Bruce looks at two financial businesses that recently reported Q3 results, both delivering around 7% RoCE. Yet one trades on 5x sales, and the other 0.7x. LSEG and TCAP.

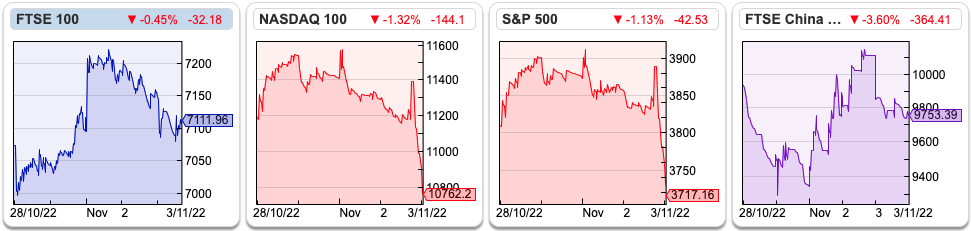

The FTSE 100 is up +0.7% in the last 5 days. Nasdaq100 is down -3.4% and the S&P500 was down -2.2%. Much of that sell-off came after the Fed raised rates by 75bp and Powell said that “the ultimate level of interest rates will be higher than previously expected.” The FTSE China 50 index was down -1.9% over the last 5 days as rumours that the Covid Zero policy would be re-thought proved to be unfounded.

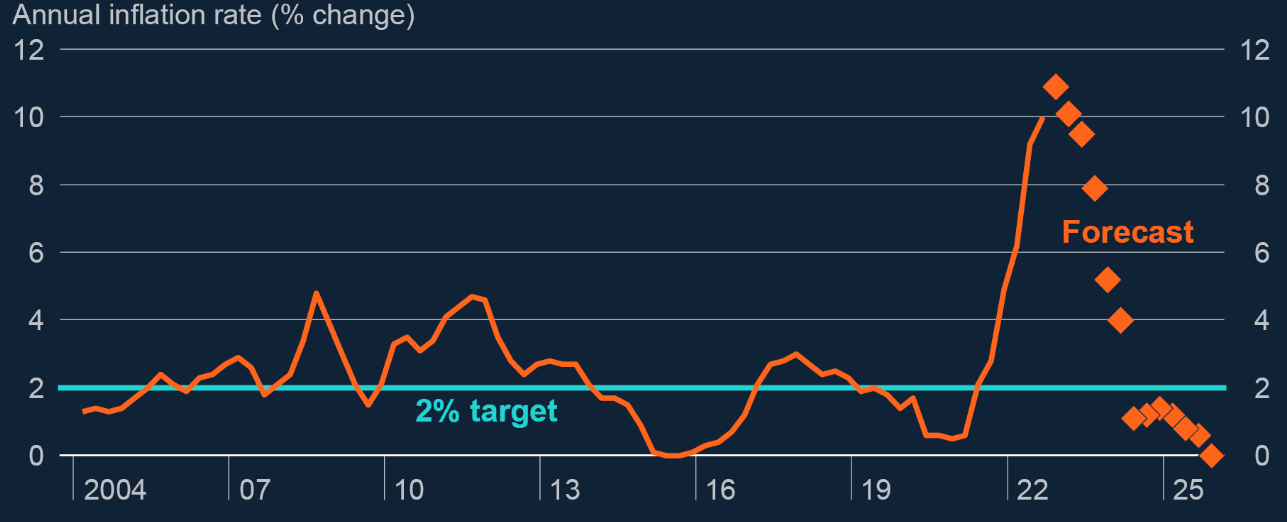

On Thursday the Bank of England raised interest rates by 75bp to 3% and shared this chart showing that they still expect inflation to fall sharply from the middle of next year. Markets are pricing in UK interest rates to peak at c. 4.5% in September next year (down from 5.25%). That’s relatively dovish compared to the Fed, which meant the pound fell against the dollar to 1.11 and is now down -3.5% in the last week.

I did suggest last year that the $7 trillion increase in G7 Central Bank balance sheets might cause inflation, and the next crisis might be around actions taken by regulators trying to stabilise markets during the pandemic.

