A look at UK retail fund flow data, from the Investment Association, which represents UK Fund Management Firms. Companies covered CLX, AQX and ESYS.

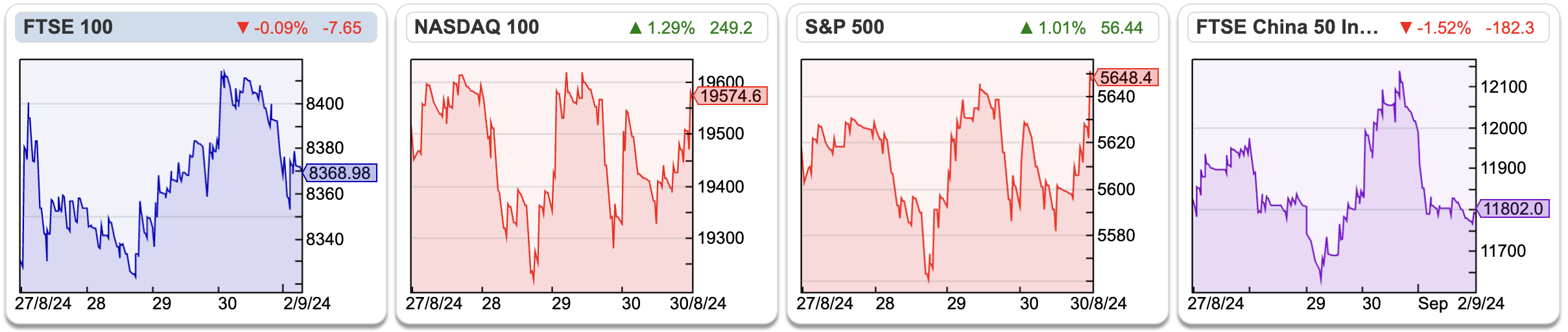

The FTSE 100 was up +0.5% to 8,369 last week. The Nasdaq100 was down -0.7% and the S&P500 was flat. Both of these US indices are up +25% YTD, whereas AIM is the worst-performing major index (flat YTD) outside of China. AIM’s poor performance has been driven by its weighting towards energy (-16% YTD) and retail (-15% YTD) sectors. Below I look at the flows of money out of the UK equity markets.

Now that the UK interest rate cycle has turned, with the Bank of England cutting interest rates by 25bp to 5.0% on 1st August, I thought I would take another look at fund flow data from the Investment Association (which represents UK fund managers). Theoretically, lower interest rates should reduce borrowers’ mortgage costs and also encourage people to invest cash on deposit at banks into the stock market. That’s the theory, in reality, we’ve had low interest rates since the financial crisis and money leaving the UK equity market.

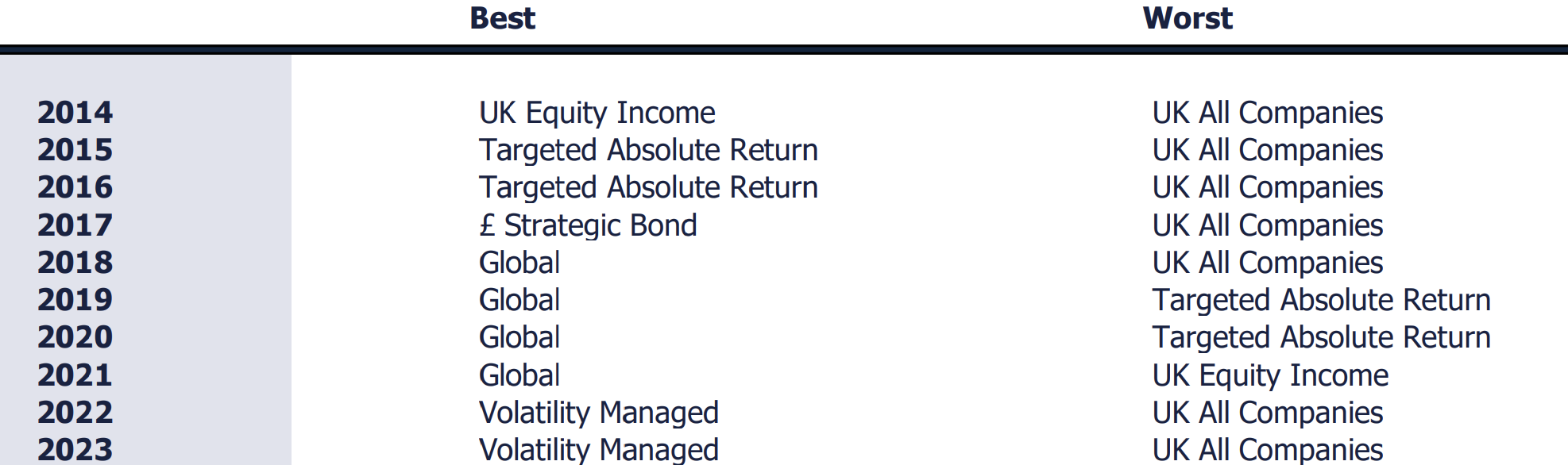

So when discussing flows of money into investment funds, it is important to be specific about UK funds, which would support the FTSE All Share and AIM indices, or whether UK investors are sending their money to US, European or Global funds (the UK is just 4% of the Global index). There’s also been a trend for retail investors to buy into Target’s Absolute Return and Volatility Managed strategies, which will invest less money into UK equity markets:

- Targeted Absolute Return – funds target a positive return over all market conditions, within a set timeframe. The idea is to have a low correlation with both equity and bond markets, and instead generate absolute returns. These were popular a decade ago, but have fallen out of favour more recently.

- Volatility Managed – managers target returns within certain volatility parameters, ordinarily offering a range of risk appetites for investors or advisors to select from. These will contain a dynamic mix of equities, bonds and cash. These have been the best-selling funds in 2022 and 2023.

The data tells an interesting story, with the worst-selling funds tending to be UK All Companies and UK Equity Income, while Global and Volatility Managed have been the best-selling funds with UK retail investors.

Among the most popular funds, there’s also been a clear rotation away from Targeted Absolute Return, which took in a net £27bn in 2015 and 2016. Since 2018 there have been consistent outflows from those funds with £14.6bn withdrawn from 2018 to 2022, presumably driven by concerns over the long-term performance. Volatility Managed has been more popular in recent years.

