Bruce suggests that company managements who are reluctant to physically meet investors could be facing a more uncertain outlook. Companies covered ABF and AGFX

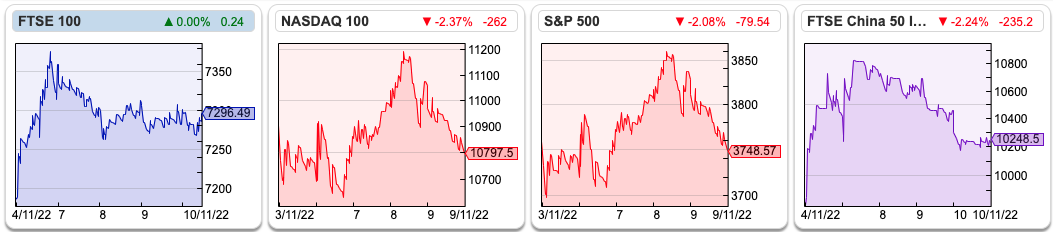

The FTSE 100 was up +1.4% in the last 5 days to 7296, while the Nasdaq100 and S&P500 were up +0.8% and +1.0% respectively. The pound weakened slightly versus to 1.138 to the dollar, down from 1.155 at the start of this week. The price of oil at $95 per barrel has remained in a trading range between $90 and $100 per barrel since the start of October.

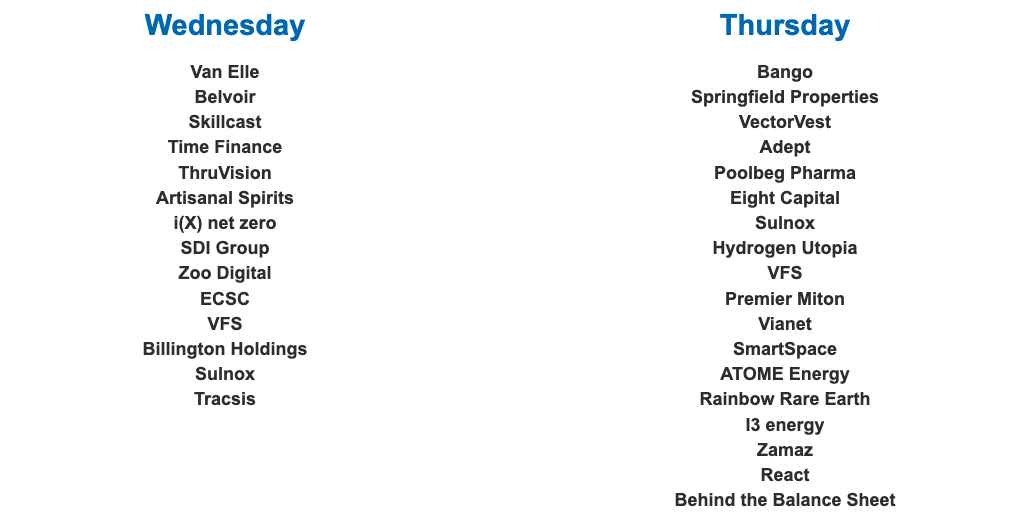

I hope that everyone is looking forward to the physical event at Mello, on Wed 16th and Thursday 17th next week. On Monday’s webinar, David commented that he had no difficulty getting individuals to attend Mello, but many company managementS are reluctant to get out in front of investors and meet them face to face. He said that over half the companies that he’d invited and turned down the opportunity, which is a much higher rate than in previous years. His interpretation was websites like PIWorld and InvestorMeetCompany allowed management to feel they were ticking the shareholder engagement box, without having to physically meet investors.

He could be correct. I have a different interpretation though, based on my experience in financial PR and corporate broking. When management gives out guidance to brokers and investors, they are 90-95% confident that the numbers will be achieved. But unless you have a subscription business with Annual Recurring Revenue, forward-looking statements are the best guess of the most likely outcome. Even if you do have good revenue visibility from subscriptions, consumers can cancel as the share price performance of Netflix -57% YTD shows.

We are in a particularly uncertain environment at the moment, and I suspect many management teams are worried that they may have to revise down guidance. However, they can’t be 100% sure if the environment is deteriorating or they might just hit their numbers (for supply chain difficulties, conditions may even be improving). It would be natural for management to feel uncomfortable going out in front of investors, telling an upbeat story and then in a month or two’s time realising that they will then have to warn versus expectations. If David published his list of companies that are not attending, we might see an above average future profit warnings.

On the positive side, that does suggest good confidence from the companies that are still getting out in front of investors. I’m glad to see SDI Group, which I own is presenting!

