As the FTSE 100 reaches a new peak, Maynard looks at another blue-chip measure setting record highs. Plus coverage of GSK, DARK, SOM and TPX.

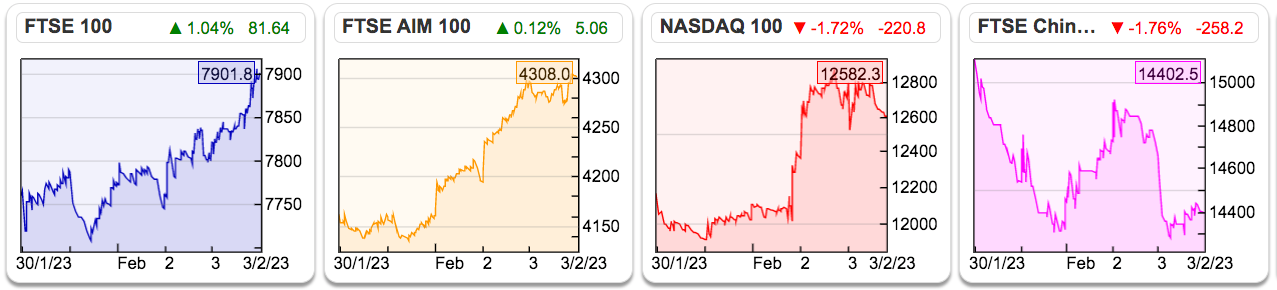

Bruce asked me to compile these commentaries while he is away on holiday. Many private investors swear their portfolios perform better when they’re not watching the markets, and a record FTSE 100 close on Friday bodes well for Bruce

The FTSE 100 climbed 1.8% last week to reach 7,902 to extend its remarkably resilient performance since the start of 2022. The past 13 months have seen the UK benchmark advance 7% with only Brazil (+5%) and India (+1%) the only other main indices showing positive returns during the same time.

Another FTSE 100 measure setting a new high is the average word count within a blue-chip annual report. The Quoted Companies Alliance calculates the typical FTSE 100 report has expanded by 46% since 2017, with the average document now weighing in at 147,000 words on 237 pages.

The QCA is therefore “calling for an overhaul of current reporting demands and better guidance so that companies can save time and money while still making appropriate disclosures to investors and the wider stakeholder community.”

The QCA quite rightly mentions ending repetition, but sadly lacks any insight as to exactly which disclosures should be overhauled. Annual reports contain all sorts of useful ‘outsider information‘ for diligent readers (e.g. audit reports) and quite often shareholder problems are caused by those companies not disclosing enough!

A small irony within the QCA’s argument is many small companies adhere to the QCA’s own governance code and explain how they meet that code in their annual report. One of this week’s shares — TPXimpact — devoted five pages to such matters in its 2022 report.

Below I look at FY 2022 results from GSK (2021 annual report: 316 pages), further misgivings at Darktrace (2022 annual report: 206 pages), an update from Somero (2021 annual report: 56 pages) and the profit warning issued by TPXimpact (2022 annual report: 192 pages).

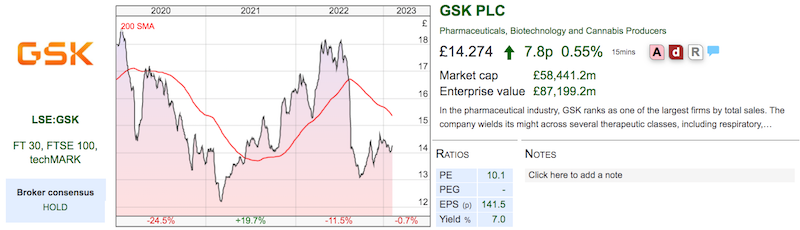

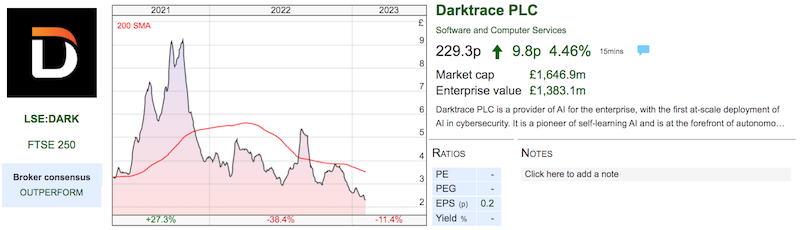

GSK (GSK): Final results

NEWS: The FTSE 100 biopharma last week announced its first annual results following the demerger of Haleon back in July.