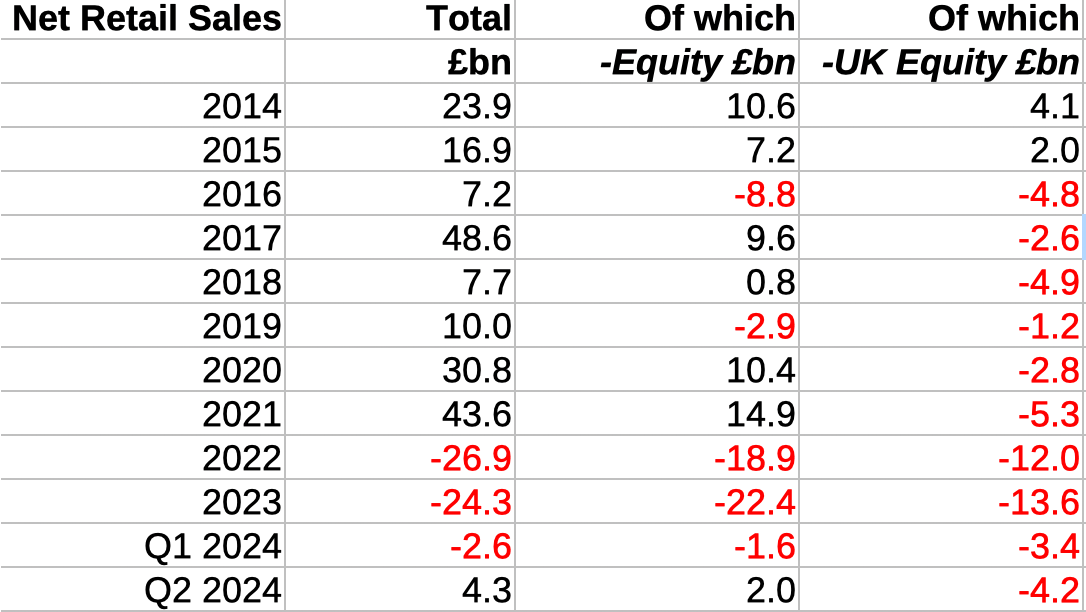

I have put the numbers in table format, showing net inflows/outflows (in red) from retail investors. The total figure includes not just Equity, but Fixed Income, Money Market Funds, Mixed Assets (like Absolute Return and Volatility Managed) plus Property. The next column is Equity, but across all geographies, so the US, Europe, Global, Asia as well as the UK. The final column on the right is UK equities, which has been negative since 2016, showing that it is difficult for the UK indices to outperform when they are seeing outflows from investors. Even during the pandemic years of 2020 and 2021 when investors had limited opportunity to spend money and so equity markets saw large inflows, the UK Equity markets still saw outflows.

It has become fashionable to blame UK corporate pension fund trustees for exiting the UK equity market, but the IMA data shows that UK retail investors have also been leaving UK equities since 2016. In the past retail flows have been seen as a contrarian indicator, for instance, heavy retail inflows in the late 1990’s were actually a “sell” signal; outflows in 2003 were a “buy” signal for those willing to swim against the tide. That contrarian signal hasn’t worked recently though.

Despite 8.5 years of outflows totalling almost £55bn, UK All Companies FuM were still £141bn, or 9% of total FuM at the end of June 2024. That’s second only to the largest category: Global Funds of £205bn, and ahead of North American funds at £106bn, and Volatility Managed £65bn, which have all seen significant inflows in the last few years. One surprise given that the interest rate cycle has turned, was Short Term Money Market cash funds continued to do well, they were the most popular fund for inflows with £1.5bn in June and stood at £33bn of balances outstanding.

This week I look at Calnex’s “in line” update which could signal that revenues have stabilised and Aquis Exchange’s profit warning. I also look at Essensy’s ahead of expectations update, but consider the investment case beyond my own risk tolerance.

Calnex AGM Trading Update

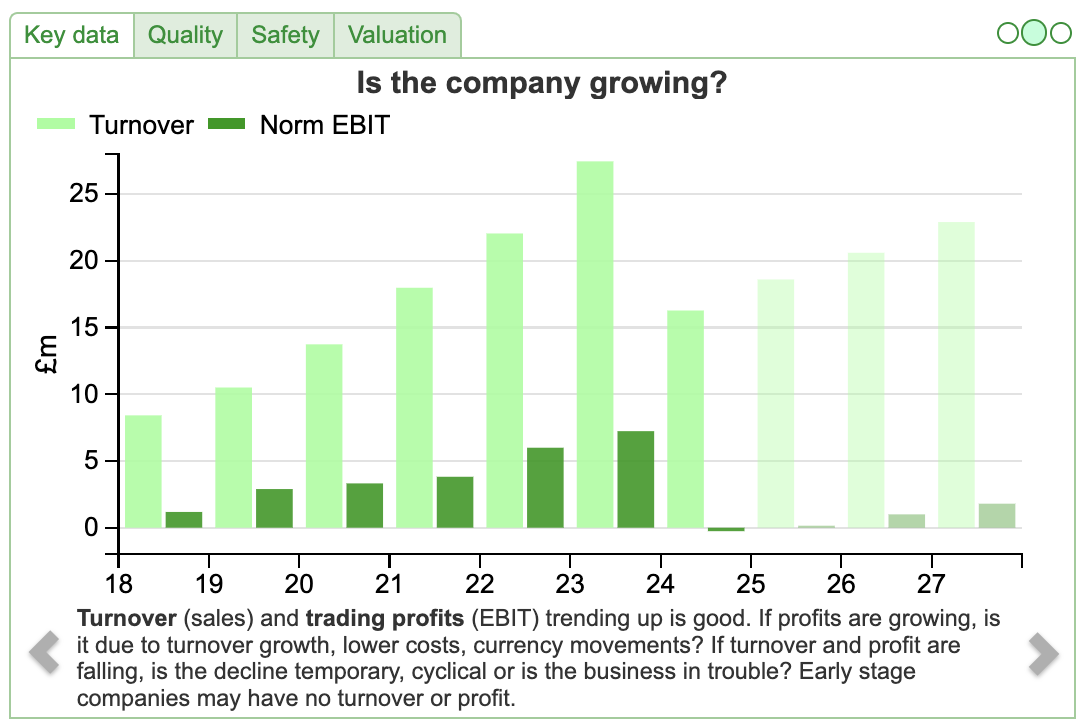

This maker of telecoms’ test equipment announced an “in line” trading update for FY Mar 2025F. That might sound rather dull, but the FY Mar 2024 results reported in May showed revenues down -41% to £16m, the business falling into a small loss, versus a profit of £7.2m FY Mar 2023. Hence “inline” implies the situation is stabilising.

This maker of telecoms’ test equipment announced an “in line” trading update for FY Mar 2025F. That might sound rather dull, but the FY Mar 2024 results reported in May showed revenues down -41% to £16m, the business falling into a small loss, versus a profit of £7.2m FY Mar 2023. Hence “inline” implies the situation is stabilising.