Here’s a link to a ‘fireside chat’ with Jim Chanos of Kynikos, the famous short seller. In February 2021 new SPACs were raising $12bn a week – he says if you extrapolated that out for the whole month, the entire US savings rate was going into SPACs. It’s hard to believe some of the speculative behaviour wasn’t driven by Central Bank liquidity. Chanos doesn’t get everything right; he was too early with Tesla short (TSLA – 39% YTD, he can laugh about it now) and has been shorting Chinese stocks for a decade. His body language suggests he’s having a good year though!

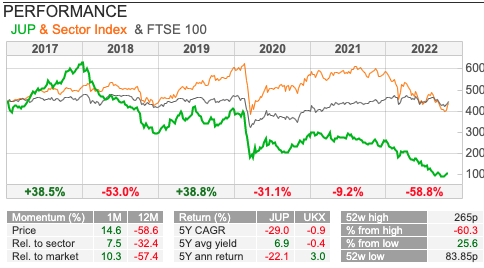

I have tried short selling with CFD’s, but gave up because I found it too hard. I’ve just found some old notes. In May 2017 I opened a short position on Jupiter AM at 472p, thinking that the fund manager wasn’t differentiated and had to compete with low-cost competitors like quant funds, index trackers and amateur investors (with the help of SharePad) simply deciding they could do a better job than the professionals. Friends who had become active fund managers told me that as long as their performance was top quartile, the economics of fund management were wonderful. But if they had one or two difficult quarters, the outflows from their fund made the business model very difficult (operational gearing of fixed costs on variable revenue). In the US there have been $790bn of mutual fund outflows so far this year. So the structural challenges that Jupiter faced informed my short thesis.

There are two elements to short selling though: i) good ideas ii) risk management. The latter is important because as your short goes against you and it rises in value, the position size increases. For that reason, in July the same year when the price rose to 520p, I took the loss. That was good risk management because the JUP shares peaked at c. 620p at the beginning of 2018 (phew). I have mixed feelings though as the JUP share price fell below 90p last month (argh!) You can’t eat vindication. Over the same time period Impax AM, the specialist environmental asset manager, which has seen billions of inflows even as others have struggled, is up c. 6.5x times. So it’s worth thinking about industry trends rather than just accounting data, ratios and valuation.

Chanos now suggests being wary of anything that offers double-digit returns when the fundamental asset can only deliver low single digits. The risk isn’t so much credit risk, rather than duration risk – the cashflows keep coming but are less valuable in a higher rate environment. He is negative on rent to own housing, data centres, Private Equity: low-yielding assets that have been levered up 5x. We might add borrowing against the value of gilts to his list!

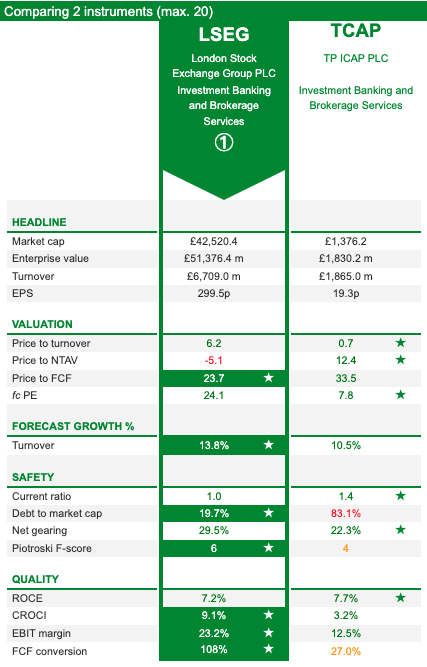

This week I look at TP ICAP Q3 results and compare them with the much larger London Stock Exchange. Both have made recent acquisitions that completed in H1 last year (LSE Refinitiv, TCAP Liquidnet) and are diversifying from their core business. Both companies ought to benefit from network effects, counterparties want to trade where other counterparties are trading, because this creates liquidity. They also collect trading data which in itself is valuable.