The statement contained GSK’s usual array of figures — a mix of adjusted/unadjusted profits, growth rates based on actual/constant currencies, progress including/excluding Covid-19 treatments and contributions with/without Haleon.

Taking the adjusted, constant-currency, Covid-included and Haleon-excluded version, turnover gained 13% and adjusted profit gained 14%. Guidance for 2023 is turnover up c7% and adjusted profit up c11%.

The numbers and forecasts seemed to meet the expectations set out in 2021 when GSK announced its grand demerger plan and predicted 2021-2026 sales and profit CAGRs of 5% and 10% respectively.

A sales ambition of £33b by 2031 now seems quite light after the statement showed revenue at £29b. But one item not moving higher is the dividend, which is expected to be unchanged for 2023.

OPINION: The £14 shares hardly look expensive trading on a 10-11x multiple and yielding 4.1%. But the standstill dividend for this year is telling, especially after the payout was chopped as part of the consumer-product demerger.

GSK had paid a constant 100p per share dividend between 2014 and 2021, but post-demerger the payout is 56.5p with spin-off Haleon perhaps adding a further 6p this year. The payments add up to a near-40% income drop versus the pre-demerger GSK.

The dividend chop seems to be a belated reaction to GSK’s disturbing long-term performance. The economics of pharmaceuticals have clearly deteriorated since the good old Zantac days, with the recent £14 being first achieved in 1997.

The validity of GSK’s financial reporting is also questionable given the group’s regular write-downs and restructuring charges. Collective 2017-2021 statutory earnings of £23b were inflated by adjustments of £10b to give underlying earnings of £33b.

The Haleon spin-off buys GSK some time to deliver on its “step-change in growth” promise, but boss Dame Emma Walmsley has held the top job for six years now while predecessors Jean-Pierre Garnier and Sir Andrew Witty both lasted eight before deciding to stand down.

That form guide suggests the next few years could herald new leadership and perhaps another corporate reshuffle, backed by exasperated long-term investors who may now be rueing Dame Emma’s decision not to engage with Unilever about its £50b approach for Haleon. The spin-off has a current £30b market value.

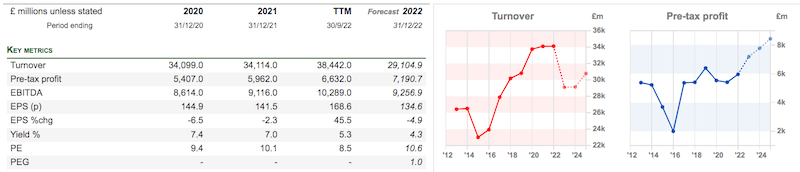

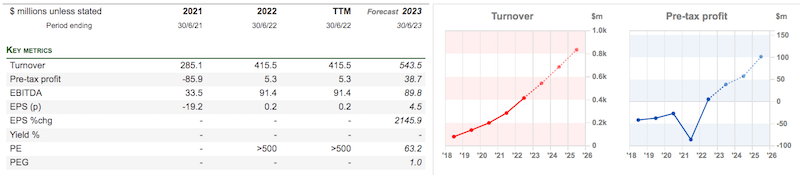

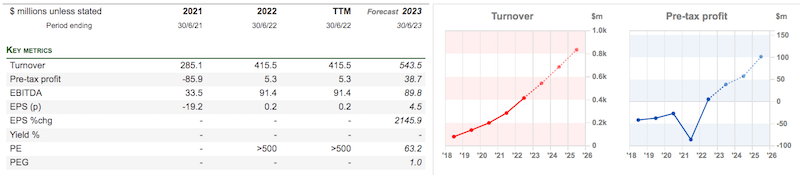

Darktrace (DARK): Statement on QCM reports

NEWS: Quintessential Capital Management’s short-selling dossier titled ‘The Dark Side Of Darktrace‘ briefly thumped DARK’s shares by 15% last Tuesday.