In March 2023, Calnex warned that customers were taking a cautious approach to investment decisions until there was better visibility on their project development timelines. That meant that FY Mar 2024 would be below the levels achieved the previous year. With a -41% drop in revenue subsequently, that March 2023 guidance appears an understatement. However, the business has net cash of £11.9m at the end of this March, so it should be able to survive industry cyclicality. It was a pandemic IPO (Oct 2020) listing on AIM at 48p and more than doubling within less than a year, but is now down -70% from its peak.

Forecasts: Cavendish, their broker, are forecasting a modest return to growth, with revenue of £19m and profits of under half a million pounds. There are no forecasts for Mar 2026F from Cavendish, which suggests management doesn’t feel confident about visibility. It also suggests that the forecasts that Sharepad has for Mar 2026F and Mar 2027F could be stale, as Calnex is the only broker listed on their most recent RNS.

Valuation: Cash is around a quarter of the market cap, while the PER looks expensive on over 151x as margins have been hit. However, assuming the business can at some point generate returns similar to FY Mar 2023 EPS of 6.4p, would put the shares on less than 9x.

Opinion: I’ve mentioned in the past that I am open to buying loss-making companies if it looks as if their problems are temporary. I am much more wary of companies that have been consistently loss-making, where management optimistically say that profits should come through in the foreseeable (or even unforeseeable) future. This looks like the former and could recover well at some point. Maynard wrote it up in detail in July 2021, highlighting some positives (a parallel with long-term multi-bagger AB Dynamics) and negatives (low cash tax paid, possible window dressing for the IPO). On balance, with the share price trading back around its Oct 2020 IPO level, I would be positive about the medium term.

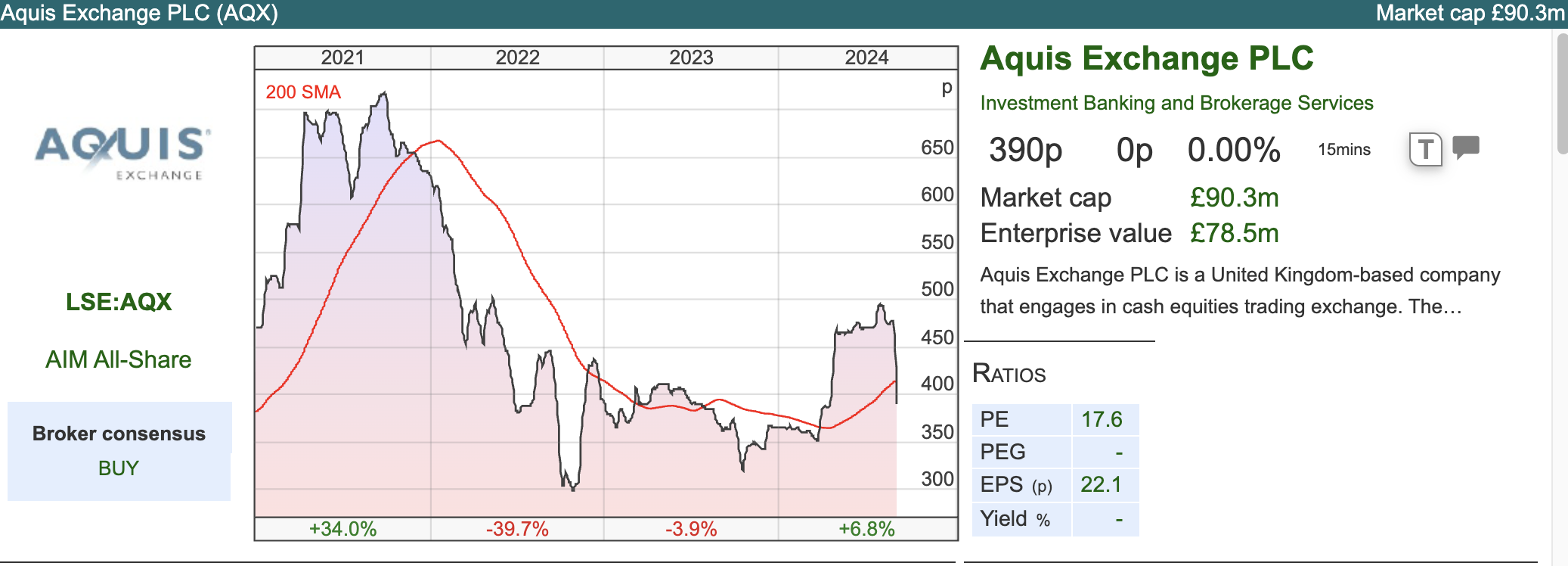

Aquis Exchange FY Dec Profit Warning

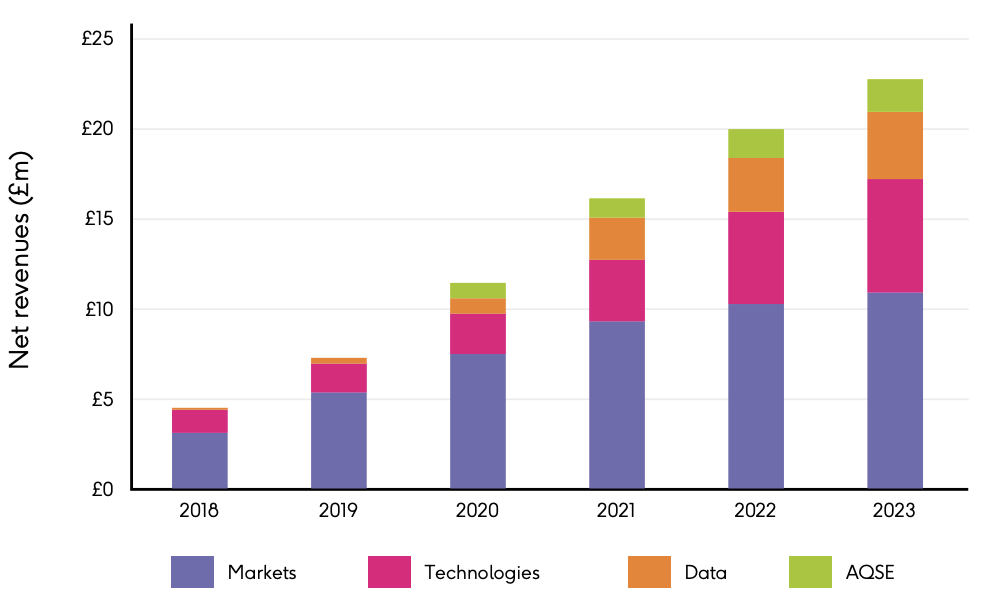

This stock exchange business is the old Plus Markets / OFEX, which was the junior market to AIM, focusing on early-stage companies, but also some family-owned illiquid businesses like Adnams Brewery. However, AQSE is less than 10% of group revenue, they also license their “matching engine” and “trade surveillance” technology to other exchanges. The technology business is around a quarter of revenue. The third business is Aquis Markets (half of group revenue) which is a subscription-based exchange offering pan-European cash equities trading. It has slowly grown its market share to become the 7th largest equities exchange in Europe. They charge traders for messages, rather than taking a small cut of the value of each trade, like other exchanges. Finally, there is the Aquis Data business (orange), which is 16% of revenues and could benefit from a European consolidated tape.