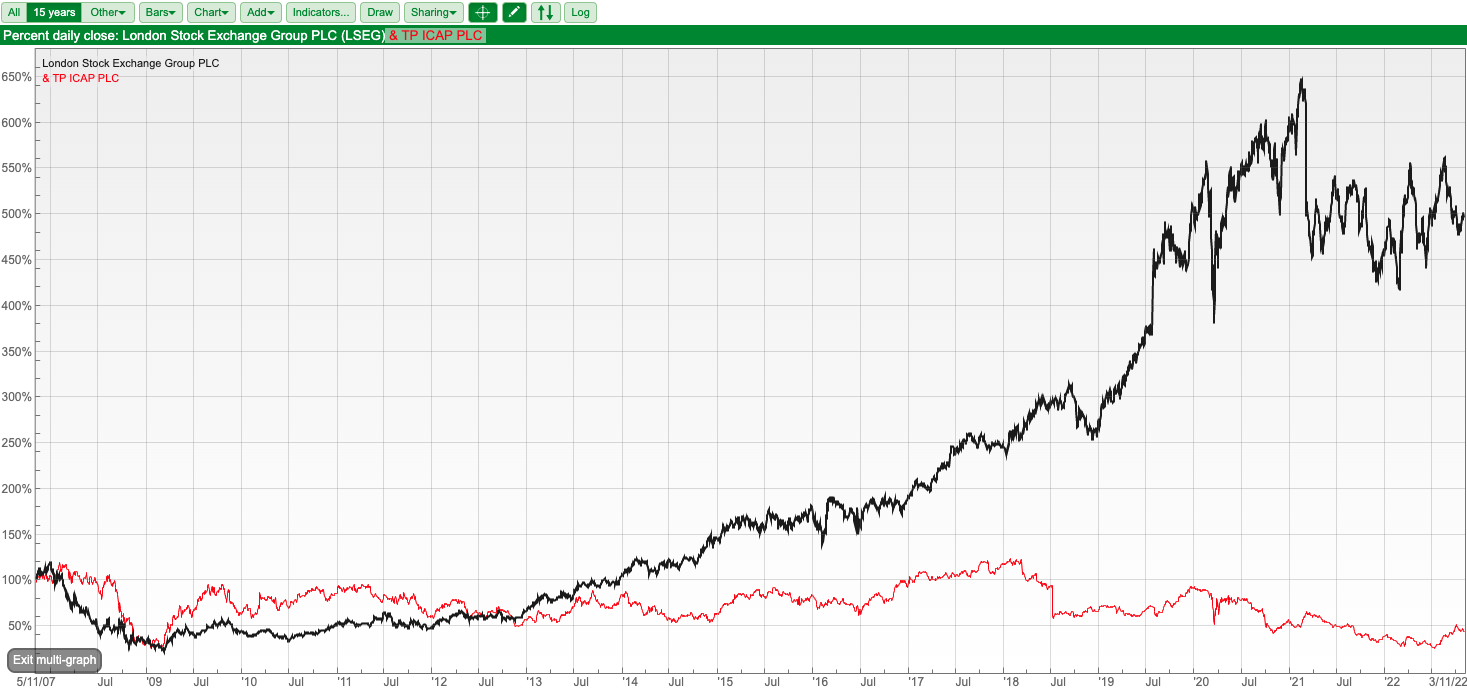

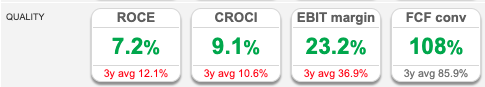

However, the LSE has been a much better performer after the financial crisis and now trades on 5x forecast sales versus TCAP 0.7x. In part that’s due to regulators trying to move more activity onto exchanges, rather than Over The Counter (OTC) which is TP ICAP’s core Global Broking business. Even without that regulatory trend though, more trading is becoming electronic rather than ‘voice broking’ over the phone. Interestingly both businesses are reporting a similar 7% RoCE.

Finally, a reminder that on Monday 7th November 2022 there’s an online Mello event, with the physical event in Chiswick, W London taking place a week and a half later on 16th & 17th November 2022. It looks like David has got many good speakers, so it should be a fun event.