This FTSE 250 cyber-security specialist has been plagued with suspicion ever since it floated in April 2001. Ties with Mike Lynch, the founder of Autonomy, have acted like a magnet for allegations of suspect practices and colourful accounting.

To recap, Autonomy developed document-management systems and was acquired by Hewlett-Packard for $11b in 2011 — only for HP to discover Autonomy had “used accounting improprieties, misrepresentations, and disclosure failures to inflate the underlying financial metrics”. Mr Lynch currently faces extradition to the States to face fraud charges.

Mr Lynch co-founded DARK during 2013 and, according to its flotation document, “provided management advice to the Group pursuant to a Supply of Services Agreement” until the IPO.

QCM’s report cites various examples of alleged ‘channel stuffing’ that involved “simulated or anticipated sales to phantom end-users” prior to the flotation.

DARK rejected the allegations and claimed it requires “visibility into the signed end-user contract and will not just rely on partner assurance.”

DARK also confirmed “contracts that did not meet Darktrace’s policies were not included in Darktrace’s financial statements either in the IPO prospectus or Darktrace’s Annual Reports since the IPO”.

OPINION: Tim Steer reviewed Autonomy in The Signs Were There and admitted it was “difficult to pinpoint one large red flag” within Autonomy’s annual reports.

QCM seems to have struggled finding one large red flag with DARK, and the dossier is certainly not perfect. The dubious resellers unearthed from Malta and Monaco could just be rogue bad apples, and the “thorough investigation” did not double-check DARK’s own case studies.

QCM also questioned DARK’s R&D spend at only 9% of sales versus 40% for a “good software company“. The figure for Microsoft is 12%.

And QCM highlighting a snippet of small print within DARK’s 2021 annual report seemed odd given the 2022 annual report has been available for months and its small print did not warrant any coverage.

A valid QCM point was DARK employing many ex-Autonomy staff. QCM notes DARK’s chief exec was a “Corporate Controller at Autonomy (2009-2011)” and speculates “whether having served as a “financial controller” for a confirmed fraud represents an appropriate credential to head a public company.”

QCM’s dossier also included numerous adverse anecdotes from employee-review sites and IT forums, and DARK shareholders who are simply trusting the numbers should probably undertake similar digging.

SharePad shows earnings advancing from last year’s $5m to almost $100m by 2025, so DARK’s £1.7b market cap may remain vulnerable until the doubts are cleared once and for all.

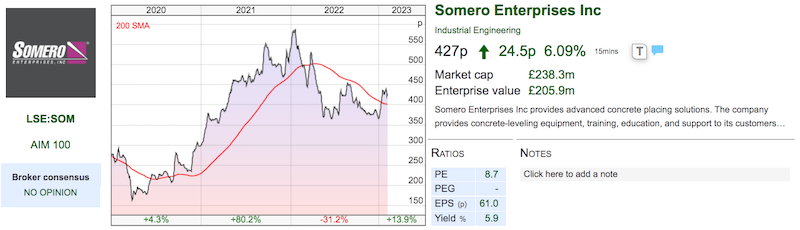

Somero Enterprises (SOM): Trading Update

NEWS: SOM’s near-6% dividend yield still appears viable following a slightly mixed update last week.

The manufacturer of concrete-levelling machines admitted it’s forthcoming 2022 results would show revenue and adjusted Ebitda a fraction below earlier expectations.

FY revenue will be $134m, versus guidance of $139m and last year’s $133m, while adjusted Ebitda will be $46m, versus guidance of $47m and last year’s $48m.

The performance ought to translate into earnings towards $0.60 per share and at least sustain the full-year $0.31 per share dividend, which translates into approximately 25p versus the 427p share price. SOM has commendably declared special dividends for each of the last six years, and net cash at $34m may well extend that run to seven.

SOM hinted 2023 would see stable revenue as cement and labour shortages continue to interfere with customer projects. Ebitda will meanwhile fall due to the costs of beefing up operations beyond the group’s domestic US market.

The somewhat muted 2022 and 2023 performances may not set pulses racing, but bear in mind SOM enjoyed a bumper 2021 when revenue boomed 51% and Ebitda surged 83%.

OPINION: SOM’s website reveals 17% of the company is owned by customers of Hargreaves Lansdown, interactive investor and AJ Bell. And working out why is not hard; SOM has for years exhibited high margins, decent ROE, significant net cash and a modest valuation complemented by all those special payouts (this article has more).