This stock exchange business is the old Plus Markets / OFEX, which was the junior market to AIM, focusing on early-stage companies, but also some family-owned illiquid businesses like Adnams Brewery. However, AQSE is less than 10% of group revenue, they also license their “matching engine” and “trade surveillance” technology to other exchanges. The technology business is around a quarter of revenue. The third business is Aquis Markets (half of group revenue) which is a subscription-based exchange offering pan-European cash equities trading. It has slowly grown its market share to become the 7th largest equities exchange in Europe. They charge traders for messages, rather than taking a small cut of the value of each trade, like other exchanges. Finally, there is the Aquis Data business (orange), which is 16% of revenues and could benefit from a European consolidated tape.

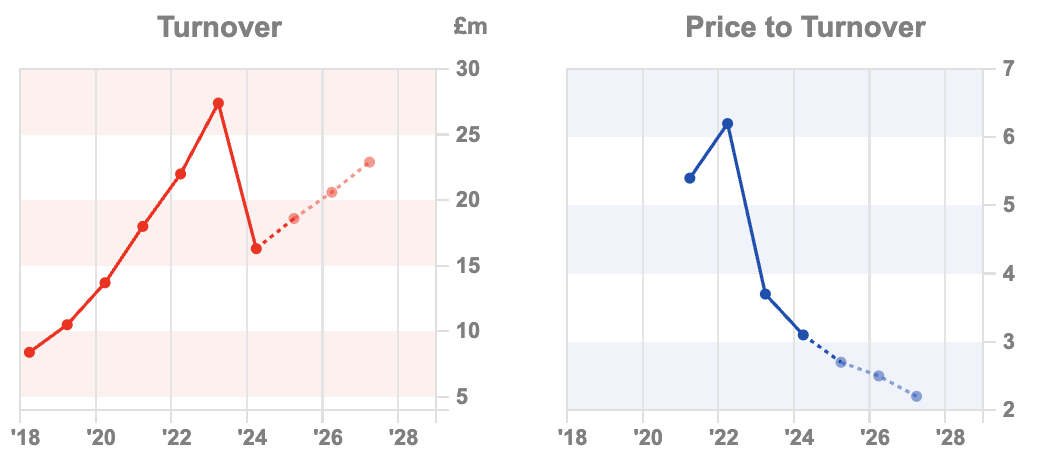

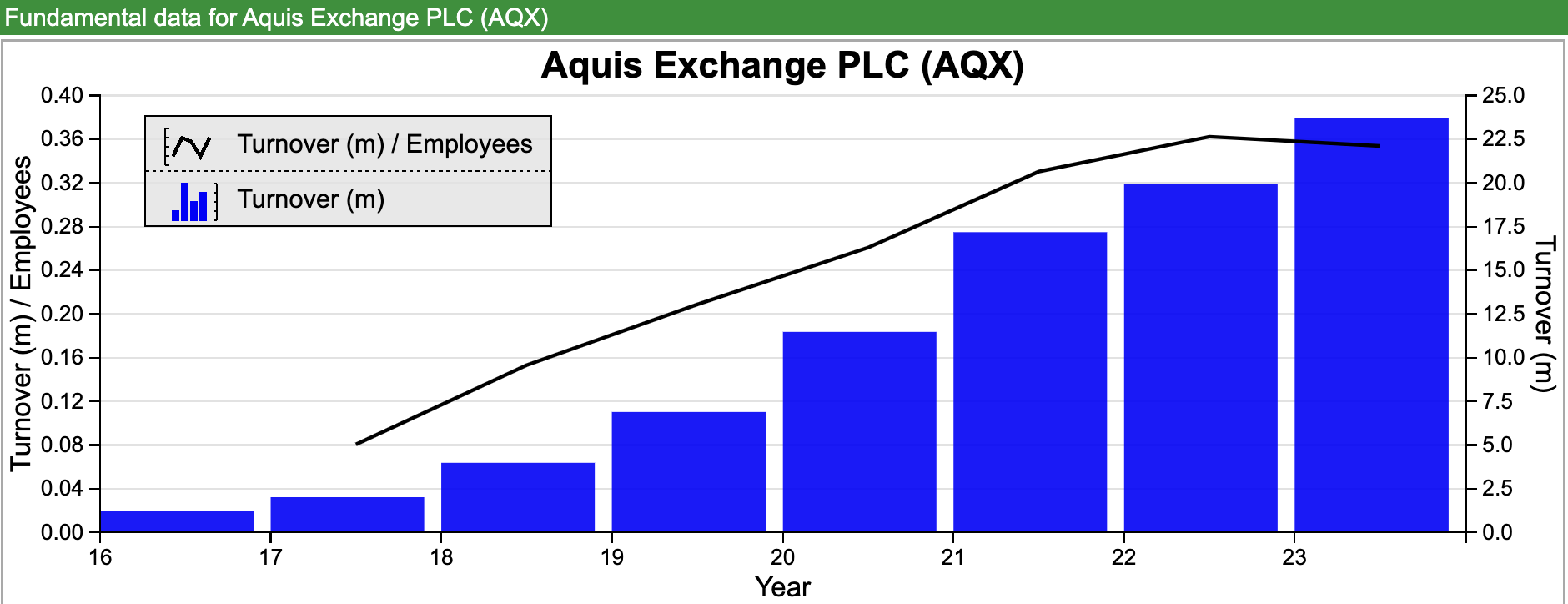

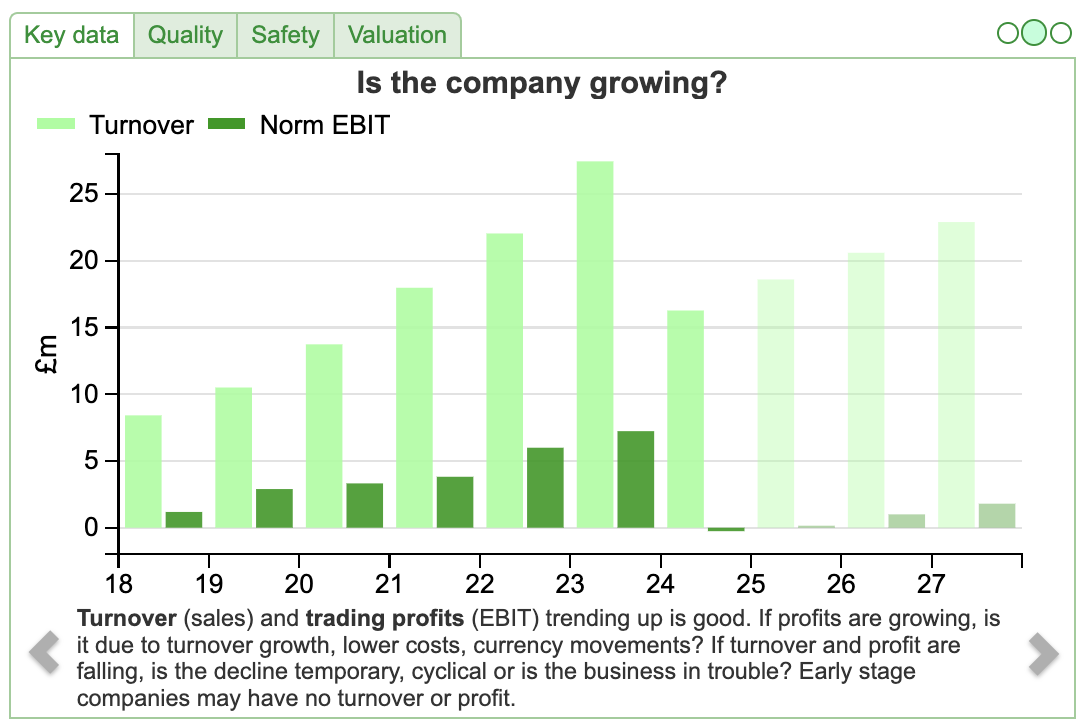

The chart below shows good top-line growth since the IPO at 269p in 2018.

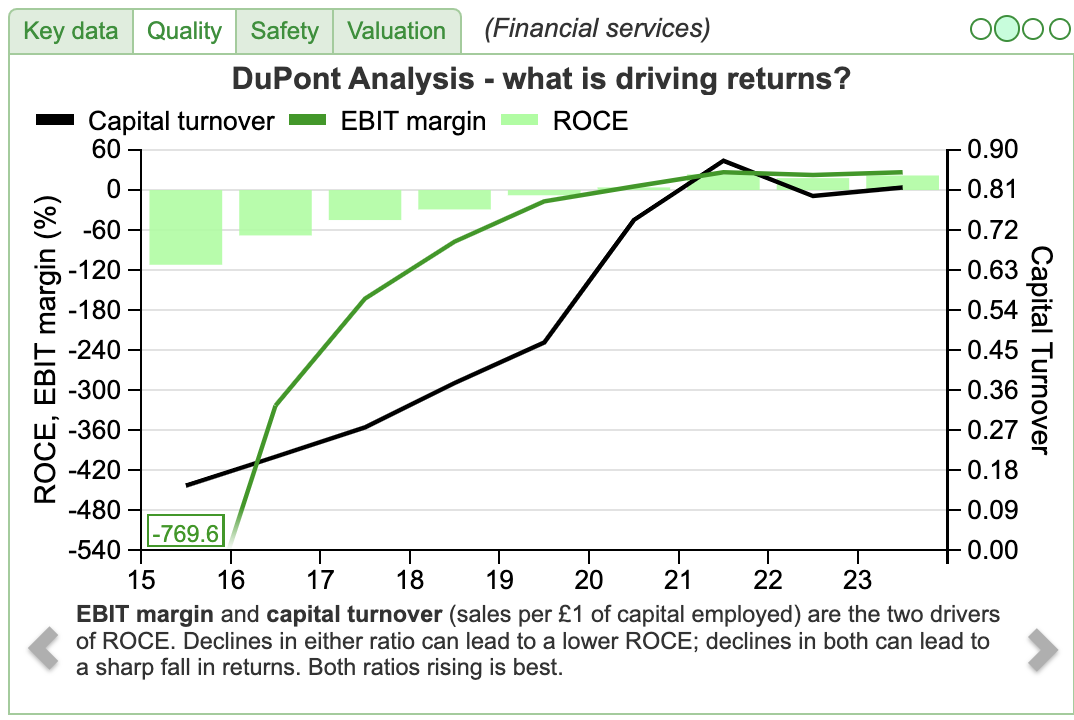

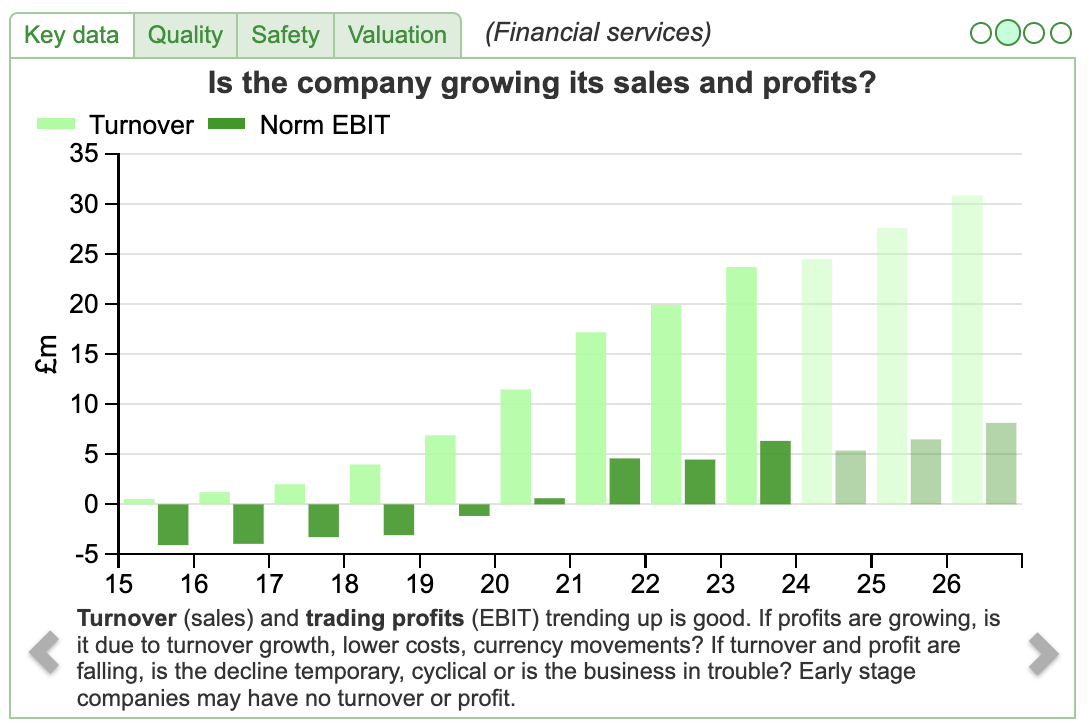

The trouble is that in the past the shares have been very expensive, trading on more than 10x revenue and making little profit, when I wrote about it in 2020. Investors were prepared to reward the shares with a high value, because of the demonstrable operational gearing, improving capital turn, profit margins and ROCE, as demonstrated by the Sharepad chart below.