TP ICAP

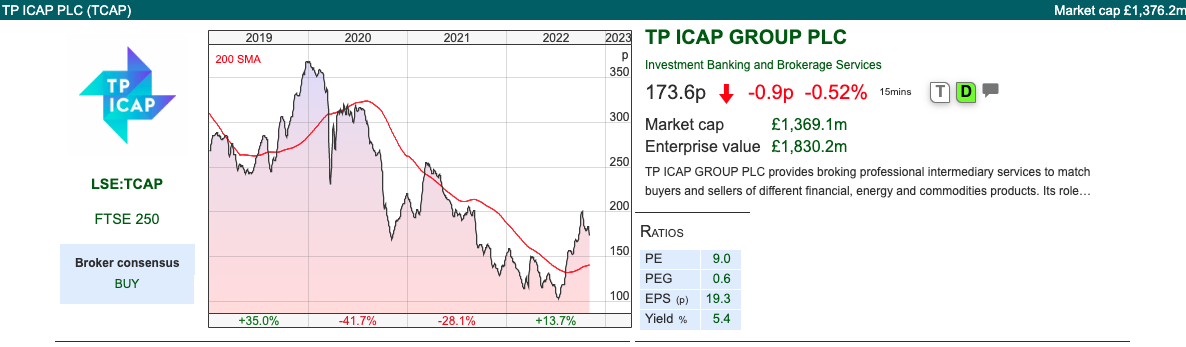

TP ICAP reported Q3 results earlier this week and said FY Dec 2022F should be ‘in line’ with expectations. SharePad shows FY Dec 2022F PBT of £213m and EPS of 22p. Q3 revenue was up +5%, excluding currency effect. TCAP reports in pounds, but generates 60% of group revenues in US dollars v 40% of costs. So the Interdealer Broker benefits from a strong dollar and on a reported basis Q3 revenues were up +14% to £508m. Good to see a reported revenue growth figure that is higher than a company-adjusted one. The ‘in-line’ performance seems to be masking strong performance in Global Broking (their OTC trading business) and weak performance in Liquidnet (a recent acquisition).

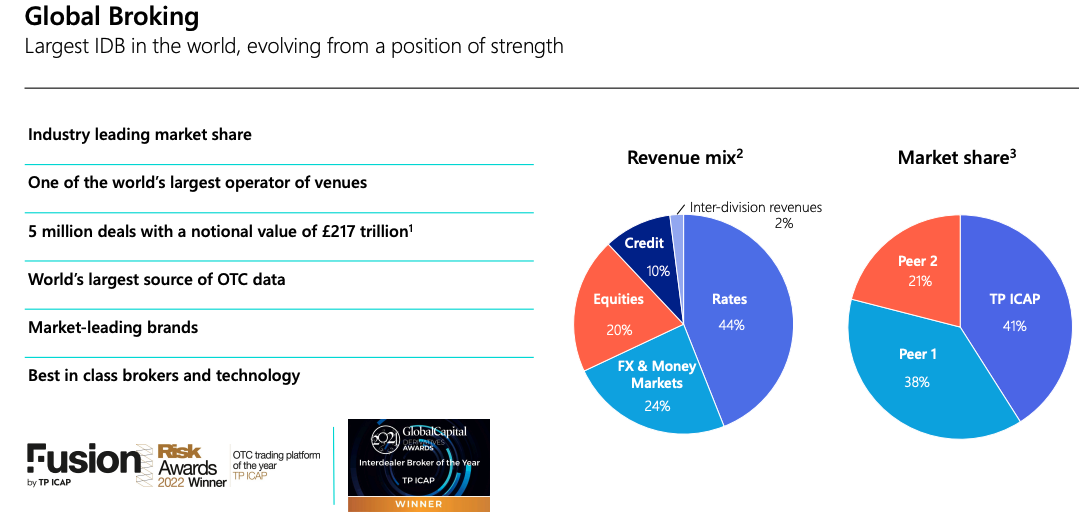

The group’s largest division is Global Broking, c. 60% of revenue and 75% of adj PBT. They have a 41% market share in OTC, in a concentrated market (only 2 other competitors – market share pie chart below right). Around 2/3 of revenues comes from rates and FX products. Last year Global Broking did 5m transactions with a notional value of £217 trillion.

