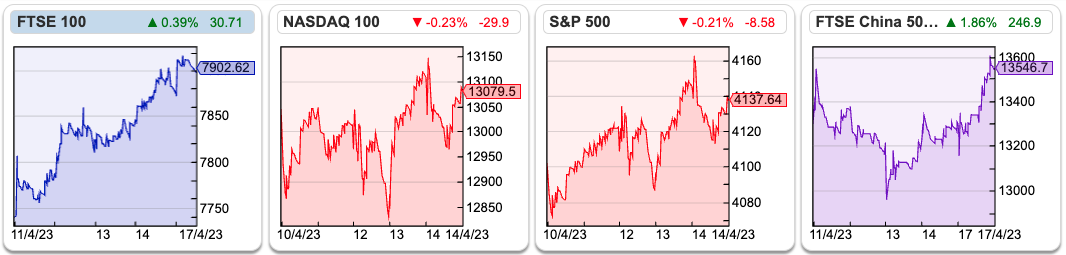

The FTSE 100 was up +2.0% in the last five days to 7,902. The Nasdaq100 was up +0.1% and S&P500 +0.8% over the same time period. The US 10Y government bond yield is 3.54%, while Brent crude is where it started the year at $86 per barrel.

Below are some thoughts on rights issues and averaging down. I tend to average down when I think that a business is fundamentally sound, and there’s an indiscriminate panic which is causing the sell-off. That is, the panic might be justified for some companies in the sector, but when a sell-off becomes indiscriminate that can also create opportunities.

So, I averaged down with Legal and General in February/March 2009, because I thought that life insurance companies with long-term liabilities were not the same risk as banks, which experience bank runs. At the time there were worries that LGEN owned banks’ tier 1 debt (the same debt that was wiped out for Credit Suisse) but that didn’t happen, so by luck or judgement averaging down worked for me as the LGEN share price halved to below 30p. Similarly, I averaged down with Sylvania Platinum when the share price halved to 6p in 2016 because of weakness in the platinum price and problems at Lonmin. It stands to reason investors really don’t want to average down into a company that de-lists or goes insolvent.

This year I have averaged down into computer games company Frontier Developments and mortgage conveyancer Smoove (previously ULS Technologies). Both have net cash but are likely to be loss-making this year and possibly next year. But I think they will survive and go on to flourish. Examples of other shares that I haven’t averaged down into include ARC, TRAK, VNET, QRT and DDDD – the latter has been de-listed and has gone into administration.

Secondly, I tend to back rescue rights issues if they are to reduce debt and put the business on a sustainable footing. I try to avoid companies that do rights issues to fund growth, so the likes of Bango (Direct Carrier Billing), Science in Sport (Sports nutrition, covered below) or Ceres (hydrogen) which have been loss-making for many years, and funded those losses by returning to shareholders with a good story about why they need more money. Shareholders have backed them, but the share count has trebled for BGO, increased 7x for SIS and CWR has seen a remarkable 35x increase in shares over the last 2 decades.

Some people like strict ‘rules based’ trading systems for averaging down or rights issues. I know what I want to avoid but don’t tend to have cast-iron rules. Every situation is different and should be judged on its own merits as information becomes available, in my view. I take inspiration from Hollywood scriptwriter, Robert Mckee, who in the context of creative writing says:

A rule says, “You must do it this way.” A principle says, “This works…and has through all remembered time.” The difference is crucial. Your work needn’t be modelled after the “well-made” play; rather, it must be well made within the principles that shape our art. Anxious, inexperienced writers obey rules. Rebellious, unschooled writers break rules. Artists master the form.

Substitute ‘writers’ for ‘investors’ in the quote, and see if you think the insight still applies.

David has launched the physical Mello Event Tues 23rd May – Thursday 25th May, at the Clayton Hotel, 626 Chiswick High Road. I intend to attend this time, so look forward to meeting readers face to face, if you are planning to attend too.

This week I look at currency broker Argentex and fund manager support services JTC. I finish with sports nutrition company Science in Sport and Superdry’s profit warning and suggested capital raising. The latter two companies are higher risk, but the valuations now are trading at distressed levels. I suggest not averaging down in either of SIS or SDRY, but if a rights issue can put the business on a sustainable footing then it makes sense to support it in my view.

Argentex 9M Dec Results

This forex currency trader that changed its year-end from March to December has now released FY results. They lead with 9M v 9M comparisons because that shows +63% revenue growth. On a more useful 12M v 12M basis revenue growth was still an impressive +54% to £50m, as they benefited from currency market volatility in the second half of last year. For comparison, ALPH reported +27% revenue growth and EQLS reported +57% over the same period. So AGFX results are strong, but a rising tide has lifted all boats in this sector.