One advantage of Mello, both the physical events and the online webinar’s is that David does let investors ask company management ‘uncomfortable’ questions. This is not the case with InvestorMeetCompany or PIWorld, in my experience. For instance, I listened into the Argentex H1 presentation on IMC this week, and asked:

“What would happen to the company’s cashflow statement if all the revenue came from trading forwards or structured solutions (FX options)?”

Management skipped this question. On the call they did say that options were higher margin and good for cashflow because clients paid the premium upfront. They then added that they wouldn’t want the product (currently 9.5% of revenue) to rise above 20% of revenue. The obvious question is:

“Why not? What are the risks with structured solutions?”

I also asked AGFX management how they stress-tested credit risk. A forward contract ought to be a rates/currency product – but we’ve seen that actually there’s a component of credit risk (AGFX took a Credit Value Adjustment of £0.9m, of which half was a specific counterparty). AGFX has been taking market share from high street banks, so there’s a chance they are doing business where bankers fear to tread.

To use a cricket analogy, I don’t think my questions were aggressive “bouncers”. Yet Harry Adams, the CEO, hid his bat behind his pad to these deliveries which were “bowled down the corridor of uncertainty around the off stump”. Instead, he preferred to select gentle “long hops” which he could stroke towards the boundary. He can do that if he likes, but the AGFX share price has fallen -21% in the last couple of days, despite management reiterating that they would beat FY expectations.

I haven’t covered Argentex H1 results below because there’s not much to add to what I wrote following the trading update at the beginning of October. However, there’s a good discussion in Sharepad’s chat function about the company’s business model and new LTIP scheme. The chat function is gaining in popularity, so I encourage readers to join the discussion.

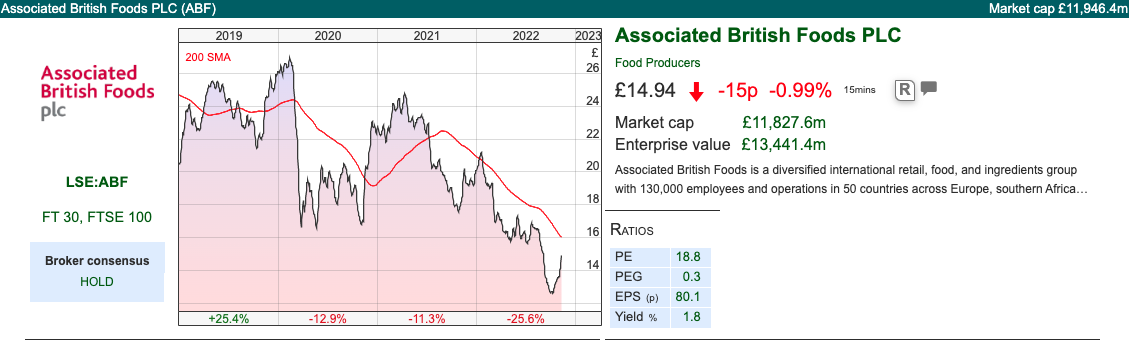

Instead, as food price inflation has been in the news, I have a look at ABF (famous for Kingsmill bread, Ryvita, Jordans and Dorset Cereals, but also Primark). ABF is reporting food sales +10%, which is much better than the supermarkets have announced.

Associated British Foods FY results to 17 Sept

ABF reported FY group revenue +22% to £17bn and statutory PBT +48% to £1.1bn earlier this week. Within that food sales are +10%, whereas Primark (just under half of sales) saw revenues +43% as the prior year was affected by lockdowns. At the start of this month, Sainsbury reported H1 grocery sales +0.2% despite claiming to be winning market share. Tesco reported food sales +1.6% at the beginning of October.

In fact, supermarkets have such a dominant position in the UK that they have to be careful about raising prices as this may invite media attention and political interference. So both Tesco and Sainsbury’s say that they are raising food prices more slowly than inflation to protect customers. This means that despite the concentrated market in the UK, which allows supermarkets to pressure small suppliers, margins have been squeezed and shareholders haven’t earnt a satisfactory return over the years. In my view, supermarkets have become like the banking sector where domestic market share and overseas expansion became more important than Return on Capital Employed. Both banks and supermarket sectors have also engaged in sale and leaseback of their properties, financial engineering to mask the deteriorating economics.

ABF seems like a better prospect. The company is split into 4 food divisions (Grocery, Sugar, Agriculture and Ingredients) and Retail, mainly Primark. The latter grew adj PBT +88%, as it enjoyed a rebound from the pandemic. However, they are still seeing problems in Germany and have taken a £206m impairment. They entered the market in 2009, though the pandemic didn’t help, low sales density in German stores pre-dated lockdowns.