Global Broking revenues were up +12% (or +20% on a reported basis). All asset classes (see revenue mix in the pie chart above left) generated high single digit to double digit growth, reflecting the continued strong performance. So the OTC business seems to benefit from current market conditions.

Unfortunately, that’s not the whole story. In Sept 2020 management announced the acquisition of Liquidnet, which is an equities trading exchange which TCAP’s management believe they can use to push into electronic trading of bonds and swaps in competition with companies such as Bloomberg, Tradeweb and MarketAxess. It represents around a third of TP ICAP’s group revenues, I couldn’t find PBT data and though it looks less profitable than other TCAP divisions. The acquisition, which completed in the first half of 2021 also looks expensive and poorly timed. The total consideration was between $575m and $700m (of which $525m was cash, and the balance earn-outs). To pay for it TCAP raised £315m in a rights issue at 140p per share, and cut the group dividend by 50%. Last week’s RNS reveals Liquidnet revenues were down -22% Q3 v Q3 last year.

Then in March this year Justin Hughes, an activist hedge fund manager took a position with total return swaps and urged management to stop buying companies and instead start selling. Hughes appears to have persuaded other shareholders that the group’s data subsidiary, Parameta, could be worth £1.5bn on its own, which is greater than TCAP’s entire market cap. Parameta, is 10% of group revenue, but reports a high adj EBIT of 40% margin and contributes a quarter of adj PBT at H1 stage. The business grew Q3 revenue +6% on a constant currency basis (or +22% on a reported basis). Hughes could be right, however, TP ICAP management say that Parameta only works because of the synergies with the Global Broking OTC division. They use the analogy of the exhaust from the Global Broking engine which is the fuel for Parameta Solutions, the Data & Analytics business.

Valuation: TP ICAP is currently trading on a PER below 7x Dec 2023F and 2024F, suggesting considerable scepticism towards forecasts. The group trades on 0.7x forecast sales. Recent history since 2015 when Tullett Prebon merged with ICAP, has been disappointing as the share price has roughly halved. More recently, TCAP share price is up +75% from its mid-July lows.

Opinion: I think it’s a fascinating situation, and bought a starter position earlier in the year, and pitched it on Mello at the BASH.* For a while the stock continued falling and the dividend yield hit 9.5%. I should have increased my position size but was put off after I talked to a contact who used to deal with TP ICAP and was negative on the company. That now looks too cautious, as even though the Liquidnet deal could be ill-judged, helpful conditions in Global Broking have meant the group should deliver versus expectations.