Despite the improvement the shares have fallen -44% from their peak above £7 per share in Sept 2021. Management now say that they have lost a contract, worth £1m to revenues and PBT (in percentage terms 4% and 15%). The shares fell -14% last week on the day of the RNS, as their house broker cut EPS estimates by -21% for this year and -17% for next year. H1 June results will be released on 12 September and there’s a presentation scheduled that day at 11am on Investor Meet Company. I’ve seen Alasdair Haynes the CEO present in the past, and he’s always engaging and enthusiastic.

Despite the improvement the shares have fallen -44% from their peak above £7 per share in Sept 2021. Management now say that they have lost a contract, worth £1m to revenues and PBT (in percentage terms 4% and 15%). The shares fell -14% last week on the day of the RNS, as their house broker cut EPS estimates by -21% for this year and -17% for next year. H1 June results will be released on 12 September and there’s a presentation scheduled that day at 11am on Investor Meet Company. I’ve seen Alasdair Haynes the CEO present in the past, and he’s always engaging and enthusiastic.

Valuation: Following the EPS cuts, the shares are now trading on a PER of 20x Dec 2025F and 4x sales the same year. Forecasts are for low teens revenue growth in Dec 2025F and 2026F, so assuming no further disappointments that seems a GARP (Growth at a Reasonable Price) type valuation.

Opinion: At 390p the shares are below the level when I wrote about them in Oct 2020. Aside from losing the £1m contract, I note a second concern is that turnover per number of employees has begun to stagnate. That’s recreating a chart that Maynard looked at when he wrote the company up.

So I would like to listen to the call and hear more details, but in general, I’m warm to this stock as the valuation has become much more reasonable.

So I would like to listen to the call and hear more details, but in general, I’m warm to this stock as the valuation has become much more reasonable.

Essensys Ahead of Expectations Trading Update

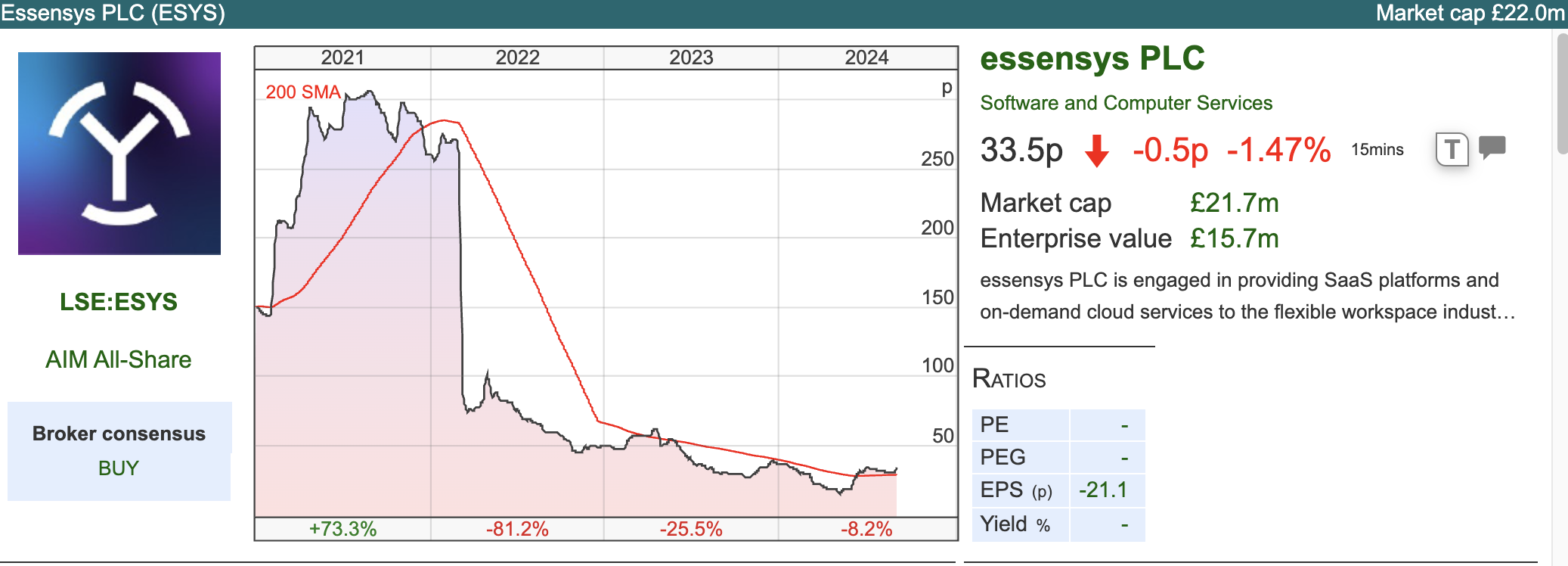

This software company uses the word “platform” in their FY July Trading Update and has been loss-making for the last 4 years. That would normally be enough for me to avoid it; however, it was on Sharepad’s “Top 10 Most Searched” list. The RNS was ahead of market expectations for FY July 2025 Revenue, EBITDA and cash and it’s also on track to be EBITDA positive in FY July 2025. So maybe worth a look for the more risk-tolerant readers?

This software company uses the word “platform” in their FY July Trading Update and has been loss-making for the last 4 years. That would normally be enough for me to avoid it; however, it was on Sharepad’s “Top 10 Most Searched” list. The RNS was ahead of market expectations for FY July 2025 Revenue, EBITDA and cash and it’s also on track to be EBITDA positive in FY July 2025. So maybe worth a look for the more risk-tolerant readers?

The shares have been listed on AIM since 2019 and looks like it does facilities management software, judging by how they describe themselves: ESYS “helps the world’s leading multi-tenant real-estate providers deliver dynamic, flexible networks of connected, digitally-enabled spaces in a hybrid world.” There’s a two-minute video explanation on their website.