Net cash rose +30% to £26m, while adjusted operating profit margin was 24%, down from 32% last year. Annoyingly the company hasn’t provided a full p&l for 12M v 12M comparisons, but looking at the 9M Dec 22 v 12M Mar 22 it looks like costs have risen sharply. Like the computer game companies, software and tech spend is capitalised on to the balance sheet, then recognised over the next few years. In the RNS, management claims that profitability is slightly ahead of expectations. It’s worth remembering though that in 2021 they slashed expectations by over 40% for FY Mar 2022 and subsequent years.

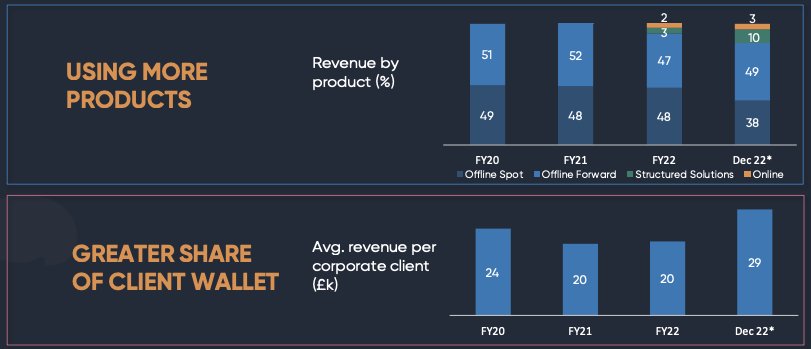

The number of corporate clients trading has increased to 1,749 and average revenue per client is now £29K up +45% from FY Mar 2022. The revenue mix has shifted from a historic 50:50, spot:forward split, to 45:55 and higher margin ‘Structured Solutions’. Management doesn’t spell out the implications of that, but very rarely in financial services have I seen higher margin activity without a trade-off. Structured solutions have now grown to 10% of revenue. Worth noting that current derivative liabilities doubled on the face of the balance sheet to £42m – that is lower than the £58m of current derivative assets. So derivative assets net-off, but I doubt the company can grow gross derivative exposure faster than revenue indefinitely.

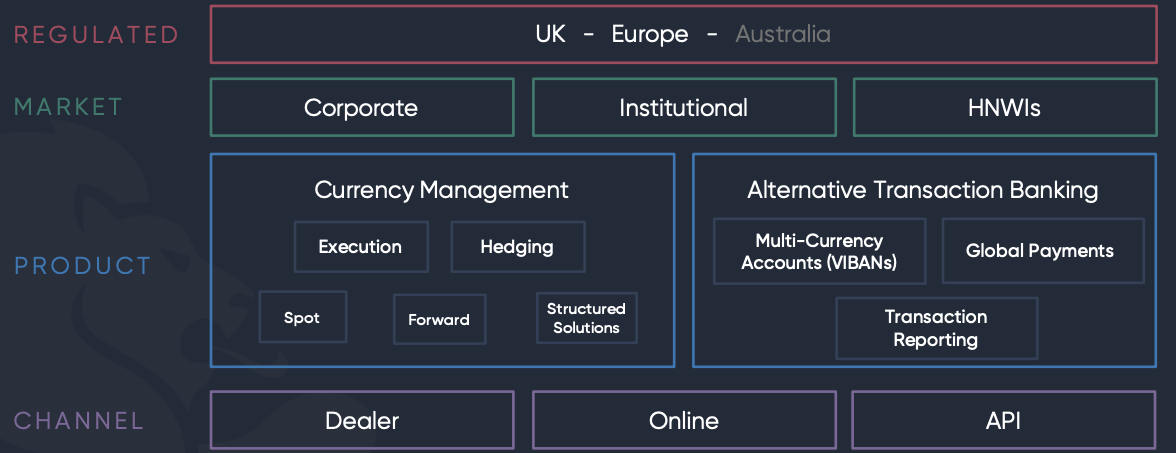

Growth: They talk about new hires in UK, Netherlands and Australia. They have a payments licence in the Netherlands and are a few months away from regulatory approval to operate in Australia. They have now launched alternative transaction banking, giving institutions multi-currency accounts. I think that this is similar to ALPH’s Alternative Solutions which grew revenue by +41% to £28m. It’s good that they are following, but the capability doesn’t sound as differentiated as management claim.

Outlook: Q1 (to March) 2023 revenue was up +34% to £12.7m. Singers, their broker, don’t seem to have revised up forecasts, perhaps expecting H2 to be a difficult comparative. Sharepad has broker forecasts of +19% revenue grow to FY 2024F so we may see upward EPS revisions.

Valuation: Singers note shows EPS of 12.0p in Dec 2024F, implying the shares are on slightly below 10x PER Dec 2024F. That does seem good value if the track record of profitable growth can be sustained. I own the shares, for this reason.