London Stock Exchange

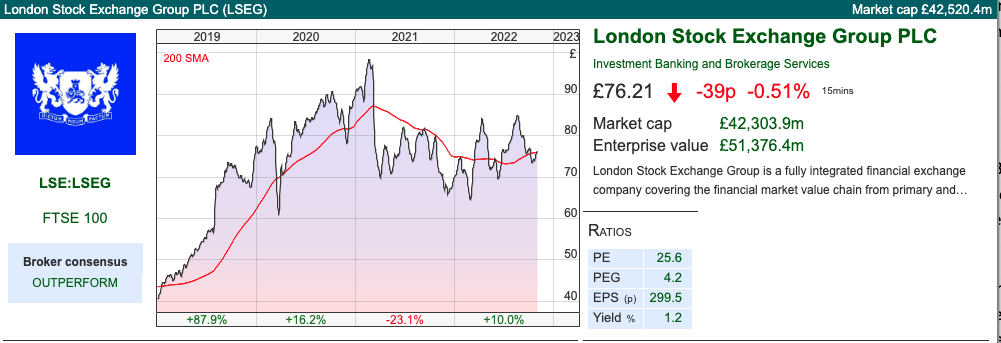

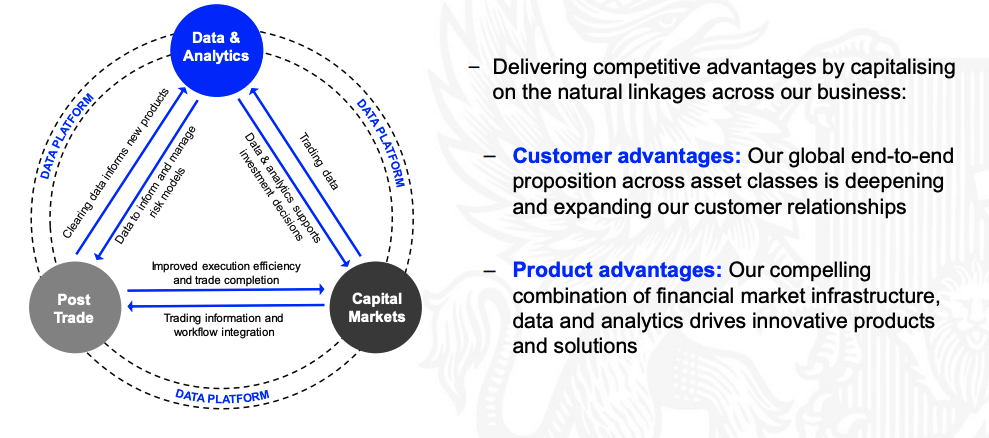

The LSE reported Q3 results a week earlier. Q3 revenues were up +15% to £2bn v Q3 last year. Medium-term revenue guidance is for 5-7% CAGR. I think most investors would agree LSEG is a more resilient business, with an EBIT margin of 23% double TCAP 12.5%. However, both are trying to expand into related activities and exploit natural linkages, some of this thinking is similar to what drove the banking sector to consolidate a couple of decades ago.

In 2019, LSE announced they were buying Refinitiv, which has the Eikon subscription database, similar to Bloomberg, for $27bn. The deal only completed last year after a long investigation by European regulators. Refinitiv was a subsidiary of news and data company Thomson Reuters, but was sold to a Private Equity consortium in 2018, who then flipped it to the LSE after 18 months. Data and analytics is now over 70% of LSEG group revenue. Refinitiv grew Annual Subscription Revenue +5.8% Q3 v Q3 last year, which has almost doubled since the acquisition are completed in Q1 2021.

Valuation: The LSE is currently trading on 21x Dec 2023F PER falling to 19x 2024F. That equates to 5x sales, which seems rather expensive for a company reporting 7% RoCE.

Opinion: I think the two businesses make an interesting contrast. The LSE’s history goes back hundreds of years, to Change Alley but for most of that time, the exchange was owned by its members. The LSE also enjoys a regulatory tailwind, being an exchange rather than an Interdealer Broker. Sharepad’s compare feature below does show a very large valuation gap though for businesses that are reporting similar revenue growth and RoCE.

Notes

The author owns shares in TP ICAP

*I pitched BGEO in early 2021 at Mello, since when the shares have more than doubled. Past performance not a predictor of future performance, but sometimes you can eat vindication ☺

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary Part 2 | 4/11/22 |LSEG, TCAP| You can’t eat vindication

Bruce looks at two financial businesses that recently reported Q3 results, both delivering around 7% RoCE. Yet one trades on 5x sales, and the other 0.7x. LSEG and TCAP.

The FTSE 100 is up +0.7% in the last 5 days. Nasdaq100 is down -3.4% and the S&P500 was down -2.2%. Much of that sell-off came after the Fed raised rates by 75bp and Powell said that “the ultimate level of interest rates will be higher than previously expected.” The FTSE China 50 index was down -1.9% over the last 5 days as rumours that the Covid Zero policy would be re-thought proved to be unfounded.

On Thursday the Bank of England raised interest rates by 75bp to 3% and shared this chart showing that they still expect inflation to fall sharply from the middle of next year. Markets are pricing in UK interest rates to peak at c. 4.5% in September next year (down from 5.25%). That’s relatively dovish compared to the Fed, which meant the pound fell against the dollar to 1.11 and is now down -3.5% in the last week.

I did suggest last year that the $7 trillion increase in G7 Central Bank balance sheets might cause inflation, and the next crisis might be around actions taken by regulators trying to stabilise markets during the pandemic.