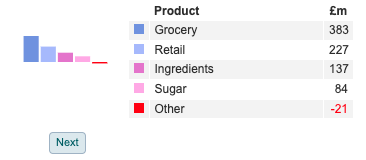

| ABF revenue breakdown by division (%) |

Breakdown by divisional PBT (£m) |

|

|

The largest food division, Grocery 22% of revenue and 26% of adjusted group profits, reports a Return on Capital of 29%. The graphics above are slightly out because Sharepad’s data provider takes a couple of days to update, but they represent a good rough guide. Grocery includes bread, cakes, breakfast cereal but also Twinnings tea. Food price inflation meant margin declined to 10.7% (v 11.5% previous year). The negotiating price rises with the retailers results in a delay in the recovery of input cost inflation (price of wheat, but also energy costs, including logistics). They also say competition is making it hard to raise prices. Allied Bakeries, the UK baking business, continues to be loss-making.

The sugar division, saw revenue grow +18% on a constant currency basis to £2bn, but adj PBT fell -5% to £162m. They’ve benefitted from European sugar prices, which were much higher this year with demand again exceeding supply. Profits were down because they spent £33m recommissioning Vivergo, a bioethanol plant in Hull. They expect sugar beet costs will increase significantly with growers facing higher input costs, they also mention that their own energy costs were hedged this year but presumably, the new hedges will be much more expensive. The bioethanol plant should compensate for some of that, as it produces electricity that is then fed into the grid.

The Agriculture division makes feed additives for farm animals and saw revenues up +11% to £1.7bn and adj PBT +7% to £47m. This is a low-margin business at the best of times, but margin fell to 2.7% driven by higher input costs. There’s also a ‘crop protection business’ – presumably, PR speak for pesticides that has had a much stronger year.

The Ingredients business, which makes bakers’ yeast, as well as more sinister-sounding food additives, saw revenues rise +19% to £1.8bn and adj PBT +3% to £159m. This division is involved in food processing, so makes vegetable seed oils, microbiome-modulating ingredients plus specialty lipids, surfactants and polyphenol-based active nutrients. Yum! There’s a fascinating book, written by a journalist who went undercover to look at how the food manufacturing industry works, called Not on the Label. I recommend it, the book describes how the industrialisation of food has been about taking basic commodities and adding value via processing, packaging and a marketing budget. Very often processed food that’s marketed as ‘healthy’ or ‘low fat, high fibre’ turns out to be the most problematic.

Related Parties: The company has a controlling shareholder / related party Wittington Investments Ltd which owns 54% of the shares. Wittington is owned by a charitable trust set up by the late W. Garfield Weston in 1958 and is run by Trustees who are his descendants. It’s unusual to have family ownership of a company this size, but I haven’t found any behaviour which harmed minority shareholders.

If anything family-owned businesses tend to be willing to make long-term decisions, rather than pressure to hit short-term targets. As it happens the company is currently buying back £500m of shares. The only institution I can see on the shareholder register is Capital Group which owns 4.99%.

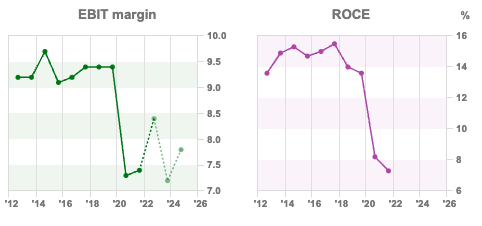

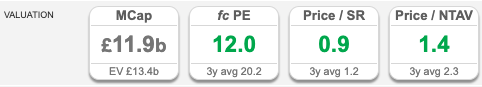

Valuation: The shares are trading on 13x Sept 2023F, well below 20x 3 year average. RoCE has been falling from a peak of 15.5% achieved in FY Sept 2017 to 7.3% achieved last year. That resulted in the share price de-rating. However, if we see RoCE expand, I would imagine that could drive a re-rating.

Opinion: ABF ought to do reasonably well in an era of rising food prices. Some investors may dislike sugar beet, the processed food industry or Primark, which might be a cause for concern from an ESG perspective. I have some sympathy with that. I feel that companies like Britvic, AG Barr and Nichols have been unfairly ‘scapegoated’ with the sugar tax.

My view is we should be looking more closely at the processed food industry and the broader causes of obesity and rise in food allergies (gluten, nut etc) not just the soft drinks makers. Ultimately there’s also some personal responsibility for people to educate themselves about what and how they eat. If this is an area that interests you, I recommend reading Felicity Lawrence, Joanna Blythman and Dr Robert Lustig.