Opinion: Like the wealth management sector that I covered last week, this is a sector with 20-30% operating margins, but where management are investing in technology. My concern is that the spend is equivalent to a retailer investing in air conditioning, or a café investing in WiFi. That is, investment spend is necessary to keep up with the competition, but the benefits accrue to customers, not the shareholders. I’m not suggesting that companies should not invest, but I do wonder if we’re seeing an ‘arms race’ of technology spend, with uncertain payback.

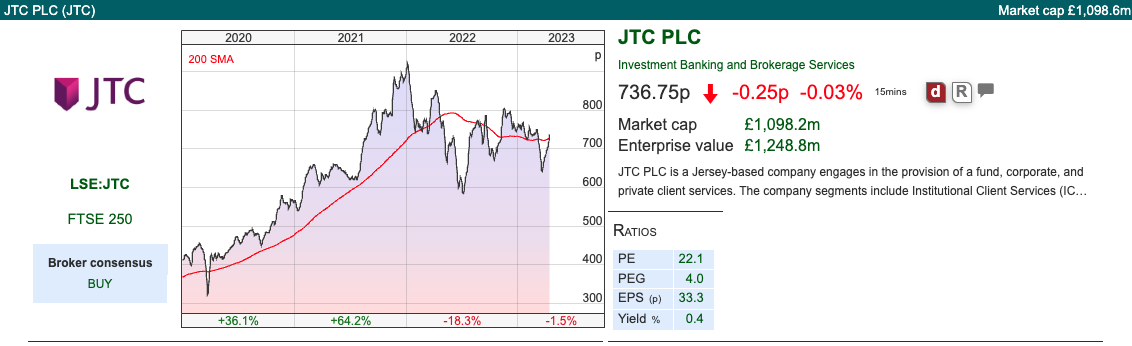

JTC FY Dec Results

The company does the back-office administration for fund managers reported FY results to Dec. At the time of the IPO in 2018 just 15% of revenue was a percentage of assets administered, instead most fees are fixed. That means JTC revenue ought to be less sensitive to the rising and falling markets than the fund managers they serve. Just over half of revenue comes from the UK & Channel Islands, with the USA the next largest contributor at 19%, but growing organically at +23% per annum (double the group organic growth rate just reported).

Management has medium-term guidance of:

- 8% – 10% net organic revenue growth per year;

- underlying EBITDA margin of 33% – 38%;

- net debt of 1.5x to 2.0x underlying EBITDA

- cash conversion in the range 85% – 90%.

Results: Revenue was up +36% to £200m, while organic growth was +12% (ahead of the medium-term guidance of 8-10%). The underlying EBITDA margin was 33% (bottom end of medium-term target range), while PBT was up +29% to £35m. Net debt was £120m at the end of Dec, or 1.8x underlying EBITDA.

History: JTC was founded in Jersey in 1987, by partners of Crills, a local law firm. The current Chief Exec joined the firm in 1991 as the fifth employee and has led the business since 1998. In 2008 there was a management buy-out and the Private Equity firm CBPE Capital invested in 2012.

In 2018 JTC listed on the LSE main market at 290p, valuing the company at a market cap of £310m on Admission. Most of the money raised (£218m) went to selling shareholders, with just £15m going to the company to fund growth. The main selling shareholder was Private Equity firm CBPE Capital, which invested in 2012 and sold down its 43% stake to zero following the IPO. Nigel Le Quesne, the current Chief Exec still has a 7% stake. In October 2021 they raised £79m at 718p in a placing to help fund the acquisition of SALI Fund Management, headquartered in Texas, for total consideration of $236m. SALI specialised in Insurance Dedicated Funds (IDF) a tax-efficient US structure favoured by hedge funds. Having grown by acquisition, there are £492m of intangibles on the balance sheet, versus shareholders’ equity of £400m, so there’s no tangible equity. I haven’t come across their name before, but JTC does seem to have an impressive client list, as this slide from their results presentation shows.

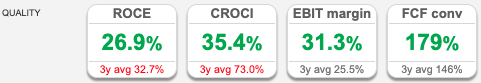

Valuation: The shares are trading on a PER 19x Dec 2024F dropping to 17x Dec 2025F, which equates to above 5x historic sales. That looks quite expensive given that the 3-year average ROCE is 7.1%. Perhaps that reflects the high-quality client relationships and high switching costs?

Opinion: Looks interesting, perhaps on the expensive end of Growth at a Reasonable Price (GaaRP)? It does make sense that fund managers would look to outsource some administrative tasks to a company like JTC. In some ways the business model is similar to Keywords Studios, consolidating support services in an industry sector where revenue can be volatile in any particular year, but the margins ought to be attractive through the cycle. KWS reports a higher RoCE (13.7%) but a lower EBIT margin (11.6%) and trades on a higher PER multiple of 22x PER Dec 2024F but lower historic price/sales of 3.5x.