Here’s a link to a ‘fireside chat’ with Jim Chanos of Kynikos, the famous short seller. In February 2021 new SPACs were raising $12bn a week – he says if you extrapolated that out for the whole month, the entire US savings rate was going into SPACs. It’s hard to believe some of the speculative behaviour wasn’t driven by Central Bank liquidity. Chanos doesn’t get everything right; he was too early with Tesla short (TSLA – 39% YTD, he can laugh about it now) and has been shorting Chinese stocks for a decade. His body language suggests he’s having a good year though!

I have tried short selling with CFD’s, but gave up because I found it too hard. I’ve just found some old notes. In May 2017 I opened a short position on Jupiter AM at 472p, thinking that the fund manager wasn’t differentiated and had to compete with low-cost competitors like quant funds, index trackers and amateur investors (with the help of SharePad) simply deciding they could do a better job than the professionals. Friends who had become active fund managers told me that as long as their performance was top quartile, the economics of fund management were wonderful. But if they had one or two difficult quarters, the outflows from their fund made the business model very difficult (operational gearing of fixed costs on variable revenue). In the US there have been $790bn of mutual fund outflows so far this year. So the structural challenges that Jupiter faced informed my short thesis.

There are two elements to short selling though: i) good ideas ii) risk management. The latter is important because as your short goes against you and it rises in value, the position size increases. For that reason, in July the same year when the price rose to 520p, I took the loss. That was good risk management because the JUP shares peaked at c. 620p at the beginning of 2018 (phew). I have mixed feelings though as the JUP share price fell below 90p last month (argh!) You can’t eat vindication. Over the same time period Impax AM, the specialist environmental asset manager, which has seen billions of inflows even as others have struggled, is up c. 6.5x times. So it’s worth thinking about industry trends rather than just accounting data, ratios and valuation.

Chanos now suggests being wary of anything that offers double-digit returns when the fundamental asset can only deliver low single digits. The risk isn’t so much credit risk, rather than duration risk – the cashflows keep coming but are less valuable in a higher rate environment. He is negative on rent to own housing, data centres, Private Equity: low-yielding assets that have been levered up 5x. We might add borrowing against the value of gilts to his list!

This week I look at TP ICAP Q3 results and compare them with the much larger London Stock Exchange. Both have made recent acquisitions that completed in H1 last year (LSE Refinitiv, TCAP Liquidnet) and are diversifying from their core business. Both companies ought to benefit from network effects, counterparties want to trade where other counterparties are trading, because this creates liquidity. They also collect trading data which in itself is valuable.

However, the LSE has been a much better performer after the financial crisis and now trades on 5x forecast sales versus TCAP 0.7x. In part that’s due to regulators trying to move more activity onto exchanges, rather than Over The Counter (OTC) which is TP ICAP’s core Global Broking business. Even without that regulatory trend though, more trading is becoming electronic rather than ‘voice broking’ over the phone. Interestingly both businesses are reporting a similar 7% RoCE.

Finally, a reminder that on Monday 7th November 2022 there’s an online Mello event, with the physical event in Chiswick, W London taking place a week and a half later on 16th & 17th November 2022. It looks like David has got many good speakers, so it should be a fun event.

TP ICAP

TP ICAP reported Q3 results earlier this week and said FY Dec 2022F should be ‘in line’ with expectations. SharePad shows FY Dec 2022F PBT of £213m and EPS of 22p. Q3 revenue was up +5%, excluding currency effect. TCAP reports in pounds, but generates 60% of group revenues in US dollars v 40% of costs. So the Interdealer Broker benefits from a strong dollar and on a reported basis Q3 revenues were up +14% to £508m. Good to see a reported revenue growth figure that is higher than a company-adjusted one. The ‘in-line’ performance seems to be masking strong performance in Global Broking (their OTC trading business) and weak performance in Liquidnet (a recent acquisition).

The group’s largest division is Global Broking, c. 60% of revenue and 75% of adj PBT. They have a 41% market share in OTC, in a concentrated market (only 2 other competitors – market share pie chart below right). Around 2/3 of revenues comes from rates and FX products. Last year Global Broking did 5m transactions with a notional value of £217 trillion.