The P/E is approximately 9 and hardly seems expensive, but SOM has been quoted since 2006 and has rarely sported a premium rating. The 600p share-price high last year was equivalent to 12-13 earnings.

The drawback is SOM’s perceived sensitivity to economic downturns. The group’s flagship machines sell for $300k-plus and concrete-laying contractors are unlikely to splash out on hefty new kit when facing uncertain workloads and weaker cash flow. Bear in mind the 2008/9 banking crash caused sales to fall by two-thirds and profits to disappear.

What exactly will prompt a higher P/E valuation for SOM is difficult to say. New “disruptive” products beyond concrete laying have been slow to take off, with such sales at just $4m in 2022. Only sidestepping the next recession may tempt the market to eventually pay a premium multiple.

Being headquartered in the States could be another downside. SOM’s annual report maybe QCA-friendly 56 pages, but it lacks a lot of standard disclosures. The financials for example contain only 17 accounting notes versus 25+ for UK-based companies.

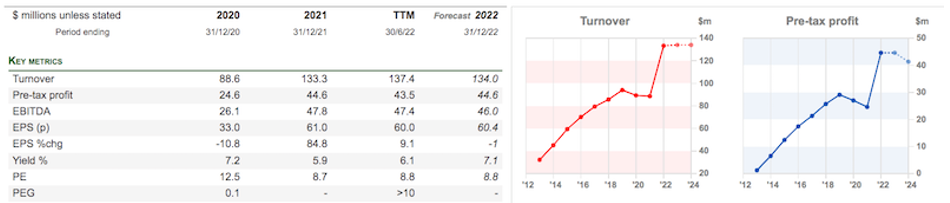

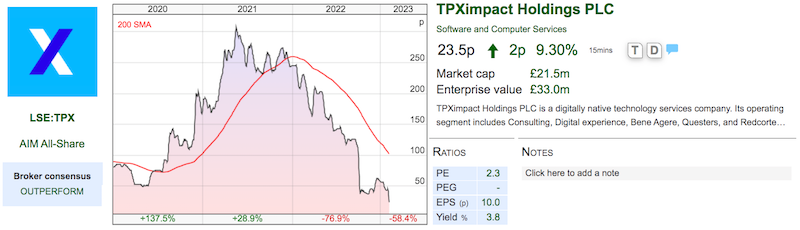

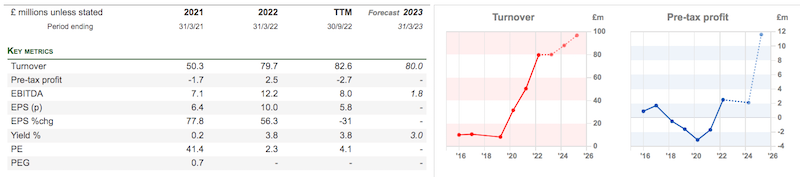

TPXimpact (TPX): Q3 Trading Update

NEWS: This “technology-enabled services company focused on digital transformation” watched its shares crash 48% last week after warning on sales, profits and bank covenants.

December was apparently blighted by a “markedly” higher rate of client staff absences due to “sickness and holidays“, which led to project delays and like-for-like Q3 revenue falling 15% — which feels quite alarming given the problems were limited to only one month.

TPX also cited a “highly competitive recruitment market” for rising costs and margin damage. Large contracts have been won on fixed bids with little scope to cater for wage inflation, and TPX ominously made no comment on what margins the group’s 2023/4 backlog might command.

November’s interims had previously guided towards full-year revenue of £90m and adjusted Ebitda of approximately £7m, but the bad news reduced the projections to £80m and approximately £2m respectively.

TPX confessed the £2m adjusted Ebitda was “unlikely to satisfy its debt covenants at 31 March 2023“. Net debt was £17.5m at the end of December, which is 8.75x that £2m projected Ebitda and well beyond the bank’s maximum 2.5x covenant.

OPINION: Earlier newsflow had already suggested trouble looming. In particular, September’s AGM revealed the co-founding CEO and CFO hastily departing after a group restructure floundered and an H1 profit alert.