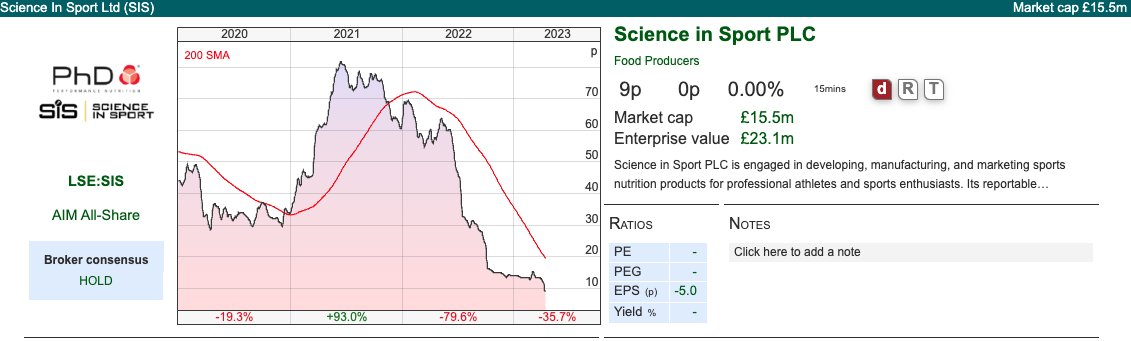

Science in Sport FY Dec Trading Update

This loss-making sports nutrition company is more speculative than I would normally cover, but the share price has sold off -90% since the middle of 2021. They put out a trading statement last week, and finished their strategic review.

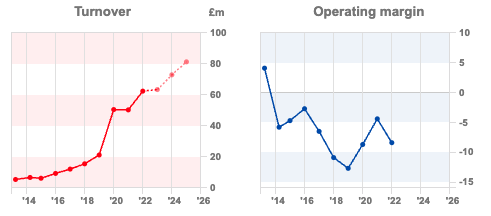

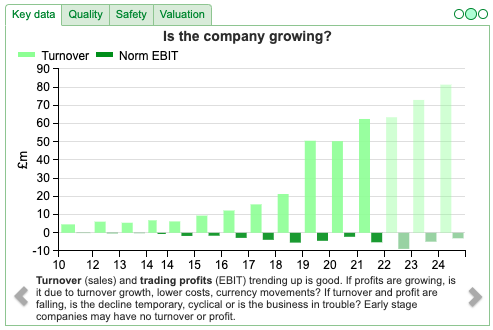

The company has two brands and sells directly through their websites phd.com (mass market brand) and scienceinsport.com (premium brand) as well as Amazon and Tmall. They have UK and international distribution through supermarkets, high street chains and specialist sports retailers. Science in Sport is looking to expand in China and is the official nutrition sponsor of the Shanghai Marathon.

For H1 Jun 2022 they reported a loss of £7m. In September last year management announced a placing at 15p per share raising £5m and a ‘strategic review’. As I mentioned in the introduction, this is a company that has funded losses by increasing the share count almost 7x from below 20m in 2014 to 172m currently. Following a strategic review management have now decided that: “shareholders’ interests are best served by seeking to maximise value through focusing on accelerating the profitable growth of the business under an ambitious growth and efficiency plan that is currently delivering in line with management’s expectations.” Reading between the lines, I think they were looking to sell assets, but no buyer was prepared to offer a silly price. Profitable growth seems a sensible strategy, but the track record suggests that it is more easily written in an RNS than actually delivered in the numbers.

Current trading: The company has a December year-end, and had previously put out a trading statement in February, saying revenue was up +1.5% to £63.5m FY Dec 2022. They said people costs were below budget last year, and expect to reduce overheads in 2023F. They have invested heavily in a 160,000 sq ft Blackburn site which they say should reduce manufacturing and logistics costs, with a payback over 3 years.

Last week they described a +2.3% growth in Q1 23 v the same quarter last year as “good”. They expect to announce a third trading update when FY 2022 results are finally released. There was no mention of profits in last week’s RNS, and Sharepad shows a loss of £9m is forecast for 2022, dropping to £5m loss in 2023F and £3m loss in 2024F. I would imagine that they could need to raise more money at some point.

Valuation: The shares are trading on 0.2x FY Dec 2023F revenues. They haven’t made any profits in the last decade and there are no profits forecast for the next couple of years.