Notes

The author owns shares in AGFX7

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary Part 2 | 11/11/22 |ABF, AGFX | Questions left unanswered

Bruce suggests that company managements who are reluctant to physically meet investors could be facing a more uncertain outlook. Companies covered ABF and AGFX

The FTSE 100 was up +1.4% in the last 5 days to 7296, while the Nasdaq100 and S&P500 were up +0.8% and +1.0% respectively. The pound weakened slightly versus to 1.138 to the dollar, down from 1.155 at the start of this week. The price of oil at $95 per barrel has remained in a trading range between $90 and $100 per barrel since the start of October.

I hope that everyone is looking forward to the physical event at Mello, on Wed 16th and Thursday 17th next week. On Monday’s webinar, David commented that he had no difficulty getting individuals to attend Mello, but many company managementS are reluctant to get out in front of investors and meet them face to face. He said that over half the companies that he’d invited and turned down the opportunity, which is a much higher rate than in previous years. His interpretation was websites like PIWorld and InvestorMeetCompany allowed management to feel they were ticking the shareholder engagement box, without having to physically meet investors.

He could be correct. I have a different interpretation though, based on my experience in financial PR and corporate broking. When management gives out guidance to brokers and investors, they are 90-95% confident that the numbers will be achieved. But unless you have a subscription business with Annual Recurring Revenue, forward-looking statements are the best guess of the most likely outcome. Even if you do have good revenue visibility from subscriptions, consumers can cancel as the share price performance of Netflix -57% YTD shows.

We are in a particularly uncertain environment at the moment, and I suspect many management teams are worried that they may have to revise down guidance. However, they can’t be 100% sure if the environment is deteriorating or they might just hit their numbers (for supply chain difficulties, conditions may even be improving). It would be natural for management to feel uncomfortable going out in front of investors, telling an upbeat story and then in a month or two’s time realising that they will then have to warn versus expectations. If David published his list of companies that are not attending, we might see an above average future profit warnings.

On the positive side, that does suggest good confidence from the companies that are still getting out in front of investors. I’m glad to see SDI Group, which I own is presenting!

One advantage of Mello, both the physical events and the online webinar’s is that David does let investors ask company management ‘uncomfortable’ questions. This is not the case with InvestorMeetCompany or PIWorld, in my experience. For instance, I listened into the Argentex H1 presentation on IMC this week, and asked:

“What would happen to the company’s cashflow statement if all the revenue came from trading forwards or structured solutions (FX options)?”

Management skipped this question. On the call they did say that options were higher margin and good for cashflow because clients paid the premium upfront. They then added that they wouldn’t want the product (currently 9.5% of revenue) to rise above 20% of revenue. The obvious question is:

“Why not? What are the risks with structured solutions?”

I also asked AGFX management how they stress-tested credit risk. A forward contract ought to be a rates/currency product – but we’ve seen that actually there’s a component of credit risk (AGFX took a Credit Value Adjustment of £0.9m, of which half was a specific counterparty). AGFX has been taking market share from high street banks, so there’s a chance they are doing business where bankers fear to tread.

To use a cricket analogy, I don’t think my questions were aggressive “bouncers”. Yet Harry Adams, the CEO, hid his bat behind his pad to these deliveries which were “bowled down the corridor of uncertainty around the off stump”. Instead, he preferred to select gentle “long hops” which he could stroke towards the boundary. He can do that if he likes, but the AGFX share price has fallen -21% in the last couple of days, despite management reiterating that they would beat FY expectations.

I haven’t covered Argentex H1 results below because there’s not much to add to what I wrote following the trading update at the beginning of October. However, there’s a good discussion in Sharepad’s chat function about the company’s business model and new LTIP scheme. The chat function is gaining in popularity, so I encourage readers to join the discussion.

Instead, as food price inflation has been in the news, I have a look at ABF (famous for Kingsmill bread, Ryvita, Jordans and Dorset Cereals, but also Primark). ABF is reporting food sales +10%, which is much better than the supermarkets have announced.

Associated British Foods FY results to 17 Sept

ABF reported FY group revenue +22% to £17bn and statutory PBT +48% to £1.1bn earlier this week. Within that food sales are +10%, whereas Primark (just under half of sales) saw revenues +43% as the prior year was affected by lockdowns. At the start of this month, Sainsbury reported H1 grocery sales +0.2% despite claiming to be winning market share. Tesco reported food sales +1.6% at the beginning of October.