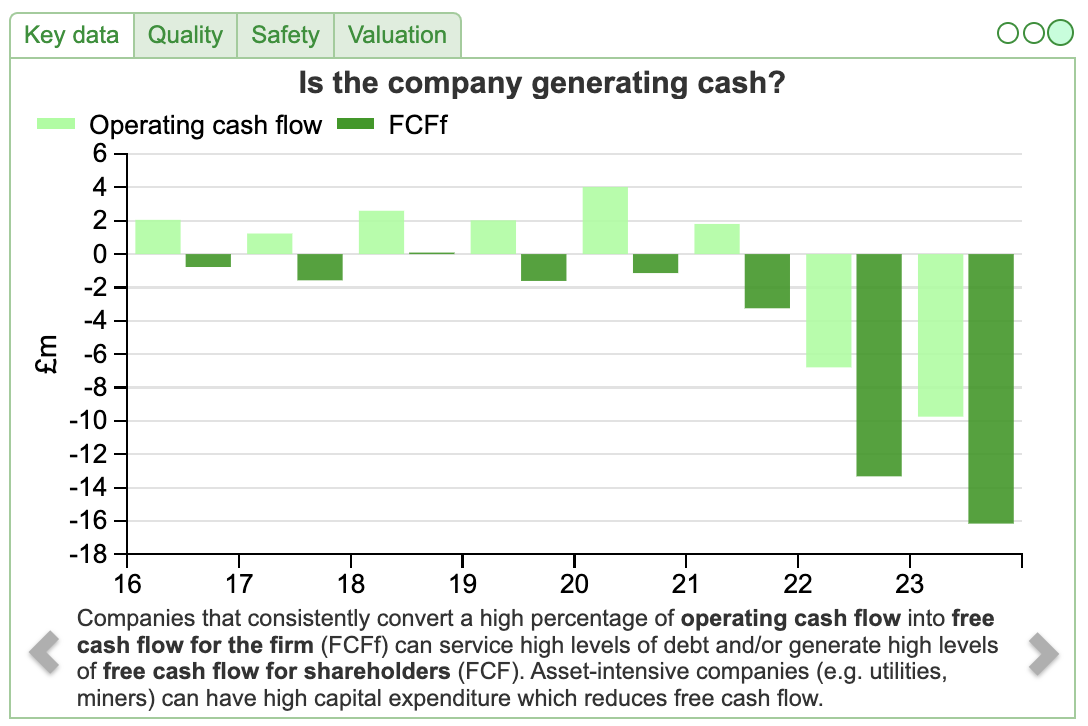

They expect to report FY July 2024 revenues of £24m, down -5% from the previous year. Forecasts were for an EBITDA loss of £1m, converting to a LBT of £5.6m so the beaten expectations were a low bar and it is still forecast to be unprofitable FY July 2025. They say that £3.1m of net cash was “significantly ahead” of expectations, but then mention a tax credit of £0.8m. Net cash is down from £7.9m in July 2023 and £24.1m in July 2022. Sharepad’s Operating Cashflow and FCFf chart (below) is alarming. The previous CFO announced that she would step down in January, and they’ve only now been able to announce a replacement.

History: The business was founded in 2006 by Mark Furness, the current Chief Exec and 30.5% shareholder. They managed to finance their growth with support from the banks, rather than any institutional equity prior to the AIM listing. They listed at 151p, raising £28m, of which half went to selling shareholders and half to the company. On admission, this valued the company at £73m. In July 2021 they then raised a further £30m at a placing price of 285p, Canaccord, Schroders, Amati and Liontrust now own disclosable stakes. However, the company has been heavily loss-making since they warned on revenues in a Mar 2022 trading update and FY July 2022 and FY July 2023 results show them losing £11m and £16m (LBT) respectively.

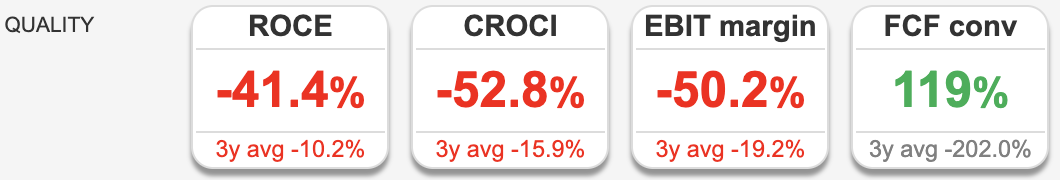

Valuation: EPS is forecast to be negative for Mar 2025F and Mar 2026F. The business is trading on 1x sales. Sharepad’s quality indicators tell a story.

Opinion: My sense is that there probably could be a viable business, with recurring revenues and management say Essensys platform has a gross margin of over 90%. However it looks like they could need to raise money again, and for me, it’s too risky to buy into before the finances are on a sustainable footing. Worth revisiting in 2025, or after they raise more money, but not before I think. The AIM market ought to be a mechanism for providing growth capital to businesses, the trouble is that retail investors are right to be cautious of unprofitable companies, having been burnt in the past. So it’s an avoid, in my view.

Notes

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 3/09/2024 | CLX, AQX, ESYS | A look at UK fund flows

The FTSE 100 was up +0.5% to 8,369 last week. The Nasdaq100 was down -0.7% and the S&P500 was flat. Both of these US indices are up +25% YTD, whereas AIM is the worst-performing major index (flat YTD) outside of China. AIM’s poor performance has been driven by its weighting towards energy (-16% YTD) and retail (-15% YTD) sectors. Below I look at the flows of money out of the UK equity markets.

Now that the UK interest rate cycle has turned, with the Bank of England cutting interest rates by 25bp to 5.0% on 1st August, I thought I would take another look at fund flow data from the Investment Association (which represents UK fund managers). Theoretically, lower interest rates should reduce borrowers’ mortgage costs and also encourage people to invest cash on deposit at banks into the stock market. That’s the theory, in reality, we’ve had low interest rates since the financial crisis and money leaving the UK equity market.

So when discussing flows of money into investment funds, it is important to be specific about UK funds, which would support the FTSE All Share and AIM indices, or whether UK investors are sending their money to US, European or Global funds (the UK is just 4% of the Global index). There’s also been a trend for retail investors to buy into Target’s Absolute Return and Volatility Managed strategies, which will invest less money into UK equity markets:

The data tells an interesting story, with the worst-selling funds tending to be UK All Companies and UK Equity Income, while Global and Volatility Managed have been the best-selling funds with UK retail investors.

Among the most popular funds, there’s also been a clear rotation away from Targeted Absolute Return, which took in a net £27bn in 2015 and 2016. Since 2018 there have been consistent outflows from those funds with £14.6bn withdrawn from 2018 to 2022, presumably driven by concerns over the long-term performance. Volatility Managed has been more popular in recent years.