Opinion: It strikes me that this is a business that ought to be successful: I’ve noticed several of my female friends have started ordering protein powder, signing up for triathlons or taking up deadlifting. That’s possibly the result of the pandemic, or perhaps seeing targeted ads on Instagram; but either way, it tweaked my interest in SIS.

However, I would like to understand better why SIS haven’t generated profits so far. If they can scale, profits ought to start dropping through to the bottom line. That operational gearing could explain why there are many high-quality institutions on the shareholder list, including Lombard Odier 21%, Aviva 11%, Schroders 6.3% and Baillie Gifford 4.2%, despite the market cap below £20m. On my watch list, but I will avoid for now.

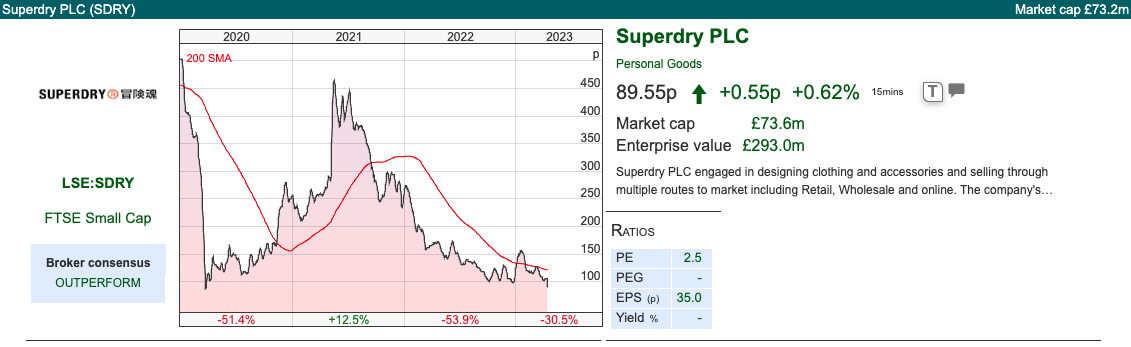

SDRY Profit Warning FY Apr

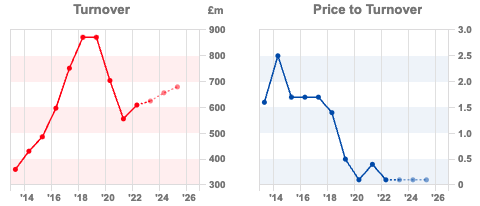

This clothes retailer with an April year end withdrew guidance for ‘broadly breakeven’ this year, implying a significant loss. Management had already reduced expectations in January to ‘broadly breakeven’ from previous guidance of £10m-£20m FY Apr 2023. Revenue is expected to be in the range of £615m-£635m, which is a very broad range considering there are just two weeks left in their financial year. Sharepad shows forecasts for FY Apr 2023 of £629m.

The main source of disappointment is the Wholesale division (37% of sales at H1), the company had previously announced was down a startling -57% in the 9-week Christmas trading period. In January management had expected problems to resolve as they said some of the decline in Wholesale was due to timing of shipments. Last week’s RNS says the division continues to be a problem.

Retail (41% of sales at H1) has continued to show good like-for-like sales growth, albeit slower than hoped for. Retail stores were growing sales at +18% in the 9-week period to end of December, versus the same 9 weeks last year. There’s no mention of E-Commerce in last week’s RNS (22% of sales in H1), which was growing at +33% over the 9-week Christmas trading period. I think we can assume that has disappointed somewhat too.

Management talks about an equity raise of c. 20% of the shares, supported by CEO/Founder Julian Dunkerton who currently owns 25% of the shares. There’s also £34m of proceeds from the sale of their Asian business, and £35m of identified cost savings (which may incur a chunky restructuring charge). The shares were off -17% on the morning of the RNS.

Valuation: It’s hard to know the EPS because we don’t know the price or the discount shares will be issued. However, the company is trading on 0.1x sales, which is safe to say is a distressed valuation. It seems extraordinary that management can sell the IP of their Asian business for $50m, with just £7m of revenues, when the market cap of the entire SDRY group (over £600m of revenues) is £74m.

Opinion: I bought the shares at H2 last year, and would support the capital raise as I think given time management can turn around the situation. However, I can imagine that shareholders who have bought at much higher levels are less positive, having seen a few ‘false dawns’ since Julian Dunkerton came back in as Chief Exec in April 2019.

If you do take a position in the likes of SDRY, SIS (or G4M, which I wrote about last week) I suggest you think about using a stop loss. Outside of backing a capital raise, these are not the sort of stocks you should be averaging down if trading continues to deteriorate, I suggest.

Notes

The author owns shares in AGFX and SDRY

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Weekly Market Commentary | 18/04/23 | AGFX, JTC, SIS, SDRY| Some thoughts on averaging down

Bruce shares some thoughts on averaging down when a share price falls versus supporting a company that needs to raise capital. Companies covered AGFX, JTC, SIS, and SDRY.