OPINION: Earlier newsflow had already suggested trouble looming. In particular, September’s AGM revealed the co-founding CEO and CFO hastily departing after a group restructure floundered and an H1 profit alert.

But maybe problems were always lurking.

After all, TPX undertook a fast-paced buy-and-build strategy with the 2018 flotation proceeds immediately purchasing four consultancies and SharePad listing a further 11 acquisitions.

The last accounts imply at least £90m was spent on deal-making (a lot when 2022 (adjusted!) earnings were £9m), and the replacement executives must now integrate all the different “digital transformation” subsidiaries into a one-stop-shop.

The inherent difficulty could be staff utilisation, and the omens here seem bleak.

Last week’s warning revealed employee numbers had risen 12% to around 1,000 including specialist contractors.

But projected sales of £80m give sales per head of only £80k, which does not allow much room for wage inflation for workers who last year cost £62k each… let alone room for other expenses, plus interest for the bank and then something left over for shareholders.

The 2022 annual report devoted at least 40 pages to ESG issues (including “neurodiverse” employees) and even TPX’s bank created “a sustainability-linked revolving credit facility that incorporates targets which align with our long-term ESG objectives”.

Perhaps all involved should have paid greater attention to more mundane matters such as contract pricing and staff productivity.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Private Investor’s Podcast with Roland Head. He does not own any shares mentioned within this commentary.

Got some thoughts on this week’s commentary from Maynard? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 07/02/23 | GSK, DARK, SOM, TPX | New FTSE Highs

As the FTSE 100 reaches a new peak, Maynard looks at another blue-chip measure setting record highs. Plus coverage of GSK, DARK, SOM and TPX.

Bruce asked me to compile these commentaries while he is away on holiday. Many private investors swear their portfolios perform better when they’re not watching the markets, and a record FTSE 100 close on Friday bodes well for Bruce

The FTSE 100 climbed 1.8% last week to reach 7,902 to extend its remarkably resilient performance since the start of 2022. The past 13 months have seen the UK benchmark advance 7% with only Brazil (+5%) and India (+1%) the only other main indices showing positive returns during the same time.

Another FTSE 100 measure setting a new high is the average word count within a blue-chip annual report. The Quoted Companies Alliance calculates the typical FTSE 100 report has expanded by 46% since 2017, with the average document now weighing in at 147,000 words on 237 pages.

The QCA is therefore “calling for an overhaul of current reporting demands and better guidance so that companies can save time and money while still making appropriate disclosures to investors and the wider stakeholder community.”

The QCA quite rightly mentions ending repetition, but sadly lacks any insight as to exactly which disclosures should be overhauled. Annual reports contain all sorts of useful ‘outsider information‘ for diligent readers (e.g. audit reports) and quite often shareholder problems are caused by those companies not disclosing enough!

A small irony within the QCA’s argument is many small companies adhere to the QCA’s own governance code and explain how they meet that code in their annual report. One of this week’s shares — TPXimpact — devoted five pages to such matters in its 2022 report.

Below I look at FY 2022 results from GSK (2021 annual report: 316 pages), further misgivings at Darktrace (2022 annual report: 206 pages), an update from Somero (2021 annual report: 56 pages) and the profit warning issued by TPXimpact (2022 annual report: 192 pages).

GSK (GSK): Final results

NEWS: The FTSE 100 biopharma last week announced its first annual results following the demerger of Haleon back in July.

The statement contained GSK’s usual array of figures — a mix of adjusted/unadjusted profits, growth rates based on actual/constant currencies, progress including/excluding Covid-19 treatments and contributions with/without Haleon.

Taking the adjusted, constant-currency, Covid-included and Haleon-excluded version, turnover gained 13% and adjusted profit gained 14%. Guidance for 2023 is turnover up c7% and adjusted profit up c11%.

The numbers and forecasts seemed to meet the expectations set out in 2021 when GSK announced its grand demerger plan and predicted 2021-2026 sales and profit CAGRs of 5% and 10% respectively.

A sales ambition of £33b by 2031 now seems quite light after the statement showed revenue at £29b. But one item not moving higher is the dividend, which is expected to be unchanged for 2023.

OPINION: The £14 shares hardly look expensive trading on a 10-11x multiple and yielding 4.1%. But the standstill dividend for this year is telling, especially after the payout was chopped as part of the consumer-product demerger.