In fact, supermarkets have such a dominant position in the UK that they have to be careful about raising prices as this may invite media attention and political interference. So both Tesco and Sainsbury’s say that they are raising food prices more slowly than inflation to protect customers. This means that despite the concentrated market in the UK, which allows supermarkets to pressure small suppliers, margins have been squeezed and shareholders haven’t earnt a satisfactory return over the years. In my view, supermarkets have become like the banking sector where domestic market share and overseas expansion became more important than Return on Capital Employed. Both banks and supermarket sectors have also engaged in sale and leaseback of their properties, financial engineering to mask the deteriorating economics.

ABF seems like a better prospect. The company is split into 4 food divisions (Grocery, Sugar, Agriculture and Ingredients) and Retail, mainly Primark. The latter grew adj PBT +88%, as it enjoyed a rebound from the pandemic. However, they are still seeing problems in Germany and have taken a £206m impairment. They entered the market in 2009, though the pandemic didn’t help, low sales density in German stores pre-dated lockdowns.

The largest food division, Grocery 22% of revenue and 26% of adjusted group profits, reports a Return on Capital of 29%. The graphics above are slightly out because Sharepad’s data provider takes a couple of days to update, but they represent a good rough guide. Grocery includes bread, cakes, breakfast cereal but also Twinnings tea. Food price inflation meant margin declined to 10.7% (v 11.5% previous year). The negotiating price rises with the retailers results in a delay in the recovery of input cost inflation (price of wheat, but also energy costs, including logistics). They also say competition is making it hard to raise prices. Allied Bakeries, the UK baking business, continues to be loss-making.

The sugar division, saw revenue grow +18% on a constant currency basis to £2bn, but adj PBT fell -5% to £162m. They’ve benefitted from European sugar prices, which were much higher this year with demand again exceeding supply. Profits were down because they spent £33m recommissioning Vivergo, a bioethanol plant in Hull. They expect sugar beet costs will increase significantly with growers facing higher input costs, they also mention that their own energy costs were hedged this year but presumably, the new hedges will be much more expensive. The bioethanol plant should compensate for some of that, as it produces electricity that is then fed into the grid.

The Agriculture division makes feed additives for farm animals and saw revenues up +11% to £1.7bn and adj PBT +7% to £47m. This is a low-margin business at the best of times, but margin fell to 2.7% driven by higher input costs. There’s also a ‘crop protection business’ – presumably, PR speak for pesticides that has had a much stronger year.

The Ingredients business, which makes bakers’ yeast, as well as more sinister-sounding food additives, saw revenues rise +19% to £1.8bn and adj PBT +3% to £159m. This division is involved in food processing, so makes vegetable seed oils, microbiome-modulating ingredients plus specialty lipids, surfactants and polyphenol-based active nutrients. Yum! There’s a fascinating book, written by a journalist who went undercover to look at how the food manufacturing industry works, called Not on the Label. I recommend it, the book describes how the industrialisation of food has been about taking basic commodities and adding value via processing, packaging and a marketing budget. Very often processed food that’s marketed as ‘healthy’ or ‘low fat, high fibre’ turns out to be the most problematic.

Related Parties: The company has a controlling shareholder / related party Wittington Investments Ltd which owns 54% of the shares. Wittington is owned by a charitable trust set up by the late W. Garfield Weston in 1958 and is run by Trustees who are his descendants. It’s unusual to have family ownership of a company this size, but I haven’t found any behaviour which harmed minority shareholders.

If anything family-owned businesses tend to be willing to make long-term decisions, rather than pressure to hit short-term targets. As it happens the company is currently buying back £500m of shares. The only institution I can see on the shareholder register is Capital Group which owns 4.99%.

Valuation: The shares are trading on 13x Sept 2023F, well below 20x 3 year average. RoCE has been falling from a peak of 15.5% achieved in FY Sept 2017 to 7.3% achieved last year. That resulted in the share price de-rating. However, if we see RoCE expand, I would imagine that could drive a re-rating.

Opinion: ABF ought to do reasonably well in an era of rising food prices. Some investors may dislike sugar beet, the processed food industry or Primark, which might be a cause for concern from an ESG perspective. I have some sympathy with that. I feel that companies like Britvic, AG Barr and Nichols have been unfairly ‘scapegoated’ with the sugar tax.

My view is we should be looking more closely at the processed food industry and the broader causes of obesity and rise in food allergies (gluten, nut etc) not just the soft drinks makers. Ultimately there’s also some personal responsibility for people to educate themselves about what and how they eat. If this is an area that interests you, I recommend reading Felicity Lawrence, Joanna Blythman and Dr Robert Lustig.

Notes

The author owns shares in AGFX7

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.