The FTSE 100 was up +2.0% in the last five days to 7,902. The Nasdaq100 was up +0.1% and S&P500 +0.8% over the same time period. The US 10Y government bond yield is 3.54%, while Brent crude is where it started the year at $86 per barrel.

Below are some thoughts on rights issues and averaging down. I tend to average down when I think that a business is fundamentally sound, and there’s an indiscriminate panic which is causing the sell-off. That is, the panic might be justified for some companies in the sector, but when a sell-off becomes indiscriminate that can also create opportunities.

So, I averaged down with Legal and General in February/March 2009, because I thought that life insurance companies with long-term liabilities were not the same risk as banks, which experience bank runs. At the time there were worries that LGEN owned banks’ tier 1 debt (the same debt that was wiped out for Credit Suisse) but that didn’t happen, so by luck or judgement averaging down worked for me as the LGEN share price halved to below 30p. Similarly, I averaged down with Sylvania Platinum when the share price halved to 6p in 2016 because of weakness in the platinum price and problems at Lonmin. It stands to reason investors really don’t want to average down into a company that de-lists or goes insolvent.

This year I have averaged down into computer games company Frontier Developments and mortgage conveyancer Smoove (previously ULS Technologies). Both have net cash but are likely to be loss-making this year and possibly next year. But I think they will survive and go on to flourish. Examples of other shares that I haven’t averaged down into include ARC, TRAK, VNET, QRT and DDDD – the latter has been de-listed and has gone into administration.

Secondly, I tend to back rescue rights issues if they are to reduce debt and put the business on a sustainable footing. I try to avoid companies that do rights issues to fund growth, so the likes of Bango (Direct Carrier Billing), Science in Sport (Sports nutrition, covered below) or Ceres (hydrogen) which have been loss-making for many years, and funded those losses by returning to shareholders with a good story about why they need more money. Shareholders have backed them, but the share count has trebled for BGO, increased 7x for SIS and CWR has seen a remarkable 35x increase in shares over the last 2 decades.

Some people like strict ‘rules based’ trading systems for averaging down or rights issues. I know what I want to avoid but don’t tend to have cast-iron rules. Every situation is different and should be judged on its own merits as information becomes available, in my view. I take inspiration from Hollywood scriptwriter, Robert Mckee, who in the context of creative writing says:

A rule says, “You must do it this way.” A principle says, “This works…and has through all remembered time.” The difference is crucial. Your work needn’t be modelled after the “well-made” play; rather, it must be well made within the principles that shape our art. Anxious, inexperienced writers obey rules. Rebellious, unschooled writers break rules. Artists master the form.

Substitute ‘writers’ for ‘investors’ in the quote, and see if you think the insight still applies.

David has launched the physical Mello Event Tues 23rd May – Thursday 25th May, at the Clayton Hotel, 626 Chiswick High Road. I intend to attend this time, so look forward to meeting readers face to face, if you are planning to attend too.

This week I look at currency broker Argentex and fund manager support services JTC. I finish with sports nutrition company Science in Sport and Superdry’s profit warning and suggested capital raising. The latter two companies are higher risk, but the valuations now are trading at distressed levels. I suggest not averaging down in either of SIS or SDRY, but if a rights issue can put the business on a sustainable footing then it makes sense to support it in my view.

Argentex 9M Dec Results

This forex currency trader that changed its year-end from March to December has now released FY results. They lead with 9M v 9M comparisons because that shows +63% revenue growth. On a more useful 12M v 12M basis revenue growth was still an impressive +54% to £50m, as they benefited from currency market volatility in the second half of last year. For comparison, ALPH reported +27% revenue growth and EQLS reported +57% over the same period. So AGFX results are strong, but a rising tide has lifted all boats in this sector.

Net cash rose +30% to £26m, while adjusted operating profit margin was 24%, down from 32% last year. Annoyingly the company hasn’t provided a full p&l for 12M v 12M comparisons, but looking at the 9M Dec 22 v 12M Mar 22 it looks like costs have risen sharply. Like the computer game companies, software and tech spend is capitalised on to the balance sheet, then recognised over the next few years. In the RNS, management claims that profitability is slightly ahead of expectations. It’s worth remembering though that in 2021 they slashed expectations by over 40% for FY Mar 2022 and subsequent years.

The number of corporate clients trading has increased to 1,749 and average revenue per client is now £29K up +45% from FY Mar 2022. The revenue mix has shifted from a historic 50:50, spot:forward split, to 45:55 and higher margin ‘Structured Solutions’. Management doesn’t spell out the implications of that, but very rarely in financial services have I seen higher margin activity without a trade-off. Structured solutions have now grown to 10% of revenue. Worth noting that current derivative liabilities doubled on the face of the balance sheet to £42m – that is lower than the £58m of current derivative assets. So derivative assets net-off, but I doubt the company can grow gross derivative exposure faster than revenue indefinitely.