GSK had paid a constant 100p per share dividend between 2014 and 2021, but post-demerger the payout is 56.5p with spin-off Haleon perhaps adding a further 6p this year. The payments add up to a near-40% income drop versus the pre-demerger GSK.

The dividend chop seems to be a belated reaction to GSK’s disturbing long-term performance. The economics of pharmaceuticals have clearly deteriorated since the good old Zantac days, with the recent £14 being first achieved in 1997.

The validity of GSK’s financial reporting is also questionable given the group’s regular write-downs and restructuring charges. Collective 2017-2021 statutory earnings of £23b were inflated by adjustments of £10b to give underlying earnings of £33b.

The Haleon spin-off buys GSK some time to deliver on its “step-change in growth” promise, but boss Dame Emma Walmsley has held the top job for six years now while predecessors Jean-Pierre Garnier and Sir Andrew Witty both lasted eight before deciding to stand down.

That form guide suggests the next few years could herald new leadership and perhaps another corporate reshuffle, backed by exasperated long-term investors who may now be rueing Dame Emma’s decision not to engage with Unilever about its £50b approach for Haleon. The spin-off has a current £30b market value.

Darktrace (DARK): Statement on QCM reports

NEWS: Quintessential Capital Management’s short-selling dossier titled ‘The Dark Side Of Darktrace‘ briefly thumped DARK’s shares by 15% last Tuesday.

This FTSE 250 cyber-security specialist has been plagued with suspicion ever since it floated in April 2001. Ties with Mike Lynch, the founder of Autonomy, have acted like a magnet for allegations of suspect practices and colourful accounting.

To recap, Autonomy developed document-management systems and was acquired by Hewlett-Packard for $11b in 2011 — only for HP to discover Autonomy had “used accounting improprieties, misrepresentations, and disclosure failures to inflate the underlying financial metrics”. Mr Lynch currently faces extradition to the States to face fraud charges.

Mr Lynch co-founded DARK during 2013 and, according to its flotation document, “provided management advice to the Group pursuant to a Supply of Services Agreement” until the IPO.

QCM’s report cites various examples of alleged ‘channel stuffing’ that involved “simulated or anticipated sales to phantom end-users” prior to the flotation.

DARK rejected the allegations and claimed it requires “visibility into the signed end-user contract and will not just rely on partner assurance.”

DARK also confirmed “contracts that did not meet Darktrace’s policies were not included in Darktrace’s financial statements either in the IPO prospectus or Darktrace’s Annual Reports since the IPO”.

OPINION: Tim Steer reviewed Autonomy in The Signs Were There and admitted it was “difficult to pinpoint one large red flag” within Autonomy’s annual reports.

QCM seems to have struggled finding one large red flag with DARK, and the dossier is certainly not perfect. The dubious resellers unearthed from Malta and Monaco could just be rogue bad apples, and the “thorough investigation” did not double-check DARK’s own case studies.

QCM also questioned DARK’s R&D spend at only 9% of sales versus 40% for a “good software company“. The figure for Microsoft is 12%.

And QCM highlighting a snippet of small print within DARK’s 2021 annual report seemed odd given the 2022 annual report has been available for months and its small print did not warrant any coverage.

A valid QCM point was DARK employing many ex-Autonomy staff. QCM notes DARK’s chief exec was a “Corporate Controller at Autonomy (2009-2011)” and speculates “whether having served as a “financial controller” for a confirmed fraud represents an appropriate credential to head a public company.”

QCM’s dossier also included numerous adverse anecdotes from employee-review sites and IT forums, and DARK shareholders who are simply trusting the numbers should probably undertake similar digging.

SharePad shows earnings advancing from last year’s $5m to almost $100m by 2025, so DARK’s £1.7b market cap may remain vulnerable until the doubts are cleared once and for all.

Somero Enterprises (SOM): Trading Update

NEWS: SOM’s near-6% dividend yield still appears viable following a slightly mixed update last week.

The manufacturer of concrete-levelling machines admitted it’s forthcoming 2022 results would show revenue and adjusted Ebitda a fraction below earlier expectations.

FY revenue will be $134m, versus guidance of $139m and last year’s $133m, while adjusted Ebitda will be $46m, versus guidance of $47m and last year’s $48m.