Global Broking revenues were up +12% (or +20% on a reported basis). All asset classes (see revenue mix in the pie chart above left) generated high single digit to double digit growth, reflecting the continued strong performance. So the OTC business seems to benefit from current market conditions.

Unfortunately, that’s not the whole story. In Sept 2020 management announced the acquisition of Liquidnet, which is an equities trading exchange which TCAP’s management believe they can use to push into electronic trading of bonds and swaps in competition with companies such as Bloomberg, Tradeweb and MarketAxess. It represents around a third of TP ICAP’s group revenues, I couldn’t find PBT data and though it looks less profitable than other TCAP divisions. The acquisition, which completed in the first half of 2021 also looks expensive and poorly timed. The total consideration was between $575m and $700m (of which $525m was cash, and the balance earn-outs). To pay for it TCAP raised £315m in a rights issue at 140p per share, and cut the group dividend by 50%. Last week’s RNS reveals Liquidnet revenues were down -22% Q3 v Q3 last year.

Then in March this year Justin Hughes, an activist hedge fund manager took a position with total return swaps and urged management to stop buying companies and instead start selling. Hughes appears to have persuaded other shareholders that the group’s data subsidiary, Parameta, could be worth £1.5bn on its own, which is greater than TCAP’s entire market cap. Parameta, is 10% of group revenue, but reports a high adj EBIT of 40% margin and contributes a quarter of adj PBT at H1 stage. The business grew Q3 revenue +6% on a constant currency basis (or +22% on a reported basis). Hughes could be right, however, TP ICAP management say that Parameta only works because of the synergies with the Global Broking OTC division. They use the analogy of the exhaust from the Global Broking engine which is the fuel for Parameta Solutions, the Data & Analytics business.

Valuation: TP ICAP is currently trading on a PER below 7x Dec 2023F and 2024F, suggesting considerable scepticism towards forecasts. The group trades on 0.7x forecast sales. Recent history since 2015 when Tullett Prebon merged with ICAP, has been disappointing as the share price has roughly halved. More recently, TCAP share price is up +75% from its mid-July lows.

Opinion: I think it’s a fascinating situation, and bought a starter position earlier in the year, and pitched it on Mello at the BASH.* For a while the stock continued falling and the dividend yield hit 9.5%. I should have increased my position size but was put off after I talked to a contact who used to deal with TP ICAP and was negative on the company. That now looks too cautious, as even though the Liquidnet deal could be ill-judged, helpful conditions in Global Broking have meant the group should deliver versus expectations.

London Stock Exchange

The LSE reported Q3 results a week earlier. Q3 revenues were up +15% to £2bn v Q3 last year. Medium-term revenue guidance is for 5-7% CAGR. I think most investors would agree LSEG is a more resilient business, with an EBIT margin of 23% double TCAP 12.5%. However, both are trying to expand into related activities and exploit natural linkages, some of this thinking is similar to what drove the banking sector to consolidate a couple of decades ago.

In 2019, LSE announced they were buying Refinitiv, which has the Eikon subscription database, similar to Bloomberg, for $27bn. The deal only completed last year after a long investigation by European regulators. Refinitiv was a subsidiary of news and data company Thomson Reuters, but was sold to a Private Equity consortium in 2018, who then flipped it to the LSE after 18 months. Data and analytics is now over 70% of LSEG group revenue. Refinitiv grew Annual Subscription Revenue +5.8% Q3 v Q3 last year, which has almost doubled since the acquisition are completed in Q1 2021.

Valuation: The LSE is currently trading on 21x Dec 2023F PER falling to 19x 2024F. That equates to 5x sales, which seems rather expensive for a company reporting 7% RoCE.

Opinion: I think the two businesses make an interesting contrast. The LSE’s history goes back hundreds of years, to Change Alley but for most of that time, the exchange was owned by its members. The LSE also enjoys a regulatory tailwind, being an exchange rather than an Interdealer Broker. Sharepad’s compare feature below does show a very large valuation gap though for businesses that are reporting similar revenue growth and RoCE.

Notes

The author owns shares in TP ICAP

*I pitched BGEO in early 2021 at Mello, since when the shares have more than doubled. Past performance not a predictor of future performance, but sometimes you can eat vindication ☺

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.