Growth: They talk about new hires in UK, Netherlands and Australia. They have a payments licence in the Netherlands and are a few months away from regulatory approval to operate in Australia. They have now launched alternative transaction banking, giving institutions multi-currency accounts. I think that this is similar to ALPH’s Alternative Solutions which grew revenue by +41% to £28m. It’s good that they are following, but the capability doesn’t sound as differentiated as management claim.

Outlook: Q1 (to March) 2023 revenue was up +34% to £12.7m. Singers, their broker, don’t seem to have revised up forecasts, perhaps expecting H2 to be a difficult comparative. Sharepad has broker forecasts of +19% revenue grow to FY 2024F so we may see upward EPS revisions.

Valuation: Singers note shows EPS of 12.0p in Dec 2024F, implying the shares are on slightly below 10x PER Dec 2024F. That does seem good value if the track record of profitable growth can be sustained. I own the shares, for this reason.

Opinion: Like the wealth management sector that I covered last week, this is a sector with 20-30% operating margins, but where management are investing in technology. My concern is that the spend is equivalent to a retailer investing in air conditioning, or a café investing in WiFi. That is, investment spend is necessary to keep up with the competition, but the benefits accrue to customers, not the shareholders. I’m not suggesting that companies should not invest, but I do wonder if we’re seeing an ‘arms race’ of technology spend, with uncertain payback.

JTC FY Dec Results

The company does the back-office administration for fund managers reported FY results to Dec. At the time of the IPO in 2018 just 15% of revenue was a percentage of assets administered, instead most fees are fixed. That means JTC revenue ought to be less sensitive to the rising and falling markets than the fund managers they serve. Just over half of revenue comes from the UK & Channel Islands, with the USA the next largest contributor at 19%, but growing organically at +23% per annum (double the group organic growth rate just reported).

Management has medium-term guidance of:

Results: Revenue was up +36% to £200m, while organic growth was +12% (ahead of the medium-term guidance of 8-10%). The underlying EBITDA margin was 33% (bottom end of medium-term target range), while PBT was up +29% to £35m. Net debt was £120m at the end of Dec, or 1.8x underlying EBITDA.

History: JTC was founded in Jersey in 1987, by partners of Crills, a local law firm. The current Chief Exec joined the firm in 1991 as the fifth employee and has led the business since 1998. In 2008 there was a management buy-out and the Private Equity firm CBPE Capital invested in 2012.

In 2018 JTC listed on the LSE main market at 290p, valuing the company at a market cap of £310m on Admission. Most of the money raised (£218m) went to selling shareholders, with just £15m going to the company to fund growth. The main selling shareholder was Private Equity firm CBPE Capital, which invested in 2012 and sold down its 43% stake to zero following the IPO. Nigel Le Quesne, the current Chief Exec still has a 7% stake. In October 2021 they raised £79m at 718p in a placing to help fund the acquisition of SALI Fund Management, headquartered in Texas, for total consideration of $236m. SALI specialised in Insurance Dedicated Funds (IDF) a tax-efficient US structure favoured by hedge funds. Having grown by acquisition, there are £492m of intangibles on the balance sheet, versus shareholders’ equity of £400m, so there’s no tangible equity. I haven’t come across their name before, but JTC does seem to have an impressive client list, as this slide from their results presentation shows.

Valuation: The shares are trading on a PER 19x Dec 2024F dropping to 17x Dec 2025F, which equates to above 5x historic sales. That looks quite expensive given that the 3-year average ROCE is 7.1%. Perhaps that reflects the high-quality client relationships and high switching costs?

Opinion: Looks interesting, perhaps on the expensive end of Growth at a Reasonable Price (GaaRP)? It does make sense that fund managers would look to outsource some administrative tasks to a company like JTC. In some ways the business model is similar to Keywords Studios, consolidating support services in an industry sector where revenue can be volatile in any particular year, but the margins ought to be attractive through the cycle. KWS reports a higher RoCE (13.7%) but a lower EBIT margin (11.6%) and trades on a higher PER multiple of 22x PER Dec 2024F but lower historic price/sales of 3.5x.

Science in Sport FY Dec Trading Update

This loss-making sports nutrition company is more speculative than I would normally cover, but the share price has sold off -90% since the middle of 2021. They put out a trading statement last week, and finished their strategic review.