The performance ought to translate into earnings towards $0.60 per share and at least sustain the full-year $0.31 per share dividend, which translates into approximately 25p versus the 427p share price. SOM has commendably declared special dividends for each of the last six years, and net cash at $34m may well extend that run to seven.

SOM hinted 2023 would see stable revenue as cement and labour shortages continue to interfere with customer projects. Ebitda will meanwhile fall due to the costs of beefing up operations beyond the group’s domestic US market.

The somewhat muted 2022 and 2023 performances may not set pulses racing, but bear in mind SOM enjoyed a bumper 2021 when revenue boomed 51% and Ebitda surged 83%.

OPINION: SOM’s website reveals 17% of the company is owned by customers of Hargreaves Lansdown, interactive investor and AJ Bell. And working out why is not hard; SOM has for years exhibited high margins, decent ROE, significant net cash and a modest valuation complemented by all those special payouts (this article has more).

The P/E is approximately 9 and hardly seems expensive, but SOM has been quoted since 2006 and has rarely sported a premium rating. The 600p share-price high last year was equivalent to 12-13 earnings.

The drawback is SOM’s perceived sensitivity to economic downturns. The group’s flagship machines sell for $300k-plus and concrete-laying contractors are unlikely to splash out on hefty new kit when facing uncertain workloads and weaker cash flow. Bear in mind the 2008/9 banking crash caused sales to fall by two-thirds and profits to disappear.

What exactly will prompt a higher P/E valuation for SOM is difficult to say. New “disruptive” products beyond concrete laying have been slow to take off, with such sales at just $4m in 2022. Only sidestepping the next recession may tempt the market to eventually pay a premium multiple.

Being headquartered in the States could be another downside. SOM’s annual report maybe QCA-friendly 56 pages, but it lacks a lot of standard disclosures. The financials for example contain only 17 accounting notes versus 25+ for UK-based companies.

TPXimpact (TPX): Q3 Trading Update

NEWS: This “technology-enabled services company focused on digital transformation” watched its shares crash 48% last week after warning on sales, profits and bank covenants.

December was apparently blighted by a “markedly” higher rate of client staff absences due to “sickness and holidays“, which led to project delays and like-for-like Q3 revenue falling 15% — which feels quite alarming given the problems were limited to only one month.

TPX also cited a “highly competitive recruitment market” for rising costs and margin damage. Large contracts have been won on fixed bids with little scope to cater for wage inflation, and TPX ominously made no comment on what margins the group’s 2023/4 backlog might command.

November’s interims had previously guided towards full-year revenue of £90m and adjusted Ebitda of approximately £7m, but the bad news reduced the projections to £80m and approximately £2m respectively.

TPX confessed the £2m adjusted Ebitda was “unlikely to satisfy its debt covenants at 31 March 2023“. Net debt was £17.5m at the end of December, which is 8.75x that £2m projected Ebitda and well beyond the bank’s maximum 2.5x covenant.

But maybe problems were always lurking.

After all, TPX undertook a fast-paced buy-and-build strategy with the 2018 flotation proceeds immediately purchasing four consultancies and SharePad listing a further 11 acquisitions.

The last accounts imply at least £90m was spent on deal-making (a lot when 2022 (adjusted!) earnings were £9m), and the replacement executives must now integrate all the different “digital transformation” subsidiaries into a one-stop-shop.

The inherent difficulty could be staff utilisation, and the omens here seem bleak.

Last week’s warning revealed employee numbers had risen 12% to around 1,000 including specialist contractors.

But projected sales of £80m give sales per head of only £80k, which does not allow much room for wage inflation for workers who last year cost £62k each… let alone room for other expenses, plus interest for the bank and then something left over for shareholders.

The 2022 annual report devoted at least 40 pages to ESG issues (including “neurodiverse” employees) and even TPX’s bank created “a sustainability-linked revolving credit facility that incorporates targets which align with our long-term ESG objectives”.

Perhaps all involved should have paid greater attention to more mundane matters such as contract pricing and staff productivity.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and co-hosts the Private Investor’s Podcast with Roland Head. He does not own any shares mentioned within this commentary.

Got some thoughts on this week’s commentary from Maynard? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.