I have put the numbers in table format, showing net inflows/outflows (in red) from retail investors. The total figure includes not just Equity, but Fixed Income, Money Market Funds, Mixed Assets (like Absolute Return and Volatility Managed) plus Property. The next column is Equity, but across all geographies, so the US, Europe, Global, Asia as well as the UK. The final column on the right is UK equities, which has been negative since 2016, showing that it is difficult for the UK indices to outperform when they are seeing outflows from investors. Even during the pandemic years of 2020 and 2021 when investors had limited opportunity to spend money and so equity markets saw large inflows, the UK Equity markets still saw outflows.

It has become fashionable to blame UK corporate pension fund trustees for exiting the UK equity market, but the IMA data shows that UK retail investors have also been leaving UK equities since 2016. In the past retail flows have been seen as a contrarian indicator, for instance, heavy retail inflows in the late 1990’s were actually a “sell” signal; outflows in 2003 were a “buy” signal for those willing to swim against the tide. That contrarian signal hasn’t worked recently though.

Despite 8.5 years of outflows totalling almost £55bn, UK All Companies FuM were still £141bn, or 9% of total FuM at the end of June 2024. That’s second only to the largest category: Global Funds of £205bn, and ahead of North American funds at £106bn, and Volatility Managed £65bn, which have all seen significant inflows in the last few years. One surprise given that the interest rate cycle has turned, was Short Term Money Market cash funds continued to do well, they were the most popular fund for inflows with £1.5bn in June and stood at £33bn of balances outstanding.

This week I look at Calnex’s “in line” update which could signal that revenues have stabilised and Aquis Exchange’s profit warning. I also look at Essensy’s ahead of expectations update, but consider the investment case beyond my own risk tolerance.

Calnex AGM Trading Update

In March 2023, Calnex warned that customers were taking a cautious approach to investment decisions until there was better visibility on their project development timelines. That meant that FY Mar 2024 would be below the levels achieved the previous year. With a -41% drop in revenue subsequently, that March 2023 guidance appears an understatement. However, the business has net cash of £11.9m at the end of this March, so it should be able to survive industry cyclicality. It was a pandemic IPO (Oct 2020) listing on AIM at 48p and more than doubling within less than a year, but is now down -70% from its peak.

Forecasts: Cavendish, their broker, are forecasting a modest return to growth, with revenue of £19m and profits of under half a million pounds. There are no forecasts for Mar 2026F from Cavendish, which suggests management doesn’t feel confident about visibility. It also suggests that the forecasts that Sharepad has for Mar 2026F and Mar 2027F could be stale, as Calnex is the only broker listed on their most recent RNS.

Valuation: Cash is around a quarter of the market cap, while the PER looks expensive on over 151x as margins have been hit. However, assuming the business can at some point generate returns similar to FY Mar 2023 EPS of 6.4p, would put the shares on less than 9x.

Opinion: I’ve mentioned in the past that I am open to buying loss-making companies if it looks as if their problems are temporary. I am much more wary of companies that have been consistently loss-making, where management optimistically say that profits should come through in the foreseeable (or even unforeseeable) future. This looks like the former and could recover well at some point. Maynard wrote it up in detail in July 2021, highlighting some positives (a parallel with long-term multi-bagger AB Dynamics) and negatives (low cash tax paid, possible window dressing for the IPO). On balance, with the share price trading back around its Oct 2020 IPO level, I would be positive about the medium term.

Aquis Exchange FY Dec Profit Warning

The chart below shows good top-line growth since the IPO at 269p in 2018.

The trouble is that in the past the shares have been very expensive, trading on more than 10x revenue and making little profit, when I wrote about it in 2020. Investors were prepared to reward the shares with a high value, because of the demonstrable operational gearing, improving capital turn, profit margins and ROCE, as demonstrated by the Sharepad chart below.

Valuation: Following the EPS cuts, the shares are now trading on a PER of 20x Dec 2025F and 4x sales the same year. Forecasts are for low teens revenue growth in Dec 2025F and 2026F, so assuming no further disappointments that seems a GARP (Growth at a Reasonable Price) type valuation.

Opinion: At 390p the shares are below the level when I wrote about them in Oct 2020. Aside from losing the £1m contract, I note a second concern is that turnover per number of employees has begun to stagnate. That’s recreating a chart that Maynard looked at when he wrote the company up.

Essensys Ahead of Expectations Trading Update

The shares have been listed on AIM since 2019 and looks like it does facilities management software, judging by how they describe themselves: ESYS “helps the world’s leading multi-tenant real-estate providers deliver dynamic, flexible networks of connected, digitally-enabled spaces in a hybrid world.” There’s a two-minute video explanation on their website.

They expect to report FY July 2024 revenues of £24m, down -5% from the previous year. Forecasts were for an EBITDA loss of £1m, converting to a LBT of £5.6m so the beaten expectations were a low bar and it is still forecast to be unprofitable FY July 2025. They say that £3.1m of net cash was “significantly ahead” of expectations, but then mention a tax credit of £0.8m. Net cash is down from £7.9m in July 2023 and £24.1m in July 2022. Sharepad’s Operating Cashflow and FCFf chart (below) is alarming. The previous CFO announced that she would step down in January, and they’ve only now been able to announce a replacement.

History: The business was founded in 2006 by Mark Furness, the current Chief Exec and 30.5% shareholder. They managed to finance their growth with support from the banks, rather than any institutional equity prior to the AIM listing. They listed at 151p, raising £28m, of which half went to selling shareholders and half to the company. On admission, this valued the company at £73m. In July 2021 they then raised a further £30m at a placing price of 285p, Canaccord, Schroders, Amati and Liontrust now own disclosable stakes. However, the company has been heavily loss-making since they warned on revenues in a Mar 2022 trading update and FY July 2022 and FY July 2023 results show them losing £11m and £16m (LBT) respectively.

Valuation: EPS is forecast to be negative for Mar 2025F and Mar 2026F. The business is trading on 1x sales. Sharepad’s quality indicators tell a story.

Opinion: My sense is that there probably could be a viable business, with recurring revenues and management say Essensys platform has a gross margin of over 90%. However it looks like they could need to raise money again, and for me, it’s too risky to buy into before the finances are on a sustainable footing. Worth revisiting in 2025, or after they raise more money, but not before I think. The AIM market ought to be a mechanism for providing growth capital to businesses, the trouble is that retail investors are right to be cautious of unprofitable companies, having been burnt in the past. So it’s an avoid, in my view.

Notes

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.