The company has two brands and sells directly through their websites phd.com (mass market brand) and scienceinsport.com (premium brand) as well as Amazon and Tmall. They have UK and international distribution through supermarkets, high street chains and specialist sports retailers. Science in Sport is looking to expand in China and is the official nutrition sponsor of the Shanghai Marathon.

For H1 Jun 2022 they reported a loss of £7m. In September last year management announced a placing at 15p per share raising £5m and a ‘strategic review’. As I mentioned in the introduction, this is a company that has funded losses by increasing the share count almost 7x from below 20m in 2014 to 172m currently. Following a strategic review management have now decided that: “shareholders’ interests are best served by seeking to maximise value through focusing on accelerating the profitable growth of the business under an ambitious growth and efficiency plan that is currently delivering in line with management’s expectations.” Reading between the lines, I think they were looking to sell assets, but no buyer was prepared to offer a silly price. Profitable growth seems a sensible strategy, but the track record suggests that it is more easily written in an RNS than actually delivered in the numbers.

Current trading: The company has a December year-end, and had previously put out a trading statement in February, saying revenue was up +1.5% to £63.5m FY Dec 2022. They said people costs were below budget last year, and expect to reduce overheads in 2023F. They have invested heavily in a 160,000 sq ft Blackburn site which they say should reduce manufacturing and logistics costs, with a payback over 3 years.

Last week they described a +2.3% growth in Q1 23 v the same quarter last year as “good”. They expect to announce a third trading update when FY 2022 results are finally released. There was no mention of profits in last week’s RNS, and Sharepad shows a loss of £9m is forecast for 2022, dropping to £5m loss in 2023F and £3m loss in 2024F. I would imagine that they could need to raise more money at some point.

Valuation: The shares are trading on 0.2x FY Dec 2023F revenues. They haven’t made any profits in the last decade and there are no profits forecast for the next couple of years.

Opinion: It strikes me that this is a business that ought to be successful: I’ve noticed several of my female friends have started ordering protein powder, signing up for triathlons or taking up deadlifting. That’s possibly the result of the pandemic, or perhaps seeing targeted ads on Instagram; but either way, it tweaked my interest in SIS.

However, I would like to understand better why SIS haven’t generated profits so far. If they can scale, profits ought to start dropping through to the bottom line. That operational gearing could explain why there are many high-quality institutions on the shareholder list, including Lombard Odier 21%, Aviva 11%, Schroders 6.3% and Baillie Gifford 4.2%, despite the market cap below £20m. On my watch list, but I will avoid for now.

SDRY Profit Warning FY Apr

This clothes retailer with an April year end withdrew guidance for ‘broadly breakeven’ this year, implying a significant loss. Management had already reduced expectations in January to ‘broadly breakeven’ from previous guidance of £10m-£20m FY Apr 2023. Revenue is expected to be in the range of £615m-£635m, which is a very broad range considering there are just two weeks left in their financial year. Sharepad shows forecasts for FY Apr 2023 of £629m.

The main source of disappointment is the Wholesale division (37% of sales at H1), the company had previously announced was down a startling -57% in the 9-week Christmas trading period. In January management had expected problems to resolve as they said some of the decline in Wholesale was due to timing of shipments. Last week’s RNS says the division continues to be a problem.

Retail (41% of sales at H1) has continued to show good like-for-like sales growth, albeit slower than hoped for. Retail stores were growing sales at +18% in the 9-week period to end of December, versus the same 9 weeks last year. There’s no mention of E-Commerce in last week’s RNS (22% of sales in H1), which was growing at +33% over the 9-week Christmas trading period. I think we can assume that has disappointed somewhat too.

Management talks about an equity raise of c. 20% of the shares, supported by CEO/Founder Julian Dunkerton who currently owns 25% of the shares. There’s also £34m of proceeds from the sale of their Asian business, and £35m of identified cost savings (which may incur a chunky restructuring charge). The shares were off -17% on the morning of the RNS.

Valuation: It’s hard to know the EPS because we don’t know the price or the discount shares will be issued. However, the company is trading on 0.1x sales, which is safe to say is a distressed valuation. It seems extraordinary that management can sell the IP of their Asian business for $50m, with just £7m of revenues, when the market cap of the entire SDRY group (over £600m of revenues) is £74m.

Opinion: I bought the shares at H2 last year, and would support the capital raise as I think given time management can turn around the situation. However, I can imagine that shareholders who have bought at much higher levels are less positive, having seen a few ‘false dawns’ since Julian Dunkerton came back in as Chief Exec in April 2019.

If you do take a position in the likes of SDRY, SIS (or G4M, which I wrote about last week) I suggest you think about using a stop loss. Outside of backing a capital raise, these are not the sort of stocks you should be averaging down if trading continues to deteriorate, I suggest.

Notes

The author owns shares in AGFX and SDRY

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.